Market Overview

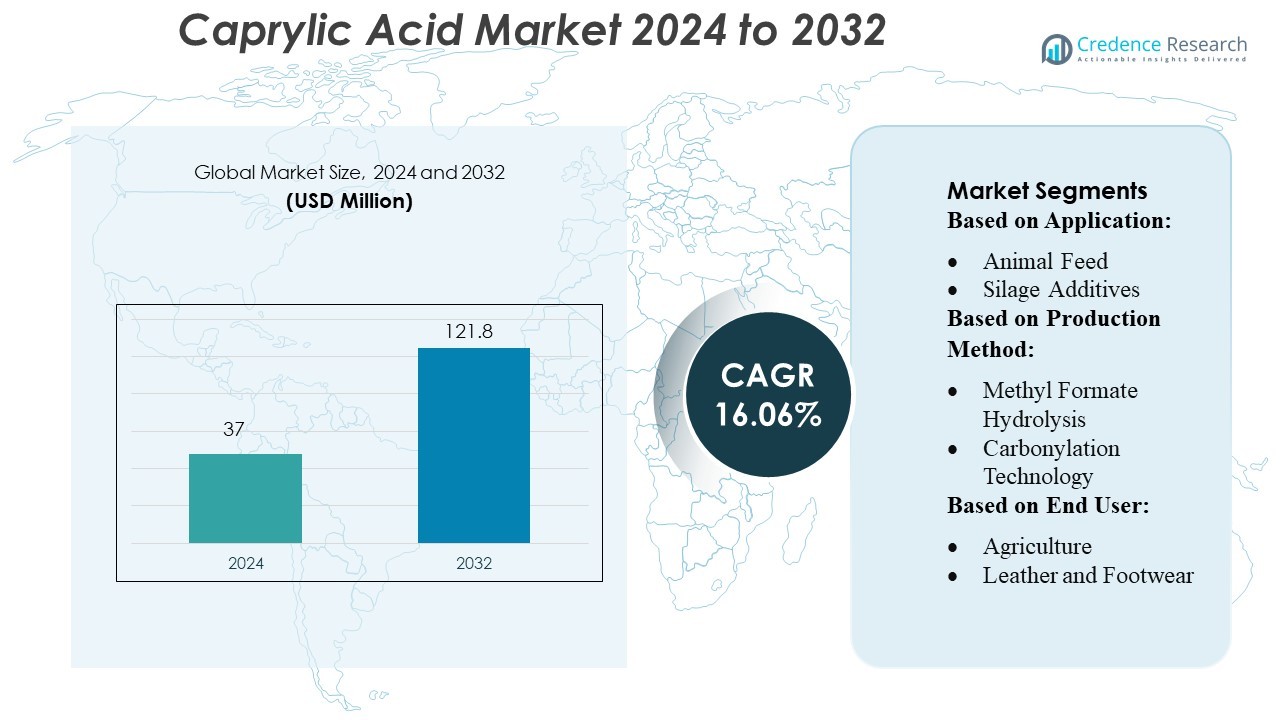

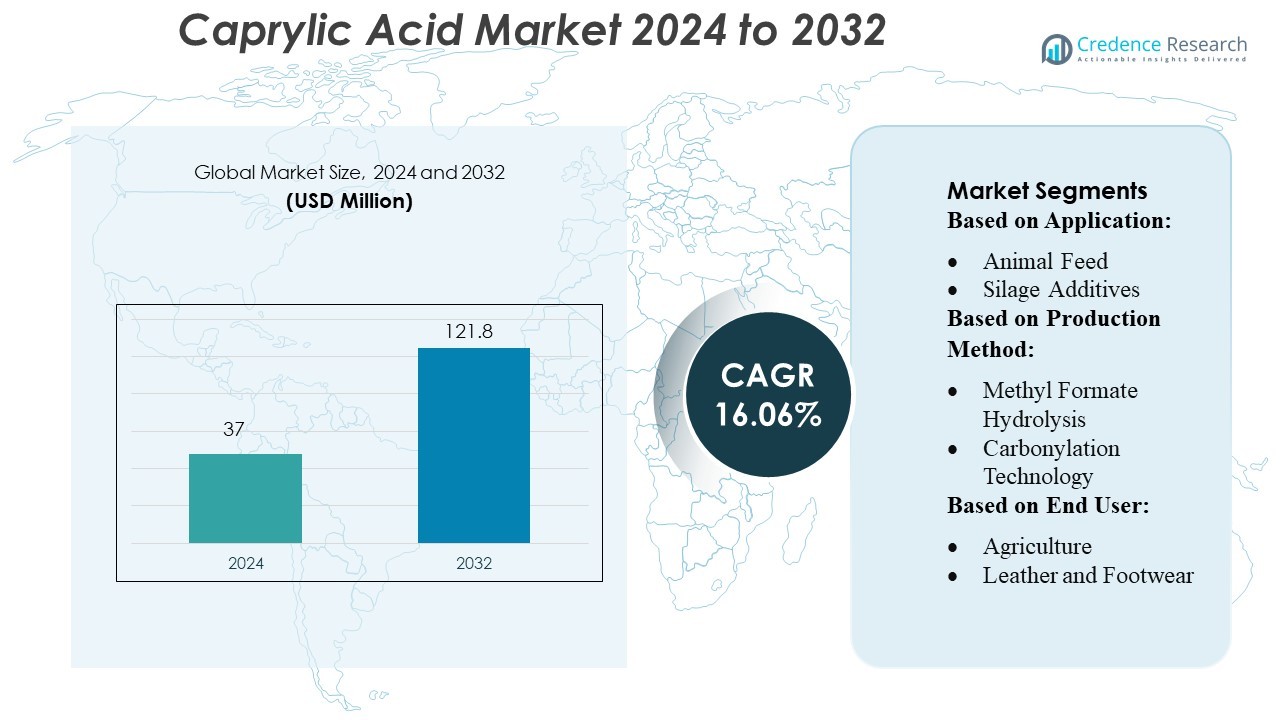

Caprylic Acid Market size was valued USD 37 million in 2024 and is anticipated to reach USD 121.8 million by 2032, at a CAGR of 16.06% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Caprylic Acid Market Size 2024 |

USD 37 Million |

| Caprylic Acid Market, CAGR |

16.06% |

| Caprylic Acid Market Size 2032 |

USD 121.8 Million |

The Caprylic Acid Market is highly competitive, with key players including Temix Oleo Srl, Emery Oleochemicals, Musim Mas Group, Pacific Oleochemicals, Oleon NV, P & G Chemicals, Wilmar International Ltd., VVF L.L.C., KLK OLEO, and PT. Ecogreen Oleochemicals driving innovation and capacity expansion. These companies leverage integrated oleochemical value chains, sustainability initiatives, and advanced processing technologies to maintain their leadership. The Asia-Pacific region emerges as the dominant market, holding approximately 42% of the global share, thanks to its strong manufacturing base, abundant raw material supply, and rising demand from food, personal care, and pharmaceutical sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Caprylic Acid Market reached USD 37 million in 2024 and is projected to attain USD 121.8 million by 2032, growing at a CAGR of 16.06%, supported by rising demand across food, nutraceutical, and personal care sectors.

- Market drivers strengthen as industries increasingly adopt natural antimicrobials, MCT-based formulations, and bio-derived fatty acids to improve product functionality and meet clean-label expectations.

- Emerging trends highlight accelerated investment in sustainable oleochemical processing, higher-purity grades, and improved extraction technologies that enhance efficiency and broaden application potential.

- Competitive intensity remains high as major players expand production capabilities, integrate supply chains, and innovate in formulation performance while addressing constraints such as raw-material price volatility and regulatory compliance.

- Regional analysis shows Asia-Pacific holding 42% of the market, driven by strong manufacturing ecosystems and raw material availability, while the food and beverage segment represents the leading share due to widespread use of caprylic acid in preservation and functional nutrition.

Market Segmentation Analysis:

By Application

The application segment of the caprylic acid market is led by the animal feed and silage additives sub-segment, which holds the dominant share due to its extensive use in enhancing feed digestibility and inhibiting microbial growth. Demand rises as livestock producers adopt medium-chain fatty acids to improve gut health and reduce antibiotic dependence. Leather tanning represents the next significant application, driven by its role as a natural preservative and conditioning agent. Additional uses in food flavoring, disinfectants, and personal care support broader market penetration, but animal feed remains the primary growth engine due to consistent consumption across agricultural economies.

- For instance, Temix Oleo Srl has a production plant in Calderara di Reno, Italy, with an annual production capacity of 50,000 tonnes of fatty acids. This capacity enables the company to supply significant volumes of fatty acids and derivatives, including specific short-chain and long-chain fatty acids, to various industrial sectors, including the feed-additive sector.

