Market Overview

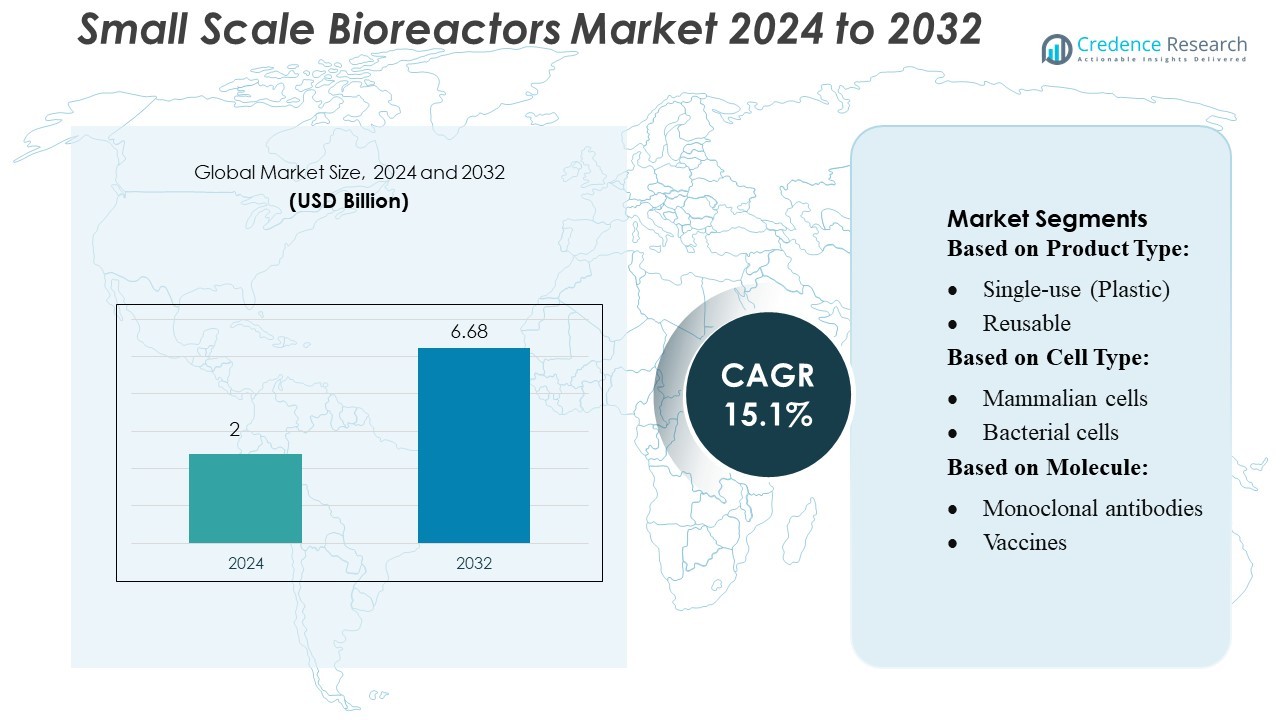

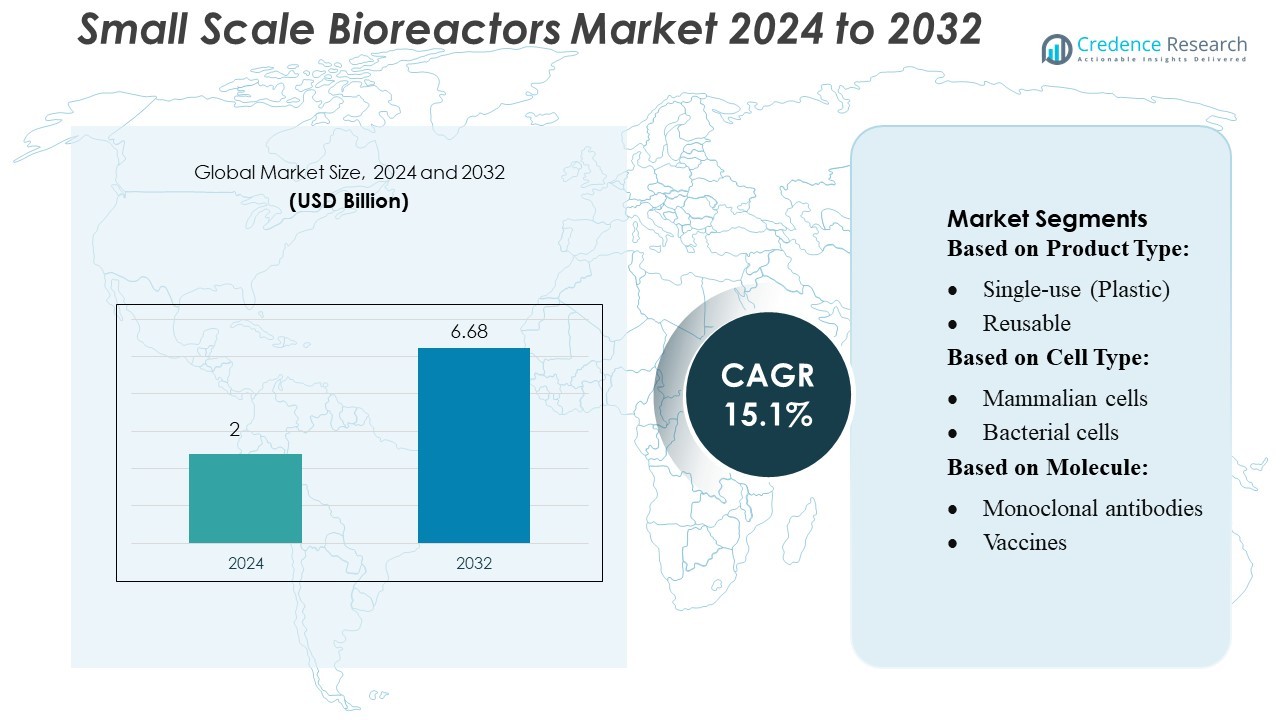

Small Scale Bioreactors Market size was valued USD 2 billion in 2024 and is anticipated to reach USD 6.68 billion by 2032, at a CAGR of 15.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Small Scale Bioreactors Market Size 2024 |

USD 2 Billion |

| Small Scale Bioreactors Market, CAGR |

15.1% |

| Small Scale Bioreactors Market Size 2032 |

USD 6.68 Billion |

The Small-Scale Bioreactors market is highly competitive, with major players such as Sartorius AG, Thermo Fisher Scientific Inc., Merck KGaA, Danaher Corporation, Eppendorf AG, Infors AG, Solida Biotech GmbH, LAMBDA Instruments GmbH, Getinge AB, and DONALDSON ITALIA S.R.L. (Solaris Biotechnology Srl) driving innovation and market expansion. These companies differentiate on features such as single-use technologies, advanced automation, and integrated sensor solutions for real-time monitoring. North America leads the regional market, commanding approximately 45.73 % of the global small-scale bioreactor market as of 2024, supported by strong R&D infrastructure and robust biopharmaceutical investment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Small Scale Bioreactors Market reached USD 2 billion in 2024 and is projected to hit USD 6.68 billion by 2032, advancing at a strong CAGR of 15.1%, driven by rapid biologics development and rising demand for flexible R&D systems.

- Growing adoption of single-use technologies and advanced automation continues to accelerate market expansion, as biopharma labs prioritize faster turnaround, reduced contamination risk, and enhanced process control.

- Intense competition among leading players, including Sartorius, Thermo Fisher, Merck, Danaher, Eppendorf, and others, is strengthening innovation in integrated sensors, data-rich platforms, and modular bioprocessing solutions.

- High equipment and consumable costs act as a restraint, particularly for small research facilities, limiting adoption of premium automated and high-throughput systems in cost-sensitive regions.

- North America remains the leading regional market with 45.73% share, supported by strong R&D investment, while the single-use bioreactor segment dominates globally with the highest share due to its scalability and operational efficiency.

Market Segmentation Analysis:

By Product Type

Single-use bioreactors dominate the small-scale bioreactors market with an estimated market share of around 60–65%, driven by their operational flexibility, reduced contamination risk, and elimination of cleaning validation. Their rapid adoption in R&D and early-stage bioprocess development supports accelerated timelines for biologics and cell-based therapies. The growth is further supported by increased demand for modular, scalable systems that enable process intensification and seamless technology transfer. Reusable systems remain relevant in long-term, high-volume academic and industrial setups, but slower turnaround and higher maintenance limit their share.

