Market Overview:

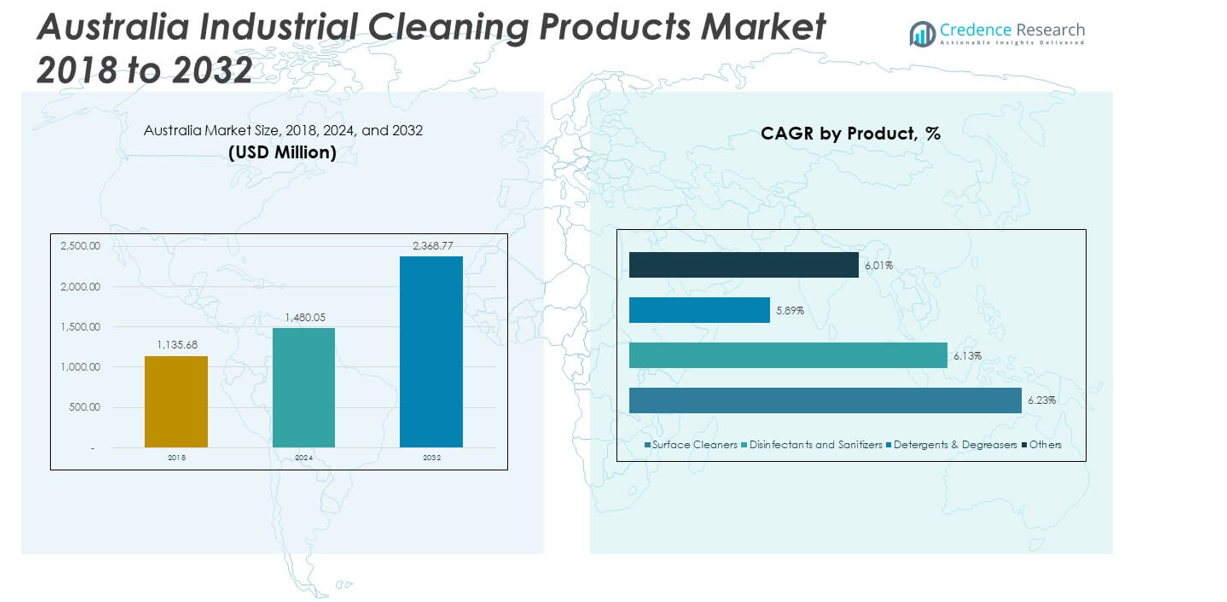

The Australia Industrial Cleaning Products Market size was valued at USD 1,135.68 million in 2018 to USD 1,480.05 million in 2024 and is anticipated to reach USD 2,368.77 million by 2032, at a CAGR of 6.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Industrial Cleaning Products Market Size 2024 |

USD 1,480.05 million |

| Australia Industrial Cleaning Products Market, CAGR |

6.05% |

| Australia Industrial Cleaning Products Market Size 2032 |

USD 2,368.77 million |

The market growth is driven by strong demand from manufacturing, food processing, and healthcare industries that require high hygiene standards. Increasing government regulations related to workplace safety and sanitation are also boosting product adoption. The focus on green and biodegradable cleaning agents continues to shape product development. Rising awareness about health and environmental sustainability among industrial operators supports consistent market expansion in Australia.

New South Wales and Victoria lead the market due to their strong industrial bases and large manufacturing clusters. Queensland and South Australia show steady growth with increasing demand from mining, energy, and defense sectors. Western Australia’s mining activities also contribute to notable product demand, while Tasmania exhibits gradual growth led by its food processing industry. Regional performance differences reflect varying industrial densities and sectoral priorities across the country.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia Industrial Cleaning Products Market was valued at USD 1,135.68 million in 2018, grew to USD 1,480.05 million in 2024, and is projected to reach USD 2,368.77 million by 2032, registering a CAGR of 6.05% during the forecast period.

- New South Wales holds the largest share at 25%, followed by Victoria with 20% and Queensland with 15%, due to their high industrial activity, strong manufacturing bases, and increasing adoption of advanced cleaning technologies.

- Western Australia is the fastest-growing region with a 12% share, supported by strong demand from the mining and energy sectors that require durable cleaning solutions for heavy industrial environments.

