Market Overview

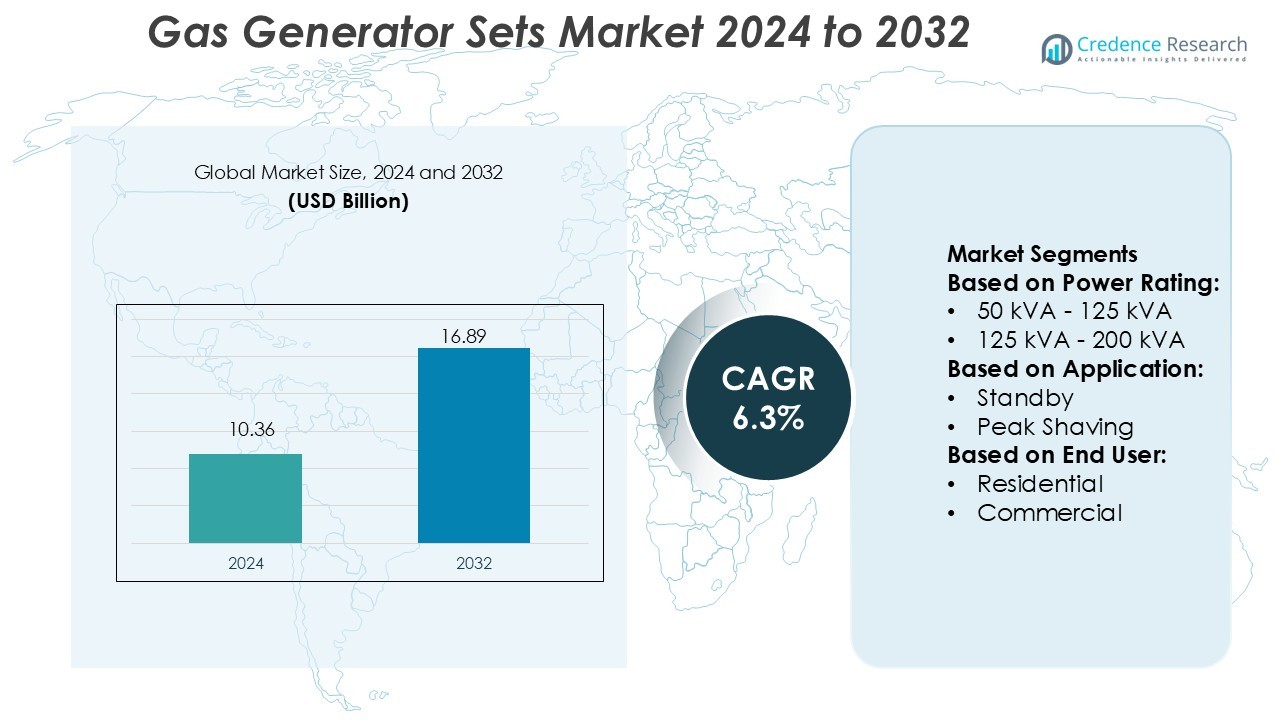

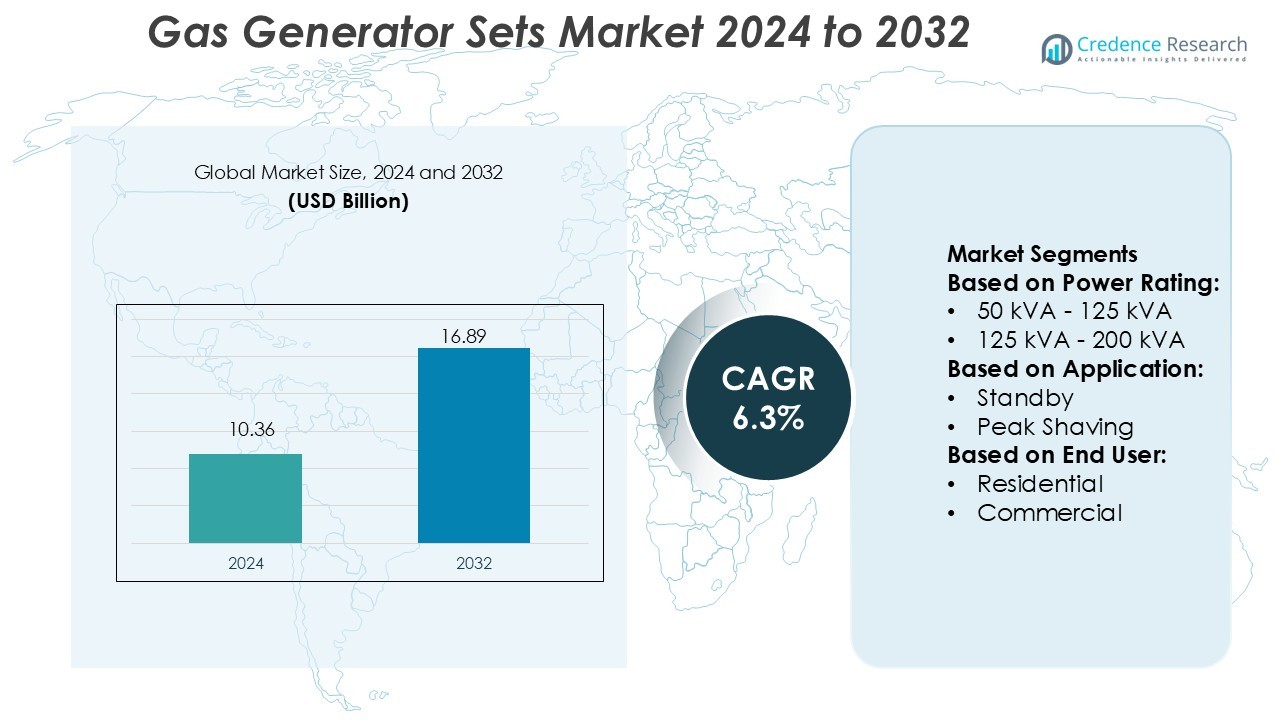

Gas Generator Sets Market size was valued USD 10.36 billion in 2024 and is anticipated to reach USD 16.89 billion by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Generator Sets Market Size 2024 |

USD 10.36 Billion |

| Gas Generator Sets Market, CAGR |

6.3% |

| Gas Generator Sets Market Size 2032 |

USD 16.89 Billion |

The Gas Generator Sets Market is dominated by key players such as Kohler Co., General Electric, Cooper Corporation, Mitsubishi Heavy Industries Ltd, Cummins Inc., AKSA Power Generation, Briggs and Stratton Corporation, Atlas Copco AB, Generac Holdings Inc., and Caterpillar Inc. These companies lead the market through continuous innovation, strategic expansions, and a focus on high-performance, eco-friendly solutions. Among the regions, North America holds the largest market share, accounting for 40% of the total market. This is primarily driven by the increasing demand for reliable backup power in both residential and commercial sectors, alongside the adoption of cleaner, more efficient power solutions. Europe and Asia-Pacific follow, with Europe benefiting from stringent environmental regulations and Asia-Pacific experiencing rapid industrialization and infrastructure development, further fueling market growth in the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Gas Generator Sets Market was valued at USD 10.36 billion in 2024 and is expected to reach USD 16.89 billion by 2032, growing at a CAGR of 6.3% during the forecast period.

- Key market drivers include increasing demand for reliable backup power in residential, commercial, and industrial sectors, as well as advancements in eco-friendly and efficient generator technologies.

- Trends such as the adoption of hybrid power systems combining gas generators with renewable energy sources and the integration of smart technologies are reshaping the market.

- The competitive landscape is marked by continuous innovation and strategic expansions by leading players like Kohler Co., General Electric, and Cummins Inc., aiming to capture a larger share of the growing market.

- North America dominates the market with a 40% share, driven by high demand for backup power solutions, followed by Europe and Asia-Pacific, which are experiencing growth due to industrialization and stringent regulations.

Market Segmentation Analysis:

By Power Rating

The >50 kVA–125 kVA segment dominates the Gas Generator Sets Market with over 32% market share. It is widely used across small commercial establishments, construction sites, and institutional facilities due to its balance of power output and cost efficiency. The segment benefits from rising demand for reliable backup power in telecom towers, hospitals, and retail complexes. Increased adoption of natural gas and bi-fuel systems further strengthens growth, supporting sustainability goals and reducing operating costs for medium-load applications.

- For instance, Kohler Co.’s KG100R model delivers a rated standby power of 100 kW (≈125 kVA) at 60 Hz and 1800 rpm, operating on natural gas or LPG. Its internal engine is a 6.2 L V‑8 turbocharged and aftercooled model (KG6208THD), and the alternator uses a rare‑earth permanent‑magnet excitation system which enables a peak motor‑starting capacity of 440 kVA at 240 V.

By Application

The Standby segment holds the largest share at 44%, driven by growing reliance on backup power across industrial and commercial sectors. Businesses prioritize standby generators to maintain operations during grid failures, especially in regions with unreliable power supply. Hospitals, data centers, and manufacturing units account for most installations. Expansion of distributed power generation and integration with smart monitoring systems enhance reliability, efficiency, and rapid response capability during power disruptions.

- For instance, GE’s LM6000 aeroderivative gas turbine–generator set can deliver ~36.6 MW of electrical output under Navy standard conditions (100 °F ambient) when paired with a generator.

By End User

The Industrial segment leads the market with nearly 47% share, supported by high energy demand in manufacturing, mining, and oil & gas operations. Industries depend on gas generator sets for continuous or emergency power during outages, ensuring uninterrupted production. Growing adoption of cleaner gas-based systems over diesel alternatives aligns with emission regulations and sustainability mandates. The segment’s expansion is reinforced by infrastructure modernization, automation, and government initiatives promoting natural gas infrastructure development.

Key Growth Drivers

Increasing Power Demand

The rising demand for reliable and continuous power supply in both industrial and commercial sectors is a major driver for the gas generator sets market. Industries such as manufacturing, construction, and healthcare require uninterrupted power to maintain operations. With power outages becoming more frequent due to natural disasters and grid instability, businesses are increasingly investing in gas-powered generators for backup power solutions. This trend is particularly evident in developing economies where electricity infrastructure is less reliable.

- For instance, Cooper Corporation’s ECOPACK gas generator series offers units in the 10 kVA–140 kVA range, such as the model CCP100101D22 which features a 1.2 L engine delivering 15.7 kW at 3 000 rpm with natural gas.

Cost-Effectiveness and Fuel Efficiency

Gas generator sets offer a more cost-effective and fuel-efficient alternative compared to diesel-powered generators. As natural gas prices remain relatively stable, businesses find it more economical to use gas-powered generators for peak shaving and backup power. The efficiency of gas-powered units also reduces operational costs in the long term. This makes them an attractive option for companies aiming to optimize energy costs while ensuring reliable power sources.

- For instance, MHI’s MGS1500G model yields a generator output of 1,500 kW (≈1,875 kVA) at 380 V and 50 Hz. Its engine model GS16R2‑PTK delivers a brake output of 1,562.5 kWm at 1,500 rpm, water‑cooled, and is designed for continuous duty.

Environmental Regulations and Sustainability Initiatives

Stringent environmental regulations, especially in developed regions, are driving the adoption of gas generator sets. Compared to diesel generators, gas-powered units emit lower levels of greenhouse gases and other pollutants. This makes them an attractive choice for organizations aiming to reduce their carbon footprint and comply with environmental standards. Governments and companies alike are increasingly focusing on sustainability, which further supports the growth of the gas generator sets market.

Key Trends & Opportunities

Technological Advancements in Generator Efficiency

Ongoing technological innovations in generator efficiency, such as advanced control systems and improved engine designs, are enhancing the performance of gas generator sets. These advancements enable generators to provide higher power output while consuming less fuel. The trend towards integrating digital technologies, such as remote monitoring and predictive maintenance, is also improving the operational efficiency and longevity of these units. Manufacturers are continually upgrading their products to meet the growing demand for more efficient and reliable power solutions.

- For instance, HSK78G gas‑generator series achieves ISO electrical efficiency of 43.2 % under certain low‑BTU conditions. Also, its physical footprint is just 6.9 m × 2.2 m × 2.8 m (L×W×H) for the 50 Hz model.

Integration with Renewable Energy Sources

A growing opportunity within the gas generator sets market lies in their integration with renewable energy sources like solar and wind. Hybrid systems that combine renewable energy with gas generators can offer continuous power even when the renewable sources are intermittent. This integration enhances the appeal of gas-powered generators in industries that are shifting toward more sustainable energy solutions. It also helps to reduce dependency on the grid while contributing to a greener environment.

- For instance, AKSA offers its natural‑gas generator series with continuous ratings from 1,160 kW up to 2,000 kW for 50/60 Hz units. In its “Gas Solutions” catalogue the company lists models in the 17 kVA to 1,320 kVA range for standby and prime operation on natural gas/LPG.

Emerging Markets and Infrastructure Development

The expansion of infrastructure in emerging markets presents significant opportunities for the gas generator sets market. As countries in Africa, Asia, and Latin America continue to develop, the demand for reliable power solutions rises. Gas-powered generators offer an affordable and scalable solution to meet the energy demands of these rapidly growing economies. Governments’ investments in infrastructure, coupled with rising industrialization and urbanization, are fueling market growth in these regions.

Key Challenges

Fluctuating Fuel Prices

The volatility of natural gas prices poses a challenge for the gas generator sets market. While gas is generally more affordable than diesel, fluctuations in global energy prices can lead to unpredictable costs for businesses relying on gas-powered generators. Price instability makes it difficult for companies to forecast long-term energy expenses and could impact the financial viability of investing in gas generator sets.

Maintenance and Operational Costs

While gas generator sets are efficient, their maintenance and operational costs can be higher than expected, especially in regions where technical expertise is limited. Regular maintenance is required to ensure optimal performance, and without proper servicing, the efficiency of the generator can decline over time. Companies in developing markets may face difficulties in maintaining these units due to a lack of skilled labor, leading to increased downtime and potential loss of power during critical periods.

Regional Analysis

North America

North America accounts for approximately 30.6% of the global gas generator sets market. The U.S. is the leading country in this region, driven by its robust natural gas infrastructure and the high demand for reliable backup power across various industries, including manufacturing, healthcare, and telecommunications. The market in North America continues to expand as power reliability becomes more critical, especially for data centers and essential services. However, the adoption of renewable energy solutions and the increasing focus on reducing carbon emissions may moderate future growth, while environmental regulations remain a challenge for the gas generator sets market.

Asia-Pacific

The Asia-Pacific region is the largest market for gas generator sets, contributing over 40% to the global market share. This dominance is driven by rapid industrialization, urbanization, and growing energy needs in countries like China, India, and Southeast Asian nations. The increasing number of commercial and industrial setups, along with a rising population, continues to fuel demand for reliable backup power solutions. Additionally, the region’s efforts to move toward cleaner energy solutions create opportunities for gas generator sets to integrate with renewable energy sources. As infrastructure continues to improve, the market in Asia-Pacific is expected to experience continued strong growth.

Europe

Europe holds a significant yet smaller share of the global market, with an estimated 20% market share for gas generator sets. The region is characterized by a strong focus on environmental regulations, energy efficiency, and grid resilience. Countries like Germany, the UK, and France are leaders in adopting gas generators due to their need for backup power in critical sectors such as healthcare, data centers, and manufacturing. However, the European market is increasingly competitive, with a strong push toward renewable energy solutions and cleaner power sources. Despite this, gas generators remain an important option for sectors requiring reliable backup power in case of grid failure.

Latin America

Latin America holds a moderate share of the gas generator sets market, accounting for around 8-10% of the global market. Key countries like Brazil, Mexico, and Argentina are experiencing growing demand for backup power solutions due to infrastructure development and rising energy needs in industries like mining, agriculture, and manufacturing. However, slow economic growth, political instability, and less-developed natural gas infrastructure in some regions could limit the market’s overall expansion. Despite these challenges, the increasing need for reliable power in urban areas and remote locations offers opportunities for growth in the region.

