Market Overview:

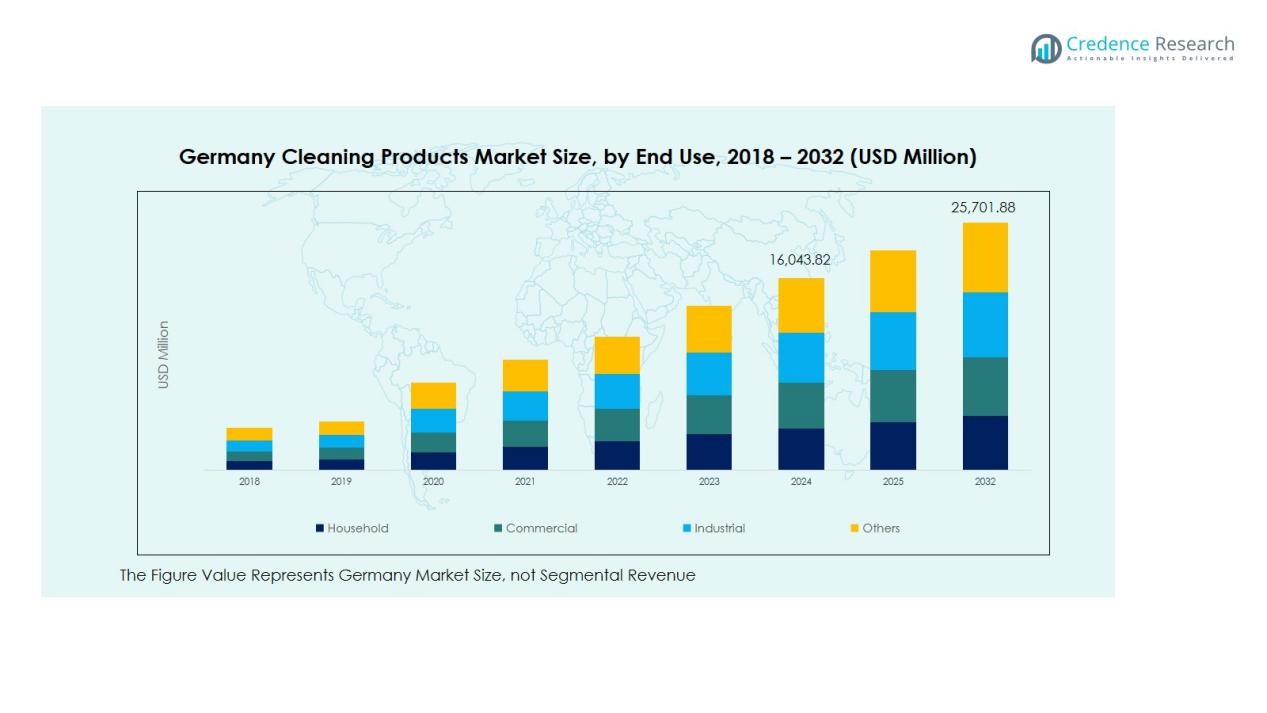

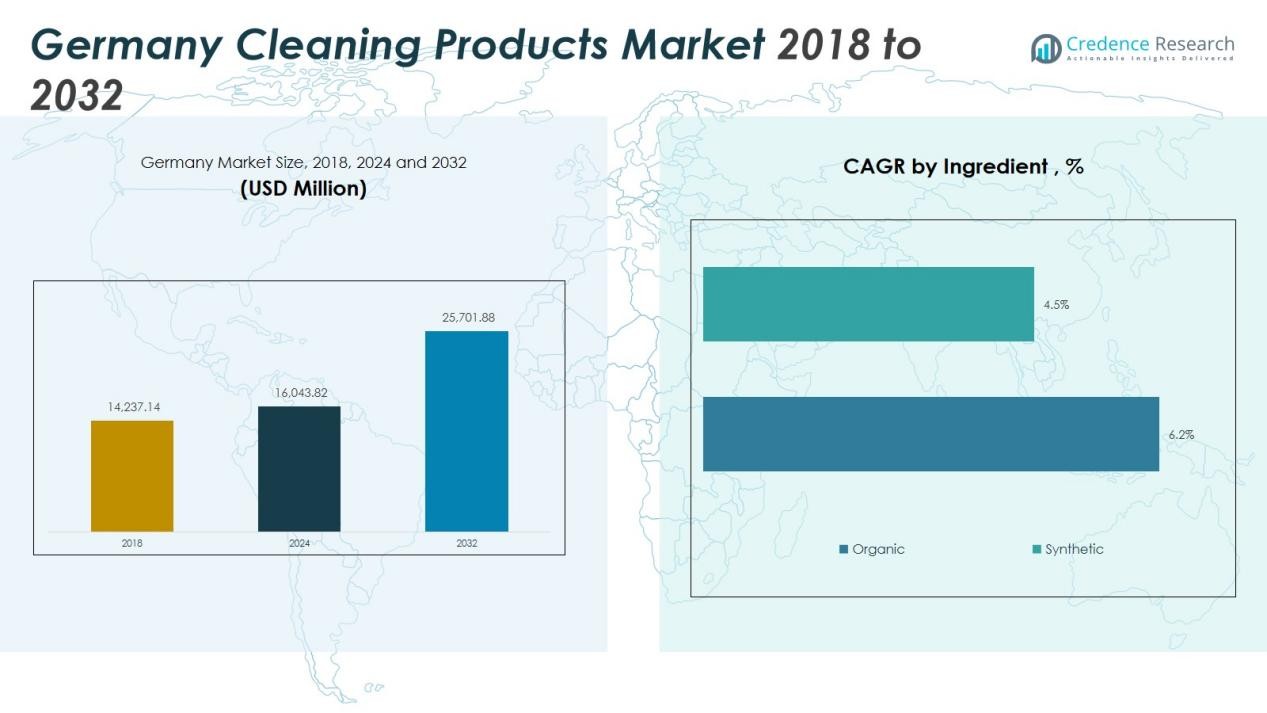

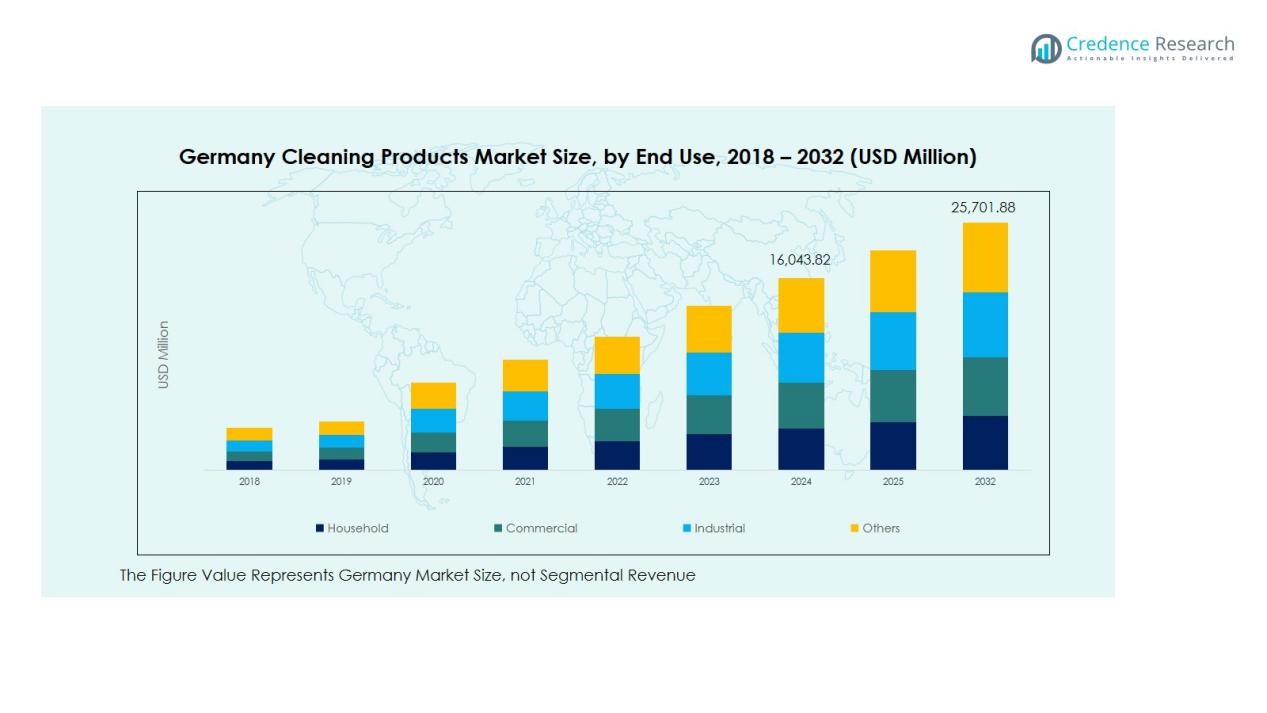

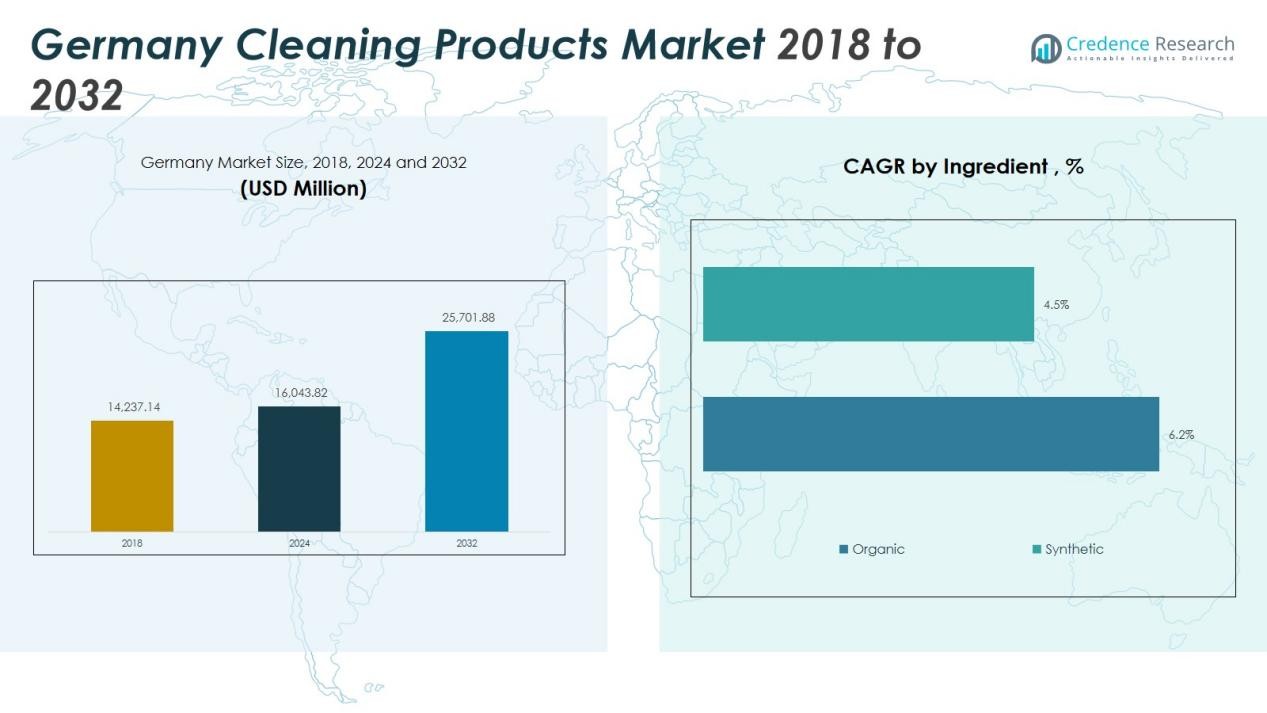

The Germany Cleaning Products Market size was valued at USD 14,237.14 million in 2018 to USD 16,043.82 million in 2024 and is anticipated to reach USD 25,701.88 million by 2032, at a CAGR of 6.07% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Cleaning Products Market Size 2024 |

USD 16,043.82 Million |

| Germany Cleaning Products Market, CAGR |

6.07% |

| Germany Cleaning Products Market Size 2032 |

USD 25,701.88 Million |

Key drivers include rising hygiene and sanitation awareness, accelerated by the pandemic, which heightened demand for cleaning and disinfectant products. Consumer preferences are shifting toward eco-friendly, biodegradable formulations and refillable packaging, prompting manufacturers to reformulate and innovate.

