Market Overview:

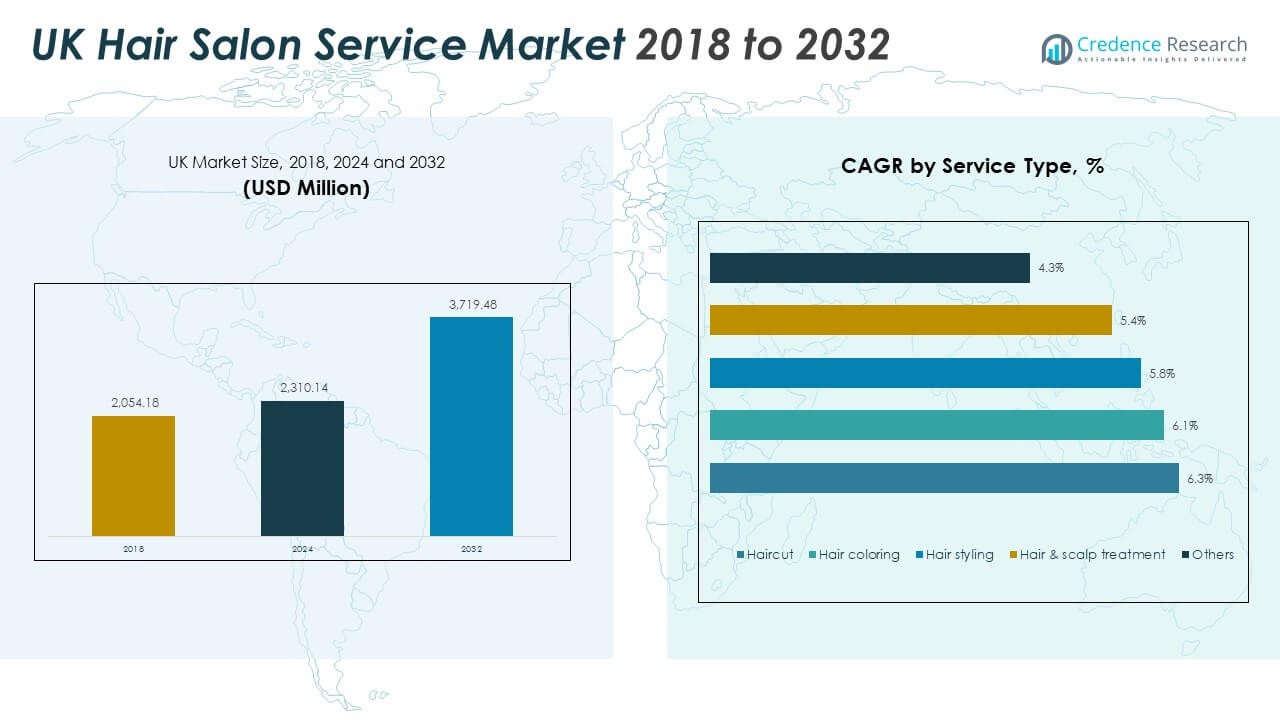

The UK Hair Salon Service Market size was valued at USD 2,054.18 million in 2018 and grew to USD 2,310.14 million in 2024, with expectations to reach USD 3,719.48 million by 2032, at a CAGR of 6.13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Hair Salon Service Market Size 2024 |

USD 2,310.14 Million |

| UK Hair Salon Service Market, CAGR |

6.13% |

| UK Hair Salon Service Market Size 2032 |

USD 3,719.48 Million |

The market is driven by rising disposable incomes and a strong cultural emphasis on personal grooming, prompting consumers to seek regular and premium salon services. Urban populations, influenced by fashion trends, social media, and celebrity endorsements, increasingly demand diverse and customized treatments. The integration of digital booking platforms, app-based consultations, and loyalty programs enhances accessibility and convenience, while salons adopting advanced technologies and wellness-oriented offerings boost client satisfaction and retention, fueling continuous expansion in service frequency and spending.

