Market Overview

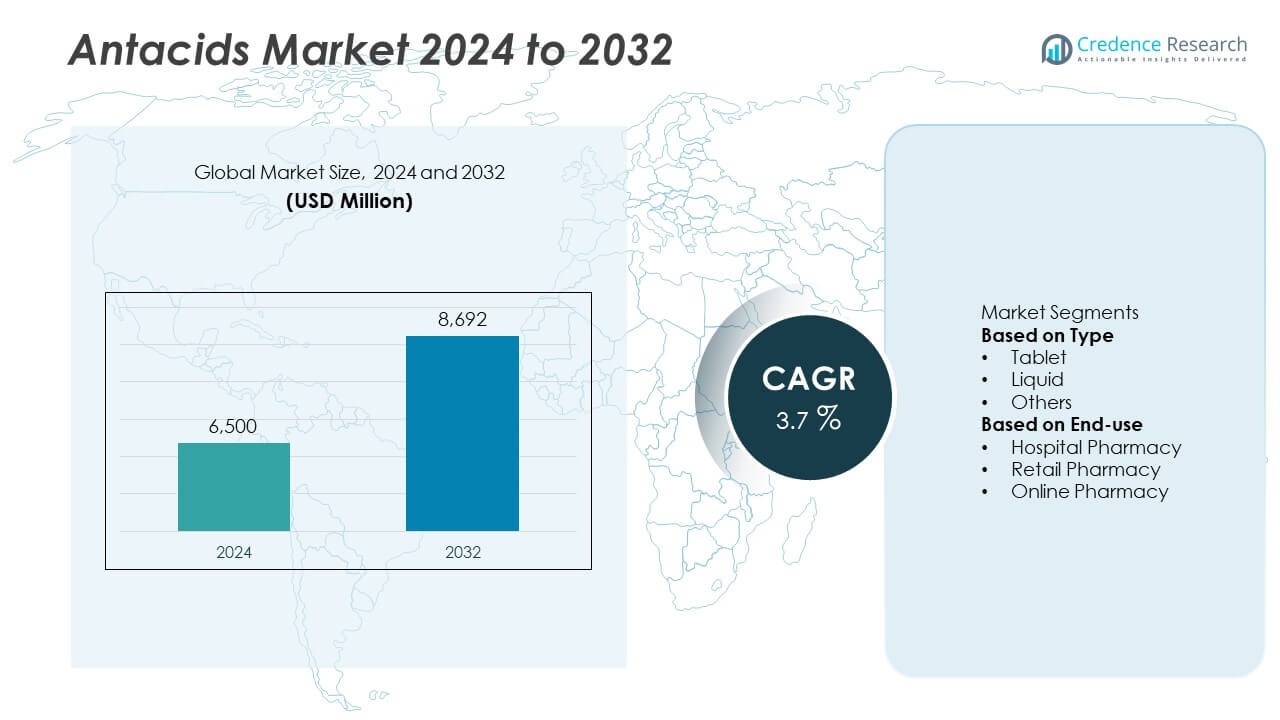

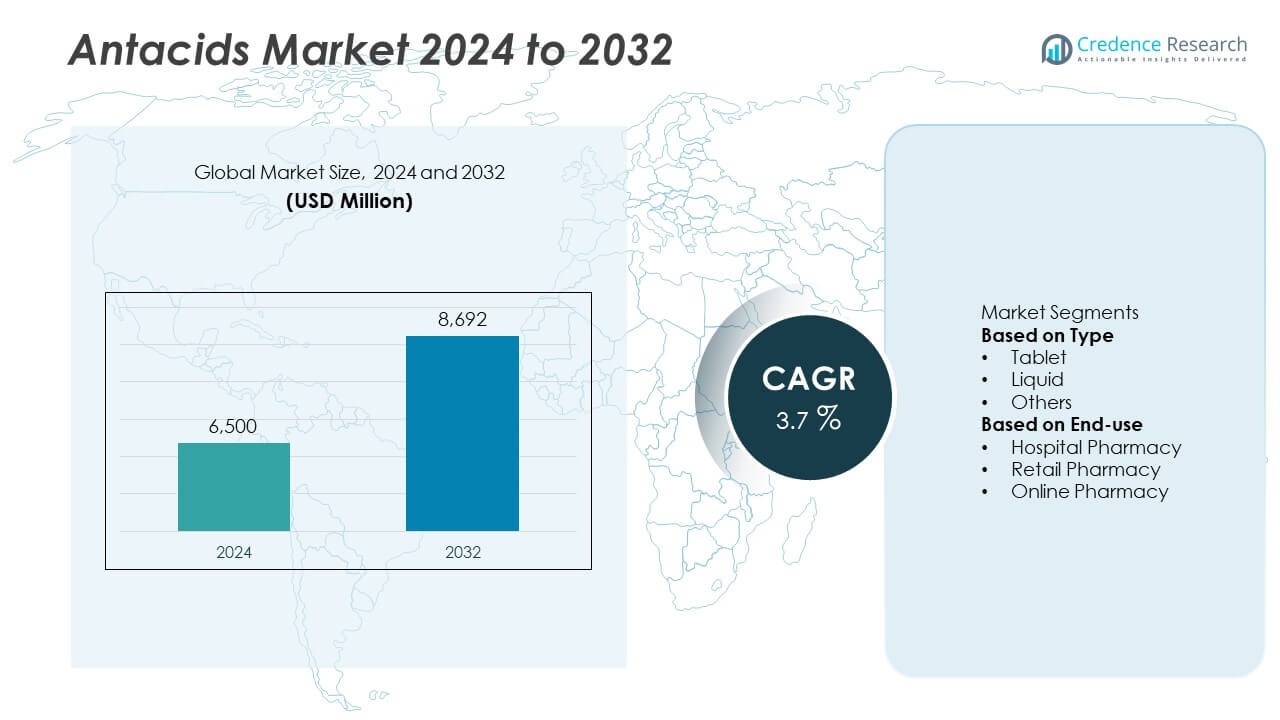

The Antacids Market was valued at USD 6,500 million in 2024 and is projected to reach USD 8,692 million by 2032, growing at a CAGR of 3.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Antacids Market Size 2024 |

USD 6,500 Million |

| Antacids Market, CAGR |

3.7% |

| Antacids Market Size 2032 |

USD 8,692 Million |

The antacids market is led by major players including Sun Pharmaceuticals Ltd., Bayer AG, GlaxoSmithKline plc, Procter & Gamble, Boehringer Ingelheim International GmbH, Takeda Pharmaceutical Company Limited, Reckitt Benckiser Group plc, Dr. Reddy’s Laboratories Ltd., Pfizer Inc., and Sanofi. These companies dominate through strong product portfolios, global distribution networks, and extensive OTC brand visibility. North America remains the leading regional market, accounting for a 37.8% share in 2024, driven by high prevalence of GERD and strong consumer reliance on self-medication. Europe follows with a 27.4% share, supported by robust retail pharmacy infrastructure and growing demand for advanced, fast-acting formulations.

Market Insights

- The antacids market was valued at USD 6,500 million in 2024 and is projected to reach USD 8,692 million by 2032, growing at a CAGR of 3.7% during the forecast period.

- Growing incidences of GERD, acidity, and indigestion due to changing diets and stressful lifestyles are driving demand for quick-relief antacid products worldwide.

- Rising consumer preference for flavored, sugar-free, and herbal-based formulations is shaping market trends, with tablets holding a 52.6% share as the dominant segment.

- The market is highly competitive, featuring key players such as Sun Pharmaceuticals, Bayer AG, GlaxoSmithKline plc, Pfizer Inc., and Sanofi, focusing on product innovation and OTC expansion.

