Market Overview

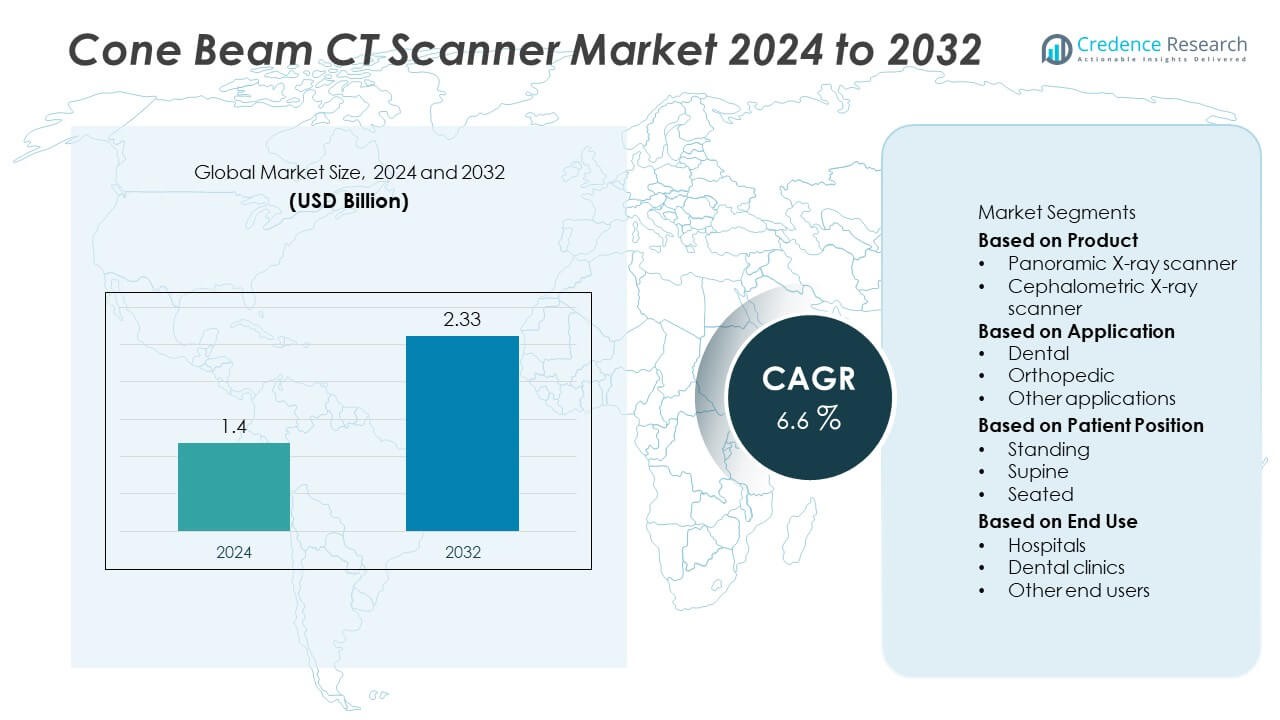

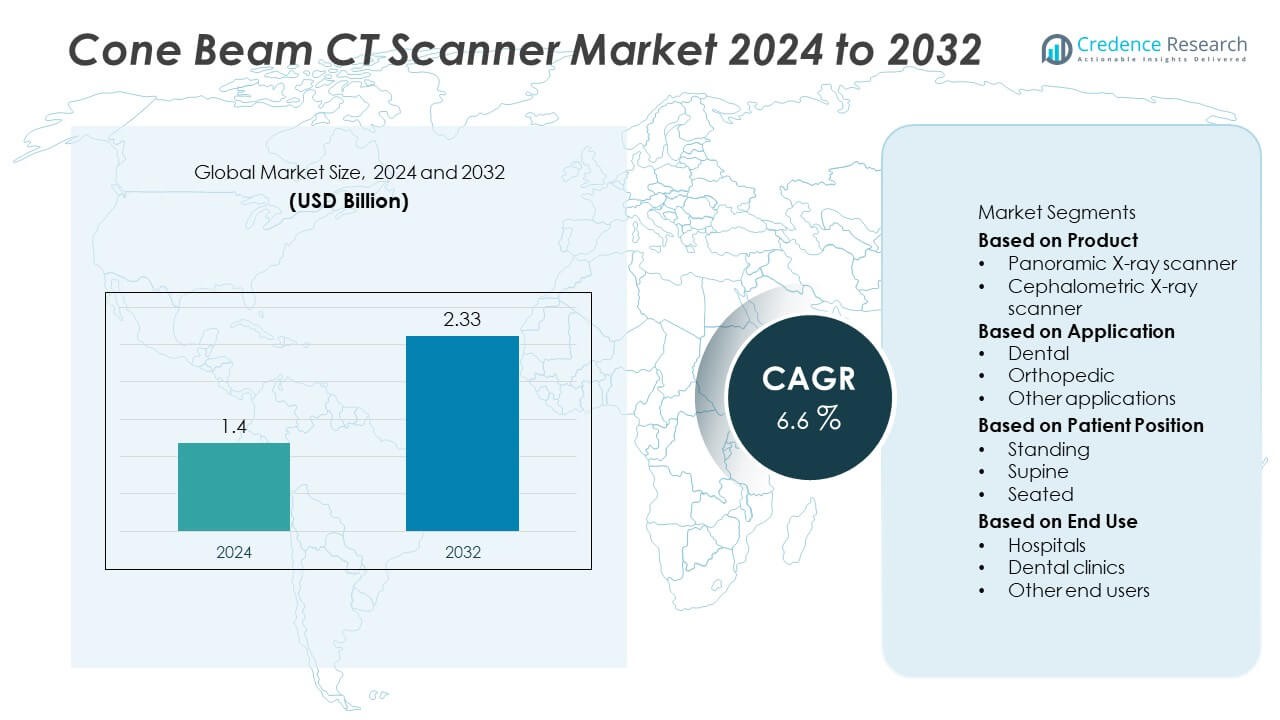

The Cone Beam CT Scanner Market was valued at USD 1.4 billion in 2024 and is projected to reach USD 2.33 billion by 2032, registering a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cone Beam CT Scanner Market Size 2024 |

USD 1.4 Billion |

| Cone Beam CT Scanner Market, CAGR |

6.6% |

| Cone Beam CT Scanner Market Size 2032 |

USD 2.33 Billion |

Top players in the Cone Beam CT Scanner market include Brainlab, AB-CT (Advanced Breast-CT), Hefei Meyer Optoelectronic Technology, CurveBeam AI, Carestream Health, Genoray, Dentsply Sirona, iCRco, Cefla Medical Equipment, and Asahi Roentgen, all focusing on advanced imaging quality, low-dose scanning, and AI-assisted diagnostics to strengthen their market positions. These companies expand portfolios with compact, clinic-friendly systems and enhanced software capabilities for dental, ENT, and orthopedic applications. Regionally, North America leads the market with a 38% share, supported by strong adoption of digital imaging technologies, while Europe follows with a 30% share, driven by increased demand for precision dentistry and low-dose imaging systems.

Market Insights

- The Cone Beam CT Scanner market reached USD 1.4 billion in 2024 and will grow at a 6.6% CAGR through 2032, driven by rising demand for advanced 3D diagnostic imaging.

- Market growth is supported by expanding dental implant procedures and orthodontic treatments, with dental applications holding a 64% segment share due to high need for precise anatomical evaluation.

- Key trends include AI-assisted diagnostics, low-dose imaging innovations, and increasing point-of-care adoption in dental and ENT clinics.

- Competition strengthens as leading manufacturers enhance imaging resolution, integrate automation tools, and expand into emerging regions through compact, cost-efficient CBCT systems.

- North America leads the global market with a 38% share, followed by Europe at 30% and Asia Pacific at 24%, while standing-position systems dominate patient positioning with a 49% share due to workflow efficiency and wide clinical compatibility.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Panoramic X-ray scanners dominated the Cone Beam CT Scanner market with a 57% share in 2024, driven by their broad use in routine dental diagnostics, implant planning, and oral pathology assessment. These scanners provide wide-field imaging with lower radiation exposure, making them a preferred choice in dental practices and imaging centers. Cephalometric X-ray scanners accounted for a 43% share, supported by growing adoption in orthodontics and maxillofacial analysis. Their capability to capture craniofacial structures accurately enhances treatment planning in orthodontic care, contributing to steady demand across specialized clinics.

