Market Overview:

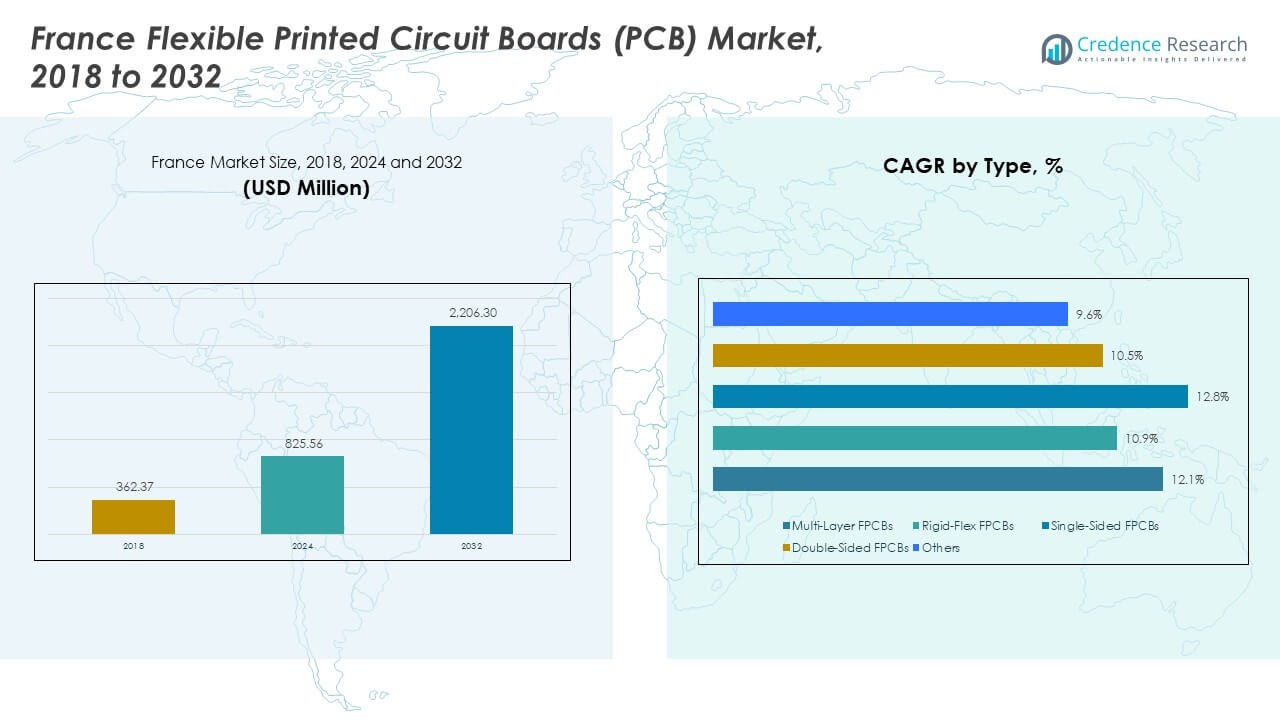

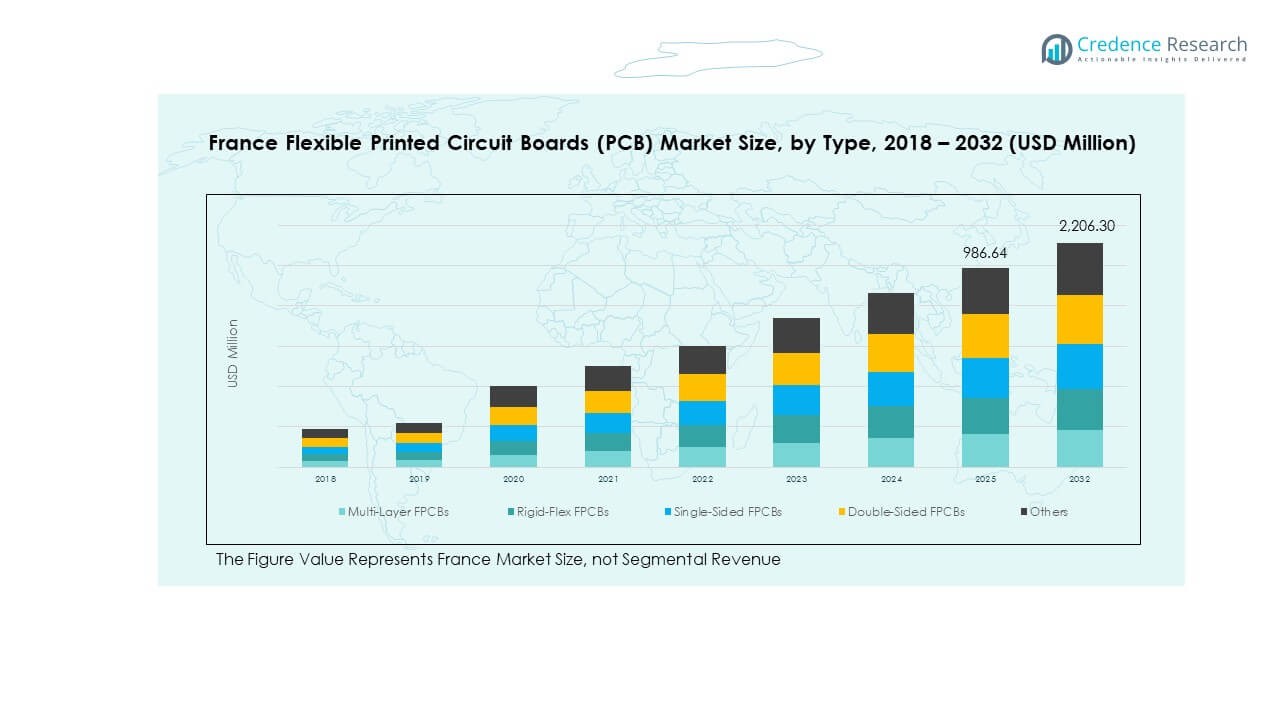

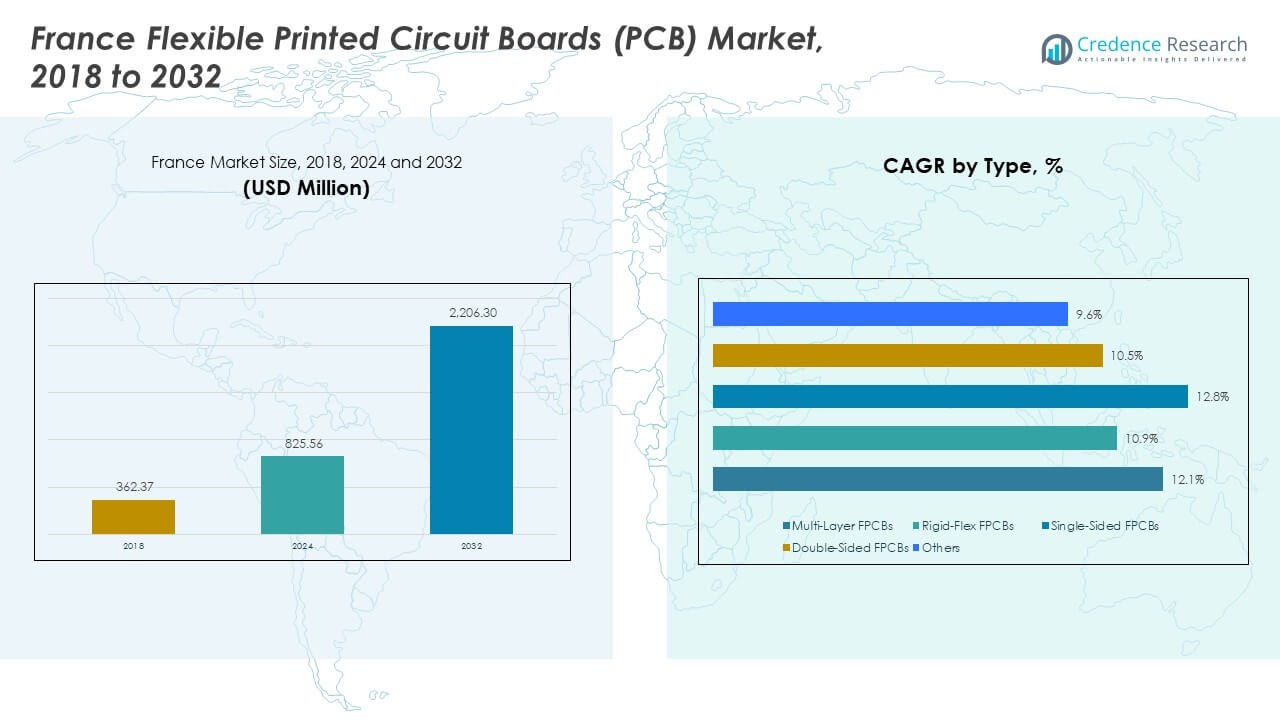

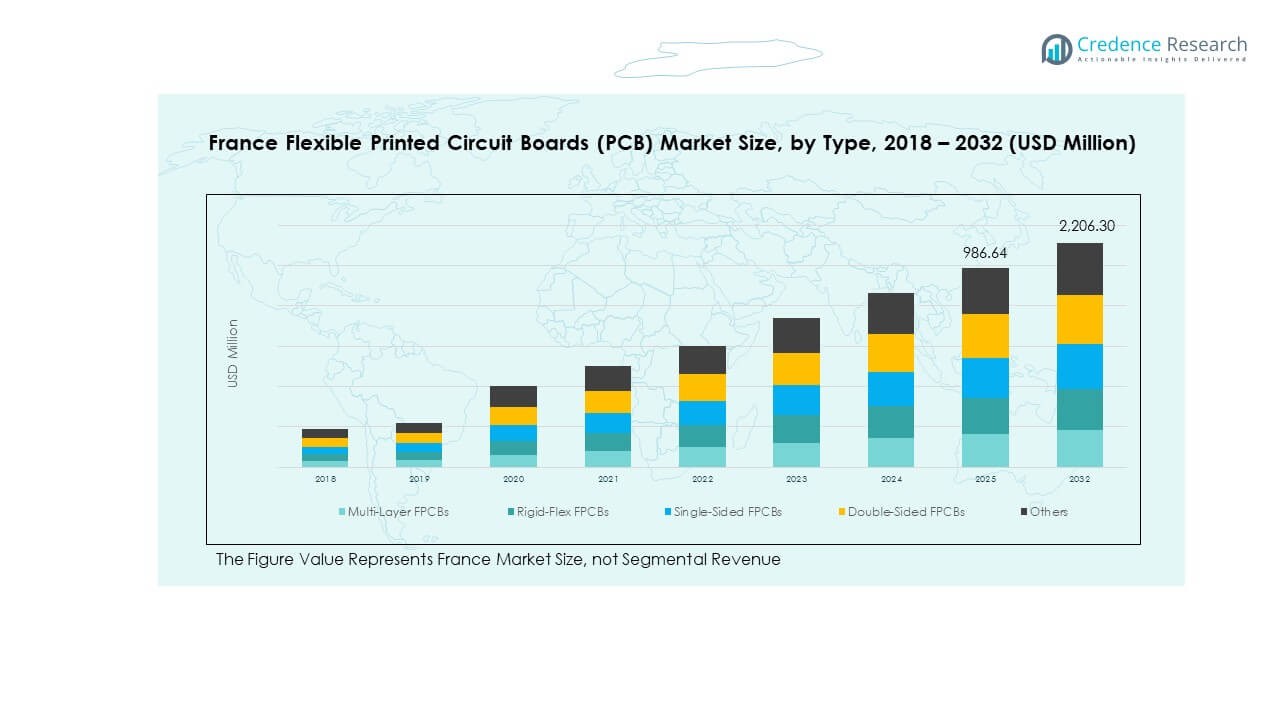

The France Flexible Printed Circuit Boards (PCB) Market size was valued at USD 362.37 million in 2018, reaching USD 825.56 million in 2024, and is anticipated to attain USD 2,206.30 million by 2032, growing at a CAGR of 12.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Flexible Printed Circuit Boards (PCB) Market Size 2024 |

USD 825.56 Million |

| France Flexible Printed Circuit Boards (PCB) Market, CAGR |

12.18% |

| France Flexible Printed Circuit Boards (PCB) Market Size 2032 |

USD 2,206.30 Million |

Growth in France’s electronics manufacturing sector and rising integration of lightweight circuit solutions across automotive, industrial, and medical devices drive market expansion. Manufacturers focus on advanced materials and precision etching to meet high-speed data transfer and compact design requirements. Increasing adoption of electric vehicles and 5G communication infrastructure also strengthens demand for multi-layer and rigid-flex PCBs. The local ecosystem benefits from R&D initiatives promoting flexible hybrid electronics and advanced packaging technologies.