- North America led the market with a 37.8% share, followed by Europe at 27.4% and Asia-Pacific at 24.9%, while slower growth in Latin America and the Middle East & Africa is restrained by limited healthcare access.

Market Segmentation Analysis:

By Type

The tablet segment dominated the antacids market in 2024, accounting for 52.6% share. Tablets remain the preferred form due to their portability, ease of dosing, and longer shelf life. Consumers favor chewable tablets for quick relief and convenience, which has strengthened their position in both prescription and over-the-counter categories. The liquid segment followed closely, driven by rapid absorption and suitability for individuals with swallowing difficulties. Ongoing innovations in flavored and sugar-free formulations continue to boost the adoption of both tablet and liquid forms globally.

- For instance, GlaxoSmithKline plc did own the Tums brand (which is now owned by Haleon) and manufactured the chewable tablets using a wet granulation process, not direct compression, with a mixture of ingredients including sucrose, corn starch, mineral oil, and talc. The primary active ingredient is calcium carbonate.

By End-use

The retail pharmacy segment led the market in 2024 with a 46.3% share, driven by high consumer dependence on over-the-counter antacid products. Easy accessibility, immediate availability, and pharmacist recommendations significantly support sales through this channel. Hospital pharmacies held a notable share due to increased use in inpatient treatments for gastrointestinal conditions. Meanwhile, online pharmacies are gaining traction as digital health platforms expand, offering home delivery and subscription-based refills that enhance consumer convenience and product reach.

- For instance, Reckitt Benckiser Group plc manufactures health and hygiene products, including Gaviscon, which are distributed and sold through various retail channels, including online platforms like 1mg.