- For instance, Infors AG’s Multifors 2 system supports up to 6 parallel vessels, each with working volumes of 320 mL to 1,000 mL, enabling modular, scalable experimentation with consistent sensor technology.

By Cell Type

Mammalian cell–based bioreactors lead this segment with an approximate market share of 55–60%, supported by their essential role in producing complex biologics such as monoclonal antibodies, viral vectors, and recombinant proteins. Their dominance stems from the strong pipeline of cell- and gene-therapy products, which require high-fidelity expression systems and controlled small-scale optimization. Bacterial and yeast cells remain vital in fermentation-based applications and enzyme production, but their lower process complexity and broader availability place them behind mammalian platforms in high-value biopharmaceutical R&D.

- For instance, Merck’s Mobius® 3 L bench-scale single-use bioreactor (designed for mammalian cells) offers a volumetric mass-transfer coefficient (kₗₐ) of up to 7.5 h⁻¹, as characterized in their application note, ensuring efficient oxygen delivery for high-density CHO cultures.

By Molecule

Monoclonal antibodies (mAbs) represent the dominant molecule segment, holding roughly 50–55% market share, driven by expanding therapeutic applications in oncology, autoimmune disorders, and infectious diseases. Small-scale bioreactors enable precise process development, clone screening, and upstream optimization essential for mAb production. Vaccines also represent a high-growth segment, particularly with the increasing need for rapid prototyping of viral vectors, mRNA platforms, and recombinant vaccine candidates. However, the larger commercial focus on mAbs and their higher development volumes ensure they remain the leading molecule type in small-scale bioreactor usage.

Key Growth Drivers

- Expansion of Biologics and Cell Therapy Pipelines

The rapid growth of biologics, including mAbs, recombinant proteins, and advanced cell therapies, drives strong demand for small-scale bioreactors. Biopharmaceutical companies increasingly rely on these systems for early-stage process development, clone selection, and high-throughput screening. Their ability to simulate large-scale conditions with high precision accelerates development timelines and improves process scalability. Rising investment in regenerative medicine, viral-vector manufacturing, and personalized therapies further strengthens adoption, as small-scale bioreactors offer the flexibility and control required for complex biological systems.

- For instance, Solida Biotech GmbH has developed its BIO-BOOK Compact bioreactor series with vessels starting at 100 mL working volume up to 50 L, enabling highly flexible early-stage screening.

- Increased Adoption of Single-use Technologies

The rising shift toward single-use bioreactors significantly propels market growth, supported by operational efficiency, reduced contamination risk, and lower upfront costs. These systems eliminate the need for cleaning validation and enable faster changeover, making them ideal for multi-product facilities and contract development organizations. Their modular design also enhances scalability and process intensification. As biopharma companies embrace agile manufacturing strategies and decentralized R&D models, single-use platforms offer the responsiveness and cost-effectiveness required to accelerate bioprocess development.

- For instance, Eppendorf AG’s BioBLU c single-use stirred-tank bioreactors cover working volumes from 100 mL up to 40 L, enabling a 400-fold scalable cell expansion with their rigid-walled vessels.

- Advancements in Automation and Process Analytical Technologies (PAT)

Growing integration of automation, real-time monitoring, and PAT tools drives adoption as companies prioritize data-rich development environments. Modern small-scale bioreactors equipped with automated control systems, advanced sensors, and digital twin capabilities enable superior process optimization and reproducibility. These technologies enhance experimental throughput, minimize human error, and support quality-by-design (QbD) frameworks. As regulatory expectations for process traceability and analytical rigor increase, automated small-scale systems become indispensable for compliant and efficient upstream development.

Key Trends & Opportunities

- Rising Demand for High-throughput and Parallel Bioreactor Systems

An increasing emphasis on rapid molecule screening and accelerated process development fuels demand for high-throughput, parallel small-scale bioreactor platforms. These systems allow researchers to execute dozens of experiments simultaneously with consistent environmental control, significantly reducing development timelines. The trend supports optimization workflows in mAb development, media formulation, and cell-line engineering. As precision biologics and personalized medicines gain traction, the need for faster, more efficient screening platforms creates strong opportunities for automated microscale and mini bioreactor solutions.