Regionally, England dominates the UK Hair Salon Service Market, particularly metropolitan hubs like London and the South East, where affluent urban populations drive demand for premium and innovative hair services. Emerging opportunities are evident in secondary cities and regional markets, where growing urbanization, increasing disposable income, and younger demographics are stimulating the adoption of both traditional and hybrid salon models. Scotland, Wales, and Northern Ireland show potential for market expansion, supported by rising consumer awareness of professional grooming, wellness integration, and accessible digital salon solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Hair Salon Service Market was valued at approximately USD 1,000 million in 2018, rose to USD 2,310.1 million in 2024, and is projected to reach USD 3,719.5 million by 2032, registering a CAGR of about 6% from 2024 to 2032.

- England leads with the largest regional share at roughly 75%, followed by Scotland at around 12%, and Wales at about 8%; England’s dominance is driven by high urban population density, greater disposable incomes, and a concentration of flagship salons.

- The fastest-growing region is London, accounting for nearly 28% of the UK market, propelled by luxury beauty trends, strong expat and youth populations, and high tourist footfall.

- In 2024, female consumers accounted for an estimated 60-62% share of UK hair salon revenues, significantly outspending male counterparts.

- Male clients held a 38-40% segment share in 2024; steady growth in male-focused hair and grooming services is enhancing their share each year

Market Drivers

Robust Consumer-Focused Salon Service Landscape

A continuous rise in disposable income and evolving consumer aspirations are foundational market drivers for the UK Hair Salon Service Market. It benefits from a strong culture of personal grooming and frequent demand for hair cutting and styling services that resonate with both men and women seeking professional solutions. The robust influence of fashion trends inspires consumers to pursue regular and seasonal transformations, increasing salon footfall and spending frequency. A growing consciousness about appearance, intensified by social media exposure and celebrity endorsements, drives more frequent visits to hair professionals. Urbanization intensifies consumer focus on grooming while driving demand for salons in metropolitan areas that embrace luxury, wellness, and customization. The proliferation of digital booking platforms streamlines access, supporting the ease and convenience of scheduling appointments across franchises and independent operators. Salons increasingly adopt technology for personalized consultations and contactless payments, boosting client satisfaction and retention. The sector also benefits from government-backed vocational programs and partnerships, providing skilled professionals and raising service standards.

- For instance, TONI&GUY UK provides a proprietary digital booking app that allows appointment management, loyalty points tracking, and news updates for users across all UK locations, demonstrating the industry trend toward seamless digital client engagement.

Influence of Technology, Fashion, and Demographics on Service Models

Salons across the UK invest in AI-powered consultations, digital infrastructure, and service automation that allow real-time appointment booking and personalized treatment recommendations. The sector’s adaptive embrace of technological solutions improves operational efficiency and client experience, shrinking wait times and maximizing staff utilization. High-street chains and boutiques innovate through mobile applications, loyalty programs, and virtual consultations, radically upgrading service models. The impact of post-pandemic digital acceleration is evident, as customers now expect instant access and seamless digital interactions through platforms or apps. Demand for luxury hair care is reinforced by affluent urban populations seeking bespoke treatments, premium products, and subscription plans. Rapid urbanization in cities such as London, Manchester, and Birmingham sets the stage for salons to cater to diverse tastes and high footfall. Government-backed initiatives in training and upskilling provide a steady pipeline of talent, critical to sustaining quality and innovation.

Role of Sustainability, Personalization, and Health-Based Offerings in Market Trajectory

Sustainability themes and eco-friendly service practices increasingly shape consumer expectations and salon strategies nationwide. The UK Hair Salon Service Market responds by integrating green-certified products, ethical sourcing, and resource-efficient processes such as reduced water and energy use. Salons elevate their value propositions through wellness integration, offering aromatherapy scalp massages, detox hair treatments, and personalized service packages tailored to individual client needs. A pronounced shift towards clean beauty and dermatological solutions signals rising consumer preference for safe, effective, and health-oriented offerings, producing stronger customer loyalty and premium pricing opportunities. Celebrity-driven campaigns and influential social media content fuel brand visibility and highlight unique service packages, driving market differentiation. The rise of unisex salons and hybrid service models expands accessibility for all demographics, while partnerships with health and wellness brands create new revenue verticals for market players.

- For instance, Aveda UK is recognized for its strong commitment to sustainability and ethical sourcing, with many of its products being vegan and its manufacturing operations powered by renewable energy, setting benchmarks for eco-friendly practices in the salon sector.

