Market Overview:

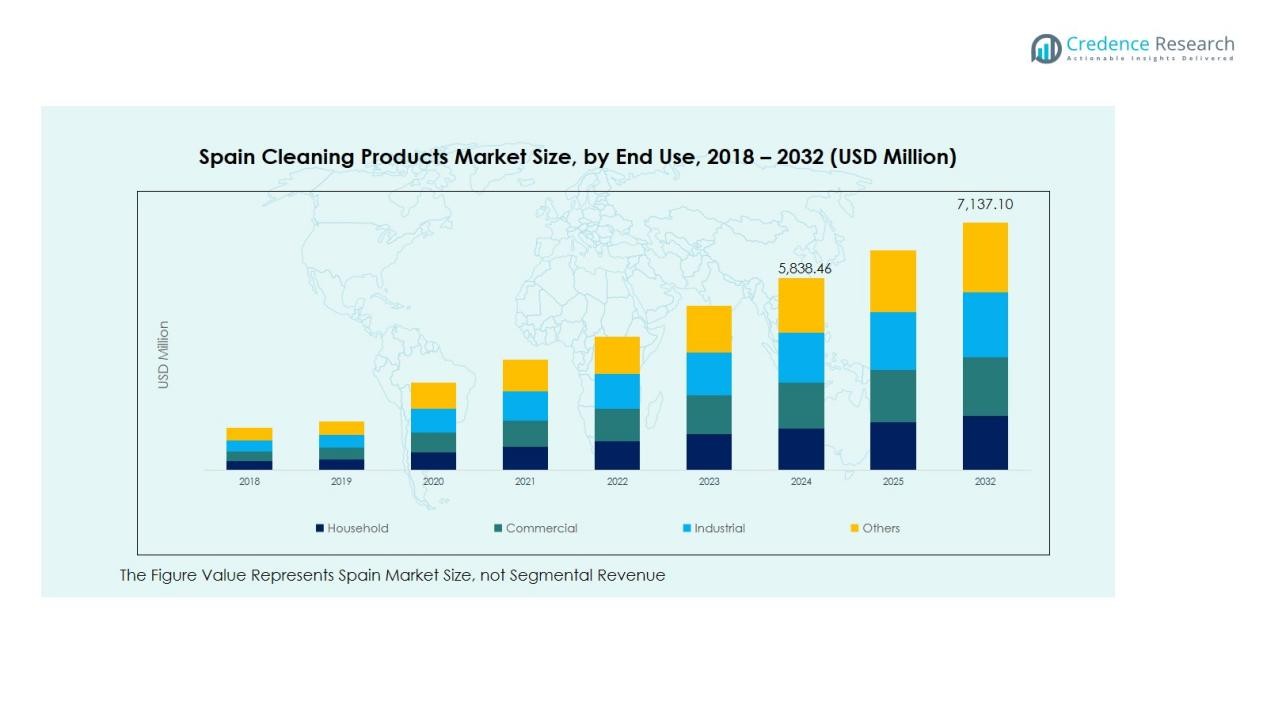

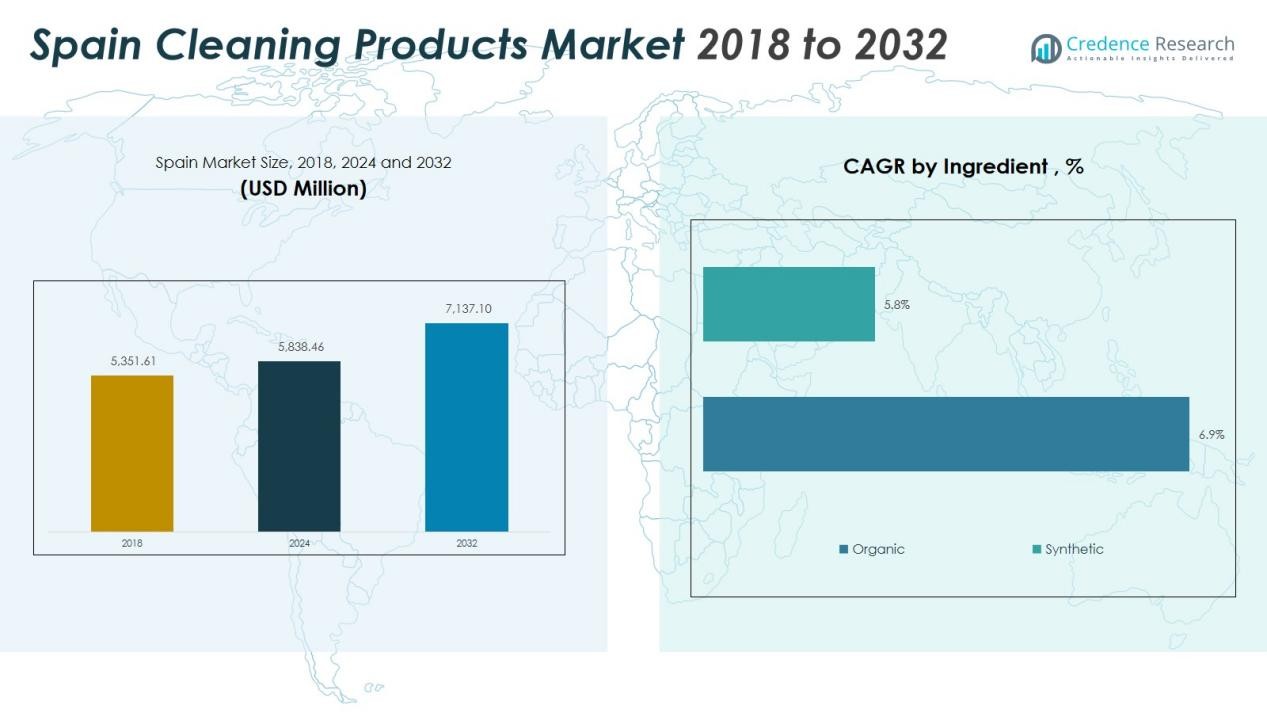

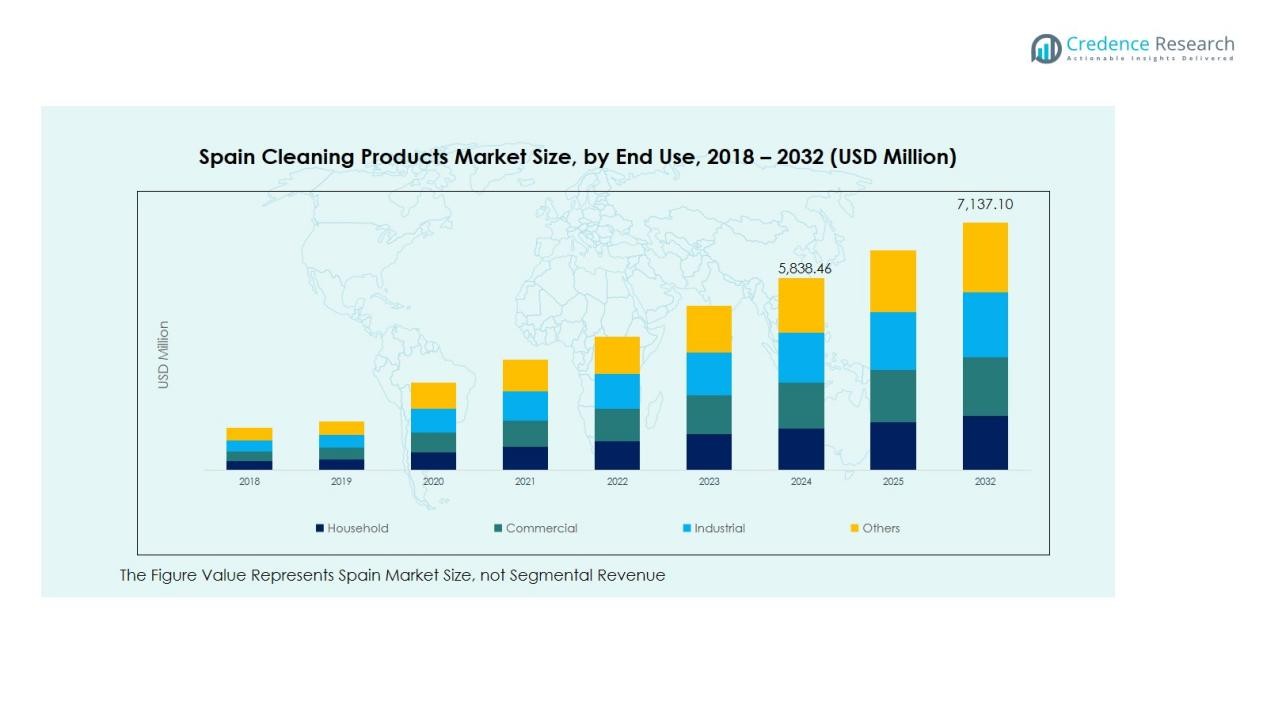

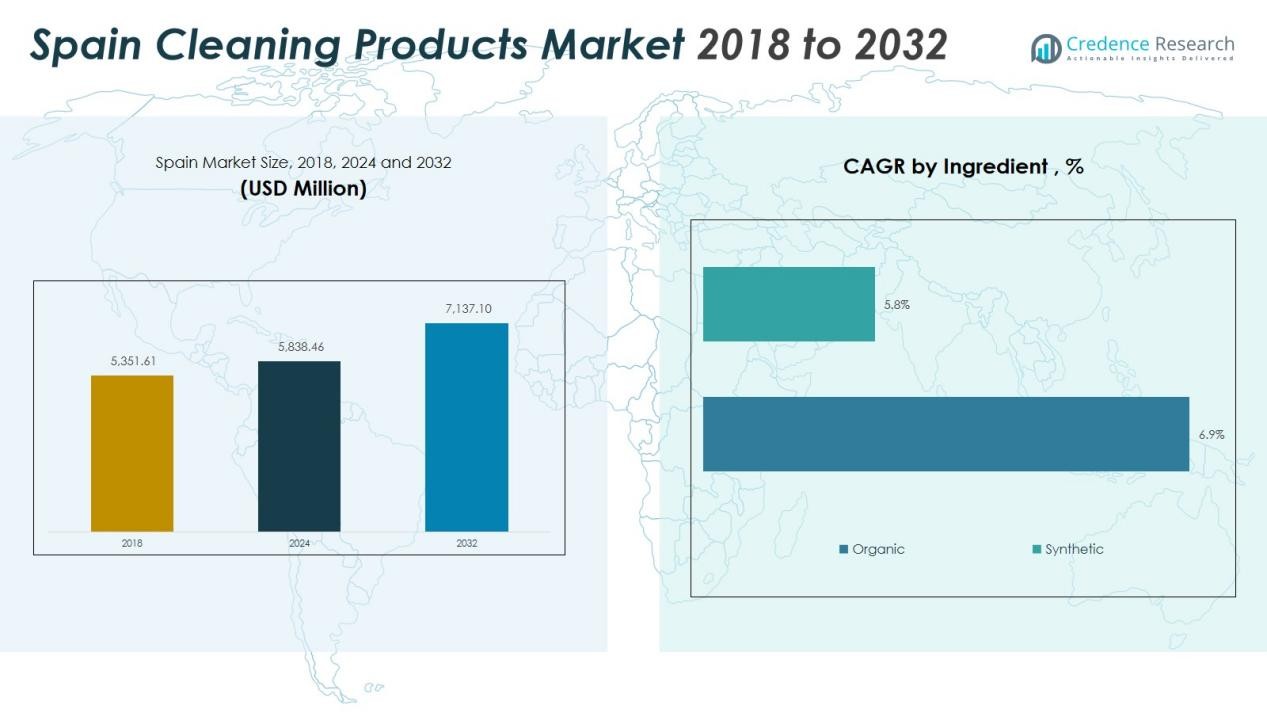

The Spain Cleaning Products Market size was valued at USD 5,351.61 million in 2018 to USD 5,838.46 million in 2024 and is anticipated to reach USD 7,137.10 million by 2032, at a CAGR of 2.54% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Cleaning Products Market Size 2024 |

USD 5,838.46 Million |

| Spain Cleaning Products Market, CAGR |

2.54% |

| Spain Cleaning Products Market Size 2032 |

USD 7,137.10 Million |

Key drivers of growth include heightened hygiene awareness, regulatory pressure, and a growing preference for sustainable cleaning solutions. Spanish consumers and institutions are increasingly opting for products with lower environmental impacts. Hygiene standards, particularly in the wake of the pandemic, continue to drive demand for surface disinfectants and laundry care products. Additionally, the institutional sector—spanning hospitality, healthcare, and public venues—is contributing to the market’s expansion as cleaning standards become more stringent.

