Market Overview:

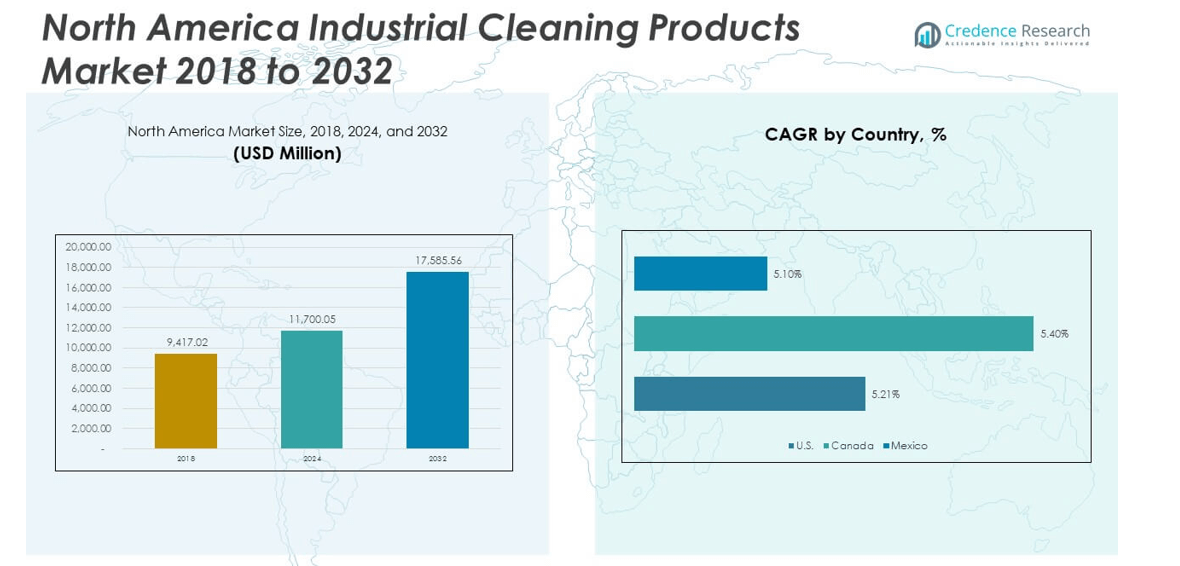

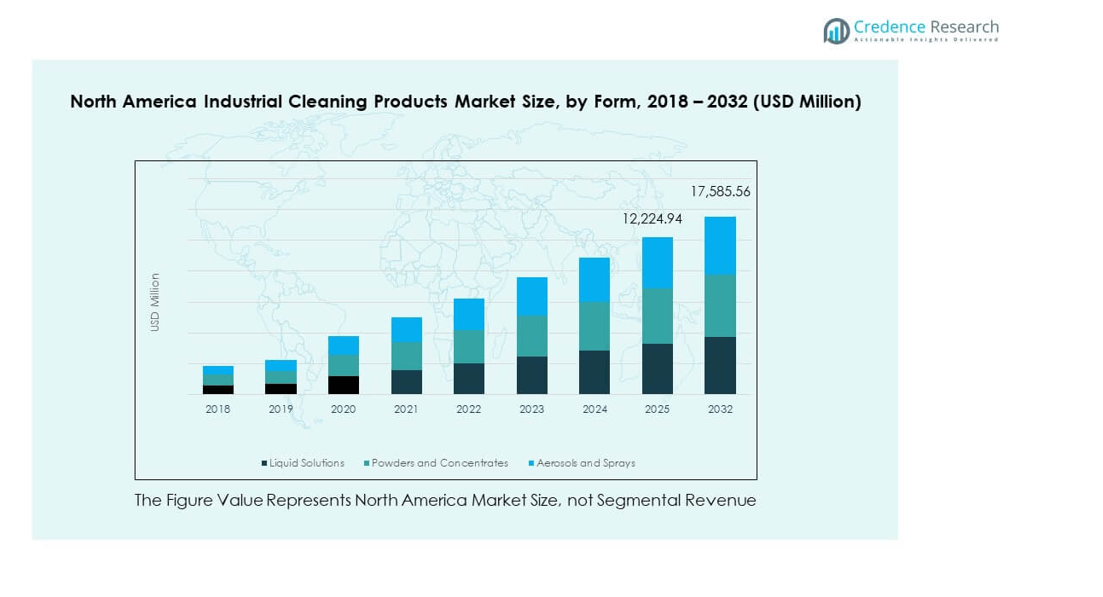

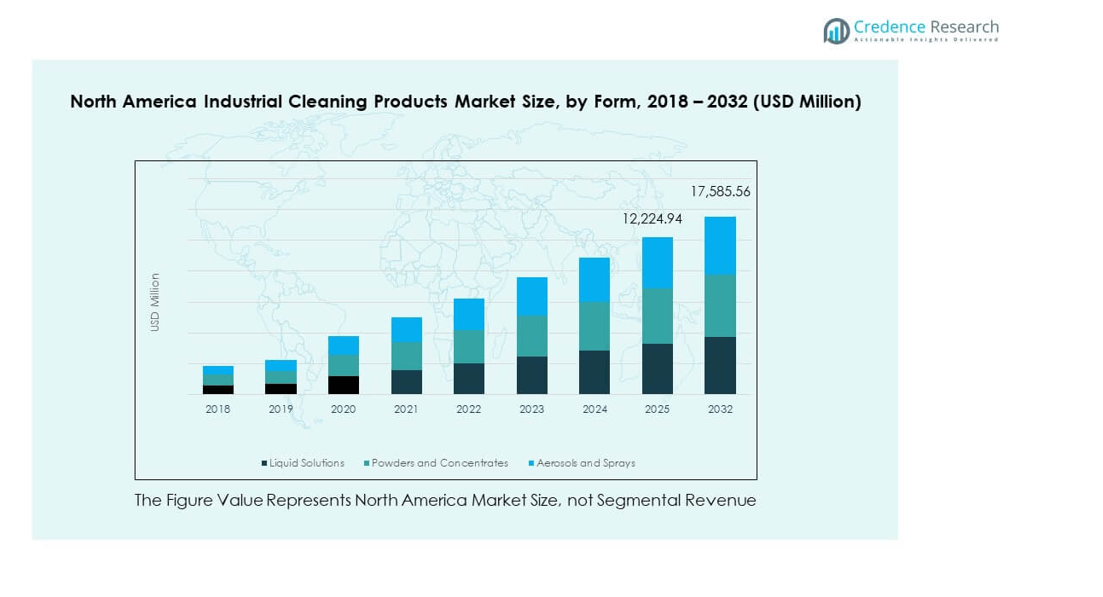

The North America Industrial Cleaning Products Market size was valued at USD 9,417.02 million in 2018 to USD 11,700.05 million in 2024 and is anticipated to reach USD 17,585.56 million by 2032, at a CAGR of 5.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Industrial Cleaning Products Market Size 2024 |

USD 11,700.05 million |

| North America Industrial Cleaning Products Market, CAGR |

5.23% |

| North America Industrial Cleaning Products Market Size 2032 |

USD 17,585.56 million |

The North America Industrial Cleaning Products Market is driven by increasing regulatory requirements and growing awareness about workplace hygiene and safety standards. Demand for high-performance cleaning solutions is rising in industries such as manufacturing, food processing, and healthcare. Companies are focusing on sustainable and eco-friendly cleaning products to meet consumer preferences and comply with environmental regulations. Technological advancements, such as automation and improved formulations, are also contributing to the market’s growth by enhancing cleaning efficiency and reducing labor costs.

The United States holds the largest share of the North America Industrial Cleaning Products Market, supported by a diverse industrial base and stringent cleanliness standards. Canada is also witnessing steady growth, particularly in sectors like healthcare and manufacturing. Emerging markets in Mexico are seeing increased demand for industrial cleaning products, as the country’s manufacturing and automotive industries expand. North America’s focus on sustainable solutions, alongside industrial growth, makes it a leading region in the global market for industrial cleaning products.

Market Insights

- The North America Industrial Cleaning Products Market size was valued at USD 9,417.02 million in 2018, USD 11,700.05 million in 2024, and is projected to reach USD 17,585.56 million by 2032, growing at a CAGR of 5.23% during the forecast period.

- The United States dominates the North America Industrial Cleaning Products Market with the largest share, holding approximately 75%, followed by Canada at 18% and Mexico at 7%. The U.S. leads due to its diverse industrial base and stringent regulatory standards.

- Canada is the fastest-growing region in the North America Industrial Cleaning Products Market, driven by a strong manufacturing sector and a shift towards eco-friendly cleaning products, contributing significantly to market expansion.

- In terms of segment share distribution, liquid solutions hold approximately 50% of the market share, followed by aerosols and sprays at 30%, exhibiting a steady growth trajectory across various industrial applications.

