Market Overview:

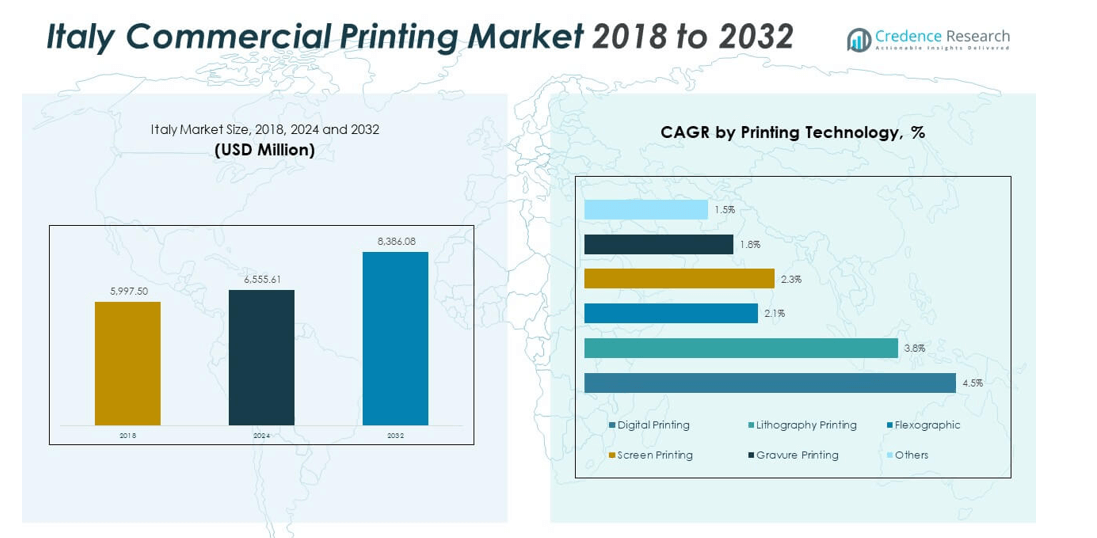

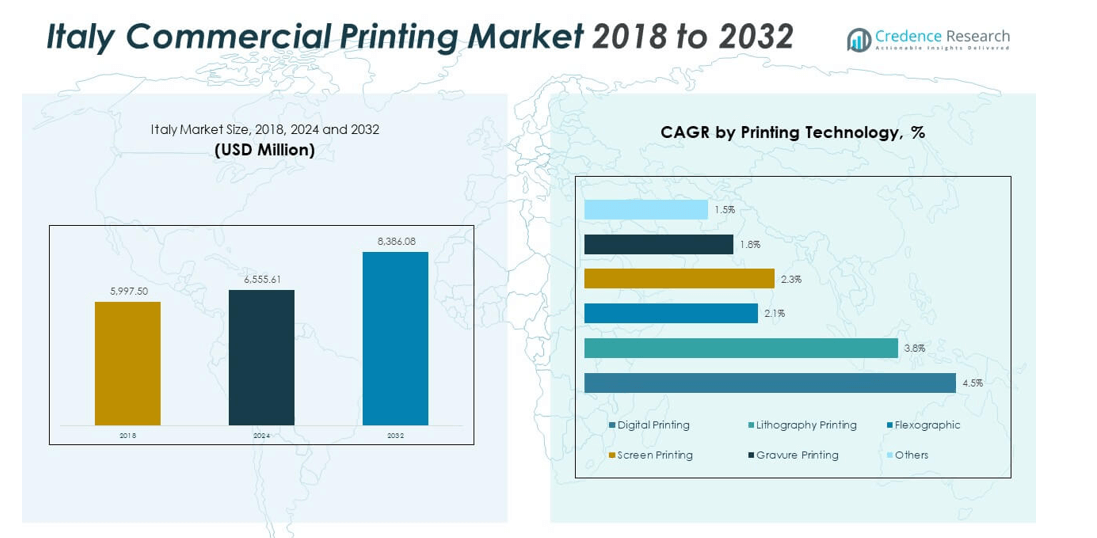

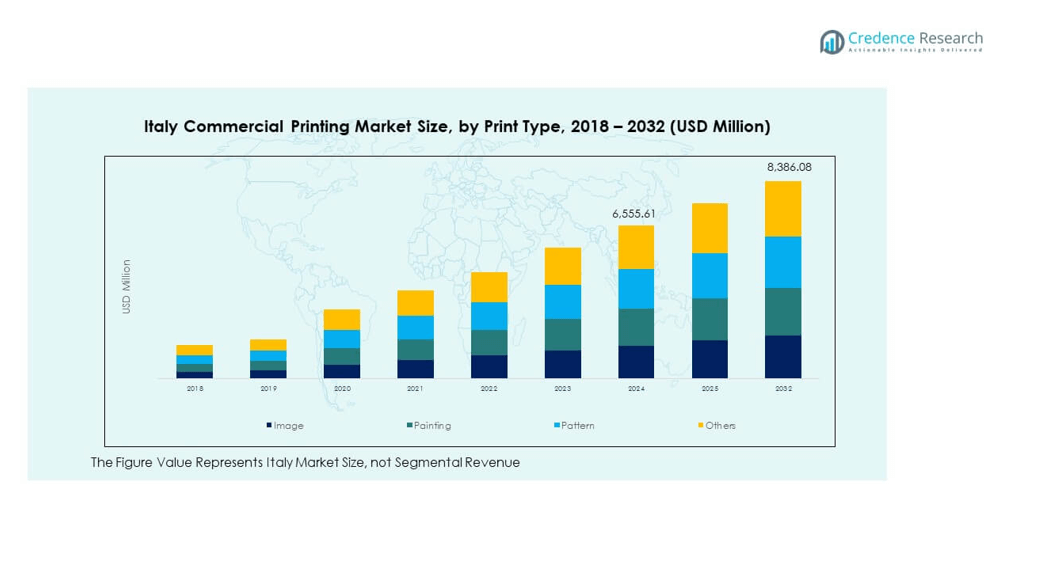

The Italy Commercial Printing Market size was valued at USD 5,997.50 million in 2018 to USD 6,555.61 million in 2024 and is anticipated to reach USD 8,386.08 million by 2032, at a CAGR of 3.13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Commercial Printing Market Size 2024 |

USD 6,555.61 million |

| Italy Commercial Printing Market, CAGR |

3.13% |

| Italy Commercial Printing Market Size 2032 |

USD 8,386.08 million |

Rising demand for personalized content and sustainable print solutions drives steady growth. Italian firms focus on short-run printing and customized designs to match brand strategies. The packaging industry’s shift toward eco-friendly materials strengthens the use of recyclable inks and papers. Investments in digital workflows reduce turnaround time and support complex print orders. Expanding e-commerce channels create demand for high-quality product labeling and visual branding. Technological upgrades improve accuracy, color consistency, and cost efficiency across facilities.

Northern Italy leads the market due to the presence of established industrial clusters and printing hubs in Lombardy, Veneto, and Emilia-Romagna. Central regions show stable adoption in publishing and advertising sectors supported by tourism-driven campaigns. Southern Italy, including Campania and Sicily, is emerging with growing investment in packaging and retail printing. Strong export activities across European clients further enhance opportunities for advanced printing applications.

Market Insights

- The Italy Commercial Printing Market size was valued at USD 5,997.50 million in 2018, reached USD 6,555.61 million in 2024, and is expected to hit USD 8,386.08 million by 2032, registering a CAGR of 3.13%.

- Northern Italy holds the largest share at around 42%, driven by strong industrial and packaging clusters in Lombardy and Veneto. Central Italy follows with about 30%, led by tourism and publishing demand, while Southern Italy captures nearly 18% due to gradual retail and advertising expansion.

- Southern Italy is the fastest-growing region with around 3.8% share, supported by packaging modernization, digital press adoption, and growing logistics activity in ports.