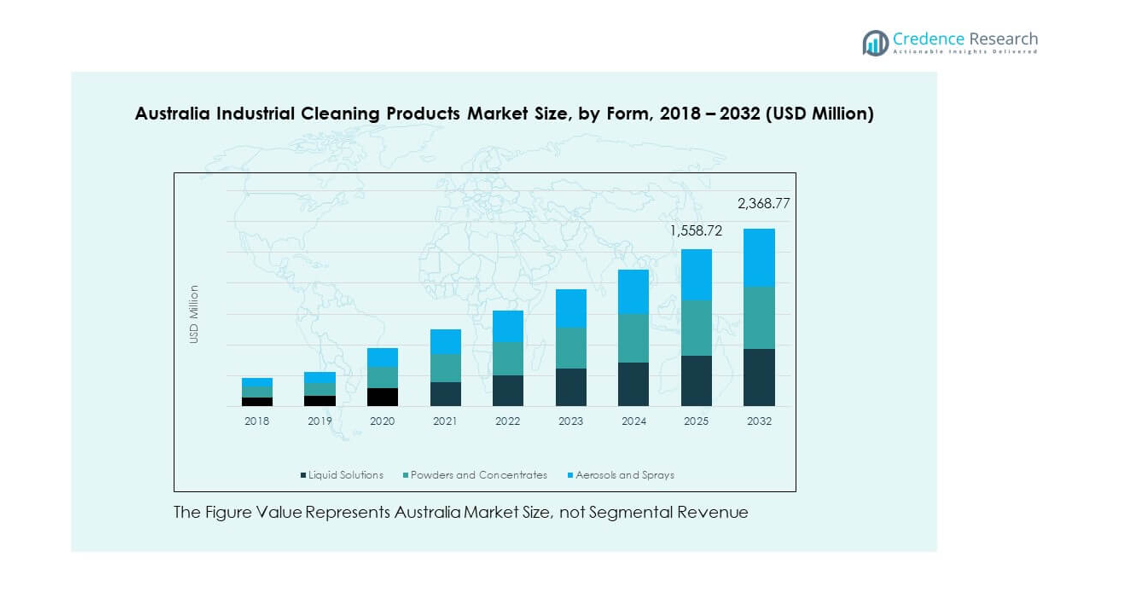

- Liquid solutions account for 50% of the market share, driven by widespread use in manufacturing and commercial facilities for their versatility and effectiveness.

- Powders and concentrates hold 30% of the share, gaining traction in large-scale operations where concentrated cleaning agents help reduce storage and transportation costs.

Market Drivers:

Rising Demand for Industrial Hygiene

The increasing need for industrial hygiene in various sectors is a major driver for the Australia Industrial Cleaning Products Market. Industries such as food processing, pharmaceuticals, and manufacturing prioritize cleanliness to comply with regulations and maintain operational efficiency. Hygiene standards are becoming stricter, leading businesses to invest in advanced cleaning products. This demand is further fueled by growing awareness about workplace safety and health. As companies strive to maintain safe working conditions, cleaning products play a crucial role in achieving these objectives.

Technological Advancements in Cleaning Equipment

The growing adoption of automated cleaning systems is reshaping the Australia Industrial Cleaning Products Market. The introduction of robotic cleaners, smart devices, and IoT-enabled equipment has enhanced cleaning efficiency. These technological advancements help businesses reduce labor costs, improve cleaning consistency, and achieve better results. Moreover, the integration of sensors in cleaning equipment enables real-time monitoring, ensuring the best cleaning practices are followed. This technological evolution is driving the demand for cleaning products that can complement automated systems.

- For instance, Kärcher’s KIRA B 50 autonomous scrubber dryer has a documented theoretical cleaning capacity of up to 2,365 m² per hour, according to official Kärcher specifications.

Stringent Regulatory Standards

Government regulations around industrial hygiene and workplace safety are pushing the demand for industrial cleaning products in Australia. Compliance with safety standards such as those set by WorkSafe Australia and other industry-specific bodies is critical for businesses. These regulations are designed to reduce health risks and environmental hazards in industrial settings. As more businesses adhere to these standards, the demand for high-quality, compliant cleaning products continues to rise. The enforcement of these regulations helps create a consistent market demand for industrial cleaning products.

- For instance, Diversey’s Oxivir disinfectant range is registered with the Australian Therapeutic Goods Administration (TGA) for use in healthcare and commercial settings, ensuring compliance with local regulatory standards.

Growing Focus on Sustainability

Environmental concerns are pushing businesses in Australia to opt for eco-friendly cleaning products. The increasing emphasis on sustainability has led to the development of green cleaning solutions that minimize environmental impact. Companies are focusing on reducing the carbon footprint of their operations, and as part of this initiative, they are switching to non-toxic and biodegradable cleaning products. This trend is contributing to the growth of the Australia Industrial Cleaning Products Market as businesses seek products that align with their sustainability goals.

Market Trends:

Shift Towards Green Cleaning Products

In the Australia Industrial Cleaning Products Market, there is a notable shift towards green and eco-friendly cleaning solutions. Consumers and businesses alike are increasingly aware of the environmental impact of traditional cleaning products. This awareness is driving demand for products that are biodegradable, non-toxic, and free from harmful chemicals. Many cleaning product manufacturers are reformulating their products to meet the growing demand for sustainable options. This trend is expected to grow, with more businesses adopting green cleaning solutions to align with environmental standards.

- For instance, Ecolab Australia launched Disinfectant 1 Wipe, a biodegradable wipe derived from wood pulp fibers, designed for effective surface disinfection while supporting sustainability initiatives in industrial and commercial settings.

Increased Adoption of Multi-Surface Cleaners

Multi-surface cleaners are becoming a preferred choice in the Australia Industrial Cleaning Products Market due to their versatility and efficiency. These products are capable of cleaning a wide range of surfaces, from floors and walls to machinery and equipment. Their ease of use and effectiveness in various industrial settings are driving their popularity. Businesses are increasingly looking for products that can streamline their cleaning processes and reduce the number of different cleaning solutions required. This trend towards multi-purpose products supports the market’s expansion as companies seek convenience and cost savings.

- For instance, companies like Seventh Generation and Method offer plant-based, biodegradable multi-surface cleaners, reflecting growing demand for sustainable cleaning solutions in commercial and industrial settings.

Demand for Specialized Cleaning Solutions

There is a growing demand for specialized cleaning products in industries with unique requirements, such as the healthcare and food processing sectors. The need for sanitizers, disinfectants, and other specialized cleaners that can effectively combat bacteria and viruses is increasing. These products are crucial in maintaining hygiene in sensitive environments where contamination risks are high. The Australia Industrial Cleaning Products Market is witnessing a rise in the development of products tailored for specific industry needs, driven by this demand for specialized solutions.

Digitalization of Cleaning Product Sales

Online platforms are playing a more prominent role in the distribution of industrial cleaning products in Australia. E-commerce websites and digital marketplaces are making it easier for businesses to purchase cleaning solutions from various brands. The convenience and accessibility of online shopping have led to a surge in demand for cleaning products through digital channels. This trend reflects the broader move towards digitalization in various industries, making online sales a key component of the Australia Industrial Cleaning Products Market.

Market Challenges Analysis:

Rising Competition from Global Brands

The Australia Industrial Cleaning Products Market faces increased competition from global brands offering similar products at competitive prices. While local manufacturers strive to differentiate themselves with innovative solutions, international players bring economies of scale and established reputations that make it difficult for smaller companies to compete. The challenge of maintaining market share and profit margins is becoming more pronounced as global brands continue to expand their reach into the Australian market. Local businesses must innovate and focus on quality to stand out in this competitive landscape.

Cost Pressures on Manufacturers

Manufacturers in the Australia Industrial Cleaning Products Market are facing cost pressures due to rising raw material prices and labor costs. This has led to higher production costs, which could affect profit margins. Companies are under pressure to find cost-effective solutions while maintaining product quality. Additionally, as environmental regulations tighten, businesses must invest in sustainable production practices, further increasing costs. These financial challenges create a difficult market environment for cleaning product manufacturers as they work to balance profitability with compliance and innovation.

Market Opportunities:

Growth in the Food Processing Sector

The increasing demand for cleaning products in the food processing sector presents a significant opportunity for the Australia Industrial Cleaning Products Market. As food safety standards become more stringent, manufacturers in this industry require specialized cleaning solutions to maintain hygiene and comply with regulations. The need for high-performance disinfectants and sanitizers in food processing plants is expected to grow. This offers substantial market potential for cleaning product manufacturers who can meet these specific requirements with effective, compliant solutions.

Technological Integration in Cleaning Products

There is a growing opportunity to integrate advanced technology into industrial cleaning products. The development of cleaning solutions that incorporate IoT, automation, and real-time data analysis is expected to enhance cleaning processes. These smart products can improve cleaning efficiency, reduce operational costs, and provide detailed insights into cleaning performance. Companies investing in the research and development of such high-tech products will be well-positioned to capture a share of the expanding Australia Industrial Cleaning Products Market.

Market Segmentation Analysis:

By Product Type

The Australia Industrial Cleaning Products Market includes various product types that cater to different cleaning needs. Surface cleaners are essential in maintaining cleanliness on various surfaces across industries, driving significant demand. Disinfectants and sanitizers are crucial for ensuring hygienic environments in sectors like healthcare and food processing. Detergents and degreasers are widely used in heavy industries to remove grease, oils, and stubborn dirt. Other cleaning products cater to niche markets, offering specialized solutions tailored to specific applications and industries.

- For example, Diversey’s Oxivir Tb disinfectant, leveraged in Australian hospitals, holds TGA (Therapeutic Goods Administration) registration for a 1-minute kill time against SARS-CoV-2 in accordance with EN 14476 testing protocols, with documentation available from the TGA registry and product specification sheets.

By Form

The market offers cleaning products in different forms to meet the diverse needs of industrial applications. Liquid solutions are the most commonly used form, offering ease of use and versatility. Powders and concentrates are gaining popularity due to their cost-effectiveness, particularly in large-scale operations. Aerosols and sprays provide convenience for cleaning smaller or more intricate areas, making them ideal for quick cleaning tasks. Each form serves different requirements depending on the scale and nature of the cleaning task at hand.

By End User

The Australia Industrial Cleaning Products Market serves a wide range of industries. The manufacturing and engineering sectors are among the largest users of industrial cleaning products due to the need for maintaining machinery and workspaces. Food and beverage processing plants require high levels of sanitation, driving demand for disinfectants and sanitizers. Healthcare facilities and laboratories also require specialized cleaning products to maintain sterile environments. Other sectors, such as automotive workshops, energy, mining, utilities, and commercial buildings, also contribute to the demand for industrial cleaning solutions.

- For instance, Whiteley Corporation’s Viraclean was recognized by the National Association of Testing Authorities (NATA) Australia for passing the AS/NZS 4269 standard by eliminating SARS-CoV-2 within 5 minutes on clinical surfaces, documented in NATA’s 2025 test result repository.

By Sales Channel

Sales channels in the Australia Industrial Cleaning Products Market include direct industrial sales, online platforms, and retail stores. Direct industrial sales remain a significant channel, as businesses prefer purchasing cleaning solutions directly from suppliers. Online sales platforms are becoming more popular due to the convenience and variety they offer. Retail stores also play a role, particularly in supplying smaller businesses or providing products for smaller-scale cleaning needs. These sales channels cater to different customer preferences and needs within the market.

Segmentation

By Product Type

- Surface Cleaners

- Disinfectants and Sanitizers

- Detergents & Degreasers

- Others

By Form

- Liquid Solutions

- Powders and Concentrates

- Aerosols and Sprays

By End User

- Manufacturing & Engineering Industries

- Food & Beverage Processing Plants

- Healthcare & Laboratories

- Transportation & Automotive Workshops

- Energy, Mining & Utilities

- Commercial Buildings & Institutions

By Sales Channel

- Direct Industrial Sales

- Online / E-commerce Platforms

- Retail Stores

Regional Analysis

New South Wales and Victoria

New South Wales (NSW) and Victoria are the leading regions in the Australia Industrial Cleaning Products Market, with a combined market share of approximately 45%. These regions host major industrial hubs, including manufacturing, food processing, and healthcare sectors, all of which are significant consumers of industrial cleaning products. NSW, home to Sydney, Australia’s financial and manufacturing center, sees a high demand for cleaning solutions in sectors that require stringent hygiene practices. Victoria, with Melbourne as a major manufacturing hub, also drives significant demand, especially in the automotive and food industries.

