Market Overview:

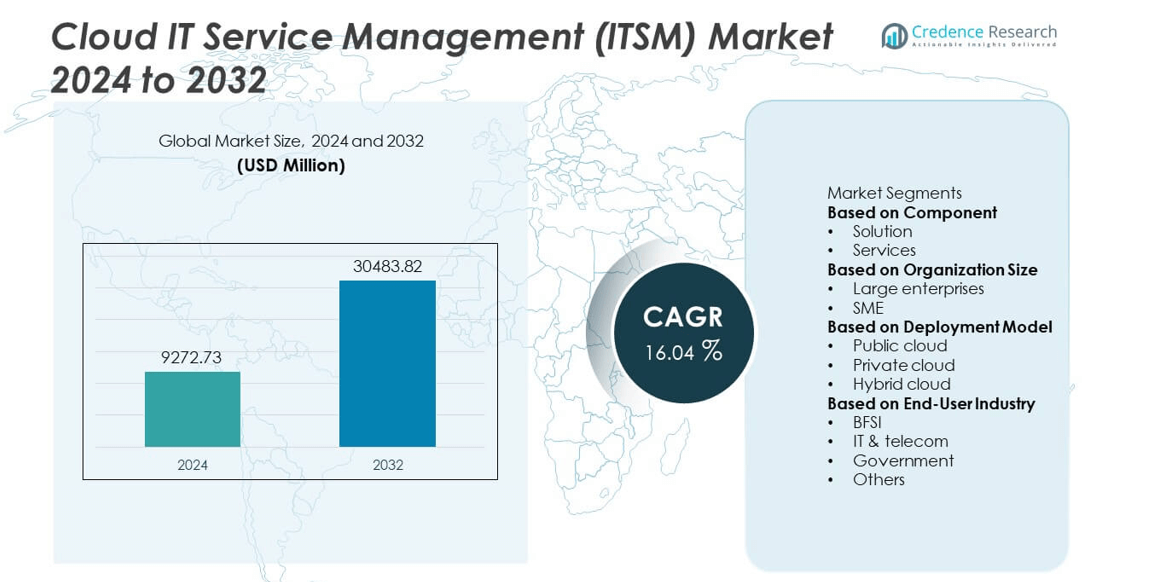

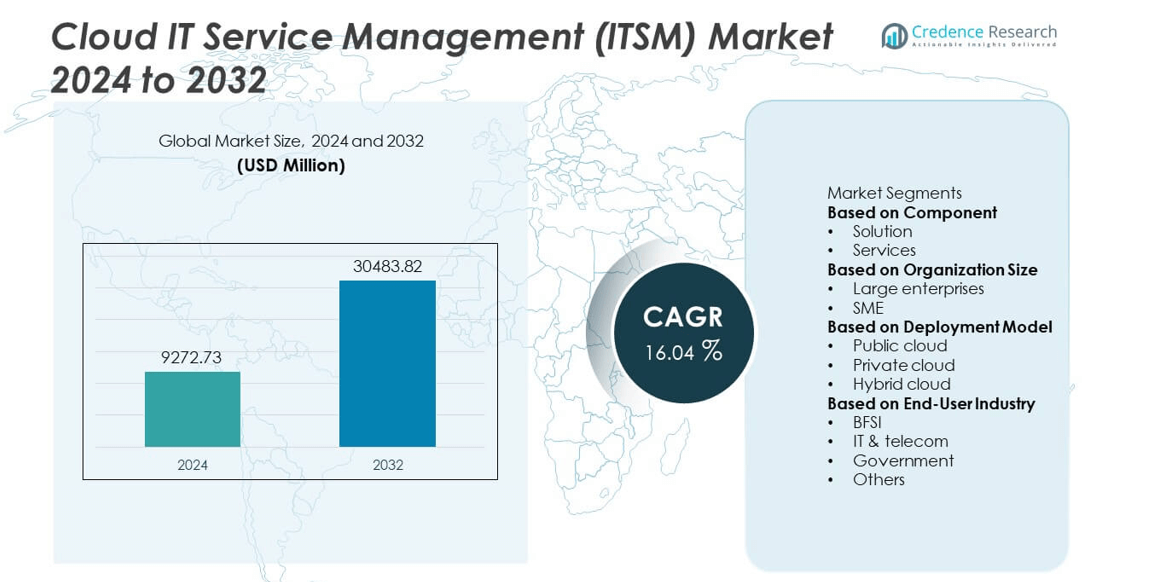

The Cloud IT Service Management (ITSM) Market was valued at USD 9272.73 million in 2024 and is projected to reach USD 30483.82 million by 2032, growing at a CAGR of 16.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud IT Service Management (ITSM) Market Size 2024 |