- Powders and concentrates account for around 20% of the market share, showing potential growth, especially in industries requiring bulk cleaning solutions, with increasing demand for cost-effective cleaning products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Drivers:

Increasing Demand for Hygiene and Safety Standards

The North America Industrial Cleaning Products Market is expanding due to rising hygiene and safety standards across various industries. With strict regulations, businesses are compelled to implement effective cleaning procedures. The need for safe and clean working environments drives the demand for industrial cleaning products. Sectors such as food processing, healthcare, and manufacturing require high-performance products to meet these regulations. Companies are investing in advanced cleaning solutions to maintain compliance with local and global standards. These trends support long-term market growth, as industries continuously focus on health and safety.

Technological Advancements in Cleaning Solutions

Technological advancements play a significant role in the growth of the North America Industrial Cleaning Products Market. The introduction of automated cleaning systems, along with eco-friendly and energy-efficient cleaning agents, is reshaping the industry. These innovations improve productivity while reducing environmental impact. Companies are focusing on integrating artificial intelligence and robotics to enhance cleaning efficiency. Such technologies streamline operations, saving both time and labor costs. The incorporation of these advanced solutions boosts market demand across several sectors, especially in high-volume industries.

- For instance, the Tennant Company’s T16AMR industrial robotic floor scrubber, launched with BrainOS AI, features a 36-inch cleaning path, 50-gallon solution tank, and can operate up to 5.5 hours per charge with lithium-ion batteries, automating labor-intensive floor cleaning in logistics and manufacturing sites.

Rising Demand for Eco-Friendly Cleaning Solutions

Sustainability trends have influenced the North America Industrial Cleaning Products Market, leading to increased demand for eco-friendly cleaning products. Manufacturers are focusing on producing biodegradable, non-toxic, and chemical-free solutions to meet consumer expectations. Eco-friendly cleaning solutions offer advantages such as lower toxicity and reduced environmental harm. These products are gaining traction among industries striving to meet sustainability goals. As regulations become stricter, businesses prioritize environmentally friendly alternatives that comply with industry standards. This trend is expected to drive the market’s growth in the coming years.

- For instance, 3M offers multiple industrial cleaning products certified to Green Seal GS-37, a third-party standard that requires formulation with minimal hazardous chemicals, demonstrated biodegradability, and stringent environmental and health safety requirements, as recognized in Green Seal’s January 2025 certification listing for the U.S. market.

Expansion of Manufacturing and Industrial Activities

The expansion of manufacturing and industrial activities in North America is driving the demand for industrial cleaning products. As the region’s industrial base grows, so does the need for efficient cleaning solutions. Factories, warehouses, and production facilities require regular cleaning to ensure smooth operations. The industrial cleaning products market benefits from these increased requirements, particularly in sectors like automotive, food and beverage, and healthcare. Growing investments in infrastructure and manufacturing contribute to the market’s steady growth and long-term demand.

Market Trends:

Shift Towards Automation in Cleaning Processes

Automation is becoming a prominent trend in the North America Industrial Cleaning Products Market. Many industries are adopting robotic cleaning systems and automated machinery to enhance cleaning efficiency. This shift improves productivity by reducing labor costs and human error. Automated cleaning processes are particularly beneficial for industries with large-scale operations, such as manufacturing plants. These innovations streamline cleaning tasks, saving both time and resources. Companies are increasingly investing in these automated systems to stay competitive and reduce operational costs.

Growth of Multi-Purpose and Concentrated Cleaning Products

The North America Industrial Cleaning Products Market is witnessing a rise in the demand for multi-purpose and concentrated cleaning products. These products offer versatility by performing various cleaning tasks, making them more cost-effective and efficient. By concentrating cleaning agents, companies can reduce storage space and transportation costs. This trend is gaining popularity across industries that require bulk cleaning supplies, such as food processing and manufacturing. Concentrated products offer more value for money and align with the growing demand for convenience and practicality.

- For instance, Ecolab launched its 4X Concentrated Cleaning System for industrial clients in mid-2023, enabling customers such as Tyson Foods to reduce cleaning product shipping weight by 63% and packaging waste by 75% compared to standard cleaning solution.

Adoption of Green Certifications and Standards

The trend towards green certifications is increasingly influencing the North America Industrial Cleaning Products Market. Many businesses are seeking environmentally friendly products that comply with green certifications, such as Green Seal and EcoLogo. These certifications assure customers that cleaning products are safe and eco-friendly. As sustainability becomes more critical to both consumers and regulators, companies are striving to enhance their product offerings to meet these standards. This shift towards greener solutions supports long-term market growth by encouraging the adoption of certified, sustainable cleaning agents.

