Market Overview

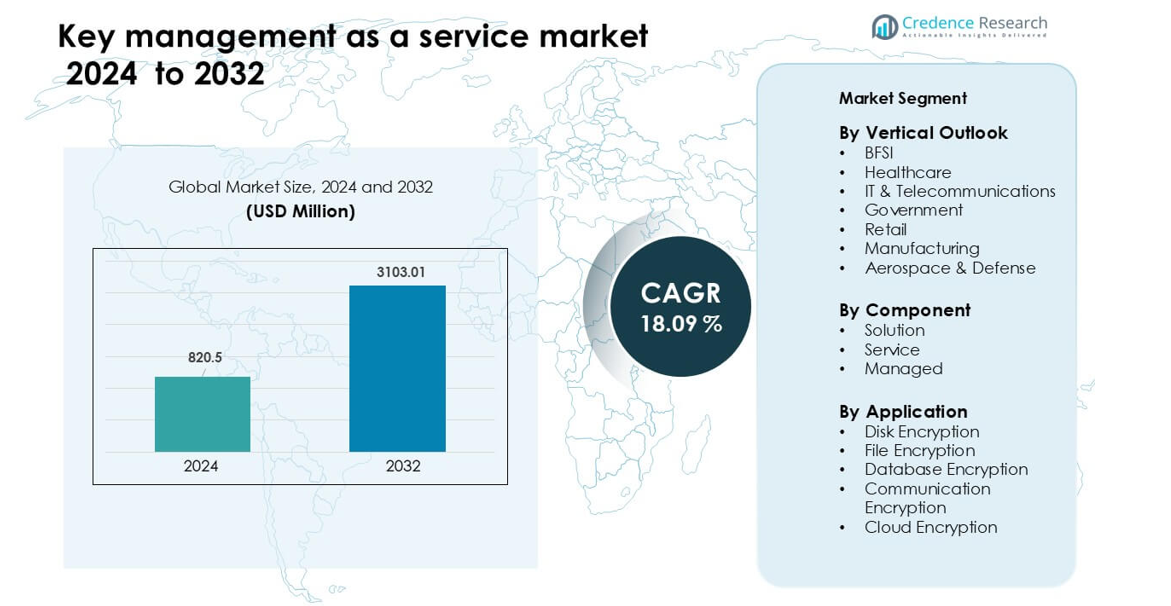

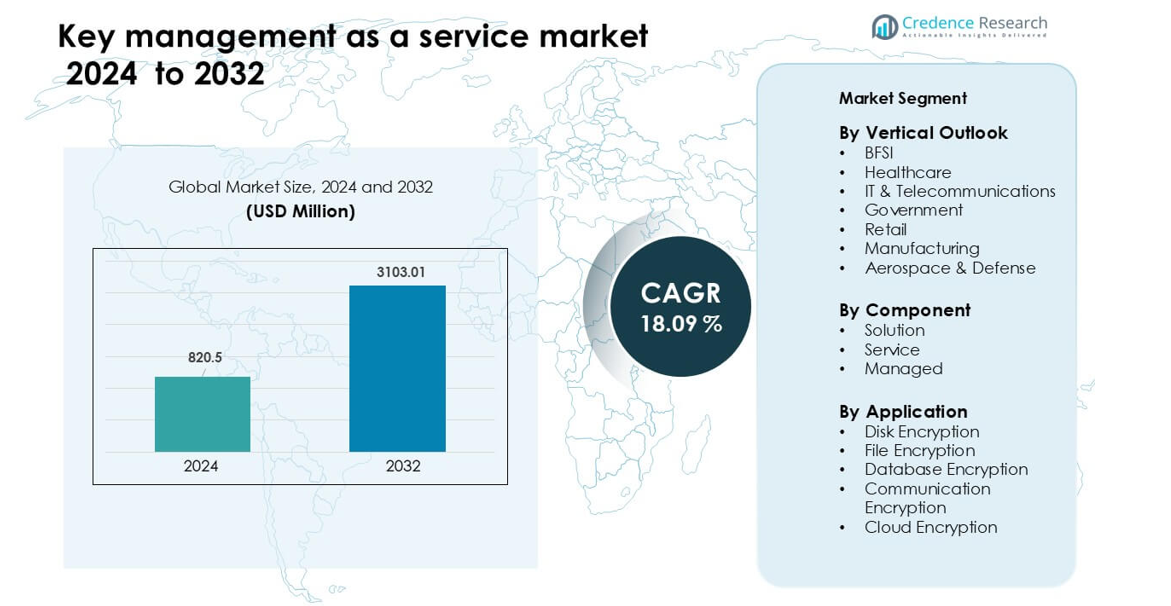

Key management as a service market was valued at USD 820.5 million in 2024 and is anticipated to reach USD 3103.01 million by 2032, growing at a CAGR of 18.09 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Key Management as a Service Market Size 2024 |

