Market Overview

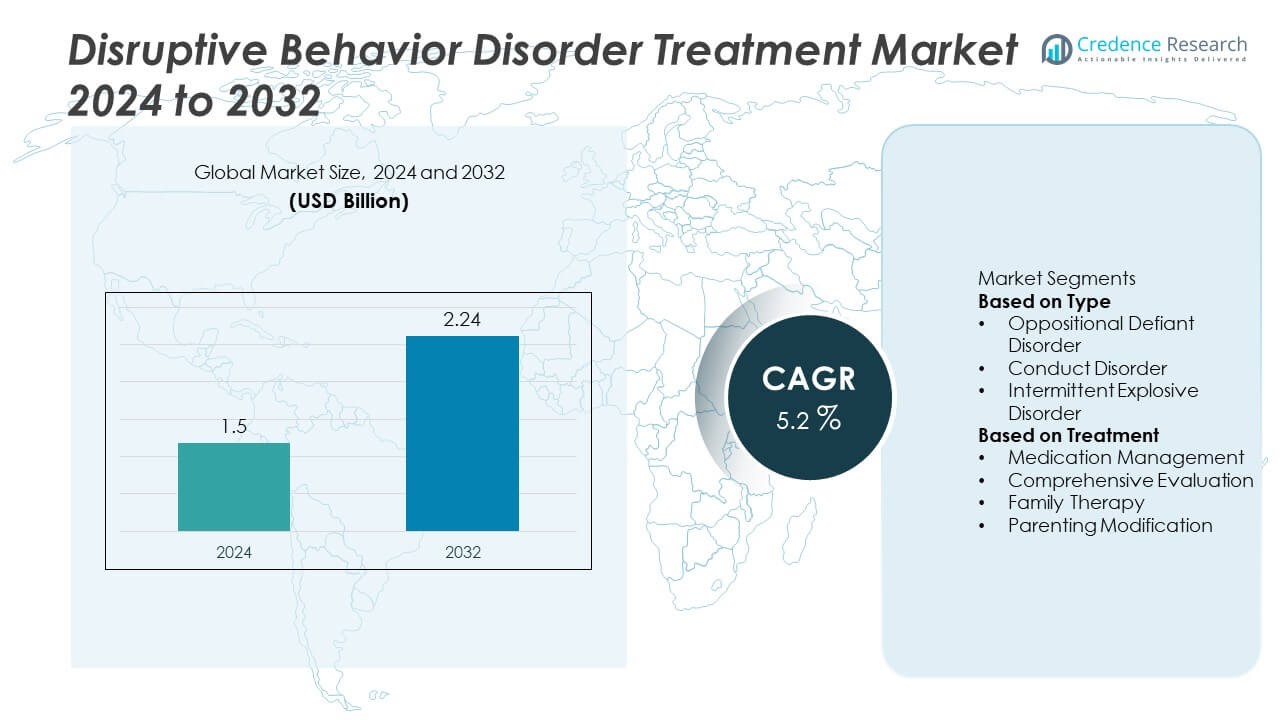

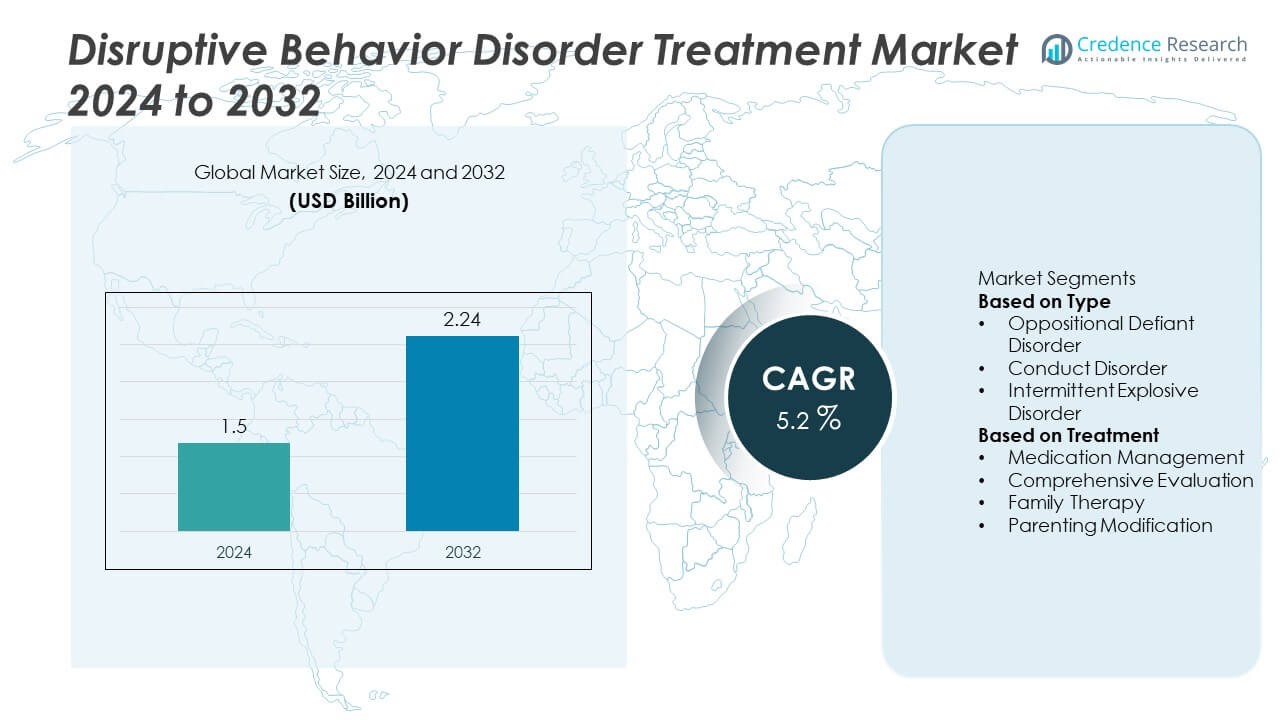

The Disruptive Behavior Disorder Treatment Market was valued at USD 1.5 billion in 2024 and is projected to reach USD 2.24 billion by 2032, registering a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Disruptive Behavior Disorder Treatment Market Size 2024 |

USD 1.5 Billion |

| Disruptive Behavior Disorder Treatment Market, CAGR |

5.2% |

| Disruptive Behavior Disorder Treatment Market Size 2032 |

USD 2.24 Billion |

The Disruptive Behavior Disorder Treatment market is led by key players including Lilly, Pfizer Inc., Johnson & Johnson Services, Inc., Bionomics, Highland Ridge Hospital, Lakeview Health, Boston Children’s Hospital, INTEGRIS Health, Chelsea Therapeutics International, Ltd., and Springwoods Behavioral Health. These companies dominate due to their diverse treatment offerings, which encompass medication management, behavioral therapies, and digital solutions. The market is primarily driven by North America, holding a 46.4% share in 2024, owing to its robust healthcare infrastructure, high awareness, and comprehensive treatment services. Asia Pacific follows with a 38% share, supported by growing healthcare access and digital therapeutics. Europe accounts for 22% of the market, with increasing government investment and awareness initiatives. These regions collectively fuel the demand for innovative treatments and continue to shape the market’s growth trajectory.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global disruptive behavior disorder treatment market reached USD 1.5 billion in 2024 and is projected to grow to USD 2.24 billion by 2032, reflecting a CAGR of 5.2%.

- Rising diagnoses of disorders like oppositional defiant disorder (ODD) (45% share) and conduct disorder (35% share) among children and adolescents are driving demand for both medication and therapeutic interventions.

- Market trends include the rapid adoption of digital therapeutics and telehealth platforms, which enhance remote access to behaviour tracking and family‑centred therapy solutions.

- Competitive activity is robust, with major companies such as Lilly, Pfizer Inc., and Johnson & Johnson Services, Inc. offering integrated medication‑therapy offerings, while healthcare providers like Boston Children’s Hospital advance service delivery.

- Regional dynamics vary: North America leads with a 46.4% share, Asia Pacific holds 38%, and Europe accounts for 22%, though fragmented coverage, stigma, and high cost present constraints in expanding treatment uptake.

Market Segmentation Analysis:

By Type

The Disruptive Behavior Disorder Treatment market is primarily driven by Oppositional Defiant Disorder (ODD) and Conduct Disorder, which collectively dominate the market with ODD holding the largest share of 45%. ODD is common among children and adolescents, with increased demand for behavioral therapies aimed at managing defiance and aggression. Conduct Disorder follows with a significant share of 35%, as it is often linked with severe behavioral disturbances and requires specialized treatment methods. Intermittent Explosive Disorder, though growing in recognition, holds a smaller market share but is gaining attention due to its disruptive nature and treatment needs.

- For instance, evidence suggests that a combination treatment approach, which integrates pharmacological therapies (such as stimulants for co-occurring ADHD or antipsychotics for severe aggression) with behavioral modification techniques (like Cognitive Behavioral Therapy and Parent Management Training), can lead to measurable improvements in symptom management and overall functioning in adolescents with conduct disorder.

By Treatment

In the treatment segment, Medication Management leads the market with a share of 40%, driven by the increasing prescription of drugs to manage symptoms of Disruptive Behavior Disorders, particularly for conditions like Conduct Disorder. Comprehensive Evaluation follows with a 30% share, as early diagnosis is critical for effective intervention. Family Therapy and Parenting Modification are gaining traction due to their long-term efficacy in modifying behavior and fostering healthy family dynamics, contributing to a more holistic approach to treatment. These therapies are seeing strong growth due to their positive impact on long-term outcomes.

