Market Overview:

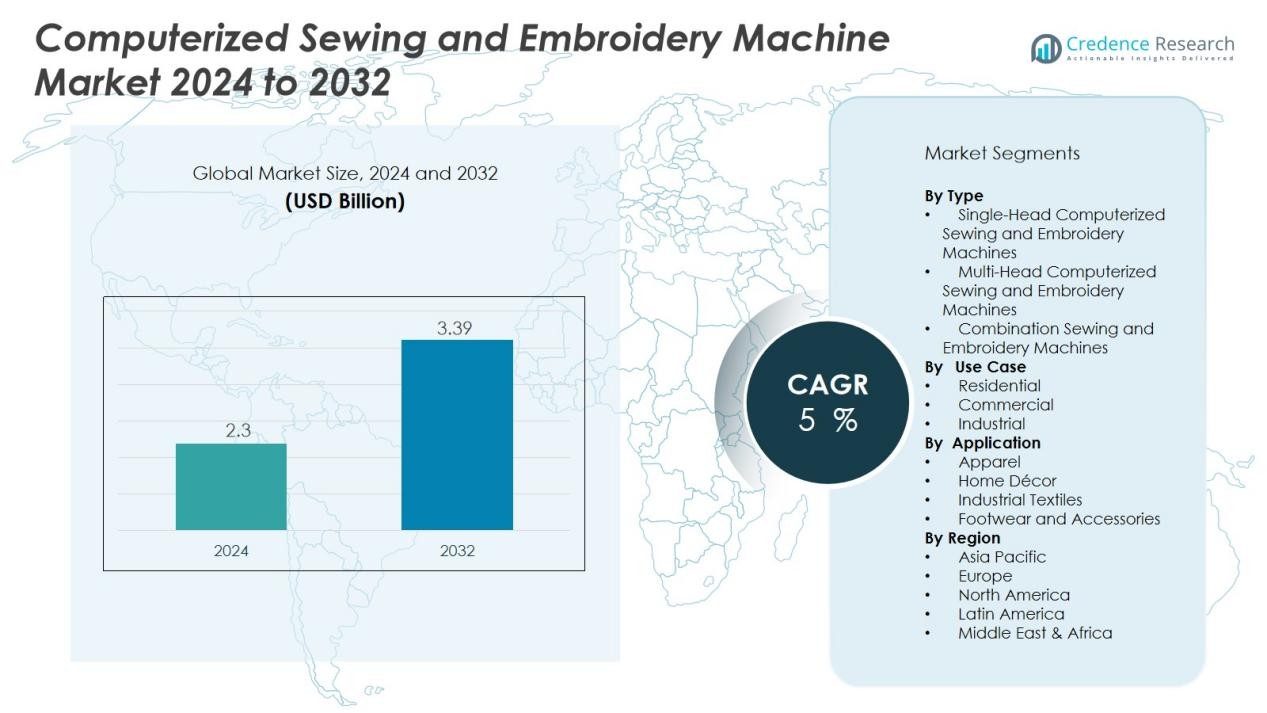

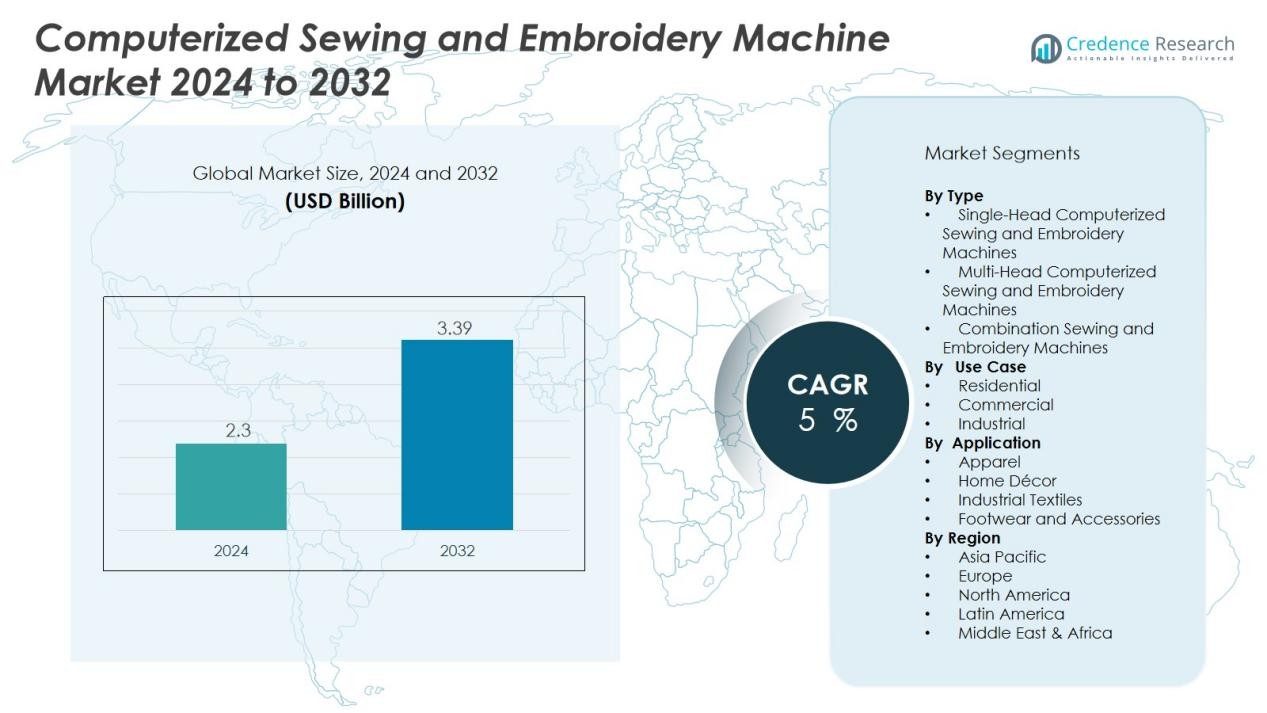

The Computerized Sewing And Embroidery Machine Market size was valued at USD 2.3 billion in 2024 and is anticipated to reach USD 3.39 billion by 2032, at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Computerized Sewing And Embroidery Machine Market Size 2024 |

USD 2.3 Billion |

| Computerized Sewing And Embroidery Machine Market, CAGR |

5% |

| Computerized Sewing And Embroidery Machine Market Size 2032 |

USD 3.39 Billion |

Key market drivers include the rising popularity of personalized fashion, advancements in digitized design software, and growing awareness of time-efficient stitching processes. The increasing number of small-scale designers and boutique manufacturers adopting automated machines further accelerates demand. Leading brands such as Brother Industries, Janome, and Bernina focus on user-friendly interfaces, multi-needle systems, and Wi-Fi connectivity to strengthen their market presence.

Regionally, Asia-Pacific holds the dominant market share, led by strong manufacturing bases in China, Japan, and India. North America follows, driven by consumer interest in DIY and customized sewing projects. Europe maintains a steady growth trajectory supported by high-end embroidery applications in fashion and home furnishings. Emerging markets in Latin America and the Middle East & Africa are witnessing rising adoption through expanding retail distribution and affordable product offerings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Computerized Sewing and Embroidery Machine Market was valued at USD 1.68 billion in 2018, reached USD 2.3 billion in 2024, and is projected to attain USD 3.39 billion by 2032, expanding at a CAGR of 5%.

- Asia-Pacific holds 46% share, driven by robust textile manufacturing in China, Japan, and India, alongside government support for automation and export-focused garment production.

- North America accounts for 28% share, fueled by strong consumer interest in DIY fashion, digital sewing integration, and premium brand availability across the United States and Canada.

- Europe captures 17% share, supported by its luxury apparel and home furnishing sectors, with Germany, Italy, and France leading innovation in digital embroidery and precision design.

- Apparel applications dominate with 51% share due to rising demand for custom clothing, while single-head machines hold 48% share, favored for their affordability

Market Drivers:

Rising Demand for Automation and Precision in Textile Production

The Computerized Sewing and Embroidery Machine Market grows with increasing demand for automation in garment manufacturing. Automated systems ensure high precision, speed, and consistency in stitching and embroidery tasks. Manufacturers prefer these machines to reduce labor costs and production time while maintaining quality. The adoption of programmable patterns and digital controls enhances productivity and minimizes manual intervention in both industrial and domestic segments.

- For instance, Tajima’s TMEZ-SC series features Intelligent Thread Management (i-TM) technology that automatically adjusts thread tension in 0.05 seconds, enabling consistent stitch quality while operating at speeds up to 1,200 stitches per minute.

Growing Popularity of Personalized and Customized Apparel

Rising consumer interest in customized fashion and home décor drives machine adoption. It enables designers to create intricate patterns, monograms, and personalized embroidery efficiently. Fashion brands and boutique stores use these machines to meet unique customer demands and improve creative flexibility. The trend toward DIY projects and small-scale entrepreneurship further supports the market’s expansion in developed and emerging economies.

- For instance, Tajima’s TMEZ-SC embroidery machine features a digitally controlled presser foot and automatic thread tension system, enabling users to achieve high consistency in designs with up to 12 needles in just one run.

Technological Advancements in Machine Features and Connectivity

Manufacturers integrate advanced features such as touchscreen controls, automatic thread cutters, and wireless connectivity to enhance user convenience. It allows seamless design transfer from software to machine, improving workflow efficiency. The introduction of multi-needle and dual-function models also supports both sewing and embroidery operations. These innovations expand product appeal among hobbyists and professionals seeking precision and operational versatility.

Expanding Textile and Apparel Manufacturing in Emerging Economies

The expansion of textile production in Asia-Pacific countries such as China, India, and Vietnam drives machine sales. Governments promote automation and modernization within textile sectors, creating strong growth opportunities. It supports large-scale industrial applications while encouraging local tailoring and fashion businesses. Increasing export-oriented garment production further stimulates demand for computerized sewing and embroidery machines across the region.

Market Trends:

Integration of Smart and Digital Technologies in Sewing Systems

The Computerized Sewing and Embroidery Machine Market is witnessing rapid integration of smart technologies to improve functionality and ease of use. Manufacturers incorporate IoT connectivity, AI-based design assistance, and mobile app compatibility to enable seamless control and customization. It allows users to upload digital designs directly from cloud platforms, reducing setup time and enhancing creative flexibility. Touchscreen interfaces and voice-guided operations simplify complex embroidery patterns for beginners and professionals alike. The focus on energy-efficient motors and automated thread management further enhances performance and sustainability. Brands also emphasize modular designs that support easy upgrades and software updates, ensuring long-term product usability.

- For Instance, Brother Industries’ Luminaire Innov-ís XP3 features an automatic electronic needle threading mechanism and over 1,500 built-in embroidery designs, including 192 Disney designs.

Rising Influence of Fashion Customization and Home-Based Entrepreneurship

Growing consumer demand for personalized products encourages the adoption of computerized sewing and embroidery machines across both residential and commercial users. Independent designers, small-scale garment producers, and home-based entrepreneurs rely on compact yet high-performance machines for niche product creation. It enables mass customization and supports emerging trends in sustainable fashion and made-to-order apparel. Online tutorials and digital learning platforms increase consumer awareness of advanced embroidery techniques, fueling adoption in domestic applications. The expansion of e-commerce channels and easy financing options also broaden access to premium machine models. The growing influence of creative communities on social media platforms further promotes innovation and user engagement in the market.

- For instance, ZSK USA Inc. offers personal on-site training with certified technicians, accommodating up to 5 trainees per session to optimize hands-on learning and improve workforce readiness.