USD 9272.73 million |

| Cloud IT Service Management (ITSM) Market, CAGR |

16.04% |

| Cloud IT Service Management (ITSM) Market Size 2032 |

USD 30483.82 million |

The Cloud IT Service Management (ITSM) market is led by major players such as Broadcom Inc, SolarWinds, IBM Corporation, Freshworks, Atlassian Inc., ServiceNow, Ivanti Inc., Microsoft Corporation, BMC Software Inc., and Open Text Corporation. These companies dominate through advanced ITSM platforms offering automation, AI integration, and analytics-driven service delivery. ServiceNow and Microsoft remain key leaders with strong SaaS-based portfolios and enterprise adoption. North America led the market in 2024 with a 40.6% share, supported by robust cloud infrastructure and rapid digital transformation. Europe followed with 27.3%, while Asia-Pacific accounted for 25.1%, emerging as the fastest-growing region due to expanding IT modernization initiatives and increasing SME cloud adoption.

Market Insights

- The Cloud IT Service Management (ITSM) market was valued at USD 9272.73 million in 2024 and is projected to reach USD 30483.82 million by 2032, growing at a CAGR of 16.04% during the forecast period.

- Increasing enterprise demand for automation, AI integration, and centralized IT operations is driving market growth, supported by the shift toward cloud-based service delivery models.

- Key trends include the adoption of self-service portals, low-code platforms, and integration of ITSM with DevOps and IT operations management for enhanced agility.

- The market is highly competitive, with players such as ServiceNow, Microsoft, IBM, Atlassian, and BMC Software leading through innovation in cloud-native ITSM platforms and analytics-driven automation.

- North America held 40.6% of the market in 2024, followed by Europe at 27.3% and Asia-Pacific at 25.1%, while the solution segment accounted for 68.3% of total revenue due to strong enterprise adoption of cloud-based ITSM tools.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The solution segment dominated the Cloud IT Service Management market in 2024, accounting for 68.3% of the total share. Its leadership stems from growing enterprise demand for integrated ITSM platforms that streamline incident, change, and problem management processes. Organizations are increasingly adopting cloud-based solutions to improve service delivery efficiency, ensure real-time monitoring, and enhance user experience. The integration of AI and automation capabilities in ITSM tools further strengthens operational agility. Leading providers such as ServiceNow, BMC Software, and Atlassian are expanding solution portfolios to address evolving IT infrastructure complexities.

- For instance, Atlassian’s Jira Service Management, in its largest enterprise configuration (Premium plan with the maximum user count), can process up to 35 million combined automation executions per month across all Jira and JSM products on a single site.

By Organization Size

Large enterprises held the largest share of 61.7% in the Cloud IT Service Management market in 2024. Their dominance is driven by extensive IT ecosystems requiring scalable and centralized management platforms. These organizations are prioritizing automation, self-service portals, and analytics-driven service optimization to enhance productivity. The growing emphasis on digital transformation and hybrid workforce management is accelerating adoption. Additionally, large enterprises are investing in cloud ITSM for enhanced compliance, performance tracking, and cost reduction, enabling more responsive and data-driven IT operations.

- For instance, Freshworks’ Freshservice platform supports more than 60,000 enterprise users, providing AI-driven self-service capabilities that reduce ticket resolution time by measurable margins.

By Deployment Model

The public cloud segment accounted for 54.6% of the Cloud IT Service Management market in 2024, emerging as the leading deployment model. Its dominance is fueled by flexibility, cost efficiency, and faster implementation compared to private setups. Public cloud ITSM solutions enable seamless scalability and remote accessibility, meeting the needs of distributed teams. Increasing adoption by SMEs and enterprises for SaaS-based ITSM platforms further drives this segment’s growth. Major vendors like IBM, ServiceNow, and Freshworks are enhancing public cloud offerings with advanced analytics and multi-tenant architectures to support diverse business environments.

Key Growth Drivers

Growing Adoption of AI-Driven ITSM Platforms

The increasing use of artificial intelligence and machine learning in ITSM platforms is driving market growth. AI-powered tools automate ticket classification, root cause analysis, and predictive maintenance, significantly improving service efficiency. Enterprises are leveraging virtual agents and chatbots to deliver faster resolutions and enhance user satisfaction. The ability of AI to streamline repetitive tasks and reduce manual workloads supports faster incident response times. This shift toward intelligent automation continues to redefine cloud ITSM operations, making them more scalable, efficient, and cost-effective.

- For instance, BMC Helix uses machine learning models to reduce Mean Time to Resolution (MTTR) by up to 75% across clients, cutting the time spent resolving incidents significantly. Some customer case studies show up to 95% self-diagnosis of issues.