Regionally, France stands as a key contributor within Europe due to its strong automotive and aerospace industries. Western and Southern France lead adoption, supported by industrial clusters and electronics design hubs. Emerging production bases in Eastern France are strengthening through partnerships and localization of component manufacturing. The country’s integration with broader EU supply chains ensures efficient distribution, while cross-border collaborations with Germany and Italy enhance innovation in high-reliability circuit design and sustainable PCB production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The France Flexible Printed Circuit Boards (PCB) Market was valued at USD 362.37 million in 2018, reached USD 825.56 million in 2024, and is projected to attain USD 2,206.30 million by 2032, registering a CAGR of 12.18% during the forecast period.

- Western France leads with 38% share, driven by strong industrial clusters and advanced R&D facilities, followed by Southern France at 27%, supported by aerospace and telecom manufacturing, and Northern & Eastern France collectively at 35%, backed by industrial and automotive production networks.

- The fastest-growing region is Southern France with a 27% share, led by rapid 5G infrastructure expansion, aerospace innovation, and increased adoption of high-reliability FPCBs.

- Multi-layer FPCBs account for over 40% of total revenue, dominating due to their superior density and application in advanced electronics and automotive systems.

- Rigid-Flex FPCBs capture around 25% share, gaining traction in aerospace, defense, and industrial automation for their structural durability and vibration resistance.

Market Drivers:

Rising Adoption of Flexible Circuitry Across Automotive and Industrial Electronics

Growing demand for compact, lightweight, and heat-resistant components in automotive electronics drives expansion in the France Flexible Printed Circuit Boards (PCB) Market. Automakers integrate FPCBs for sensors, ADAS systems, and infotainment modules to improve performance and reliability. Industrial automation solutions also rely on flexible circuits for motion control and robotics. It supports stable connectivity under vibration and high-temperature conditions. Advancements in flexible copper laminates and polymer films improve mechanical endurance. The transition toward electric and hybrid vehicles increases the requirement for high-density interconnect PCBs. These applications stimulate investment in local manufacturing capacity.

- For example, Infineon Technologies AG worked with Flex Ltd. to implement a zone control unit platform that uses flexible circuit substrates for power distribution and gateway functions. It supports stable connectivity under vibration and high‐temperature conditions. Advancements in flexible copper laminates and polymer films improve mechanical endurance.

Technological Advancements in Miniaturization and Design Complexity

Continuous innovation in fine-line circuitry, surface-mount technology, and multilayer stacking enhances the performance of flexible PCBs. French and European manufacturers adopt laser direct imaging and roll-to-roll fabrication for precision and scalability. It enables thinner, lighter circuits suitable for smartphones, wearables, and medical implants. Miniaturization trends in consumer electronics drive the need for compact yet durable interconnect solutions. The introduction of high-speed data applications pushes signal integrity requirements. Local R&D initiatives improve thermal management and power delivery efficiency. These factors support the technology leadership of France’s electronics ecosystem.

- For instance, laser direct imaging systems from major vendors now support line widths below 20 µm and overlay accuracy of ±3 µm, enabling manufacture of ultra‐fine flexible circuits. French and European manufacturers adopt laser direct imaging and roll-to-roll fabrication for precision and scalability. It enables thinner, lighter circuits suitable for smartphones, wearables, and medical implants.

Strong Growth in 5G Infrastructure and Telecommunications Equipment

The expansion of 5G networks fuels large-scale adoption of high-frequency flexible circuits. Telecom providers deploy FPCBs in antenna modules, base stations, and communication satellites. It enhances data transmission stability and minimizes signal loss. High-bandwidth systems require advanced substrates with low dielectric constants. Manufacturers focus on low-loss materials and reinforced laminates for thermal control. Growth in France’s smart city projects boosts fiber-optic and wireless connectivity devices. The continuous network upgrades strengthen market prospects across the telecom supply chain.

Expansion of Consumer Electronics Manufacturing and Design Capabilities

France witnesses steady growth in consumer electronics production supported by design innovation and automation. Flexible circuits enable slim, durable, and energy-efficient devices such as smartwatches, tablets, and foldable phones. It ensures space optimization and supports dynamic product designs. Manufacturers collaborate with OEMs to localize assembly lines and reduce import dependency. Demand for flexible hybrid electronics boosts partnerships between material suppliers and circuit designers. The focus on eco-friendly substrates aligns with EU sustainability regulations. Rapid innovation in compact device assembly drives consistent market momentum.

