Market Overview

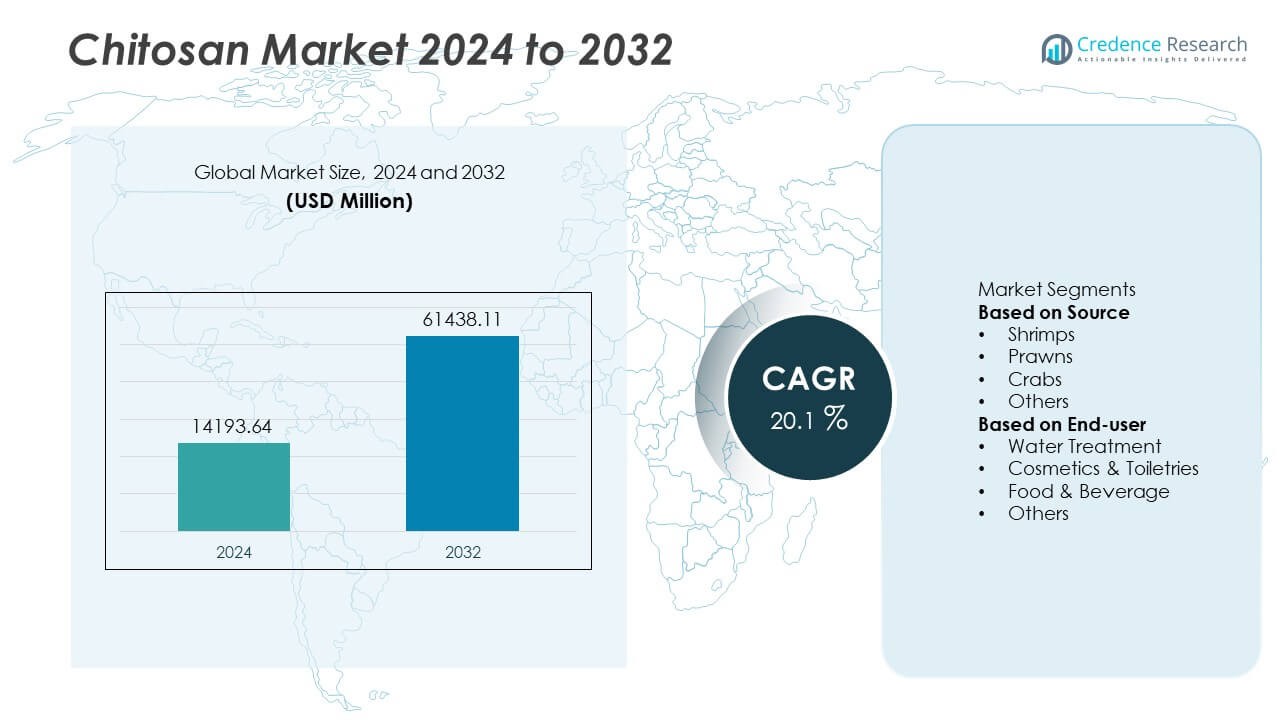

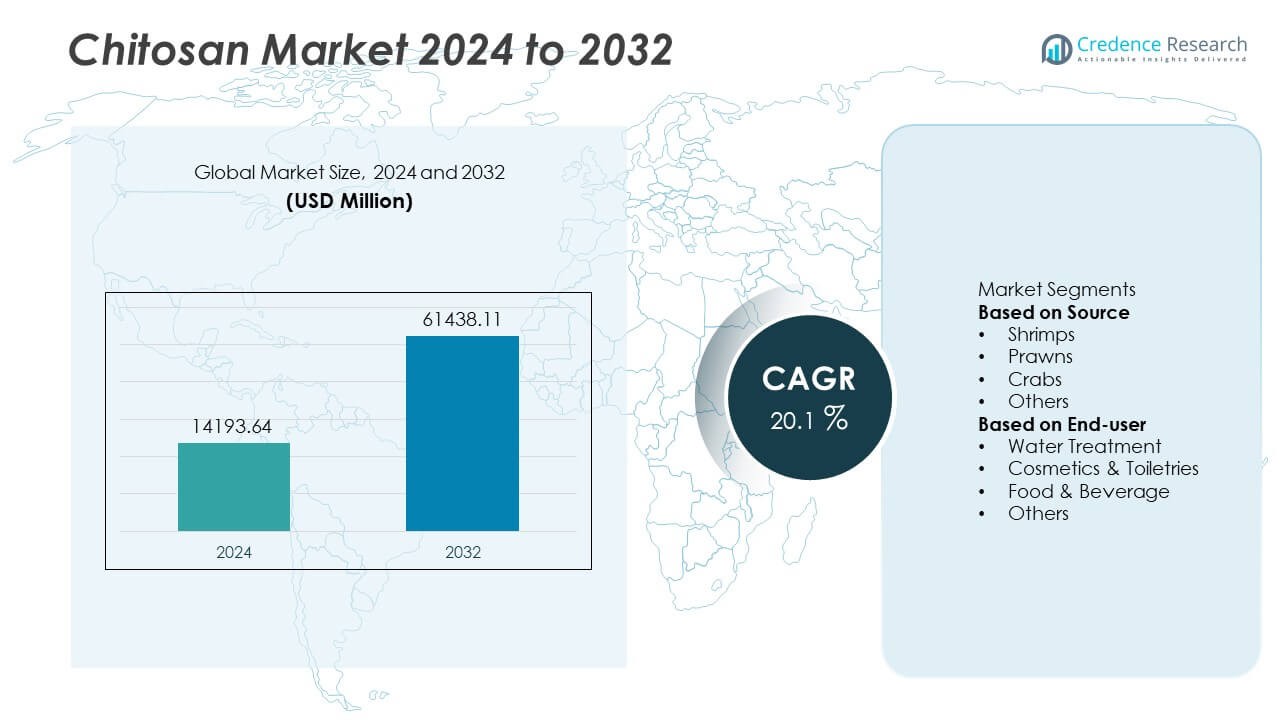

The Chitosan Market was valued at USD 14,193.64 million in 2024 and is projected to reach USD 61,438.11 million by 2032, growing at a strong CAGR of 20.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chitosan Market Size 2024 |

USD 14,193.64 Million |

| Chitosan Market, CAGR |

20.1% |

| Chitosan Market Size 2032 |

USD 61,438.11 Million |

The chitosan market is led by key players such as Heppe Medical Chitosan GmbH, Kitozyme S.A., Primex EHF, FMC Corporation, Zhejiang Golden-Shell Pharmaceutical Co., Ltd., G.T.C. Bio Corporation, Panvo Organics Pvt. Ltd., Advanced Biopolymers AS, Biophrame Technologies, and Meron Biopolymers Pvt. Ltd. These companies focus on innovation in high-purity and pharmaceutical-grade chitosan for diverse end-use sectors. Asia-Pacific dominates the global market with a 39.6% share in 2024, supported by abundant raw material supply and large-scale production facilities. North America follows with 28.3% share, driven by growing adoption in water treatment and biomedical applications, while Europe, holding 24.1% share, benefits from sustainability-focused regulations and strong biopolymer research initiatives.

Market Insights

Market Insights

- The chitosan market was valued at USD 14,193.64 million in 2024 and is projected to reach USD 61,438.11 million by 2032, growing at a CAGR of 20.1% during the forecast period.

- Rising demand for biodegradable and eco-friendly materials in pharmaceuticals, food, and water treatment sectors drives market expansion. The shrimp-based chitosan segment leads with a 58.7% share, supported by high availability and superior purity levels.

- Emerging trends include increased adoption of fungal-derived chitosan, advancements in extraction technologies, and its integration into sustainable packaging and agricultural formulations.