USD 820.5 million |

| Key Management as a Service Market, CAGR |

18.09% |

| Key Management as a Service Market Size 2032 |

USD 3103.01 million |

The key management as a service market is shaped by major players such as IBM Corporation, CipherCloud, Unbound Tech, Google, Thales (Gemalto), Intel Corporation, Sepior ApS, Egnyte, and KeyNexus Inc. These companies lead through advanced cloud integration, stronger encryption controls, and support for multi-cloud security needs. Their focus on automation, compliance readiness, and scalable key orchestration strengthens global adoption. North America remained the leading region in 2024 with 38% share, driven by strict data protection rules, high cloud usage, and strong investments from BFSI, healthcare, and technology sectors.

Market Insights

- The key management as a service market reached USD 820.5 million in 2024 and is anticipated to reach USD 3103.01 million by 2032, growing at a CAGR of 18.09 % during the forecast period.

- Strong demand came from the BFSI segment, which held about 31% share due to strict compliance needs and heavy cloud adoption across financial systems.

- Multi-cloud expansion and zero-trust security frameworks shaped major trends, pushing firms to shift toward centralized and automated key handling platforms.

- Competition intensified as IBM Corporation, CipherCloud, Unbound Tech, Google, Thales (Gemalto), and Intel Corporation advanced cloud-ready encryption tools with faster key rotation and strong compliance support.

- North America led with 38% share, driven by strict data protection laws and high cloud usage, while Asia-Pacific grew fastest as enterprises expanded digital infrastructure and strengthened cybersecurity spending.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vertical Outlook

The BFSI segment led the key management as a service market in 2024 with about 31% share. Banks and insurers drove demand due to rising cloud migration, higher digital transaction volumes, and strict data protection mandates. Healthcare and IT & telecommunications recorded steady gains as providers secured patient data, electronic records, and large communication networks. Government and defense agencies expanded adoption to safeguard classified data and support national cybersecurity programs. Retail and manufacturing followed as these sectors increased reliance on connected systems and required stronger protection for customer and operational data.

- For instance, one of India’s largest private banks—with over 43 million customers and 5,430 branches uses Thales’ CipherTrust Cloud Key Manager to manage encryption keys across AWS and Azure, gaining full visibility into when and how their keys are generated, used, and retired.

By Component

The solution segment dominated the key management as a service market in 2024 with nearly 54% share. Firms selected scalable key lifecycle tools to support encryption-heavy workloads and meet compliance goals. Services grew as organizations sought expert deployment support and rapid integration with cloud platforms. Managed key management advanced due to rising preferences for outsourced security operations that reduce internal workloads. Demand across all components increased as companies handled more sensitive data and adopted multi-cloud environments that required centralized cryptographic control.

- For instance, Thales’ CipherTrust Cloud Key Manager supports automated key rotation jobs: organizations can schedule rotation of hundreds of master keys per cloud subscription, helping reduce compliance burden.

By Application

Cloud encryption held the largest share in 2024 with about 37% share, driven by rapid enterprise cloud adoption and strict regulations on data protection. Disk and file encryption grew as businesses secured stored information, remote devices, and shared content. Database encryption gained traction due to rising cyberattacks targeting structured records across finance, healthcare, and retail. Communication encryption expanded with higher use of unified communication tools and remote work models. Each application advanced as companies adopted stronger encryption policies to limit breach risks and protect data across expanding digital ecosystems.

Key Growth Drivers

Growing Regulatory Pressure and Data Protection Needs

New privacy laws required stronger control over encrypted data and increased the use of key management tools. Firms faced strict audits and heavy penalties for poor data handling, so they adopted safer systems. Key management as a service offered clear logs, controlled access, and better monitoring to meet these laws. Companies used these services to secure personal, financial, and health records. Governments updated regulations often, which pushed firms to adopt flexible platforms. Clearer compliance paths helped many sectors raise security levels and drove steady market growth.

- For instance, Thales’ CipherTrust Cloud Key Manager produces detailed log records for every key operation (creation, rotation, import/export), which can be exported to a SIEM or syslog server for audit purposes.

Rising Cloud Adoption Across All Industries

Cloud use expanded across every major sector and created strong demand for secure key handling. Companies moved workloads to public and hybrid clouds and needed reliable encryption to protect sensitive data. Key management as a service helped organizations keep control of cryptographic keys while using remote systems. Many firms lacked in-house security skills, so they turned to outside platforms for simple and safe key storage. Global rules also pushed firms toward stronger cloud security. These factors encouraged widespread adoption and made cloud growth a major driver for this market.

Rapid Increase in Cyberattacks Targeting Sensitive Data

Cyberattacks became more common and more advanced, forcing organizations to strengthen encryption methods. Hackers targeted stored data, cloud files, and internal databases across many industries. Firms used key management services to close security gaps and limit damage from breaches. Centralized control helped teams rotate, store, and revoke keys quickly. Attack costs also increased, which pushed companies to invest in safer systems. Better risk awareness across leadership groups supported this shift. The rising threat landscape made strong encryption a priority and boosted demand for key management as a service.

Key Trends & Opportunities

Expansion of Multi-Cloud and Hybrid IT Environments

Multi-cloud use increased as companies mixed services from several providers. This created new security issues because each cloud followed different rules. Key management as a service helped firms unify key control across all systems. Central tools simplified encryption tasks and reduced manual errors. This trend opened opportunities for flexible platforms that supported many cloud setups. Firms also needed tools that scaled with heavy workloads, creating strong demand for advanced and automated services. Growing hybrid networks made unified key control an important market opportunity.

- For instance, Thales’ Cloud Key Manager supports automation via RESTful APIs, allowing enterprises to rotate, backup, and manage hundreds of master keys per cloud subscription programmatically, rather than handling each key manually.

Growth of Zero-Trust Security Adoption

Many firms shifted to zero-trust security models to protect modern networks. Zero-trust required strict verification and constant checking of user actions. Encryption played a major role, which increased demand for strong key management. Companies needed tools that worked well with identity systems and provided real-time control. Key management services offered this support and helped firms move toward zero-trust faster. Vendors gained new opportunities by creating tools that linked with security platforms. The move toward zero-trust made encryption and key control central to long-term security plans.

- For instance, Thales’ CipherTrust Manager gives granular role‑based access control and integrates with identity systems so that only verified identities can perform key lifecycle operations (generation, rotation, deletion) strengthening zero‑trust governance.

Key Challenges

High Integration Complexity in Large Enterprises

Large firms often struggled to connect key management with existing systems. Older networks and custom apps required extra setup steps, slowing adoption. Integration problems increased the need for skilled teams, raising project costs. Some firms delayed upgrades because of these challenges. Vendors had to offer special support and simpler tools to reduce these hurdles. Complex systems also caused delays in meeting security goals. This challenge remained a major barrier for companies with wide and older IT setups.

Limited Security Expertise in Small and Mid-Size Companies

Smaller firms often lacked the skills needed to manage encryption and key policies. Many teams understood basic security but struggled with advanced key handling. This skill gap created risks during setup and daily use. Smaller budgets also limited access to expert help. These issues slowed adoption and made firms depend more on outside support. Vendors needed easier tools to reach this segment. Without simpler systems, many small firms continued facing delays in adopting strong key management.

Regional Analysis

North America

North America led the key management as a service market in 2024 with about 38% share. Strong adoption of cloud platforms, strict data protection rules, and higher cyberattack risks supported steady growth. The U.S. dominated due to advanced security spending by BFSI, healthcare, and tech firms. Canada added momentum as businesses modernized IT systems and adopted zero-trust frameworks. Widespread use of multi-cloud setups increased the need for unified key handling. Major vendors and rapid regulatory updates further strengthened the region’s leadership, helping North America maintain a clear edge over other markets.

Europe

Europe held nearly 29% share in 2024, driven by strict privacy laws and strong industry compliance needs. The GDPR requirement for strict encryption practices raised demand for centralized key control. Germany, the U.K., and France led adoption as enterprises transitioned to cloud and hybrid systems. Financial services, government agencies, and telecom firms pushed the market forward through higher investments in secure IT modernization. Growing cyber risks and national security initiatives also supported broader uptake. These factors helped Europe remain one of the most security-driven markets for key management services.

Asia-Pacific

Asia-Pacific accounted for about 23% share in 2024 and remained the fastest-growing regional market. Rapid digitalization in China, India, Japan, and South Korea increased the need for cloud-based encryption tools. Expanding fintech ecosystems and large e-commerce networks created high demand for secure data handling. Rising cybercrime and new national cybersecurity rules encouraged firms to adopt structured key management. Cloud migration across IT, telecom, and manufacturing sectors boosted uptake further. Strong investments in modern security infrastructure supported the region’s growth and positioned Asia-Pacific as a long-term opportunity.

Latin America

Latin America held around 6% share in 2024, supported by growing cloud adoption and stronger regulatory efforts. Brazil and Mexico led the market as enterprises modernized IT operations and improved data protection systems. Expanding digital banking, e-commerce activity, and rising breach incidents pushed firms toward centralized encryption management. Adoption remained slower compared to developed regions due to budget limits and skills gaps. However, more companies moved toward managed security services, raising the use of cloud-based key management. This shift strengthened the region’s growth potential.

Middle East & Africa

The Middle East & Africa region captured nearly 4% share in 2024, driven by rising cybersecurity concerns and expanding digital transformation programs. Gulf countries such as the UAE and Saudi Arabia adopted advanced encryption solutions to protect government, finance, and energy sector data. Cloud service expansion across emerging markets supported the need for secure key handling. Many organizations relied on managed platforms due to limited in-house expertise. Growing investment in national cybersecurity frameworks further supported market activity. Despite smaller scale, the region continued showing strong long-term growth prospects.

Market Segmentations:

By Vertical Outlook

- BFSI

- Healthcare

- IT & Telecommunications

- Government

- Retail

- Manufacturing

- Aerospace & Defense

By Component

By Application

- Disk Encryption

- File Encryption

- Database Encryption

- Communication Encryption

- Cloud Encryption

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the key management as a service market features IBM Corporation, CipherCloud, Unbound Tech, Google, Thales (Gemalto), Intel Corporation, Sepior ApS, Egnyte, and KeyNexus Inc. Companies expanded their reach with strong cloud-ready encryption tools and simple key control systems. Many vendors improved integration with major cloud platforms to support multi-cloud use. Firms focused on faster key rotation, safer storage, and zero-trust support. Players added automation features to reduce human error and improve daily security tasks. Several companies invested in quantum-safe methods to prepare for future risks. Partnerships with financial, healthcare, and telecom firms helped vendors grow. Many providers also offered managed services for teams lacking security skills. These strategies strengthened competition and pushed vendors to deliver better performance and stronger compliance features across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Egnyte launched Project Hub an AI-powered data-infrastructure platform for the AEC sector; while not strictly a KMaaS move, it implies deeper investment in secure key/control infrastructure.

- In April 2025, Intel corporation Highlighted a security advisory concerning encryption-key exposure on Intel Apollo Lake platforms a relevant risk to key-management services.

- In March 2025, IBM Corporation Announced a broader push in its as-a-service portfolio (though not specifically KMaaS) as part of infrastructure management tools

Report Coverage

The research report offers an in-depth analysis based onVertical Outlook, Component, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for cloud-based key control will rise as enterprises expand multi-cloud systems.

- Zero-trust adoption will push firms to use stronger and more automated encryption tools.

- Quantum-safe cryptography will gain traction as companies prepare for future security risks.

- AI-driven key monitoring will improve threat detection and reduce manual workload.

- More industries will shift from on-premise key systems to fully managed cloud platforms.

- Integration with identity and access management tools will become a core requirement.

- Regulatory pressure will increase adoption in BFSI, healthcare, government, and telecom sectors.

- Cross-border data flow rules will encourage firms to adopt region-specific key governance.

- SMEs will adopt simpler and low-cost managed services to close skill gaps.

- Global vendors will expand partnerships with cloud providers to strengthen market presence.