Regionally, the market is concentrated in Germany’s western and southern regions, where high-income households and strong retail infrastructure support premium product adoption. Eastern and northern areas show slower but steady uptake, often focusing on value-and-volume segments. Manufacturers and distributors targeting Germany typically focus innovation and premium launches in the more urbanized western zones before expanding nationally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Germany Cleaning Products Market was valued at USD 14,237.14 million in 2018, USD 16,043.82 million in 2024, and is expected to reach USD 25,701.88 million by 2032, growing at a CAGR of 6.07% during the forecast period.

- Western and Southern Germany dominate the market, accounting for 55% of total market share due to high population density, affluent consumers, and strong retail infrastructure supporting premium product demand.

- Northern and Eastern Germany, though showing slower growth, hold steady potential, with Eastern Germany focusing on value-for-money products and Northern Germany contributing to 25% of the total market share, driven by consumer price sensitivity.

- Surface cleaners dominate the product segment, holding 30% of the market share, followed by toilet cleaners at 20%, and dishwashing products at 15%, with other segments like fabric and glass cleaners showing steady growth.

- The organic ingredient segment is gaining traction, representing 40% of the market, driven by consumer preference for eco-friendly, non-toxic solutions, while synthetic cleaning products maintain 60% market share due to their cost-effectiveness and established performance.

Market Drivers:

Market Drivers:

Rising Hygiene and Sanitation Awareness

The increased focus on hygiene and sanitation is a primary driver in the Germany Cleaning Products Market. The COVID-19 pandemic heightened public awareness of cleanliness and its direct impact on health, leading to a surge in demand for cleaning products. Institutions, businesses, and households are prioritizing sanitation to prevent illness, further boosting consumption of disinfectants and surface cleaners. It has also led to sustained demand for sanitizing products even post-pandemic.

- For instance, Clariant implemented large-scale disinfectant production at its Gendorf facility, manufacturing 2 million liters monthly during the COVID-19 outbreak to supply regional hospitals and vital institutions in Bavaria.

Shift Toward Eco-friendly Products

Germany’s strong environmental consciousness is driving a shift toward eco-friendly cleaning products. Consumers are increasingly opting for biodegradable, non-toxic, and sustainable cleaning solutions. Companies in the Germany Cleaning Products Market are reformulating their products to meet these demands, focusing on plant-based ingredients, recyclable packaging, and reducing harmful chemicals. This trend aligns with Germany’s broader sustainability goals, enhancing the appeal of green cleaning solutions.

- For instance, Henkel offers Somat All in 1 Pro Nature dishwasher tablets, which are made from 94 percent nature-based ingredients and come in a biodegradable and 100% water-soluble case.