- Leading players such as Heppe Medical Chitosan GmbH, Kitozyme S.A., and FMC Corporation focus on high-grade chitosan production, strategic partnerships, and geographic expansion to enhance competitiveness.

- Asia-Pacific dominates with a 39.6% share, followed by North America at 28.3% and Europe with 24.1%, driven by strong industrial adoption, raw material availability, and supportive environmental regulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source

The shrimp segment dominates the chitosan market, accounting for 58.7% share in 2024. Its dominance is attributed to the high availability of shrimp shells as a sustainable and cost-effective raw material. Shrimps provide superior-quality chitosan with excellent biocompatibility, purity, and deacetylation levels suitable for pharmaceuticals, cosmetics, and water treatment. The growing seafood industry and improved waste utilization practices further enhance supply. Crab and prawn sources contribute notably due to regional availability, while the “others” category, including squid and fungal-based chitosan, is gaining traction for non-animal and allergen-free applications.

- For instance, Primex EHF processes shrimp shell waste at its Siglufjordur facility in Iceland, producing high-quality chitosan that meets the necessary standards for applications, including those that comply with European Pharmacopoeia requirements.

By End-User

The water treatment segment leads the chitosan market with 41.6% share in 2024, driven by rising global demand for eco-friendly flocculants and coagulants. Chitosan’s biodegradability and heavy metal adsorption properties make it ideal for wastewater purification and industrial effluent treatment. Governments are increasingly promoting sustainable water management, boosting adoption in municipal and industrial sectors. The cosmetics and toiletries segment follows, supported by its use in anti-aging and moisturizing formulations, while food and beverage applications expand due to chitosan’s role as a natural preservative and dietary fiber enhancer.

- For instance, Zhejiang Golden-Shell Pharmaceutical Co., Ltd. is a major manufacturer of chitin and chitin derivatives in China, producing a range of chitosan products that are used in various industries including water treatment, biomedical engineering, and cosmetics.

Key Growth Drivers

Rising Demand for Biodegradable Materials

The increasing shift toward sustainable and eco-friendly materials is a major driver for the chitosan market. Industries are adopting chitosan due to its biodegradability, non-toxicity, and renewable origin from marine waste. Governments and environmental agencies are promoting bio-based alternatives to synthetic polymers, accelerating chitosan use in water treatment, agriculture, and pharmaceuticals. This growing emphasis on circular economy models and sustainable raw materials continues to enhance market growth across developed and emerging economies.

- For instance, KitoZyme S.A. produces chitosan from fungal sources, eliminating marine waste dependency and providing a highly sustainable, premium alternative to traditional crustacean-derived products, supporting use in high-value applications like medical biopolymers and cosmetics.

Expanding Use in Water Treatment Applications

The rapid industrialization and rising water pollution levels have heightened demand for efficient purification solutions. Chitosan’s ability to remove heavy metals, dyes, and suspended solids makes it an effective biopolymer for wastewater treatment. Governments are enforcing stricter discharge norms, encouraging adoption of natural flocculants over chemical-based counterparts. The product’s cost-effectiveness and compatibility with various pH levels have made it highly preferred in municipal and industrial water treatment projects worldwide.

- For instance, Panvo Organics Pvt. Ltd. is a notable supplier of chitosan-based products, which are widely used as effective, natural flocculants in the water treatment sector, known for removing contaminants like microplastics. These products are a key part of the global industrial-grade chitosan market.

Growing Applications in Pharmaceuticals and Cosmetics

The rising use of chitosan in drug delivery systems, wound healing, and skincare formulations is fueling market expansion. Its biocompatibility, antimicrobial properties, and film-forming ability make it ideal for controlled drug release and tissue engineering. In cosmetics, chitosan serves as a natural thickener and moisturizing agent, gaining popularity in organic and premium product lines. Increasing consumer demand for chemical-free personal care products and pharmaceutical innovations is further boosting the global chitosan demand.

