Market Overview

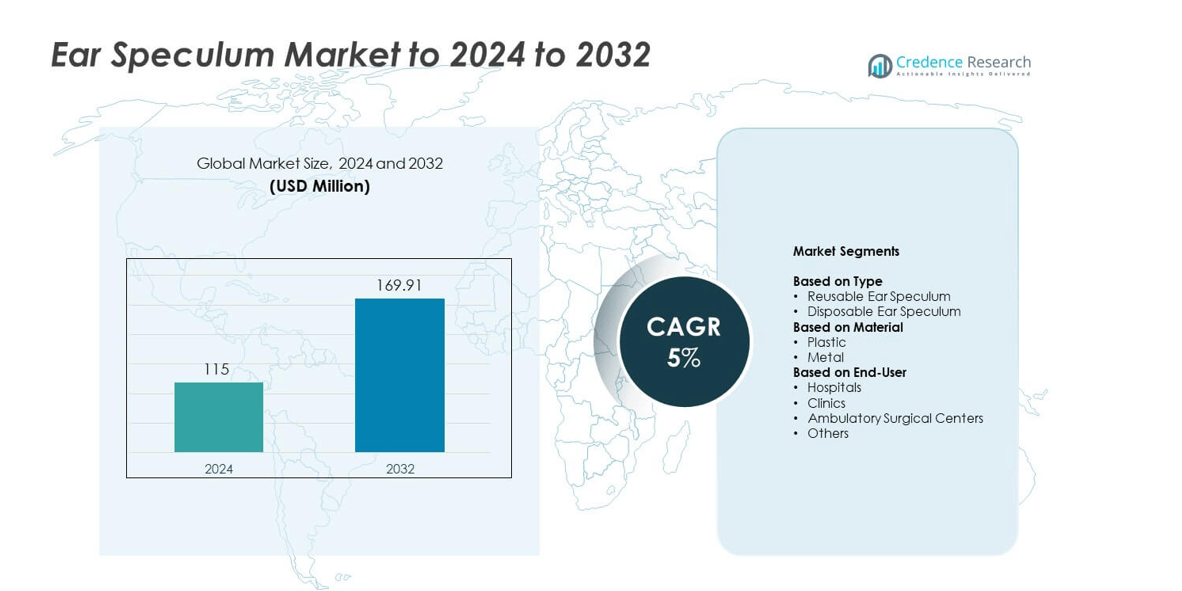

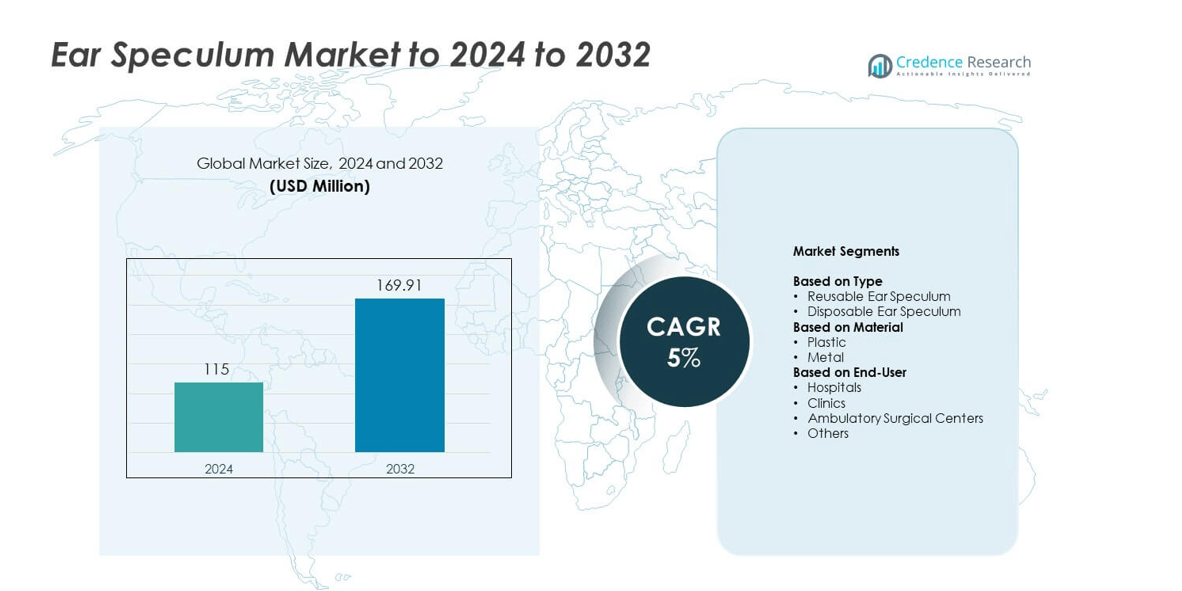

Ear Speculum Market size was valued at USD 115 million in 2024 and is anticipated to reach USD 169.91 million by 2032, at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ear Speculum Market Size 2024 |