- For instance, LAMBDA Instruments GmbH’s MINIFOR benchtop bioreactor supports working volumes from 35 mL up to 6 L, enabling highly parallel configurations with very small footprint (22 × 38 × 40 cm per unit).

- Growth of Continuous and Intensified Bioprocessing

Continuous bioprocessing and intensified upstream operations present a major opportunity, with small-scale bioreactors serving as essential test beds for perfusion strategies and high-density cultures. Developers increasingly explore intensified processes to improve productivity, reduce footprint, and enable flexible manufacturing. Small-scale systems with integrated sensors and enhanced control support early-stage evaluation of continuous operations. As industry adoption shifts toward smaller, multiproduct facilities, demand for small-scale bioreactors capable of simulating continuous processes continues to strengthen.

- For instance, Danaher Corporation, through its Cytiva subsidiary, offers a perfusion platform capable of cell-specific perfusion rates of 20 pL/(cell·day), as demonstrated in their Xcellerex XDR bioreactor application notes coupled with automated perfusion control.

- Expansion in Academic and Contract Development Organizations (CDOs)

Rising collaborations between biopharma companies, academia, and CDOs create new opportunities for small-scale bioreactor suppliers. Academic institutes increasingly adopt small-scale systems for training, fundamental research, and synthetic biology applications. CDOs use these platforms to deliver rapid, cost-effective development support for startups and mid-sized biotech firms. The increasing outsourcing of early-stage development and the proliferation of innovation hubs globally expand the user base for compact, flexible bioreactor systems.

Key Challenges

- High Cost of Advanced Automated Systems

Despite their advantages, advanced small-scale bioreactors equipped with automation, PAT tools, and integrated analytics remain expensive for small biotech firms and academic users. High acquisition and maintenance costs limit accessibility, especially for high-throughput or multi-parallel configurations. Budget constraints in academic and early-stage R&D environments also delay procurement decisions. These cost barriers hinder widespread adoption, particularly in emerging markets where capital investment capabilities are lower, slowing overall market penetration.

- Scalability Limitations and Variability Across Platforms

Ensuring seamless scalability from small-scale to pilot and production-scale bioreactors remains a challenge due to differences in mixing, oxygen transfer, shear stress, and control strategies. Variability between brands and formats can lead to inconsistencies during scale-up and technology transfer. These issues increase development complexity and require additional validation work, extending timelines. The lack of universal standardization in small-scale bioreactor design further complicates reproducibility, making it difficult for companies to streamline end-to-end bioprocess development.

Regional Analysis

North America

North America leads the small scale bioreactors market with about 46% share, driven by strong biopharmaceutical R&D activity and widespread adoption of single-use technologies. The region benefits from advanced research institutions, well-funded biotech startups, and a high concentration of CDMOs. The U.S. remains the core growth engine, supported by expanding biologics pipelines and early-stage process development needs. Government support for cell and gene therapy development further strengthens demand for small, flexible bioreactor systems.

Europe

Europe holds roughly 30% of the market, supported by mature biotechnology ecosystems in Germany, the UK, France, and Switzerland. Strong regulatory standards, extensive biosimilars development, and investments in academic and industrial bioprocessing research fuel adoption. European CDMOs increasingly rely on small scale bioreactors for optimization and scale-down modeling. Continued EU funding and national biotech initiatives help expand capacity while promoting process innovation and high-quality biologics manufacturing across the region.

Asia-Pacific

Asia-Pacific represents one of the fastest-growing regions, accounting for around 20–25% of the market. Rapid expansion of biologics manufacturing in China, India, South Korea, and Japan drives strong demand for small scale bioreactors. Government support for biotech innovation, lower operating costs, and the rise of regional CDMOs contribute to accelerated adoption. The focus on vaccines, biosimilars, and cell therapy research strengthens opportunities for single-use and modular systems across the region.

