Market Overview:

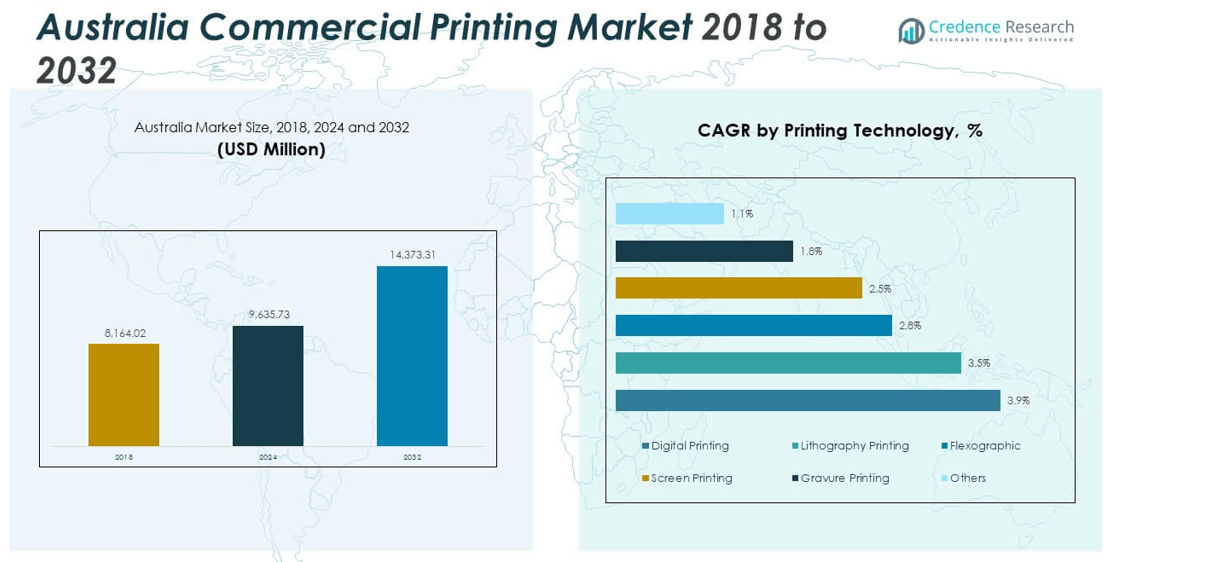

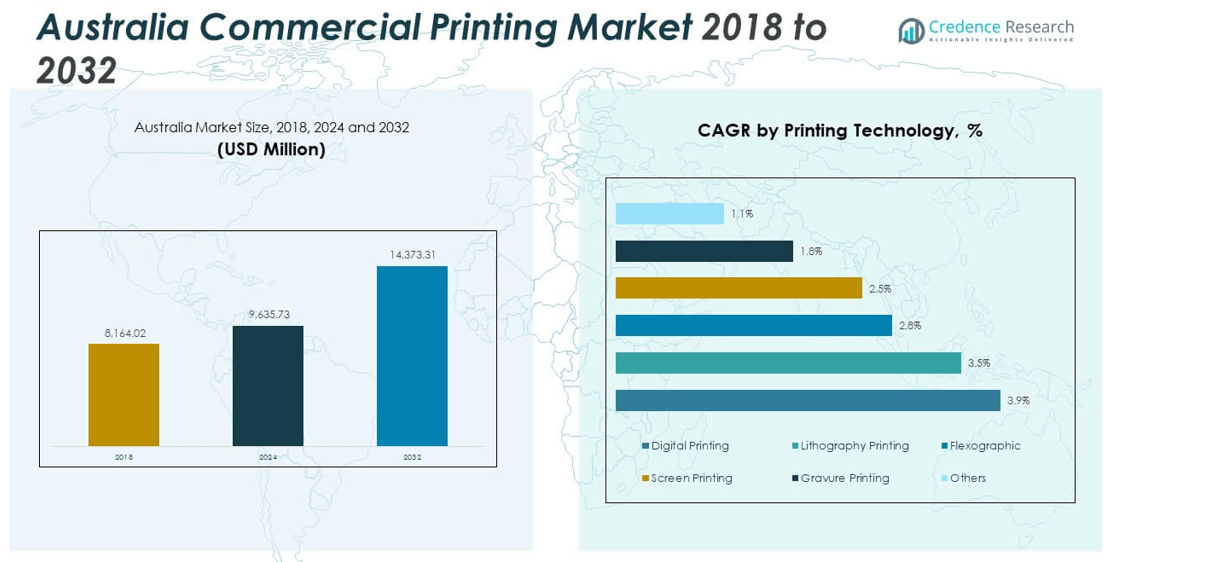

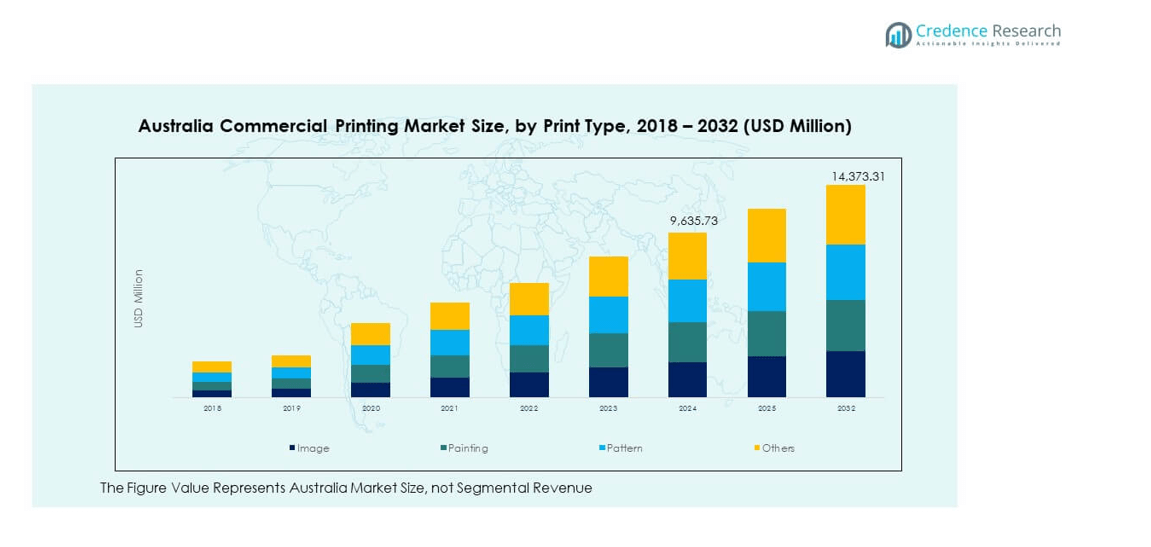

The Australia Commercial Printing Market size was valued at USD 8,164.02 million in 2018 to USD 9,635.73 million in 2024 and is anticipated to reach USD 14,373.31 million by 2032, at a CAGR of 5.13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Commercial Printing Market Size 2024 |

USD 9,635.73 million |

| Australia Commercial Printing Market, CAGR |

5.13% |

| Australia Commercial Printing Market Size 2032 |

USD 14,373.31 million |

The Australia Commercial Printing Market expands steadily due to growing demand for packaging, advertising, and marketing materials. Increasing adoption of digital printing technology allows faster, high-quality production and cost-effective short runs. E-commerce growth drives the need for branded packaging and promotional materials. Sustainability trends push for eco-friendly inks and recyclable paper, boosting innovation in print materials. Corporates and educational institutions continue to rely on printed communication and documentation. Advancements in automation improve workflow efficiency and production capacity across print facilities.

Eastern Australia leads the market due to strong corporate presence and industrial development in New South Wales and Victoria. Sydney and Melbourne remain central hubs for advertising, publishing, and packaging printing. Western Australia and Queensland show rising potential, supported by growing retail and logistics activities. Southern states contribute through educational and government print demand. Regional players strengthen competitiveness with niche services like sustainable and large-format printing. Expanding digital capabilities across emerging regions improve accessibility and national market balance.

Market Insights

- The Australia Commercial Printing Market was valued at USD 8,164.02 million in 2018, reached USD 9,635.73 million in 2024, and is projected to hit USD 14,373.31 million by 2032, expanding at a CAGR of 5.13% during the forecast period.

- Eastern Australia leads with 48% market share, driven by concentrated corporate hubs, educational institutions, and established publishing and advertising networks across Sydney and Melbourne.

- Western and Northern Australia together hold about 28% market share, supported by strong demand from mining, industrial labeling, and construction-related printing.

- Southern and Central Australia capture around 24% of the market, emerging as the fastest-growing regions due to SME expansion, educational printing, and sustainable digital print startups.

