Market Overview

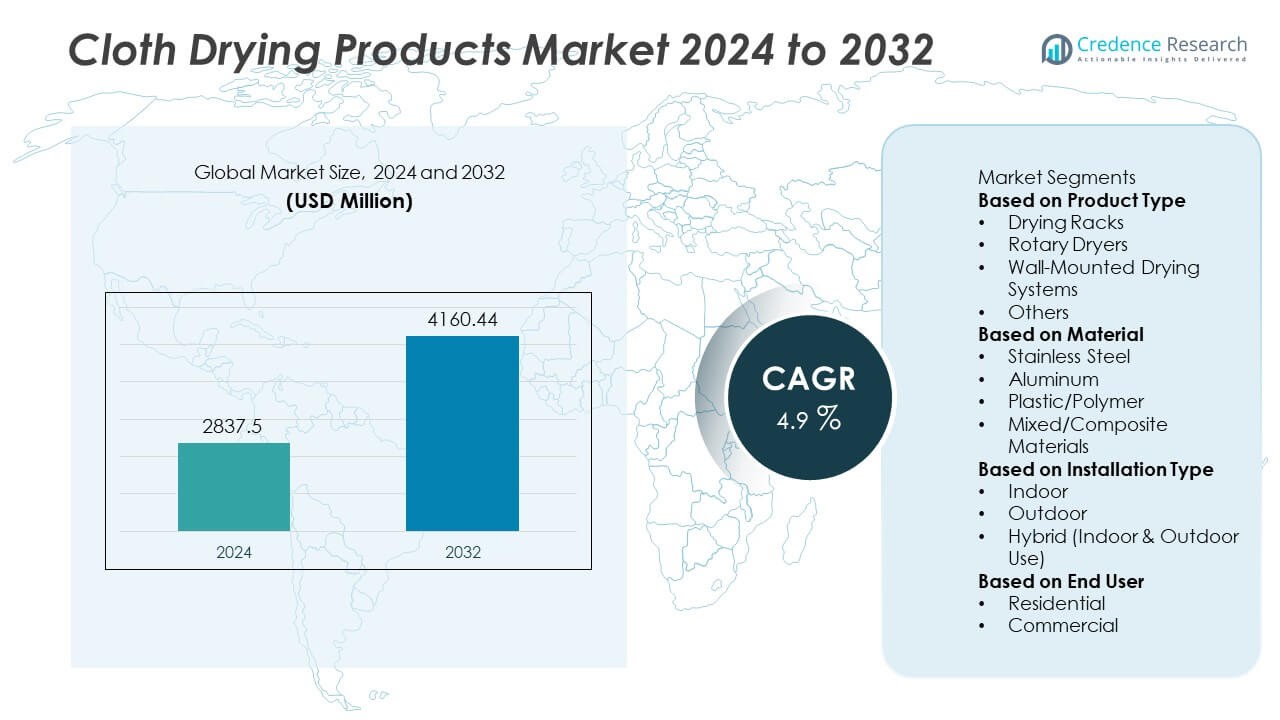

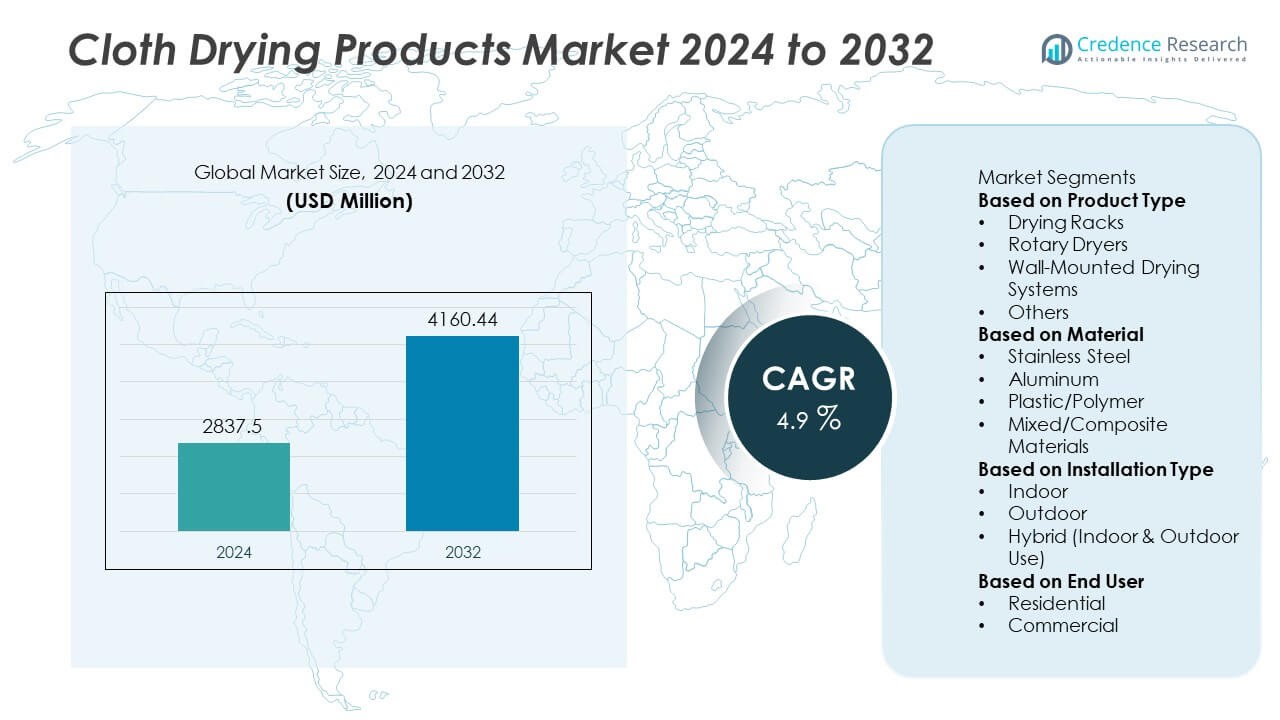

The Cloth Drying Products Market reached USD 2,837.5 million in 2024 and is projected to grow to USD 4,160.44 million by 2032, registering a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloth Drying Products Market Size 2024 |

USD 2,837.5 Million |

| Cloth Drying Products Market, CAGR |

4.9% |

| Cloth Drying Products Market Size 2032 |

USD 4,160.44 Million |

The Cloth Drying Products market is driven by leading manufacturers such as Leifheit AG, Whitmor Inc., Hills Home Living, Vileda (Freudenberg Group), Juwel Metallwarenfabrik GmbH, Drynatural, Honey-Can-Do International LLC, Brabantia Branding B.V., Minky Homecare, and Home-it USA. These companies focus on durable, space-efficient drying systems designed for indoor and outdoor use, including foldable racks, rotary dryers, and wall-mounted units. Asia-Pacific leads the market with a 31% share, supported by rapid urbanization and the growing need for compact laundry solutions in high-density residential areas. North America and Europe follow, driven by sustainability preferences and increasing adoption of energy-efficient, non-electric drying alternatives in apartments and small homes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cloth Drying Products market reached USD 2,837.5 million in 2024 and is projected to reach USD 4,160.44 million by 2032 at a 4.9% CAGR, driven by rising demand for energy-efficient and space-saving laundry solutions.

- Growing preference for manual and low-electricity drying products acts as a key driver, with drying racks holding a 38% segment share as households adopt foldable and portable solutions for compact urban living spaces.

- The market observes strong trends toward heated and smart drying systems, while e-commerce and direct-to-consumer channels expand brand visibility and enable customized product offerings across residential and commercial users.

- Competitive intensity increases as key players invest in corrosion-resistant stainless steel designs, ergonomic folding mechanisms, and modular systems, while brands differentiate through durability, load capacity, and space-optimized structures.

- Asia-Pacific leads the market with a 31% regional share followed by North America at 30% and Europe at 27%, whereas Latin America and Middle East & Africa hold 7% and 5%, supported by growth in urban housing and laundry service facilities.

Market Segmentation Analysis:

By Product Type:

Drying racks hold the leading position with a 38% share in the product type segment. Consumers prefer drying racks due to their foldable designs, portability, and compatibility with small living spaces. Rotary dryers gain adoption in outdoor areas, supported by larger drying capacity. Wall-mounted systems appeal to urban households seeking space-saving, fixed installations. Other product variants, including heated and smart drying systems, expand due to rising interest in energy-efficient laundry solutions. Growth in compact housing and eco-focused drying habits supports long-term demand for versatile and collapsible drying product designs.

- For instance, Leifheit AG launched its Pegasus 200 Solid model, engineered with a 20-meter drying length and a special powder coating providing lasting rust protection.

By Material:

Stainless steel represents the dominant material category with a 41% share in the market. Users value stainless steel for its corrosion resistance, long product lifespan, and strength under heavy laundry loads. Aluminum products remain popular due to lightweight structure and ease of movement in indoor and outdoor drying spaces. Plastic and polymer drying units serve budget-conscious buyers and families seeking child-safe and rust-free solutions. Mixed and composite materials support innovative product development, using hybrid structures for improved durability. Increased consumer focus on long-lasting, sustainable home products strengthens preference for stainless steel drying systems.

- For instance, Honey-Can-Do International designs indoor racks using various materials like powder-coated steel or resin components, which are selected for durability and utility across their product lines.

By Installation Type:

Indoor drying solutions account for a 47% share and lead the installation type segment. Demand remains strong across apartments and smaller homes where outdoor drying areas are limited. Outdoor drying products continue to serve users in low-humidity climates, offering higher capacity and energy-free operation. Hybrid drying systems, suitable for both indoor and outdoor use, appeal to flexible usage preferences and seasonal needs. Growth in urban housing, rising adoption of heating-assisted indoor drying, and interest in low-energy laundry practices support the expansion of indoor drying product installations.

Key Growth Drivers

Rising Demand for Space-Saving Laundry Solutions

Urban households adopt compact cloth drying products to optimize limited living spaces. Drying racks, wall-mounted, and foldable systems support small apartments and multi-family housing. Consumers seek indoor drying options due to unpredictable weather and restrictions on outdoor drying in many residential communities. Manufacturers focus on lightweight, durable materials and multifunctional designs that allow easy use and storage. Growing rental housing and student accommodation markets further increase demand for portable and versatile drying solutions across global urban centers.

- For instance, Vileda (Freudenberg Group) manufactures foldable indoor drying racks made with sturdy steel frames that fold flat for compact storage, with some models designed to support a load capacity of up to 20 kg.

Growing Preference for Energy-Efficient Laundry Methods

Users shift toward manual and low-energy drying systems to reduce electricity consumption and environmental impact. Rotary dryers and indoor racks eliminate dependence on electric dryers and support long-term utility savings. Consumers prioritize sustainable home products as awareness of eco-friendly living continues to rise. Cloth drying products made from recyclable and long-lasting materials strengthen adoption in energy-conscious households. Government incentives encouraging reduced appliance usage in peak energy seasons also support this growth driver.

- For instance, Brabantia offers a range of steel-armed rotary dryers, such as the Lift-O-Matic and Topspinner, with options providing a 50-meter UV-resistant drying line. These products feature a sturdy construction and the “umbrella” system to keep lines taut, with many customers reporting them to be robust and well-made.

Expansion of Organized Laundry Services and Hospitality Sector

Commercial laundry services, hotels, and hostels increase usage of high-capacity cloth drying systems to manage frequent washing cycles. Durable stainless steel racks and rotary drying units support heavy loads and faster turnover. Growth in tourism and serviced apartments expands demand for drying solutions in shared and private laundry areas. Vendors develop stronger, corrosion-resistant structures to meet commercial usage needs. The rising number of laundromats, especially in urban regions, reinforces market adoption.

Key Trends & Opportunities

Adoption of Smart and Heated Drying Solutions

Manufacturers introduce heated airers, electric-assisted drying stands, and smart drying systems with timers and sensors. These products help households dry clothes faster during humid or winter seasons. IoT-enabled controls and foldable heated frames appeal to premium buyers seeking convenience and efficiency. Brands explore modular designs with temperature adjustment and energy-saving modes. This trend creates opportunities for partnerships with smart home appliance platforms and energy-efficient product certifications.

- For instance, Daewoo launched a heated airer with a 300-watt heating element and offers around 20m of total drying space. It is reportedly more energy-efficient than a tumble dryer and costs approximately 8p per hour to run, though actual drying times are not a guaranteed 55 minutes for a full load.

Growth of Online Distribution and Direct-to-Consumer Brands

E-commerce platforms drive strong visibility for cloth drying products across residential and commercial buyers. Consumers compare materials, load capacity, and installation styles before purchasing. Direct-to-consumer brands expand with subscription-based accessories and extended warranty services. Digital retail supports broader reach in regions with limited home improvement stores. Influencer marketing and home organization trends also improve product demand, creating opportunities for premium and customized drying solutions.

- For instance, Honey-Can-Do International is a housewares and storage products company that was acquired by Can Do Brands in January 2025. The company offers a range of products, including various types of steel-folding drying racks.

Key Challenges

Limited Use in High-Humidity and Monsoon Conditions

Regions with persistent humidity or long monsoon periods face slow drying cycles, reducing product effectiveness. Users may prefer electric dryers despite higher costs and energy use. Mold risk increases when clothes remain damp indoors, discouraging reliance on traditional drying racks. Manufacturers are pressured to improve airflow features and moisture-resistant materials. This challenge drives interest in heated and hybrid drying systems, but price sensitivity remains a barrier.

Intense Competition from Electric Clothes Dryers

Widespread adoption of electric dryers creates strong competition, especially in regions with stable electricity access. Consumers prefer automated drying for convenience, speed, and reduced manual effort. Cloth drying products must differentiate through sustainability, cost savings, and compact storage benefits. Marketing efforts are needed to highlight advantages for small-space living and energy efficiency. Companies must invest in design innovation to maintain competitiveness against automated laundry appliances.

Regional Analysis

North America

North America holds a 30% share of the Cloth Drying Products market, supported by strong demand for indoor and space-saving drying solutions. The United States leads due to a high concentration of apartment living and restrictions on outdoor drying in several communities. Consumers invest in foldable racks, wall-mounted systems, and heated drying products to reduce reliance on electric dryers and save energy. Growth in student housing, rental properties, and small urban homes strengthens product adoption. Canada shows rising interest in environmentally friendly laundry habits, reinforcing demand for durable stainless steel and multi-functional drying units.

Europe

Europe accounts for a 27% share of the market, driven by a long-standing culture of line drying and strong sustainability preferences. Households in Germany, Italy, France, and the United Kingdom adopt rotary dryers and wall-mounted systems to reduce electricity consumption and comply with eco-conscious living trends. Space-saving designs gain traction in dense urban housing zones, particularly in multifamily apartments. Demand increases for high-quality stainless steel and aluminum materials suited for humid outdoor environments. European consumers value durable, corrosion-resistant structures, supporting premium product offerings from established regional and international manufacturers.

Asia-Pacific

Asia-Pacific leads the market with a 31% share, fueled by large populations, rapid urbanization, and growth in compact living arrangements. China and India show strong adoption of low-cost plastic/polymer drying racks and wall-mounted indoor systems in high-density residential areas. Japan and South Korea prefer foldable and ceiling-mounted designs due to limited floor space in apartments. Rising energy costs and humid climates support interest in hybrid and heated drying products. As digital retail expands, online distribution accelerates product accessibility across major cities, strengthening long-term demand for innovative and portable drying solutions.

Latin America

Latin America holds a 7% market share, driven by increasing urban apartment living and the expansion of laundromats and shared housing facilities. Brazil and Mexico adopt both indoor and outdoor drying units, depending on regional climate conditions and household space availability. Demand grows for budget-friendly plastic and mixed-material drying racks, appealing to cost-sensitive users. Tourism and hospitality sector growth supports commercial usage of high-capacity rotary drying systems. Market expansion remains steady as e-commerce improves access to international brands and compact, easy-to-install drying solutions across major metropolitan areas.

Middle East & Africa

The Middle East & Africa account for a 5% share of the market, influenced by climate variations and expanding residential infrastructure. Gulf countries utilize outdoor rotary dryers in low-humidity seasons but rely on indoor drying stands during extreme heat conditions. South Africa and parts of East Africa adopt affordable drying racks and portable foldable units for small and shared housing spaces. Growth in expatriate housing, student accommodations, and hospitality environments supports product penetration. Limited indoor space and shifting weather patterns encourage demand for hybrid drying designs that function both indoors and outdoors.

Market Segmentations:

By Product Type

- Drying Racks

- Rotary Dryers

- Wall-Mounted Drying Systems

- Others

By Material

- Stainless Steel

- Aluminum

- Plastic/Polymer

- Mixed/Composite Materials

By Installation Type

- Indoor

- Outdoor

- Hybrid (Indoor & Outdoor Use)

By End User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cloth Drying Products market includes key players such as Leifheit AG, Whitmor Inc., Hills Home Living, Vileda (Freudenberg Group), Juwel Metallwarenfabrik GmbH, Drynatural, Honey-Can-Do International LLC, Brabantia Branding B.V., Minky Homecare, and Home-it USA. Competition centers on product durability, space-saving designs, and materials such as stainless steel, aluminum, and high-strength polymers. Companies focus on foldable, wall-mounted, and heated drying systems that support indoor usage in compact homes. Vendors strengthen brand visibility through e-commerce channels, direct-to-consumer sales, and partnerships with home improvement retailers. Product innovation emphasizes lightweight structures, corrosion resistance, and enhanced load capacity to improve user convenience. Manufacturers expand their reach by targeting student accommodations, rental housing, and hospitality facilities. Pricing strategies, sustainability messaging, and modular designs further differentiate products in a highly cost-sensitive market. As energy-efficient living trends accelerate, companies invest in hybrid and smart drying solutions to meet evolving consumer needs and reinforce competitive advantage.

Key Player Analysis

- Leifheit AG

- Whitmor, Inc.

- Hills Home Living

- Vileda (Freudenberg Group)

- Juwel Metallwarenfabrik GmbH

- Drynatural

- Honey-Can-Do International, LLC

- Brabantia Branding B.V.

- Minky Homecare

- Home-it USA

Recent Developments

- In 2025, Brabantia introduced the HangOn Drying Rack Too series (18 m and 22 m) as a smart, space-efficient drying solution.

- In 2025, Vileda (part of Freudenberg Home and Cleaning Solutions) launched a strategic brand collaboration with Dr. Beckmann in the German market, bundling drying racks (such as Vileda’s Infinity Flex) with laundry-sheet products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Installation Type, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise for compact and foldable drying products in small urban homes.

- Energy-efficient drying systems will gain adoption as households reduce electricity use.

- Smart and heated drying solutions will expand in regions with long humid seasons.

- Manufacturers will introduce corrosion-resistant materials to extend product durability.

- Multi-functional drying designs will support hybrid indoor and outdoor use.

- E-commerce and direct-to-consumer channels will strengthen global product accessibility.

- Premium brands will target hotels, student housing, and shared laundry facilities.

- Sustainable and recyclable materials will become a core purchasing preference.

- Modular drying systems will enable easier installation and space optimization.

- Emerging economies will increase product usage as housing density and laundromat services grow.