Key Trends & Opportunities

Innovation in Non-Marine and Fungal-Based Chitosan

Growing interest in vegan and allergen-free alternatives is driving research into fungal-based chitosan production. These non-animal sources address supply chain volatility and allergen concerns associated with shellfish-derived chitosan. Advancements in biotechnology and fermentation processes are improving yield, quality, and cost efficiency. This shift presents opportunities for new entrants to develop sustainable, ethically sourced chitosan suited for food, biomedical, and cosmetic applications, widening the market scope.

- For instance, Heppe Medical Chitosan GmbH has developed a fungal-derived chitosan process using Aspergillus niger fermentation that yields over 8 kg of high-purity chitosan per batch with molecular weights between 80 kDa and 120 kDa, achieving pharmaceutical-grade consistency validated by ISO 13485 standards.

Integration into Agricultural and Food Applications

Chitosan’s natural antimicrobial and biodegradable properties are opening new opportunities in agriculture and food industries. It is increasingly used in seed coating, crop protection, and edible films to enhance shelf life and reduce post-harvest losses. Regulatory support for organic farming and sustainable packaging is further expanding adoption. The compound’s ability to improve soil health and promote plant immunity makes it a promising material for eco-friendly agricultural solutions.

- For instance, G.T.C. Bio Corporation is a recognized manufacturer and supplier of chitin and chitosan for various applications, including agriculture. Chitosan is widely used in agriculture as a natural biopesticide and plant growth enhancer that boosts plants’ innate ability to defend themselves against fungal, bacterial, and viral infections.

Key Challenges

High Production Costs and Raw Material Variability

Despite strong potential, the chitosan market faces challenges from high production costs and raw material inconsistencies. Extraction from marine waste requires complex deacetylation processes that vary by source and quality. Seasonal fluctuations in shellfish availability can affect supply stability and pricing. The industry needs technological advancements to optimize yield and develop cost-effective production techniques to achieve large-scale commercial viability.

Regulatory Barriers and Standardization Issues

Varying international regulations and lack of standardized product grades hinder global trade and commercialization. Inconsistent purity levels and performance across suppliers limit chitosan’s widespread acceptance in pharmaceutical and food industries. Meeting stringent quality and safety standards requires high investment in R&D and certification. Developing harmonized global regulatory frameworks and improving product traceability will be essential to overcome these barriers and unlock full market potential.

Regional Analysis

North America

North America holds a 28.3% share in 2024, driven by increasing adoption of chitosan in water treatment, pharmaceuticals, and cosmetics. The United States leads due to advanced biotechnology research and strong environmental regulations promoting biodegradable materials. Growing investments in drug delivery systems and biomedical applications further strengthen regional growth. Rising consumer preference for natural personal care ingredients and eco-friendly packaging supports demand. Canada contributes notably through sustainable seafood waste management initiatives that enhance chitosan supply and production consistency, reinforcing North America’s leadership in the global chitosan market.

Europe

Europe accounts for a 24.1% share in 2024, supported by stringent environmental policies and high demand for biopolymer-based materials. The region benefits from strong research initiatives in sustainable chemistry and advanced water purification technologies. Countries such as Germany, France, and the United Kingdom are leading users of chitosan in pharmaceuticals, cosmetics, and wastewater treatment. Increasing adoption of biodegradable coatings in food packaging also fuels demand. Supportive regulatory frameworks promoting the circular economy and innovation in waste valorization are positioning Europe as a key market for sustainable chitosan applications.

Asia-Pacific

Asia-Pacific dominates the global chitosan market with a 39.6% share in 2024, led by large-scale production in China, Japan, and India. The abundance of marine waste and expanding aquaculture industry provide an ample raw material base for chitosan manufacturing. Growing use in water purification, food preservation, and biomedical fields fuels strong regional demand. Rising government support for sustainable product development and low-cost manufacturing enhances export opportunities. Increasing adoption in agriculture for crop protection and soil conditioning further boosts Asia-Pacific’s role as the most dynamic and fastest-growing regional market.