Regionally, growth is concentrated in urban centers such as Madrid, Barcelona, and Valencia, where retail penetration and institutional cleaning demand are highest. Coastal areas see seasonal spikes in institutional cleaning chemicals, while inland regions witness steady growth in household cleaner demand as consumer income levels rise and eco-awareness increases. Northern and eastern regions are generally adopting natural and eco-friendly products faster than other areas.

Market Insights:

Market Insights:

- The Spain Cleaning Products Market was valued at USD 5,351.61 million in 2018 and is projected to reach USD 7,137.10 million by 2032, growing at a CAGR of 2.54% during the forecast period from 2024 to 2032.

- Madrid, Barcelona, and Valencia are the top regional markets, accounting for over 50% of the total market share. These regions dominate due to high population density, strong retail penetration, and institutional demand.

- The fastest-growing region is northern and eastern Spain, which is rapidly adopting natural and eco-friendly products. These regions are driven by increasing eco-awareness and rising disposable income.

- The surface cleaners segment holds the largest share in the Spain Cleaning Products Market, followed by dishwashing products. Surface cleaners dominate due to their everyday use across households and institutions, with a significant focus on hygiene.

- The household cleaning segment leads the market with a substantial share of over 60%, driven by strong consumer demand for household sanitizing solutions, especially post-pandemic. Commercial and industrial segments follow closely, catering to higher performance needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Hygiene Awareness Post-Pandemic

The Spain Cleaning Products Market has witnessed a surge in demand driven by increased hygiene awareness, particularly following the COVID-19 pandemic. The heightened focus on sanitation and cleanliness has encouraged both consumers and businesses to invest in cleaning solutions. This shift is especially notable in the institutional sector, including healthcare and hospitality, where strict hygiene protocols have become the norm. As consumers continue to prioritize health and safety, the market for cleaning products is expected to expand, especially in disinfectants and surface cleaners.

- For instance, Sanytol, a leading Spanish disinfectant manufacturer, has achieved 99.9% elimination of bacteria, fungi and viruses across its product portfolio, ensuring comprehensive microbial control that aligns with institutional sanitation standards.

Growing Preference for Eco-Friendly Products

Consumer preference for environmentally friendly cleaning products is becoming a key driver in the Spain Cleaning Products Market. There is a growing shift towards sustainable and natural formulations, driven by both consumer awareness and regulatory pressure. Spanish consumers are increasingly opting for products that are biodegradable, free of harmful chemicals, and packaged in eco-friendly materials. Manufacturers are responding by developing green products that cater to this demand, contributing to the market’s growth and innovation.

