Market Overview:

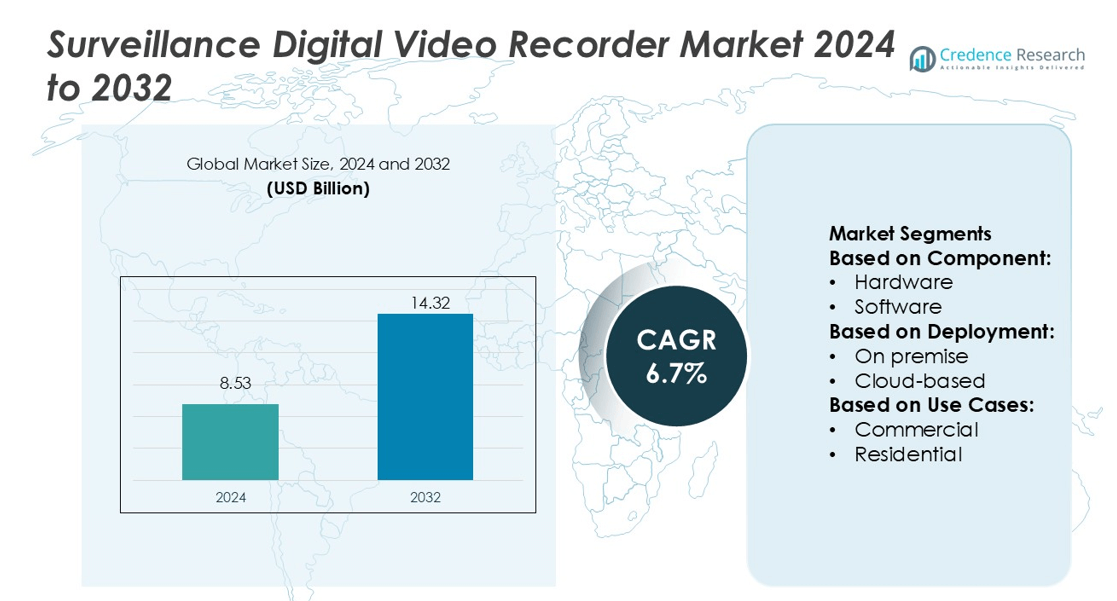

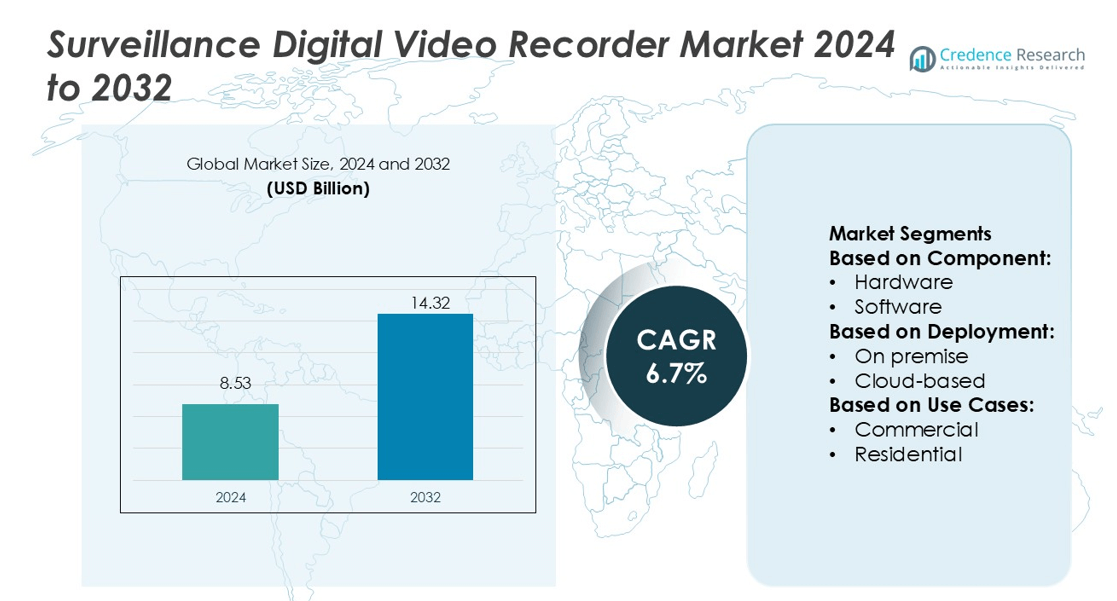

Surveillance Digital Video Recorder Market size was valued USD 8.53 billion in 2024 and is anticipated to reach USD 14.32 billion by 2032, at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Surveillance Digital Video Recorder Market Size 2024 |