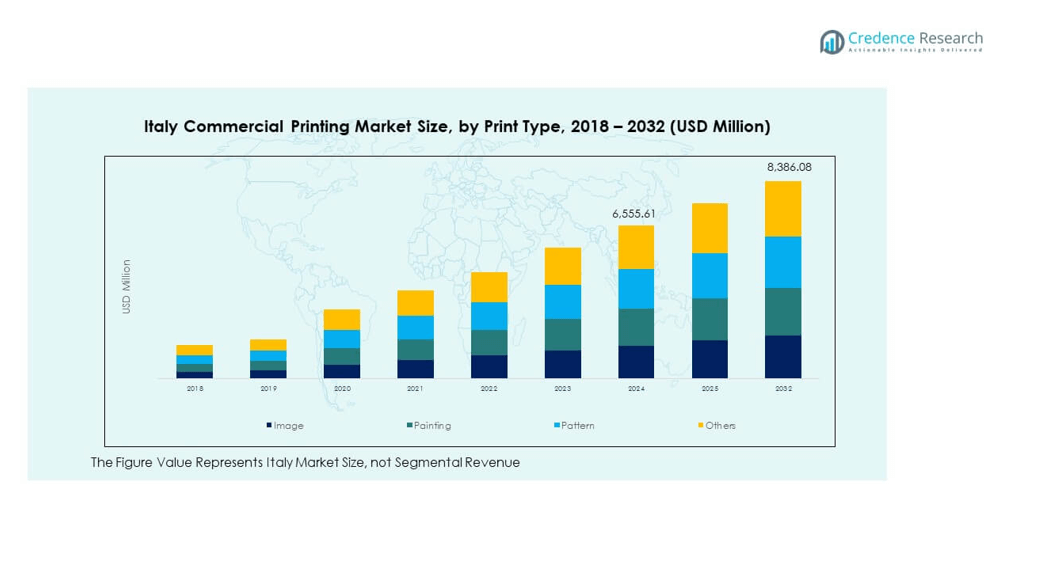

- By print type, image printing accounts for approximately 34% of total revenue, reflecting wide use in advertising and media materials.

- Pattern and painting segments collectively represent around 45%, driven by packaging, labeling, and decorative applications across retail and industrial sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Personalized and On-Demand Print Solutions

]The Italy Commercial Printing Market benefits from rapid adoption of digital technologies that enable on-demand and variable data printing. Businesses prioritize short-run printing to meet changing marketing needs with minimal waste. Retailers and FMCG brands drive customized packaging and promotional campaigns, enhancing brand recall. Print providers expand digital capacity to meet shorter turnaround requirements. E-commerce growth pushes demand for product labels and shipping materials. Publishers use flexible print schedules to manage fluctuating orders. This shift toward digital workflows reduces excess inventory. It creates an agile environment for customer-specific printing applications.

Expanding Adoption of Sustainable Printing Practices Across Industries

Rising environmental awareness drives printers toward eco-friendly inks and recyclable materials. Firms adopt water-based and soy-based inks to comply with green policies. Packaging converters redesign substrates to meet circular economy goals. The Italy Commercial Printing Market evolves with firms obtaining certifications for sustainable production. Printers invest in energy-efficient presses and waste reduction systems. Retail brands favor suppliers using biodegradable coatings. Public institutions integrate green criteria in procurement. Sustainability now forms a key selling point in B2B tenders. It positions Italian firms as responsible industry participants.

- For example, Fedrigoni holds FSC certification for its paper products, supporting sustainable packaging and printing practices. Many Italian commercial printers also use water-based and soy-based inks to meet environmental standards and reduce VOC emissions during production.

Technological Advancements Enhancing Print Efficiency and Quality

Automation, AI, and hybrid printing systems improve operational efficiency and quality assurance. New inkjet and electrophotographic presses reduce downtime through predictive maintenance. AI-based workflow automation ensures color precision and image alignment. The Italy Commercial Printing Market benefits from equipment upgrades that enhance throughput. Printers integrate cloud-based systems for centralized control. Variable data technology supports personalized campaigns across sectors. Automation minimizes labor costs while ensuring print accuracy. These technologies strengthen service quality and reliability. It boosts competitiveness in high-volume and specialty segments.

Strong Industrial Base and Demand from Diverse End-User Sectors

Italy’s broad industrial ecosystem supports commercial print applications across manufacturing, retail, and publishing. FMCG and luxury sectors depend on premium packaging and marketing materials. Corporate offices rely on brochures, catalogues, and presentation materials. The Italy Commercial Printing Market gains from continuous demand in promotional advertising and direct mail. Educational institutions require exam papers and administrative documents. Public offices maintain steady use of official print forms. Cultural industries promote events and exhibitions through print channels. This diverse base ensures steady demand across economic cycles. It strengthens industry resilience against digital-only transitions.

- For instance, Gruppo Cordenons produces specialty papers used in luxury packaging for FMCG brands. FMCG and luxury sectors depend on premium packaging and marketing materials. Corporate offices rely on brochures, catalogues, and presentation materials.

Market Trends

Rise of Digital Transformation and Smart Printing Infrastructure

Print service providers adopt cloud-connected presses that track job performance and optimize workflows. Smart printing solutions integrate IoT and analytics for real-time diagnostics. Automation reduces manual input while improving reliability. The Italy Commercial Printing Market observes growing investments in end-to-end digital ecosystems. Print-on-demand services gain popularity among SMEs. Cloud-based collaboration tools allow remote job approvals. Integration of ERP systems enhances cost transparency. Firms monitor sustainability performance through connected dashboards. These trends modernize traditional printing operations for higher agility.

- For example, OMET offers IoT-enabled printing presses under its Digital Solutions line, which enable real-time machine monitoring and predictive maintenance to enhance uptime and performance. Similarly, EFI provides cloud-based workflow systems that support remote job approvals and ERP integration, helping printing companies improve automation and production efficiency.

Growth in Luxury and Specialty Packaging Applications

Premium brands emphasize tactile finishes, metallic foils, and embossing in packaging. Designers use digital embellishment to differentiate luxury goods. The Italy Commercial Printing Market benefits from advanced substrate compatibility and decorative printing. Packaging houses employ hybrid presses to mix offset quality with digital flexibility. Limited-edition prints for fashion and wine industries drive new opportunities. Personalization supports niche brand identity. Short-run jobs offer economic benefits for boutique producers. Specialty coatings improve protection and aesthetic value. The segment shows robust adoption across regional SMEs.

Integration of Variable Data Printing and Cross-Media Campaigns

Marketing teams combine print and digital media for higher engagement. QR codes and AR-based content link printed ads to online experiences. The Italy Commercial Printing Market witnesses increased deployment of variable data tools. Brands customize mailers, coupons, and labels with personalized messages. Direct mail remains effective for targeted consumer outreach. Data-driven campaigns boost conversion rates in competitive markets. Printers adopt customer analytics to design optimized print strategies. Personalization improves customer retention across multiple touchpoints. This convergence strengthens print relevance in digital ecosystems.

Expansion of Outsourced and Managed Print Services

Businesses delegate print operations to external service providers to reduce overhead. Managed print service (MPS) firms offer maintenance, supply, and workflow solutions. The Italy Commercial Printing Market gains from demand for cost transparency and process control. Firms integrate digital platforms for automated job submission. Outsourcing helps enterprises focus on core business activities. Providers deploy subscription-based print models for predictable expenses. MPS solutions improve sustainability reporting by tracking print usage. Corporate clients prefer centralized vendors for multi-location management. It supports long-term industry partnerships and service evolution.

- For example, Ricoh Italy provides managed print services (MPS) that monitor print usage, automate job submissions, and centralize device management for corporate clients. These subscription-based solutions help organizations improve cost control, reduce paper waste, and support sustainability goals across multiple locations.

Market Challenges Analysis

Rising Digital Substitution and Declining Traditional Print Demand

Digital communication tools reduce dependence on brochures, flyers, and newspapers. Online advertising absorbs large portions of corporate budgets. The Italy Commercial Printing Market faces declining offset print orders. Publishers cut physical circulation to favor e-books and online editions. Younger audiences prefer mobile-first content. This transition challenges legacy press operators. Maintaining profitability becomes harder with shrinking volumes. Firms must adapt by investing in hybrid and digital systems. Success depends on service diversification and innovation speed.

High Operational Costs and Pressure on Margins

Energy costs, raw material fluctuations, and labor shortages increase production expenses. Small and mid-sized printers struggle to sustain price competitiveness. The Italy Commercial Printing Market experiences tighter margins under intense competition. High ink and paper costs strain operational budgets. Supply disruptions cause unpredictable delivery timelines. Frequent equipment upgrades demand capital investment. Many firms consolidate operations to remain efficient. Competitive pricing from online printers adds pressure. Managing efficiency becomes critical to preserve profitability and stability.

Market Opportunities

Expanding Role of Digital Printing in Packaging and E-Commerce

Online retail growth boosts demand for printed labels, boxes, and promotional inserts. Short-run packaging supports customized branding for smaller sellers. The Italy Commercial Printing Market can leverage this through digital packaging technologies. Personalization tools enhance unboxing experiences and brand connection. Integration of smart labels with track-and-trace codes offers added value. Printers expanding into e-commerce packaging gain recurring contracts. Digital workflows simplify design-to-delivery timelines. This segment opens sustainable revenue opportunities for flexible print providers.

Growing Adoption of Green Printing and Recyclable Substrates

Sustainability commitments drive businesses toward eco-certified printers. Firms use biodegradable and recycled substrates to meet buyer preferences. The Italy Commercial Printing Market benefits from policies promoting circular production. Green technologies attract multinational clients focusing on compliance. Equipment upgrades to energy-efficient systems strengthen brand reputation. Print houses adopting closed-loop recycling models gain credibility. Demand for sustainable packaging continues to rise among consumer brands. Early adoption ensures competitive advantage in regulated markets. It opens new B2B partnerships across eco-conscious industries.

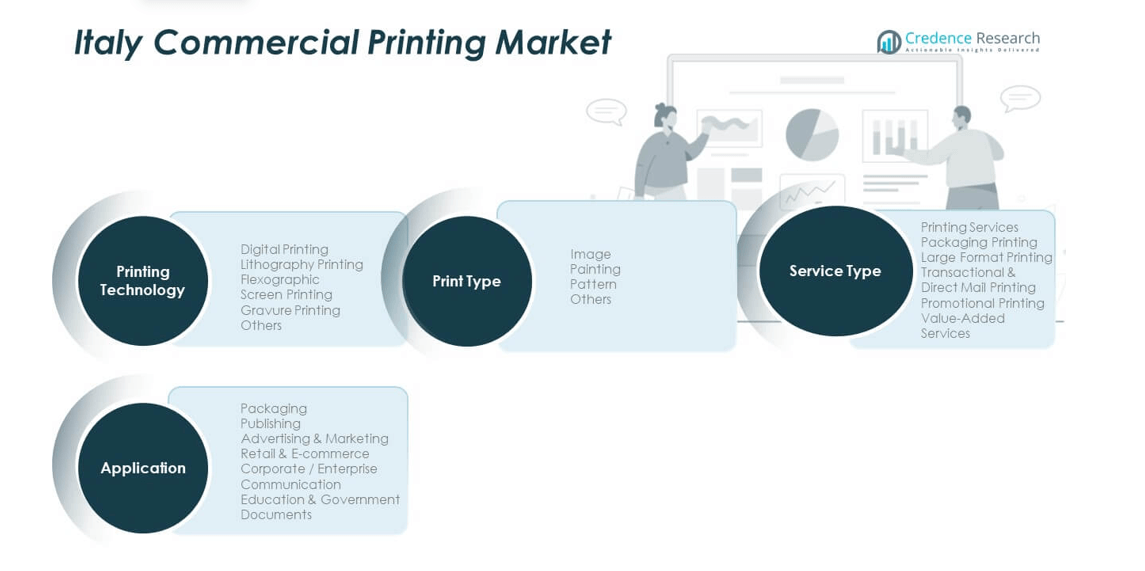

Market Segmentation Analysis

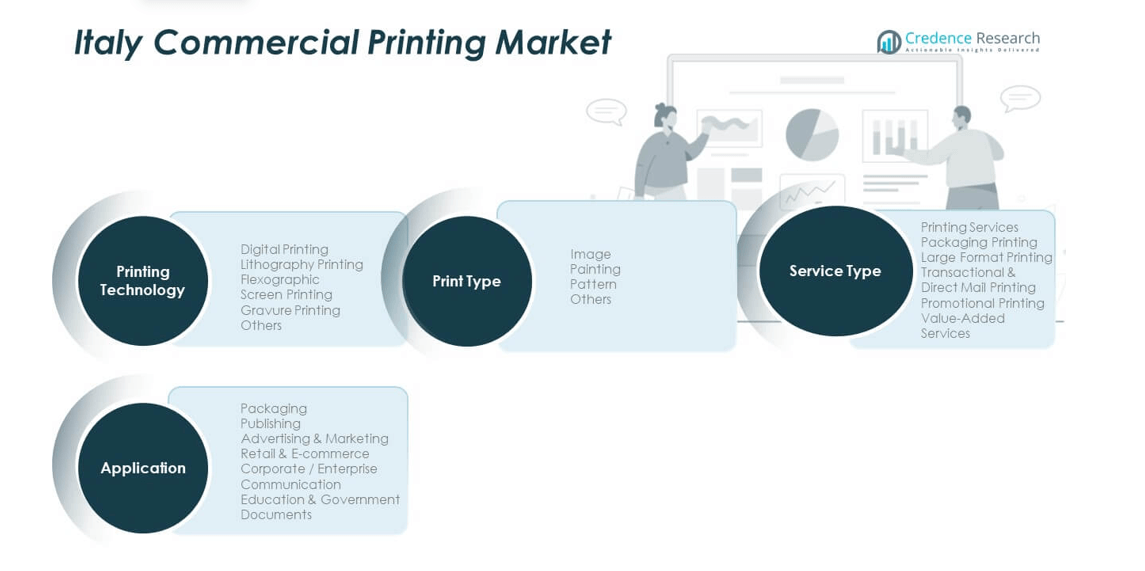

By Printing Technology

Digital printing dominates due to its flexibility, cost efficiency, and ability to handle variable data. Lithography printing remains vital for high-volume runs in packaging and publishing. Flexographic printing grows in demand for labels and flexible materials. Screen printing supports niche applications requiring texture and durability. Gravure printing serves luxury packaging and long-run jobs. The Italy Commercial Printing Market uses multiple technologies to balance quality and speed. Each method finds relevance across product segments. Continuous innovation strengthens print diversity. It ensures wide adaptability across client needs.

- For example, HP Print AI’s Perfect Output feature, introduced in 2024, automatically removes unwanted ads and formatting errors from web pages before printing. The tool optimizes about 50% of browser-based print jobs, ensuring cleaner and more accurate results across compatible HP printers.

By Application

Packaging leads due to strong retail and FMCG activity. Publishing retains significance through educational and cultural printing. Advertising and marketing applications drive creative print formats. Retail and e-commerce firms rely on dynamic print promotions and inserts. Corporate communication demands professional brochures and presentations. Education and government sectors maintain consistent documentation requirements. The Italy Commercial Printing Market meets these varied needs through tailored solutions. Multi-sector demand sustains market stability. It enhances resilience against cyclical shifts in ad spending.