USD 115 million |

| Ear Speculum Market, CAGR |

5% |

| Ear Speculum Market Size 2032 |

USD 169.91 million |

The Ear Speculum Market is shaped by key companies such as Medline Industries, Inc., GF Health Products, Inc., Hill-Rom Holdings, Inc., KaWe, Baxter (Hillrom Rudolf Riester GmbH), Sklar Surgical Instruments, Welch Allyn, Inc., 3M Company, and Heine Optotechnik GmbH & Co. KG, all of which strengthen the market through advancements in reusable metal designs and high-volume disposable plastic models. Their focus on ergonomic improvements, safety features, and broad distribution supports rising clinical demand. North America leads the market with a 38% share in 2024 due to strong ENT infrastructure and high diagnostic volumes, followed by Europe with steady adoption across hospitals and specialty clinics.

Market Insights

- The Ear Speculum Market was valued at USD 115 million in 2024 and is projected to reach USD 169.91 million by 2032, growing at a CAGR of 5% during the forecast period.

- Growth is driven by rising ENT disorder cases, expanding otoscopy screenings, and strong adoption of infection-control practices that boost demand for disposable plastic models holding 58% share.

- Key trends include increasing use of ergonomic designs, pediatric-friendly options, and improved material blends that enhance comfort and diagnostic visibility; reusable types dominate with 63% share.

- The market remains moderately competitive, with major players focusing on sterilization-safe materials, broader distribution networks, and high-quality reusable metal tools preferred in hospitals leading with 49% share.

- North America leads with 38% market share due to strong ENT infrastructure, followed by Europe with stable demand; Asia Pacific grows fastest due to expanding healthcare access and higher pediatric infection rates.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Reusable ear speculums hold about 63% share in 2024, making them the dominant type due to their long service life, cost efficiency, and wide use in ENT examinations. Hospitals and clinics prefer reusable options because they support repeated sterilization without losing structural stability. Demand rises as healthcare providers focus on reducing medical waste and lowering procurement costs. Disposable ear speculums grow steadily as they offer strong hygiene control for high-volume outpatient settings, especially in pediatric and general practice units where cross-contamination risk is high.

- For instance, Heine Optotechnik’s technical literature for its reusable ear specula (made of high-density SANALON S plastic) states that the products can be reprocessed for up to 360 cycles (autoclavable at up to 134 °C).

By Material

Plastic ear speculums lead this segment with nearly 58% share in 2024, driven by their light weight, patient comfort, and low manufacturing cost. Plastic models dominate routine otoscopy procedures because they provide flexibility and reduce the risk of tissue irritation. Adoption rises in primary care units as single-use plastic variants support strict infection prevention protocols. Metal ear speculums maintain stable demand in specialized ENT departments due to their durability, precision fit, and compatibility with repeated high-temperature sterilization cycles required in advanced diagnostic procedures.

- For instance, the parent company of Welch Allyn, Baxter International, operates a global manufacturing network of approximately 50 facilities in nearly 25 countries as of its 2022 reports.

By End-User

Hospitals dominate this segment with about 49% share in 2024, supported by large patient inflow, diversified ENT services, and strong adoption of reusable and metal ear speculums. Hospitals use these devices in emergency units, audiology labs, and operating rooms, which drives consistent procurement. Clinics expand use due to rising ear infection cases and increased reliance on disposable variants. Ambulatory surgical centers show steady growth as they invest in ENT-focused equipment for minor procedures, while other end users adopt basic models for routine ear examinations.

Key Growth Drivers

Rising ENT Disorder Prevalence

Growing cases of ear infections, hearing disorders, and wax impaction drive higher use of ear speculums across hospitals and clinics. Rising urban pollution and increased pediatric ear issues create strong examination demand. Healthcare providers perform more routine otoscopy screenings, which boosts procurement of both reusable and disposable models. Expanding access to ENT care in developing regions also strengthens long-term growth. This trend makes rising ENT disorder prevalence one of the most important growth drivers in the Ear Speculum Market.