Latin America

Latin America holds a 5.1% share in 2024, driven by expanding seafood processing industries and growing focus on environmental sustainability. Brazil, Mexico, and Chile are major contributors, utilizing shrimp and crab waste for chitosan extraction. The market is witnessing rising adoption in water treatment and food processing sectors. Government initiatives promoting marine waste valorization and renewable material usage support regional growth. Although production capacity remains limited, increasing collaborations with Asian suppliers and growing demand for eco-friendly materials are expected to enhance market development over the coming years.

Middle East & Africa

The Middle East & Africa region accounts for a 2.9% share in 2024, with growing adoption of chitosan in water treatment and agricultural applications. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa are investing in biopolymer technologies to support sustainability goals. Rising concerns about water scarcity and industrial pollution drive demand for natural flocculants. Limited local raw material availability has encouraged import-dependent supply chains. However, expanding R&D collaborations and increasing awareness of bio-based materials are expected to create new opportunities for market expansion in the region.

Market Segmentations:

By Source

- Shrimps

- Prawns

- Crabs

- Others

By End-user

- Water Treatment

- Cosmetics & Toiletries

- Food & Beverage

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the chitosan market highlights the presence of major players such as Heppe Medical Chitosan GmbH, Kitozyme S.A., Primex EHF, FMC Corporation, Zhejiang Golden-Shell Pharmaceutical Co., Ltd., G.T.C. Bio Corporation, Panvo Organics Pvt. Ltd., Advanced Biopolymers AS, Biophrame Technologies, and Meron Biopolymers Pvt. Ltd. These companies focus on product innovation, sustainable production methods, and the development of high-purity chitosan grades for pharmaceutical, food, and water treatment applications. Strategic collaborations, R&D investments, and regional expansions are key competitive strategies adopted to enhance market reach. Manufacturers are also emphasizing the use of alternative raw materials, such as fungal-derived chitosan, to overcome supply challenges and meet regulatory requirements. Increasing patent activity and technological advancements in extraction processes further intensify market competition, while growing demand for biodegradable materials encourages both established players and new entrants to expand production capacities globally.

Key Player Analysis

- Heppe Medical Chitosan GmbH

- Kitozyme S.A.

- Primex EHF

- FMC Corporation

- Zhejiang Golden-Shell Pharmaceutical Co., Ltd.

- T.C. Bio Corporation

- Panvo Organics Pvt. Ltd.

- Advanced Biopolymers AS

- Biophrame Technologies

- Meron Biopolymers Pvt. Ltd.

Recent Developments

- In May 2025, KitoZyme S.A. reported the production of uniform chitosan microparticles using advanced spray-drying techniques, achieving controlled particle diameters between 0.5 and 5 micrometres for pharmaceutical use.

- In September 2023, Heppe Medical Chitosan (HMC) introduced the first-ever chitosan molecular weight standards at EUCHIS. This innovation enables researchers and customers to utilize dependable chitosan for molecular weight analysis without comparing them to other materials.

- In March 2023, Heppe Medical Chitosan GmbH commenced participation in the “Zielwirk” consortium to develop mRNA-loaded chitosan nanoparticles for drug delivery, with initial trials producing homogeneous particles under 200 nm.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Source, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for chitosan will grow as industries shift toward biodegradable and sustainable materials.

- Advancements in extraction and purification technologies will improve production efficiency.

- Pharmaceutical and biomedical applications will expand due to chitosan’s biocompatibility and healing properties.

- Water treatment will remain a major growth area as environmental regulations tighten.

- Fungal and non-marine sources of chitosan will gain popularity to reduce allergen concerns.

- Integration into food preservation and packaging will strengthen its role in the circular economy.

- Research into nanotechnology-based chitosan formulations will create new opportunities.

- Collaboration between biotech firms and academic institutions will accelerate product innovation.

- Emerging economies will increase production capacity, enhancing global supply stability.

- Consumer demand for eco-friendly cosmetics and personal care products will drive market expansion.

Market Insights

Market Insights