Emergence of Franchise Models, Influencer Collaborations, and Value-Added Experiences

The UK Hair Salon Service Market is witnessing an uptick in franchise expansion and influencer-backed collaborations that accelerate market penetration and introduce new service innovations. Franchises and established chains streamline service delivery through standardized operations, cross-location loyalty schemes, and integrated marketing campaigns. The influx of influencer and celebrity partnerships infuses salons with aspirational value and exclusivity, prompting customers to seek premium offerings and branded experiences. Technology-driven loyalty programs, subscription grooming packages, and app-based communication channels consolidate client retention efforts, maximizing lifetime value. Salons increasingly combine hair care, wellness, and retail, broadening their scope and creating immersive, multifunctional environments for customers seeking long-term relationships. This strategic market evolution underscores the sector’s commitment to differentiation, experience-driven growth, and sustained relevance in a competitive environment.

Market Trends

Rise of Personalization, Sustainability, and Digital Innovation in UK Salon Operations

The UK Hair Salon Service Market is reshaping operations by integrating advanced personalization, sustainability measures, and digital platforms that redefine the standard for client service. Salons are increasingly investing in personalized care strategies, tailoring solutions to meet the needs of diverse clientele ranging from youth seeking bold transformations to professionals opting for managed, healthy looks. Sustainability remains a core thread, with salons adopting eco-friendly practices such as green-certified products, resource conservation, and recycling programs to align services with consumer demand for responsible business models. Digital booking solutions, loyalty apps, and virtual consultation technologies now serve as market differentiators, allowing clients to engage seamlessly from appointment scheduling to aftercare advice. The importance of these trends is amplified by competitive dynamics, compelling salons to continually innovate and optimize both service offering and client engagement.

Expansion of Unisex Salons, Hybrid Service Models, and Inclusive Branding

Key market trends reflect the shift towards unisex salons and inclusive service portfolios that break traditional gender boundaries while incorporating flexible, hybrid models for evolving consumer needs. Unisex concepts foster democratized access to premium grooming and styling, driving market growth among younger and more diverse audiences. Salons strengthen client relationships by offering mix-and-match service packages, combining haircuts with scalp wellness, coloring, and styling in one comprehensive appointment experience. The adoption of health-based, dermatological services complements this trend, producing a wellness-oriented reputation for market leaders. These initiatives foster stronger brand loyalty and sustain repeat visits, anchoring long-term business viability amid intense competition.

- For instance, Rush Hair & Beauty operates unisex salons across the UK, offering a diverse range of hair and beauty services for all genders, reflecting inclusive branding and professional expertise in its service offerings.

Intensified Focus on High-Margin Specialized Services and Franchise-Led Growth

The UK Hair Salon Service Market is seeing an increase in the demand for specialized services, such as custom color, keratin treatments, and aromatherapy scalp massages, which attract clients willing to pay a premium for unique and expert results. Franchise and brand-led expansion further strengthens market share, with operators such as Rush Hair & Beauty and Toni & Guy championing innovative service models and retaining brand prominence across urban centers. These players emphasize digital transformation, loyalty integration, and quality assurance, differentiating their salons while leveraging economies of scale for operational efficiency. The convergence of traditional and wellness-based programming enables salons to build sustainable streams of revenue despite fluctuating consumer trends.

Strengthening of Retail Integration and Collaborative Market Growth

Retail integration through in-salon product sales and partner collaborations emerges as a defining trend, enabling salons to diversify revenue sources and offer end-to-end client solutions. Strategic alliances with product brands, health companies, and lifestyle platforms extend market reach and introduce fresh, cross-promotional opportunities for salon operators. These partnerships foster innovation and support value-added client experiences, keeping salons ahead in a crowded and rapidly evolving competitive landscape. A shared focus on omni-channel customer engagement connects in-person services with digital consultation, marketing, and product delivery, broadening market presence and supporting sustained expansion for sector leaders.

- For instance, Regis Salons UK has partnered with Wella Professionals for over 20 years, offering guests premium hair color products and ensuring stylists are trained through Wella’s professional programs, reinforcing high-quality salon services.