Key Growth Drivers

Rising Prevalence of Gastrointestinal Disorders

Increasing cases of acid reflux, GERD, and peptic ulcers are driving global demand for antacids. Changing dietary patterns, higher consumption of processed foods, and stress-related digestive issues have led to frequent heartburn incidents. The growing elderly population, more prone to gastric problems, also contributes significantly. Pharmaceutical companies are expanding product lines with advanced formulations to meet this rising need, ensuring consistent market growth across both prescription and over-the-counter segments.

- For instance, Takeda Pharmaceutical Company Limited announced an investment to build a new manufacturing facility in Osaka for plasma-derived therapies (PDTs) with a plasma fractionation capacity of more than 2 million liters annually, expected to be operational by around 2030.

Expansion of Over-the-Counter (OTC) Availability

Easy access to antacids without prescriptions has boosted market penetration globally. Retail pharmacies and supermarket chains offer a wide range of branded and generic products, increasing consumer reach. The preference for self-medication, coupled with strong marketing campaigns by major players, has enhanced OTC sales. Additionally, awareness programs promoting early treatment for acidity and heartburn are accelerating adoption, particularly in urban areas with fast-paced lifestyles.

- For instance, Bayer AG did implement a significant digital retail visibility program for its Rennie antacid line. This initiative was part of a broader strategy to boost e-commerce and digital capabilities in their Consumer Health division.

Product Innovation and Flavor Diversification

Manufacturers are focusing on developing flavored, sugar-free, and combination-based formulations to improve compliance and consumer experience. Advances in fast-dissolving tablets and suspension-based liquids ensure quicker relief and better absorption. These innovations cater to diverse consumer preferences, including pediatric and geriatric groups. Companies are also introducing travel-friendly packaging formats that add convenience, helping strengthen brand loyalty and sustain growth in competitive markets.

Key Trends & Opportunities

Growth of E-commerce and Digital Pharmacy Platforms

The shift toward online pharmacies offers major opportunities for market expansion. Consumers increasingly prefer online channels for convenience, home delivery, and access to detailed product reviews. Digital platforms enable brands to expand geographic reach and implement personalized marketing. Subscription-based refill models and bundled offers further drive repeat purchases, especially in developed economies with strong e-health infrastructure.

- For instance, Sanofi partnered with Alibaba Health to integrate its Digestive Wellness portfolio into the Tmall e-pharmacy platform, achieving digital reach across more than 400 cities in China.

Rising Demand for Natural and Herbal Antacids

Consumer preference for chemical-free and plant-based antacids is shaping product innovation. Companies are incorporating natural ingredients like licorice root, aloe vera, and calcium carbonate derived from herbal sources. These formulations appeal to health-conscious users seeking long-term digestive wellness. The growing focus on clean-label products and preventive care trends positions natural antacids as a key growth segment within the broader market.

- For instance, Sun Pharmaceutical Industries Ltd. did not launch a specific digestive relief product line with deglycyrrhizinized licorice extract; however, it has a general consumer healthcare digestive portfolio which includes products like Pepfiz and Pepmelt, and also launched a new prescription medication called Fexuclue (fexuprazan) for erosive esophagitis.

Key Challenges

Side Effects and Overuse Concerns

Frequent or excessive use of antacids can lead to complications such as altered calcium levels or kidney issues. Consumers often misuse OTC products without proper medical guidance, resulting in potential health risks. These safety concerns have prompted regulatory agencies to enforce stricter labeling and usage guidelines. Educating users about appropriate dosage and alternative treatments remains crucial to maintaining consumer trust and sustaining long-term market stability.

Intense Market Competition and Price Pressure

The antacids market faces stiff competition among established pharmaceutical brands and generic manufacturers. Price-sensitive consumers in emerging economies drive companies to offer low-cost options, reducing overall profit margins. This competitive environment limits differentiation and forces players to focus heavily on marketing and promotional strategies. Sustained innovation and strategic collaborations are necessary to maintain brand visibility and achieve consistent revenue growth amid tightening competition.

Regional Analysis

North America

North America dominated the antacids market in 2024 with a 37.8% share, supported by the high prevalence of gastroesophageal reflux disease (GERD) and widespread self-medication practices. Strong healthcare infrastructure, high consumer awareness, and the presence of leading pharmaceutical companies such as Pfizer Inc., Johnson & Johnson, and GlaxoSmithKline plc contribute to market leadership. The U.S. drives regional demand through advanced product formulations, including fast-dissolving tablets and combination therapies. Continuous innovation and OTC availability further sustain growth, while rising obesity rates and stress-induced acidity maintain consistent product demand.