By Service Type

Printing services form the foundation, supported by packaging and large-format printing. Transactional and direct mail printing maintains relevance in targeted outreach. Promotional printing caters to seasonal and brand campaigns. Value-added services include design, logistics, and fulfillment support. The Italy Commercial Printing Market evolves with clients preferring integrated offerings. Service diversification builds loyalty and recurring contracts. Automation improves job turnaround times. Managed workflows enhance reliability and reduce manual intervention. The shift toward bundled services drives operational scalability.

By Print Type

Image printing dominates commercial jobs such as catalogues and marketing visuals. Pattern and decorative printing serve luxury and interior applications. Painting-based prints cater to fine art reproductions. Other types include industrial labeling and specialized materials. The Italy Commercial Printing Market adapts to creative demand through advanced ink and substrate compatibility. Print customization supports artistic and promotional sectors alike. New pigment technologies expand color vibrancy. Improved resolution capabilities attract high-end clientele. This variety ensures balanced growth across creative and industrial segments.

- For example, HP Latex printers deliver consistent 1200 DPI resolution using thermal printheads to produce sharp, color-accurate images. The technology supports a wide range of substrates with water-based inks that are odorless and environmentally certified, making it suitable for indoor and outdoor commercial applications.

Segmentation

By Printing Technology:

- Digital Printing

- Lithography Printing

- Flexographic Printing

- Screen Printing

- Gravure Printing

- Others

By Application:

- Packaging

- Publishing

- Advertising & Marketing

- Retail & E-commerce

- Corporate / Enterprise Communication

- Education & Government Documents

By Service Type:

- Printing Services

- Packaging Printing

- Large Format Printing

- Transactional & Direct Mail Printing

- Promotional Printing

- Value-Added Services

By Print Type:

- Image

- Painting

- Pattern

- Others

Regional Analysis

Northern Italy Dominates With Largest Share

Northern Italy accounts for roughly 55 % of the Italy Commercial Printing Market. The industrial concentration in regions like Lombardy, Veneto and Emilia-Romagna drives demand from manufacturing, retail, and luxury-goods sectors. Major printing houses and packaging converters operate there. Strong export orientation and proximity to logistic hubs help sustain high volumes. Corporate headquarters and advertising agencies located in the North fuel demand for marketing print, packaging and publishing services. It remains the most mature and competitive sub-region in the market.