Growth in Urbanization and Household Spending

Germany’s urbanization trend is another key factor propelling market growth. The rise in apartment living and smaller spaces has increased the demand for cleaning solutions that address specific needs, such as multi-purpose cleaners and space-saving packaging. In urban centers, there is also greater disposable income, encouraging consumers to invest in premium, specialized cleaning products. It supports the growing adoption of high-quality products in residential and commercial spaces.

Technological Advancements in Cleaning Products

Innovations in cleaning technology are shaping the Germany Cleaning Products Market. The development of smart cleaning systems, such as self-cleaning surfaces and automated cleaning devices, has broadened the product range available to consumers. Such advancements make cleaning tasks more efficient, appealing to time-conscious individuals and businesses. The integration of digital solutions, like IoT-enabled dispensers, is enhancing the convenience and effectiveness of cleaning, further expanding market opportunities.

Market Trends:

Emergence of Eco‑Conscious Product Lines and Sustainable Packaging

Manufacturers in the Germany Cleaning Products Market introduce formulations that omit phosphates, optical brighteners and other legacy chemicals. Consumers demand biodegradable and plant‑derived ingredients and packaging made from recycled plastic or refillable systems. Firms respond by redesigning containers and supply chains to reduce waste and align with regulatory pressure on chemical use. Private‑label brands gain traction by offering cost‑effective green alternatives alongside established players. The competition intensifies around both performance and environmental credential.

- For instance, everdrop, a Munich-based manufacturer, offers concentrated cleaning tabs that when used from the third refill onwards, save up to 92% CO2 emissions and up to 88% water consumption compared to liquid products in disposable plastic bottles, with the company having prevented over 1.3 million disposable plastic bottles from entering the market since its launch in 2019.

Growth of Smart Cleaning Solutions and Multi‑Purpose Offerings

The market sees rapid uptake of high‑efficiency products and smart cleaning appliances that support the trend toward convenience. It integrates sensors, automation and connectivity in devices while chemical vendors promote concentrated formats and multi‑surface cleaners to save time and storage. Retailers and online platforms promote bundles and subscriptions for impulse‑free replenishment. The shift toward digital commerce accelerates the availability of niche formats and smaller‑batch launches that cater to specific needs. This trend reshapes value chains and encourages collaborations between chemical formulators and tech firms.

- For instance, Ecovacs’ DEEBOT X1 Turbo robot vacuum demonstrates this integration with a 5000Pa suction power and TrueMapping 2.0 dToF LiDAR technology that delivers 2X coverage and 4X accuracy, enabling cleaning rates of 1,500–3,000 m²/h across complex floor layouts

Market Challenges Analysis:

Stringent Regulatory and Reformulation Burdens

Manufacturers operating in the Germany Cleaning Products Market face intensifying regulation tied to chemical safety, packaging waste and environmental impact. It compels companies to reformulate products, redesign packaging and comply with rigorous testing protocols. Many smaller producers struggle with the compliance costs and lead‑time pressures that major players can absorb. Complex labelling rules and the demand for full ingredient disclosure further elevate operational challenges. This regulatory push reduces flexibility for rapid innovation and increases time to market for new offerings. Firms that manage compliance while preserving profit margins gain competitive advantage.

Cost Pressures and Supply‑Chain Volatility

The market contends with rising raw‑material, energy and logistics costs, which squeeze margins across the supply chain. It has led to scenarios where producers face prolonged lead times or ingredient shortages that delay product flows. Smaller participants may lose scale advantages when bulk input costs rise and pricing cannot fully adjust. Rising consumer price sensitivity in Germany further limits the ability to pass costs to end‑users. Intense competition in the Germany Cleaning Products Market amplifies margin erosion when brands compete on price rather than differentiation. Firms must optimise manufacturing, sourcing and distribution to remain viable under these pressures.