By Production Method

Methyl formate hydrolysis represents the dominant production method in the caprylic acid market, capturing the largest share owing to its higher yield efficiency and cost-effectiveness compared to alternative processes. This method benefits from stable raw material availability and scalable operations, making it the preferred choice among major manufacturers. Carbonylation technology follows, supported by advancements in catalytic systems that improve conversion rates. Other production pathways contribute marginally, primarily in specialized or small-scale facilities. The dominance of methyl formate hydrolysis is reinforced by its optimized reaction control and lower operational complexity.

- For instance, Emery Oleochemicals operates a specialty oleochemicals facility in the U.S. with a nameplate capacity of 48 000 tonnes per year, as disclosed in its 2022 annual report, which underpins its efficient use of methyl formate feedstock.

By End-User

Agriculture emerges as the leading end-user segment in the caprylic acid market, holding the highest market share due to strong utilization in animal nutrition, silage preservation, and crop protection formulations. Rising livestock production and shifting preferences toward natural feed additives drive sustained demand. The leather and footwear industry follows, leveraging caprylic acid’s antimicrobial and softening properties in tanning and finishing processes. Additional end-users include food processing, pharmaceuticals, and personal care, each adopting caprylic acid for its functional benefits. However, agriculture continues to dominate due to consistent consumption volumes and broad applicability.

Key Growth Drivers

Rising Demand for Medium-Chain Triglycerides (MCTs)

The growing use of medium-chain triglycerides in dietary supplements, functional foods, and personal nutrition drives caprylic acid consumption. Manufacturers increase MCT production to meet demand for clean-label, energy-boosting formulations, as caprylic acid serves as a key component due to its rapid metabolization. The fitness, clinical nutrition, and weight-management sectors integrate MCT-based ingredients into powders, beverages, and medical foods, supporting sustained uptake. Expanding applications in sports nutrition and therapeutic diets further strengthen market growth.

- For instance, Musim Mas Group manufactures MCTs under its MASESTER® brand, offering grades with 99%, 98%, 95%, 70%, and 60% caprylic acid (C8) according to its product specifications.

Expanding Use in Personal Care and Cosmetics

The cosmetics sector increasingly incorporates caprylic acid-based esters and derivatives due to their emollient properties, stability, and compatibility with natural formulations. Brands shift toward plant-derived and skin-friendly ingredients, positioning caprylic acid as a preferred component in moisturizers, cleansers, sunscreens, and anti-aging products. Its ability to enhance texture and product spreadability contributes to wide adoption. Rising consumer interest in organic and multifunctional personal care solutions, along with product innovation from global cosmetic manufacturers, supports ongoing growth across mature and emerging markets.

- For instance, Pacific Oleochemicals, Sdn. Bhd. operates its Pasir Gudang plant with the KORTACID series including the C8–C10 fraction (caprylic/capric acid blend) (CAS 68937-75-7) as part of its portfolio.

Growing Application in Pharmaceuticals and Antimicrobial Solutions

Pharmaceutical formulations rely on caprylic acid for its antimicrobial and antifungal efficacy, boosting its use in drug delivery systems and topical treatments. Its stability and compatibility with active pharmaceutical ingredients encourage adoption in capsules, oral liquids, ointments, and preservative systems. Increasing demand for safe, broad-spectrum antimicrobial agents in clinical environments further accelerates usage. Manufacturers leverage caprylic acid in formulations targeting Candida management and gut health, strengthening its presence in nutraceuticals, functional therapies, and preventive healthcare applications.

Key Trends & Opportunities

Shift Toward Bio-based Raw Materials

Rising emphasis on sustainability encourages manufacturers to use bio-based feedstocks derived from renewable sources such as coconut and palm kernel oil. This transition aligns with corporate sustainability commitments and regulatory support for low-impact chemical production. Companies explore cleaner extraction technologies, boosting efficiency while minimizing emissions. These advancements create opportunities for suppliers offering certified, traceable, and eco-friendly caprylic acid grades. Demand from cosmetic and food industries for naturally sourced inputs strengthens the market’s shift toward greener alternatives.

- For instance, Oleon NV reports that over 95% of its raw materials are renewable, underscoring its bio-based chemical strategy. It achieved 100% traceability to palm oil mills in 2024, along with 72 % traceability to plantations, supported by third-party satellite monitoring.