USD 8.53 billion |

| Surveillance Digital Video Recorder Market, CAGR |

6.7% |

| Surveillance Digital Video Recorder Market Size 2032 |

USD 14.32 billion |

The Surveillance Digital Video Recorder Market is led by major players focusing on product innovation, AI-based analytics, and smart storage solutions. Companies such as Hikvision, Dahua, Bosch, Hanwha Vision, Motorola Solutions, Axis Communications, and Tiandy Technologies drive market competition through advancements in video resolution, cloud integration, and data security. Continuous R&D investments have enhanced recording efficiency, edge analytics, and remote accessibility. North America leads the global market with a 34% share, supported by large-scale surveillance deployments in smart cities, commercial infrastructure, and government security projects emphasizing AI-enabled, high-definition digital recording systems.

Market Insights

- The Surveillance Digital Video Recorder Market was valued at USD 8.53 billion in 2024 and is expected to reach USD 14.32 billion by 2032, growing at a CAGR of 6.7%.

- Market growth is driven by the rising adoption of AI-based analytics, real-time monitoring, and smart storage technologies across public and private sectors.

- Key trends include the shift toward hybrid and cloud-based DVR systems, integration of 4K recording, and enhanced cybersecurity features.

- Leading players focus on technological innovation and global expansion, while high installation and maintenance costs remain a restraint for small enterprises.

- North America dominates the market with a 34% share, followed by Asia Pacific at 29%, driven by smart city projects, infrastructure security, and high demand for hardware components, which hold the largest segment share in global surveillance applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The hardware segment dominates the Surveillance Digital Video Recorder Market with a 54% share. Its dominance stems from the rising installation of high-definition cameras and advanced storage devices in surveillance systems. The demand for reliable and high-capacity DVR units has increased due to the need for continuous recording in commercial and public areas. Hardware innovations, including 4K recording, solid-state storage, and PoE-enabled systems, further strengthen this segment’s growth. Software and services follow, driven by analytics integration and remote monitoring capabilities across enterprises and security facilities.

- For instance, Hikvision’s DeepinMind Series NVRs integrate GPU-based video analytics, enabling real-time face recognition with processing speeds of up to 16 pictures per second (or 48 images per second on high-end models) for analysis.

By Deployment

The on-premise segment holds the largest market share of 61%, supported by its secure data management and low latency. Organizations with strict security and data ownership requirements prefer on-premise deployment for critical infrastructure surveillance. However, cloud-based systems are rapidly gaining traction due to scalability, centralized data access, and cost efficiency. Advancements in hybrid DVR systems enable seamless storage integration between on-site servers and cloud networks, expanding adoption in government, transportation, and retail sectors.

- For instance, Axis’s network video recorders offer pre-loaded licenses and up to 5-year warranties for rack and appliance models designed for mixed on-premised and cloud-connected environments.

By Use Cases

Gun detection leads the use case segment with a 27% share, driven by rising concerns about public safety and mass surveillance. AI-based video analytics enable real-time identification of firearms, reducing response time in emergencies. Crowd monitoring and intrusion detection are also key growth areas, supported by advanced motion sensors and object recognition algorithms. Traffic management and incident detection applications are expanding with the adoption of smart city initiatives. Continuous innovation in AI-enabled video analytics ensures broader adoption across public and private surveillance infrastructures.

Key Growth Drivers

Increasing Demand for Real-Time Video Surveillance

The need for real-time monitoring across public and private sectors is driving market expansion. Advanced digital video recorders enable high-resolution recording and instant playback, improving situational awareness and security efficiency. Governments and enterprises are investing heavily in surveillance infrastructure to ensure public safety, reduce crime, and manage crowd control. The integration of AI-based analytics in DVRs enhances detection accuracy and operational responsiveness, further fueling the demand for smart surveillance systems worldwide.

- For instance, Motorola Solutions’ AI NVR 2X Value appliance supports up to 80 camera channels for recording with capacities of 6 TB, 12 TB, 16 TB, and 24 TB storage configurations.

Technological Advancements in AI and Analytics

Artificial intelligence and machine learning integration have transformed DVR functionalities, enabling intelligent video analysis and automated alerts. Modern DVRs now support facial recognition, license plate identification, and anomaly detection, allowing proactive threat management. Manufacturers are increasingly embedding edge computing to process data locally, reducing latency and bandwidth usage. These innovations not only improve security outcomes but also support cost-effective monitoring solutions, positioning AI-powered DVRs as a cornerstone of next-generation surveillance systems.