Market Opportunities:

Market Opportunities:

Expansion into Premium and Eco‑Friendly Segments

European consumers demand higher‑value and sustainable household care solutions. In the Germany Cleaning Products Market producers can capitalise on this shift by launching premium formulations with plant‑based ingredients and minimalist packaging. It opens room for niche entrants and established brands to differentiate on performance and green credentials. Retailers embrace premium tiers to target affluent urban households. Consumers willing to pay extra for visible quality or environmental benefit fuel this growth.

Digital Commerce Growth and Service‑Based Models

The increasing share of online retail presents a significant avenue for growth in the cleaning sector. It allows suppliers in the Germany Cleaning Products Market to test direct‑to‑consumer channels, subscription models, and smaller‑batch delivery formats. Manufacturers may partner with e‑commerce platforms to reach younger, convenience‑oriented buyers. On‑demand refill and bundling schemes reduce packaging waste and enhance loyalty. Brands that build logistics and digital interfaces now will capture cost‑efficient coverage across remote and urban regions.

Market Segmentation Analysis:

By Product Type

The Germany Cleaning Products Market is primarily segmented into surface cleaners, toilet cleaners, glass and metal cleaners, floor cleaners, fabric cleaners, dishwashing products, and others. Surface cleaners lead the market, driven by growing demand for multipurpose, all-surface cleaning solutions. Toilet and floor cleaners also hold significant shares, as hygiene awareness increases across both residential and commercial sectors. Fabric and dishwashing products follow in importance, with eco-friendly formulations gaining traction. The “others” category, which includes personal care cleaners and building cleaners, shows consistent growth as diverse cleaning needs emerge.

- For Instance, Werner & Mertz’s Frosch brand launched its first 100% recycled PET bottle for its ecological cleaning product range in 2016, reaching an annual production of over 20 million bottles by 2019 and more than 40 million by 2021.

By Ingredient

The market is divided into organic and synthetic cleaning products. Synthetic ingredients dominate due to their proven effectiveness, cost efficiency, and wide availability. However, the organic segment is rapidly growing, driven by consumer preference for sustainable and non-toxic formulations. The shift toward eco-friendly products, spurred by environmental consciousness, supports organic product adoption. It remains a key growth area, especially among health-conscious consumers and environmentally responsible brands.

By End-use

The end-use segments in the Germany Cleaning Products Market include household, commercial, and industrial applications. Household cleaning products account for the largest share, fueled by high consumer demand for personal hygiene and home sanitation. The commercial segment follows closely, driven by institutional demand for cleaning and disinfecting products. The industrial segment, though smaller, is expanding as more manufacturing and processing industries prioritize cleanliness and regulatory compliance.

- For Instance, Ecolab has a significant presence in the global healthcare sector, with its comprehensive programs utilized in numerous facilities worldwide. For instance, as of 2021, over 2,500 operating rooms nationwide (presumably in the US) were reported to be using the Ecolab OR Program, which helps commercial operators maintain elevated hygiene standards.

Segmentations:

By Product Type Segment Analysis

- Surface cleaners

- Toilet cleaners

- Glass & metal cleaners

- Floor cleaners

- Fabric cleaners

- Dishwashing products

- Others (personal care cleaners, building cleaner, etc.)

By Ingredient Segment Analysis

By End-use Segment Analysis

- Household

- Commercial

- Industrial

- Others

By Price Range Segment Analysis

Regional Analysis:

Regional Analysis of the Germany Cleaning Products Market: Western and Southern Germany

Western and Southern Germany are the key regions driving the Germany Cleaning Products Market. These areas are characterized by high population density, urbanization, and a significant presence of affluent consumers, leading to greater demand for premium and eco-friendly cleaning products. Western Germany, including cities like Cologne and Düsseldorf, has a strong retail infrastructure that supports both traditional and e-commerce distribution. Southern Germany, home to Munich and Stuttgart, benefits from high-income households, making it an attractive region for manufacturers focusing on premium product offerings. This region’s preference for sustainable, organic cleaning solutions continues to shape market trends.