Market Challenges

Operational Pressures and Staffing Shortages Confronting Salon Owners

Rising operational costs and acute staffing shortages have created significant market challenges for the UK Hair Salon Service Market, with business owners struggling to retain profitability amid inflationary pressures. Labour costs make up a majority of expense portfolios and are increasingly difficult to manage due to new wage regulations and post-Brexit market complexity. Many salons experience disruption from high rates of employee turnover and face barriers to hiring skilled professionals for technical roles and client-facing service delivery. The industry’s service-driven nature limits the ability to reclaim VAT on input costs, further exacerbating profitability concerns for operators across the UK. The 2024 Budget increased staff-related expenses, adding to financial volatility and prompting some owners to reevaluate margins and operational strategy.

Competitive Intensity and Market Entry Barriers Affecting Growth Potential

Fierce market competition challenges salons to develop effective differentiation strategies while sustaining client relationships through price-value optimization. New entrants in the form of independent stylists and mobile beautician platforms challenge traditional salons by offering increased flexibility and lower overheads. Licensing and staff training requirements present additional hurdles, especially for operators expanding into secondary markets or seeking scale. Uncertainty from economic fluctuations impacts consumer confidence and discretionary spending rates, while high-street salon locations endure greater competition for footfall amid declining storefront numbers. Strategic adaptability, resource efficiency, and innovation remain crucial for market participants to preserve their positioning through volatile periods.

Market Opportunity

Expansion into Regional Markets and Emerging Digital Platforms Unlocks Growth

The UK Hair Salon Service Market finds opportunities for growth through expansion into secondary cities and regional markets where rising urban populations and youth demographics stimulate demand for accessible and affordable salon services. Emerging digital platforms, including online booking, loyalty apps, and remote consultation systems, allow salons to connect with new client bases and streamline operational management for future scalability. Service models integrating wellness, health, and beauty create a path for cross-market innovation, supporting the development of new verticals and partnerships that extend reach and brand value.

Investment in Training, Sustainability Practices, and Franchise Partnerships to Accelerate Future Growth

Market opportunities also derive from the sector’s investment in vocational education and government-sponsored training programs that continually upgrade the skillset of stylists and beauty specialists. Salons implementing sustainability practices and ethical sourcing appeal to increasingly eco-conscious clientele, opening avenues for brand differentiation and premium pricing. Franchise partnerships, influencer collaborations, and omni-channel retail models are expected to provide significant momentum for market expansion, as the convergence of luxury, wellness, and technology creates multi-dimensional client experiences and drives industry leadership.

