Market Overview:

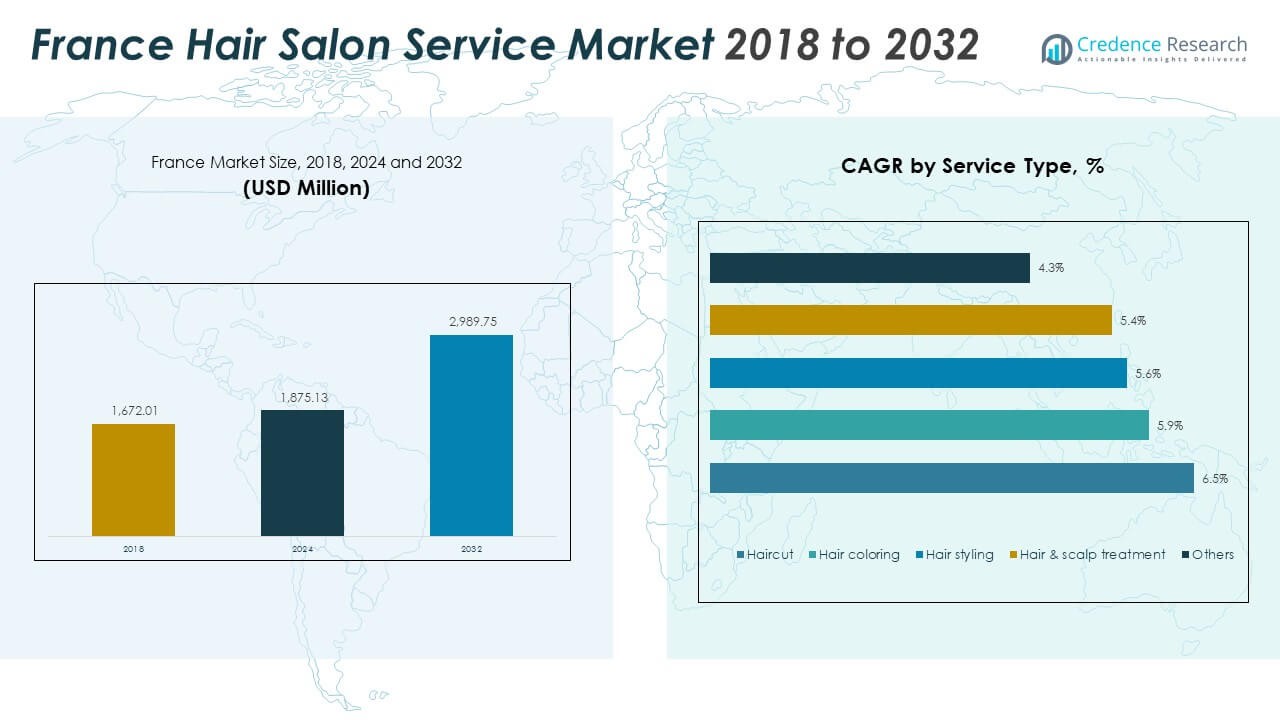

The France Hair Salon Service Market size was valued at USD 1,672.01 million in 2018 to USD 1,875.13 million in 2024 and is anticipated to reach USD 2,989.75 million by 2032, at a CAGR of 6.00% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Hair Salon Service Market Size 2024 |

USD 1,875.13 Million |

| France Hair Salon Service Market, CAGR |

6.00% |

| France Hair Salon Service Market Size 2032 |

USD 2,989.75 Million |

The growth of the France Hair Salon Service Market is fueled by increasing grooming awareness and demand for premium, specialized services. Consumers are opting for advanced hair care treatments, including color services, scalp treatments, and styling solutions. The market also benefits from digital transformation, making salon appointments more accessible and convenient. Social media trends influence style preferences, driving demand for innovative, fashionable hair services across various consumer groups.