- For instance, Springwoods Behavioral Health employs various evidence-based programs and diagnostic methods to provide targeted interventions for a range of mental and behavioral conditions.

Key Growth Drivers

Rising prevalence of disruptive behaviour disorders

The increasing incidence of disorders such as Oppositional Defiant Disorder and Conduct Disorder among children and adolescents significantly drives market growth. Clinicians and parents are more aware of behavioural issues, leading to more diagnoses and treatment uptake. Schools and community programmes also support early interventions, prompting greater demand for therapies and medications. This expanding patient pool directly raises treatment volumes and generates new opportunities for service and product development in the disruptive behaviour disorder treatment market.

- For instance, Boston Children’s Hospital has a substantial research enterprise, and studies co-authored by its researchers and external institutions such as Harvard and Johns Hopkins have found that school-based interventions and environmental changes can lead to significant improvements in various mental health and behavioral outcomes.

Growing accessibility and integration of digital therapeutics

Digital tools and telehealth services now provide remote access to treatment for disruptive behaviour disorders, increasing reach beyond traditional clinical settings. Mobile apps, virtual consultations and behaviour‑tracking platforms help manage conditions effectively, especially in underserved regions. These innovations lower treatment barriers and attract providers to adopt such offerings. As digital solutions become more accepted and reimbursable, market participants leverage them to expand services, improving overall market growth for disruptive behaviour disorder treatment.

- For instance, the government of India’s eSanjeevani platform, the world’s largest telemedicine implementation, has provided over 370 million remote consultations nationwide, significantly bridging the urban-rural care gap.

Surging healthcare investment in paediatric mental health

Governments and private payers are prioritising children’s mental health, allocating funding and launching policies to improve access to care. Programmes focus on disruptive behaviour disorder screening, early intervention, and family‑based therapies. This strategic support enhances the infrastructure and reimbursement environment, enabling wider adoption of treatments. The favourable policy climate encourages companies to invest in novel therapies and support services, boosting growth in the disruptive behaviour disorder treatment market.

Key Trends & Opportunities

Strengthening focus on family‑centred and behavioural therapies

Family therapy, parenting modification and behavioural support are gaining prominence, as clinicians recognise their long‑term benefits in treating disruptive behaviour disorders. Parents increasingly seek such therapies over purely medication‑based routes. This trend offers opportunities for service providers to extend specialised programmes and for tech firms to build supportive tools. An ecosystem shift toward holistic, multi‑modal treatment opens new growth paths in the market.

- For instance, established evidence-based interventions like Multisystemic Therapy (MST) or Functional Family Therapy (FFT) have demonstrated improved long-term behavioral outcomes for children and adolescents with Conduct Disorder, with studies showing significant reductions in recidivism and out-of-home placements

Expansion of emerging markets and underserved regions

Emerging economies in Asia‑Pacific, Latin America and Middle East & Africa present high‑potential opportunities for disruptive behaviour disorder treatment expansion. Rising disposable incomes, improving healthcare infrastructure and growing awareness of paediatric mental health support increased demand in these regions. Market players can enter or expand in these geographies through local partnerships, affordable service models and low‑cost digital solutions, capturing incremental growth.

- For instance, specific programs like the SAS Brazil telemedicine program performed over 22,000 teleconsultations, with mental health being the primary reason for consultation, for nearly 6,500 participants in vulnerable situations during a period in the pandemic.

Key Challenges

Stigma and limited awareness around behavioural disorders

Despite improvements, significant stigma persists around disruptive behaviour disorders, particularly in lower‑income countries. Many children remain undiagnosed and untreated due to cultural barriers and lack of awareness. This hinders market growth and reduces early‑intervention uptake. Overcoming these obstacles requires education initiatives and regional outreach, but progress is gradual and can slow market development.

Fragmented treatment landscape and high costs

The treatment space for disruptive behaviour disorders involves multiple modalities—medication, therapy, digital tools—and varies widely across regions. High cost of specialised programmes and limited reimbursement coverage in many markets restrict access. Poor standardisation of care and uneven distribution of qualified professionals further complicate delivery. These issues raise barriers for widespread adoption and global scale‑up of disruptive behaviour disorder treatments.

Regional Analysis

North America

North America held a market share of 46.4% in the disruptive behavior disorder treatment market in 2024. Strong infrastructure, high awareness of behavioral disorders among children and adolescents, and extensive availability of specialist services support regional dominance. Major therapeutic centres and reimbursement policies favour early diagnosis and intervention, boosting uptake of comprehensive evaluations and parenting modification programs. The large insured population and advanced healthcare systems further propel growth, while challenges such as service‑cost pressures and provider shortages moderate expansion.

Europe

Europe captured around 22% of the disruptive behavior disorder treatment market in 2024. The region benefits from well‑established healthcare systems, rigorous regulatory standards for mental health services, and growing public investment in pediatric behavioral care. Increased government campaigns and school‑based screening initiatives raise diagnosis rates and demand for both medication management and family therapy. However, wide variation in mental‑health coverage across countries and lingering social stigma in some areas restrict consistent uptake and create uneven growth across the region.

Asia Pacific

Asia Pacific accounted for roughly 38% of the disruptive behavior disorder treatment market in 2024. Rapid population growth, rising disposable incomes, and improving healthcare access drive the region’s expansion. Countries like China and India are investing heavily in mental‑health infrastructure, and digital‑therapy platforms are increasingly deployed to reach remote communities. While traditional therapy options remain limited in many zones, the shifting cultural attitudes and expanding telehealth services offer significant opportunity for market players.

Latin America

Latin America secured about 8% share of the disruptive behavior disorder treatment market in 2024. Growth in this region is propelled by increasing awareness of behavioral conditions among youth and improving coverage of mental‑health services in key countries such as Brazil and Mexico. However, economic instability, limited specialty care access and uneven reimbursement slow progress. Despite these challenges, growth prospects remain positive as governments prioritise behavioral‑health initiatives and private providers introduce accessible service models.

Middle East & Africa

The Middle East & Africa region held around 7% of the global disruptive behavior disorder treatment market in 2024. Expansion is driven by infrastructure investment, rising youth populations, and growing recognition of mental‑health issues in Gulf states and North Africa. Telehealth and family‑therapy services gather momentum in urban centres, while cultural barriers and limited specialist availability hinder rural penetration. On‑going reforms in healthcare delivery and increasing private‑sector participation present growth pathways for treatment providers.

Market Segmentations:

By Type

- Oppositional Defiant Disorder

- Conduct Disorder

- Intermittent Explosive Disorder

By Treatment

- Medication Management

- Comprehensive Evaluation

- Family Therapy

- Parenting Modification

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the disruptive behavior disorder treatment market includes key players such as Lilly, Pfizer Inc., Johnson & Johnson Services, Inc., Bionomics, Highland Ridge Hospital, Lakeview Health, Boston Children’s Hospital, INTEGRIS Health, Chelsea Therapeutics International, Ltd., and Springwoods Behavioral Health. These companies hold significant market share due to their diverse treatment offerings that combine medication management, behavioral therapies, and digital solutions. Their strong R&D investments, strategic collaborations, and established global presence enable them to meet the rising demand for effective treatments. Market growth is driven by continuous innovations, expansion into emerging markets, and increased awareness of disruptive behavior disorders. New entrants face high barriers, particularly in regulatory compliance, cost control, and competition from established players with comprehensive, well‑integrated treatment services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Springwoods Behavioral Health

- Chelsea Therapeutics International, Ltd.

- Lilly

- Pfizer Inc.

- Johnson & Johnson Services, Inc.

- Bionomics

- INTEGRIS Health

- Highland Ridge Hospital

- Boston Children’s Hospital

- Lakeview Health

Recent Developments

- In June 2024, Eli Lilly announced a collaboration with QurAlis, a biotech company focused on neurodegenerative diseases. This partnership involves licensing QRL-204, an experimental antisense oligonucleotide therapy currently in preclinical development for amyotrophic lateral sclerosis (ALS) and frontotemporal dementia (FTD). QRL-204 aimed to restore UNC13A function, a critical regulator of neurotransmitter release.

- In September 2023, Tris Pharma announced that Health Canada had granted authorization for Quillivant ER (extended-release methylphenidate) in both oral suspension and chewable tablet forms for treating ADHD in children aged six to 12 years.

Report Coverage

The research report offers an in-depth analysis based on Type, Treatment and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will shift strongly toward integrated treatment models combining medication, family therapy and parenting modification.

- Providers will increasingly adopt telehealth and digital solutions to improve access in remote and underserved regions.

- Growth in emerging economies will accelerate as healthcare infrastructure expands and mental‑health awareness rises.

- Service providers will emphasise early diagnosis and comprehensive evaluation to improve treatment outcomes.

- Key players will invest heavily in research and development of novel therapies and digital behavioural tools.

- Outcome‑based reimbursement models will emerge, linking payment to measurable improvements in disruptive behaviour symptoms.

- Multi‑modal care programmes will gain traction, merging behavioural therapies with pharmacological treatments and digital support.

- Stakeholders will explore personalised treatment plans using data analytics to tailor interventions to individual patient profiles.

- Stigma‑reduction efforts and public‑awareness campaigns will boost uptake of treatment across younger populations.

- Barriers such as fragmented care pathways, high costs and limited specialist availability will prompt solutions that simplify access and coordination.