Market Segmentation Analysis

By Service Type

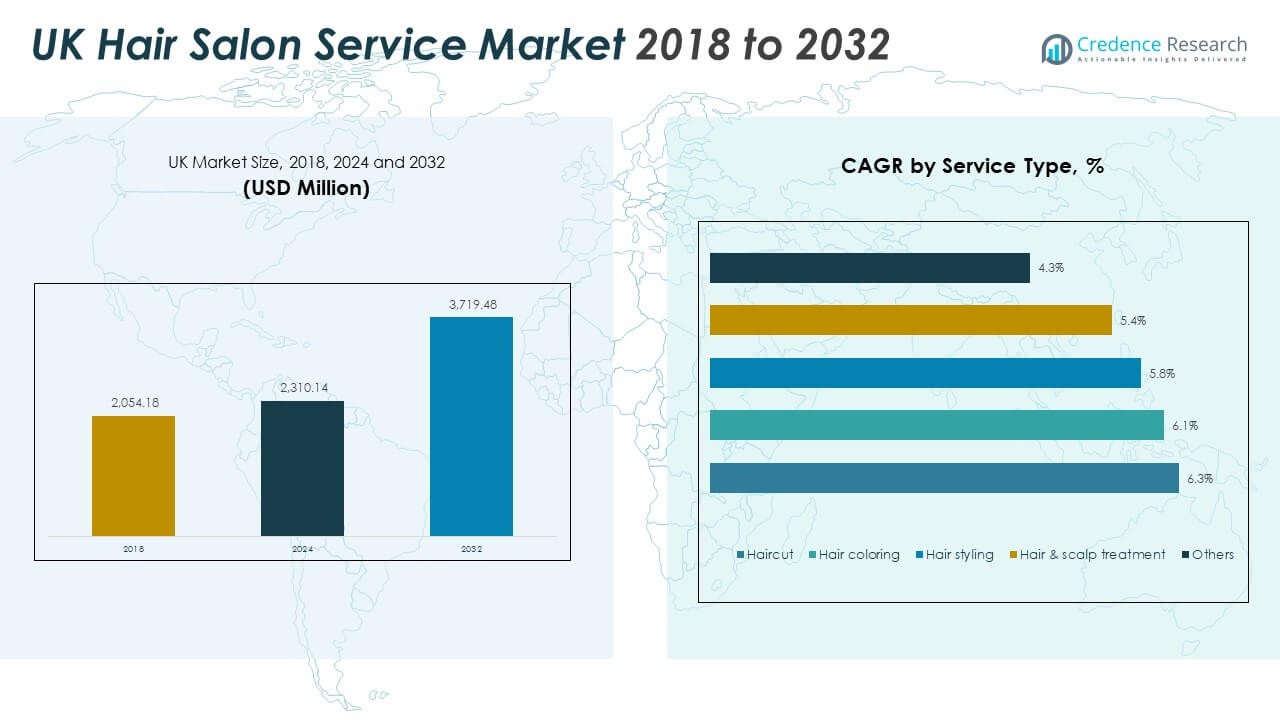

Haircut services form the largest segment in the UK Hair Salon Service Market, accounting for the bulk of routine customer visits across both urban and regional salons. Hair colouring has seen rising demand driven by diverse consumer preferences and fashion influences, particularly among younger demographics seeking vibrant or personalized looks. Hair styling is supported by events, social functions, and professional needs, adding value to service bundles and premium offerings. Hair and scalp treatments, including wellness and dermatological solutions, are outpacing traditional services as consumers become increasingly focused on health-oriented care and long-term maintenance. The ‘Others’ category includes extensions, smoothing systems, and niche treatments, broadening the addressable base with specialty expertise.

- For instance, Headmasters and other leading UK salons use the Dyson Supersonic hair dryer, a professional-grade tool recognized for improving hair smoothness and shine, as highlighted in Dyson’s product literature and verified reviews.

By Salon Type

Full-service salons dominate the UK Hair Salon Service Market, offering comprehensive treatments alongside premium ambience and brand experience. Chain and franchise salons leverage brand strength, digital convenience, and standardized quality to attract repeat business in high-traffic locations. Barbershops remain fast-rising, responding to demand for male-centric solutions and modern grooming trends. Mobile and at-home salons capture suburban and remote segments, providing flexibility for time-constrained consumers. Salon-spas integrate wellness and beauty, fostering loyalty among clients seeking holistic and premium services.

- For instance, Ruffians Barbers in the UK employs Wahl professional grooming equipment, aligning with industry-standard tools and service practices highlighted in salon press releases and UK grooming profiles.

By Consumer Group

Female clients generate the majority of revenues for the UK Hair Salon Service Market and drive innovation in service portfolios, from hair colouring to advanced treatments. Male consumers now represent a substantial and growing segment, propelled by shifting grooming habits and an expanded focus on scalp health and styling.

By Price Range

Premium salons offer bespoke services and exclusive experiences, catering to affluent clients who prioritize quality and customization. Mid-market salons appeal to a wide base with balanced pricing and reliable results, anchoring the sector’s growth in resilient demand. Value and economy salons target price-sensitive consumers and deliver essential services, supporting industry stability amid economic shifts.

Segmentation

By Service Type

- Haircut

- Hair colouring

- Hair styling

- Hair & scalp treatment

- Others

By Salon Type

- Full-Service Salons

- Chain/Franchise Salons

- Barbershops

- Mobile/At-Home Salons

- Salon-Spas

By Consumer Group

By Price Range

- Premium

- Mid-Market

- Value/Economy

Regional Analysis

England – Driving Salon Services with Premium Segment Dominance

England accounts for nearly 67% of the UK Hair Salon Service Market, with London and surrounding metropolitan regions leading growth due to high population density and elevated household incomes. The capital’s sophisticated taste for luxury and personalized grooming solutions cultivates a thriving premium salon ecosystem that attracts both local and international clientele. Salon operators in the South East distinguish their offerings with advanced treatments, digital booking infrastructure, and bespoke service integrations that target affluent urban consumers. Competitive intensity, fashion-forward clientele, and ongoing investment in high-street salons underpin England’s leadership within the national market.

