Market Overview:

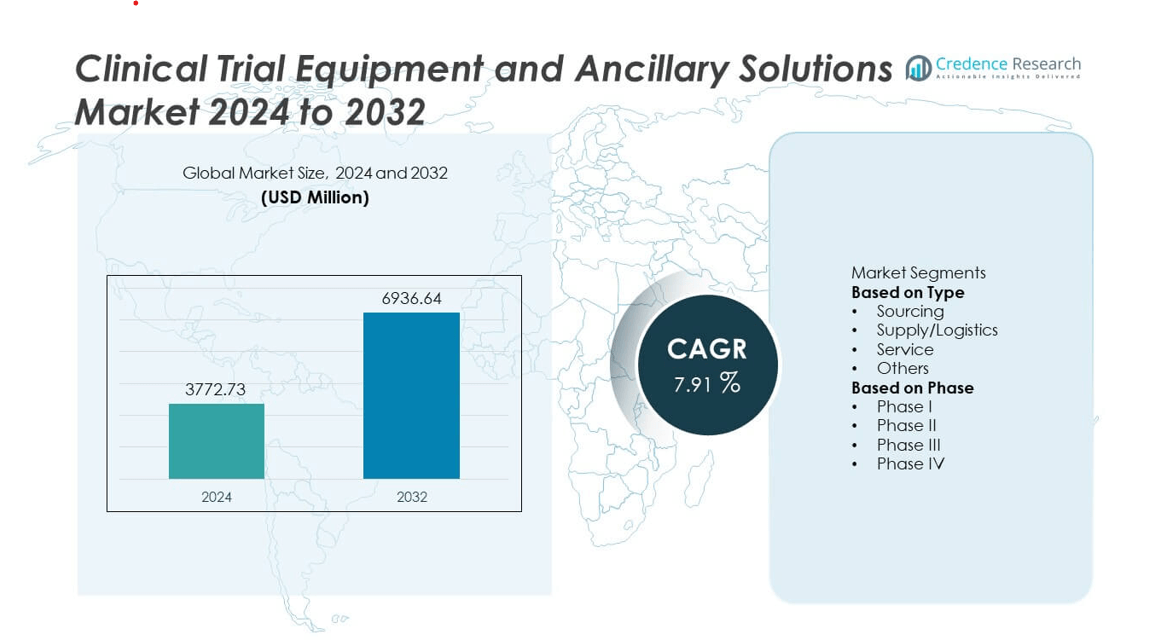

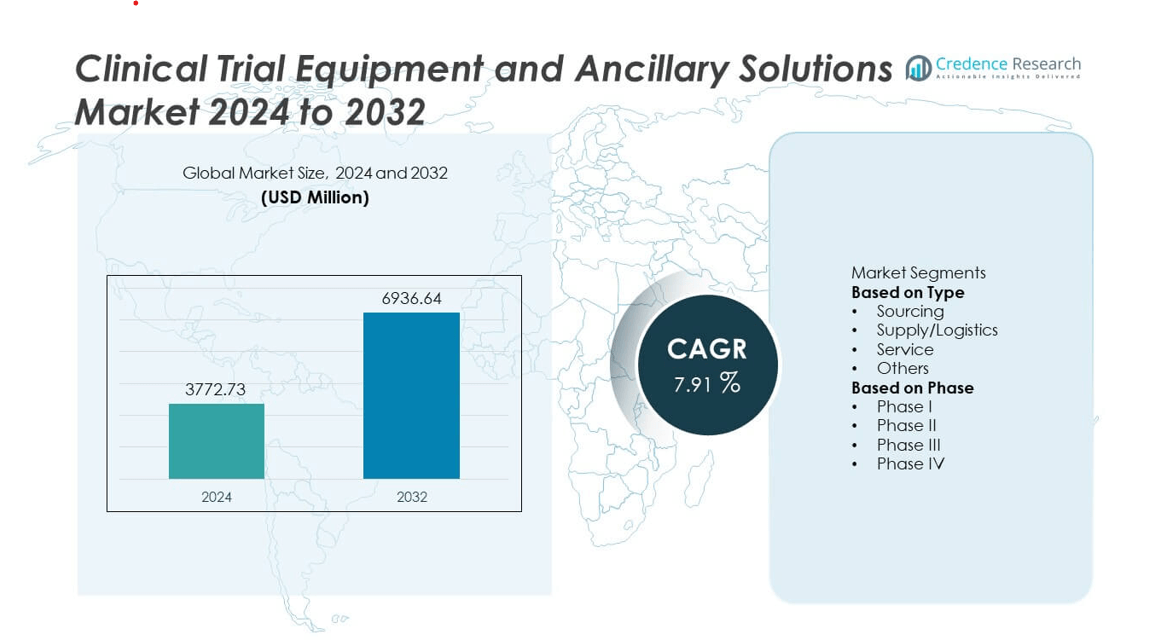

The Clinical Trial Equipment and Ancillary Solutions market was valued at USD 3772.73 million in 2024 and is projected to reach USD 6936.64 million by 2032, growing at a CAGR of 7.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Clinical Trial Equipment and Ancillary Solutions Market Size 2024 |