Central Italy Holds Moderate Share With Balanced Demand

Central Italy contributes around 25 % of the market share. The presence of publishing houses, cultural institutions and medium-size enterprises supports consistent print demand. Cities such as Rome, Florence and Tuscany’s manufacturing clusters require both commercial print and packaging services. Demand arises from education, government printing, retail catalogues and regional advertising. The sub-region shows stable growth due to diversified end-users. Capacity expansions remain modest compared to the North but maintain steady demand.

Southern Italy And Islands Show Emerging Potential

Southern regions and islands furnish about 20 % of the market share. Economic activity remains lower than in the North and Central Belt. E-commerce growth and rising retail penetration slowly increase demand for packaging and promotional print. Tourism-driven retail and hospitality sectors contribute seasonal print demand. Local SMEs drive small-volume print jobs, customized labels and marketing materials. Growth remains slower but offers room for expansion with digital transformation and improved logistics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Grafica Veneta

- Rotolito Lombarda

- Pozzoni Printing Group

- Giunti Editore (Printing Division)

- Canale & C.

- Mondadori Printing (Mondadori Group)

- Arti Grafiche Boccia

- Coptip Group

- Grafiche Antiga

- Longo S.p.A.

- Campisi Group

- Litosud S.p.A.

Competitive Analysis

Key players from global printing and packaging firms hold significant influence. Large firms with advanced digital and flexographic capabilities serve major packaging, retail and publishing clients. These players benefit from scale, supply-chain integration and capability to manage high-volume runs. Medium-size Italian printers focus on niche segments such as luxury packaging, short-run print, on-demand services, and specialized publishing. They leverage flexibility, quicker turnaround and customer-specific solutions. Smaller local providers operate in regional markets, often catering to SMEs, local retail, direct mail or transactional printing. They compete on price, speed and proximity to clients. The dynamic between large scale operators and agile small firms intensifies competition. The Italy Commercial Printing Market sees pressure on margins, pushing firms toward consolidation or specialization. Firms that invest in digital presses, sustainable practices and value-added services maintain advantage over legacy operators. New entrants offering managed print services or e-commerce-linked packaging solutions pose additional competitive pressure. The competitive landscape rewards flexibility, technological investment and sectoral focus.

Recent Developments

- In May 2025, TRESU unveiled the InkFlex circulator for automated water-based ink circulation and the iCoat II offline coating system at Print4All in Milan, Italy. The InkFlex features dual pumps and a user-friendly interface for flexo printing, while the iCoat II offers modular configuration for short-run digital sheetfed coating jobs. These launches target efficient, high-performance printing in the commercial sector.

- In March 2025, Uteco Converting announced Active Pack, a patented flexo technology reducing energy and waste by up to 50% with ESG Industry 5.0 certification, and Onyx OMNIA, a hybrid FlexoDigital machine for high-volume production, ahead of Print4All 2025 in Milan.

Report Coverage

The research report offers an in-depth analysis based on Printing Technology, Application, Service Type and Print Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Italy Commercial Printing Market will advance with greater adoption of digital printing and automated workflows.

- Growth in e-commerce will enhance packaging and labeling print demand across regional logistics hubs.

- Sustainability will shape product innovation through eco-inks, recyclable substrates, and energy-efficient presses.

- Hybrid printing combining offset and digital systems will expand across packaging and advertising applications.

- Increased personalization and short-run production will redefine customer engagement for retail and corporate sectors.

- Cloud integration and data analytics will optimize production efficiency and color accuracy across facilities.

- Consolidation among mid-sized print firms will strengthen operational capacity and service reliability.

- Luxury packaging and decorative printing will attract global brands investing in high-end Italian craftsmanship.

- Managed print services will gain traction as companies outsource document and promotional workflows.

- Government sustainability mandates will accelerate modernization of legacy printing infrastructure nationwide.