Market Trends:

Emergence of Eco-Friendly Materials and Green Manufacturing Practices

Sustainability shapes production strategies across the France Flexible Printed Circuit Boards (PCB) Market. Manufacturers transition to halogen-free laminates and bio-based resins to meet regulatory standards. It reduces hazardous waste and enhances recyclability in end-of-life products. The shift supports France’s circular economy framework for electronics. Local companies invest in cleaner etching solutions and closed-loop waste recovery. Eco-friendly processing attracts global electronics brands seeking green supply chains. The trend reinforces long-term compliance with EU RoHS and REACH policies. It also strengthens brand credibility in export markets.

Integration of Flexible Hybrid Electronics and Smart System Design

Flexible hybrid electronics combine printed circuits with integrated sensors and chips to enable smart product functionality. The trend gains traction across healthcare, aerospace, and defense applications. It allows the creation of curved or wearable electronic structures with embedded intelligence. The France Flexible Printed Circuit Boards (PCB) Market benefits from early adoption in biomedical sensors and flight control systems. Collaboration between R&D centers and OEMs accelerates design innovation. It expands the application scope beyond traditional consumer and automotive segments. These advancements improve overall system flexibility and performance reliability.

- For example, prototypes developed at CEA-Leti embed sensors per square centimetre on a flexible substrate for wearable aerospace monitoring. The trend gains traction across healthcare, aerospace, and defense applications. It allows the creation of curved or wearable electronic structures with embedded intelligence.

Increasing Customization and Demand for Low-Volume, High-Mix Production

Manufacturers experience rising orders for customized flexible circuits in France’s niche industries. Small-batch, application-specific designs support medical imaging, instrumentation, and industrial automation. It encourages the deployment of agile manufacturing systems using digital design workflows. 3D printing and additive circuit fabrication shorten prototype timelines. Market participants adopt modular production lines to enhance adaptability. The trend reflects the shift from standardized mass production to tailored solutions. It creates new opportunities for specialized suppliers and design consultants.

Adoption of Advanced Connectivity Solutions and IoT Integration

IoT integration continues to shape PCB functionality through embedded communication and sensing capabilities. Flexible PCBs enable compact device structures in connected systems across homes, factories, and vehicles. It enhances reliability in continuous operation environments. French manufacturers develop circuits compatible with Bluetooth, Wi-Fi, and LPWAN modules. Demand for energy-efficient, bendable components grows with wearable and smart infrastructure applications. Cross-industry collaboration between IoT platform developers and PCB makers expands product versatility. This integration accelerates France’s transition toward connected, data-driven ecosystems.

Market Challenges Analysis:

High Production Costs and Limited Domestic Fabrication Infrastructure

High equipment costs and dependence on imported materials create production constraints in the France Flexible Printed Circuit Boards (PCB) Market. Limited local fabrication capacity affects lead times and price competitiveness. It raises procurement expenses for OEMs and assemblers. Manufacturers face difficulty in scaling due to high setup and maintenance costs. Supply chain gaps in flexible laminates and conductive adhesives restrict large-scale output. Smaller firms struggle with automation investment and skilled labor availability. These limitations slow domestic value addition and rely heavily on Asian supply networks.

Complex Design Standards and Stringent Quality Compliance Requirements

Complex industry standards and evolving compliance rules present design and certification challenges. Aerospace, medical, and automotive sectors demand rigorous performance validation for flexible circuits. It increases testing time and regulatory costs for manufacturers. Miniaturized designs complicate trace routing and thermal dissipation. Maintaining electrical stability under dynamic bending adds engineering complexity. The necessity for multi-layer accuracy and signal integrity demands advanced simulation tools. Limited access to high-end design software restricts smaller players from achieving consistent performance benchmarks. Regulatory audits add another layer of operational pressure.

Market Opportunities:

Growing Demand for Medical Electronics and Wearable Device Integration

The increasing use of miniaturized medical sensors and diagnostic tools creates strong growth prospects. Flexible circuits enable precise signal monitoring and patient comfort in portable devices. It finds application in glucose monitors, neurostimulators, and cardiovascular systems. France’s healthcare innovation initiatives promote local PCB research partnerships. The sector’s expansion aligns with the broader European medical device innovation strategy. High focus on patient-centric electronics boosts R&D investment in reliability and safety. The trend opens export potential to neighbouring EU healthcare markets.