USD 3772.73 million |

| Clinical Trial Equipment and Ancillary Solutions Market, CAGR |

7.91% |

| Clinical Trial Equipment and Ancillary Solutions Market Size 2032 |

USD 6936.64 million |

The Clinical Trial Equipment and Ancillary Solutions market is led by key players including Quipment SAS, Myonex, Thermo Fisher Scientific, Inc., Emsere (formerly MediCapital Rent), Marken (UPS-United Parcel Service), Ancillare, LP, Parexel International (MA) Corporation, Woodley Equipment Company Ltd., IRM, and Imperial CRS, Inc. These companies drive market growth through global distribution networks, rental services, and advanced logistics management for clinical trials. North America led the global market with a 42.5% share in 2024, driven by a robust clinical research ecosystem and strong biopharmaceutical investments. Europe followed with a 28.1% share, supported by well-established trial infrastructure, while Asia-Pacific emerged as the fastest-growing region due to expanding R&D capabilities and increasing clinical trial outsourcing.

Market Insights

- The Clinical Trial Equipment and Ancillary Solutions market was valued at USD 3772.73 million in 2024 and is projected to reach USD 6936.64 million by 2032, growing at a CAGR of 7.91%.

- Rising global clinical trial activity and increasing demand for standardized equipment sourcing, logistics, and ancillary services are driving market expansion.

- Growing adoption of digital inventory systems, real-time monitoring, and cold-chain logistics is shaping market trends toward higher operational transparency and efficiency.

- The market is competitive with key players such as Thermo Fisher Scientific, Quipment SAS, Myonex, Marken (UPS-United Parcel Service), and Parexel International focusing on global partnerships and automation to enhance service delivery.

- North America led with a 42.5% share in 2024, followed by Europe at 28.1%, while the supply/logistics segment dominated by type with 46.2% share due to its critical role in managing temperature-sensitive clinical materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Supply/Logistics dominated the Clinical Trial Equipment and Ancillary Solutions market in 2024, accounting for 46.2% of the total share. This segment’s leadership is driven by the increasing demand for efficient distribution of temperature-sensitive materials, such as vaccines, biologics, and investigational drugs. The growing adoption of specialized cold chain systems, packaging solutions, and real-time tracking technologies supports the safe delivery of clinical trial materials. Rising global outsourcing of logistics to third-party providers and expanding multi-regional clinical trials further strengthen this segment’s dominance by ensuring compliance and operational efficiency.

- For instance, Marken, a UPS subsidiary, manages more than 6.6 million time-critical drug shipments annually across more than 220 countries and territories using temperature control containers capable of maintaining ranges between -80°C and +25°C.

By Phase

Phase III trials held the largest market share of 52.8% in 2024, owing to their pivotal role in assessing treatment efficacy and safety across large patient populations. This phase requires extensive equipment, ancillary supplies, and logistics support to manage complex study designs and global trial networks. Growing investment in late-stage drug development and rising numbers of biologic and oncology trials continue to fuel demand. The increasing emphasis on patient-centric trial models and remote monitoring also enhances equipment standardization during Phase III studies.

- For instance, Parexel leverages its extensive expertise and global infrastructure to support clinical development, having participated in over 1,000 development programs for rare diseases and more than 800 immunotherapy projects globally.

Key Growth Drivers

Rising Volume of Global Clinical Trials

The increasing number of clinical trials worldwide is a major driver of the Clinical Trial Equipment and Ancillary Solutions market. Pharmaceutical and biotechnology firms are expanding R&D pipelines, particularly for oncology, infectious diseases, and rare disorders. This growth demands efficient equipment sourcing, standardized ancillary supplies, and reliable logistics systems to support global operations. The rise in multi-country studies has also accelerated demand for temperature-controlled storage, digital monitoring devices, and regulatory-compliant supply solutions that ensure consistency across diverse trial environments.

- For instance, Thermo Fisher Scientific supports clinical trials through its Clinical Supply Chain Services, a component of its comprehensive pharmaceutical services provided via brands like Patheon and PPD.

