Market Overview

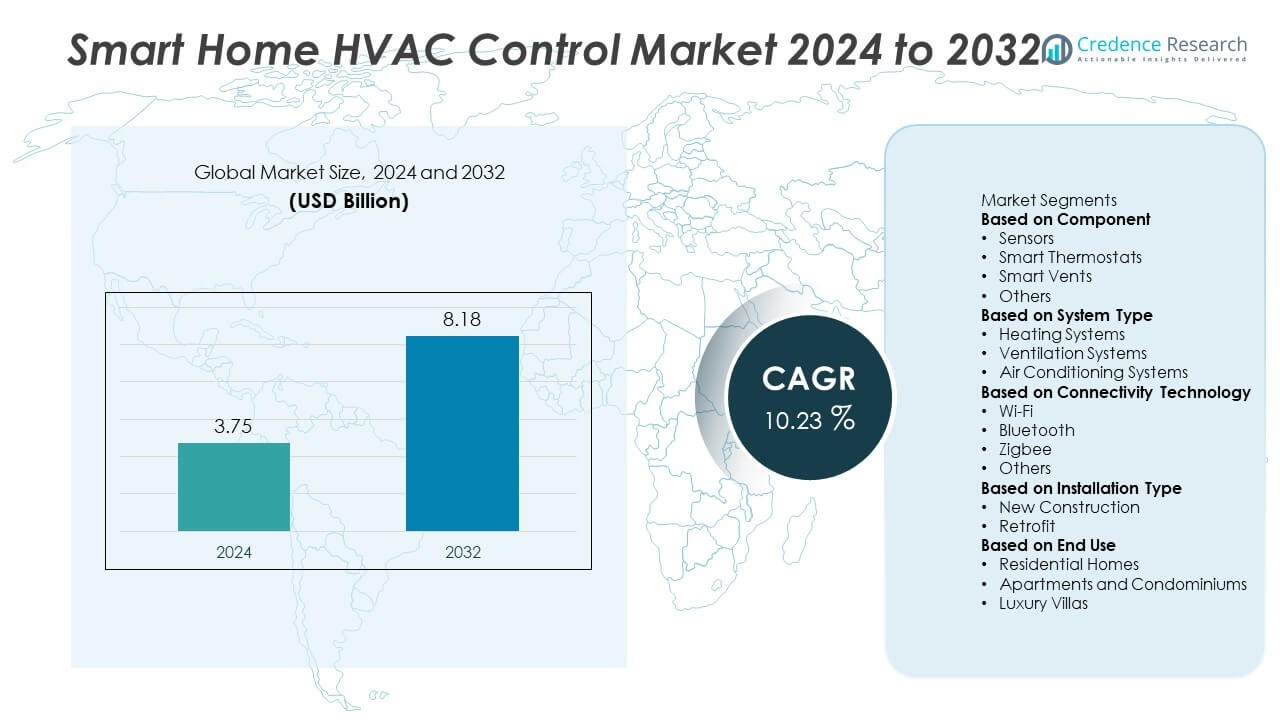

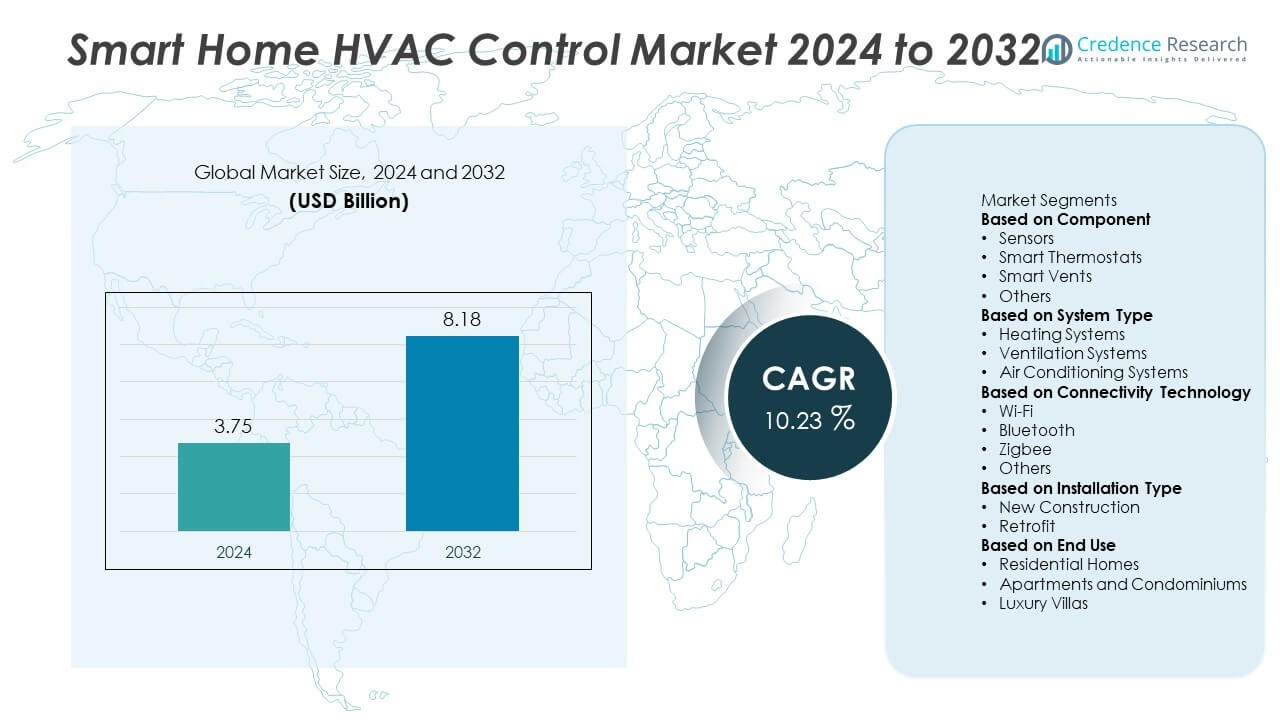

The Smart Home HVAC Control market was valued at USD 3.75 billion in 2024 and is projected to reach USD 8.18 billion by 2032, expanding at a CAGR of 10.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Home HVAC Control Market Size 2024 |

USD 3.75 Billion |

| Smart Home HVAC Control Market, CAGR |

10.23% |

| Smart Home HVAC Control Market Size 2032 |

USD 8.18 Billion |

The Smart Home HVAC Control market is led by major players including Honeywell International Inc., Johnson Controls International plc, Siemens AG, Schneider Electric SE, Emerson Electric Co., Carrier Global Corporation, Ecobee Inc., Lennox International Inc., Daikin Industries Ltd., and LG Electronics Inc. These companies drive innovation through AI-based thermostats, IoT connectivity, and energy-efficient control solutions. North America dominates the global market with a 39.4% share in 2024, supported by advanced smart home adoption and favorable energy regulations. Europe follows with a 28.3% share, driven by sustainability initiatives and widespread integration of automation technologies in residential infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Smart Home HVAC Control market was valued at USD 3.75 billion in 2024 and is projected to reach USD 8.18 billion by 2032, expanding at a CAGR of 10.23%.

- Market growth is driven by rising demand for energy-efficient systems, smart thermostats, and connected climate control devices across residential applications.

- Key trends include AI-based predictive maintenance, IoT integration with home ecosystems, and expansion of cloud-enabled remote monitoring solutions.

- Leading players such as Honeywell, Siemens, Carrier, Ecobee, and LG Electronics focus on innovation, interoperability, and sustainable HVAC control technologies.

- Regionally, North America holds 39.4% share, followed by Europe with 28.3%, while the smart thermostat segment dominates with 46.7% share, supported by increasing adoption of voice-assisted and app-controlled home automation systems.

Market Segmentation Analysis:

By Component

The smart thermostats segment dominated the Smart Home HVAC Control market in 2024, holding a 46.7% share. Their leadership stems from widespread adoption in residential settings due to convenience, energy efficiency, and integration with voice assistants like Alexa and Google Assistant. Smart thermostats enable precise temperature control and remote access through mobile apps, driving strong consumer preference. Manufacturers such as Honeywell, Ecobee, and Nest continue innovating with learning algorithms that optimize energy consumption, reducing utility costs. Sensors and smart vents also show growing demand as homeowners seek enhanced indoor comfort and automation.

- For instance, Ecobee’s Smart Thermostat Premium is equipped with a dual-band Wi-Fi module (2.4 GHz + 5 GHz) and an onboard air-quality sensor capable of detecting volatile organic compounds at concentrations above 200 ppb. Independent energy studies conducted by Ecobee found that users saved an average of 26 kWh per month through occupancy-based temperature scheduling.

By System Type

The air conditioning systems segment accounted for the largest 52.1% share of the Smart Home HVAC Control market in 2024. Its dominance is driven by rising use of connected cooling systems in urban households, particularly in hot climates. Integration of smart thermostats and IoT-based controllers enhances efficiency and allows real-time monitoring. The growing popularity of inverter ACs and energy rating systems further supports market expansion. Heating and ventilation systems also contribute steadily, benefiting from automation trends in cold regions and improved airflow control solutions for better indoor air quality.

- For instance, Daikin Industries’ Ururu Sarara series integrates intelligent humidity and temperature control using advanced sensors and inverter technology to maintain a stable and comfortable indoor environment.

By Connectivity Technology

The Wi-Fi segment led the Smart Home HVAC Control market in 2024 with a 54.3% share. Wi-Fi-enabled systems offer seamless connectivity, allowing users to control HVAC settings remotely through smartphones and smart speakers. Easy installation, compatibility with home automation platforms, and real-time performance tracking make Wi-Fi the preferred choice for consumers. Zigbee and Bluetooth technologies are also growing as alternative connectivity options, especially in multi-device ecosystems where energy-efficient communication is essential. The trend toward interoperable smart home systems continues to enhance user experience and support faster adoption of connected HVAC solutions.

Key Growth Drivers

Rising Demand for Energy Efficiency and Cost Savings

The increasing need for energy-efficient home systems is a major driver of the Smart Home HVAC Control market. Consumers are adopting smart thermostats and connected HVAC solutions to monitor energy consumption and reduce electricity bills. These systems use AI and sensor data to optimize heating and cooling based on occupancy and weather conditions. Governments worldwide promote energy conservation through green building standards and rebates, further boosting adoption. The growing awareness of sustainability and environmental impact supports long-term demand for smart HVAC technologies.

- For instance, Honeywell International’s T10 Pro Smart Thermostat utilizes RedLINK® Room Sensors with occupancy detection and remote temperature averaging. Field studies showed households achieving average power savings of 72 kWh per quarter through adaptive scheduling and geofencing features linked to the Honeywell Home App.

Increasing Integration with Smart Home Ecosystems

The seamless integration of HVAC systems with broader smart home ecosystems significantly drives market growth. Modern HVAC controls now connect with lighting, security, and voice assistant platforms, providing enhanced convenience and automation. Users can adjust temperature settings through smartphones or smart speakers, improving comfort and efficiency. Companies like Google, Amazon, and Honeywell are expanding interoperability across devices, strengthening user engagement. The trend toward unified home automation systems continues to accelerate the adoption of smart HVAC control solutions globally.

- For instance, Johnson Controls’ GLAS Smart Thermostat features a translucent OLED touch display and supports Microsoft Cortana, Alexa, and Google Assistant. The system measures indoor air quality levels, including CO₂ and volatile compounds exceeding 1000 ppm, and automatically triggers ventilation adjustments via connected building networks.

Growing Urbanization and Smart Building Development

Rapid urbanization and the growth of smart buildings are fueling demand for intelligent HVAC systems. Smart city initiatives and increasing adoption of connected infrastructure are encouraging residential developers to integrate advanced climate control systems. These technologies enhance indoor air quality and comfort while reducing energy waste. Rising disposable income and consumer awareness of advanced home technologies further support market expansion. Builders and property managers increasingly view smart HVAC control as an essential component of modern, sustainable living environments.

Key Trends & Opportunities

Adoption of AI and Machine Learning in HVAC Systems

AI and machine learning are transforming smart HVAC control by enabling predictive maintenance and automated temperature optimization. These technologies analyze data from sensors to adjust performance in real time, improving comfort and efficiency. Manufacturers are integrating AI algorithms that learn user habits and environmental factors to personalize climate control. Predictive analytics also helps detect faults before failures occur, reducing maintenance costs. The ongoing shift toward self-learning HVAC systems offers strong opportunities for innovation and market growth.

- For instance, Siemens AG’s Desigo CC platform incorporates an AI-based adaptive control algorithm that processes over 20,000 sensor data points per facility per day. Field deployment at Siemens’ Zug campus demonstrated energy savings of 135 MWh annually, achieved through real-time machine-learning temperature prediction and automated chiller scheduling.

Expansion of Wireless and Cloud-Based HVAC Solutions

Wireless connectivity and cloud integration are emerging as key trends in the Smart Home HVAC Control market. Wi-Fi and Zigbee-based systems enable remote control and real-time monitoring through mobile applications. Cloud connectivity allows data synchronization, multi-device management, and energy performance tracking. These solutions provide flexibility and scalability, appealing to both homeowners and system integrators. The demand for interoperable and easily upgradeable systems is creating opportunities for cloud-based service providers and HVAC manufacturers offering software-driven solutions.

- For instance, Schneider Electric’s EcoStruxure™ Building Operation connects more than 250,000 devices globally via cloud-hosted analytics. The platform processes over 2.5 billion data transactions monthly and enables predictive fault detection that cuts unplanned HVAC downtime by an average of 480 hours annually across large residential and commercial deployments.

Key Challenges

High Installation and Integration Costs

Despite technological advancement, high initial installation and integration costs remain a major barrier to market adoption. Smart HVAC systems require compatible sensors, controllers, and network connectivity, which increase setup expenses. Retrofitting older homes with connected systems can be particularly costly. While energy savings offset long-term costs, price sensitivity in developing regions limits adoption. Manufacturers are addressing this challenge through modular systems and cost-efficient smart thermostat designs to improve market accessibility.

Cybersecurity and Data Privacy Concerns

As HVAC systems become more connected, cybersecurity risks pose a growing challenge. Unauthorized access or data breaches can compromise user privacy and disrupt system functionality. Consumers are increasingly concerned about sharing data through cloud-based or voice-enabled platforms. Manufacturers must invest in encryption, secure communication protocols, and firmware updates to maintain trust. Compliance with data protection regulations and transparent privacy policies are essential to ensure safe and reliable smart HVAC control adoption.

Regional Analysis

North America

North America held the largest share of 39.4% in the Smart Home HVAC Control market in 2024. The region’s dominance is supported by strong adoption of smart home technologies and advanced HVAC systems. Consumers in the U.S. and Canada prefer energy-efficient, connected solutions integrated with platforms like Alexa and Google Home. The presence of major players such as Honeywell, Carrier, and Ecobee accelerates innovation. Government incentives promoting energy-efficient appliances also drive demand. Rising consumer awareness of energy conservation and comfort enhancement continues to strengthen market growth across residential and smart building projects.

Europe

Europe accounted for 28.3% share of the global Smart Home HVAC Control market in 2024. The region’s growth is driven by strict energy efficiency regulations and sustainability goals under the European Green Deal. Countries such as Germany, the U.K., and France lead adoption of smart thermostats and automation systems. Increasing retrofitting of existing buildings with intelligent HVAC solutions supports expansion. Consumers’ preference for eco-friendly technologies and demand for remote climate control features contribute significantly. Partnerships between technology firms and HVAC manufacturers are further accelerating innovation across the European smart home ecosystem.

Asia Pacific

Asia Pacific captured 23.7% share of the Smart Home HVAC Control market in 2024. The region’s rapid urbanization and rising middle-class population drive strong demand for connected home solutions. Countries such as China, Japan, and South Korea are at the forefront of smart technology integration in residential infrastructure. Growing investments in smart city projects and increased awareness of indoor air quality enhance adoption. Expanding e-commerce and declining sensor costs support accessibility. Local players are collaborating with global brands to deliver cost-effective, energy-efficient HVAC systems tailored to regional climates and consumer needs.

Latin America

Latin America represented 5.1% share of the Smart Home HVAC Control market in 2024. Growth in Brazil, Mexico, and Argentina is supported by rising urbanization and improving internet connectivity. Consumers are showing growing interest in energy-efficient devices that help reduce utility expenses. Expansion of smart home product availability through online channels boosts adoption. However, higher installation costs and limited smart infrastructure pose challenges. Manufacturers are focusing on affordable solutions and strategic partnerships with local distributors to strengthen market penetration and increase awareness of connected HVAC benefits in residential settings.

Middle East & Africa

The Middle East & Africa accounted for 3.5% share of the Smart Home HVAC Control market in 2024. Demand is driven by extreme climatic conditions and rising investments in smart buildings and luxury housing. Countries such as the UAE and Saudi Arabia are leading in adopting intelligent air conditioning and ventilation control systems. Government initiatives promoting sustainable energy use support adoption of efficient HVAC technologies. Africa’s growing urban centers are gradually embracing connected devices through expanding broadband access. However, high installation costs and limited awareness continue to restrain wider adoption across the region.

Market Segmentations:

By Component

- Sensors

- Smart Thermostats

- Smart Vents

- Others

By System Type

- Heating Systems

- Ventilation Systems

- Air Conditioning Systems

By Connectivity Technology

- Wi-Fi

- Bluetooth

- Zigbee

- Others

By Installation Type

- New Construction

- Retrofit

By End Use

- Residential Homes

- Apartments and Condominiums

- Luxury Villas

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Smart Home HVAC Control market includes major players such as Honeywell International Inc., Johnson Controls International plc, Siemens AG, Schneider Electric SE, Emerson Electric Co., Carrier Global Corporation, Ecobee Inc., Lennox International Inc., Daikin Industries Ltd., and LG Electronics Inc. These companies compete through technological innovation, product integration, and energy-efficient system design. Leading players focus on developing AI-enabled thermostats, IoT-based controllers, and cloud-connected HVAC platforms to enhance user comfort and efficiency. Strategic partnerships with home automation firms and utility providers help expand smart ecosystem compatibility. Continuous R&D investment supports the introduction of predictive maintenance features and voice-controlled interfaces. Many manufacturers also prioritize sustainability by incorporating eco-friendly materials and low-energy components. Intense competition and growing consumer expectations are driving ongoing advancements in automation, connectivity, and energy optimization across the global smart home HVAC control landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Honeywell International Inc.

- Johnson Controls International plc

- Siemens AG

- Schneider Electric SE

- Emerson Electric Co.

- Carrier Global Corporation

- Ecobee Inc.

- Lennox International Inc.

- Daikin Industries Ltd.

- LG Electronics Inc.

Recent Developments

- In September 2025, Johnson Controls expanded its thermal management portfolio by introducing a scalable liquid cooling solution designed for high-density data centers.

- In January 2025, Honeywell International Inc. (via its Honeywell Home brand) introduced the X2S Smart Thermostat, compatible with Matter and supporting both 2.4 GHz and 5 GHz Wi-Fi.

- In December 2024, Mitsubishi Electric acquired Crystal Air Holdings Limited, an Irish company specializing in air-conditioning installation and maintenance services.

- In February 2024, Carrier Global Corporation launched its new “Carrier Smart Thermostat” (24 V model) aimed at residential new-construction and retrofit markets, featuring tool-free wiring and QR-code start-up.

Report Coverage

The research report offers an in-depth analysis based on Component, System Type, Connectivity Technology, Installation Type, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing adoption of connected home technologies.

- AI-based temperature prediction will enhance automation and energy efficiency.

- Integration with smart home platforms will improve interoperability and user convenience.

- Demand for cloud-based HVAC control systems will increase among urban households.

- Voice assistants and mobile applications will drive remote system management.

- Sustainable and low-energy solutions will gain more attention in product innovation.

- North America will maintain its leadership position with continued technological advancements.

- Asia Pacific will emerge as the fastest-growing region due to smart city development.

- Partnerships between HVAC manufacturers and tech firms will strengthen product ecosystems.

- Enhanced data analytics and IoT connectivity will redefine home climate management efficiency.