Rising Demand for Scalable and Flexible IT Infrastructure

Organizations are increasingly shifting to cloud-based ITSM solutions to improve scalability and resource utilization. Cloud ITSM enables businesses to dynamically manage workloads, integrate with multiple systems, and adapt to changing business needs. The flexibility offered by SaaS models allows IT teams to deploy updates and add functionalities quickly. Enterprises benefit from improved service delivery, reduced downtime, and enhanced collaboration across departments. As remote work and hybrid IT environments expand, demand for flexible and cloud-native service management solutions continues to accelerate.

- For instance, over 1 billion Atlassian Automation rules run each month across the entire Atlassian portfolio, with the exact number of triggers handled by Jira Service Management dependent on the specific plan (e.g., Standard, Premium, Enterprise) and the number of users.

Growing Emphasis on Digital Transformation and Automation

The rise of digital transformation initiatives across industries is fueling the adoption of cloud-based ITSM platforms. Businesses are automating IT processes to boost agility, reduce costs, and enhance customer experiences. Cloud ITSM systems enable centralized visibility, real-time analytics, and process standardization across global operations. This transformation allows organizations to align IT services with strategic business objectives. Vendors are integrating automation and orchestration capabilities into their ITSM solutions, helping enterprises improve incident resolution, manage complex infrastructures, and achieve operational excellence.

Key Trends & Opportunities

Integration of ITSM with DevOps and IT Operations Management

The convergence of ITSM with DevOps and ITOM is creating new growth opportunities. Enterprises are adopting unified cloud platforms to enable seamless collaboration between development, operations, and support teams. Integrated solutions help improve service delivery speed, automate change management, and ensure continuous monitoring. This alignment reduces system downtime and improves agility in managing hybrid environments. Vendors are enhancing interoperability between ITSM and DevOps tools to support faster deployment cycles and ensure consistent service reliability.

- For instance, Broadcom’s AIOps and DX Unified Infrastructure Management tools ingest extensive metrics, alarms, logs, and topology data, enhancing operational visibility and reliability across hybrid IT environments by providing comprehensive, single-pane-of-glass observability and automated analytics to help manage and resolve potential issues.

Increased Adoption of Self-Service and Low-Code Platforms

The rising use of self-service portals and low-code development tools is reshaping the cloud ITSM market. These platforms empower users to resolve common issues independently and enable IT teams to build workflows without deep coding expertise. The trend supports faster service delivery, reduced ticket volumes, and improved user satisfaction. Low-code ITSM solutions also enhance customization, allowing organizations to tailor dashboards and processes to specific needs. This approach is gaining popularity among SMEs seeking cost-efficient and agile IT service management systems.

- For instance, ServiceNow’s Creator Workflows are used to rapidly build and scale custom, low-code applications across the enterprise, enabling organizations to move from an initial idea to a functional app in less than a day, which demonstrates the rising adoption of citizen-developer-driven ITSM customization.

Key Challenges

Data Security and Compliance Concerns

Data security and regulatory compliance remain major challenges in cloud-based ITSM deployment. Managing sensitive organizational data in multi-tenant cloud environments exposes businesses to privacy and compliance risks. Industries such as BFSI and healthcare require strict adherence to standards like GDPR and HIPAA. Ensuring data encryption, access control, and secure integration with third-party applications is crucial. Vendors must strengthen cybersecurity frameworks and transparency to build customer trust and ensure safe cloud ITSM adoption.

Integration Complexities with Legacy Systems

Many enterprises face challenges integrating modern cloud ITSM platforms with legacy IT infrastructures. Outdated systems often lack APIs and compatibility required for seamless connectivity. This complexity increases implementation time, costs, and operational risks. Organizations with hybrid IT setups struggle to synchronize data across multiple environments. Vendors are addressing this issue by offering modular and API-driven solutions. However, ensuring interoperability without disrupting existing workflows remains a significant barrier to full-scale cloud ITSM deployment.

Regional Analysis

North America

North America dominated the Cloud IT Service Management (ITSM) market in 2024, accounting for 40.6% of the total share. The region’s leadership is driven by rapid cloud adoption, advanced IT infrastructure, and a strong focus on digital transformation. Enterprises across the U.S. and Canada are investing heavily in automation and AI-enabled ITSM platforms to streamline operations. Key vendors such as ServiceNow, IBM, and BMC Software continue to expand their cloud portfolios, supporting enterprise modernization. The growing demand for hybrid work solutions and managed IT services further reinforces North America’s dominance in the global market.

Europe

Europe accounted for 27.3% of the global Cloud IT Service Management market in 2024, supported by stringent data protection regulations and expanding enterprise digitalization. Countries like the United Kingdom, Germany, and France lead adoption, emphasizing compliance-driven ITSM implementation under GDPR frameworks. The region’s growing focus on cloud-based IT governance and automation is fueling demand for scalable service management solutions. European organizations are increasingly deploying hybrid cloud platforms to enhance efficiency and ensure data sovereignty. Collaboration between global vendors and regional service providers continues to drive technological innovation and market growth.