Expansion of Biopharmaceutical Research and Development

Growing investments in biopharmaceutical innovation are significantly boosting the demand for advanced trial equipment and ancillary services. Biologic therapies, vaccines, and gene-based treatments require precise handling, calibration, and monitoring equipment. As R&D spending increases, sponsors and contract research organizations (CROs) are partnering with specialized service providers to optimize material management and distribution. The surge in precision medicine and personalized drug trials further strengthens market growth by driving demand for tailored equipment and data-integrated supply solutions.

- For instance, Myonex expanded its global footprint with several supply centers managing drug kits per year across numerous active countries, including the US, UK, Germany, and France.

Increasing Focus on Efficiency and Standardization

Clinical trial stakeholders are prioritizing efficiency, cost optimization, and standardization across study phases. Equipment rental models, centralized sourcing, and digital inventory management are becoming essential for reducing delays and waste. Standardized ancillary solutions enable consistent performance across trial sites and improve data integrity. Regulatory expectations for traceability and quality compliance also fuel investments in automated tracking and smart logistics systems. This shift toward streamlined operations enhances transparency and accelerates trial timelines, fostering sustained market growth.

Key Trends & Opportunities

Adoption of Digital Supply Chain and IoT Technologies

Integration of digital tracking, IoT sensors, and data analytics is transforming clinical trial logistics management. These technologies provide real-time visibility into equipment condition, location, and temperature control, improving accountability and reducing losses. The use of cloud-based platforms enables automated documentation and compliance tracking across multiple trial sites. As the industry shifts toward decentralized trials, digital connectivity between sponsors, CROs, and suppliers becomes essential. This trend presents major opportunities for innovation in smart monitoring and predictive logistics solutions.

- For instance, Emsere provides IoT-enabled equipment tracking systems that monitor a rental fleet of over 10,000 devices across more than 9,000 global trial sites. The system integrates temperature probes capable of accurate temperature sensing and transmits real-time data to its cloud-based logistics dashboard, which provides instant alerts and documentation for proactive intervention and regulatory compliance.

Growing Outsourcing to Specialized Service Providers

Outsourcing of clinical trial supply, logistics, and equipment management to specialized providers is increasing rapidly. Pharmaceutical companies are focusing on core R&D activities while relying on external partners for operational execution. This trend supports greater flexibility, scalability, and regulatory compliance in global trials. Service providers offering integrated sourcing, packaging, and transport solutions gain a competitive advantage by ensuring quality and on-time delivery. Expanding outsourcing partnerships also create opportunities for technological upgrades and strategic alliances in emerging markets.

- For instance, Ancillare has supported more than 4,000 clinical trials across over 100 countries. The company leverages a vast global depot network and expertise in procurement, operations, logistics, and regulatory matters to create tailored clinical supply and equipment programs.

Key Challenges

Complex Regulatory and Compliance Requirements

The market faces significant challenges in meeting diverse regulatory standards across regions. Varying guidelines for storage, transport, and documentation of trial materials increase operational complexity. Compliance with Good Clinical Practice (GCP) and Good Distribution Practice (GDP) regulations requires continuous monitoring and certification. Non-compliance risks delays, financial penalties, and trial disruptions. Companies must invest heavily in staff training and quality assurance systems to navigate evolving global standards, which can strain smaller providers and delay market entry in developing regions.

High Cost of Specialized Equipment and Logistics Infrastructure

The procurement and maintenance of specialized clinical trial equipment and temperature-controlled logistics systems require substantial capital investment. Small and mid-sized sponsors often face budget constraints when implementing advanced monitoring tools and automated tracking systems. Managing global distribution networks adds further cost pressure due to fluctuating fuel prices and transportation complexities. Balancing cost efficiency with quality assurance remains a key challenge for providers. The high financial burden may slow adoption of innovative solutions among emerging and resource-limited markets.

Regional Analysis

North America

North America dominated the Clinical Trial Equipment and Ancillary Solutions market in 2024, accounting for 42.5% of the total share. The region’s dominance is attributed to the presence of leading pharmaceutical companies, strong R&D investments, and advanced clinical research infrastructure. The United States remains a key contributor due to high trial volume and early adoption of digital logistics technologies. Growing focus on precision medicine and biologics further fuels demand for specialized trial equipment. Strategic collaborations between CROs and technology providers continue to strengthen operational efficiency and support regulatory compliance across the region.

Europe

Europe held a 28.1% share of the Clinical Trial Equipment and Ancillary Solutions market in 2024, supported by strong regulatory frameworks and government initiatives promoting clinical research transparency. Countries such as Germany, the United Kingdom, and France lead regional growth with significant pharmaceutical R&D expenditure. Increasing adoption of automated trial logistics, coupled with emphasis on data integrity and temperature-controlled solutions, drives market expansion. Collaboration between sponsors and logistics providers enhances efficiency across multi-site trials. Continuous efforts to harmonize trial standards across the European Union further boost equipment and ancillary service adoption.