Scotland – Increasing Market Penetration with Wellness Innovation

Scotland secures approximately 17% of the UK Hair Salon Service Market, with Glasgow and Edinburgh setting benchmarks for emerging wellness-centric salon experiences and growing demand for unisex formats. Salon operators differentiate through eco-friendly products, scalp health treatments, and hybrid service models that appeal to both traditional and younger consumers. The subregion leverages government training programs to expand expertise and elevate service quality, supporting growth in metropolitan areas and suburban towns.

Wales and Northern Ireland – Expanding Reach with Value-Driven Solutions

Wales and Northern Ireland together represent 16% of the UK Hair Salon Service Market, characterized by steady expansion in value and mid-market salons meeting rising grooming expectations. Client engagement intensifies in Cardiff, Belfast, and adjacent urban centers, where operators cater to price-sensitive demographics and foster brand loyalty through local outreach and community-driven initiatives. The accessibility of mobile and at-home salons combined with increased awareness of professional hair care supports ongoing inclusion and diversifies market reach in these subregions.

Key Player Analysis

Competitive Analysis

The UK Hair Salon Service Market features a diverse and dynamic competitive landscape comprised of established franchise chains, branded salons, and a significant base of independent operators. Names such as Toni & Guy, Rush Hair & Beauty, and Saks Hair & Beauty capture sizable urban market share through expansive networks, recognizable branding, and consistent investment in digital transformation and advanced service models. These brands drive innovation by integrating AI-based consultations, subscription-based grooming packages, and eco-friendly certifications, which serve to differentiate services and attract premium clientele. The presence of international firms such as Regis Corporation and Dessange International increases competitive intensity, particularly in the premium and metropolitan segments. Local and boutique salons maintain strong community ties and singular client experiences, supporting resilience in face of growth by national and global operators. Barbershops and unisex chains register rapid expansion by targeting the male consumer segment and executing flexible, lower-cost service models. Technology adoption and sustainability initiatives increasingly define leadership in the UK Hair Salon Service Market, as salons that leverage digital booking, data-driven marketing, and ethical sourcing report higher retention and market share. Entry barriers such as licensing, staff training, and digital infrastructure needs limit market saturation and favor established brands that can deploy capital and expertise at scale.

Recent Developments

- In October 2025, L’Oréal S.A. reinforced its presence in the UK hair salon service market through the acquisition of the House of Creed and by entering a long-term strategic partnership with Kering Group in luxury beauty and wellness. This partnership is set to expand L’Oréal’s portfolio in niche fragrances and luxury salon services, positioning the brand at the forefront of premium beauty and wellness innovations in the UK salon market.

- In June 2025, L’Oréal announced its acquisition of Color Wow, one of the fastest-growing professional haircare brands. This acquisition was strategically significant for the Professional Products Division, as Color Wow’s robust UK presence and track record for innovative solutions including 130+ beauty industry awards are expected to bolster L’Oréal’s salon-focused offerings and accelerate global expansion initiatives within the UK market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Service Type, Salon Type, Consumer Group and Price Range. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Digital transformation and AI integration will accelerate innovation in service personalization, scheduling, and customer relationship management for salons across the UK Hair Salon Service Market.

- Social media and influencer campaigns will shape consumer preferences, with brands leveraging targeted online marketing to broaden reach and strengthen retention.

- A rise in male grooming services and unisex salon formats will expand addressable market segments and boost service diversity for operators.

- Sustainability will become essential, driving increased adoption of eco-friendly products, packaging, and resource-efficient practices throughout the sector.

- Demand for natural, organic, and clean-label formulations will influence product selection and brand loyalty, amplifying a shift toward ingredient transparency.

- Hybrid salon concepts and co-working spaces will attract new investors and independent stylists, supporting flexible business models and collaborative innovation.

- The premium segment is set to benefit from greater interest in bespoke treatments, wellness integration, and exclusive experiences, establishing new benchmarks for service quality.

- Expansion in regional and suburban markets will promote accessibility and inclusivity, growing the consumer base for mobile and at-home salons.

- Challenges such as rising operational costs, staffing shortages, and competitive intensity will prompt salons to focus on efficiency, differentiation, and client experience.

- Strategic partnerships, mergers, and ongoing R&D investment will reshape market structure and supply chains, allowing stakeholders to adapt to evolving consumer expectations and regulatory changes.