Rising Investments in Semiconductor Packaging and Electric Mobility

Expanding semiconductor and EV manufacturing strengthens opportunities for flexible PCB suppliers. High thermal conductivity and vibration resistance make these circuits essential for power modules. It supports the integration of advanced sensors and control systems. France’s industrial policies promote clean mobility and local chip production. Partnerships between material companies and OEMs enhance supply chain stability. The push for energy-efficient vehicles increases demand for flexible interconnect solutions. This growth creates long-term prospects for domestic and regional market participants.

Market Segmentation Analysis:

By Type

Dominance of Multi-Layer and Rigid-Flex FPCBs

Multi-Layer FPCBs hold the leading position in the France Flexible Printed Circuit Boards (PCB) Market due to their superior signal integrity, high wiring density, and compatibility with compact electronic assemblies. They are widely applied in automotive control units, industrial robotics, and communication modules requiring high performance under thermal stress. Rigid-Flex FPCBs also demonstrate strong growth, driven by aerospace, defense, and medical device applications where vibration resistance and reliability are essential. It supports hybrid circuit architectures that reduce connector weight and enhance design flexibility. Single-sided and double-sided circuits maintain relevance in cost-sensitive applications such as home appliances and small consumer devices. Emerging hybrid designs in the “Others” category use stretchable substrates for wearables and advanced healthcare sensors.

- For instance, in a recent high-reliability project reported by the CEA‑Leti research centre, a rigid-flex multilayer board with 2 flexible and 8 rigid layers achieved minimum annular rings of 50 µm and reduced weight by over 30%. They are widely applied in automotive control units, industrial robotics, and communication modules requiring high performance under thermal stress. Rigid-Flex FPCBs also demonstrate strong growth, driven by aerospace, defense, and medical device applications where vibration resistance and reliability are essential.

By End Use

Expanding Role Across Automotive, Aerospace, and Electronics Sectors

Industrial electronics lead end-use adoption due to growing automation and process control requirements. Automotive applications show rapid expansion driven by electric mobility and sensor-based technologies. It enhances energy efficiency and design compactness in power management systems. Aerospace and defense sectors use high-reliability FPCBs for avionics, radar, and navigation systems, supporting weight reduction and performance under extreme conditions. IT and telecom industries benefit from flexible circuits in 5G base stations and fiber-optic equipment. Consumer electronics remain a consistent contributor with demand for wearables, smartphones, and tablets. The growing focus on innovation and localized production strengthens France’s position in flexible PCB manufacturing.

- For example, an OEM integrated flexible circuits into over 100,000 EV battery management systems to support space- and weight-optimized interconnects. It enhances energy efficiency and design compactness in power-management systems. Aerospace and defense sectors use high-reliability FPCBs for avionics, radar, and navigation systems, supporting weight reduction and performance under extreme conditions.

Segmentation:

By Type

- Multi-Layer FPCBs

- Rigid-Flex FPCBs

- Single-Sided FPCBs

- Double-Sided FPCBs

- Others

By End Use

- Industrial Electronics

- Aerospace & Defense

- IT & Telecom

- Automotive

- Consumer Electronics

- Others

Regional Analysis:

Western France – Dominant Manufacturing and Design Hub

Western France holds the leading position in the France Flexible Printed Circuit Boards (PCB) Market with a 38% share. The region benefits from established electronics manufacturing clusters, research institutes, and industrial automation facilities. It supports major automotive and aerospace suppliers with advanced PCB integration for control and communication systems. Cities such as Nantes and Rennes host several R&D centers focused on flexible circuit miniaturization and material innovation. Strong collaboration between OEMs and technology startups enhances the ecosystem’s resilience. The presence of skilled engineers and government-backed innovation grants continues to attract new investments in flexible electronics and smart manufacturing technologies.

Southern France – Expanding Aerospace and Telecommunication Base

Southern France accounts for around 27% of the total market share, driven by a robust aerospace and telecommunication sector. Toulouse serves as a key hub for high-reliability circuit applications in avionics and defense electronics. It supports advanced manufacturing capabilities for rigid-flex and multi-layer FPCBs used in aircraft and satellite systems. The region experiences growing demand from telecommunication infrastructure projects tied to 5G deployment. Local suppliers are upgrading facilities to meet strict quality and safety standards. It benefits from supply chain proximity to semiconductor manufacturers and system integrators operating across the Mediterranean corridor.