- For instance, Dentsply Sirona’s Orthophos S system delivers a field of view up to 11×10 cm and uses a pulsed exposure mode that cuts radiation output by 60%, supporting safer high-resolution imaging for implant workflows.

By Application

Dental applications held the leading position with a 64% share in 2024, driven by rising dental implant procedures, orthodontic treatments, and demand for precise 3D imaging. Dentists use cone beam CT for accurate surgical planning, assessment of tooth morphology, and detection of pathological conditions. Orthopedic applications accounted for a 22% share, supported by increasing use in extremity imaging and joint evaluation. Other applications such as ENT and sinus imaging represented the remaining 14%, benefiting from improved diagnostic accuracy and lower radiation exposure compared to conventional CT.

- For instance, Carestream Health’s CS 9600 platform features automated positioning with 10 facial landmarks and supports ultra-high-resolution scans at 75 µm, which enhances accuracy during implant depth and angulation planning.

By Patient Position

Standing-position systems dominated with a 49% share in 2024, driven by their space efficiency, ease of positioning, and suitability for most dental and ENT imaging procedures. These systems offer stable image quality and support faster workflow in high-volume clinical settings. Seated-position scanners accounted for a 34% share, favored for improved patient comfort and accessibility for elderly or mobility-impaired individuals. Supine-position systems held the remaining 17% share, primarily used in advanced diagnostic settings where complete immobilization and precise anatomical evaluation are required.

KEY GROWTH DRIVERS

Rising Demand for Advanced Dental Imaging

The growing number of dental implant procedures, orthodontic treatments, and maxillofacial evaluations drives strong adoption of cone beam CT scanners. Clinics prefer CBCT technology because it delivers accurate 3D imaging with lower radiation exposure than conventional CT. Increased emphasis on early diagnosis and precise treatment planning supports wider use in routine and specialized dental practices. Expanding dental tourism and rising awareness of oral health further accelerate market growth, especially in developing regions with growing private dental clinic networks.

- For instance, Planmeca’s ProMax 3D Mid system offers an endodontic imaging mode with a selectable voxel size down to 75 µm, enabling clear visualization of root canals and cortical bone. The typical anode current for the system is in the range of 1–14 mA.

Technological Advancements Enhancing Imaging Quality

Continuous innovation in imaging software, detector technology, and AI-assisted diagnostics enhances the clinical value of cone beam CT systems. Manufacturers develop scanners with faster image processing, sharper resolution, and optimized radiation dose control. AI-powered tools support automated measurements and improved diagnostic accuracy for dental and ENT applications. These advancements streamline workflows and reduce interpretation errors, making CBCT systems more attractive to clinics aiming to improve efficiency and patient outcomes.

- For instance, Dentsply Sirona’s Axeos CBCT integrates a high-definition sensor with a voxel resolution of up to 80 µm and an Intelligent Low Dose mode which uses a dedicated filter to provide 3D images at the radiation dose of a standard 2D X-ray, thereby maintaining image sharpness while minimizing patient exposure.

Growing Adoption in ENT and Orthopedic Applications

Beyond dentistry, cone beam CT systems gain traction in ENT and orthopedic diagnostics due to their ability to capture high-resolution images of sinuses, ear structures, and extremities. Their compact design and lower operational cost compared to full-size CT scanners make them suitable for clinics seeking cost-effective imaging solutions. Faster turnaround times and improved patient comfort support broader integration in outpatient settings. This diversification of clinical applications strengthens market expansion across multiple medical specialties.