Stringent Regulatory Standards

Stricter regulations regarding hygiene and product safety are also fueling growth in the Spain Cleaning Products Market. Government policies and industry standards continue to enforce higher hygiene expectations, particularly in commercial sectors such as foodservice and healthcare. These regulations ensure that cleaning products meet specific performance standards, creating a demand for high-quality, effective products. Compliance with these regulations drives manufacturers to innovate and deliver products that cater to both regulatory needs and consumer preferences.

- For Instance, Ecolab offers EPA-registered antimicrobial surface cleaners, such as the Peroxide Multi Surface Cleaner and Disinfectant, which is a hospital disinfectant proven to achieve a 99.999% reduction (5-log kill) of certain bacteria (e.g., Staphylococcus aureus [MRSA], Listeria monocytogenes) with a 3-5 minute contact time in high-touch hospital settings.

Expansion of Retail Channels and E-Commerce

The expansion of retail channels, particularly the growth of e-commerce platforms, plays a significant role in the Spain Cleaning Products Market. Online shopping provides consumers with easy access to a wide range of cleaning products, from household to industrial cleaners, often at competitive prices. The convenience of online shopping, along with the ability to compare products and read reviews, has significantly impacted purchasing behavior. E-commerce platforms are becoming increasingly important as a distribution channel, further boosting market growth.

Market Trends:

Surge in Natural and Eco‑Friendly Formulations

The Spain Cleaning Products Market is seeing a clear pivot toward naturally derived ingredients and sustainable packaging. Manufacturers overhaul traditional formulas and introduce biodegradable surfactants and refill‑friendly containers. Consumers in Spain show strong preference for products that highlight environmental credentials and mild chemical composition. Retailers support this shift by dedicating shelf space to eco‑labels and promoting green assortments. The emphasis on cleaner, greener cleaning solutions drives both premiumisation and niche brand growth.

- For example, the Frosch brand, manufactured by Werner & Mertz, launched its first dishwashing liquid in a 100% Post-Consumer Recyclate (PCR) PET bottle in 2014 as part of its ‘Recyclate Initiative’.

Digital Commerce Expansion and Direct‑to‑Consumer Engagement

E‑commerce platforms fuel broader access and higher visibility for cleaning products across Spain. Online marketplaces host both legacy cleaning brands and agile start‑ups targeting younger consumers via social media. It becomes easier for manufacturers to gather user feedback, experiment with limited‑edition drops and tailor offers to regional demand patterns. Subscription models and bundle packs gain traction, enhancing repeat‑purchase behaviour. Meanwhile, brick‑and‑mortar channels evolve by offering click‑and‑collect and in‑store digital integrations to stay competitive in this changing landscape.

- For Instance, Amazon.es recorded e-commerce net sales of approximately US$4.6 billion in 2023 across all product categories, and its marketplace offerings include a wide variety of goods. Amazon reported having over 17,000 active Spanish SMEs selling on its platform as of 2024, though the product categories they primarily sell and their exact 2023 number are less specific.

Market Challenges Analysis:

High‑Cost Pressures and Raw Material Instability

The Spain Cleaning Products Market faces growing margin pressure thanks to rising input costs and supply disruptions. Manufacturers find it difficult to secure consistent access to raw materials, which leads to higher production expenses and potential formula compromises. Longer delivery times for key ingredients sometimes force producers to delay product launches or scale back output. Price sensitivity among consumers limits the ability to fully pass on higher costs, which squeezes profitability. Some smaller brands struggle to maintain competitive pricing while meeting quality standards.

Intense Price Competition and Regulatory Burdens

It proves challenging for companies in the Spain Cleaning Products Market to thrive amidst aggressive competition from low‑cost or informal players. Many smaller suppliers operate without full compliance to chemical or safety regulations, placing regulated brands at a disadvantage. Strict regulation around cleaning products—covering ingredient approval, labelling and disposal—adds complexity and raises operational costs. Meeting such compliance requirements slows innovation and restricts rapid product development. Established companies must balance regulatory investments with the need to maintain competitive pricing and protect brand value.