Market Challenges Analysis:

High Cost and Complex Maintenance Requirements

The Computerized Sewing and Embroidery Machine Market faces challenges due to the high cost of advanced machines and their maintenance needs. Many small businesses and individual users hesitate to invest in premium models because of high upfront expenses. It requires regular software updates, part replacements, and calibration to maintain performance. Technical issues or lack of skilled operators can cause downtime and productivity losses. Manufacturers must provide accessible after-sales support and affordable service packages to retain customers. Limited awareness of machine maintenance among users further affects long-term reliability.

Limited Skill Availability and Training Infrastructure

A major challenge lies in the shortage of trained personnel capable of operating and troubleshooting computerized systems effectively. It restricts adoption, particularly in small-scale industries and developing regions. Learning to use advanced embroidery software and programming functions demands time and training. The lack of structured skill development programs creates dependence on manual processes in many textile units. Manufacturers and training institutes must collaborate to improve workforce readiness. Without adequate education and technical support, the market’s full automation potential remains underutilized.

Market Opportunities:

Expansion of Smart and Connected Sewing Solutions

The Computerized Sewing and Embroidery Machine Market offers strong growth opportunities through the adoption of smart and connected technologies. Integration of Wi-Fi, cloud storage, and AI-assisted design tools allows users to manage and customize projects remotely. It enhances workflow efficiency and appeals to tech-savvy consumers and professionals seeking automation. Manufacturers can introduce app-based interfaces and digital pattern libraries to attract younger demographics. Growing interest in home-based creative businesses creates demand for compact, connected machines with multi-function capabilities. Collaboration with software developers can further expand product compatibility and customer engagement.

Growing Demand in Emerging and Niche Market Segments

Emerging economies present significant potential due to expanding textile manufacturing and rising disposable income among small business owners. It enables local artisans and fashion entrepreneurs to invest in affordable computerized machines for creative production. Increasing interest in sustainable fashion, customized embroidery, and limited-edition apparel drives niche opportunities. Manufacturers can leverage this demand by offering eco-friendly materials and energy-efficient designs. Partnerships with vocational institutions and fashion schools can also create new customer bases. Strong e-commerce penetration in Asia-Pacific and Latin America will further boost market accessibility and product visibility.

Market Segmentation Analysis:

By Type

The Computerized Sewing and Embroidery Machine Market is segmented into single-head, multi-head, and combination machines. Single-head models dominate due to their affordability and suitability for home users and small businesses. It delivers precise stitching and advanced design control with easy operation. Multi-head machines gain popularity in industrial sectors for high-speed production and uniform embroidery on bulk fabrics. Combination models offering both sewing and embroidery functions attract users seeking versatility and space efficiency, making them a preferred choice for small enterprises and creative studios.

- For instance, the Bernina 790 PLUS combination machine integrates both sewing and embroidery operations, featuring a maximum stitch width of 9 mm and a large 7″ touchscreen display, streamlining workflow for creative studios seeking multifunctionality in compact workspaces.

By Use Case

The market caters to both residential and commercial applications, with growing adoption across both segments. Residential users favor compact, user-friendly machines for DIY projects and personalized clothing designs. It benefits from rising interest in creative hobbies and home-based fashion ventures. Commercial users, including apparel manufacturers and boutiques, prioritize productivity, speed, and multi-needle operations for mass customization. The increasing use of digital design libraries further enhances efficiency across both use cases.

- For instance, Melco International introduced the Melco SUMMIT commercial embroidery machine in September 2024, which operates at 1500 stitches per minute.

By Application

Applications include apparel, home décor, and industrial textiles. Apparel holds the leading share due to strong demand for customized garments and intricate embroidery patterns. It also finds growing use in home décor, including curtains, upholstery, and linens, reflecting consumer preference for personalized aesthetics. Industrial applications involve uniform production and branding textiles, where high precision and consistency are critical. The expanding creative economy continues to support broad adoption across all application areas.