Northern and Eastern France – Emerging Centers for Industrial and Automotive Applications

Northern and Eastern France together capture a combined 35% share, emerging as competitive centers for industrial and automotive electronics. The Lille–Metz corridor supports PCB manufacturing for EVs, powertrain modules, and factory automation systems. It benefits from cross-border trade links with Germany and Belgium, facilitating technology transfer and raw material sourcing. The region focuses on cost-effective, medium-volume production catering to local OEMs. Strategic investments in automation and surface-mount technologies strengthen its output capacity. Rising adoption of Industry 4.0 frameworks fosters partnerships between research institutions and mid-scale manufacturers, positioning the region for sustained growth in the flexible PCB ecosystem.

Key Player Analysis:

- Cicor France

- Elvia PCB

- Eurocircuits France

- ESR (Electronique Signalisation et Réparation)

- Sefram France

- RPC Technologie

- SMIEW France

- AFI (Advanced Flexible Interconnect)

- PCB Services France

- Multi-Circuit Boards

Competitive Analysis:

The France Flexible Printed Circuit Boards (PCB) Market features a mix of domestic producers and European suppliers competing on innovation, quality, and customization. Key players such as Cicor France, Elvia PCB, Eurocircuits France, and AFI emphasize advanced manufacturing, miniaturization, and eco-friendly designs. It benefits from strong R&D capabilities and proximity to key automotive, aerospace, and electronics clients. Companies are expanding product portfolios to address flexible hybrid and multi-layer applications. Strategic partnerships with material suppliers and OEMs enhance value chain integration. Competition centers on performance reliability, turnaround time, and compliance with EU sustainability regulations.

Recent Developments:

- In April 2025, Cicor Group successfully acquired significant business activities of the French Éolane Group, marking a major milestone in the company’s pan-European growth strategy. The Paris Commercial Court accepted Cicor’s offer, and the business transfer was completed on April 22, 2025. As part of this strategic acquisition, Cicor integrated five engineering and production sites in France and two additional sites in Morocco into its existing EMS business. The transaction added approximately 890 employees and CHF 125 million of profitable sales to the Cicor Group, creating significant synergy potential. This acquisition strengthened Cicor’s market leadership in the aerospace and defence sector, as Éolane is one of the leading providers in the French Electronic Manufacturing Services market with a strong position in strategic sectors including aerospace and defence, railway, and nuclear technology.

- In 2024, Eurocircuits announced major investments focused on process optimization and increasing efficiency to become a more sustainable and efficient manufacturer. The company invested 1.9 million euros in PCB production to replace systems and modernize process steps. To support its fast-growing PCB assembly business, which was handling an average of 70 orders per working day at the end of 2023, Eurocircuits implemented new automation measures, additional APIs to component suppliers, optimized production planning, and strengthened key processes in production. Additionally, the company expanded its renewable energy generation by adding more modules to its solar park, with a goal to increase energy production by 30% in 2024.

- In November 2024, Elvia PCB Group announced a significant identity evolution, adopting a new name: Elvia Electronics. This rebranding reflects the company’s strategic vision to position itself as a European leader in advanced electronic technologies beyond traditional PCB manufacturing. The group’s core values remain unchanged, with continued commitment to delivering high-quality products with a focus on innovation, performance, and sustainability. Earlier, in March 2022, Tikehau Ace Capital, a private equity firm specializing in strategic industries and technologies, finalized the acquisition of 100% of the capital of Elvia PCB. Following this acquisition, Alain Dietsch was appointed CEO, joining the company after more than twenty years of experience in the electronics and defense sector, while Bruno Cassin, who successfully managed the group for almost thirty years, left his operational functions to join the Supervisory Board.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type and End Use segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion in EV and aerospace sectors will boost demand for multi-layer flexible PCBs.

- France’s focus on sustainable electronics will drive eco-friendly material innovation.

- Growing integration of flexible hybrid circuits will reshape medical and defense designs.

- 5G deployment will accelerate production of high-frequency and low-loss flexible boards.

- Increased automation will enhance manufacturing efficiency and reduce defect rates.

- Collaboration between OEMs and R&D centers will strengthen domestic design expertise.

- Smart wearable and IoT applications will widen the market’s consumer electronics base.

- Rising export potential across Europe will create new trade and supply chain channels.

- Miniaturization and lightweight component trends will drive premium PCB adoption.

- Policy support for green manufacturing and local sourcing will improve competitiveness.