Key Trends & Opportunities

Integration of AI and Automated Diagnostic Tools

AI-driven imaging analysis is becoming a key trend in the CBCT industry. Automated detection of anatomical landmarks, bone density measurement, and pathology identification enhances diagnostic accuracy and reduces clinician workload. Clinics adopt AI-supported CBCT platforms to improve precision in orthodontics, implantology, and ENT assessments. As AI capabilities evolve, integration with cloud-based imaging systems and digital workflows will create new opportunities for streamlined operations and data-driven treatment planning.

- For instance, Planmeca’s Romexis AI module analyzes CBCT datasets to perform automatic segmentation of jaws and nerve canals, a process that significantly reduces manual tracing time in implant planning workflows compared to traditional methods.

Increasing Demand for Low-Dose and Patient-Friendly Systems

Growing awareness of radiation safety drives development of low-dose CBCT systems that maintain high imaging clarity. Manufacturers introduce optimized scan modes and advanced filtration technology to reduce exposure, particularly for children and repeat imaging cases. Demand increases for compact, ergonomic systems that improve patient comfort and reduce motion artifacts. This trend supports wider adoption in dental chains, pediatric clinics, and outpatient centers seeking safer and more accessible imaging solutions.

- For instance, J. Morita’s Veraview X800 uses an automatic dose reduction function that can cut the radiation exposure by as much as 40% in areas with lower bone density, while achieving a high resolution of 80 µm voxel size in specific small field-of-view modes.

Expansion of Point-of-Care Imaging in Clinics

Smaller, portable, and clinic-friendly CBCT units are gaining popularity as point-of-care imaging becomes a priority in dental and ENT practices. These systems eliminate the need for external imaging referrals, enabling faster diagnosis and improved patient experience. Reduced installation space and simplified operation attract private clinics and mid-sized healthcare facilities. This shift toward in-house imaging supports stronger market penetration and creates opportunities for manufacturers offering compact, high-performance scanners.

Key Challenges

High Cost of Equipment and Installation

Cone beam CT scanners require significant investment in hardware, installation, and maintenance, which limits adoption among small and mid-sized clinics. Additional costs such as shielding, software licensing, and operator training increase financial burden. Many clinics rely on financing programs or shared imaging centers, slowing independent adoption. Cost pressure is more pronounced in emerging markets where healthcare budgets remain limited. Manufacturers must address affordability through efficient designs and flexible financing solutions to widen market reach.

Limited Reimbursement and Regulatory Barriers

In several regions, reimbursement for CBCT imaging remains restricted or inconsistent, discouraging investment by healthcare providers. Regulatory approvals can also be time-consuming due to strict standards for radiation-emitting devices. These barriers delay market entry for new models and reduce adoption among clinics seeking predictable revenue streams. Differences in national regulations further complicate global expansion for manufacturers. Addressing reimbursement gaps and ensuring compliance with evolving regulatory frameworks are essential for broader market penetration.

Regional Analysis

North America

North America held a 38% share of the Cone Beam CT Scanner market in 2024, driven by strong adoption of advanced dental imaging technologies and widespread use in orthodontics, implantology, and ENT diagnostics. The region benefits from high healthcare spending, a large base of dental specialists, and rapid integration of AI-enabled imaging software. Growing demand for minimally invasive procedures supports increased use of CBCT for accurate pre-operative planning. Favorable reimbursement in select applications and expanding dental chains further strengthen market growth. The presence of leading manufacturers and strong digital health infrastructure enhances adoption across clinics and hospitals.

Europe

Europe accounted for a 30% share in 2024, supported by rising emphasis on precision dentistry, growing orthodontic treatments, and adoption of low-dose imaging technologies. Strong regulatory guidelines encourage the use of safer and more efficient diagnostic tools, accelerating replacement of conventional X-ray systems with CBCT scanners. Countries such as Germany, the U.K., and France lead adoption due to well-established dental care networks and increasing demand for implant-based treatments. Investments in digital workflows and AI-driven analysis tools further support CBCT integration across dental practices, ENT clinics, and outpatient imaging centers.

Asia Pacific

Asia Pacific captured a 24% share of the Cone Beam CT Scanner market in 2024, driven by rapid growth in dental tourism, expanding private dental clinics, and rising awareness of early oral disease diagnosis. China, Japan, South Korea, and India show strong uptake due to improving healthcare infrastructure and increased focus on advanced 3D imaging. Growing disposable incomes and demand for cosmetic dentistry further boost adoption of CBCT systems. The region also benefits from local manufacturing capabilities and cost-effective product offerings, making advanced imaging more accessible to mid-sized practices and hospitals.

