Market Overview

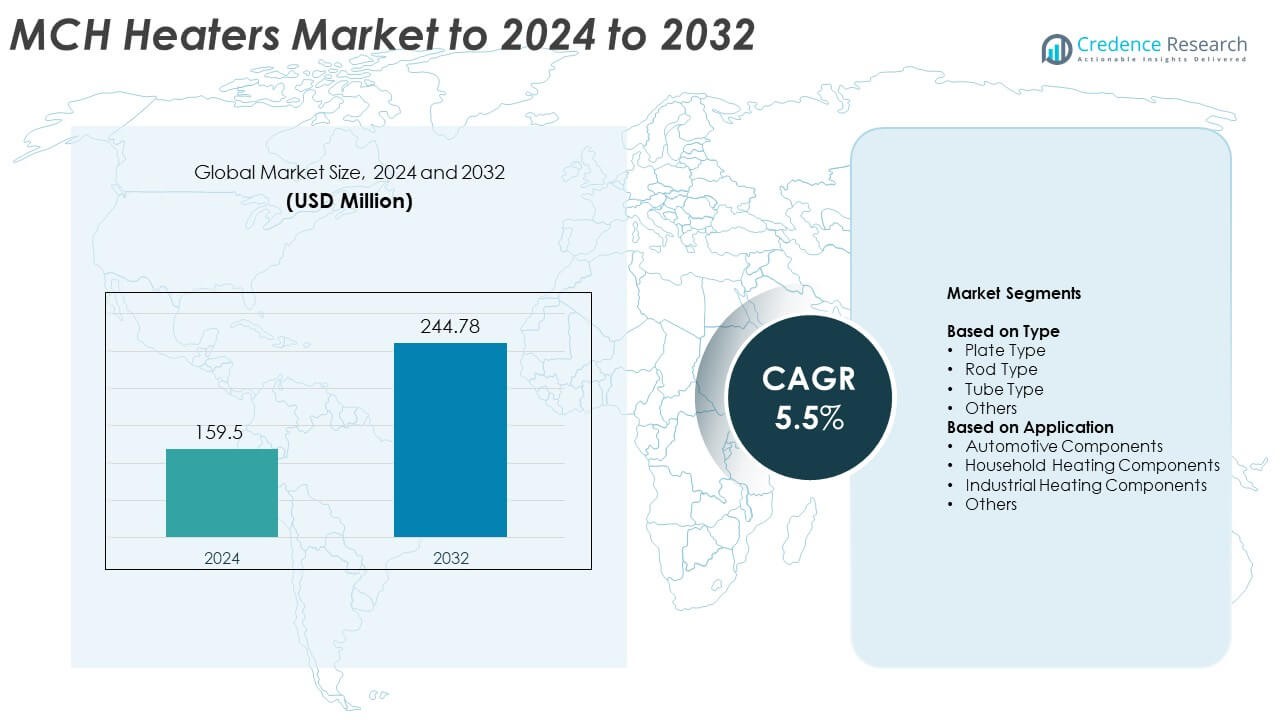

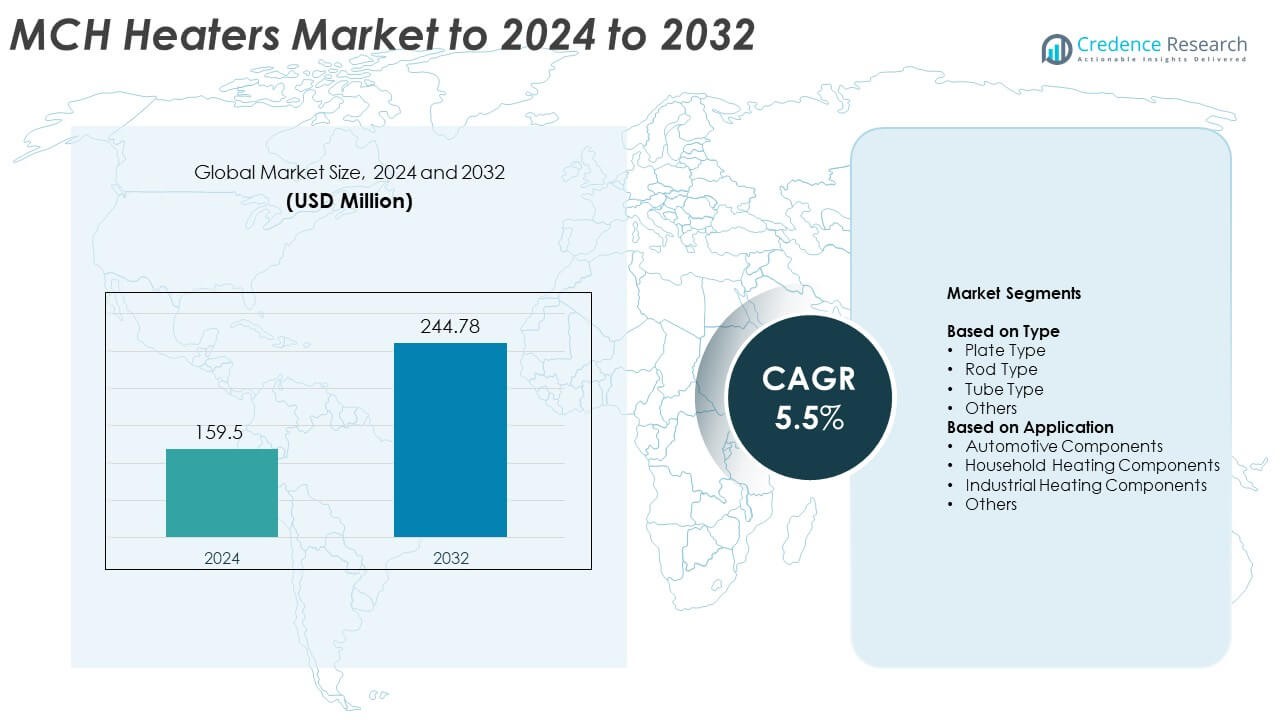

MCH Heaters Market size was valued at USD 159.5 Million in 2024 and is anticipated to reach USD 244.78 Million by 2032, at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| MCH Heaters Market Size 2024 |

USD 159.5 Million |

| MCH Heaters Market , CAGR |

5.5% |

| MCH Heaters Market Size 2032 |

USD 244.78 Million |

The MCH Heaters Market is shaped by major players including Xiamen Innova, NTK Technical Ceramics, Analog Technologies, Chongqing Chaoli Electric, Kyocera, and Innovacera, each focusing on advanced ceramic heating solutions with strong thermal efficiency and durability. These companies compete through material innovation, precision manufacturing, and integration of compact heater designs across automotive, industrial, and household applications. Asia Pacific leads the global market with about 36% share in 2024, driven by large-scale electronics manufacturing and rapid EV expansion. North America follows with nearly 32% share, supported by strong adoption in automotive electronics and industrial automation, while Europe holds around 27% share due to its advanced appliance and vehicle production base.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The MCH Heaters Market was valued at USD 159.5 Million in 2024 and is projected to reach USD 244.78 Million by 2032, growing at a CAGR of 5.5%.

- Strong demand for high-efficiency heating components in EV battery systems and compact industrial tools drives overall market expansion, supported by the dominant plate type segment holding about 46% share.

- Miniaturization of electronics and wider integration of ceramic micro-heaters in medical, lab, and smart appliance devices shape key market trends.