Innovation in High-Purity and Specialty Grades

Producers increasingly invest in advanced purification techniques to deliver high-purity caprylic acid grades tailored for pharmaceuticals, electronics, and specialty applications. These refined variants offer improved stability, low odor, and enhanced performance, attracting manufacturers seeking precise formulation requirements. Innovations in fractionation and enzymatic processing enable consistent quality and tighter specifications. Such advancements open new revenue avenues, particularly in medical nutrition, controlled-release formulations, and high-performance personal care products, where ingredient consistency and compliance are critical.

- For instance, P & G Chemicals offers a suite of fatty acids including C-895, C-898, and C-899, which correspond to caprylic acid (C8) cuts with specifications designed for high-purity use.

Rising Adoption in Food Preservation and Safety

The food industry identifies caprylic acid as an effective natural antimicrobial agent for extending shelf life and enhancing safety—especially in dairy, meat, and ready-to-eat products. As consumer demand for clean-label preservatives grows, caprylic acid-based solutions offer a compelling alternative to synthetic additives. Manufacturers increasingly develop blends and formulations that meet regulatory standards while improving flavor retention and microbial control. This trend presents significant growth potential for suppliers targeting natural food preservation markets globally.

Key Challenges

Volatility in Raw Material Prices

The market relies heavily on coconut and palm kernel oil as primary feedstocks, making caprylic acid production highly sensitive to agricultural fluctuations. Climate variations, supply chain disruptions, and geopolitical constraints affect crop availability and pricing. This volatility increases production costs and affects manufacturers’ ability to maintain consistent pricing for downstream industries. Companies must optimize sourcing strategies and explore diversified feedstocks to mitigate financial risk, but cost unpredictability continues to challenge market stability.

Regulatory and Environmental Compliance Constraints

Strict regulations regarding sustainable sourcing, chemical handling, and environmental impact pose challenges for producers. Compliance with global standards—such as REACH, FDA guidelines, and eco-certification norms—requires continuous investment in process upgrades, documentation, and quality control. Additionally, growing scrutiny of palm-derived ingredients pressures manufacturers to demonstrate responsible sourcing practices. These requirements increase operational complexity, raise production costs, and limit market entry for smaller players, slowing growth in certain regions.

Regional Analysis

North America

North America holds a significant share of the caprylic acid market, accounting for around 32%, driven by the strong presence of food processing, nutraceutical, and personal care industries. The region actively adopts medium-chain triglyceride (MCT) formulations across dietary supplements and functional foods. Growing consumer preference for clean-label ingredients strengthens demand from manufacturers seeking natural antimicrobial agents. The U.S. dominates regional uptake due to advancements in formulation technologies and expanding health-focused product portfolios. Regulatory support for safe fatty acid applications also enhances market penetration. Overall, North America continues to maintain substantial growth momentum through diversified end-use consumption.

Europe

Europe represents approximately 27% of the global caprylic acid market, supported by stringent quality standards and increasing demand for plant-based, sustainable chemical ingredients. The region’s cosmetics and personal care sectors adopt caprylic acid for emulsification, stabilization, and antimicrobial functions in premium formulations. Germany, France, and the U.K. lead consumption with strong R&D activity and emphasis on eco-friendly ingredients. Rising interest in natural preservatives across food and beverage applications further boosts adoption. The region’s evolving regulatory landscape encourages the shift toward bio-based fatty acids, enhancing the market’s long-term stability and reinforcing Europe’s position as a key consumer.

Asia-Pacific

Asia-Pacific constitutes the largest share at roughly 36%, fueled by expanding industrial manufacturing, rising health awareness, and high-volume production of oleochemicals. China and India drive significant demand due to their growing dietary supplement, pharmaceutical, and personal care industries. Increasing consumption of MCT-based nutrition products and functional foods further elevates caprylic acid usage. The region benefits from strong raw material availability, cost-efficient production capabilities, and rapid urbanization. Rising adoption of natural antimicrobial agents by local manufacturers strengthens market expansion. Asia-Pacific continues to dominate global supply and consumption, supported by steady industrialization and growing export competitiveness.

