Market Overview:

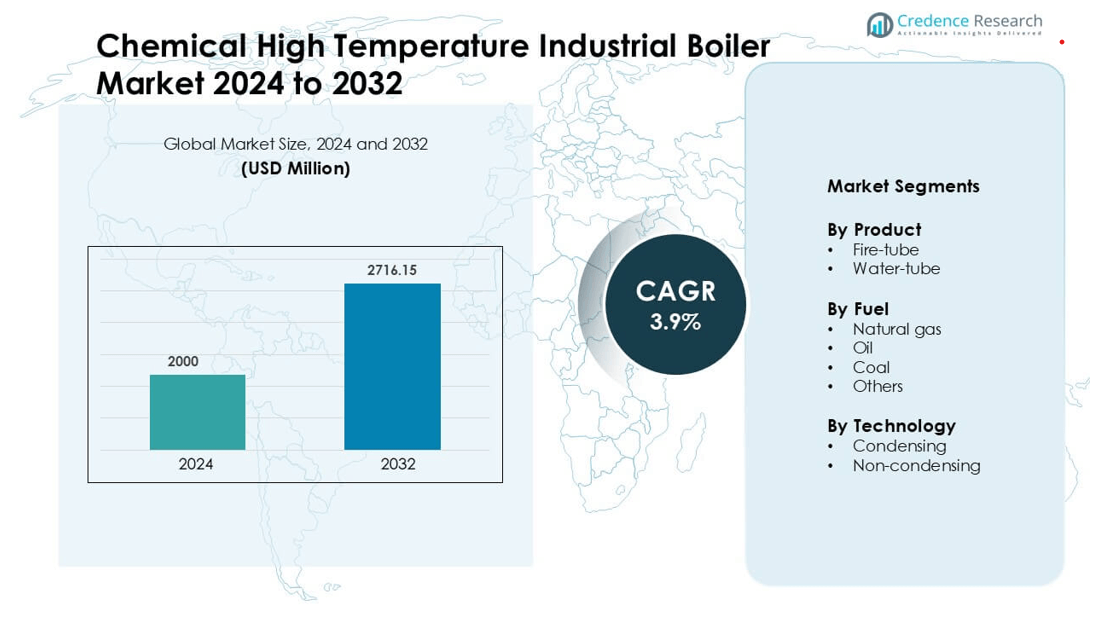

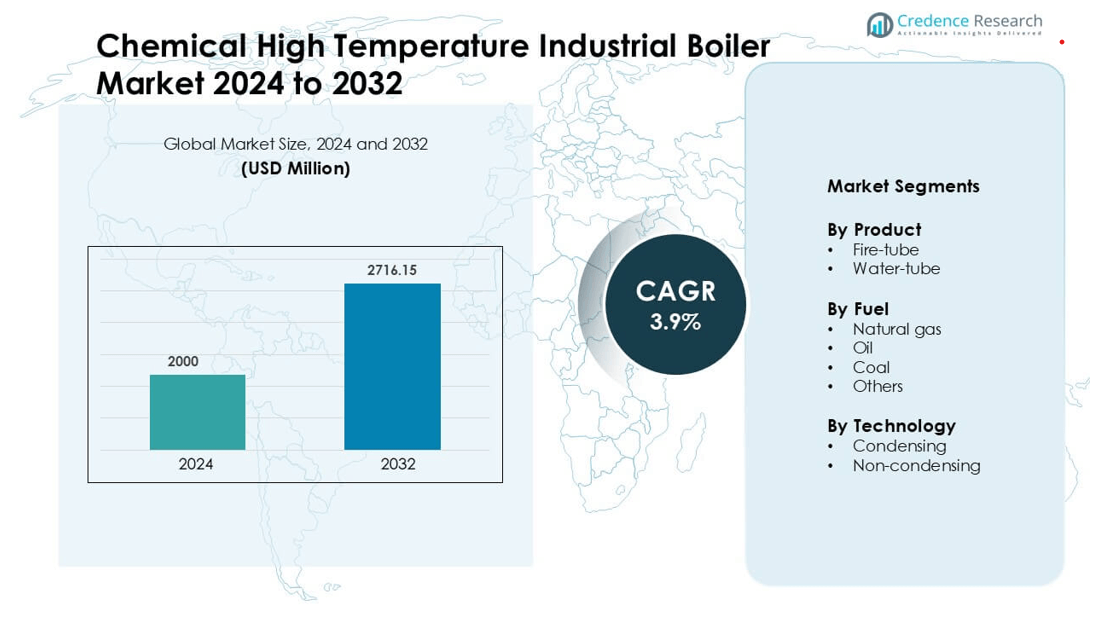

Chemical High Temperature Industrial Boiler Market was valued at USD 2000 million in 2024 and is anticipated to reach USD 2716.15 million by 2032, growing at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chemical High Temperature Industrial Boiler Market Size 2024 |

USD 2000 million |

| Chemical High Temperature Industrial Boiler Market, CAGR |

3.9% |

| Chemical High Temperature Industrial Boiler Market Size 2032 |

USD 2716.15 million |

The Chemical High Temperature Industrial Boiler market includes key players such as Cleaver-Brooks, Doosan Heavy Industries & Construction, Babcock and Wilcox Enterprises, Clayton Industries, FERROLI, FONDITAL, Fonderie Sime, Cochran, Forbes Marshall, and Bharat Heavy Electricals. These companies focus on high-efficiency designs, natural gas combustion, advanced heat-recovery systems, and automated controls to support continuous chemical processing. North America remains the leading region with 33% market share, driven by strict emission regulations, widespread adoption of condensing technology, and strong investment in refinery and specialty chemical production. As industries replace aging boilers with fuel-efficient models, established manufacturers expand service portfolios and technical upgrades to strengthen competitiveness.

Market Insights

- The Chemical High Temperature Industrial Boiler market reached a significant valuation at USD 2000 million in 2024 and continues to expand at a steady CAGR of 3.9%, supported by rising steam demand in chemical processing and petrochemicals.

- Energy-efficient natural gas and condensing boilers drive market growth, reducing emissions and fuel costs in large chemical plants.

- Manufacturers introduce automated controls, IoT monitoring, and waste-heat recovery systems as key trends, improving performance and lowering operational downtime.

- Cleaver-Brooks, Doosan Heavy Industries & Construction, Babcock and Wilcox Enterprises, Clayton Industries, FERROLI, and Forbes Marshall compete through service contracts, retrofits, and modular systems, while smaller players focus on regional supply.