- For instance, in its 2024 Impact Report, Green Seal confirmed that Green Seal–certified cleaning products protected 9.8 million students and teachers from harmful chemicals and asthma triggers in 2023, and saved an estimated 192 million pounds of plastic through certified sustainable packaging across the US cleaning sector.

Focus on Customization and Specialized Cleaning Solutions

Customization is emerging as a key trend in the North America Industrial Cleaning Products Market. Companies are now offering specialized cleaning solutions tailored to the specific needs of various industries. Industries such as aerospace, pharmaceuticals, and healthcare require cleaning products designed for unique cleaning challenges. These solutions ensure that cleaning tasks are carried out effectively while maintaining industry standards. The trend towards providing customized products is expected to grow as companies continue to focus on meeting specialized needs, thus expanding the market’s reach.

Market Challenges Analysis:

Stringent Regulatory and Compliance Standards

The North America Industrial Cleaning Products Market faces challenges due to stringent regulatory and compliance standards. The cleaning products must adhere to various safety, environmental, and health regulations, which increases the complexity of production. Compliance with these regulations requires manufacturers to invest in research, testing, and certification. These costs can create barriers to entry for new players and strain existing manufacturers. The ever-evolving regulatory landscape adds uncertainty to the market, forcing companies to adapt constantly to maintain product approval and avoid penalties.

Increasing Competition and Price Sensitivity

Intense competition within the North America Industrial Cleaning Products Market poses a challenge to market participants. Companies are under pressure to maintain competitive pricing while offering high-quality products. Price sensitivity among consumers, especially in price-driven industries, forces companies to adjust their pricing strategies. This leads to reduced profit margins for manufacturers, particularly in sectors with thin margins. To stay competitive, businesses must innovate while managing costs effectively, which can be challenging amidst growing market saturation.

Market Opportunities:

Expansion in Emerging Industrial Sectors

The North America Industrial Cleaning Products Market presents opportunities in emerging industrial sectors, such as the cannabis industry and biotechnology. These sectors require specialized cleaning products due to their unique processes and environments. As these industries expand, the demand for effective and compliant cleaning solutions is expected to increase. Companies that can provide targeted cleaning products for these growing markets stand to benefit from the expanding customer base. This opportunity allows market players to diversify their offerings and tap into new revenue streams.

Rising Adoption of E-commerce Sales Channels

The growing adoption of e-commerce platforms presents an opportunity for the North America Industrial Cleaning Products Market to expand its reach. E-commerce allows manufacturers to tap into a broader consumer base, especially in the small business and individual sectors. It enables companies to offer a wider range of products and increase sales through online platforms. The convenience of online shopping, coupled with the ability to deliver bulk cleaning products to various industries, opens new avenues for growth. E-commerce will likely play an increasingly significant role in the market’s future.

Market Segmentation Analysis:

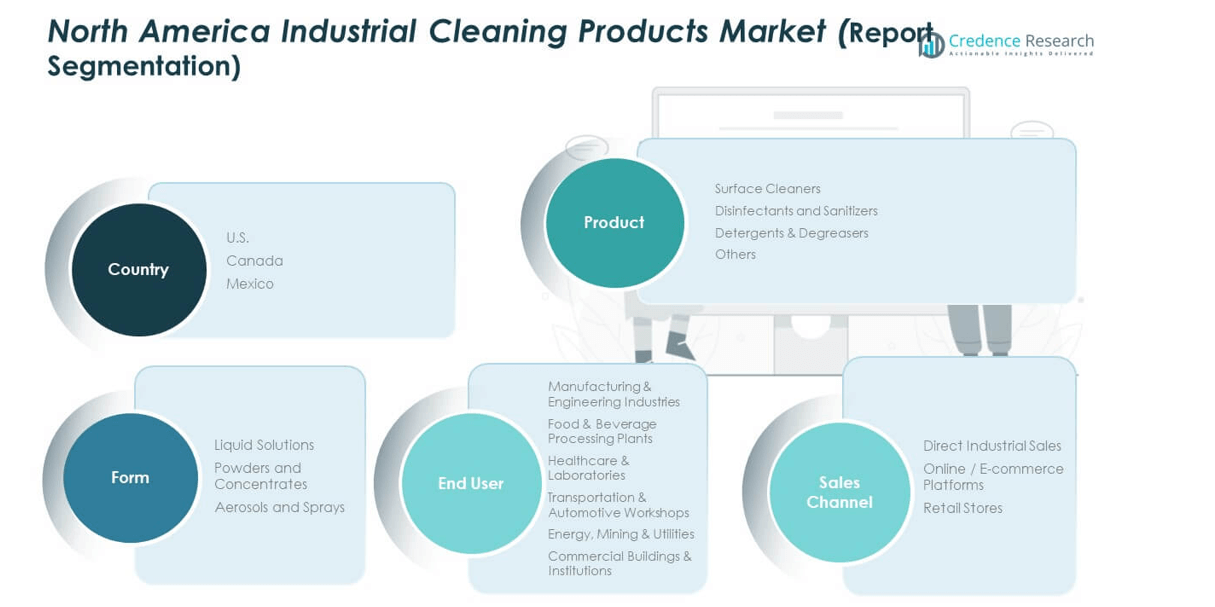

By Product Type

The North America Industrial Cleaning Products Market is segmented into surface cleaners, disinfectants and sanitizers, detergents and degreasers, and others. Surface cleaners account for a significant share as they are widely used across various industries for everyday cleaning. Disinfectants and sanitizers are in demand due to rising hygiene standards in healthcare and food industries. Detergents and degreasers are essential for industries requiring intensive cleaning, such as automotive and manufacturing. Other products in the market include specialized cleaners for niche applications like laboratories and electronics.

- For instance, Ecolab’s Sink & Surface Cleaner Sanitizer is designed to eliminate the need for rinsing, improving cleaning efficiency in foodservice operations. The product is part of Ecolab’s broader efforts to reduce labor requirements and enhance operational productivity in North American foodservice deployments.

By Form

In the North America Industrial Cleaning Products Market, cleaning products are available in liquid solutions, powders and concentrates, and aerosols and sprays. Liquid solutions are the most commonly used form, offering ease of application for various cleaning tasks. Powders and concentrates are gaining popularity as they offer cost-effective solutions, especially in large-scale industrial operations. Aerosols and sprays are preferred for precision cleaning, particularly in applications where surface contamination needs to be minimized, such as in electronics manufacturing.

- For instance, Diversey’s disinfectant liquids, such as those tested under EN 1276, have been independently certified to achieve at least a 5-log reduction (99.999% reduction) in bacterial load including pathogens like Staphylococcus aureus and E. coli within a 5-minute contact time, as validated in quantitative suspension testing.

By End User

The North America Industrial Cleaning Products Market serves a diverse range of end users, including manufacturing and engineering industries, food and beverage processing plants, healthcare and laboratories, transportation and automotive workshops, energy, mining, and utilities, and commercial buildings and institutions. The manufacturing sector requires cleaning products for maintaining machinery and workspaces. The food and beverage industry prioritizes hygiene, driving demand for specialized cleaners. Healthcare and laboratory facilities require highly effective disinfectants. Automotive workshops demand heavy-duty degreasers, while the energy and mining sectors require industrial-strength cleaners for maintenance.

By Sales Channel

Sales channels for industrial cleaning products include direct industrial sales, online/e-commerce platforms, and retail stores. Direct sales are common in large-scale industrial environments, where companies purchase in bulk. Online and e-commerce platforms are gaining traction as businesses increasingly prefer the convenience and variety offered by online shopping. Retail stores cater to smaller businesses and consumers, providing cleaning products for less intensive applications. Each sales channel serves a unique segment, ensuring that industrial cleaning products reach a broad range of customers across North America.

Segmentation

By Product Type

- Surface Cleaners

- Disinfectants and Sanitizers

- Detergents & Degreasers

- Others

By Form

- Liquid Solutions

- Powders and Concentrates

- Aerosols and Sprays

By End User

- Manufacturing & Engineering Industries

- Food & Beverage Processing Plants

- Healthcare & Laboratories

- Transportation & Automotive Workshops

- Energy, Mining & Utilities

- Commercial Buildings & Institutions

By Sales Channel

- Direct Industrial Sales

- Online / E-commerce Platforms

- Retail Stores

Regional Analysis

United States

The United States holds the dominant share of the North America Industrial Cleaning Products Market, accounting for approximately 75% of the region’s total market value. The country’s large industrial base, including manufacturing, automotive, and food processing sectors, drives high demand for industrial cleaning products. Stringent regulatory standards regarding cleanliness and safety in workplaces further contribute to the market’s growth. The U.S. also leads the adoption of innovative cleaning solutions, such as automated cleaning systems and eco-friendly products. Its established infrastructure and significant market size make it the key contributor to the market’s expansion in North America.