- Competition intensifies as major manufacturers enhance ceramic materials, improve precision printing, and expand customized heater offerings for fast-response applications.

- Asia Pacific leads the market with 36% share, followed by North America at 32% and Europe at 27%, while automotive applications remain the top segment with nearly 41% share due to rising EV production and thermal management needs.

Market Segmentation Analysis:

By Type

Plate type leads this segment with about 46% share in 2024 due to its strong use in fast-response heating systems and compact thermal modules. Manufacturers prefer plate-type MCH heaters because the design offers uniform heat transfer, low thermal inertia, and high durability for high-precision applications. Rod and tube types record stable demand in industrial and household devices, supported by steady replacement cycles. Other formats grow at a slower pace as most new designs shift toward flat, energy-efficient heater architectures that support miniaturized components.

- For instance, Kyocera’s alumina plate-type ceramic heaters are specified for normal operation up to 800 °C and a maximum operating temperature of 1000 °C, showing suitability for compact, high-temperature heating modules.

By Application

Automotive components dominate this segment with nearly 41% share in 2024, driven by rising adoption of MCH heaters in battery heating, sensor de-icing, cabin components, and emission-control modules. Automakers rely on MCH technology because it delivers fast heating, high efficiency, and stable performance in harsh environments. Household heating components show consistent demand from kitchen appliances and personal care devices, while industrial heating components expand with wider use in manufacturing, fluid control, and precision equipment. Other uses contribute smaller but steady volume.