Latin America

Latin America holds about 9% of the caprylic acid market, supported by increasing demand from food processing, agriculture, and personal care segments. Brazil and Mexico lead regional consumption as manufacturers incorporate caprylic acid in food preservatives, animal feed formulations, and cosmetic products. The growing adoption of natural and plant-derived ingredients aligns with rising consumer awareness of product safety and quality. Expanding agricultural activities also drive usage in livestock nutrition and microbial control solutions. Although the region faces import dependency for oleochemicals, improving supply chains and industrial diversification continue to strengthen its role in the global market.

Middle East & Africa (MEA)

The Middle East & Africa accounts for around 6% of the caprylic acid market, driven by emerging applications in food preservation, cosmetics, and healthcare formulations. The region experiences rising consumer interest in high-quality personal care products, pushing manufacturers to adopt natural fatty acids for emulsification and antimicrobial purposes. South Africa and the UAE represent leading markets due to growing retail and manufacturing capabilities. Increasing utilization of caprylic acid in livestock feed and agricultural solutions further supports demand. Although MEA remains a developing market, evolving industrial sectors and expanding imports contribute to steady market growth.

Market Segmentations:

By Application:

- Animal Feed

- Silage Additives

By Production Method:

- Methyl Formate Hydrolysis

- Carbonylation Technology

By End User:

- Agriculture

- Leather and Footwear

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Caprylic Acid Market features prominent players such as Temix Oleo Srl, Emery Oleochemicals, Musim Mas Group, Pacific Oleochemicals Sdn. Bhd., Oleon NV, P & G Chemicals, Wilmar International Ltd., VVF L.L.C., KLK OLEO, and PT. Ecogreen Oleochemicals. The Caprylic Acid Market remains highly dynamic, characterized by strong emphasis on manufacturing efficiency, product purity, and sustainable sourcing practices. Companies compete through advancements in oleochemical processing technologies, particularly in high-purity medium-chain triglycerides tailored for food, nutraceutical, and personal care applications. The market also witnesses growing investment in bio-based production routes, driven by global demand for natural ingredients and compliance with evolving regulatory standards. Producers focus on optimizing cost structures, expanding production capacities, and strengthening distribution networks to enhance global reach. Innovation in antimicrobial, emulsifying, and stabilizing functionalities further differentiates product offerings. Additionally, strategic collaborations, backward integration into raw material sourcing, and continuous R&D investments enable manufacturers to improve quality consistency and operational flexibility. Overall, competition remains intense as market participants seek to balance sustainability, performance, and scalability to capture emerging opportunities across diverse end-use sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, BASF launched its formic acid on the eAuction digital platform, which allows customers to streamline procurement, get market insights, and track auctions in real-time. This move is part of BASF’s strategy to be a preferred partner for sustainable intermediates and enhance customer experience through efficient digital tools.

- In October 2024, BioVeritas established operations to create sustainable fuels together with biochemical. Through bacterial fermentation, the process transforms biomass into both caproic acid and multiple volatile fatty acids.

- In July 2024, Re’equil announced the launch of the serum is formulated with 1% Encapsulated Salicylic Acid (BHA) and 5% Granactive ACNE (a bioactive peptide) as its key ingredients to treat acne and regulate sebum production.

- In April 2024, Wild Biome launched a two-part supplement system, Detoxification and Repopulation, developed for leaky gut syndrome and its associated issues in dogs. For Detoxification, the MCT-3 Oil supplement is designed to detoxify the gut microbiome, targeting the overgrowth of yeast with its concentration of caprylic acid.

Report Coverage

The research report offers an in-depth analysis based on Application, Production Method, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as demand rises for natural and clean-label ingredients across food, nutraceutical, and cosmetic applications.

- Manufacturers will increasingly adopt bio-based and sustainable production methods to align with global environmental standards.

- Rising interest in medium-chain triglycerides will strengthen the use of caprylic acid in dietary supplements and functional nutrition.

- Growth in premium personal care products will drive higher adoption of caprylic acid as an emulsifier and stabilizer.

- Advancements in oleochemical processing will improve product purity and enhance performance across multiple industries.

- Expanding pharmaceutical applications will support long-term market penetration due to its antimicrobial and solubilizing properties.

- Companies will invest more in capacity expansion to meet growing demand from emerging economies.

- Strengthening regulatory emphasis on natural preservatives will increase adoption in food and beverage formulations.

- Supply chain integration will improve raw material availability and reduce production volatility.

- Increased R&D efforts will generate new application opportunities in specialized industrial and chemical segments.