Canada

Canada represents a smaller, yet growing, portion of the North America Industrial Cleaning Products Market, holding around 18% of the regional market share. Canada’s industrial sectors, such as mining, oil and gas, and healthcare, require efficient cleaning solutions to meet high hygiene standards. The country’s focus on sustainability and environmental regulations encourages the adoption of green cleaning products. Canada’s expanding manufacturing industry and its investment in infrastructure are likely to increase demand for industrial cleaning products in the coming years, especially as industrial activities continue to expand.

Mexico

Mexico accounts for the remaining 7% of the North America Industrial Cleaning Products Market. The country’s industrial sector, primarily focused on manufacturing and automotive, is growing rapidly, driving demand for cleaning solutions. Mexico’s proximity to the United States and its trade agreements with North American countries further support the market’s growth potential. The rise of industrial parks and foreign direct investment in the country contributes to increased demand for effective and efficient industrial cleaning solutions. As these industries continue to expand, Mexico is expected to experience steady growth in its industrial cleaning products market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Dow Inc.

- Clariant AG

- Evonik Industries AG

- Solvay SA

- Stepan Company

- Ecolab Inc.

- 3M

- Zep, Inc.

- Buckeye International, Inc.

- Other Key Players

Competitive Analysis

The North America Industrial Cleaning Products Market is highly competitive, with several key players dominating the landscape. Companies such as Ecolab, Diversey Holdings, and SC Johnson Professional lead the market, offering a wide range of cleaning solutions designed to meet the diverse needs of industries like manufacturing, food processing, and healthcare. Ecolab stands out for its comprehensive suite of cleaning and sanitation products, while Diversey is known for its innovative green cleaning solutions that align with sustainability trends. SC Johnson Professional has made significant strides with its focus on environmentally safe cleaning products. The market also includes regional players like Spartan Chemical Company, Inc. and Kimberly-Clark Professional, who focus on delivering customized cleaning products for niche applications. Competition is intensifying due to the increasing demand for sustainable and technologically advanced cleaning solutions. As environmental concerns grow, companies are investing in eco-friendly product lines to align with regulations and customer preferences for green alternatives. Innovations in cleaning technologies, such as automated and robotic cleaning systems, are helping companies differentiate themselves. Key players are also focusing on expanding their distribution networks through direct sales, e-commerce platforms, and retail partnerships to enhance product accessibility.

Recent Developments

- In November 2025, Ecolab Inc. announced an expansion of its exclusive partnership with The Home Depot, rolling out the Ecolab Scientific Clean product line at more than 180 Home Depot locations across Canada and online. This initiative brings nine new cleaning products—ranging from degreasers and bathroom cleaners to pressure wash concentrates and floor care solutions—targeted at commercial, industrial, and residential end users seeking high-performance, professional-grade cleaning options.

- In November 2025, Solenis completed the acquisition of NCH Corporation, further strengthening its position in the industrial cleaning products landscape in North America. This strategic move integrates NCH’s expertise and product portfolio into Solenis, enhancing its solutions for hygiene, cleaning, and water management across the region.

- In October 2025, SuperKlean Washdown Products formally launched NozzlePro, a new division with a fully operational online store offering industrial spray nozzles ready for immediate shipment throughout North America. NozzlePro extends SuperKlean’s reach into the spray nozzle market and meets the demand for quick delivery and specialized product support from industrial customers in sectors such as food processing and beverage production.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, End User and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The North America Industrial Cleaning Products Market will continue to grow, driven by stringent regulations across industries.

- Innovation in eco-friendly and sustainable cleaning solutions will propel the demand for green products.

- Technological advancements in automated cleaning solutions will reshape the market, improving efficiency and reducing labor costs.

- The increasing adoption of e-commerce platforms for product distribution will expand market accessibility.

- Demand for multi-purpose cleaning products will rise due to their cost-effectiveness and versatility across industries.

- The manufacturing sector will remain a key growth driver, particularly with the expansion of industrial activities in the U.S. and Canada.

- The market will witness an uptick in customized cleaning solutions designed to meet specific industrial needs.

- Healthcare and food processing industries will continue to drive demand for high-standard disinfectants and sanitizers.

- Rising awareness about hygiene and workplace cleanliness will further fuel product adoption in non-traditional sectors.

- Increased focus on sustainability, alongside regulatory pressures, will encourage continuous innovation in the cleaning product formulations.