Middle East & Africa

The Middle East & Africa (MEA) region has a smaller but steadily growing market, contributing approximately 10-12% to the global gas generator sets market. The demand in this region is driven by the need for reliable power in industries such as oil & gas, mining, and construction, particularly in remote areas and off-grid locations. As infrastructure development continues in emerging economies like Saudi Arabia, Nigeria, and South Africa, the market for gas-powered generators is expected to grow. However, the rise of solar and hybrid systems, along with challenges related to fuel supply logistics, may pose hurdles to rapid growth in the region.

Market Segmentations:

By Power Rating:

- 50 kVA – 125 kVA

- 125 kVA – 200 kVA

By Application:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Gas Generator Sets Market is highly competitive, with key players such as Kohler Co., General Electric, Cooper Corporation, Mitsubishi Heavy Industries Ltd, Cummins Inc., AKSA Power Generation, Briggs and Stratton Corporation, Atlas Copco AB, Generac Holdings Inc., and Caterpillar Inc. The Gas Generator Sets Market is characterized by intense competition, driven by continuous innovation and advancements in technology. Companies in this sector are focusing on enhancing product performance, energy efficiency, and reducing emissions to meet the growing demand for sustainable power solutions. The market is also witnessing increasing investments in research and development to introduce eco-friendly, high-performance generators. Strategic partnerships, mergers, and acquisitions are common as companies aim to expand their geographic reach and diversify their product offerings. Furthermore, the rise in power outages, along with the growing need for reliable backup power across industries such as residential, commercial, and industrial, continues to fuel market growth. Manufacturers are also capitalizing on the demand for renewable energy sources, incorporating hybrid solutions that combine gas-powered generators with solar and battery storage systems to cater to environmentally conscious customers. This focus on innovation and sustainability is expected to shape the future competitive landscape of the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kohler Co.

- General Electric

- Cooper Corporation

- Mitsubishi Heavy Industries Ltd

- Cummins Inc.

- AKSA Power Generation

- Briggs and Stratton Corporation

- Atlas Copco AB

- Generac Holdings Inc.

- Caterpillar Inc.

Recent Developments

- In August 2025, GE Vernova announced a expansion of its generator manufacturing facility in Schenectady, New York, adding 50 jobs to boost production of H65 and H84 generators for gas turbines.

- In June 2025, Baseline Energy Services launched the NexGen 400, a 400-kW mobile natural-gas generator designed to significantly reduce emissions. This next-generation generator uses smart sensors to analyze the quality of the natural gas and automatically adjust combustion parameters for improved power output and lower emissions.

- In October 2024, HIMOINSA has unveiled its Yanmar-powered HGY series generators, designed for critical power supply needs. The HGY series boasts Yanmar engines, with current offerings ranging from 1250kVA to 3500kVA, and plans to extend this range up to 4,000 kVA in the future.

- In April 2024, Rolls-Royce announced a collaboration with Landmark and ASCO to develop innovative CO2 recovery power generation solutions. This partnership aims to enhance the efficiency of generator sets by integrating carbon capture technology, thereby reducing greenhouse gas emissions.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for gas generator sets is expected to grow steadily due to increasing reliance on backup power in residential, commercial, and industrial sectors.

- Technological advancements in fuel efficiency and emissions control will drive the development of more eco-friendly and cost-effective generators.

- Hybrid power systems combining gas generators with renewable energy sources like solar and wind are projected to become more popular.

- The rise of off-grid applications, particularly in remote areas and emerging markets, will contribute to market expansion.

- The integration of smart technologies, such as IoT and remote monitoring, will enhance the functionality and reliability of gas generator sets.

- Regulatory pressures for cleaner energy solutions will push manufacturers to innovate and adopt sustainable practices in production and operation.

- Increasing natural gas availability and affordability is expected to drive the adoption of gas-powered generators over traditional diesel models.

- The industrial and construction sectors are likely to remain key drivers of gas generator set demand, especially in large-scale operations.

- Growth in developing regions, particularly in Asia-Pacific, will be fueled by urbanization and industrialization.

- Ongoing investments in the power generation infrastructure, along with growing awareness of energy resilience, will further solidify market growth.