Market Overview

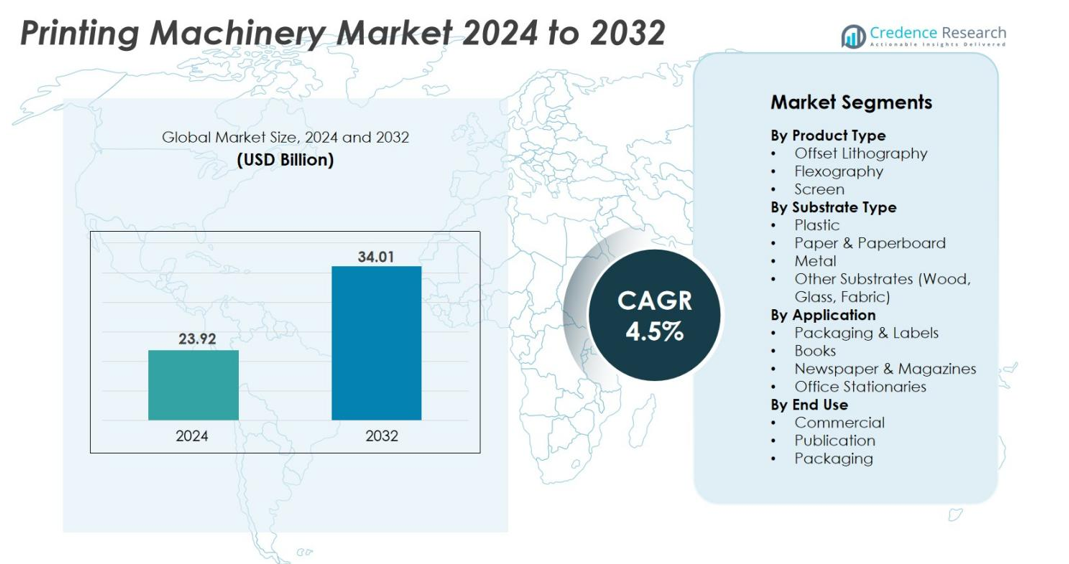

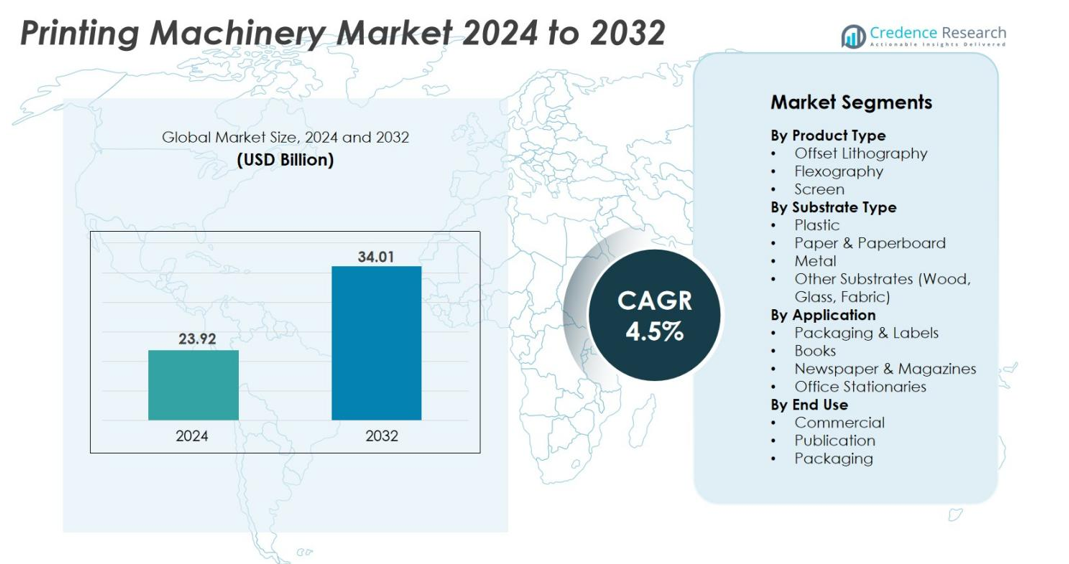

Printing Machinery market size was valued USD 23.92 Billion in 2024 and is anticipated to reach USD 34.01 Billion by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Printing Machinery market Size 2024 |

USD 23.92 Billion |

| Printing Machinery market, CAGR |

4.5% |

| Printing Machinery market Size 2032 |

USD 34.01 Billion |

The Printing Machinery market is led by global companies such as Heidelberg, Komori Corporation, Fujifilm Holdings, Bobst Group, Agfa-Gevaert, Koenig & Bauer, HP Inc., and Oce NV. These players compete through automation, high-speed presses, digital workflow integration, and sustainable printing capabilities. Heidelberg and Komori remain strong in offset systems, while HP and Fujifilm lead in digital and inkjet printing for short runs and variable data applications. Bobst dominates packaging machinery, especially for corrugated and flexible substrates. Asia Pacific is the leading region with a 44% market share, supported by strong industrial growth, large-scale packaging production, and rising investments in automated printing solutions.

Market Insights

- The Printing Machinery market was valued at USD 23.92 Billion in 2024 and is projected to reach USD 34.01 Billion by 2032 at a 4.5% CAGR, driven by rising demand across packaging, commercial printing, and labeling.

- Growing consumption of printed packaging in food, beverages, pharmaceuticals, and e-commerce acts as a key driver, pushing investments in flexographic, offset, and digital presses to achieve high-speed, multi-color, and cost-efficient production.

- Digital and hybrid printing trends gain momentum due to short-run customization, variable data printing, and reduced setup time, while sustainability boosts adoption of water-based inks and eco-efficient machinery.

- Competition remains strong among Heidelberg, Komori, Fujifilm, Bobst, HP, and Koenig & Bauer, as companies focus on automation, color management, remote diagnostics, and maintenance services to strengthen market presence.

- Asia Pacific leads with a 44% share, followed by Europe at 25% and North America at 21%; paper and paperboard hold the largest substrate share, while packaging and labels dominate applications with the highest equipment installations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Offset lithography holds the dominant position in the product type segment with a 52% market share. It remains the preferred printing technology for high-volume commercial work, publishing, and packaging because it delivers sharp images, supports a wide range of inks, and keeps printing costs low in long runs. Flexography continues to expand in flexible packaging and labels, while screen printing is used for specialty graphics and short-run decorative prints. However, strong demand from FMCG and publishing keeps offset equipment ahead of other technologies.

- For instance, manroland Goss, a leading offset press manufacturer, reported that its ROLAND 700 series presses are capable of printing up to 18,000 sheets per hour, used extensively by large commercial printers for sharp, high-quality image reproduction on a variety of substrates.

By Substrate Type

Paper and paperboard lead the substrate segment with a 60% market share. This dominance is driven by heavy usage in folding cartons, corrugated boxes, magazines, brochures, and office stationery. Rising demand for sustainable and recyclable packaging supports paper adoption in retail, e-commerce, and consumer goods. Plastic substrate demand remains high in flexible pouches and labels for food and cosmetics, while metal, wood, glass, and fabric serve niche decorative and industrial printing applications.

- For instance, MTuTech’s UV DTF printers offer advanced printing technology that transfers high-resolution, vibrant designs onto curved and irregular surfaces like glass, metal, and wood without surface pre-treatment.

By Application

Packaging and labels hold the largest application share at 48%, driven by increasing consumption of branded cartons, pouches, and logistics materials. FMCG, food, pharmaceuticals, and e-commerce companies rely on printed packaging for product identity, safety information, and tracking features such as barcodes and QR codes. Books and office stationery show stable demand from education and corporate sectors, while the newspaper and magazine segment grows slower due to digital alternatives. The strong expansion of packaged consumer goods keeps packaging the fastest-growing segment in printing machinery investment.

Key Growth Drivers

Rising Demand for Printed Packaging

The Printing Machinery market experiences steady growth due to rising consumption of printed packaging across food, beverages, pharmaceuticals, cosmetics, and e-commerce shipments. Brands prioritize high-quality printed labels, corrugated boxes, folding cartons, and flexible pouches to enhance product appearance, regulatory compliance, and supply-chain traceability. The surge in online retail pushes demand for durable, barcode-enabled packaging and shipment tracking prints. Flexible packaging drives adoption of advanced flexographic and digital machinery, supporting short-run, custom printing. Companies also invest in high-speed presses capable of handling large-volume packaging orders with faster setup and reduced waste.

- For instance, Konica Minolta’s digital production presses achieve speeds up to 100 pages per minute with resolutions as high as 2400 dpi, offering superb color finishing and quick turnaround, enabling packaging suppliers to efficiently produce high-quality printed materials on various media types, directly supporting growth in digitally printed packaging formats.

Technological Advancements and Automation

Automation and digitalization significantly boost market growth by improving speed, precision, and workflow efficiency. New machines integrate automated plate setting, color calibration, real-time quality monitoring, and predictive maintenance systems. Digital printing gains popularity for variable data printing, shorter print cycles, and on-demand customization. Manufacturers also deploy eco-efficient systems that reduce ink usage, energy consumption, and setup time. Automated finishing lines and robotic material handling further increase output while reducing labor dependency. As print service providers seek faster turnaround and higher print quality, investment in modern, automated printing machinery continues to rise.

- For instance, Xerox has integrated AI-powered real-time quality monitoring in their iGen digital presses that uses sensors and vision systems to detect printing defects instantly. This technology reduces waste by identifying errors within the first 100 sheets and initiating immediate corrective actions, achieving near-zero defect rates during high-speed production runs.

Shift Toward Sustainable Printing Practices

Sustainability becomes a major driver as industries adopt recyclable packaging, biodegradable inks, water-based coatings, and energy-efficient printing systems. Governments enforce strict regulations on packaging waste, chemical emissions, and ink toxicity, prompting manufacturers to upgrade machinery. Paper and paperboard packaging gain traction due to recyclability benefits, leading to higher demand for compatible printing equipment. Press makers launch systems that support low-VOC inks, reduced waste setup, and environmentally conscious workflows. Converters and brand owners prefer machinery that supports sustainability certifications and compliance, strengthening sales of advanced eco-friendly printing technologies.

Key Trends & Opportunities

Growth of Digital and Hybrid Printing Platforms

Digital printing expands rapidly as consumers favor shorter print runs, personalization, and fast delivery. Hybrid machines that combine digital and conventional printing enable high-quality graphics with low setup costs. Growing demand for customized labels, variable barcodes, and seasonal packaging offers strong growth potential. Small and mid-size converters benefit from fast plate changes, reduced inventory, and minimal wastage. The shift toward on-demand packaging production creates new revenue opportunities for printing machinery suppliers.

- For instance, Heidelberg’s Gallus Labelfire 340 digital inline label printing system delivers print speeds up to 70 meters per minute and a maximum print area of 1428 square meters per hour, integrating digital embellishment and inline finishing for complex label designs.

Smart Packaging and Security Printing

Smart packaging featuring QR codes, RFID, holograms, and track-and-trace technology drives adoption of specialized printing systems. Industries like pharmaceuticals, electronics, and luxury goods depend on anti-counterfeit features, boosting demand for precision printing machinery. High-resolution digital presses can print security labels, microtext, and scannable features required for authentication. As regulatory compliance becomes stricter, companies invest in machines capable of advanced printing for serialization and brand protection.

- For instance, Pharmapack offers serialization technologies including barcodes, RFID, and QR codes that enable real-time visibility and traceability compliant with U.S. DSCSA and European FMD regulations, ensuring robust anti-counterfeit safeguards.

Key Challenges

High Capital and Maintenance Costs

Printing machinery requires significant initial investment along with regular maintenance, spare parts, and skilled labor. Small and mid-size printing houses face difficulty adopting high-cost digital or automated presses. Mechanical complexity also increases downtime and repair expenses, creating operational challenges. Upgrading machinery to meet sustainability and automation requirements adds additional financial burden. These cost barriers slow adoption among low-budget and regionally constrained print operators.

Shift Toward Digital Media

The rise of digital content reduces demand for traditional newspaper and magazine printing. Online media, e-books, and digital advertisements pressurize revenue across commercial publishing. Printers must diversify into packaging, labeling, and specialty printing to offset volume losses. Companies not adapting to new applications or technology may experience declining machinery utilization. This shift forces the industry to rely more heavily on packaging and industrial segments to drive long-term equipment sales.

Regional Analysis

Asia Pacific

Asia Pacific dominates the Printing Machinery market with a 44% share, driven by strong packaging and commercial printing demand in China, India, Japan, and South Korea. The region benefits from rapid industrialization, expanding FMCG production, and large export-oriented manufacturing. E-commerce and retail growth accelerate the need for labels, cartons, and corrugated packaging. Governments promote investment in printing and converting infrastructure, encouraging adoption of high-speed flexographic and digital presses. Local and international press manufacturers expand their presence to meet rising demand for automation and cost-efficient printing equipment.

Europe

Europe accounts for 25% of the market, supported by advanced printing technology adoption and a strong base of premium packaging producers. Germany, Italy, the U.K., and France lead machinery deployment for folding cartons, flexible packaging, and commercial printing. Sustainability regulations promoting recyclable packaging fuel demand for modern printing systems using eco-friendly inks and energy-efficient technology. The region also contributes to innovation, with manufacturers focusing on digital presses, automation, and hybrid platforms. Growth continues in pharmaceutical, cosmetics, and luxury goods packaging, which require high-quality graphics and security printing.

North America

North America holds a 21% market share, largely driven by the U.S. and Canada. The region’s printing industry focuses on high-end packaging, fast label printing, and commercial applications such as brochures and corporate materials. Advancement in digital presses supports on-demand printing, short runs, and personalization. Growth in food and beverage, healthcare, and logistics increases investment in flexographic and digital machinery. However, the publication segment declines due to digital media, shifting printer investments toward packaging and variable data printing.

Latin America

Latin America captures a 6% share, with Brazil, Mexico, and Argentina leading adoption. Growth is supported by rising consumption of packaged food, beverages, and consumer goods, driving demand for printed cartons, labels, and flexible packaging. Local converters increasingly replace older presses with efficient flexographic and digital machines that reduce ink and substrate waste. Economic fluctuations and import dependency slow upgrades for small printing houses, but multinational packaging companies continue installing modern equipment to meet quality and branding requirements.

Middle East & Africa

The Middle East & Africa region holds a 4% market share, fueled by expanding retail, e-commerce, and FMCG production. The UAE, Saudi Arabia, and South Africa represent the largest markets, investing in commercial packaging and label printing technologies. Industrialization and growth in food processing boost demand for corrugated boxes and logistics labeling. Equipment sales remain concentrated in large packaging converters, as smaller print shops struggle with upgrade costs. Nonetheless, increasing localization of packaging manufacturing and import substitution continues to support gradual machinery adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations

By Product Type

- Offset Lithography

- Flexography

- Screen

By Substrate Type

- Plastic

- Paper & Paperboard

- Metal

- Other Substrates (Wood, Glass, Fabric)

By Application

- Packaging & Labels

- Books

- Newspaper & Magazines

- Office Stationaries

By End Use

- Commercial

- Publication

- Packaging

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Printing Machinery market features a mix of global manufacturers and regional players that supply offset, flexographic, digital, and specialty printing equipment. Key companies such as Heidelberg, Fujifilm, Komori, Agfa-Gevaert, HP, Bobst, and Koenig & Bauer compete through print quality, automation, substrate versatility, and cost efficiency. Manufacturers invest in high-speed presses, computer-to-plate technology, real-time color calibration, remote diagnostics, and hybrid solutions that combine digital and conventional printing. Partnerships with packaging converters and print service providers strengthen product reach, especially in the fast-growing labels and flexible packaging segments. Companies also expand aftermarket services through consumables, print heads, software upgrades, and maintenance contracts, ensuring recurring revenue. Sustainability remains a major competitive factor, as press makers introduce machines compatible with water-based inks, low-VOC coatings, and reduced energy use. The market continues to shift toward digital platforms and automated workflows, pushing competitors to innovate faster to maintain market share.

Key Player Analysis

Recent Developments

- In October 2025, Xerox Holdings Corporation unveiled its Proficio Production Series, featuring the PX300 and PX50 presses at the PRINTING United Expo, enhancing productivity and automation in high-volume digital printing.

- In October 2025, Rajoo Engineers Limited acquired a 60% stake in Kohli Printing and Converting Machines Pvt. Ltd., expanding its product portfolio and strengthening its footprint in the printing and converting machinery market.

- In September 2025, MS Printing Solutions, a subsidiary of JK Group (Dover Corporation), introduced five new multi-pass digital textile printers, designed to deliver higher print precision and speed for industrial fabric printing applications.

Report Coverage

The research report offers an in-depth analysis based on Product, Substrate, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for automated printing systems will increase as converters seek faster production and reduced labor dependency.

- Digital presses will grow rapidly due to short-run packaging, personalization, and variable data printing.

- Hybrid machines that combine digital and traditional printing will gain adoption across commercial and packaging segments.

- Sustainability requirements will push manufacturers to develop presses compatible with water-based inks and low-VOC coatings.

- Smart printing workflows will expand with real-time color management, predictive maintenance, and remote diagnostics.

- Flexible packaging and labels will remain the fastest-growing application segment for printing machinery.

- Print service providers will invest more in energy-efficient equipment to reduce operating costs and waste.

- Security printing for QR codes, serialization, and anti-counterfeiting will boost demand in pharmaceuticals and premium goods.

- Upgraded finishing, die-cutting, and converting systems will be bundled with printing machinery for end-to-end automation.

- Asia Pacific will continue to lead installations as packaging, e-commerce, and industrial production rise.