- For instance, Panasonic’s NH-E80JA1WPH tumble dryer uses a PTC heating element rated at 1900 W with a maximum drying temperature of 65 °C, demonstrating reliable household heating integration of compact ceramic-based heaters.

Key Growth Drivers

Rising Demand for High-Efficiency Heating Solutions

Growing use of compact and energy-efficient heating components across automotive, household appliances, and industrial equipment drives strong adoption of MCH heaters. Manufacturers favor MCH technology because it delivers rapid thermal response, uniform heating, and high durability. Expansion of electric vehicles, smart home appliances, and compact industrial modules widens the application base. This broad use positions high-efficiency heating demand as a major growth driver shaping long-term market expansion.

- For instance, ERS electronic’s AirCool PRIME thermal chucks offer a temperature range from −60 °C to 300 °C, enabling efficient and uniform thermal control for semiconductor probing and other precision processes.

Expansion of Electric and Hybrid Vehicles

The rapid shift toward electric and hybrid vehicles increases the need for advanced heating components that support battery temperature regulation, sensor protection, and cabin comfort systems. MCH heaters offer fast heat-up, low energy loss, and stability under fluctuating loads, making them ideal for EV thermal management. Rising EV production across Asia, Europe, and North America strengthens demand and establishes automotive electrification as a key growth driver.

- For instance, KLC’s high voltage PTC heaters for electric cars and buses are designed to operate on a wide voltage range of 12V to 999V (with UL/CSA approvals for 12V–600V systems).

Growth of Precision Manufacturing and Industrial Automation

Industries adopting high-precision tools and automated manufacturing systems increasingly rely on stable, controllable micro-heating solutions. MCH heaters enable accurate temperature control for fluid handling units, semiconductor tools, 3D printers, and compact industrial modules. Their long service life and consistent heat output help maintain workflow efficiency. This rising adoption across advanced manufacturing environments makes industrial automation a key growth driver in the market.

Key Trends and Opportunities

Miniaturization and Integration in Compact Electronic Devices

Growing demand for smaller and more efficient electronic devices creates strong opportunities for MCH heaters. Their thin structure, fast heating capability, and compatibility with compact designs support integration in wearables, sensors, and micro-actuation systems. Companies focus on developing ultrathin heater formats that enhance device performance while reducing power consumption. Miniaturization remains a key trend creating major opportunities for next-generation compact electronics.

- For instance, TDK’s automotive-grade NTCG06 SMD temperature sensors measure only 0.6 × 0.3 mm with thickness down to 0.3 mm, highlighting how thermal components can be integrated into very small electronic assemblies.

Rising Use in Medical and Laboratory Equipment

The medical sector increasingly adopts MCH heaters for diagnostic tools, sample conditioning units, portable devices, and point-of-care instruments. These heaters provide stable, contamination-free heating essential for clinical and laboratory accuracy. Growing investment in portable diagnostic devices and precision health monitoring amplifies demand. This shift positions medical applications as a key trend and opportunity supporting long-term market growth.

- For instance, IST AG’s micro heaters are designed for applications requiring temperatures from −50 °C up to 800 °C, combining fast response and high precision suitable for analytical and sensing equipment.

Advancements in Material Engineering for Higher Durability

Continuous improvements in ceramic formulations and metallization techniques enhance heater longevity, thermal efficiency, and tolerance to extreme conditions. Manufacturers explore new ceramic composites and optimized printing patterns to improve reliability under high-load cycles. These advancements open new opportunities in aerospace, industrial control, and automotive applications. Material innovation therefore stands as a key trend and opportunity that strengthens the market’s technological foundation.

Key Challenges

High Production Costs and Complex Manufacturing Processes

The specialized fabrication process for MCH heaters involves precise layering, controlled sintering, and strict quality standards, which raise overall production costs. Smaller manufacturers struggle to scale due to limited access to advanced ceramic processing and metallization technology. These constraints restrict price competitiveness in cost-sensitive markets. As a result, manufacturing complexity remains a key challenge limiting rapid capacity expansion.

Limited Awareness and Slow Adoption in Traditional Applications

Many end-users in conventional heating applications continue to rely on resistance-wire or PTC heaters due to familiarity and lower upfront cost. Limited awareness of MCH heater performance benefits slows adoption, especially in developing regions. Inconsistent distribution networks and lack of standardized integration guidelines further delay wider market penetration. This creates a key challenge that restrains broader adoption across legacy sectors.

Regional Analysis

North America

North America holds about 32% share in 2024, driven by strong adoption of MCH heaters in automotive electronics, industrial automation, and high-end household appliances. Growth remains steady as EV production expands in the United States and Canada, increasing demand for compact and fast-response heating components. Manufacturers in this region focus on improving thermal efficiency and reliability for advanced automotive and semiconductor applications. Strong R&D activity and early technology adoption continue to make North America a leading contributor to overall market revenue.

Europe

Europe accounts for nearly 27% share in 2024, supported by strong automotive manufacturing, stringent energy-efficiency regulations, and rising demand for advanced heating elements in premium household appliances. The region benefits from increasing deployment of thermal components in EV platforms, emission-control systems, and compact industrial equipment. Countries such as Germany, France, and the U.K. lead adoption due to robust engineering capabilities and higher investment in automation technologies. Continuous innovation in ceramics and metallized heating substrates strengthens Europe’s position in the global market.

Asia Pacific

Asia Pacific commands the largest share at about 36% in 2024, fueled by strong electronics manufacturing, high-volume appliance production, and rapid automotive electrification in China, Japan, and South Korea. The region benefits from large-scale industrial operations and cost-efficient manufacturing ecosystems that support wide use of MCH heaters. Growing semiconductor output and expansion of EV supply chains enhance market momentum. Continuous investment in precision heating technology positions Asia Pacific as the fastest-growing regional market with strong long-term potential.

Latin America

Latin America holds roughly 3% share in 2024, with growth centered in automotive component manufacturing and household appliance production. Brazil and Mexico lead regional adoption due to expanding industrial bases and rising demand for energy-efficient heating elements. Wider use of ceramic-based heaters in small appliances and temperature-control components supports steady market movement. Although growth is moderate, improving manufacturing capabilities and rising electronics assembly activities are expected to increase regional participation over the forecast period.

Middle East and Africa

Middle East and Africa capture nearly 2% share in 2024, driven by growing industrial automation, increased investment in local manufacturing, and rising adoption of advanced heating components in HVAC and household appliances. The region shows gradual expansion as countries focus on diversifying industrial activity beyond oil and gas. Demand increases for durable and efficient heating elements suitable for harsh operating environments. Although the market remains small, improving infrastructure and rising consumer appliance penetration support future growth prospects.

Market Segmentations:

By Type

- Plate Type

- Rod Type

- Tube Type

- Others

By Application

- Automotive Components

- Household Heating Components

- Industrial Heating Components

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The MCH Heaters Market features strong competition among key players such as Xiamen Innova, NTK Technical Ceramics, Analog Technologies, Chongqing Chaoli Electric, Kyocera, and Innovacera. Companies focus on advanced ceramic heater designs that deliver fast thermal response, stable performance, and long operating life. Many manufacturers invest in high-precision production technologies to support rising demand from automotive electronics, industrial automation, and compact household appliances. Product differentiation is driven by improved material engineering, enhanced durability, and tighter thermal control. Firms also strengthen their positions through expanded distribution networks, partnerships with component suppliers, and the introduction of customized heater solutions for niche applications. Growing emphasis on energy efficiency and compactness continues to shape competitive strategy across the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Chongqing Chaoli Electric obtained a new patent for an “MCH Ceramic Heating Component” (Announcement No. CN222736313U). The design effectively suppresses the deformation stress of metal plates during welding, which increases product yield and reduces production costs.

- In 2025, Analog Technologies announced the release of a new series of metal ceramic heaters (MCH) with 4 types available and plans to develop more models.

- In 2024, Xiamen Innova highlighted advancements in its MCH heaters for soldering irons, including the potential to integrate a PT1000 temperature sensor directly into the MCH heater design, which allows for more compact and precise temperature control.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as EV production accelerates and needs efficient thermal components.

- Demand for compact heating solutions will rise with growth in miniaturized electronics.

- Medical and laboratory device adoption will increase due to precision temperature control needs.

- Manufacturers will invest more in advanced ceramic materials to boost heater durability.

- Integration of smart sensors with MCH heaters will gain traction across industrial systems.

- Appliance makers will adopt MCH heaters to meet energy-efficiency standards worldwide.

- Industrial automation growth will drive higher use of reliable micro-heating modules.

- Adoption will widen in aerospace and defense for lightweight, high-performance heating.

- Production capacity will expand in Asia as manufacturers scale to meet global demand.

- Technological innovation will enhance performance, enabling entry into new niche applications.