Market Overview

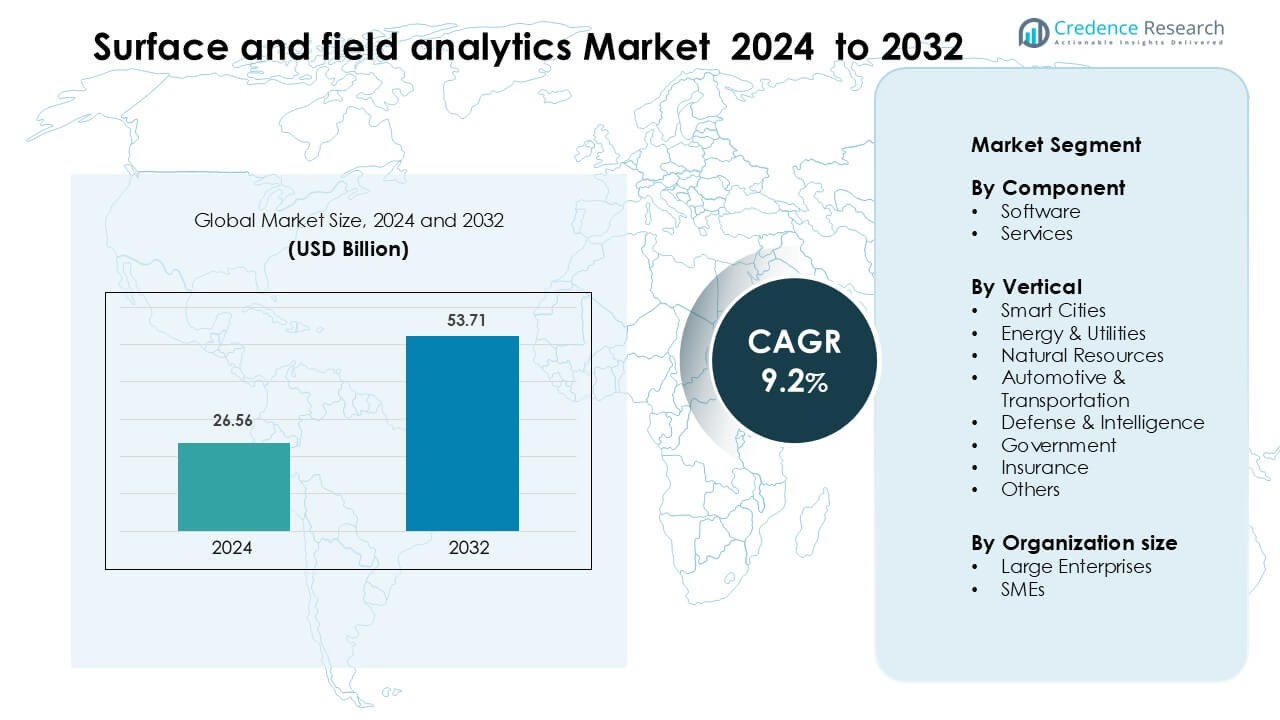

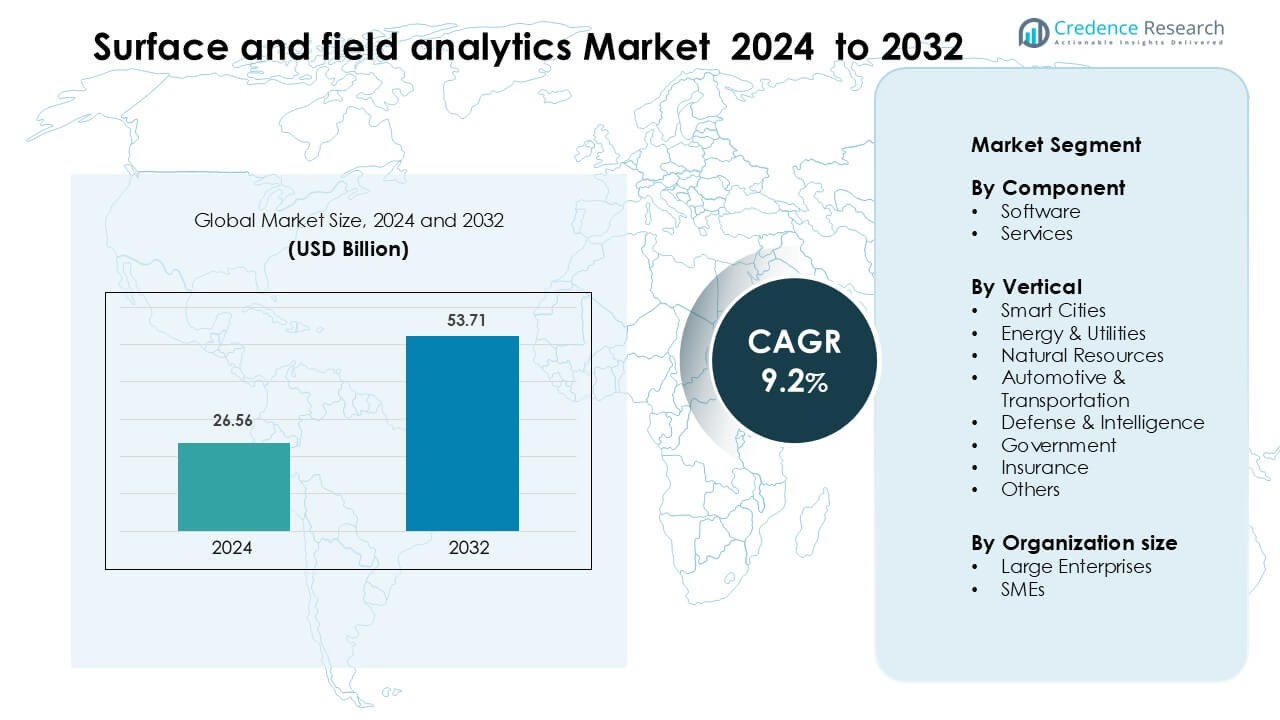

Surface and field analytics Market was valued at USD 26.56 billion in 2024 and is anticipated to reach USD 53.71 billion by 2032, growing at a CAGR of 9.2 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Surface and field analytics Market Size 2024 |

USD 26.56 Billion |

| Surface and field analytics Market, CAGR |

9.2 % |

| Surface and field analytics Market Size 2032 |

USD 53.71 Billion |

The Surface and Field Analytics Market is shaped by leading companies such as Nikon Corporation, ULVAC-PHI, Inc., Shimadzu Corporation, Bruker Corporation, JEOL Ltd., Carl Zeiss AG, Thermo Fisher Scientific, Waters Corporation, Olympus Corporation, and Danaher Corporation. These players compete through advanced imaging systems, high-resolution surface analyzers, and AI-supported field-data platforms used across smart cities, energy, transportation, and natural-resource applications. Their focus on precision instruments and automated workflows strengthens global adoption. North America leads the market with about 37% share in 2024, driven by strong digital infrastructure, high investment in predictive analytics, and widespread use of drone-enabled field intelligence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Surface and field analytics Market was valued at USD 26.56 billion in 2024 and is anticipated to reach USD 53.71 billion by 2032, growing at a CAGR of 9.2 % during the forecast period.