Latin America

Latin America held a 5% share in 2024, supported by growing dental implant procedures, rising orthodontic care demand, and expanding private dental networks. Countries such as Brazil and Mexico lead adoption as clinics modernize equipment and enhance diagnostic accuracy. Increased training programs and partnerships with global imaging manufacturers help improve clinician familiarity with CBCT technology. Despite budget constraints in public healthcare, the private sector drives market growth. Growing medical tourism and demand for high-quality dental treatments further support the expansion of CBCT systems across key regional markets.

Middle East & Africa

The Middle East & Africa region recorded a 3% share in 2024, driven by improving dental care infrastructure and rising investment in advanced diagnostic technologies. Countries such as the UAE and Saudi Arabia lead adoption due to strong private healthcare spending and growing interest in cosmetic dentistry. Clinics increasingly adopt CBCT for precise implant planning and ENT evaluations. In Africa, adoption remains limited but is gradually rising with expansions in private dental services and international partnerships. Continued investment in healthcare modernization creates long-term potential for CBCT penetration across the region.

Market Segmentations:

By Product

- Panoramic X-ray scanner

- Cephalometric X-ray scanner

By Application

- Dental

- Orthopedic

- Other applications

By Patient Position

By End Use

- Hospitals

- Dental clinics

- Other end users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Cone Beam CT Scanner market features key players such as Brainlab, AB-CT (Advanced Breast-CT), Hefei Meyer Optoelectronic Technology, CurveBeam AI, Carestream Health, Genoray, Dentsply Sirona, iCRco, Cefla Medical Equipment, and Asahi Roentgen. These companies enhance competitiveness by developing high-resolution imaging systems, low-dose technologies, and AI-enabled diagnostic tools that support precise clinical decision-making. Many manufacturers focus on compact, workflow-friendly designs to meet the needs of dental clinics, ENT centers, and outpatient facilities. Strategic initiatives include product launches, partnerships with imaging software providers, and expansion into emerging markets with cost-effective systems. Companies also strengthen after-sales service networks and offer integrated digital platforms to improve practice efficiency. As demand for accurate 3D imaging rises across dental, orthopedic, and ENT applications, competition intensifies with ongoing innovation in software automation, radiation dose optimization, and multi-modality integration.

Key Player Analysis

- Brainlab

- AB-CT (Advanced Breast-CT)

- Hefei Meyer Optoelectronic Technology

- CurveBeam AI

- Carestream Health

- Genoray

- Dentsply Sirona

- iCRco

- Cefla Medical Equipment

- Asahi Roentgen

Recent Developments

- In July 2024, CurveBeam AI received FDA 510(k) clearance for an enhanced X-ray source for its HiRise system, enabling improved image quality in larger patients.

- In April 2024, CurveBeam AI launched a new Cone-Beam CT Imaging Orthopedics Course approved for ASRT continuing education credits.

- In March 2024, CurveBeam AI announced that the first personalized knee replacement procedure was planned using its HiRise weight-bearing CBCT system.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Patient Position, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for 3D dental imaging will rise as implant and orthodontic procedures continue to increase.

- AI-driven diagnostic tools will enhance accuracy and reduce interpretation time for clinicians.

- Low-dose CBCT systems will gain traction as radiation safety becomes a stronger priority.

- Compact and portable scanners will see higher adoption in small clinics and outpatient centers.

- Integration with digital workflows and cloud-based imaging platforms will streamline clinical operations.

- ENT and orthopedic applications will expand, supporting broader use beyond dental practices.

- Manufacturers will focus on improving image resolution and faster processing capability.

- Emerging markets in Asia Pacific and Latin America will adopt CBCT systems as healthcare infrastructure modernizes.

- Advanced software automation will support precise surgical planning and real-time assessment.

- Strategic partnerships between imaging companies and dental chains will accelerate global deployment.