Market Overview

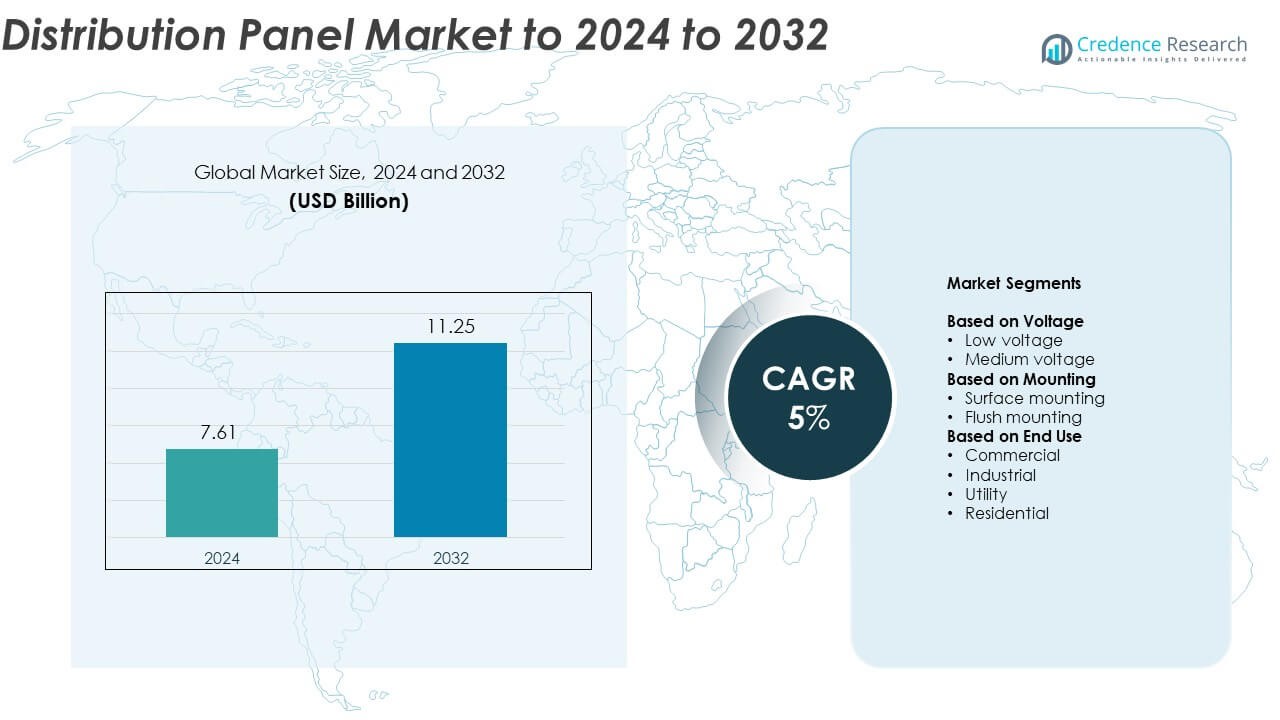

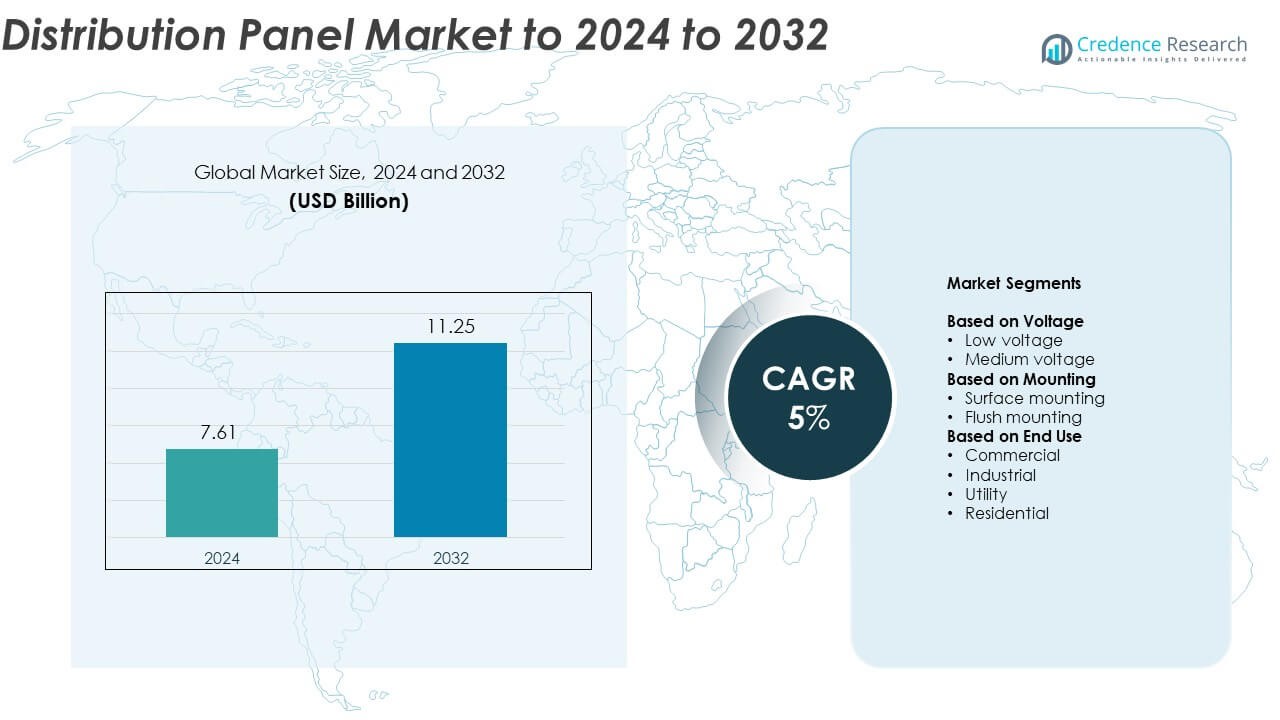

The distribution panel market size was valued at USD 7.61 billion in 2024 and is anticipated to reach USD 11.25 billion by 2032, at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Distribution Panel Market Size 2024 |

USD 7.61 Billion |

| Distribution Panel Market, CAGR |

5% |

| Distribution Panel Market Size 2032 |

USD 11.25 Billion |

The distribution panel market is dominated by major players such as Siemens, ABB, Schneider Electric, Eaton, and General Electric, which collectively account for a significant share due to their strong product portfolios and global presence. These companies focus on digitalized power management solutions, energy efficiency, and smart grid compatibility to maintain their leadership. North America leads the global market with approximately 34.7% share in 2024, supported by large-scale industrial automation and grid modernization projects. Europe follows with 27.9% share, driven by strict energy regulations, while Asia Pacific, holding 29.3% share, is emerging as the fastest-growing region fueled by rapid urbanization and expanding industrial infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The distribution panel market was valued at USD 7.61 billion in 2024 and is projected to reach USD 11.25 billion by 2032, growing at a CAGR of 5%.

- Growing demand for reliable power infrastructure, industrial automation, and renewable energy integration is driving market growth worldwide.

- Smart and digital distribution panels are gaining traction as industries focus on efficiency, real-time monitoring, and predictive maintenance solutions.

- The market is moderately consolidated, with leading players focusing on product innovation, sustainability, and regional expansion to strengthen competitiveness.

- North America leads with 34.7% share, followed by Europe at 27.9%, and Asia Pacific at 29.3%, while the low voltage segment dominates with nearly 63.4% share in 2024.

Market Segmentation Analysis:

By Voltage