Asia-Pacific

Asia-Pacific accounted for 19.7% of the Clinical Trial Equipment and Ancillary Solutions market in 2024 and is expected to register the fastest growth during the forecast period. Rapid expansion of clinical research activities in China, India, Japan, and South Korea drives demand for trial equipment and logistics services. Rising investments from global pharmaceutical firms and CROs strengthen regional capabilities. The growing focus on cost-effective and patient-centric trials accelerates adoption of digital monitoring and cold-chain logistics solutions. Supportive government policies and increasing availability of skilled research professionals further enhance the region’s market potential.

Latin America

Latin America captured 6.1% of the Clinical Trial Equipment and Ancillary Solutions market share in 2024, driven by growing participation in multinational clinical studies. Brazil and Mexico are the leading markets, supported by expanding healthcare infrastructure and a favorable regulatory environment. Rising collaborations between CROs and international sponsors improve supply chain management and trial execution. Increasing demand for efficient logistics services, particularly for temperature-sensitive materials, supports steady growth. Continuous improvements in trial site management and regional training programs are helping enhance compliance, boosting the adoption of ancillary and equipment services.

Middle East & Africa

The Middle East & Africa held a 3.6% share of the Clinical Trial Equipment and Ancillary Solutions market in 2024. Growth in the region is fueled by expanding clinical research centers, particularly in the Gulf Cooperation Council (GCC) countries and South Africa. Governments are actively promoting clinical trial participation through supportive regulations and investment in medical infrastructure. Demand for specialized logistics and equipment services is increasing due to rising pharmaceutical partnerships. However, limited trial infrastructure and high operational costs continue to pose challenges in certain parts of the region, restraining broader market penetration.

Market Segmentations:

By Type

- Sourcing

- Supply/Logistics

- Service

- Others

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Clinical Trial Equipment and Ancillary Solutions market is highly competitive, featuring major players such as Quipment SAS, Myonex, Thermo Fisher Scientific, Inc., Emsere (formerly MediCapital Rent), Marken (UPS-United Parcel Service), Ancillare, LP, Parexel International (MA) Corporation, Woodley Equipment Company Ltd., IRM, and Imperial CRS, Inc. These companies focus on offering end-to-end equipment sourcing, rental, logistics, and supply management services for global clinical trials. Strategic alliances, mergers, and regional expansions are common as vendors seek to enhance operational efficiency and geographic reach. Leading players are increasingly adopting digital inventory management systems, temperature-controlled logistics, and automated tracking technologies to ensure regulatory compliance and reliability. The emphasis on customized solutions for decentralized and hybrid trials, coupled with demand for faster equipment turnaround and sustainability-focused supply chains, continues to define the competitive dynamics of this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Quipment SAS

- Myonex

- Thermo Fisher Scientific, Inc.

- Emsere (formerly MediCapital Rent)

- Marken (UPS-United Parcel Service)

- Ancillare, LP

- Parexel International (MA) Corporation

- Woodley Equipment Company Ltd.

- IRM

- Imperial CRS, Inc.

Recent Developments

- In October 2025, Thermo Fisher Scientific, Inc. announced the launch of a “Clinical Trial Carbon Calculator” to help sponsors quantify and reduce the environmental footprint of their studies.

- In September 2025, Parexel International (MA) Corporation partnered with Paradigm Health to deliver an AI-native trial operations model aimed at compressing study timelines.

- In January 2025, Ancillare, LP launched its state-of-the-art cold chain management services tailored for temperature-sensitive clinical trial supplies.

- In May 2024, Emsere entered into a partnership with Clario to provide an end-to-end ophthalmic medical imaging equipment solution for clinical trials.

Report Coverage

The research report offers an in-depth analysis based on Type, Phase and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing clinical trial volumes across emerging regions.

- Digital tracking and IoT-based logistics solutions will enhance real-time visibility and compliance.

- Demand for temperature-controlled storage and transport will continue to rise with biologics growth.

- Outsourcing to specialized service providers will become more common among trial sponsors.

- Automation in equipment management and inventory tracking will improve operational efficiency.

- Decentralized and hybrid clinical trials will drive the need for flexible equipment supply models.

- Sustainability and eco-friendly packaging will gain importance in logistics strategies.

- Strategic partnerships between CROs and supply companies will strengthen market integration.

- Asia-Pacific and Latin America will witness rapid adoption due to expanding R&D infrastructure.

- Advanced analytics and predictive planning tools will optimize trial equipment distribution and reduce delays.