Market Opportunities:

Emergence of Premium Eco‑Sustainable Cleaning Solutions

The Spain Cleaning Products Market presents rich potential for premium eco‑sustainable offerings that align with growing consumer demand for reduced environmental impact. Brands can focus on biodegradable ingredients, minimal‑waste packaging and refill systems to meet rising expectations. It opens opportunities for niche brands to differentiate through high‑performance “green” credentials and premium pricing. Retailers can allocate dedicated space for eco‑certified ranges, while manufacturers partner with material science innovators to deliver effective yet sustainable formulas. Expanding the green category also enables entry into export markets where Spanish formulations hold regional appeal.

Professional and Institutional Segment Expansion

The Spain Cleaning Products Market also benefits from growth in commercial, hospitality and healthcare cleaning needs. Organizations seek validated surface‑sanitisation solutions, traceable supply‑chains and service models with hygiene compliance embedded. It allows manufacturers to develop tailored B2B lines, introduce subscription‑based replenishment and integrate digital monitoring of usage. Strategic alliances with cleaning‑service providers and facility‑management firms can secure large volume contracts and lock‑in brand loyalty. The institutional focus supports scale, higher margins and longer‑term partnerships, presenting a decisive growth pathway for ambitious market players.

Market Segmentation Analysis:

By Product Type

The market segments by product type include surface cleaners, toilet cleaners, glass & metal cleaners, floor cleaners, fabric cleaners, dishwashing products and others. Surface cleaners hold a leading share owing to their broad daily use and hygiene focus. Toilet and floor cleaners gain traction through regular sanitation routines. Dishwashing products and fabric cleaners advance through niche innovations and value‑added features. Other categories—such as building cleaners and personal‑care cleaners—also offer incremental growth paths.

- For Instance, Procter & Gamble’s Mr. Clean Antibacterial Cleaner reduces bacteria counts by 99.9% on hard, non-porous surfaces when used as directed, which includes a 10-minute contact time for disinfecting against certain bacteria.

By Ingredient

The ingredient segmentation splits into organic and synthetic formulations. Synthetic products currently dominate based on cost and performance reliability. Organic or naturally derived formulations are gaining ground, driven by consumer and regulatory preference for safer, sustainable elements. It remains critical for manufacturers in Spain to adapt formulations, reduce harmful chemical load and shift packaging to match growing eco‑conscious demand. This shift presents both challenges and opportunities in the market.

- For Instance, Soria Natural, a Spanish natural medicine company, was established in 1987, although its founder began working with medicinal plants in 1982. The company describes its product catalog as containing more than 800 natural references, primarily formulated with plant-based medicinal ingredients.

By End‑Use

End‑use segmentation comprises household, commercial and industrial applications. The household segment offers extensive volume, given the proliferation of home‑care routines and increased hygiene consciousness. Commercial end‑use—including hospitality, healthcare and retail—drives demand for high‑performance cleaning solutions and contracts. The industrial segment caters to manufacturing and large‑scale facilities, requiring tailored cleaning chemicals and services. It remains important for companies to tailor offerings across these end‑use categories to maximise coverage.

Segmentations:

By Product Type Segment:

- Surface cleaners

- Toilet cleaners

- Glass & metal cleaners

- Floor cleaners

- Fabric cleaners

- Dishwashing products

- Others (personal care cleaners, building cleaner, etc.)

By Ingredient Segment:

By End-use Segment:

- Household

- Commercial

- Industrial

- Others

By Price Range Segment:

Regional Analysis:

Northern and Central Spain – Urban Concentration and Premium Demand

The market in the northern and central regions of Spain shows strong demand for premium cleaning solutions in urban centres. High‑income consumers and dense urban populations in areas such as Madrid and the Basque Country drive uptake of eco‑friendly and high‑performance cleaning products. Retailers in these regions tend to carry broader product assortments, and brands respond with targeted launches and local marketing. The Spain Cleaning Products Market benefits here from strong infrastructure, rapid e‑commerce penetration and a willingness to pay for quality. Manufacturers aiming for premium positioning should focus efforts on these zones.