Queensland and South Australia

Queensland and South Australia together account for about 35% of the market share in the Australia Industrial Cleaning Products Market. Queensland, with its thriving mining and energy sectors, relies heavily on industrial cleaning products for equipment maintenance and operational safety. South Australia, known for its aerospace, defense, and manufacturing industries, experiences consistent demand for cleaning solutions, especially in specialized sectors requiring high standards of cleanliness. The growth of these regions’ industrial sectors is directly contributing to the increased demand for industrial cleaning products.

Western Australia and Tasmania

Western Australia and Tasmania make up the remaining 20% of the market. Western Australia, with its significant mining industry, is a key player in the industrial cleaning products market due to the need for cleaning equipment in harsh environments. Tasmania’s market share is relatively smaller but still notable, driven by the food processing and agricultural industries. The industrial sectors in these regions rely on efficient cleaning solutions to meet operational and safety standards. These areas show steady growth potential, though their demand remains smaller compared to the larger industrial hubs of NSW and Victoria.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- XO2

- Dow Inc.

- Gard Chemicals

- Evonik Industries AG

- Chemform

- Stepan Company

- Ecolab Inc.

- 3M

- BASF SE

- Agar Cleaning Systems Pty Ltd.

- Other Key Players

Competitive Analysis

The Australia Industrial Cleaning Products Market is highly competitive, with several key players offering a diverse range of cleaning solutions. Prominent companies such as SC Johnson Professional, Diversey Holdings Ltd, and Ecolab Inc. lead the market. SC Johnson Professional is well-regarded for its innovative, eco-friendly cleaning solutions, serving industries like healthcare, education, and hospitality. Diversey Holdings is a major player, offering a broad portfolio of industrial cleaning and hygiene solutions, particularly targeting the foodservice and healthcare sectors. Ecolab Inc. is another key competitor, known for its advanced cleaning systems and water treatment solutions, which are crucial in industries such as manufacturing and food processing. These companies compete on product innovation, quality, and compliance with regulatory standards. The market also sees competition from smaller local players that offer niche products tailored to specific industries. Price sensitivity and the demand for environmentally sustainable cleaning solutions drive competition, as businesses seek both cost-effective and environmentally friendly cleaning products. Companies are focusing on product differentiation, green solutions, and superior customer service to maintain a competitive edge in the market.

Recent Developments

- In November 2025, Evonik Industries AG finalized the divestment of its betaines business in Indonesia, but continues to emphasize its presence in the Australian market, particularly with its advanced and sustainable biosurfactant solutions.

- In June 2025, BASF SE entered a cooperation agreement with FUCHS to jointly deliver advanced flotation and dewatering solutions for Australia’s mining industry. This partnership combines BASF’s chemistry expertise with FUCHS’s on-ground presence and aims to enhance performance and service capability for industrial clients in Australia.

- In June 2024, Chemform, an Australian-owned cleaning chemicals manufacturer, enhanced its commitment to sustainability by introducing an updated line of environmentally friendly cleaning products and expanding its carbon-neutral initiatives.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, End User and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for eco-friendly and sustainable cleaning solutions will drive the market’s growth in the coming years.

- Technological innovations, such as automation in cleaning equipment, will continue to enhance product efficiency and expand the market.

- The food and beverage processing sector will be a major growth driver, with increasing regulatory standards for cleanliness.

- Rising awareness about workplace hygiene and safety will fuel the adoption of industrial cleaning products across various sectors.

- The trend toward multifunctional cleaning products that can serve multiple industries will support market diversification.

- E-commerce platforms will emerge as key sales channels, enabling wider distribution and access to cleaning solutions.

- The healthcare and pharmaceuticals industries will increasingly demand specialized cleaning products due to stricter hygiene requirements.

- Continuous product development, particularly in disinfectants and sanitizers, will cater to the growing need for enhanced sanitation solutions.

- Regional expansion and strategic collaborations by key players will open new market opportunities in untapped areas.

- Increasing government regulations and compliance requirements in various industries will further support the demand for industrial cleaning products.