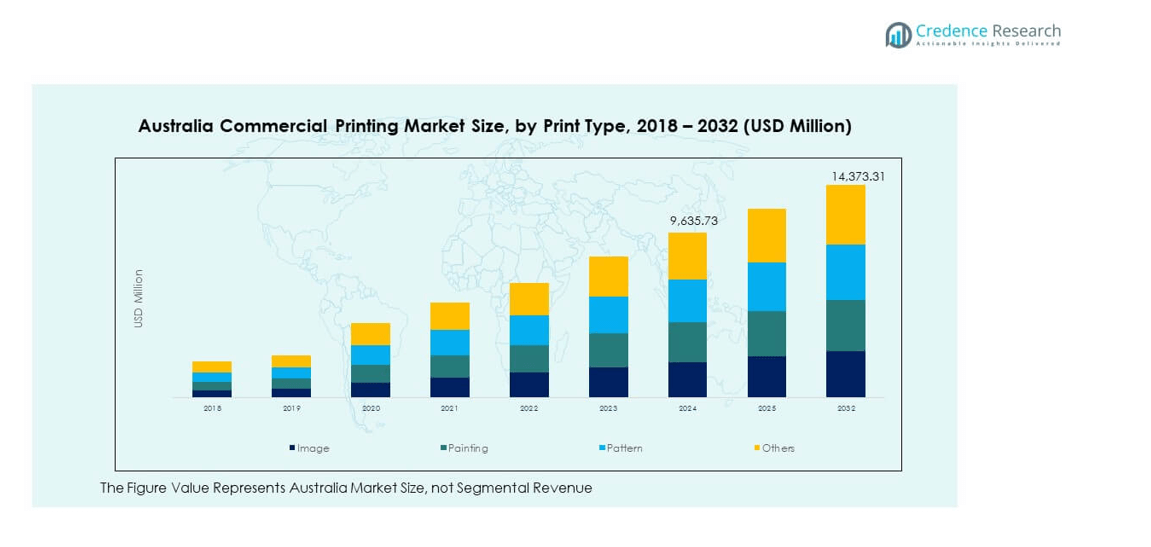

- By print type, image and pattern printing jointly represent nearly 60% of segmental output, while painting and other formats account for about 40%, reflecting the market’s growing tilt toward visual design and functional packaging applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Adoption of Digital Printing and Workflow Automation

The Australia Commercial Printing Market experiences steady expansion driven by the strong shift toward digital printing systems. Print service providers replace traditional offset presses with digital solutions that offer shorter turnaround times and flexible job customization. Automation in prepress and workflow management reduces manual errors and enhances production speed. Print-on-demand services help companies manage smaller, targeted campaigns efficiently. Growing e-commerce and marketing firms favor personalized printing, driving greater investments in digital presses. Advanced software integration supports seamless job tracking and quality assurance. It enhances cost-efficiency for both small and large print houses. This evolution supports sustained modernization across printing facilities nationwide.

- For instance, Universal Approach added a third Konica Minolta AccurioPress C14000 in March 2025, expanding capacity after tripling its facility size to support growing print volumes in large format and digital printing.

Expanding Packaging Demand Across FMCG and E-Commerce Sectors

Surging product diversification in FMCG and retail pushes demand for high-quality printed packaging. The growing e-commerce industry relies on durable and visually appealing packages to reinforce branding and product safety. Companies adopt eco-friendly inks and recyclable substrates to meet environmental standards. It drives investment in advanced flexographic and digital printing technologies tailored for corrugated and flexible packaging. Brand owners prioritize premium finishes and detailed labeling to attract consumers. Food and beverage companies increase their use of shelf-ready printed boxes and pouches. Rapidly changing consumer expectations create continuous design updates. This strengthens packaging print volumes and enhances supplier competitiveness across the sector.

Sustainability Push Driving Innovation in Print Materials and Inks

Growing awareness about carbon reduction promotes the use of sustainable materials. Printers adopt soy-based and water-based inks that reduce VOC emissions without compromising color quality. It fosters innovation in biodegradable films and recycled paper stock across print segments. Print service providers gain certification for environmental compliance to win corporate contracts. Government incentives encourage adoption of green technologies across manufacturing hubs. The transition supports long-term cost savings by minimizing waste generation. Recyclable substrates align with global sustainability commitments of major brands. Such measures enhance industry credibility and open doors for export opportunities in eco-conscious markets.

