Market Overview

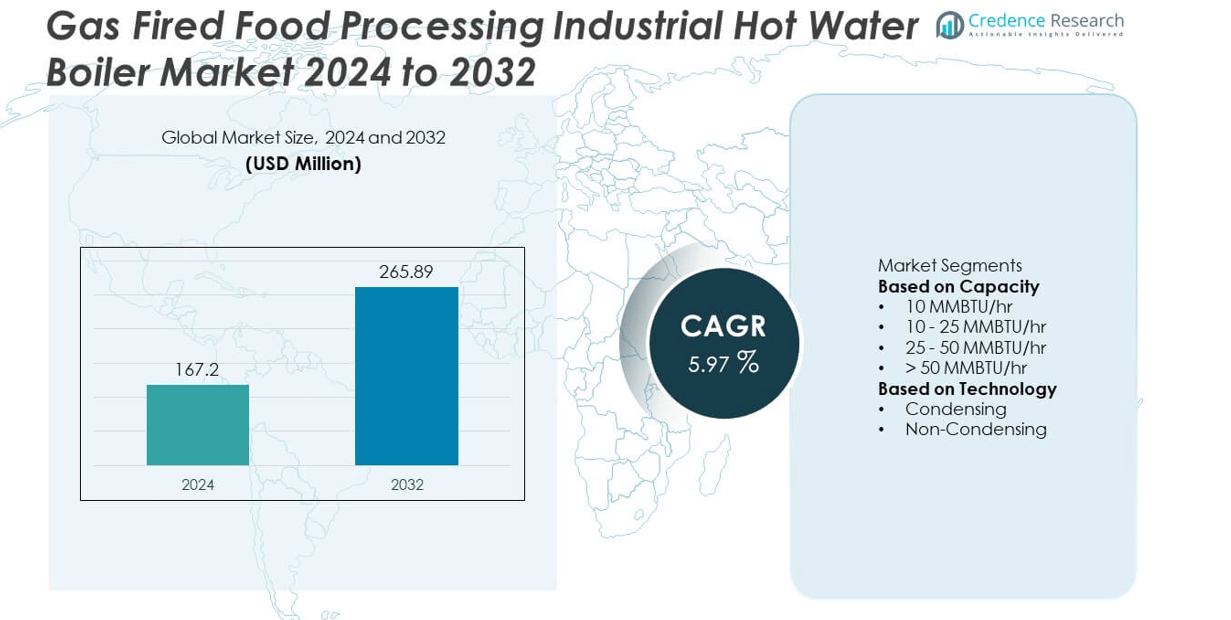

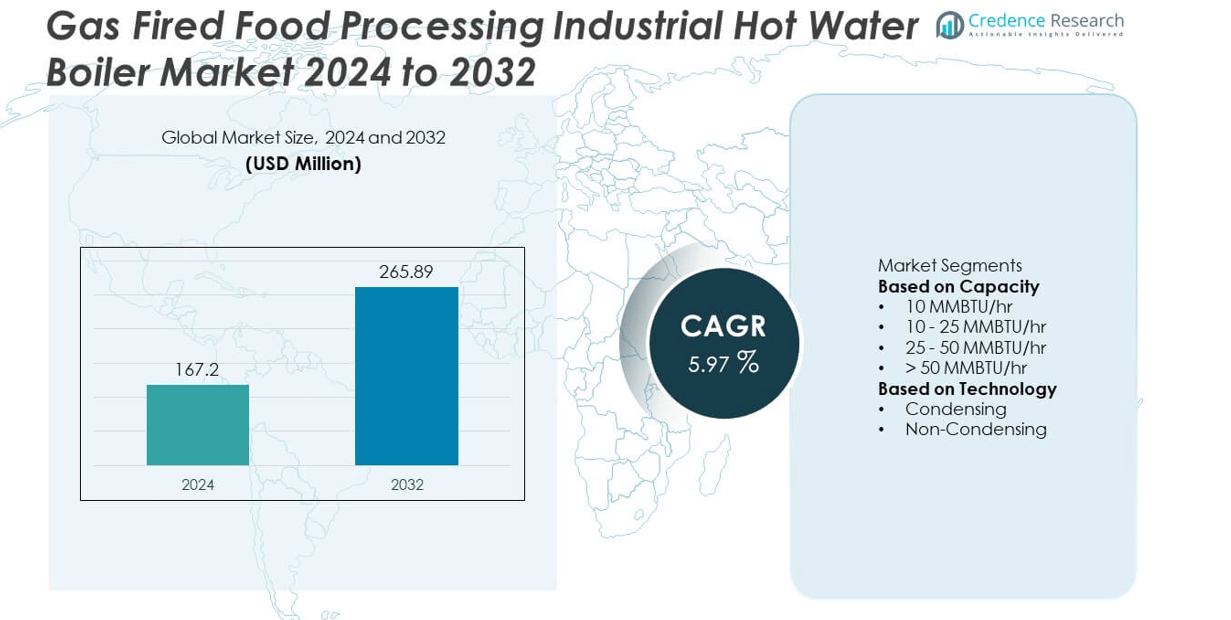

The Gas Fired Food Processing Industrial Hot Water Boiler market was valued at USD 167.2 million in 2024 and is projected to reach USD 265.89 million by 2032, registering a CAGR of 5.97% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Fired Food Processing Industrial Hot Water Boiler Market Size 2024 |

USD 167.2 million |

| Gas Fired Food Processing Industrial Hot Water Boiler Market, CAGR |

5.97% |

| Gas Fired Food Processing Industrial Hot Water Boiler Market Size 2032 |

USD 265.89 million |

The Gas Fired Food Processing Industrial Hot Water Boiler market is shaped by leading companies such as Fulton, Bosch Industriekessel, California Boiler, EPCB Boiler, Hoval, Hurst Boiler & Welding, Cleaver-Brooks, ALFA LAVAL, Forbes Marshall, and Babcock Wanson. These players focus on energy-efficient boiler systems, low-NOx combustion, heat recovery integration, and advanced digital controls to support sanitation, pasteurization, and ingredient heating across dairy, bakery, beverage, and ready-meal processing. Asia Pacific leads the market with a 42% share, driven by expanding food production capacity and modernization of thermal systems. North America holds 34% share, supported by strong regulatory compliance and efficiency upgrades, while Europe maintains 29% share backed by sustainability policies and carbon reduction targets.

Market Insights

- The Gas Fired Food Processing Industrial Hot Water Boiler market reached USD 167.2 million in 2024 and is projected to reach USD 265.89 million by 2032, registering a CAGR of 5.97% during the forecast period.