- North America leads with 33% market share, followed by Europe at 28% and Asia-Pacific at 27%, while the fire-tube segment and natural gas fuel type hold major shares due to wide industrial acceptance and environmental compliance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Fire-tube boilers lead the product segment with 52% market share due to lower maintenance costs, compact installation, and reliable heating efficiency for small and medium industrial units. These systems serve food processing, chemical blending, and textile dyeing lines with consistent steam output. Water-tube boilers gain traction in large-scale refineries, metal processing, and power generation where high pressure and rapid steam generation are required. Demand for water-tube units rises in heavy industries, but fire-tube units remain dominant because manufacturers prefer low operational complexity and stable thermal performance in continuous production cycles.

- For instance, Thermax Limited offers a coil-type fire-tube steam boiler series with capacities from 50 kg/h to 850 kg/h of steam, clearly addressing the small-to-medium industrial unit segment.

By Fuel

Natural gas-based high-temperature boilers hold 44% market share, driven by cleaner combustion, lower emissions, and compliance with industrial air-quality norms. Industries adopt gas boilers to meet sustainability targets and reduce particulate output compared to coal and oil alternatives. Oil-fired units remain relevant in regions with unstable gas supply, while coal-based boilers appeal to cost-sensitive operators but face regulatory limitations. Biofuels and hybrid alternatives emerge under the “Others” category as companies shift toward renewable heat sources, yet natural gas retains its lead due to steady supply, high thermal efficiency, and reduced maintenance downtime.

- For instance, Thermax Ltd. offers a natural-gas fired D-Type boiler with capacity up to 500 TPH steam at pressures up to 115 kg/cm²(g) and temperatures of 510 °C, underscoring its suitability for heavy industrial applications.