Growing Corporate Branding and Marketing Expenditure

Corporate advertising drives extensive demand for brochures, business reports, and marketing collateral. The Australia Commercial Printing Market benefits from firms increasing budgets for brand promotion and product visibility. Real estate, hospitality, and education sectors require high-quality visual materials for campaigns. Professional printing ensures consistent brand identity across multiple media platforms. Enterprises depend on print vendors offering both offset and digital capabilities to meet tight schedules. It pushes small print firms to adopt hybrid printing technologies. Events and trade exhibitions generate consistent orders for posters, catalogs, and banners. This reinforces the steady demand base across commercial and institutional segments.

- For instance, Canon introduced its new B2-sheetfed inkjet press, varioPRESS iV7, capable of producing 8,700 B2 sheets per hour in 2024.

Market Trends

Integration of Cloud-Based Print Management Platforms

Digital transformation accelerates across the Australia Commercial Printing Market through cloud-enabled workflow systems. Firms deploy software platforms for centralized job scheduling and remote proofing. These tools help streamline order processing, reduce downtime, and ensure print accuracy. Cloud storage allows clients to manage templates and print files securely. It improves collaboration between design teams and production units. Real-time dashboards provide visibility into production metrics and cost allocation. Cloud platforms support predictive maintenance through integrated analytics. This trend drives operational transparency and reduces dependency on physical job tracking.

- For instance, FUJIFILM Business Innovation Australia’s Sky Services operates on a hybrid multi-tenancy cloud model that securely segregates customer data. The platform supports proactive monitoring, usage forecasting, and fleet management to improve uptime and operational efficiency across managed print environments.

Hybrid Printing Technologies Combining Offset and Digital Capabilities

Printing firms invest in hybrid systems that merge offset quality with digital flexibility. It enables cost-effective production of variable data prints while maintaining large-scale output efficiency. Hybrid printers support personalized marketing jobs without sacrificing color consistency. These machines handle both short-run and bulk tasks under a unified workflow. The shift bridges traditional offset printing with modern digital precision. Print providers capitalize on this blend to cater to dynamic client requirements. The approach improves asset utilization and reduces setup time. Hybrid adoption continues to expand among mid-tier and premium print service providers.

Increased Focus on Value-Added Finishing and Print Customization

Consumers seek visually appealing designs that enhance tactile experience. Print firms introduce specialty coatings, embossing, and metallic foiling to create distinctive visual appeal. It elevates product packaging for luxury, cosmetics, and beverage brands. Growing use of digital embellishment systems expands creative possibilities. Automation in finishing lines reduces manual interventions and improves precision. Print providers emphasize differentiation through texture and surface innovation. Custom finishing adds higher profit margins across print segments. Demand for personalized packaging continues to drive this design-oriented trend.

- For instance, Canon Australia integrates digital embellishment technologies with automated finishing lines to reduce manual handling and improve precision in specialty coatings, embossing, and metallic foiling for luxury brand packaging.

Adoption of Sustainable Business Models and Circular Printing Practices

Environmental responsibility shapes strategic planning in the printing industry. The shift toward closed-loop recycling systems enhances material efficiency. It minimizes waste while promoting the reuse of paper and ink components. Companies integrate renewable energy sources into print production lines. Green certification attracts large enterprise clients focused on ESG goals. Suppliers develop waterless offset systems to limit chemical use. Sustainable logistics models reduce carbon emissions during delivery. These evolving practices redefine competitive advantage within environmentally aware markets.

Market Challenges Analysis

Rising Operational Costs and Shortage of Skilled Technicians

The Australia Commercial Printing Market faces increasing expenses linked to energy consumption and raw material procurement. Paper price volatility and higher ink costs strain profit margins. Small and medium print houses find it difficult to maintain consistent profitability. The industry also faces a shortage of trained technicians proficient in digital workflow management. Upgrading equipment demands significant capital investment, slowing adoption among smaller players. It creates uneven productivity levels across regions. Maintenance delays and limited parts availability disrupt continuous operations. Workforce upskilling remains a top priority to ensure print quality and operational reliability.

Digital Displacement and Declining Traditional Print Volumes

Shifts in consumer preference toward digital media reduce demand for newspapers, magazines, and office prints. It pressures commercial printers that depend on long-run offset jobs. Clients adopt online campaigns and e-brochures for cost efficiency. The structural decline in conventional publishing segments lowers overall revenue growth. Print companies must diversify into packaging and promotional printing to offset losses. The transition phase challenges firms unprepared for technological adaptation. It intensifies competition among surviving print providers. Strategic repositioning remains essential to sustain profitability in the evolving market landscape.