- Market growth is driven by the rising need for reliable sanitation, pasteurization, and ingredient heating systems, with the 10–25 MMBTU/hr capacity segment holding a 46% share due to strong adoption across medium-scale dairy, meat, bakery, and beverage plants.

- Key trends include increasing preference for condensing technology with a 62% share, supported by energy efficiency targets, low-NOx combustion solutions, and broader adoption of digital boiler monitoring and heat recovery systems.

- Competition involves leading players such as Fulton, Bosch Industriekessel, California Boiler, EPCB Boiler, Hoval, Hurst Boiler & Welding, Cleaver-Brooks, ALFA LAVAL, Forbes Marshall, and Babcock Wanson, focusing on lifecycle optimization and turnkey boiler room solutions.

- Asia Pacific leads with a 42% regional share, followed by North America at 34% and Europe at 29%, driven by modernization of food processing facilities and fuel cost management initiatives across major production hubs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Capacity Segment

The 10–25 MMBTU/hr capacity segment holds the dominant position with a market share of 46% in the Gas Fired Food Processing Industrial Hot Water Boiler market. Food and beverage processors prefer this range due to its balanced thermal output, suitability for continuous operations, and stable energy consumption for cleaning, pasteurization, and ingredient heating. The 10 MMBTU/hr segment accounts for 28% share, serving small and mid-scale facilities with lower steam and hot water demand. The 25–50 MMBTU/hr segment represents 19% share, supported by large-scale dairy, meat, and beverage plants. Units above 50 MMBTU/hr hold the remaining 7% share, catering to specialized, high-throughput processing environments.

- For instance, Bosch Industriekessel supplied a highly efficient steam boiler system to the global dairy processor Lactalis at their Stranraer production facility, enabling reliable and efficient steam generation for milk processing, including pasteurization and CIP sanitation lines.

By Technology Segment

The condensing boiler segment leads with a market share of 62%, driven by higher thermal efficiency, reduced fuel usage, and compliance with emission reduction standards. Food processors adopt condensing systems to optimize operating costs and support sustainability commitments, especially in regions with strict carbon regulations. The non-condensing segment holds a 38% share, serving facilities that prioritize lower upfront costs and simpler system design, particularly in replacement or retrofit applications. Increasing integration of low-NOx burners, smart controls, and heat recovery systems further strengthens the adoption of condensing boilers in bakery, dairy, brewery, and ready-to-eat food processing plants.

- For instance, Babcock Wanson integrated a low-NOx burner achieving below 30 mg/Nm³ NOx emissions in a ready-meal preparation facility, while digital controls reduced excess air levels and improved fuel-to-flame response time to under 200 milliseconds during batch load changes.

KEY GROWTH DRIVERS

Rising Demand for Energy-Efficient Thermal Systems

Food and beverage manufacturers increase the use of energy-efficient heating systems to reduce fuel consumption and production costs. Gas fired industrial hot water boilers provide consistent temperature control for pasteurization, CIP cleaning, ingredient preparation, and sanitation. Adoption rises as processors focus on improving heat transfer efficiency and reducing operational waste. Plants handling dairy, meat, sauces, bakery, and ready-to-eat products benefit from rapid response heating and stable thermal output. Energy optimization targets and fuel cost management further strengthen demand for modern boiler systems, supporting market expansion across varied processing scales.

- For instance, Fulton supplied a system supporting a ramp-up time of under 7 minutes to full load, enabling continuous sanitation cycles and reducing fuel losses linked to idle heating periods.

Growing Food Safety and Hygiene Compliance Requirements

Strict hygiene regulations increase the use of advanced hot water boiler systems to support sanitization, sterilization, and safe processing temperatures. Gas fired units ensure reliable hot water supply for cleaning vessels, pipelines, conveyors, and packaging components. Facilities adopt systems with precise temperature control to meet food safety certification standards. Manufacturers upgrade older boilers to reduce contamination risks and support automated sanitation cycles. Higher awareness about cross-contamination prevention and consumer safety drives investment in high-performance boiler technologies across dairy, beverage, and protein processing facilities.

- For instance, Cleaver-Brooks provides fully integrated and rigorously factory-tested boiler systems used in industries like food processing and manufacturing for various applications including heating, cooking, and sterilization of equipment to ensure safety and potentially help reduce microbial loads in those environments.

Expansion of Process Automation and Heat Recovery Adoption

Automation in food production encourages deployment of integrated boiler systems with smart controls, real-time monitoring, and automated load adjustments. Heat recovery systems allow plants to reuse waste heat and reduce operational costs. Boiler manufacturers offer digital diagnostics and remote performance management, improving uptime and maintenance planning. Integration with energy management platforms supports consistent hot water availability across complex production lines. As processors scale capacity and optimize thermal resources, automated and heat-recovery-enabled gas fired boiler solutions gain wider acceptance.

KEY TRENDS & OPPORTUNITIES

Shift Toward Low-NOx and Condensing Boiler Technologies

Food processors adopt condensing boilers to lower fuel usage and emissions while maximizing efficiency. Low-NOx burner configurations support compliance with regional air quality standards and sustainability goals. Manufacturers integrate corrosion-resistant heat exchangers and condensate recovery features to improve lifecycle performance. The trend enables cost savings for high-demand processes such as dairy pasteurization, brewing, and sauce preparation. Rising corporate sustainability commitments and carbon reduction programs create strong opportunities for condensing boiler deployment across global food production hubs.

- For instance, ALFA LAVAL supplied a stainless-steel T25 gasketed plate heat exchanger that enabled a Carlsberg brewery in Xichang, China, to heat water to 98-99 degrees Celsius using recovered wort vapor heat, reducing total steam consumption by approximately 10%.

Growth of Modular and High-Capacity Boiler Solutions

Expanding output in beverage, frozen foods, and ready-meal facilities increases the demand for modular and scalable boiler configurations. Modular systems reduce installation time, maintenance downtime, and space requirements while enabling flexible load management. High-capacity units support continuous thermal processing in large dairy and meat plants. Manufacturers explore factory-assembled systems to accelerate delivery and commissioning. This trend creates opportunities for suppliers offering turnkey thermal energy solutions and integrated boiler room modernization programs.

- For instance, Hurst Boiler & Welding supplied a skid-mounted system that was pre-tested, a process intended to reduce site work and allow for a more efficient installation and commissioning phase, supporting high-volume sanitation and ingredient preparation lines.

KEY CHALLENGES

High Installation and Fuel Cost Pressures

Capital investments for advanced condensing and low-emission boiler systems remain significant, especially for small and mid-scale processors. Fuel price fluctuations affect lifecycle operating costs and budgeting decisions. Facilities may delay upgrades or select lower-efficiency alternatives when financial resources are limited. Integration with existing piping and thermal systems can require additional engineering and downtime. These cost-related barriers influence adoption speed across emerging manufacturing regions.

Complex Maintenance and Skilled Workforce Requirements

Modern gas fired boiler systems involve advanced control electronics, heat exchangers, and combustion optimization components. Ensuring reliable performance requires skilled technicians and structured maintenance programs. Facilities without trained boiler operators face risks of reduced efficiency and unscheduled downtime. Access to specialized parts and service networks varies across regions, affecting response times and ownership experience. Addressing workforce development and service infrastructure remains essential for broader technology adoption.

Regional Analysis

North America

North America holds a market share of 34% driven by strong food processing capacity, stringent hygiene standards, and modernization of heating systems across dairy, meat, bakery, and beverage industries. The United States leads adoption with investments in high-efficiency condensing boilers and low-NOx burner technology to comply with emission rules. Canada supports growth through expansion in frozen food, ready-meal manufacturing, and beverage production. Energy optimization programs encourage facilities to replace aging boilers with automated, heat-recovery-enabled systems. Strong presence of boiler manufacturers and service providers enhances long-term market development.

Europe

Europe accounts for a market share of 29% supported by environmental regulations, energy management directives, and sustainability commitments by food producers. Germany, France, Italy, and the Netherlands deploy high-efficiency gas fired boiler systems in dairy, bakery, brewing, and confectionery segments. Manufacturers invest in condensing technology and digital boiler controls to reduce fuel use and lower carbon emissions. Government-backed carbon reduction programs support boiler upgrades and process heat optimization. Growing demand for processed and packaged food reinforces adoption across mid-sized and large production facilities.

Asia Pacific

Asia Pacific leads the market with a market share of 42% powered by a large and expanding food and beverage manufacturing sector, particularly in China, India, Japan, and South Korea. Rapid growth in dairy, meat processing, instant foods, and beverage bottling increases demand for efficient thermal systems. Food companies invest in reliable hot water generation for cleaning, sterilization, and ingredient preparation. Urbanization and export-oriented production strengthen boiler demand in high-throughput facilities. Local manufacturing and favorable fuel availability support market expansion across this region.

Latin America

Latin America holds a market share of 8% driven by growth in meat processing, bakery products, beverages, and dairy production. Brazil, Mexico, and Argentina invest in efficient gas fired hot water boilers to support sanitation and production heat requirements. Facilities adopt boilers with improved combustion control and heat recovery systems to reduce energy expenses. Development of cold chain and packaged food industries boosts demand for stable process heating. Infrastructure and fuel price variability remain adoption challenges, but modernization trends indicate gradual market growth.

Middle East & Africa

The Middle East & Africa region represents a market share of 5% supported by expansion in beverage bottling, bakery, and processed food manufacturing. Gulf countries adopt gas fired boilers for energy-efficient production aligned with food security goals and industrial diversification plans. South Africa and Egypt strengthen packaged food processing, driving investment in modern heating systems with low emissions and simplified maintenance. Availability of natural gas supports commercial boiler deployment; however, limited technical service networks and capital constraints influence adoption speed. Long-term prospects remain positive as regional food production capacity continues to expand.

Market Segmentations:

By Capacity

- 10 MMBTU/hr

- 10 – 25 MMBTU/hr

- 25 – 50 MMBTU/hr

- > 50 MMBTU/hr

By Technology

- Condensing

- Non-Condensing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape or analysis in the Gas Fired Food Processing Industrial Hot Water Boiler market features key players including Fulton, Bosch Industriekessel, California Boiler, EPCB Boiler, Hoval, Hurst Boiler & Welding, Cleaver-Brooks, ALFA LAVAL, Forbes Marshall, and Babcock Wanson. Manufacturers focus on improving thermal efficiency, reducing fuel consumption, and enhancing system automation to support continuous food processing operations. Condensing boiler systems gain strategic importance as processors target lower emissions and heat recovery benefits. Companies strengthen their portfolios through turnkey boiler room solutions, IoT-enabled monitoring platforms, and modular, skid-mounted systems designed for rapid installation. Strategic partnerships with food producers, engineering consultants, and energy service firms help optimize lifecycle performance and maintenance planning. Competitive efforts emphasize low-NOx combustion technology, corrosion-resistant heat exchangers, and digital controls for temperature precision in sanitation and pasteurization processes. As production volumes grow in bakery, dairy, beverage, and ready-meal segments, market competition shifts toward service reliability, remote diagnostics, and long-term operational cost reduction.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fulton

- Bosch Industriekessel

- California Boiler

- EPCB Boiler

- Hoval

- Hurst Boiler & Welding

- Cleaver-Brooks

- ALFA LAVAL

- Forbes Marshall

- Babcock Wanson

Recent Developments

- In September 2025, Forbes Marshall exhibited at World Food India 2025 to showcase its emissions-control, steam and hot-water solutions tailored for food-processing plants.

- In August 2025, Alfa Laval also signed a Memorandum of Understanding (MoU) with AquaGreen to advance biomass & waste-to-energy thermal solutions.

- In January 2025, Alfa Laval announced the establishment of a new Food Innovation Centre in Copenhagen to support food-industry thermal and processing solutions, which is planned to open in 2027

Report Coverage

The research report offers an in-depth analysis based on Capacity, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of high-efficiency condensing boilers will increase across large food processing plants.

- Heat recovery and waste-energy utilization will become standard design features in new boiler systems.

- Digital monitoring, remote diagnostics, and predictive maintenance will strengthen operational reliability.

- Low-NOx and ultra-low emission burner technology will expand to meet strict air quality rules.

- Modular and skid-mounted boiler packages will support faster installation and capacity scaling.

- Integration with automation, CIP systems, and smart energy platforms will improve process consistency.

- Hybrid thermal systems combining gas boilers with renewable heat sources will gain traction.

- Local manufacturing and service networks will expand to reduce downtime and maintenance costs.

- Food safety and hygiene certification requirements will drive upgrades to advanced temperature-control systems.

- Regional investments in dairy, beverage, bakery, and ready-meal production will sustain long-term market growth.