- For instance, Hanwha Vision’s AI Box “AIB-800” supports up to 8 channels of conventional ONVIF/SUNAPI cameras, applying real-time AI detection of people, vehicles, faces, and license plates.

Expansion of Smart Cities and Infrastructure Projects

Rising investments in smart city projects and transportation infrastructure are significantly boosting DVR adoption. Governments are deploying surveillance systems in urban areas for traffic management, law enforcement, and public safety. The growing integration of IoT devices within city frameworks has created the need for centralized video storage and analytics solutions. DVR systems play a crucial role in enabling coordinated security responses, efficient data management, and continuous urban monitoring, thus strengthening their relevance in large-scale infrastructure developments.

Key Trends & Opportunities

Shift Toward Hybrid and Cloud-Based DVR Systems

The industry is witnessing a shift from traditional on-premise setups to hybrid and cloud-based DVR architectures. Cloud connectivity offers remote access, scalable storage, and simplified data management, appealing to enterprises seeking flexibility. Hybrid DVRs combine the reliability of local storage with the scalability of cloud environments. This trend enables organizations to maintain control over sensitive data while benefiting from the efficiency and accessibility offered by cloud technology, opening opportunities for vendors providing integrated cloud surveillance platforms.

- For instance, Dahua’s S-XVR series offers detachable SSD modules in 256 GB, 512 GB and 1 TB capacities, facilitating easy capacity expansion in hybrid storage designs.

Growing Adoption of AI-Enabled Video Analytics

AI-driven DVRs are gaining prominence for their ability to deliver advanced threat detection and behavioral analysis. The integration of algorithms for motion detection, face recognition, and object tracking improves situational awareness and decision-making. This shift aligns with the rising preference for proactive surveillance over reactive monitoring. Manufacturers focusing on AI-enabled analytics are capturing strong market positions, especially in sectors like retail, defense, and transportation, where real-time insights and predictive alerts enhance safety and operational efficiency.

- For instance, Infinova’s VS231-A4 series supports video structuring of object attributes (faces, pedestrians, motor/non-motor vehicles) and is designed to output target attributes and images to a backend platform for big data analysis.

Key Challenges

High Installation and Maintenance Costs

The initial setup of advanced DVR systems involves significant expenditure on hardware, network infrastructure, and software integration. Regular maintenance and upgrades to accommodate newer analytics technologies further add to operational costs. Small and medium enterprises often face budget constraints that limit adoption, particularly in developing regions. Balancing cost efficiency with performance remains a key challenge for vendors, prompting the development of scalable, modular DVR systems to cater to cost-sensitive customers.

Data Privacy and Cybersecurity Concerns

The increasing connectivity of DVRs through cloud and IoT ecosystems raises concerns about data breaches and cyberattacks. Unauthorized access or tampering can compromise sensitive video data, posing serious risks to both public and private sectors. Compliance with data protection regulations such as GDPR and regional cybersecurity standards adds complexity for manufacturers. Strengthening encryption, authentication, and network security protocols has become essential to maintain trust and ensure the safe deployment of surveillance DVR systems.

Regional Analysis

North America

North America leads the Surveillance Digital Video Recorder Market with a 34% share, supported by extensive adoption in public safety, retail, and industrial surveillance. The U.S. government’s investments in smart city and border security programs drive steady growth in the region. Technological advancements in AI-based analytics, high-definition recording, and cybersecurity-integrated DVR systems have strengthened adoption across enterprises. Major manufacturers focus on product upgrades and partnerships with security agencies to improve operational reliability, making North America a key hub for innovation and large-scale surveillance deployments.

Europe

Europe holds a 26% share of the global market, driven by regulatory frameworks promoting enhanced public security and infrastructure monitoring. Countries such as Germany, the U.K., and France are implementing AI-enabled video analytics and GDPR-compliant data management systems. Growing urban surveillance and transportation monitoring demand are accelerating DVR integration. Local manufacturers are focusing on hybrid cloud-enabled DVR solutions to support multi-site video storage. Additionally, European security projects emphasize interoperability and high data protection standards, which are further propelling technological advancement in this region.

Asia Pacific

Asia Pacific accounts for 29% of the global market, fueled by rapid urbanization, industrial expansion, and government-backed safety programs. China, Japan, and India are major contributors, investing heavily in AI-based surveillance networks and traffic monitoring systems. Expanding manufacturing and retail infrastructure have increased the demand for scalable DVR solutions with advanced storage capacity. Local vendors are innovating with cost-effective, high-resolution digital video recorders tailored to regional needs. The region’s strong focus on public surveillance and smart city initiatives continues to make Asia Pacific a high-growth market for DVR systems.