Market Opportunities

Emergence of Smart Packaging and Digital Print Personalization

The Australia Commercial Printing Market gains new growth avenues from smart packaging solutions. Integration of QR codes and NFC tags enhances customer engagement. Digital print personalization allows product traceability and interactive branding. Print firms collaborate with consumer goods brands to deliver unique campaign experiences. High adoption of variable data printing supports targeted marketing strategies. It opens opportunities in pharmaceuticals, food delivery, and retail applications. Businesses exploring connected packaging drive continuous product innovation. Rising interest in personalized prints creates recurring demand cycles.

Expanding Outsourcing Opportunities Among Corporate Clients

Large enterprises outsource print management to specialized vendors for cost optimization. Managed print services gain traction across education, finance, and healthcare sectors. It enables organizations to focus on core operations while ensuring consistent brand presentation. Growing preference for subscription-based print models provides stable recurring revenue streams. Firms offering end-to-end print solutions secure long-term contracts. It enhances client retention and operational scalability. Outsourcing trends strengthen the commercial printing ecosystem in Australia’s urban centers. This development supports service diversification and competitiveness among print providers.

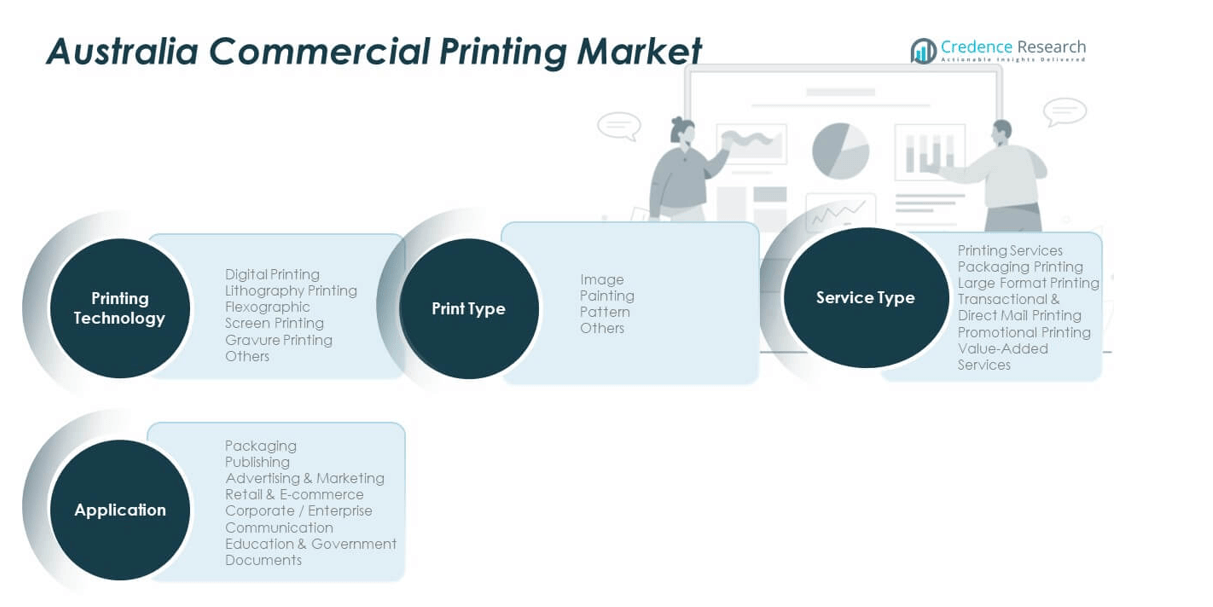

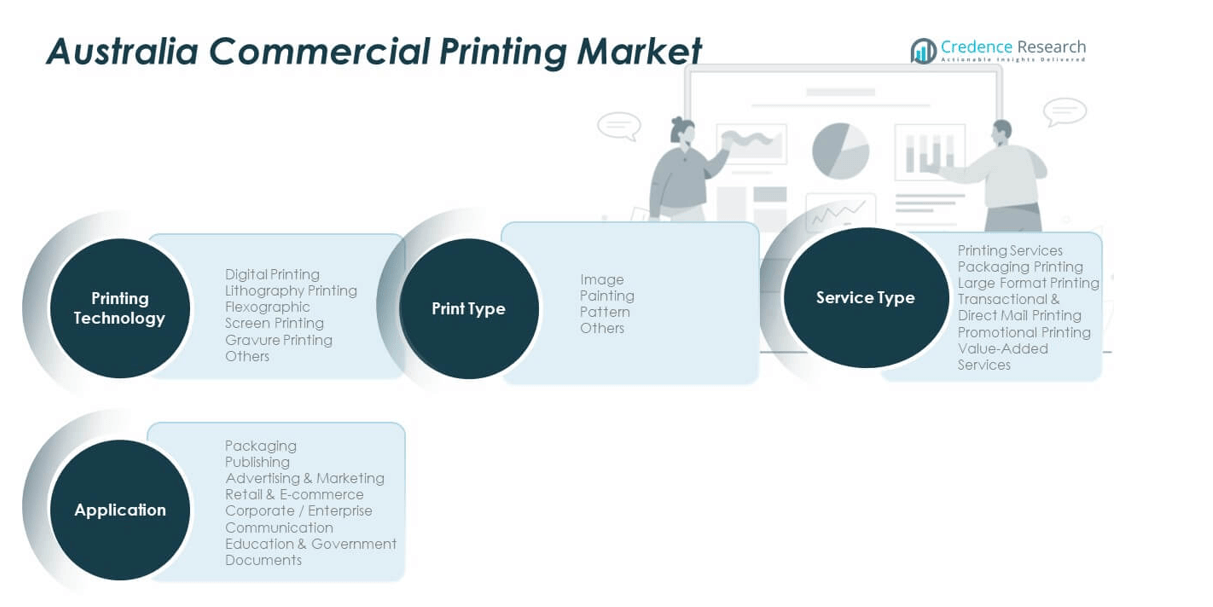

Market Segmentation Analysis

By Printing Technology

The Australia Commercial Printing Market is segmented into digital, lithography, flexographic, screen, gravure, and others. Digital printing dominates due to its flexibility and rapid job setup, suitable for personalized marketing and short-run tasks. Lithography retains its role in bulk commercial and publishing jobs. Flexographic printing leads in packaging because of high-speed production and superior color accuracy. Screen printing remains preferred in signage and textiles, while gravure printing serves premium packaging. Each technology caters to distinct output needs across business verticals.

By Application

Packaging forms the largest application segment, driven by FMCG, retail, and e-commerce expansion. Publishing maintains relevance through educational content and government communication. Advertising and marketing printing sustain high demand from corporate campaigns. Retail and e-commerce depend on visual packaging and promotional labels. Corporate communication printing includes annual reports, presentations, and stationery. Educational institutions and government entities rely on certified print documentation. These segments together drive diverse revenue streams across print service providers.

- For instance, Mimaki Australia partnered with Shann Australia in April 2025 to expand distribution of digital packaging print solutions nationwide. Publishing maintains relevance through educational content and government communication.

By Service Type

Printing services encompass standard and value-added offerings covering packaging, large-format, transactional, and promotional jobs. Packaging printing remains the top contributor, supported by branding and compliance labeling. Large-format printing caters to outdoor advertising and trade shows. Transactional and direct mail printing aids banks and telecom operators in customer engagement. Promotional printing supports retail displays and seasonal marketing. Value-added services such as finishing, embossing, and variable data design enhance customer satisfaction and profit margins.

- For instance, Konica Minolta Australia supports packaging jobs via AccurioPress models installed at firms like Universal Approach with expanded facilities.

By Print Type

Print types include image, painting, pattern, and others, reflecting artistic and functional applications. Image prints dominate in advertising, catalog, and product packaging segments. Pattern prints grow rapidly in textile and interior décor applications. Paint-based prints cater to creative art reproductions and customized visuals. Other print forms support niche markets such as event branding and product labeling. The diversity in print type ensures wide adaptability of commercial printers to varied client requirements across industries.

Segmentation

By Printing Technology:

- Digital Printing

- Lithography Printing

- Flexographic Printing

- Screen Printing

- Gravure Printing

- Others

By Application:

- Packaging

- Publishing

- Advertising & Marketing

- Retail & E-commerce

- Corporate / Enterprise Communication

- Education & Government Documents

By Service Type:

- Printing Services

- Packaging Printing

- Large Format Printing

- Transactional & Direct Mail Printing

- Promotional Printing

- Value-Added Services

By Print Type:

- Image

- Painting

- Pattern

- Others

Regional Analysis

Eastern Australia – Dominant Printing and Packaging Hub (Approx. 48% Market Share)

Eastern Australia holds the largest share of the Australia Commercial Printing Market, driven by dense commercial activity across New South Wales and Victoria. Sydney and Melbourne anchor the region’s dominance due to their high concentration of corporate offices, publishing houses, and advertising agencies. The region benefits from strong infrastructure, skilled labor, and advanced digital printing adoption. Growing demand from FMCG packaging and retail promotion sustains continuous order volumes. It also leads in sustainable print initiatives with eco-certified paper and water-based ink use. Government and education sectors contribute steady institutional print demand. Eastern Australia remains the focal point for technological innovation and high-value print services.

Northern and Western Australia – Expanding Industrial and Resource-Linked Demand (Approx. 28% Market Share)

Northern and Western Australia show rising demand driven by mining, construction, and logistics industries. Perth serves as a key industrial hub where printed manuals, labeling, and technical documentation remain vital. The mining sector fuels steady requirements for safety signage and compliance materials. Print service providers focus on durable and outdoor-ready materials suited for extreme environments. It benefits from regional investment in packaging for resource exports. Digital large-format printing also supports event branding and infrastructure projects. Western Australia’s trade connections reinforce its role in supplying specialized industrial print solutions.

Southern and Central Australia – Growing Institutional and SME Printing Base (Approx. 24% Market Share)

Southern and Central Australia maintain a solid printing base supported by education, government, and small enterprise sectors. Adelaide, Canberra, and Hobart are key contributors with universities, public agencies, and manufacturing firms generating continuous print needs. The demand centers on transactional, promotional, and educational printing. It benefits from emerging digital print startups that cater to short-run, personalized orders. Regional printers emphasize flexibility and quick delivery to serve local businesses. Growing tourism in Tasmania also drives demand for marketing and souvenir packaging. While smaller in size, this region’s consistent institutional support stabilizes market performance nationwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Australia Commercial Printing Market remains moderately fragmented, featuring a mix of global and domestic players competing across diverse print applications. Leading companies such as IVE Group, CMYKhub, Kwik Kopy, Fuji Xerox Australia, and Snap Print Solutions hold significant market presence due to broad service portfolios and advanced digital capabilities. It reflects an ongoing shift toward automation, sustainability, and end-to-end workflow solutions. Firms invest in eco-friendly inks, cloud-based management systems, and hybrid print technologies to enhance efficiency. Competitive differentiation relies on quality consistency, turnaround time, and customer customization. Regional print firms gain strength through niche offerings such as luxury packaging and promotional printing. Strategic mergers and technology upgrades define ongoing market positioning. Continuous investment in automation and digital transformation ensures steady competitiveness across Australia’s print landscape.

Recent Developments

- In November 2025, Mimaki Australia established a new distribution partnership with Australian Graphic Servicing (AGS), integrating AGS into its dealer network to broaden access to advanced printing technologies for commercial applications.

- In April 2025, Mimaki Australia partnered with Shann Australia to expand nationwide distribution of print solutions, enhancing product availability and customer support across the Australian commercial printing market.

Report Coverage

The research report offers an in-depth analysis based on Printing Technology, Application, Service Type and Print Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Australia Commercial Printing Market is expected to expand through wider adoption of digital and hybrid printing systems that improve flexibility and cost efficiency.

- Sustainability initiatives will guide production processes, promoting eco-friendly inks, recyclable substrates, and waste reduction practices.

- Packaging printing will remain the strongest contributor due to high demand from FMCG, e-commerce, and food sectors emphasizing visual branding.

- Investments in automation and AI-driven workflow systems will enhance operational speed and precision across print facilities.

- Customization and variable data printing will become essential tools for brand marketing and personalized communication.

- Print-on-demand and short-run digital services will strengthen small and medium enterprises by lowering inventory risks.

- Cloud-based print management and online ordering systems will streamline client interactions and reduce turnaround times.

- The competitive landscape will consolidate as major players expand service portfolios through mergers and technology partnerships.

- Value-added finishing and decorative print applications will rise in popularity across luxury packaging and retail advertising.

- Continued integration of smart packaging and traceability technologies will redefine printing’s role in Australia’s digital supply chain.