- Market growth is driven by rising adoption of drone-based inspections, real-time geospatial intelligence, and AI-supported surface-mapping tools across smart cities, utilities, transportation, and natural-resource sectors.

- Key trends include rapid integration of cloud-native analytics, expansion of autonomous field-inspection technologies, and increased use of AI models for anomaly detection, predictive insights, and terrain-condition forecasting.

- The competitive landscape includes players such as Nikon Corporation, ULVAC-PHI, Shimadzu, Bruker, JEOL, Carl Zeiss, Thermo Fisher Scientific, Waters, Olympus, and Danaher, focusing on precision instruments, hyperspectral imaging, and automated analytics workflows.

- North America leads with 37% share, followed by Europe at 29% and Asia-Pacific at 24%, while software dominates the component segment with around 62% share due to strong adoption of AI-enabled analytics platforms.

Market Segmentation Analysis:

By Component

Software leads the Surface and Field Analytics Market with about 62% share in 2024 due to rapid adoption of AI-enabled mapping platforms, geospatial modeling tools, and automated anomaly-detection systems. Demand grows as enterprises prioritize real-time visualization, predictive insights, and strong integration with drones and field sensors. Services hold the remaining share and expand as organizations seek managed analytics, system integration, and on-site calibration support to improve operational accuracy. Growth in software is driven by rising digital workflows, lower processing costs, and the shift toward centralized decision dashboards across industrial and public sectors.

- For instance, Pix4D software is widely used across industries such as construction, agriculture, and surveying, and that it facilitates cloud-based mapping and real-time site analytics.

By Vertical

Smart Cities dominate this segment with nearly 28% share in 2024 as municipalities deploy surface-level scanning, environmental monitoring, and GIS-based analytics to improve infrastructure planning and mobility systems. Energy and utilities follow due to strong use of field analytics in pipeline inspection, grid condition assessment, and asset-failure prediction. Natural resources, automotive, defense, government, and insurance segments expand as each sector adopts remote sensing, real-time field data capture, and high-resolution surface analysis to boost efficiency, safety, and compliance across distributed operations.

- For instance, Esri India is actively involved in India’s Smart Cities Mission, where it deploys its ArcGIS-based solutions to help urban local bodies manage and visualize their infrastructure. These solutions enable field staff to perform essential tasks such as collecting inspection data, visualizing water and sewage networks, and maintaining assets via real-time dashboards.

By Organization Size

Large enterprises hold the dominant share at around 64% in 2024, supported by strong investment capacity, advanced digital transformation programs, and the need for high-accuracy field intelligence across large asset bases. Adoption rises as major corporations integrate geospatial analytics, automated surface diagnostics, and drone-based field mapping into reliability programs. SMEs show steady growth due to rising cloud-based deployments, modular pricing, and the increasing availability of lightweight analytics tools. Demand increases as smaller firms seek faster site assessment, reduced survey costs, and improved risk mitigation across construction, utilities, and natural-resource operations.

Key Growth Drivers

Rising Adoption of Real-Time Geospatial Intelligence

Growing demand for real-time geospatial intelligence drives the Surface and Field Analytics Market as governments and enterprises rely on high-resolution surface data to enhance planning, asset monitoring, and risk prediction. Organizations deploy drone-based inspections, IoT sensors, and automated mapping platforms to capture live field conditions across infrastructure, utilities, and natural environments. This shift supports faster decisions, improves safety, and reduces operational downtime. Smart city programs and regulated industries use these tools to monitor structural stress, land shifts, and environmental impact with greater accuracy. The integration of AI models strengthens anomaly detection and forecasting, making real-time insights a core requirement for large-scale field operations.

- For instance, Hexagon’s HxGN Connect platform, deployed in public safety and infrastructure operations, uses assistive AI on real-time IoT and asset data streams to issue alerts based on detected anomalies such as sudden changes in sensor readings or unusual patterns of movement.

Expansion of Smart City and Infrastructure Modernization Programs

Global investment in smart cities and modern infrastructure fuels strong demand for surface and field analytics, especially as urban planners require precise terrain mapping, traffic flow assessment, and real-time environmental measurements. Countries adopt intelligent city systems to upgrade mobility networks, assess road health, and control pollution levels. Analytics platforms help identify maintenance needs early and support long-term infrastructure resilience. Public agencies deploy surface scanners, GIS tools, and field-sensor networks to improve project planning accuracy. Rising adoption of digital twins accelerates this trend by enabling simulation of future urban loads, supporting better decisions around construction, zoning, and resource use.

- For instance, Hexagon’s M.App Enterprise / LuciadRIA platform can fuse a vast number of diverse data sources, including billions of LiDAR points, BIM data, high-resolution imagery, and live IoT sensor feeds. This integrated data can then be used to simulate and analyze complex urban phenomena such as weather patterns, traffic flow, and urban heat island effects for comprehensive full-city digital twin applications.

Growing Use of Predictive Maintenance Across Industries

Predictive maintenance initiatives boost market growth as industries adopt surface and field analytics to detect early signs of wear, corrosion, leaks, or structural deformation. Asset-heavy sectors such as energy, utilities, transportation, and natural resources depend on precise surface data to prevent costly failures. High-frequency imaging, spectral analysis, and intelligent field mapping help operational teams detect faults before they escalate. Organizations use analytics dashboards to track asset conditions and schedule timely repairs, lowering downtime costs. The shift toward automated inspections using drones and robotic platforms strengthens adoption, making predictive maintenance a strategic priority for operational continuity.

Key Trend & Opportunity

Integration of AI-Enhanced Analytics for Automated Insights

Artificial intelligence creates major opportunities by transforming surface and field analytics into automated, high-accuracy systems capable of advanced pattern recognition and anomaly detection. Machine learning models improve interpretation of satellite images, ground scans, and sensor-based surface readings with stronger precision. Companies invest in AI-driven geoprocessing engines that predict soil shifts, infrastructure degradation, and environmental pressure points. The rise of multimodal analytics combining imagery, spectral data, and geospatial inputs accelerates insight generation. As training datasets expand, AI-enabled tools reduce manual analysis time and support higher-confidence decisions for both public and industrial users.

- For instance, Satelytics applies AI‑powered analytics to 50‑cm resolution multispectral imagery from Pleiades satellites to flag encroachments and pipeline risk zones, and integrates alerts into Southern Company’s ArcGIS‑based operational system.

Growth of Cloud-Native and Scalable Analytics Platforms

Cloud-native systems offer major growth opportunities as organizations shift from hardware-intensive processing to scalable, subscription-based analytics architectures. Cloud deployment supports fast data ingestion from drones, mobile devices, and distributed sensors, enabling multi-location field teams to work collaboratively. Companies gain the ability to run complex surface simulations, 3D modeling, and predictive workflows without heavy infrastructure investments. This trend also supports SMEs that require flexible pricing and lower entry barriers. Increasing API availability enhances integration with digital twins, asset-management platforms, and enterprise workflows, making cloud-based analytics central to digital transformation strategies.

- For instance, Esri’s ArcGIS Velocity, which is a cloud-native add-on to ArcGIS Online, can ingest real-time IoT data, handle streaming data for live spatial analytics, and trigger alerts supporting operations directly in the cloud without on-premises infrastructure.

Expanding Use of Autonomous Inspection Technologies

Autonomous drones, land rovers, and robotic scanners create a strong opportunity by improving the speed and safety of field surveys. These systems conduct surface inspections in hazardous areas, remote sites, or large terrains without human intervention. Automation accelerates data collection, reduces labor costs, and improves repeatability of surveys. Industries such as mining, construction, and utilities integrate autonomous systems to perform routine scans, detect early degradation, and gather surface metrics at scale. As regulatory permissions expand and sensor payloads become more advanced, autonomous inspection technologies will play a vital role in next-generation field analytics.

Key Challenge

High Implementation and Integration Costs

High deployment costs remain a major challenge, particularly for SMEs and public agencies with limited technology budgets. Advanced analytics systems require investments in drone fleets, LIDAR devices, spectral sensors, GIS software, and integration platforms. Many organizations struggle with the additional cost of training, calibration, and data-processing expertise. Legacy operational workflows create integration delays, especially when merging new surface datasets with older infrastructure records. These costs often slow early adoption and reduce scalability, making budget approvals difficult. Vendors must offer modular pricing, managed services, and cloud-based alternatives to reduce entry barriers and accelerate market expansion.

Data Quality, Security, and Compliance Constraints

Data accuracy and security pose significant obstacles because surface and field analytics depend on large volumes of sensitive geospatial and operational information. Errors in sensor calibration, poor scan quality, or inconsistent field data can affect decision reliability. Industries handling critical assets such as utilities, defense, and government—face strict regulations concerning data storage, sharing, and cross-border transfer. Cybersecurity threats increase as more surface data moves through cloud platforms and IoT networks. Organizations must implement strong encryption, identity controls, and compliance frameworks to ensure trustworthy analytics. Vendors need to support standardized data models to prevent quality gaps and interoperability issues.

Regional Analysis

North America

North America leads the Surface and Field Analytics Market with nearly 37% share in 2024, supported by strong adoption of advanced geospatial mapping, drone inspections, and AI-driven field assessment tools. Utility providers, transportation agencies, and smart city programs invest heavily in real-time condition monitoring to enhance safety and operational continuity. The United States drives most demand due to mature digital infrastructure and higher spending on predictive maintenance. Increasing deployment of autonomous inspection systems and cloud-based analytics platforms strengthens market expansion across energy, natural resources, and government applications.

Europe

Europe accounts for around 29% share in 2024, driven by strong environmental monitoring regulations, infrastructure modernization efforts, and high uptake of surface imaging and GIS-based analytics. Countries such as Germany, the U.K., and France accelerate adoption to support sustainability targets, land-use planning, and asset reliability programs. Demand grows in transportation, utilities, and defense applications as authorities prioritize precision field intelligence. The region’s shift toward digital twins and cross-border geospatial data collaboration encourages broader implementation of cloud-native platforms and AI-enhanced field analytics solutions.

Asia-Pacific

Asia-Pacific holds approximately 24% share in 2024, fueled by rapid urbanization, major smart city investments, and expansion of energy and transportation networks. China, India, Japan, and South Korea lead adoption as governments digitize infrastructure monitoring and deploy large-scale sensor networks. Industries increasingly use surface analytics for land mapping, pipeline inspection, and construction planning. Rising drone usage and improved satellite imaging capabilities accelerate growth. The region benefits from lower hardware costs and expanding domestic manufacturing of sensing and mapping technologies, making Asia-Pacific the fastest-growing market segment.

Latin America

Latin America captures about 6% share in 2024, supported by increasing application of surface and field analytics in mining, utilities, and agriculture. Countries such as Brazil, Chile, and Mexico adopt remote sensing, terrain modeling, and predictive inspection tools to improve operational efficiency and reduce environmental risks. Investment in urban development and infrastructure upgrades boosts demand for accurate geospatial data. While adoption remains slower due to budget constraints, cloud deployments and drone-based inspection services help overcome integration barriers and expand access to advanced field analytics across the region.

Middle East & Africa

The Middle East & Africa region holds close to 4% share in 2024, with demand rising across oil & gas, construction, and government sectors. Gulf countries invest in surface analytics to support large-scale infrastructure projects, smart city development, and environmental monitoring of desert and coastal zones. African economies adopt field analytics for mining, land management, and utility maintenance. Expanding investments in digital transformation and remote sensing satellites improve regional capabilities. Despite early-stage adoption and limited technical infrastructure in some nations, rising interest in automated inspection and geospatial intelligence fuels steady market growth.

Market Segmentations:

By Component

By Vertical

- Smart Cities

- Energy & Utilities

- Natural Resources

- Automotive & Transportation

- Defense & Intelligence

- Government

- Insurance

- Others

By Organization size

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Surface and Field Analytics Market features strong competition among global technology manufacturers and specialized analytics providers that deliver advanced geospatial, imaging, and field-intelligence solutions. Key players such as Nikon Corporation, ULVAC-PHI, Inc., Shimadzu Corporation, Bruker Corporation, JEOL Ltd., Carl Zeiss AG, Thermo Fisher Scientific, Waters Corporation, Olympus Corporation, and Danaher Corporation focus on high-precision instruments, hyperspectral imaging systems, and AI-enabled analysis platforms. These companies strengthen portfolios through sensor upgrades, improved spectral resolution, and faster processing tools tailored for smart cities, energy, transportation, and natural-resource sectors. Strategic moves include product launches, cloud-integration partnerships, and expansion of automated inspection technologies. Vendors also compete through modular software, automated workflows, and strong after-sales calibration services. Increasing demand for real-time field intelligence pushes companies to enhance interoperability across drones, satellites, and IoT sensors. The competitive landscape continues to evolve as players prioritize accuracy, scalability, and multi-industry deployment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, Waters Corporation launched a Charged Aerosol Detector (CAD) designed for use with its Empower chromatography data system, expanding its instrument portfolio that supports sensitive detection workflows used in surface/field sample analysis.

- In January 2025, Shimadzu Corporation released the SPM-9700HT Plus high-resolution scanning probe microscope tailored for demanding surface analysis tasks. The system offers faster scanning, higher stability, and a more user-friendly interface to support precise 3D surface characterization across diverse applications.

Report Coverage

The research report offers an in-depth analysis based on Component, Vertical, Organization Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for AI-driven surface interpretation and automated field insights will grow across major industries.

- Drone-based inspection and high-resolution imaging will become standard for field surveys and asset monitoring.

- Cloud-native analytics platforms will expand as enterprises shift toward scalable, real-time processing.

- Digital twin adoption will rise, enabling predictive modeling for infrastructure, utilities, and environmental systems.

- Autonomous ground and aerial inspection robots will gain stronger traction in hazardous and remote locations.

- Integration between IoT sensors, GIS systems, and analytics dashboards will strengthen workflow efficiency.

- More governments will invest in geospatial intelligence to support smart city planning and land-use optimization.

- Increased regulatory focus on environmental compliance will boost surface-condition monitoring tools.

- Market competition will intensify as players introduce faster, more accurate, and multi-modal surface analysis technologies.

- SMEs will adopt lightweight, subscription-based analytics solutions as costs reduce and cloud tools mature.