Northern and Eastern Germany Market Landscape

Northern and Eastern Germany exhibit slower but steady growth in the cleaning products market. These regions, including cities like Hamburg and Leipzig, tend to focus on value-for-money cleaning solutions, with consumers showing a preference for more affordable options. The household and commercial sectors drive the majority of demand in these areas, but environmental concerns and health consciousness are gradually influencing purchasing decisions. While rural areas in these regions lag behind in terms of premium product adoption, they present opportunities for companies targeting cost-effective and sustainable products.

Growth Prospects Across Urban and Rural Areas

Urban areas across Germany are central to the growth of the cleaning products market, with high demand for both household and commercial cleaning solutions. It is in these cities that premium and specialized products see the most traction. In contrast, rural areas, while slower in growth, still present untapped potential, particularly for more affordable, multi-purpose cleaning products. The expansion of distribution networks, including online platforms, will drive further growth in less densely populated areas, where consumers are becoming more aware of cleaning solutions’ environmental impact and effectiveness.

Key Player Analysis:

- Henkel AG & Co. KGaA

- Reckitt Benckiser Group plc

- The Procter & Gamble Company

- Unilever plc

- BASF SE

- Clariant AG

- 3M Company

- The Clorox Company

- Ecolab Inc.

- Kao Corporation

Competitive Analysis:

The Germany Cleaning Products Market is highly competitive, with several prominent players vying for market share. Leading companies such as Henkel AG & Co. KGaA, Reckitt Benckiser Group plc, The Procter & Gamble Company, Unilever plc, and BASF SE dominate the landscape. These firms benefit from established brand recognition, extensive distribution networks, and a diverse product portfolio catering to both premium and affordable segments. They continually innovate, focusing on eco-friendly and sustainable cleaning solutions to meet shifting consumer demands for environmentally conscious products.

Competition intensifies as smaller, specialized brands enter the market with unique offerings, including organic and biodegradable products. The larger companies respond by adapting their product lines to align with sustainability trends, ensuring they remain competitive. Price sensitivity, particularly in value-driven regions, also influences market dynamics, requiring both established and new entrants to carefully balance quality and cost to maintain consumer loyalty.

Recent Developments:

- In March 2025, Procter & Gamble launched the Always Pocket Flexfoam and became the first-ever period care partner at Coachella.

- In October 2025, Henkel announced an expansion of its strategic partnership with Dow to decarbonize its adhesives portfolio by integrating low-carbon feedstocks and renewable electricity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Ingredient, End-use and Price Range. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for eco-friendly cleaning products will continue to rise, driven by increasing environmental awareness among consumers.

- Sustainability-focused formulations, such as plant-based and biodegradable ingredients, will gain more market share as consumers prioritize eco-conscious purchasing.

- The shift toward premium cleaning products will persist, particularly in urban areas where higher income levels support the purchase of high-quality, specialized solutions.

- Technological advancements in cleaning, including smart cleaning devices and automated systems, will create new opportunities for innovation and differentiation in the market.

- The influence of digital commerce will increase, with online retail platforms becoming an essential distribution channel for cleaning products, especially in remote regions.

- Consumer preference for multi-purpose cleaners will grow as households and businesses seek more efficient, space-saving solutions.

- The commercial and industrial segments will expand as businesses continue to prioritize cleanliness, hygiene, and compliance with health regulations.

- Smaller players offering niche, eco-friendly, or innovative products will face strong competition from established companies adapting their portfolios to meet evolving consumer needs.

- Pricing pressure will remain a challenge, particularly in value-driven regions, requiring companies to balance quality and affordability.

- Regional expansion into Eastern and Northern Germany will offer growth opportunities, as these areas show increased awareness of sustainable cleaning solutions.

Market Drivers:

Market Drivers: Market Opportunities:

Market Opportunities: