Market Overview:

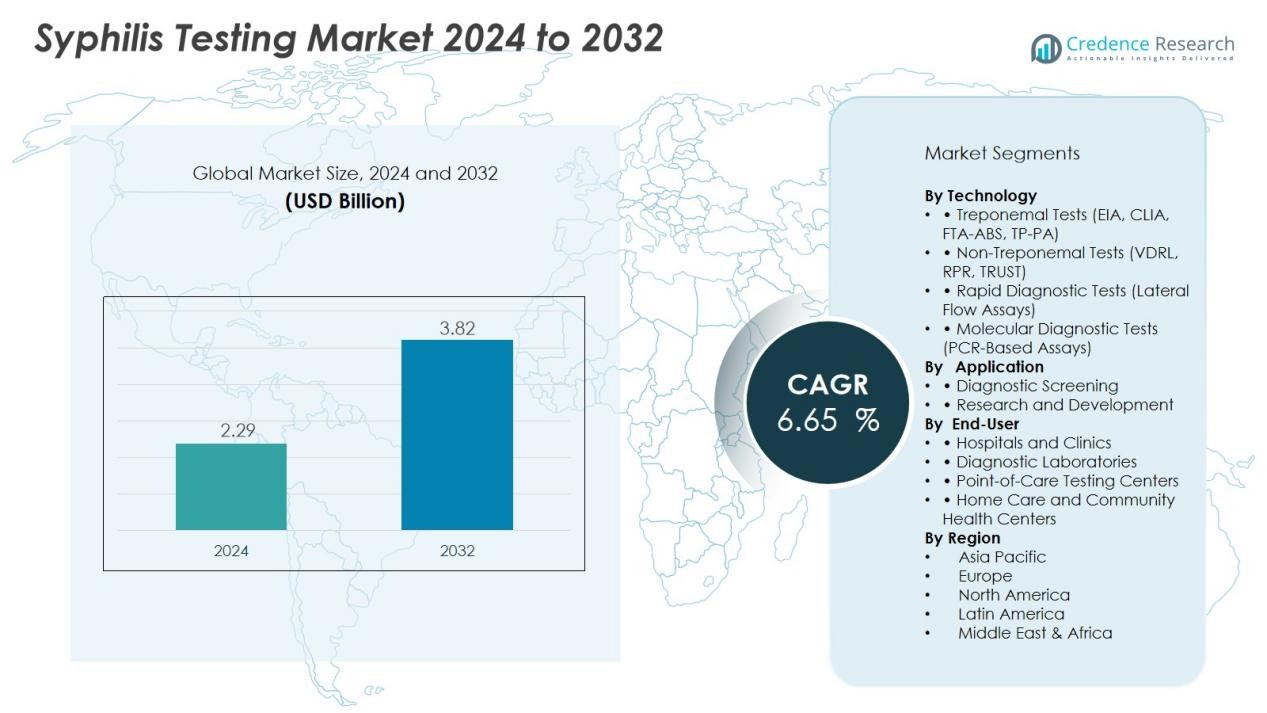

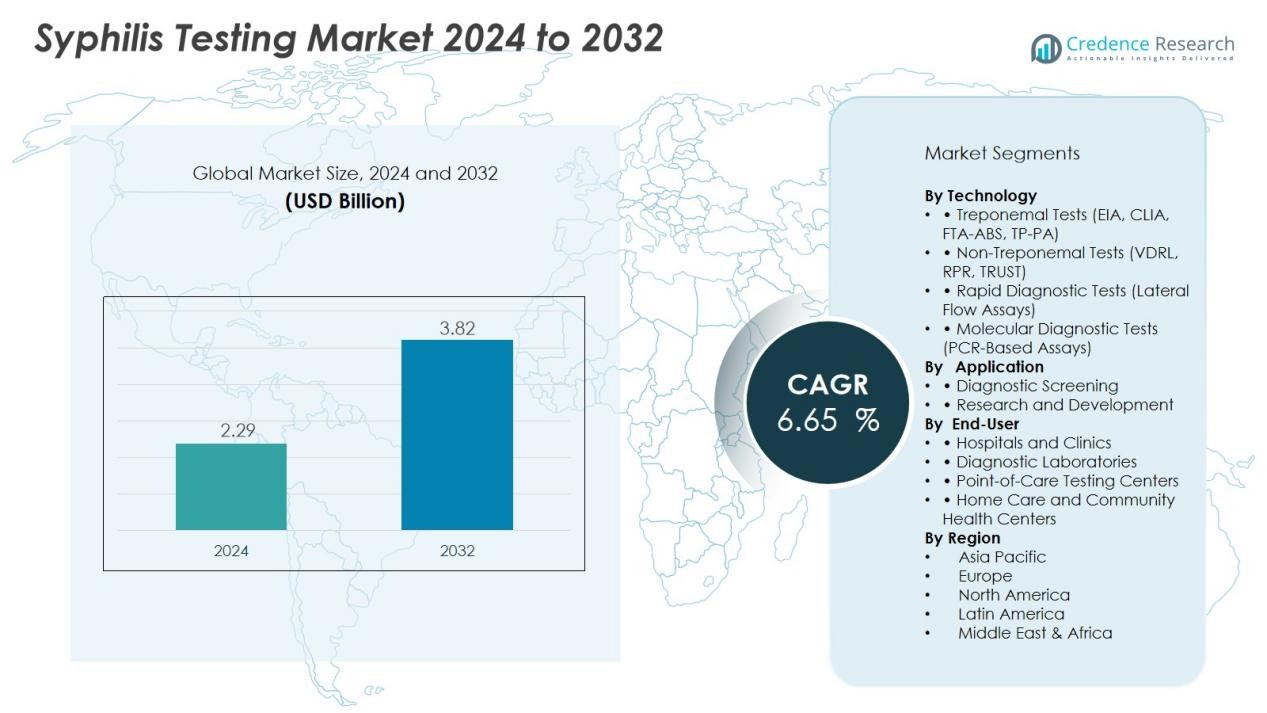

The Syphilis Testing Market size was valued at USD 2.29 billion in 2024 and is anticipated to reach USD 3.82 billion by 2032, at a CAGR of 6.65 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Syphilis Testing Market Size 2024 |

USD 2.29 Billion |

| Syphilis Testing Market, CAGR |

6.65% |

| Syphilis Testing Market Size 2032 |

USD 3.82 Billion |

Market growth is primarily driven by the growing prevalence of syphilis, particularly in developing economies, and the inclusion of routine syphilis testing in antenatal care programs. Government initiatives promoting early diagnosis and treatment, coupled with greater access to healthcare facilities, further enhance demand. Additionally, the availability of cost-effective rapid diagnostic tests (RDTs) from both public and private healthcare providers supports large-scale testing efforts.

Regionally, North America holds the dominant market share due to strong healthcare infrastructure, extensive STI awareness campaigns, and high diagnostic adoption rates. Europe follows, supported by structured screening protocols and public health investments. Asia-Pacific is the fastest-growing region, driven by expanding healthcare access, increasing disease burden, and government-led prevention programs across India, China, and Southeast Asia.

Market Insights:

- The Syphilis Testing Market was valued at USD 1.52 billion in 2018, reached USD 2.29 billion in 2024, and is expected to attain USD 3.82 billion by 2032, growing at a CAGR of 6.65% during the forecast period.

- North America leads with 38% share due to advanced diagnostic infrastructure, high awareness levels, and strong government-backed STI control programs.

- Europe holds 30% share, driven by structured healthcare systems, standardized screening protocols, and public investments in preventive health initiatives.

- Asia-Pacific follows with 25% share and remains the fastest-growing region, supported by rapid healthcare expansion, large population base, and government-led disease prevention campaigns in China, India, and Southeast Asia.

- Treponemal-based testing accounts for 55% of the technology segment, driven by its superior accuracy and diagnostic reliability, while hospitals and clinics hold 48% of the end-user share due to large-scale screening and antenatal care programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Global Prevalence of Syphilis and Increasing Awareness Programs

The growing incidence of syphilis across developing and developed regions strongly drives testing demand. Public health organizations and NGOs are intensifying awareness campaigns to promote early screening and treatment. The Syphilis Testing Market benefits from these initiatives, which improve patient education and reduce infection-related complications. Rising public health funding and integration of STI testing into national healthcare programs continue to strengthen market growth.

- For instance, WHO prequalified the Determine™ Antenatal Care Panel on July 15, 2025, marking the first bundled rapid diagnostic test capable of simultaneously detecting HIV, hepatitis B virus, and syphilis in a single test platform, with dual HIV/syphilis rapid tests now prequalified by WHO across three different product formulations to support elimination efforts in high-burden regions.

Technological Advancements in Diagnostic Solutions

Innovations in diagnostic technologies enhance the accuracy and efficiency of syphilis detection. Rapid point-of-care testing kits, automated analyzers, and molecular-based assays provide faster and more reliable results. It enables healthcare professionals to diagnose infections in early stages and initiate timely treatment. The introduction of multiplex testing platforms capable of detecting multiple STIs in a single assay further boosts adoption among healthcare providers.

- For Instance, The Syphilis Health Check™ rapid test, distributed in the U.S. by Trinity Biotech for Diagnostics Direct, is an FDA-cleared and CLIA-waived qualitative immunochromatographic assay that detects T. pallidum antibodies in a fingerstick blood sample, providing preliminary results in 10 minutes.

Government Screening Initiatives and Preventive Healthcare Programs

Many governments mandate routine syphilis screening, particularly for pregnant women and high-risk populations. These initiatives improve disease control and reduce congenital syphilis cases. It promotes greater use of both serological and rapid testing methods within public healthcare systems. Continuous policy support and international collaborations among WHO and CDC further reinforce market expansion across global healthcare networks.

Growing Access to Point-of-Care and Home-Based Testing

The expansion of decentralized diagnostic solutions fuels market adoption in underserved regions. Point-of-care and home-based test kits improve accessibility, particularly in low-resource settings. It reduces dependency on laboratory infrastructure while ensuring timely detection and treatment initiation. The rising trend toward self-testing, supported by telemedicine and digital health platforms, strengthens consumer-driven demand for reliable and convenient diagnostic products.

Market Trends:

Adoption of Rapid and Point-of-Care Diagnostic Technologies

The adoption of rapid and point-of-care (POC) diagnostic technologies is transforming disease detection and patient management. Healthcare providers increasingly prefer these systems for their speed, portability, and minimal infrastructure needs. The Syphilis Testing Market benefits from innovations in immunochromatographic and lateral flow assays that deliver results within minutes. It supports immediate clinical decisions and reduces patient loss to follow-up in resource-limited settings. The demand for POC testing continues to grow in community health programs and mobile clinics targeting high-risk populations. Integration of these tools into primary healthcare facilities strengthens early diagnosis efforts. Manufacturers are expanding product portfolios with dual or triple tests that simultaneously detect HIV and other STIs, improving efficiency and patient outcomes.

- For instance, Abbott’s SD BIOLINE Syphilis test delivers results in under 20 minutes and is field-validated with a sensitivity of 99.3% for syphilis detection in mobile outreach settings.

Integration of Digital Health Platforms and Automation in Diagnostics

Digital health technologies are reshaping diagnostic workflows and data management practices. Automated analyzers, cloud-based reporting systems, and AI-driven diagnostic tools are gaining momentum in laboratories worldwide. It enhances testing accuracy, streamlines result interpretation, and ensures faster turnaround times. The growing use of connected diagnostic platforms allows remote result sharing and real-time disease surveillance, which supports public health monitoring. Laboratories and clinics are adopting automated systems to handle high testing volumes efficiently while reducing manual errors. Partnerships between diagnostic companies and digital health firms are promoting the development of integrated testing ecosystems. These advancements align with global efforts to strengthen infectious disease management and improve healthcare accessibility.

- For Instance, Roche Diagnostics’ cobas pro integrated solutions system is a modular and scalable platform capable of processing up to 4,400 tests per hour through various configurations, with the potential for higher rates using newer analytical units.

Market Challenges Analysis:

Limited Awareness and Stigma in Low-Resource Regions

Lack of awareness and cultural stigma surrounding sexually transmitted infections continue to restrain testing rates. Many individuals avoid testing due to social discrimination and limited health education. The Syphilis Testing Market faces barriers in rural and underdeveloped regions where healthcare infrastructure remains weak. It restricts access to timely diagnosis and treatment, allowing infections to progress undetected. Insufficient government funding and limited outreach programs further delay efforts to achieve universal screening goals. These gaps in awareness and acceptance reduce the overall effectiveness of public health initiatives aimed at controlling disease spread.

Regulatory Barriers and Inconsistent Quality Standards

Differences in regulatory frameworks across countries create challenges for diagnostic product approvals and commercialization. Companies face delays in obtaining certifications due to varying validation criteria and documentation requirements. It affects the launch of innovative testing solutions, particularly for point-of-care and home-use applications. Inadequate quality control in low-cost test kits also raises concerns over result accuracy and reliability. Limited reimbursement policies for diagnostic tests discourage widespread adoption in cost-sensitive markets. These regulatory and operational challenges slow market expansion and restrict the penetration of advanced diagnostic technologies in several regions.

Market Opportunities:

Expansion of Screening Programs and Public Health Partnerships

Rising investments in global health initiatives create strong opportunities for diagnostic expansion. Governments and international organizations are prioritizing syphilis screening within maternal and child health programs. The Syphilis Testing Market benefits from these collaborative efforts aimed at reducing congenital infections. It supports large-scale procurement of rapid diagnostic kits for use in hospitals and community clinics. Increased donor funding and technical assistance from WHO and UNICEF accelerate testing adoption in low-income nations. Integration of syphilis screening with HIV and hepatitis programs strengthens healthcare delivery and enhances disease management efficiency.

Technological Innovation and Growth of Home-Based Testing Solutions

Continuous advancements in diagnostic technologies open new avenues for market growth. Companies are developing compact, digital, and smartphone-compatible test kits for home use. It improves accessibility, reduces testing hesitancy, and empowers individuals to monitor their health privately. The growing acceptance of telemedicine and e-pharmacy services supports remote consultations and result interpretation. Manufacturers focusing on low-cost, easy-to-use, and AI-integrated systems will gain a competitive edge in emerging markets. Expanding distribution through online platforms and retail pharmacies further broadens consumer reach and accelerates diagnostic adoption worldwide.

Market Segmentation Analysis:

By Technology

The market is categorized by technology into treponemal and non-treponemal tests, with treponemal assays holding the dominant share. These tests, including enzyme immunoassays (EIA) and chemiluminescent immunoassays (CLIA), provide higher accuracy and are used for confirmatory diagnosis. The Syphilis Testing Market is expanding as laboratories adopt automated platforms for improved throughput and precision. It benefits from the growing adoption of rapid diagnostic tests (RDTs) that enable on-site results and immediate treatment initiation. The demand for molecular diagnostic methods such as PCR-based assays is also increasing in reference laboratories for early and complex case detection.

- For instance, Roche’s cobas® Syphilis test, deployed on the cobas® 6800/8800 systems, can process up to 960 tests in an 8-hour shift, significantly improving early detection capabilities in high-volume settings.”

By Application

Based on application, the market is segmented into diagnostic screening and research. Diagnostic screening dominates due to high testing volumes in hospitals, sexual health clinics, and blood banks. It supports early detection and prevention programs, especially among pregnant women and high-risk populations. Research applications are expanding with rising studies on STI epidemiology, vaccine development, and resistance patterns. The growing collaboration between research institutions and diagnostic manufacturers drives new assay innovations and sensitivity improvements.

- For instance, the National Institute of Allergy and Infectious Diseases (NIAID) established four Cooperative Research Centers with $41.6 million in five-year grants to conduct collaborative research on syphilis, gonorrhea, and chlamydia vaccines, with each center expected to identify at least 1 candidate vaccine ready for clinical trials by program completion.

By End User

Hospitals and clinics hold the leading share in the end-user segment, supported by structured screening procedures and government-backed health programs. It ensures wide access to diagnostic services and comprehensive patient care. Diagnostic laboratories follow, leveraging automation and high-throughput systems for mass testing. Point-of-care settings and community health centers are gaining momentum, supported by portable test kits and self-testing trends that enhance outreach in remote areas.

Segmentations:

By Technology

- Treponemal Tests (EIA, CLIA, FTA-ABS, TP-PA)

- Non-Treponemal Tests (VDRL, RPR, TRUST)

- Rapid Diagnostic Tests (Lateral Flow Assays)

- Molecular Diagnostic Tests (PCR-Based Assays)

By Application

- Diagnostic Screening

- Research and Development

By End User

- Hospitals and Clinics

- Diagnostic Laboratories

- Point-of-Care Testing Centers

- Home Care and Community Health Centers

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds 38% share of the global market, driven by advanced diagnostic infrastructure and strong public health systems. The United States leads due to extensive screening programs, awareness campaigns, and high testing volumes among high-risk populations. The Syphilis Testing Market in this region benefits from continuous research funding and government-led STI control strategies. It also gains momentum from technological innovations in automated testing and digital reporting platforms. Private diagnostic networks and community clinics play a vital role in expanding accessibility. Canada follows with consistent policy support for sexual health programs and nationwide screening protocols. The presence of major diagnostic firms enhances regional competitiveness and accelerates new product approvals.

Europe

Europe accounts for 30% share of the global market, supported by structured healthcare systems and strong regulatory compliance. The region’s growth is led by countries such as Germany, France, and the United Kingdom, which maintain organized screening frameworks. It emphasizes integrated public health campaigns and early detection in antenatal and sexual health settings. Increased use of rapid tests and laboratory automation enhances accuracy and turnaround time. Government initiatives focusing on reducing congenital syphilis cases boost adoption in both public and private healthcare sectors. The growing collaboration between research bodies and diagnostic manufacturers supports innovation and high-quality testing outcomes.

Asia-Pacific

Asia-Pacific captures 25% share of the global market and exhibits the fastest growth rate during the forecast period. Rapid expansion of healthcare access in China, India, and Southeast Asia drives testing demand. The region benefits from government-backed awareness campaigns and integration of STI screening into primary healthcare services. It experiences strong adoption of cost-effective rapid diagnostic kits suited for low-resource environments. Rising investments in healthcare infrastructure and public-private partnerships strengthen diagnostic capacity. Increasing urbanization and awareness among younger populations support large-scale testing initiatives. The growing involvement of international health organizations continues to advance disease control and prevention strategies across the region.

Key Player Analysis:

- Abbott Laboratories

- AdvaCare Pharma

- Beckman Coulter Inc.

- Becton Dickinson and Co.

- Bio Rad Laboratories Inc.

- Biolytical Laboratories Inc.

- Calibre Scientific Inc.

- Cepheid Inc.

- DiaSorin SpA

- Everlywell Inc.

- Hoffmann La Roche Ltd.

- Hologic Inc.

Competitive Analysis:

The Syphilis Testing Market remains competitive, with key players focusing on innovation, accessibility, and accuracy enhancement. Leading companies such as Abbott Laboratories, AdvaCare Pharma, Beckman Coulter Inc., Becton Dickinson and Co., Bio-Rad Laboratories Inc., and Biolytical Laboratories Inc. dominate the landscape through extensive product portfolios and global distribution networks. It benefits from continuous investment in rapid diagnostic technologies, automation, and molecular assay development. Companies emphasize improving detection sensitivity and reducing turnaround times to meet public health requirements. Strategic collaborations with governments and NGOs expand testing availability in developing regions. New product approvals, technological upgrades, and partnerships strengthen competitive positioning, while regional expansions help firms capture unmet demand in low-resource markets.

Recent Developments:

- In October 2025, Abbott reported strong third-quarter results and reaffirmed its full-year 2025 guidance.

- In November 2025, AdvaCare Pharma expanded partnerships in the MENA region, focusing on new opportunities for growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on By Technology, By Application, By End User, By Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Syphilis Testing Market will witness steady growth driven by expanding global screening initiatives and improved diagnostic access.

- Integration of rapid and point-of-care testing solutions will enhance early detection in remote and low-resource regions.

- Automation and digital connectivity in laboratories will streamline diagnostic workflows and support real-time data sharing.

- Increased government funding for STI prevention programs will strengthen large-scale testing and awareness campaigns.

- Rising collaborations between diagnostic firms and public health organizations will accelerate product innovation and market penetration.

- The adoption of molecular-based and AI-assisted diagnostic tools will improve test accuracy and efficiency.

- Growing preference for home-based and self-testing kits will expand consumer access and reduce testing hesitation.

- Manufacturers will focus on affordable, easy-to-use diagnostic kits to address demand in developing economies.

- Regulatory harmonization and faster approval processes will support the commercialization of advanced diagnostic technologies.

- Sustained emphasis on antenatal and population-wide screening will continue to drive demand and improve global disease control outcomes.