By Technology

Condensing boiler technology leads the segment with 57% market share as it captures latent heat from exhaust gases, reducing fuel consumption and overall cost per steam unit. Manufacturers upgrade systems with advanced heat exchangers to enhance thermal efficiency and meet energy-saving mandates. Non-condensing boilers remain in older industrial plants due to lower upfront cost and simpler design but face gradual replacement. Adoption of condensing systems increases in chemical, pharmaceutical, and food industries where continuous high-temperature steam demand and strict emission standards support investment in energy-efficient boiler operations.

Key Growth Drivers

Rising Industrial Heat Demand in Chemicals and Petrochemicals

The chemical and petrochemical sectors require high-pressure steam for distillation, cracking, polymerization, and solvent recovery. Industrial boilers support continuous thermal loads with stable efficiency and low downtime. Growth in plastics, specialty chemicals, and fertilizers increases the need for reliable steam generation systems. Natural gas–based high-temperature boilers help plants reduce emissions and meet regulatory norms in developed markets. Expanding refinery capacity in Asia-Pacific and the Middle East also strengthens boiler adoption. Manufacturers invest in robust materials, corrosion-resistant tubes, and advanced control systems to ensure safety and improve thermal performance. The push for higher productivity and reduced operational risk keeps high-temperature industrial boilers essential in large-scale chemical production facilities.

- For instance, Titan Chemicals Corporation in Southeast Asia installed two packaged super-heated steam boilers rated at 200,000 lb/hr capacity each (approx. 90.7 t/h) at 750 psig/750°F conditions, to support its polyolefin plant.

Energy Efficiency Regulations and Emission Reduction Goals

Governments enforce strict emission standards to lower NOx, SOx, and particulate levels from industrial heat systems. Condensing boilers gain acceptance because they recover waste heat and reduce fuel consumption. Companies upgrade aging plants with high-efficiency units to lower carbon output and meet sustainability goals. Energy-efficiency incentives and compliance penalties accelerate replacement of outdated equipment in chemicals, food processing, and pharmaceuticals. Smart automation, real-time combustion monitoring, and advanced heat exchangers support cleaner operations. Industries shifting from coal and oil to natural gas further expand demand. As environmental audits tighten, high-temperature boilers with improved thermal efficiency become the preferred choice, creating continuous manufacturing opportunities for OEMs and service providers.

- For instance, Nationwide Boiler, Inc. delivered a packaged 180,000 lb/hr watertube boiler with its CataStak™ SCR system for a food-processing facility; source tests after install showed NOₓ emissions of less than 1.5 ppm (corrected to 3% O₂) and CO under 1 ppm.

Automation and Digital Monitoring in Industrial Boilers

Digitally controlled boilers optimize combustion, ensure temperature accuracy, and detect performance deviations in real time. Predictive maintenance platforms reduce unexpected shutdowns and extend component life. Chemical plants deploy integrated monitoring systems to manage fuel usage, steam pressure, and heat cycling. IoT-enabled sensors track burner efficiency, emission levels, and scaling trends, helping operators reduce fuel costs. Remote connectivity supports troubleshooting and minimizes manual intervention. Manufacturers develop advanced safety interlocks and automated pressure-control modules for high-load chemical operations. Growing adoption of smart controls creates long-term aftermarket opportunities for software upgrades, sensors, and maintenance contracts, driving sustained market expansion.

Key Trends & Opportunities

Shift Toward Natural Gas and Hybrid Fuel Systems

Industries replace conventional coal and oil boilers with cleaner natural gas systems to meet efficiency and emission targets. Hybrid fuel technologies that integrate biofuels and waste heat recovery expand in regions with environmental compliance pressure. Condensing systems gain preference due to reduced heat losses and rising fuel cost awareness. Manufacturers explore hydrogen-ready boiler designs to serve future decarbonization needs. Companies in chemicals and pharmaceuticals benefit from lower operating costs and improved thermal consistency. Nations investing in gas pipeline infrastructure create new supply security, encouraging long-term adoption of gas-fired high-temperature industrial boilers.

- For instance, Bosch Industriekessel GmbH offers hybrid boiler units capable of using excess electric energy of up to 5 MW per boiler alongside biofuels, reducing fuel purchase needs.