Asia-Pacific

Asia-Pacific held 25.1% of the Cloud IT Service Management market in 2024 and is projected to record the fastest growth through 2032. The expansion is driven by rapid enterprise digitalization, cloud infrastructure investments, and government-led smart technology initiatives. Countries such as China, India, Japan, and South Korea are witnessing rising adoption of ITSM tools for agile service delivery and IT process automation. SMEs in the region are migrating to SaaS-based ITSM platforms for cost-effective operations. Increasing collaborations between cloud providers and managed service companies are accelerating market expansion and enhancing service accessibility across diverse industries.

Latin America

Latin America captured 4.2% of the Cloud IT Service Management market in 2024, supported by growing cloud migration and digital transformation initiatives among small and medium-sized enterprises. Brazil and Mexico lead adoption, driven by expanding IT ecosystems and increasing demand for cloud-hosted service management platforms. The region’s shift toward automation and self-service IT operations is enhancing enterprise productivity. Strategic partnerships between regional IT firms and global vendors are helping overcome integration challenges. As data security awareness and 5G network expansion improve, the market is expected to experience steady growth across major Latin American economies.

Middle East & Africa

The Middle East & Africa held 2.8% of the global Cloud IT Service Management market in 2024. The region’s growth is fueled by rising investments in digital transformation and cloud-first policies, particularly in the UAE, Saudi Arabia, and South Africa. Enterprises are adopting ITSM platforms to improve service delivery, reduce downtime, and support remote operations. Government-led initiatives in smart cities and e-governance are creating opportunities for cloud-based service management solutions. Although infrastructure challenges persist in rural areas, increasing enterprise IT spending and regional partnerships with global cloud providers are driving consistent market expansion.

Market Segmentations:

By Component

By Organization Size

By Deployment Model

- Public cloud

- Private cloud

- Hybrid cloud

By End-User Industry

- BFSI

- IT & telecom

- Government

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cloud IT Service Management (ITSM) market is highly competitive, with key players including Broadcom Inc, SolarWinds, IBM Corporation, Freshworks, Atlassian Inc., ServiceNow, Ivanti Inc., Microsoft Corporation, BMC Software Inc., and Open Text Corporation driving innovation and market growth. These companies focus on expanding cloud-based ITSM portfolios through automation, AI integration, and analytics-driven solutions to enhance service efficiency. ServiceNow and Atlassian lead in enterprise ITSM adoption, offering scalable SaaS platforms with strong workflow automation capabilities. IBM and Microsoft leverage hybrid cloud and AI technologies to strengthen end-to-end service management. Emerging vendors such as Freshworks and Ivanti are gaining momentum with cost-effective, user-friendly ITSM platforms tailored for SMEs. Strategic collaborations, product upgrades, and acquisitions remain central to gaining a competitive edge, while market players continue to emphasize real-time analytics, low-code customization, and self-service features to meet evolving enterprise IT transformation demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Broadcom Inc

- SolarWinds

- IBM Corporation

- Freshworks

- Atlassian Inc.

- ServiceNow

- Ivanti Inc.

- Microsoft Corporation

- BMC Software Inc.

- Open Text Corporation

Recent Developments

- In October 2025, Atlassian also introduced the “Service Collection” bundle combining AI, ITSM (via Jira Service Management), and CSM in one package.

- In June 2025, Freshworks launched “Freshservice Journeys”, a new AI-assisted capability within its IT/employee service management offering.

- In March 2025, IBM Corporation unveiled a new “as-a-Service” model for its Storage Ceph solution to simplify infrastructure management and support IT operations.

- In November 2023, BMC Software Inc. announced that its Helix Service Management solution now includes generative AI, low-code/no-code development, and contextual tooling

Report Coverage

The research report offers an in-depth analysis based on Component, Organization Size, Deployment Model, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly as enterprises continue adopting cloud-based IT operations.

- AI and machine learning will enhance automation and predictive analytics in ITSM platforms.

- Integration with DevOps and IT operations management will streamline workflows and incident resolution.

- Self-service and low-code ITSM solutions will gain popularity among SMEs for cost efficiency.

- Vendors will focus on AI-driven chatbots and virtual assistants to improve service response times.

- Hybrid and multi-cloud ITSM deployments will increase to support complex enterprise environments.

- Security and compliance management will remain central to ITSM solution development.

- Partnerships between cloud providers and ITSM vendors will strengthen service portfolios.

- Demand for analytics-driven performance monitoring and automation will continue to grow.

- Asia-Pacific will emerge as the fastest-growing region due to accelerating digital transformation initiatives.