Europe

Europe held a 27.4% share of the global antacids market in 2024, driven by rising digestive health concerns and the popularity of herbal and natural antacid formulations. Countries such as Germany, the U.K., and France lead consumption due to strong retail pharmacy networks and regulatory support for OTC medicines. Manufacturers emphasize sugar-free and flavor-enhanced variants to attract health-conscious consumers. The growing elderly population, coupled with lifestyle-induced gastric issues, continues to boost regional demand. Collaborations between healthcare providers and pharmaceutical firms enhance patient access and sustain steady market expansion.

Asia-Pacific

Asia-Pacific accounted for a 24.9% share in 2024, emerging as the fastest-growing regional market. Rapid urbanization, dietary changes, and stress-related digestive disorders have increased antacid consumption across China, India, and Japan. Expanding healthcare access, coupled with aggressive marketing by regional manufacturers, has improved consumer reach. Rising disposable incomes and growing awareness of gastrointestinal health also support market growth. Local players are investing in low-cost and herbal-based formulations to capture demand from price-sensitive populations, while digital pharmacy platforms are accelerating product distribution in emerging economies.

Latin America

Latin America represented a 6.2% share of the antacids market in 2024, driven by increasing incidences of acidity and digestive discomfort linked to changing diets. Brazil and Mexico lead regional sales due to expanding retail pharmacy chains and growing self-medication trends. Multinational brands are strengthening their market presence through partnerships with local distributors. Rising health awareness and accessibility to OTC antacid products further support growth. However, economic fluctuations and limited healthcare coverage in rural areas continue to pose challenges to sustained market penetration across smaller economies.

Middle East & Africa

The Middle East & Africa held a 3.7% share of the global antacids market in 2024, with growing demand fueled by lifestyle changes and an increasing burden of gastrointestinal disorders. Urban centers such as Saudi Arabia, the UAE, and South Africa are key growth hubs due to expanding pharmacy networks and improved product accessibility. International brands are investing in awareness campaigns and localized marketing strategies to reach diverse consumer bases. Despite limited healthcare infrastructure in certain areas, rising disposable incomes and improving retail distribution are supporting steady regional growth.

Market Segmentations:

By Type

By End-use

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the antacids market is characterized by strong presence of major players such as Sun Pharmaceuticals Ltd., Bayer AG, GlaxoSmithKline plc, Procter & Gamble, Boehringer Ingelheim International GmbH, Takeda Pharmaceutical Company Limited, Reckitt Benckiser Group plc, Dr. Reddy’s Laboratories Ltd., Pfizer Inc., and Sanofi. These companies compete through extensive product portfolios, brand reputation, and global distribution networks. Leading manufacturers focus on developing fast-acting, flavored, and sugar-free formulations to enhance consumer appeal and expand OTC sales. Strategic mergers, product launches, and marketing campaigns further strengthen their market positioning. Innovation in combination therapies and sustained investments in R&D help improve treatment efficacy and extend brand presence across regions. Emerging regional players are entering the market with cost-effective generics and herbal-based products, intensifying competition. The ongoing shift toward e-commerce and self-medication continues to reshape competitive strategies, emphasizing affordability, convenience, and improved patient experience.

Key Player Analysis

- Sun Pharmaceuticals Ltd.

- Bayer AG

- GlaxoSmithKline plc

- Procter & Gamble

- Boehringer Ingelheim International GmbH

- Takeda Pharmaceutical Company Limited

- Reckitt Benckiser Group plc

- Reddy’s Laboratories Ltd.

- Pfizer Inc.

- Sanofi

Recent Developments

- In September 2025, Dr. Reddy’s launched Tegoprazan (50 mg), a next-generation potassium-competitive acid blocker for acid-peptic diseases, in India.

- In November 2024, Bayer AG completed the sale of its antacid brand Talcid® (heartburn/indigestion remedy) to STADA Arzneimittel AG as part of its portfolio optimisation.

- In July 2024, Dr. Reddy’s Laboratories Ltd. signed a non-exclusive licensing agreement with Takeda Pharmaceutical Company Limited to launch the novel antacid drug Vonoprazan (under the brand name VONO™) in India.

Report Coverage

The research report offers an in-depth analysis based on Type, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fast-acting and long-lasting antacid formulations will continue to rise.

- Expansion of e-commerce and online pharmacies will strengthen product accessibility.

- Growing consumer preference for natural and herbal-based antacids will drive innovation.

- Manufacturers will focus on sugar-free, flavored, and travel-friendly product formats.

- Increasing self-medication trends will boost over-the-counter product sales globally.

- Strategic collaborations between pharmaceutical companies will enhance distribution reach.

- Continuous R&D investments will lead to improved formulation stability and faster relief.

- Emerging economies in Asia-Pacific will witness strong growth due to rising urbanization.

- Digital marketing and telehealth platforms will influence consumer purchasing behavior.

- Sustainability-focused packaging and environmentally safe ingredients will gain higher adoption.