- For instance, the official Amplifon 2023 Annual Report mentions that the company offers free hearing tests, which resulted in an aggregate customer savings of around 300 million euros.

Shift Toward Infection Control Practices

Stricter hygiene protocols across healthcare systems encourage adoption of disposable ear speculums. Facilities aim to reduce cross-contamination risk, particularly in pediatric and high-volume outpatient settings. Global emphasis on infection prevention boosts recurring demand for sterile, single-use models. Reusable variants also gain attention due to enhanced sterilization standards and improved material durability. This shift toward infection control practices stands out as a key growth driver for the Ear Speculum Market.

- For instance, 3M reported in its Third-Quarter 2023 results release that it recorded a pre-tax charge of $4.2 billion related to the Combat Arms Earplug litigation settlement.

Expansion of Primary Care and ENT Infrastructure

Governments and private operators are expanding ENT clinics, audiology centers, and primary care units. More trained ENT specialists and broader diagnostic coverage increase the number of otoscopy procedures performed daily. Investment in compact diagnostic tools supports higher device turnover and replacement cycles. Growth in ambulatory surgical centers further promotes adoption of high-quality speculums for minor procedures. The expansion of ENT and primary care infrastructure remains a central growth driver in the Ear Speculum Market.

Key Trends & Opportunities

Rising Demand for Disposable Plastic Speculums

Healthcare providers increasingly prefer disposable plastic variants due to convenience, safety, and lower contamination risk. Manufacturers are offering improved comfort designs, smoother edges, and enhanced visibility features that support routine examinations. The shift toward sterile single-use products opens opportunities for high-volume supply contracts. Growing awareness of infection control, especially in pediatrics, strengthens this trend as a major opportunity in the Ear Speculum Market.

- For instance, Becton, Dickinson and Company reports that it produces over 3 billion syringes and needles per year for the U.S. market, with global manufacturing sites having a significantly larger total capacity, as documented in company data.

Development of Ergonomic and Pediatric-Friendly Designs

Producers are introducing softer material blends, varied size options, and optimized shapes tailored for pediatric care. Demand rises for patient-friendly tools that reduce discomfort and improve diagnostic accuracy. ENT professionals seek ergonomic models that enhance handling and visibility during examinations. Customized designs for neonatal and child-care environments create a strong innovation opportunity. This makes ergonomic and pediatric-focused advancements a key trend and opportunity in the Ear Speculum Market.

- For instance, the official GN Store Nord 2023 Annual Report for the year reported total organic revenue growth of 13 % in GN Hearing. The company generated DKK 1.1 billion in free cash flow, excluding M&A.

Key Challenges

Sterilization Gaps in Resource-Limited Facilities

Many small hospitals and clinics lack advanced sterilization equipment, which limits safe reuse of metal and durable plastic speculums. Inconsistent cleaning practices raise contamination risks and reduce device lifespan. This challenge pressures providers to shift toward disposable models, which may increase operational cost. Limited awareness of proper sterilization protocols further slows adoption of reusable high-grade products. These sterilization gaps pose a significant challenge for the Ear Speculum Market.

Environmental Concerns from Single-Use Waste

Growing reliance on disposable plastic speculums increases medical waste, which creates environmental pressure. Healthcare regulators are urging reduced plastic use, pushing manufacturers to explore sustainable materials. However, biodegradable or eco-friendly alternatives often cost more and lack widespread availability. Balancing infection control needs with waste reduction remains difficult for many facilities. These environmental concerns form a major challenge in the Ear Speculum Market.

Regional Analysis

North America

North America holds about 38% share in the Ear Speculum Market in 2024 due to strong ENT infrastructure, high otoscopy procedure rates, and widespread adoption of reusable metal and high-grade plastic models. Hospitals and specialty ENT clinics drive steady procurement, supported by continuous investments in diagnostic equipment. The region benefits from advanced infection control practices, which boosts demand for disposable variants in outpatient settings. Rising awareness of pediatric ear health strengthens routine screening volumes, while strong manufacturer presence ensures consistent product availability across the United States and Canada.

Europe

Europe accounts for nearly 29% share in 2024, driven by robust public healthcare systems and growing ENT service utilization. High adoption of sterilizable metal speculums remains common in teaching hospitals, while private clinics increasingly prefer disposable options for hygiene control. Countries such as Germany, the United Kingdom, and France support market growth through improved ENT facility coverage and strong regulatory standards. Rising elderly populations with higher ear-related complications also elevate diagnostic demand. Expansion of ambulatory centers and pediatric care units further boosts ear speculum usage across the region.

Asia Pacific

Asia Pacific holds about 22% share in 2024 and stands as the fastest-growing region, supported by expanding healthcare access, increasing ENT specialist availability, and rising patient inflow for ear infections. Higher birth rates and pediatric ear disorders drive substantial use of disposable plastic models in India, China, and Southeast Asia. Governments are investing in primary care and community clinics, improving diagnostic capacity. Growing medical tourism strengthens adoption of advanced ENT tools in developed markets such as Japan and South Korea. Increasing awareness of hygiene in clinical settings accelerates the shift toward single-use products.

Latin America

Latin America captures close to 7% share in 2024, supported by improving healthcare frameworks and rising demand for routine ENT examinations. Hospitals in Brazil, Mexico, and Argentina are adopting higher-quality reusable metal speculums, while smaller clinics rely heavily on low-cost disposable options. Growth improves as regional health systems expand pediatric and primary care programs targeting early detection of ear disorders. Budget constraints limit rapid adoption of premium models, yet rising private healthcare investments help create new opportunities. Training initiatives for ENT professionals further support exam tool usage.

Middle East and Africa

The Middle East and Africa region holds around 4% share in 2024, with growth led by expanding hospital networks and increasing ENT specialization in Gulf countries. Uptake of reusable speculums rises in well-funded facilities, while disposable variants gain traction in public-sector clinics focused on infection control. Many parts of Africa face limited diagnostic infrastructure, which slows adoption but creates long-term potential as healthcare access improves. Investments in community health programs and rising awareness of ear disease screening support gradual market expansion across the region.

Market Segmentations:

By Type

- Reusable Ear Speculum

- Disposable Ear Speculum

By Material

By End-User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Ear Speculum Market is shaped by major companies such as Medline Industries, Inc., GF Health Products, Inc., Hill-Rom Holdings, Inc., KaWe, Baxter (Hillrom Rudolf Riester GmbH), Sklar Surgical Instruments, Welch Allyn, Inc., 3M Company, and Heine Optotechnik GmbH & Co. KG. These manufacturers compete by expanding product portfolios with improved reusable and disposable designs that support diverse ENT procedures. Many players focus on stronger distribution networks to meet rising demand from hospitals, clinics, and ambulatory centers. Innovation centers on ergonomic shapes, enhanced visibility, and patient-comfort features that improve diagnostic accuracy. Companies also invest in compliance with global sterilization and safety standards to support procurement in regulated markets. Growing emphasis on infection control encourages development of sterile single-use options, while premium segments benefit from durable metal models used in specialized ENT units. Sustainability, material quality, and cost efficiency continue to guide competitive differentiation across both developed and emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Baxter (Hillrom) updated the Welch Allyn MacroView Plus otoscope materials (US-FLC108-240006 v1.0, ) highlighting LumiView clear single-use ear specula that provide up to 4x brighter views than traditional black specula and positioning them as the standard tip for MacroView systems.

- In 2025, KaWe offers reusable and disposable ear specula compatible with their otoscope systems (e.g., KaWe EUROLIGHT series).

- In 2025, Heine Optotechnik launched a new generation of handheld diagnostic instruments called the HEINE X Series, with the new HEINE BETA X Otoscope and BETA X Ophthalmoscope becoming available that year.\

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as ENT examinations increase across all care settings.

- Disposable plastic speculums will gain wider adoption due to strict hygiene standards.

- Reusable metal models will remain important in advanced ENT departments needing durability.

- Pediatric-focused designs will expand as child ear disorder cases rise.

- Manufacturers will invest more in ergonomic and patient-comfort features.

- Hospitals will continue to dominate demand with high procedure volumes.

- Clinics and ambulatory centers will adopt compact diagnostic tools at a faster pace.

- Asia Pacific will lead growth due to expanding healthcare access and ENT capacity.

- Sustainability concerns will drive interest in eco-friendly and recyclable material options.

- Digital otoscopy integration will increase the need for compatible speculum designs