Île-de-France, led by Paris, holds the largest market share due to its dense population, high disposable income, and trend-driven consumer behavior. Other major urban regions like Rhône-Alpes and Provence-Alpes-Côte d’Azur are emerging as key markets, driven by expanding consumer bases and a rising focus on premium and specialized services. Suburban and rural areas are also witnessing growth, supported by the increasing adoption of mobile and at-home salon services, providing broader access to professional hair care.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France Hair Salon Service Market was valued at USD 1,672.01 million in 2018, USD 1,875.13 million in 2024, and is anticipated to reach USD 2,989.75 million by 2032, with a CAGR of 6.00% during the forecast period.

- The Île-de-France region leads with the highest market share, followed by Rhône-Alpes and Provence-Alpes-Côte d’Azur, primarily due to their high population density and strong demand for premium services in urban areas like Paris, Lyon, and Marseille.

- The Rest of France, including regions like Nouvelle-Aquitaine and Occitanie, is the fastest-growing area, driven by increased access to mobile salons and franchises expanding into these areas, making services more convenient and affordable for customers.

- The Male consumer group holds a steady share in the market, contributing significantly to overall salon visits, while Female consumers command the largest share, accounting for the majority of the market revenue.

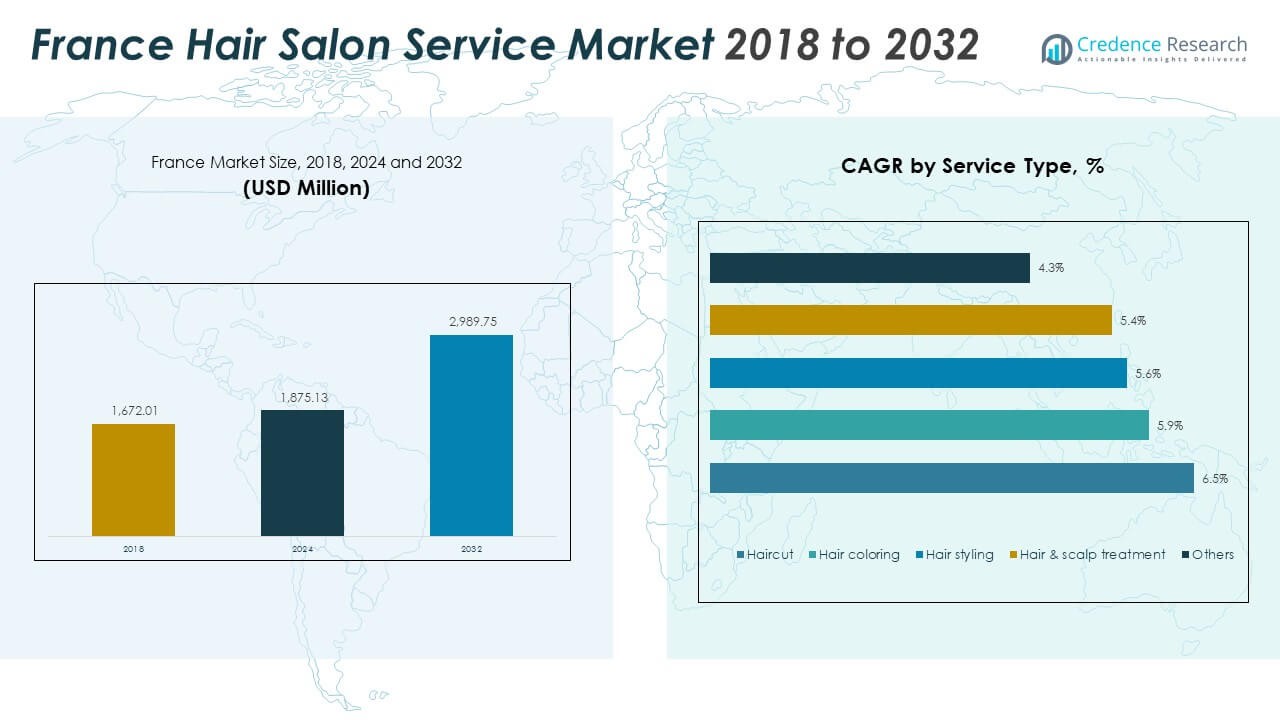

- The service segment for Haircut dominates, followed by Hair Coloring, reflecting strong demand for essential and trendy haircare services across both genders.

Market Drivers

Rising Focus on Personal Grooming and Premium Haircare Adoption

Growing personal grooming interest fuels consistent demand across urban and semi-urban areas. Customers choose professional haircare to maintain appearance and follow style trends. The France Hair Salon Service Market gains support from rising preferences for premium treatments. Young consumers request colour services and advanced scalp care to match fashion cycles. Digital influence drives faster uptake of global hair styling ideas. Working professionals invest in routine grooming to maintain a polished look. Social platforms push experimentation with new textures and shades. Strong disposable income in major cities strengthens premium service adoption.

- For example, L’Oréal Professionnel’s Metal Detox system uses a patented molecule, Glicoamine, to neutralize metals in the hair. Instrumental testing has shown up to a 97% reduction in hair breakage after just one use of the system.

Expansion of Men’s Grooming Culture Across Urban and Suburban Centers

Men’s grooming shifts from basic cuts to specialised beard and hair treatments. Salons expand male-focused services to capture rising demand. Premium grooming brands partner with salons to promote advanced products. It gains traction among younger male customers seeking defined styles. Urban centres record high frequency of visits due to lifestyle habits. Suburban regions follow similar growth patterns with growing service awareness. Digital booking increases convenience for quick sessions. Influencer content encourages male clients to explore diverse grooming options.

Growing Popularity of Organic and Clean-Label Haircare Products

Consumers shift to natural formulas to reduce chemical exposure. Salons upgrade product lines to meet rising interest in clean-label haircare. Organic ingredients gain strong acceptance among health-focused customers. It strengthens differentiation for premium and mid-range salons. Product makers develop sulphate-free and ammonia-free ranges to meet safety needs. Demand for scalp-friendly treatments rises across sensitive user groups. Awareness campaigns influence buying choices in major cities. Eco-focused salons gain steady visibility across younger demographics.

- For example, Davines Group reported €295 million in worldwide sales for 2024, marking a 12% year-on-year increase, with France contributing a 16% growth. The company maintains partnerships with over 50,000 professional salons globally, offering products like Naturaltech and other eco-focused lines.

Strong Demand for Specialised Hair Treatments and Fashion-Driven Styling

Advanced styling requests increase due to fast-moving beauty trends. Salons introduce keratin, smoothing and bond-repair treatments to serve high demand. The France Hair Salon Service Market benefits from rising interest in protective and strengthening solutions. Fashion events and media create strong visibility for curated looks. Customers choose specialised care to address dryness, colour damage and frizz. Professionals upgrade skills to deliver high-precision services. Technology-enhanced tools raise output quality across premium salons. Growing brand collaborations expand access to new treatment lines.

Market Trends

Rise of Digital Appointment Ecosystems and Omni-Channel Customer Experience

Digital booking platforms reshape how clients schedule salon visits. Omni-channel interaction helps salons manage customer flow with precision. The France Hair Salon Service Market integrates apps for faster check-ins and service tracking. Customers enjoy transparent menus and stylist availability before arrival. Loyalty programs shift to digital formats to improve retention. Mobile-based reminders reduce missed appointments. Review features support service selection with higher confidence. Digital payments gain steady traction across all age groups.

- For example, Franck Provost, a leading French hair salon chain, offers a mobile app that allows customers to book appointments and manage their loyalty rewards. The app, available on Google Play with over 10,000 downloads, provides real-time appointment availability and a digital loyalty program for users.

Growing Shift Toward Personalised Haircare and Data-Backed Styling Solutions

Salons deploy diagnostic tools to map hair texture and strength. Customers prefer personalised treatments built on specific needs. Data-backed assessment allows stylists to tailor formulas for better results. It builds trust among clients seeking long-term hair health improvement. Brands offer customised masks and serums to match individual profiles. High-end salons invest in AI-supported analysis tools. Stylists align treatment cycles with seasonal changes. Growing demand for custom routines increases repeat visits.