Coastal and Tourism‑Driven Markets – Seasonal Peaks and Institutional Usage

Spain’s coastal regions, especially around Barcelona, Valencia and the Andalusian coast, receive large tourist volumes and host extensive hospitality infrastructure. The influx of visitors injects higher seasonal demand for institutional and commercial‑grade cleaning chemicals such as surface disinfectants and floor cleaners. It provides growth opportunities for manufacturers serving hotels, vacation rentals and public venues. The cleaning products market in these zones tends to favour branded, bulk solutions that meet rigorous hygiene protocols. Firms should tailor regional strategies to accommodate tourist seasonality and institutional procurement.

Rural and Inland Spain – Price‑Sensitive and Value‑Focused Growth

In less densely populated inland and rural parts of Spain the demand leans toward economy and value segments of cleaning products. Homeowners in these areas prioritise cost‑effectiveness and basic utility more than premium features. Trade channels include hypermarkets and discount chains rather than boutique stores, so it is crucial to optimise packaging size, price tier and distribution reach. The Spain cleaning products market finds growth here through volume rather than margin, and brands that adapt to local buying behaviour gain traction. Targeting these segments helps achieve nationwide market coverage and complements urban premium strategies.

Key Player Analysis:

Competitive Analysis:

In the competitive landscape of the Spain Cleaning Products Market, four key players dominate. Henkel Ibérica SA, Persan SA, Kao Corporation SA, and Asevi Company S.L. lead through scale, brand recognition and innovation. Henkel Ibérica holds a strong presence through its global consumer‑brands unit, which extends home‑care and laundry offerings in Spain and leverages advanced innovation and sustainability capabilities. Persan SA maintains a competitive edge in domestic cleaning segments, especially laundry and dishwashing categories, and positions itself as a family‑owned Spanish leader in home‑care. Kao Corporation SA operates via its Spanish affiliate with investment in production sites and broad cleaning portfolio, combining global expertise with local execution. Asevi Company S.L. targets the value and niche eco‑friendly segment, emphasising vegan products, recycled packaging and scent differentiation to drive growth in off‑price and emerging channel segments. Each of these firms shows distinct strengths: Henkel in brand depth and R&D, Persan in local manufacturing scale, Kao in global reach, and Asevi in agility and green credentials.

Recent Developments:

- In October 2025, Henkel announced an expansion of its strategic partnership with Dow to decarbonize its adhesives portfolio by integrating low-carbon feedstocks and renewable electricity.

- In March 2025, Persan SA announced the acquisition of Mibelle Group from Migros, marking a significant step in expanding its international presence and advanced product offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Ingredient, End-use and Price Range. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for cleaning products will expand with heightened hygiene awareness across households and institutions.

- Eco‑friendly and biodegradable formulations will gain larger share of consumer preferences.

- Manufacturers will invest in refillable packaging and zero‑waste systems to meet sustainability expectations.

- E‑commerce channels will capture more volume with convenient delivery and click‑and‑collect services.

- Commercial and institutional segments—such as hospitality, healthcare and education—will offer significant growth opportunities.

- Brands will deploy advanced formulations with antimicrobial and multifunctional properties to meet stricter hygiene regulations.

- Regional strategies will differentiate: urban centres will favour premium products, while value lines will cater to rural markets.

- Collaboration between cleaning firms and smart‑home/IoT platforms will lead to connected and subscription‑based models.

- Smaller niche brands will disrupt traditional players with agile innovation and strong eco‑credentials.

- Global trade and export links will support Spanish manufacturers targeting neighbouring European markets and beyond.

Market Insights:

Market Insights: