Market Overview:

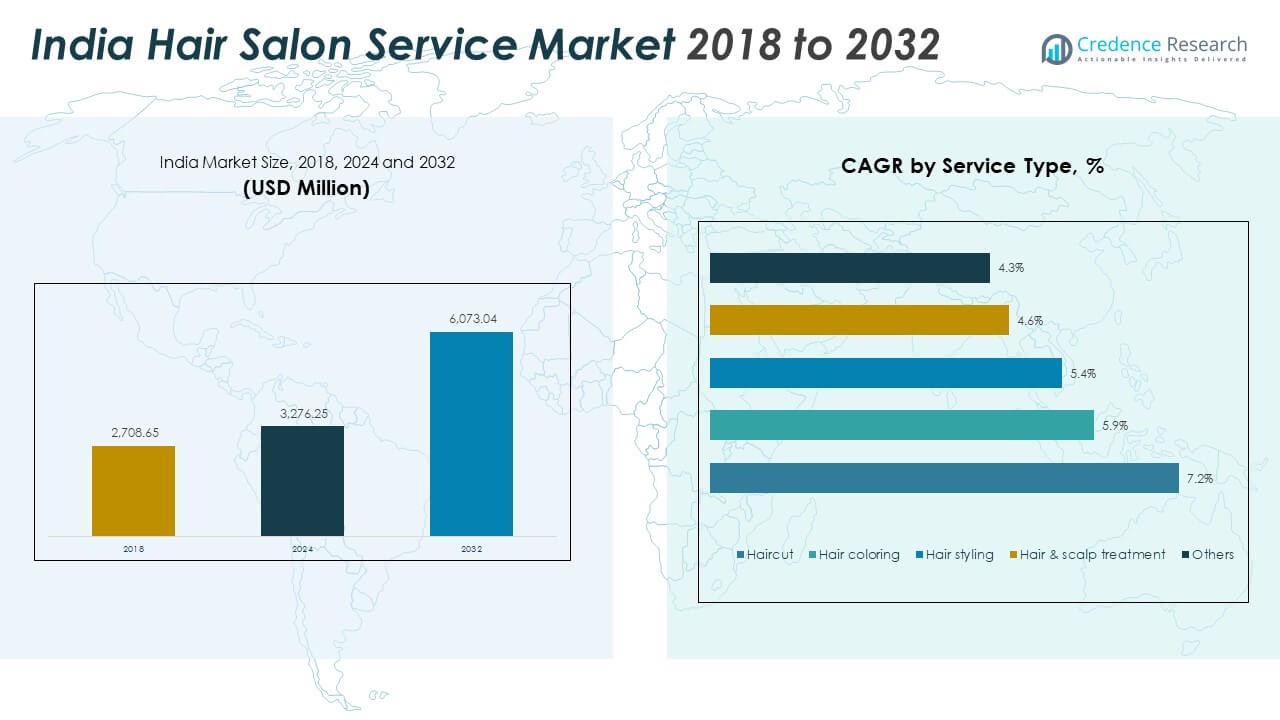

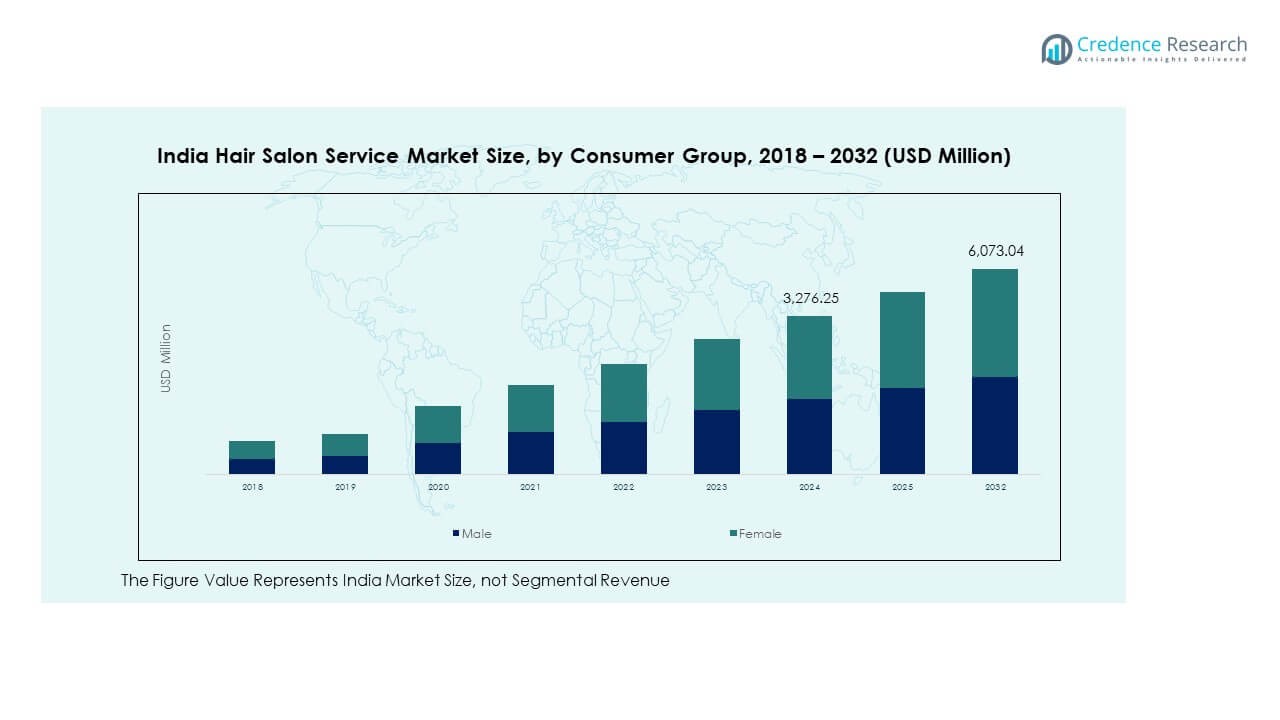

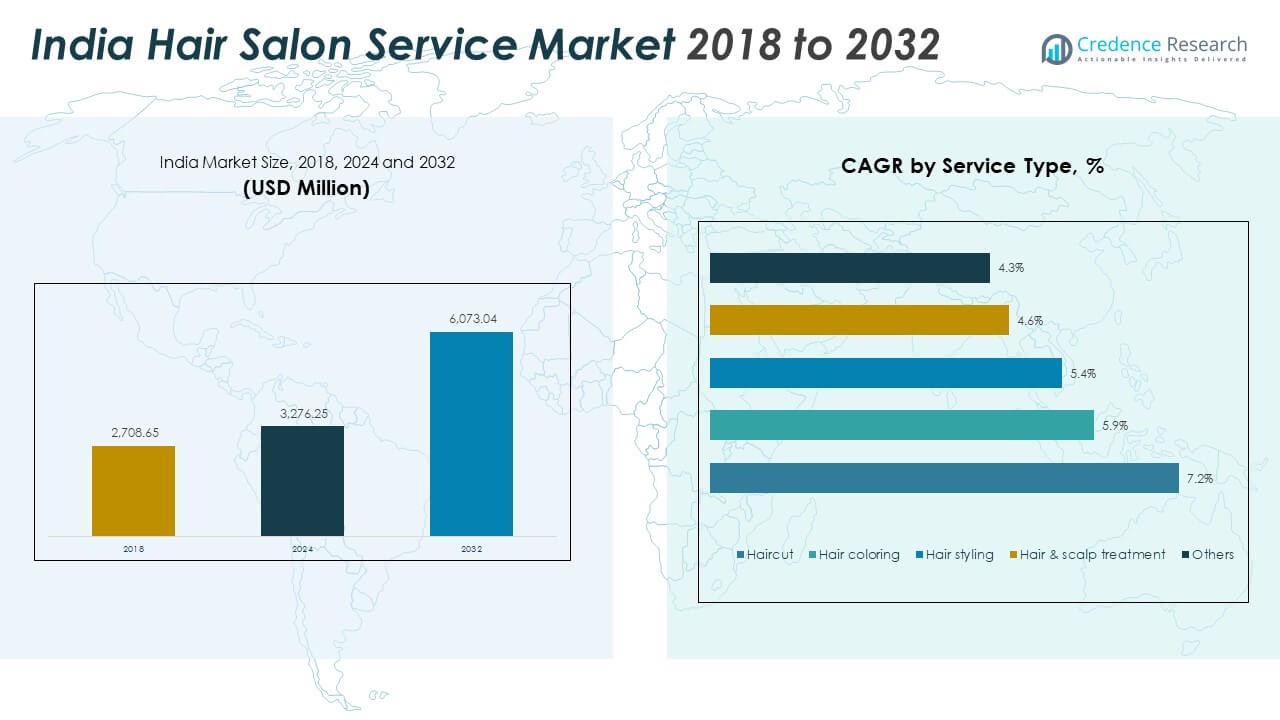

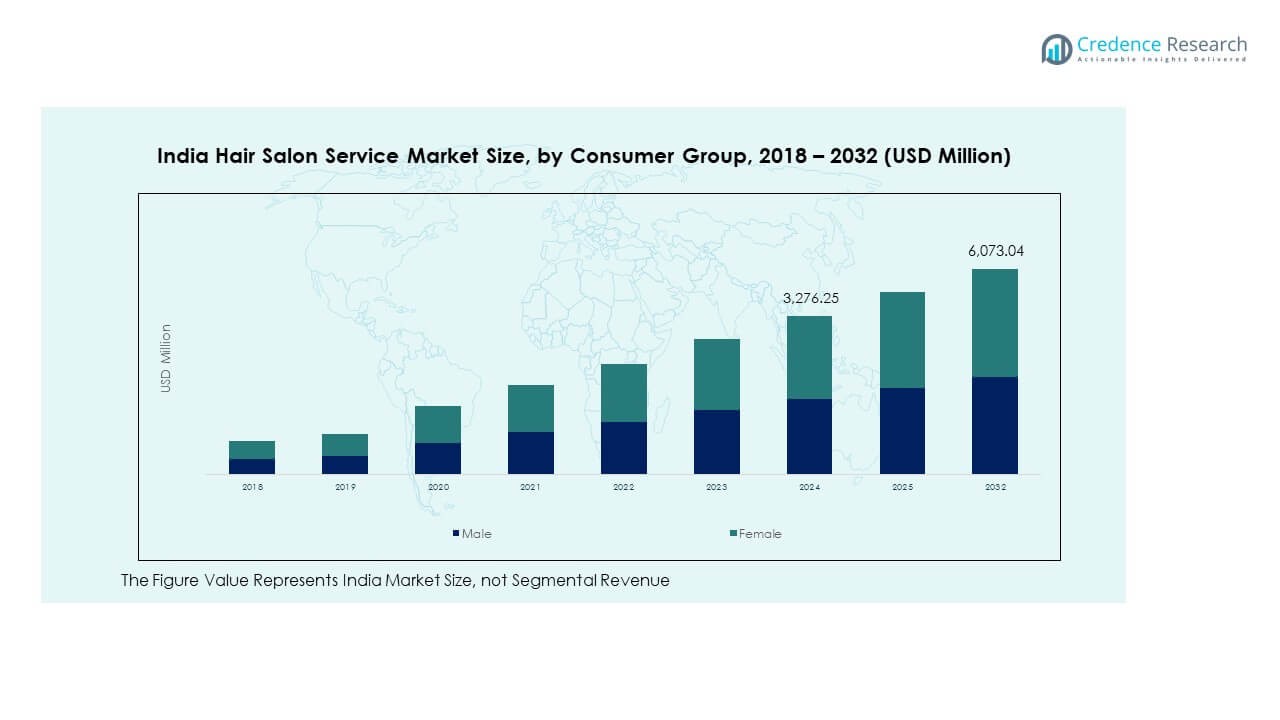

The India Hair Salon Service Market size was valued at USD 2,708.65 million in 2018, rose to USD 3,276.25 million in 2024, and is anticipated to reach USD 6,073.04 million by 2032, at a CAGR of 8.02% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Hair Salon Service Market Size 2024 |

USD 3,276.25 Million |

| India Hair Salon Service Market, CAGR |

8.02% |

| India Hair Salon Service Market Size 2032 |

USD 6,073.04 Million |

The growth of the India Hair Salon Service Market is driven by increasing disposable incomes, urbanization, and rising consumer awareness around personal grooming and beauty. The shift toward premium salon services, including hair coloring, styling, and treatments, is also contributing to the market’s expansion. The rise of digital platforms for booking salon services and the increasing adoption of mobile and at-home services further fuel market growth. The growing influence of social media and beauty trends among younger generations also propels the demand for salon services.

Regionally, North India leads the market, driven by major urban centers like Delhi and Gurgaon with high disposable incomes and a large consumer base. The West and Central India regions, with cities like Mumbai and Pune, are also significant players in the market, showing strong adoption of salon services. Emerging cities in the South and East, such as Bengaluru and Kolkata, are witnessing rapid growth due to an expanding middle class and increasing awareness about professional haircare services. These regions present high growth potential, as the demand for quality and innovative salon services rises.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The India Hair Salon Service Market was valued at USD 2,708.65 million in 2018, grew to USD 3,276.25 million in 2024, and is projected to reach USD 6,073.04 million by 2032, at a CAGR of 8.02%.

- North India leads the market with approximately 40% share, driven by major urban centers like Delhi and Gurgaon, where disposable incomes are high and salon services are in high demand. West and Central India follow with around 30%, with cities like Mumbai and Pune showing strong adoption of grooming services.

- South and East India collectively account for 30% of the market share, with rapid growth in tier-2 and tier-3 cities. Rising disposable incomes and increasing urbanization are key drivers in these regions.

- The male segment holds a significant portion of the market, contributing around 45% in 2024, with strong growth in male grooming services, including haircuts, styling, and treatments. The female segment remains dominant, contributing about 55% of the market share.

- The highest growth is seen in the mobile/at-home salon services segment, with increased demand for convenience, followed by the full-service salons segment, which continues to attract consumers looking for premium and comprehensive hair care.

Market Drivers:

Rising Disposable Income Among Consumers

The growing disposable income in India is significantly boosting the demand for hair salon services. Consumers are increasingly willing to spend on premium grooming services, as their purchasing power rises. The India Hair Salon Service Market benefits from this trend, as people opt for quality services and personalized treatments. Urbanization has led to higher disposable income in both metropolitan and emerging tier-2 cities, making salon services more affordable to a wider consumer base. This increase in spending capacity allows more consumers to indulge in luxury services, enhancing market growth.

- For instance, Naturals Salon & Spa, founded in 2000, has grown to over 800 outlets across 20+ states as of July 2025, making it one of India’s largest salon chains with official expansion figures repeatedly cited by the brand and industry press.

Changing Lifestyle Preferences and Grooming Culture

Shifting consumer attitudes towards personal care and grooming are also driving market growth. India’s evolving beauty culture, influenced by global trends, is encouraging people to indulge in regular salon visits. The increasing popularity of hairstyling, hair treatments, and coloring services is changing the dynamics of the India Hair Salon Service Market . Salons now provide specialized services such as hair extensions, scalp treatments, and keratin treatments, which attract consumers seeking enhanced beauty standards. This growing focus on grooming has become an integral part of lifestyle, especially in urban centers.

- For instance, Lakmé Salon operates more than 450 salons and employs over 4,000 experts nationwide as of 2024, supporting specialized beauty services and consistent expansion into premium hair care and grooming treatments.

Technological Advancements in Salon Services

The integration of advanced technologies in salons has fueled the growth of the market. Digital appointment booking, AI-based hair analysis, and online consultations have made salon services more accessible. The rise of mobile and web apps, offering services like doorstep appointments, has improved consumer convenience. Salons are adopting automation and tech-driven tools, enhancing the overall customer experience. These technological innovations are streamlining operations, increasing efficiency, and allowing salons to reach a wider customer base, especially in emerging markets.

Influence of Social Media and Beauty Influencers

Social media platforms and beauty influencers are playing a crucial role in promoting salon services. Platforms like Instagram and YouTube are increasingly influencing consumer preferences by showcasing hairstyling tutorials, reviews, and transformations. Influencers often promote new trends and salons, drawing in their followers. This trend is particularly prevalent among the younger demographic, who are looking to emulate their favorite stars and personalities, contributing to the growth of the India Hair Salon Service Market . This social media influence continues to shape consumer expectations and drive footfall to salons.

Market Trends:

Growth of Specialized Salon Services

There is a rising demand for specialized salon services in India, including premium hair treatments like keratin, Botox, and organic haircare. These services cater to consumers looking for advanced, customized hair care. The India Hair Salon Service Market is seeing the introduction of such services in high-end salons, which focus on quality and results. Specialized treatments are attracting a premium clientele willing to pay more for superior services that meet specific hair care needs. This trend indicates a shift towards more luxurious, tailored salon experiences across the country.

Expansion of Salon Chains and Franchises

The salon industry in India is witnessing a surge in the number of chain salons and franchises. Brands are expanding their presence across cities, from metro hubs to smaller towns, offering standardized services. The rise of well-known salon chains, such as VLCC and Naturals, has been a major trend. These salon chains are expanding rapidly due to their brand recognition and consistent service quality. The India Hair Salon Service Market benefits from this expansion as it offers a more reliable and widespread salon experience. Consumers are now choosing branded salons for their trustworthiness and quality.

Increase in Mobile and At-Home Salon Services

Mobile salons are emerging as a popular trend in India, offering door-to-door beauty and hair care services. With the increasing convenience of at-home services, more consumers are opting for personalized treatments in the comfort of their homes. The India Hair Salon Service Market is seeing growth in mobile salon offerings, particularly among busy professionals and elderly clients. The ease and privacy offered by at-home salons contribute to their growing demand. This convenience has significantly expanded the customer base, especially in metropolitan cities where time-saving services are in high demand.

- For instance, Urban Company’s Salon Prime services (including at-home hair and beauty treatments) have received a customer rating of 4.85 based on over 1.2 million reviews, as published on their official website.

Shift Towards Eco-Friendly and Sustainable Beauty Products

The demand for eco-friendly and sustainable beauty products is rising, and the salon industry is no exception. Consumers are becoming more aware of the environmental impact of salon products, leading to a preference for organic and natural treatments. Salons in India are adopting cruelty-free, vegan, and eco-friendly products to cater to environmentally conscious clients. The trend is driving the India Hair Salon Service Market towards more sustainable beauty practices, as consumers prioritize health and wellness alongside beauty. This shift is also prompting salons to adopt greener operational practices.

- For instance, Enrich launched Born Ethical, a sustainable beauty brand offering vegan, natural, and cruelty-free products packaged in recyclable materials, as officially announced by the company and covered in industry publications.

Market Challenges Analysis:

High Competition and Price Sensitivity

The India Hair Salon Service Market faces significant competition, with numerous salons offering similar services. This intense competition is driving salons to cut prices, particularly in tier-2 and tier-3 cities, which could impact profitability. The price sensitivity of Indian consumers also limits the market’s ability to maintain premium pricing for certain services. Salons must innovate to differentiate themselves in a crowded market and attract clients willing to pay more for superior services. The emergence of budget salons further intensifies this competition, making it difficult to maintain high profit margins.

Lack of Skilled Workforce

A major challenge in the India Hair Salon Service Market is the shortage of well-trained professionals. The industry requires skilled hair stylists, colorists, and beauticians to maintain high service standards. However, there is a gap in the availability of skilled professionals, leading to a lack of consistency in service delivery. To address this, salons must invest in training programs and create career development opportunities to retain talent. The shortage of skilled staff also hinders the growth potential of salons, particularly in smaller towns and rural areas.

Market Opportunities:

Rural Market Expansion

The India Hair Salon Service Market has significant growth opportunities in rural and semi-urban areas. Although metro cities have a well-established salon culture, smaller towns and villages present an untapped market. As disposable income rises in rural areas, there is potential for salons to expand their services beyond traditional haircuts, offering hair treatments and styling services. Salons entering these markets can cater to a growing demand for grooming services, creating new revenue streams. Expanding into these regions presents a profitable growth avenue for salon chains and independent operators.

Health and Wellness Trends

With an increasing focus on health and wellness, there is an opportunity for salons to offer integrated services that combine beauty with health. Wellness-focused salons providing holistic treatments, such as Ayurvedic haircare, stress-relief therapies, and scalp massages, are gaining traction. This trend can help salons tap into a more health-conscious customer base. The India Hair Salon Service Market stands to benefit by offering these complementary services, aligning with evolving consumer preferences. Salons that offer holistic beauty solutions can attract a loyal, wellness-focused clientele.

Market Segmentation Analysis

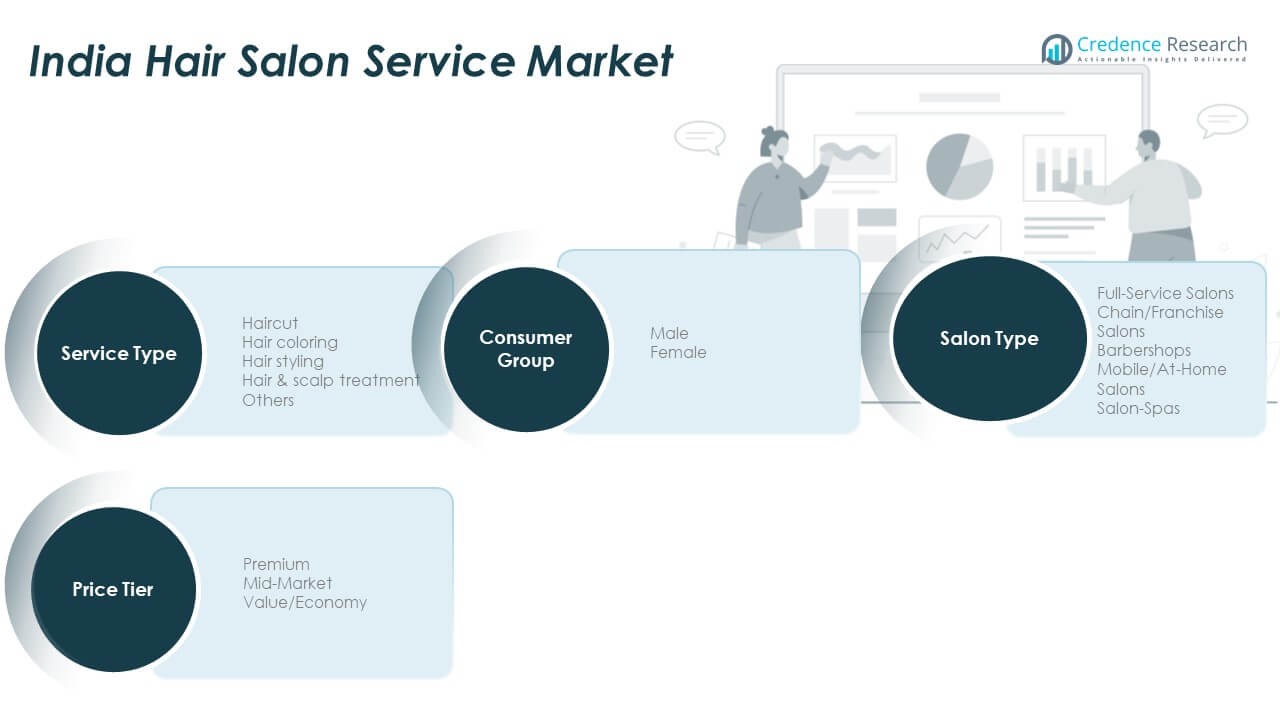

By Service Type

The India Hair Salon Service Market is segmented into various service types, including haircuts, hair coloring, hair styling, hair & scalp treatments, and others. Haircuts remain the most basic and widely offered service across salons, while hair coloring and styling services are gaining popularity due to evolving fashion trends. Hair and scalp treatments are growing in demand as consumers seek personalized care for their hair health. Specialized services such as keratin and organic treatments are also gaining market share in premium salons. This diversification in services is helping salons cater to various consumer needs, expanding their client base.

- For instance, L’Oréal Professionnel’s Metal Detox technology has been shown to reduce hair breakage by up to 99% in one use, according to laboratory testing and in-salon trials conducted by L’Oréal.

By Salon Type

Salon types in the India Hair Salon Service Market include full-service salons, chain/franchise salons, barbershops, mobile/at-home salons, and salon-spas. Full-service salons offer a wide range of services, including haircuts, styling, and treatments, attracting a large consumer base. Chain/franchise salons are rapidly expanding, offering consistent services across locations. Barbershops continue to serve traditional male clientele, while mobile/at-home salons are gaining traction among busy professionals. Salon-spas cater to the high-end market with luxurious services and spa treatments. This segmentation allows consumers to choose services that fit their preferences, budgets, and convenience.

By Consumer Group

The market is segmented by consumer group into male and female segments. The female segment dominates the India Hair Salon Service Market due to higher engagement in grooming and beauty treatments. Women seek hair care and styling services more frequently than men. However, the male segment is growing, driven by increased awareness of grooming and styling services. Men are now opting for specialized services such as beard grooming and hair coloring, which were traditionally dominated by women. This shift is broadening the service offerings and contributing to the market’s expansion.

- For instance, Urban Company’s “at-home salon” services, which cater to both male and female customers, have gained significant popularity, with strong demand for grooming and styling services in the home setting,

By Price Range

The India Hair Salon Service Market is further divided based on price range into premium, mid-market, and value/economy segments. Premium salons offer high-end services with premium pricing, targeting affluent consumers. Mid-market salons cater to the mass market, offering a balance between affordability and quality. The value/economy segment serves budget-conscious customers seeking basic services at lower prices. Each segment caters to different income groups and provides varying levels of service and experience. This price-based segmentation enables salons to target a wide range of customers with diverse financial capacities.

Segmentation

By Service Type

- Haircut

- Hair colouring

- Hair styling

- Hair & scalp treatment

- Others

By Salon Type

- Full-Service Salons

- Chain/Franchise Salons

- Barbershops

- Mobile/At-Home Salons

- Salon-Spas

By Consumer Group

By Price Range

- Premium

- Mid-Market

- Value/Economy

Regional Analysis

North India Region Dominance (approx. 40 % share)

North India commands roughly 40 % of the India Hair Salon Service Market. Major urban centres such as Delhi, Gurgaon and Chandigarh drive strong demand due to higher incomes and concentrated populations. High awareness of grooming trends and premium service adoption enhance market activity in this region. Franchise salons and branded outlets expand aggressively in metropolitan zones. Consumer willingness to spend on hair treatments and styling supports premium service uptake. Many salons here adopt advanced technology and online bookings to serve affluent clientele.

West & Central India Region (approx. 30 % share)

West and Central India hold an estimated 30 % share of the India Hair Salon Service Market. Mumbai, Pune and Ahmedabad lead the region with vibrant salon ecosystems and strong fashion‑centric demand. Tier‑2 cities in Maharashtra and Gujarat show rising salon penetration and service diversification. Chains and regional brands expand into these growing markets. Marketing campaigns target male grooming and diverse age groups to broaden consumer reach. Competitive pricing combined with quality service helps maintain share in this region.

South & East India Region (approx. 30 % share)

South and East India combined contribute about 30 % to the India Hair Salon Service Market. Southern states such as Karnataka, Tamil Nadu and Telangana show strong adoption of branded salons and treatments. Eastern regions such as West Bengal, Odisha and Bihar are emerging but remain less saturated than metros. Mobile and at‑home salon services gain traction in both urban and semi‑urban areas here. Consumer preferences for specialised hair care and colour services reflect national grooming trends. Market potential remains high in under‑penetrated districts and smaller cities.

Key Player Analysis

- L’Oréal Professionnel / L’Oréal S.A.

- Jawed Habib Hair & Beauty

- Naturals Salon

- BBlunt

- Toni & Guy

- Looks Salon

- VLCC

- Geetanjali Salon

- Enrich Salon

Competitive Analysis

The India Hair Salon Service Market features a mix of national chains, regional brands and independent salons. Major players such as Lakmé Salon, Green Trends, Naturals and Jawed Habib invest in brand building, staff training and service standardization. These chains expand branch networks into tier‑2 and tier‑3 cities to capture underserved segments. Independent salons compete on personalization, local appeal and competitive pricing, which helps them retain cost‑sensitive customers. Mobile and at‑home salon services introduce new competition by offering convenience and flexibility, forcing traditional salons to adopt digital booking and loyalty programmes. Players differentiate through service innovation, such as high‑end treatments, eco‑friendly products and membership models. Operational efficiency remains a key hurdle for smaller operators, while larger chain salons focus on scaling operations and enhancing customer experience to stay competitive.

Recent Developments

- In November 2025, Indian premium haircare brand &Done secured ₹6.5 crore in pre-seed funding led by All In Capital. Since its launch, &Done has partnered with more than 1,500 stylists across over 300 premium salons in tier-1 cities, leveraging a salon-distribution strategy combined with direct-to-consumer products for at-home hair care.

- In September 2025, L’Oréal finalized the acquisition of Color Wow, marking a key step to strengthen its innovation pipeline in professional haircare. Additionally, the company entered into a long-term strategic partnership in luxury beauty and wellness with Kering, which includes the acquisition of the House of Creed and extends L’Oréal’s presence in high-end fragrances and beauty solutions.

- In April 2024, Looks Salon expanded its partnership with Redken, launching “Looks Prive” in Malcha Marg, Delhi. This marks their second flagship collaboration, promising luxurious hair treatments using Redken’s advanced product portfolio and technology.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Service Type, Salon Type, Consumer Group and Price Range. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for premium services such as hair treatments, styling, and coloring will continue to rise.

- Consumer preference for personalized grooming experiences will drive salon innovations.

- Mobile and at-home salon services will expand to meet consumer convenience needs.

- Growth in disposable income across urban and semi-urban areas will increase salon spending.

- Salons will focus on offering eco-friendly, organic, and sustainable beauty treatments.

- Chain salons will penetrate tier-2 and tier-3 cities, expanding market reach.

- Advanced technologies like AI-driven hair analysis and online booking will enhance service delivery.

- Men’s grooming services, including haircuts and styling, will see a significant increase in demand.

- Franchise and branded salons will dominate the market as consumers seek consistency and quality.

- Salons will leverage social media influencers and digital marketing to attract younger consumers.