Latin America

Latin America holds a smaller 5–7% share but is gradually expanding due to increasing biotechnology activity in Brazil, Mexico, and Argentina. Growing interest in biosimilars manufacturing and academic research drives incremental adoption of small scale bioreactors. While infrastructure and technical limitations slow the pace, government initiatives and collaborations with global biotech companies are helping build capacity. The region shows potential as investments in training and early-stage biologics development increase.

Middle East & Africa

The Middle East & Africa accounts for approximately 3–5% of the market, supported by emerging biotech investments in the Gulf countries and South Africa. Growth is driven by efforts to strengthen healthcare manufacturing capabilities, pilot bioprocessing facilities, and academic research programs. Although the region faces challenges such as limited technical expertise, rising government funding and collaborations with international bioprocessing companies are helping accelerate adoption of small scale bioreactors.

Market Segmentations:

By Product Type:

- Single-use (Plastic)

- Reusable

By Cell Type:

- Mammalian cells

- Bacterial cells

By Molecule:

- Monoclonal antibodies

- Vaccines

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Small-Scale Bioreactors Market features a diverse mix of global leaders and specialized innovators, including Infors AG, Merck KGaA, Solida Biotech GmbH, Eppendorf AG, LAMBDA Instruments GmbH, Danaher Corporation, Sartorius AG, Getinge AB, Thermo Fisher Scientific Inc., and DONALDSON ITALIA S.R.L. (Solaris Biotechnology Srl). the Small-Scale Bioreactors Market is defined by rapid technological innovation, increased automation, and expanding adoption of single-use bioprocessing systems. Companies compete by offering platforms that deliver higher precision, improved culture monitoring, and seamless scalability from R&D to pilot-scale production. Advanced control software, integrated sensors, and real-time data analytics have become central differentiators, enabling users to optimize process efficiency and reproducibility. Market participants also prioritize modular system designs that support diverse cell lines and applications, strengthening their appeal across biopharmaceutical development, vaccine production, and academic research. Strategic collaborations, expanded service portfolios, and regional manufacturing investments further intensify competition, as vendors aim to enhance operational flexibility and reduce time-to-market for emerging biologics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Infors AG

- Merck KGaA

- Solida Biotech GmbH

- Eppendorf AG

- LAMBDA Instruments GmbH

- Danaher Corporation

- Sartorius AG

- Getinge AB

- Thermo Fisher Scientific Inc.

- DONALDSON ITALIA S.R.L.

Recent Developments

- In April 2025, Thermo Fisher Scientific introduced the 5L DynaDrive Single-Use Bioreactor, a benchtop solution to improve scalability and efficiency in bioprocess development. Designed for use by large biopharmaceutical companies, CDMOs, and emerging biotech firms, the system enables seamless scale-up from 1 to 5,000 liters, facilitating cost-effective progression from laboratories to commercial manufacturing.

- In April 2025, AGC Biologics announced it would equip its new Yokohama, Japan facility with two 5,000 L Thermo Scientific DynaDrive Single-Use Bioreactors to enhance its large-scale mammalian biologics production capabilities.

- In November 2024, Lonza completed its first Good Manufacturing Practice (GMP) product batch at its new mammalian manufacturing facility in Portsmouth, New Hampshire. This facility is designed for small- to mid-scale biologics production, particularly for rare disease treatments, and is equipped with a 2,000L single-use bioreactor system.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Cell Type, Molecule and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt single-use bioreactors to improve flexibility and reduce contamination risks.

- Automation and advanced control software will strengthen process consistency and enable real-time optimization.

- Demand for high-throughput small-scale systems will grow as biologics R&D pipelines expand globally.

- Integration of data analytics and AI tools will enhance predictive monitoring and experimental accuracy.

- Modular and scalable platforms will gain traction to support seamless transition from lab-scale to pilot-scale production.

- Rising interest in continuous bioprocessing will drive innovation in compact perfusion-enabled bioreactors.

- Academic and research institutions will increase investments in benchtop bioreactors to accelerate early-stage development.

- Renewable and sustainable materials will see greater adoption in single-use consumables.

- Emerging markets will expand their bioprocessing infrastructure, boosting demand for cost-efficient small-scale systems.

- Collaborations between equipment providers and biopharma companies will intensify to co-develop application-specific solutions.