The low voltage segment dominates the distribution panel market, accounting for nearly 63.4% share in 2024. This segment’s leadership is driven by widespread adoption in residential, commercial, and light industrial applications due to its safety, compactness, and ease of installation. Increasing urban infrastructure projects and smart building developments further boost demand for low voltage panels. Manufacturers are enhancing product designs with digital monitoring and circuit protection features to improve energy efficiency and operational reliability across distributed networks.

- For instance, Siemens P1 panelboards offer up to 66 one-pole circuits and a maximum bus rating of 400 A, supporting low-voltage distribution in compact enclosures.

By Mounting

The surface mounting segment leads the market with around 57.6% share in 2024. Its dominance is attributed to its simple installation, cost efficiency, and suitability for both new and retrofit construction projects. The segment benefits from rising adoption in industrial facilities and commercial complexes where accessibility and maintenance convenience are key. Growing use in modular electrical systems and energy-efficient building designs supports its continued growth, as surface-mounted panels provide flexible configurations that meet diverse voltage and load requirements.

- For instance, The Schneider Pulse smart panel offers 36 usable spaces within a 200 A main panel and 225 A busbar rating, supporting up to 145 A of solar backfeed in the CSED model.

By End Use

The industrial segment holds the largest share, representing approximately 39.8% of the distribution panel market in 2024. This segment’s growth is propelled by expanding manufacturing activities, automation integration, and increasing demand for stable power distribution in production facilities. Industries such as oil and gas, automotive, and food processing require reliable electrical systems to ensure operational safety and reduce downtime. Advancements in smart monitoring technologies and integration with IoT-based energy management systems continue to strengthen industrial adoption worldwide.

Key Growth Drivers

Rising Demand for Reliable Power Infrastructure

The growing need for stable and uninterrupted electricity in residential, industrial, and commercial sectors is a major driver of the distribution panel market. Rapid urbanization and infrastructure expansion in developing economies have increased the demand for advanced electrical distribution systems. Governments are investing in grid modernization and smart city projects, further accelerating installations. The shift toward electrification of transportation and renewable energy integration has also strengthened the requirement for efficient distribution panels that ensure safety, scalability, and continuous power flow.

- For instance, Leviton load centers are designed to be “solar-ready” with a standard 225 A bus rating across the line, and are available in models providing 42 spaces, making them suitable for accommodating service upgrades in modern grid-modernization projects.

Expansion of Industrial Automation and Manufacturing

The increasing adoption of automation across industries is fueling demand for advanced distribution panels capable of supporting intelligent control systems. Modern factories rely on precise electrical management for robotics, machinery, and process control systems. The rise of Industry 4.0 and industrial IoT has driven manufacturers to integrate smart panels equipped with sensors and remote monitoring features. These systems enhance operational efficiency and energy management, supporting long-term cost savings and improved reliability across production and assembly environments.

- For instance, WAGO’s PFC200 controller includes two Ethernet ports plus RS-232/RS-485 and supports the 750/753 I/O series for factory integration.

Growth in Renewable Energy Projects

The rapid expansion of renewable energy sources such as solar and wind power has boosted the demand for efficient distribution panels. These systems are essential for managing energy generation, storage, and load balancing within hybrid and grid-connected systems. Global sustainability goals and government incentives for clean energy deployment have accelerated installations across utility and commercial sectors. Distribution panels designed for renewable integration ensure stable energy flow and protection against fluctuations, supporting a more resilient and sustainable power infrastructure.

Key Trends & Opportunities

Integration of Smart and Digital Technologies

The adoption of intelligent distribution panels equipped with IoT sensors and digital control systems is a rising trend in the market. These panels enable real-time monitoring, predictive maintenance, and data-driven energy optimization. Utilities and facility managers are investing in smart panels to enhance power reliability and efficiency while reducing operational costs. The integration of cloud-based analytics and automation platforms presents significant opportunities for market players to develop innovative, connected solutions aligned with modern energy management practices.

- For instance, Phoenix Contact EMpro meters measure LV parameters up to 690 V and communicate via Modbus/TCP, PROFINET, or EtherNet/IP for real-time monitoring.

Rising Focus on Energy Efficiency and Sustainability

Growing emphasis on green building standards and energy-efficient electrical systems is shaping the distribution panel market. Manufacturers are designing eco-friendly panels that reduce energy losses and improve system performance. The adoption of low-emission materials and recyclable components aligns with sustainability goals across industrial and commercial projects. Increasing implementation of energy codes and certification programs, such as LEED and BREEAM, further promotes demand for high-efficiency panels that support sustainable infrastructure development worldwide.

- For instance, ABB reports that its digital low-voltage distribution solutions, including ABB Ability Energy and Asset Manager, can help reduce maintenance costs by up to 40% and improve operational efficiency (or reduce operating/energy costs) by up to 30%.

Key Challenges

High Installation and Maintenance Costs

The high initial investment associated with advanced distribution panels remains a major challenge for widespread adoption, especially in small-scale industries and residential projects. Installation often requires skilled labor, compliance with safety regulations, and specialized equipment, which adds to overall costs. Maintenance expenses also increase due to the complexity of modern systems incorporating digital and smart components. This cost barrier can delay upgrades and replacements, particularly in regions with limited capital infrastructure investment.

Fluctuating Raw Material Prices and Supply Chain Constraints

Volatility in the prices of raw materials such as copper, aluminum, and steel significantly impacts production costs for distribution panels. Supply chain disruptions caused by geopolitical issues and transportation delays have further increased procurement challenges. Manufacturers face difficulties in maintaining price stability and meeting delivery schedules. These fluctuations affect profit margins and limit scalability, prompting the industry to explore alternative materials and localized sourcing strategies to mitigate dependency and ensure consistent supply.

Regional Analysis

North America

North America dominates the distribution panel market, accounting for around 34.7% share in 2024. The region’s growth is driven by strong investments in grid modernization, industrial automation, and renewable energy projects. The United States leads the market due to the rapid adoption of smart panels in commercial and residential sectors. Increasing replacement of outdated electrical systems and expansion of data centers further support market expansion. Canada also contributes significantly with sustainable building initiatives and growing focus on clean energy integration, enhancing regional demand for efficient and digital distribution panels.

Europe

Europe holds approximately 27.9% share of the distribution panel market in 2024, supported by strict energy efficiency regulations and widespread electrification across industries. Countries such as Germany, France, and the United Kingdom are leading adopters of advanced electrical infrastructure. The push toward renewable energy and smart grid deployment has increased demand for intelligent power distribution solutions. Investments in sustainable housing and EV charging infrastructure are further strengthening growth. The region’s commitment to achieving carbon neutrality continues to drive innovation in eco-friendly and high-performance distribution panel systems.

Asia Pacific

Asia Pacific accounts for nearly 29.3% share of the distribution panel market in 2024 and is projected to witness the fastest growth through 2032. Rapid urbanization, industrial development, and infrastructure expansion across China, India, and Japan are major factors driving demand. Growing investments in manufacturing, commercial buildings, and power generation projects are fueling adoption. The increasing integration of renewable energy and smart city initiatives supports large-scale installations. Expanding construction activity and government programs for rural electrification further enhance market penetration across developing economies in the region.

Latin America

Latin America represents about 4.5% share of the distribution panel market in 2024. The region’s growth is supported by expanding power generation capacity and modernization of distribution networks. Brazil and Mexico lead due to rising industrialization and energy infrastructure upgrades. Renewable energy projects, particularly solar and wind, are contributing to the need for efficient power management systems. Growing investments in urban development and smart grid projects are expected to further boost demand, while local manufacturing and import partnerships improve accessibility and cost efficiency.

Middle East and Africa

The Middle East and Africa hold around 3.6% share in the global distribution panel market in 2024. The region is witnessing steady growth driven by large-scale construction projects, infrastructure expansion, and industrial diversification. Gulf countries are investing in energy-efficient and smart building solutions as part of their sustainability goals. Africa’s rising electrification initiatives and renewable energy deployment are also contributing to demand. Increasing government focus on grid reliability and adoption of digital power management solutions are expected to support long-term market growth across this region.

Market Segmentations:

By Voltage

- Low voltage

- Medium voltage

By Mounting

- Surface mounting

- Flush mounting

By End Use

- Commercial

- Industrial

- Utility

- Residential

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the distribution panel market is characterized by the presence of leading global and regional manufacturers such as Siemens, ABB, Schneider Electric, Eaton, General Electric, Legrand, Hager Group, Larsen & Toubro, alfanar Group, Abunayyan Holding, INDUSTRIAL ELECTRIC MFG, ESL POWER SYSTEMS, EAMFCO, Norelco, NHP, AGS, and Meba Electric. Market participants are focusing on product innovation, digital integration, and expansion of smart energy management solutions to strengthen their competitive positions. Companies are investing in automation and IoT-enabled technologies to enhance operational reliability and optimize power distribution efficiency. Strategic collaborations with utilities, construction firms, and industrial clients are helping players broaden their market presence. Emphasis on energy-efficient designs, compliance with safety standards, and sustainable manufacturing practices further drives differentiation. Continuous R&D investments, coupled with after-sales service expansion and localized production strategies, remain key to maintaining competitiveness in the evolving global distribution panel industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens

- ABB

- Schneider Electric

- Eaton

- General Electric

- Legrand

- Hager Group

- Larsen & Toubro

- alfanar Group

- Abunayyan Holding

- INDUSTRIAL ELECTRIC MFG

- ESL POWER SYSTEMS

- EAMFCO

- Norelco

- NHP

- AGS

- Meba Electric

Recent Developments

- In 2025, ABB launched an advanced low voltage power distribution solution geared towards AI-ready data centers, focusing on enhancing reliability, security, and efficiency.

- In 2024, Schneider Electric introduced the Easy9 Pro, an “affordable, dependable, and flexible final distribution solution” designed specifically for panel builders and contractors.

- In 2024, Siemens unveiled Electrification X as a new platform within its Siemens Xcelerator digital business platform to modernize the power grid and manage electrification.

Report Coverage

The research report offers an in-depth analysis based on Voltage, Mounting, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing demand for smart and digital distribution panels will drive future market expansion.

- Integration of IoT and AI technologies will enhance monitoring and predictive maintenance capabilities.

- Rapid industrial automation will continue to boost demand for advanced power distribution systems.

- Growing adoption of renewable energy sources will increase the need for efficient load management panels.

- Expanding infrastructure and urbanization projects in emerging economies will strengthen market growth.

- Manufacturers will focus on energy-efficient and eco-friendly panel designs to meet sustainability goals.

- Rising investments in grid modernization will create opportunities for high-performance distribution solutions.

- The residential sector will see greater adoption of compact and modular distribution panels.

- Increasing focus on safety standards and compliance will shape product innovation.

- Strategic partnerships and mergers will enhance global market presence and technology development.