Expansion of Boutique and Niche Concept Salons Across High-Value Zones

Boutique salons gain visibility through curated interiors and specialised menus. Customers choose these formats for personalised attention and unique service themes. It appeals to fashion-driven segments looking for premium care. Niche concepts like curl-only salons or colour-exclusive studios gain traction. Urban areas support faster adoption due to trend influence. Mid-sized cities follow with rising interest in specialised offerings. Salon chains launch niche sub-brands to target select groups. Experience-focused layouts boost customer engagement.

Accelerated Growth of Sustainable Salon Practices and Green Operations

Sustainability steers innovation across major salon chains. Water-saving tools and energy-efficient dryers reduce operational burden. The France Hair Salon Service Market shifts toward recycled packaging and refill systems. Customers value eco-certified products in routine care. Waste-reduction programs increase credibility among environmentally aware clients. Green salons gain strong traction among young demographics. Training programs promote responsible chemical use. Sustainable sourcing influences product selection across premium outlets.

- For example, ECOHEADS nozzles are designed to reduce water consumption by up to 65% per rinse in salons. This water-saving technology has been widely adopted in the industry, with many salons documenting measurable reductions in water usage.

Market Challenges Analysis

High Operating Costs and Strong Pressure on Skilled Workforce Availability

Operating expenses rise due to rent, energy and labour factors across key regions. Premium zones face higher commercial rentals that impact profitability. The France Hair Salon Service Market experiences persistent staffing shortages. Skilled stylists move toward independent setups, affecting retention. Training budgets increase due to rapid changes in techniques. Equipment upgrades require steady investment to stay competitive. Small salons struggle to match pricing flexibility offered by large chains. Balancing service quality with cost control remains difficult.

Intense Competitive Landscape and Rising Customer Expectations Across Segments

Competition increases across chains, boutique studios and freelance operators. Customers demand high-precision styling with minimal wait time. It places pressure on salons to maintain upgraded tools and advanced formulas. Frequent discounting reduces margins for smaller outlets. Strong digital comparison culture raises expectations for consistent service delivery. Negative reviews affect walk-in traffic quickly. New entrants adopt trend-driven formats that challenge traditional models. Service differentiation becomes harder across crowded markets.

Market Opportunities

Growing Expansion of Premium and Wellness-Integrated Haircare Concepts

Wellness integration opens new revenue pathways for salons across major cities. Customers seek stress-relief experiences paired with haircare routines. The France Hair Salon Service Market gains momentum through spa-linked treatment menus. Demand rises for scalp detox, aromatherapy blends and nutrient-infused masks. Premium salons position wellness as a core value proposition. Growing focus on holistic grooming boosts portfolio upgrades. Tourism zones offer potential for luxury-driven salon formats. High-end collaborations expand access to specialised ingredients.

Digital Innovation, Franchise Growth and Wider Reach Across Emerging Zones

Digital tools create expansion potential for franchise-based chains. Technology aids in service standardisation across multiple locations. It improves customer flow management through unified platforms. Emerging suburbs become prime targets for mid-tier expansions. Online visibility boosts discovery for new outlets. Influencer partnerships increase traction among young audiences. Low-competition pockets allow growth for concept-based studios. Scalable models strengthen nationwide brand presence.

Market Segmentation Analysis

By Service Type

The haircut segment remains the largest in the France Hair Salon Service Market. Customers regularly seek fresh cuts and trims, with a steady flow of repeat clients ensuring strong demand. High-frequency visits are common for men and women who prefer maintaining a well-groomed appearance. Salons often introduce specialized packages to cater to various hair types and styles. Hair colouring services continue to see significant growth. With evolving beauty trends, customers opt for colour treatments ranging from highlights to full transformations. It attracts both young consumers experimenting with new looks and mature clients seeking grey coverage. Premium salons focus on high-quality dyes that offer longer-lasting results and enhanced hair health. Hair styling services, particularly for special events, are increasingly popular in the France Hair Salon Service Market. Customers seek professional stylists for weddings, parties, and photo shoots. Salons respond by offering diverse styling options that align with seasonal fashion trends and celebrity-inspired looks. High-quality tools and premium products help deliver desired results consistently. The demand for hair and scalp treatments rises as consumers seek healthy hair and a nourishing scalp. This segment includes services like deep conditioning, keratin treatments, and scalp detox. Salons focus on offering treatments that address specific concerns, such as dandruff, hair thinning, and dry scalp. It appeals to customers who prioritize long-term hair health.

- For instance, Franck Provost operates nearly 700 salons across 30 countries and is recognized as one of France’s largest hair salon franchises, offering a wide range of haircutting services and reporting strong repeat business in its French outlets.

By Salon Type

Full-service salons dominate the France Hair Salon Service Market. They offer a wide range of services, from haircuts and colouring to treatments and styling. Customers appreciate the convenience of accessing comprehensive haircare solutions under one roof. These salons often become the go-to for both regular and special occasion needs, enhancing customer loyalty. Chain and franchise salons are expanding rapidly across France, offering standardized services with a familiar brand experience. These salons focus on efficiency, delivering consistent results at accessible prices. Their broad presence in urban and suburban areas ensures they capture a large portion of the market, attracting customers seeking convenience and affordability. Barbershops, traditionally focused on men’s grooming, continue to maintain a strong presence. These establishments cater to male consumers looking for haircuts, beard trims, and other grooming services. The rise of trendy and upscale barbershops appeals to both younger and older male clientele, offering a more personalized, high-quality experience. Mobile and at-home salons have gained traction due to convenience. These services allow customers to book appointments for haircuts and styling in the comfort of their homes.

- For instance, the Provalliance Group, which encompasses 17 brands including Franck Provost, manages 3,500 salons globally and serves 36 million clients annually as per its group profile and industry news in 2025.

By Consumer Group

The male consumer segment has seen steady growth, with increasing demand for haircuts, beard grooming, and scalp treatments. Male consumers are becoming more conscious of their grooming habits, seeking specialized services to maintain a polished look. Barbershops and salons offering personalized services continue to see an uptick in male clientele. The female consumer group remains the dominant segment in the France Hair Salon Service Market. Women tend to frequent salons more often, seeking haircuts, colouring, and styling services. This group places a premium on hair health and aesthetics, driving demand for treatments that focus on hair vitality, shine, and colour longevity.

By Price Range

The premium segment in the France Hair Salon Service Market is led by high-end salons that provide luxury services. These salons cater to customers who value quality, advanced techniques, and exclusive products. The demand for premium services continues to rise, driven by affluent customers seeking superior haircare and styling experiences. Mid-market salons offer quality services at more affordable prices. This segment appeals to a wide range of consumers who prioritize balance between price and service quality. These salons serve as an accessible option for customers who seek professional haircare without the premium price tag, driving steady demand across urban areas. Value and economy salons serve customers who prioritize cost-efficiency over luxury services. While these salons may offer fewer high-end treatments, they cater to budget-conscious consumers.

Segmentation

By Service Type

- Haircut

- Hair colouring

- Hair styling

- Hair & scalp treatment

- Others

By Salon Type

- Full-Service Salons

- Chain/Franchise Salons

- Barbershops

- Mobile/At-Home Salons

- Salon-Spas

By Consumer Group

By Price Range

- Premium

- Mid-Market

- Value/Economy

Regional Analysis

Île‑de‑France and Paris Metropolitan Region

The Paris metropolitan region holds approximately 35 % share of the France Hair Salon Service Market thanks to dense population and high disposable income. Premium salons and international brands cluster in this area, driving high‑end service consumption. It sees efficient roll‑out of digital booking systems and advanced treatments. Tourists visiting Paris also contribute to increased demand for stylist services. Rural and lower income regions do not match this pace of growth. Investment in franchise chains remains strongest here. Leading salons leverage fashion‑week visibility and celebrity clients to further boost presence.

Other Major Urban Regions – Rhône‑Alpes/Auvergne‑Rhône‑Alpes & Provence‑Alpes‑Côte d’Azur

The Auvergne‑Rhône‑Alpes plus Provence‑Alpes‑Côte d’Azur region jointly account for around 30 % of the market share. Cities like Lyon, Marseille and Nice host strong salon ecosystems benefiting from tourism and local luxury spenders. It features rising demand for both premium and mid‑market services. Coastal areas capture seasonal spikes via visitor traffic. Growth in suburban zones here supports mid‑tier salon expansion. Stylists adopt event‑driven styling services to meet holiday‑demand surges. Competitive pressure intensifies among boutique salons in these urban pockets.

Rest of France – Including Nouvelle‑Aquitaine, Occitanie and Northern Regions

The remaining regions of France cumulatively represent around 35 % of the market share. These areas still show moderate growth due to lower urban density and smaller spending power per capita. Salon chains are gradually expanding into secondary cities in this region. It offers potential for mobile and at‑home service models where brick‑and‑mortar penetration remains lower. Local consumer preferences vary significantly by region, requiring tailored service offerings. Regional franchises that adapt pricing and service formats are gaining traction. Growth rates here lag behind flagship metropolitan zones but show steady advancement.

Key Player Analysis

- L’Oréal Professionnel / L’Oréal S.A.

- Henkel AG & Co. KGaA (Germany)

- Schwarzkopf (Germany)

- Unilever PLC (France/Netherlands)

- The Procter & Gamble Company

- Franck Provost

- DESSANGE

- Jean‑Louis David

- VOG Coiffure

- Tchip Coiffure

- Saint Algue

Competitive Analysis

The France Hair Salon Service Market features a mix of independent salons, national chains and international franchise brands all competing for share. Large full‑service chains leverage strong brand recognition, economies of scale and streamlined training to deliver consistent service across locations. Independent boutique salons differentiate through niche styling, personalised client relationships and premium treatments. Mobile/at‑home salons exploit convenience and flexibility to capture time‑pressed consumers. Salon‑spa hybrids leverage the wellness trend, bundling hair services with skincare and spa treatments to command higher prices. Competitive intensity remains high due to low entry barriers for basic services, driving margin pressure. Chains respond by standardising operations and introducing loyalty programmes to retain clients. Independent players focus on premium positioning and unique experiences to defend niche segments. Pricing strategies vary widely, with premium salons targeting affluent consumers while value‑oriented salons compete on cost and convenience. Innovation in service delivery, digital engagement and product partnerships becomes key competitive levers.

Recent Developments

- In March 2025, Innovative Beauty Group introduced Curls Matter, a specialized hair care product range developed for consumers with curly hair in France. The product line was launched in 150 Monoprix retail locations across the country and features a three-step treatment system with naturally derived ingredients, along with packaging containing at least 30% recycled materials.

- In February 2024, L’Oréal made a significant addition to the French hair salon market with the introduction of Kérastase Première. This high-end hair care product line leverages molecular technology to deliver advanced structural hair repair, marking L’Oréal’s most substantial product innovation in the last five years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Service Type, Salon Type, Consumer Group and Price Range. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing adoption of digital tools for booking and customer management will enhance salon efficiency.

- Rising demand for premium services driven by affluent consumers will push the growth of high-end salons.

- Mobile and at-home salon services will see continued expansion due to consumer demand for convenience.

- Men’s grooming services will continue to grow as more men embrace hairstyling and beard grooming.

- Innovations in haircare products, such as organic and clean-label offerings, will attract more health-conscious customers.

- Salon-spa hybrids combining wellness services with traditional haircare will see more traction among consumers seeking holistic beauty solutions.

- Strong growth is expected in suburban areas as more franchise models expand outside major metropolitan regions.

- The France Hair Salon Service Market will increasingly rely on influencer-driven marketing to attract younger consumers.

- Mobile payment integration and loyalty programs will enhance customer retention and convenience in the salon industry.

- Regulatory developments will shape the market, as salons must comply with environmental and consumer safety standards.