Latin America

Latin America represents a 6% share of the Surveillance Digital Video Recorder Market, driven by improving security infrastructure and urban monitoring initiatives. Countries such as Brazil and Mexico are adopting advanced video surveillance systems to address rising crime and public safety concerns. The growing deployment of cloud-integrated DVRs across commercial and government sectors enhances operational efficiency. While economic constraints limit high-end system adoption, ongoing smart city projects and partnerships with global security providers are gradually expanding market penetration across the region.

Middle East & Africa

The Middle East & Africa region captures a 5% market share, supported by investments in critical infrastructure protection and smart surveillance projects. The UAE, Saudi Arabia, and South Africa are key contributors, implementing advanced security systems in transportation hubs, oil facilities, and public spaces. The integration of AI and networked DVRs enables enhanced monitoring across urban areas. Although infrastructure limitations persist in parts of Africa, the growing focus on digital transformation and national security continues to drive steady adoption of surveillance DVR systems across the region.

Market Segmentations:

By Component:

By Deployment:

By Use Cases:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Surveillance Digital Video Recorder Market is characterized by intense competition among leading players such as Tiandy Technologies Co., Ltd., Axis Communications AB, Motorola Solutions, Inc., Hanwha Vision Co., Ltd., Dahua Technology Co., Ltd., Infinova, TKH Group N.V., Zhejiang Uniview Technologies Co., Ltd., Robert Bosch GmbH, and Hangzhou Hikvision Digital Technology Co., Ltd. The Surveillance Digital Video Recorder Market is highly competitive, with companies focusing on innovation, quality, and technological differentiation to expand their global footprint. Market participants are investing in AI-driven analytics, advanced compression technologies, and cloud-enabled DVR systems to enhance performance and security efficiency. The shift toward hybrid surveillance architectures and smart city integrations continues to shape competitive strategies. Vendors are emphasizing cybersecurity, remote monitoring, and high-resolution recording capabilities to meet rising end-user expectations. Strategic alliances, mergers, and continual R&D investment enable firms to strengthen market positioning and respond to evolving industry demands effectively.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tiandy Technologies Co., Ltd.

- Axis Communications AB

- Motorola Solutions, Inc.

- Hanwha Vision Co., Ltd.

- Dahua Technology Co., Ltd.

- Infinova

- TKH Group N.V.

- Zhejiang Uniview Technologies Co., Ltd.

- Robert Bosch GmbH

- Hangzhou Hikvision Digital Technology Co., Ltd.

Recent Developments

- In August 2024, Robert Bosch GmbH, a global provider of innovative safety and security solutions, launched an assembly line in India dedicated to video systems and solutions featuring the FLEXIDOME IP Starlight 5000i cameras.

- In May 2024, Hanwha Vision Co., Ltd. introduced an AI Box, AIB-800, designed to transform any standard ONVIF-compatible video surveillance camera into an AI-powered analytics device. This AI Box offers a cost-effective solution for businesses to upgrade their existing camera systems, allowing them to harness AI capabilities without modifying or fully replacing their current security infrastructure, according to the company.

- In April 2024, Axis Communications AB launched an open cloud-based platform, Axis Cloud Connect, designed to deliver more secure, flexible, and scalable security solutions. Tailored for seamless integration with Axis devices, Axis Cloud Connect offers businesses a robust suite of managed services, including system and device management, video, and data delivery, while addressing the growing demand for advanced cybersecurity.

- In April 2024, Siemens inaugurated the first building complex of the Siemens Technology Center (STC) at the Garching Research Campus near Munich, Germany, where it will bundle all its corporate research activities in Germany

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment, Use Cases and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with increasing demand for intelligent and real-time surveillance solutions.

- Integration of AI and machine learning will enhance analytics accuracy and threat detection efficiency.

- Hybrid DVR systems combining on-premise and cloud storage will gain wider adoption.

- Government initiatives for smart city and infrastructure safety will strengthen large-scale deployments.

- Advancements in data compression will improve storage efficiency and recording quality.

- Growing adoption of 4K and higher-resolution cameras will drive upgrades in DVR technology.

- Cybersecurity integration will become a key differentiator in surveillance product design.

- Expansion of IoT-enabled devices will increase data collection and remote monitoring capabilities.

- Energy-efficient and compact DVR models will attract small and medium-sized enterprises.

- Strategic partnerships and software-driven innovation will shape future competitive advantages.