Growing Adoption of Condensing and Waste Heat Recovery Technologies

Energy-intensive chemical plants seek systems that minimize heat losses and reduce lifecycle costs. Condensing boilers recapture exhaust heat, delivering higher thermal efficiency than traditional models. Waste heat recovery units convert flue gas energy into usable steam or power, supporting sustainability initiatives. Industries integrating heat exchangers and economizers report better fuel productivity and reduced carbon intensity. Manufacturers upgrade designs with corrosion-resistant alloys and enhanced burner controls. Demand increases in food processing, pharmaceuticals, and petrochemicals where operational efficiency affects profitability. Government-backed energy audits and industrial modernization programs accelerate these technology deployments.

- For instance, a petro-chemical plant in Malaysia installed a waste-heat boiler with a thermal capacity of 2.5 MW and realized a fuel-consumption reduction of 56.41 t per annum alongside CO₂-emission savings of 149.29 t per annum through a heat-recovery upgrade.

Customization and Modular Boiler Designs

Chemical plants and refineries prefer modular boiler systems for quick installation, reduced footprint, and flexible steam output. Containerized units serve expansion projects and remote industrial zones with limited infrastructure. Modular designs ease maintenance and enable scalable capacity adjustments based on production demands. OEMs provide customization with advanced refractory materials, high-pressure drums, and low-emission burners. Short project timelines in specialty chemical production create opportunities for rapid-deployment high-temperature systems. Rental and temporary boiler services also gain traction as industries maintain continuity during shutdowns and plant upgrades.

Key Challenges

High Capital and Maintenance Costs

High-temperature industrial boilers require durable materials, advanced controls, and precision engineering, which increase upfront costs. Small and mid-sized chemical units delay replacements due to budget constraints, extending the life of outdated equipment. Maintenance expenses rise because scaling, corrosion, and wear demand periodic inspection and component replacement. Operators require skilled technicians to manage burner tuning, pressure balancing, and steam quality control. In developing regions, financing limitations restrict access to modern systems, slowing technology adoption. Although long-term fuel savings justify investment, the initial spend remains a barrier for cost-sensitive industries.

Regulatory Compliance and Emission Constraints

Emissions from industrial boilers face tightening regulations across air quality, carbon output, and hazardous discharge. Older coal- and oil-fired models require retrofitting with scrubbers, low-NOx burners, or alternative fuel systems, which increases operating complexity. Compliance paperwork and audit requirements add administrative workload for plant operators. Failure to meet standards results in fines or forced shutdowns, pushing companies to upgrade. However, transitioning to cleaner fuel sources depends on gas infrastructure, which is not available in every region. The shift toward decarbonization demands continuous investment in new technologies, challenging manufacturers and end users with evolving standards.

Regional Analysis

North America

North America leads the Chemical High Temperature Industrial Boiler market with 33% market share, supported by strong demand from chemical processing, petrochemical refining, and specialty materials production. The region invests in high-efficiency natural gas and condensing boiler systems to meet strict emission regulations. Growth in shale gas supply lowers fuel costs, encouraging industries to shift from coal and oil to cleaner heat generation. Technological upgrades, digital monitoring, and predictive maintenance strengthen adoption in the U.S. and Canada. Replacement of aging boilers in large chemical clusters creates ongoing opportunities for manufacturers and service providers across the region.

Europe

Europe holds 28% market share, driven by strict environmental compliance, carbon regulations, and rapid shift toward energy-efficient condensing boilers. Chemical manufacturers invest in cleaner combustion systems to meet EU emission norms and sustainability goals. Countries such as Germany, Italy, and France lead adoption in chemical synthesis, plastics, and pharmaceutical steam operations. Biofuel integration, waste heat recovery, and hydrogen-ready boiler designs gain interest under green transition initiatives. Funding for industrial decarbonization and modernization encourages replacement of outdated units, strengthening demand for high-performance boilers with advanced automation and heat recovery solutions across European industries.

Asia-Pacific

Asia-Pacific accounts for 27% market share and remains the fastest-growing region due to strong chemical production in China, India, Japan, and South Korea. Expanding petrochemical complexes, fertilizer plants, and specialty chemical manufacturing drive high-pressure boiler installations. Industrial expansion, lower manufacturing costs, and rising foreign investments support large-scale capacity additions. Natural gas adoption increases but coal-fired systems still operate in cost-sensitive areas, creating a mixed fuel environment. Governments introduce emission control policies and promote modern condensing units to reduce industrial carbon output. Continuous demand for industrial heat makes the region a key revenue hub for OEMs.

Latin America

Latin America captures 7% market share, supported by moderate expansion in petrochemicals, food processing, and mining-related chemical production. Brazil, Mexico, and Argentina lead installations, especially in plants modernizing outdated boiler fleets. Limited access to natural gas networks in some areas slows transition from oil and coal systems, but refinery upgrades and industrial investments improve prospects. Manufacturers promote modular and mobile high-temperature boilers to serve remote industrial zones. Environmental enforcement remains uneven, yet multinational chemical companies push for efficient and lower-emission systems aligned with global sustainability standards.

Middle East & Africa (MEA)

MEA holds 5% market share, driven by refinery expansion, petrochemical diversification, and industrial infrastructure projects. The Middle East invests in high-capacity water-tube boilers for large chemical and oil processing plants, supported by low-cost natural gas availability. Africa shows rising demand in fertilizers, mining chemicals, and food industries but adoption remains gradual due to financing constraints. Government-led industrialization and foreign investment programs encourage modernization of heat systems. Energy-efficiency goals and emission control frameworks increase interest in advanced combustion technologies, creating long-term opportunities for boiler suppliers and service companies.

Market Segmentations:

By Product

By Fuel

- Natural gas

- Oil

- Coal

- Others

By Technology

- Condensing

- Non-condensing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Chemical High Temperature Industrial Boiler market features international boiler manufacturers, engineering companies, and specialized combustion system suppliers offering high-pressure steam solutions for chemical industries. Players such as Cleaver-Brooks, Doosan Heavy Industries & Construction, Babcock and Wilcox Enterprises, Clayton Industries, FERROLI, FONDITAL, Fonderie Sime, Cochran, Forbes Marshall, and Bharat Heavy Electricals focus on advanced designs, longer operating life, and improved fuel efficiency. Companies expand portfolios with natural gas–based and condensing boiler models to meet rising sustainability and emission-control standards. Automation, IoT monitoring, and predictive maintenance strengthen aftermarket revenues through service contracts, burner upgrades, and parts replacement. Strategic partnerships with chemical producers and engineering contractors help secure long-term supply agreements. Many manufacturers invest in modular and skid-mounted systems to serve facilities that require rapid deployment or limited installation space. As global chemical capacity expands, competition intensifies, leading to greater product innovation, digitalization, and fuel-flexible boiler designs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cleaver-Brooks

- Foredie Sime

- FERROLI

- Doosan Heavy Industries & Construction

- Babcock and Wilcox Enterprises

- Clayton Industries

- FONDITAL

- Forbes Marshall

- Cochran

- Bharat Heavy Electricals

Recent Developments

- In August 2025, FERROLI released its first Sustainability Report. The program expands product carbon-footprint tracking across boiler lines. It guides lower-emission industrial heating solutions.

- In February 2025, Cleaver-Brooks showcased ClearFire-CE at AHR Expo 2025. The condensing hydronic line targets high-efficiency process heat needs. Event materials highlighted integrated Ember controls and TurboFer® heat transfer

Report Coverage

The research report offers an in-depth analysis based on Product, Fuel, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-efficiency condensing boilers will increase in chemical and petrochemical plants.

- Natural gas–based boilers will replace older coal and oil units due to emission rules.

- IoT-enabled monitoring and predictive maintenance will become standard in new installations.

- Modular and skid-mounted boiler systems will gain traction for faster deployment.

- Waste-heat recovery solutions will expand as industries target energy savings.

- Hydrogen-ready and hybrid fuel boiler designs will open new decarbonization pathways.

- Service contracts, retrofits, and spare parts business will grow faster than new unit sales.

- Automation will reduce manual operation and enhance safety in high-temperature systems.

- Asia-Pacific will witness strong project investments from chemical and refinery expansions.

- Manufacturers will shift toward fuel-flexible designs to support future sustainability goals.