Segmentations:

By Type

- Single-Head Computerized Sewing and Embroidery Machines

- Multi-Head Computerized Sewing and Embroidery Machines

- Combination Sewing and Embroidery Machines

By Use Case

- Residential

- Commercial

- Industrial

By Application

- Apparel

- Home Décor

- Industrial Textiles

- Footwear and Accessories

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific Leads the Global Market

Asia-Pacific holds 46% share of the global Computerized Sewing and Embroidery Machine Market, making it the leading regional hub. The region’s dominance stems from strong textile and apparel manufacturing bases in China, Japan, and India. It benefits from government incentives promoting automation and digital transformation in the textile industry. Rapid industrialization and increasing disposable income also fuel home-based and small-scale adoption. Japan and South Korea contribute significantly through innovation in precision and smart sewing technologies. China’s export-oriented garment production further supports high machine demand across commercial and industrial applications.

North America Exhibits Strong Growth Momentum

North America accounts for 28% share, supported by the increasing preference for automated and customized sewing solutions. The region’s growth is driven by strong consumer interest in DIY and personalized embroidery applications. It benefits from advanced retail distribution, strong digital integration, and widespread availability of premium machine brands. The United States leads regional adoption with high spending on creative home décor and fashion products. Canada and Mexico also show consistent demand through expanding small manufacturing units. Growing awareness of sustainable and digital textile practices further enhances market prospects in the region.

Europe Maintains Steady Demand in Premium Segments

Europe holds 17% share, driven by a well-established fashion and home furnishing industry. The region emphasizes quality craftsmanship and precision, supporting demand for high-end embroidery machines. It benefits from growing investments in textile innovation and smart manufacturing technologies. Germany, Italy, and France lead in adopting digital design integration for couture and luxury apparel production. The market also gains traction among boutique designers and small-scale textile firms focusing on creative excellence. Strong export networks and skilled craftsmanship continue to maintain Europe’s stable market position.

Key Player Analysis:

- Baby Lock

- Bernina International AG

- Brother Industries Ltd.

- Durkopp Adler AG

- Elna International Corp. SA

- Husqvarna AB

- Janome Sewing Machine Co., Ltd.

- Juki Corporation

- Necchi Italia S.r.l.

- Pfaff Sewing Machines

- Ricoma International Corporation

- SunStar Precision Co., Ltd.

Competitive Analysis:

The Computerized Sewing and Embroidery Machine Market features strong competition among global and regional manufacturers focused on innovation and user experience. Key players include Baby Lock, Bernina International AG, Brother Industries Ltd., Durkopp Adler AG, Elna International Corp. SA, and Husqvarna AB. These companies invest heavily in R&D to enhance automation, connectivity, and precision features. It emphasizes advanced software integration, touchscreen control, and multi-needle functionality to improve productivity and design flexibility. Strategic partnerships with distributors and online platforms expand product reach across both consumer and industrial segments. Brands strengthen market position through compact models for home users and high-speed industrial machines for large-scale operations. Continuous product upgrades and digital service solutions remain central to maintaining competitive differentiation in the evolving textile machinery landscape.

Recent Developments:

- In September 2025, Baby Lock launched its Anthem Quilting machine and held a live launch event to showcase new technology for quilters and sewists.

- In June 2025, Bernina International AG unveiled their next-generation sewing and embroidery machines, including models with integrated scanners and advanced placement technology, at a major launch event.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Use Case, Application, and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The market will continue expanding through rapid adoption of digital sewing technologies in both commercial and domestic sectors.

- Advancements in AI-assisted design and wireless connectivity will transform embroidery precision and workflow efficiency.

- Rising consumer interest in personalized apparel and home décor will strengthen product demand globally.

- Manufacturers will focus on compact, multi-functional models catering to home-based designers and small businesses.

- Sustainability will shape product development, emphasizing energy-efficient motors and recyclable components.

- Training programs and online tutorials will increase user proficiency, supporting broader market penetration.

- E-commerce and direct-to-consumer sales channels will drive accessibility and price competitiveness.

- Partnerships with fashion schools and textile institutes will create new customer bases and innovation pipelines.

- Automation in textile manufacturing across Asia-Pacific will continue to lead machine adoption and exports.

- Integration of cloud-based design storage and real-time software updates will define the next phase of technological evolution.