Market Overview:

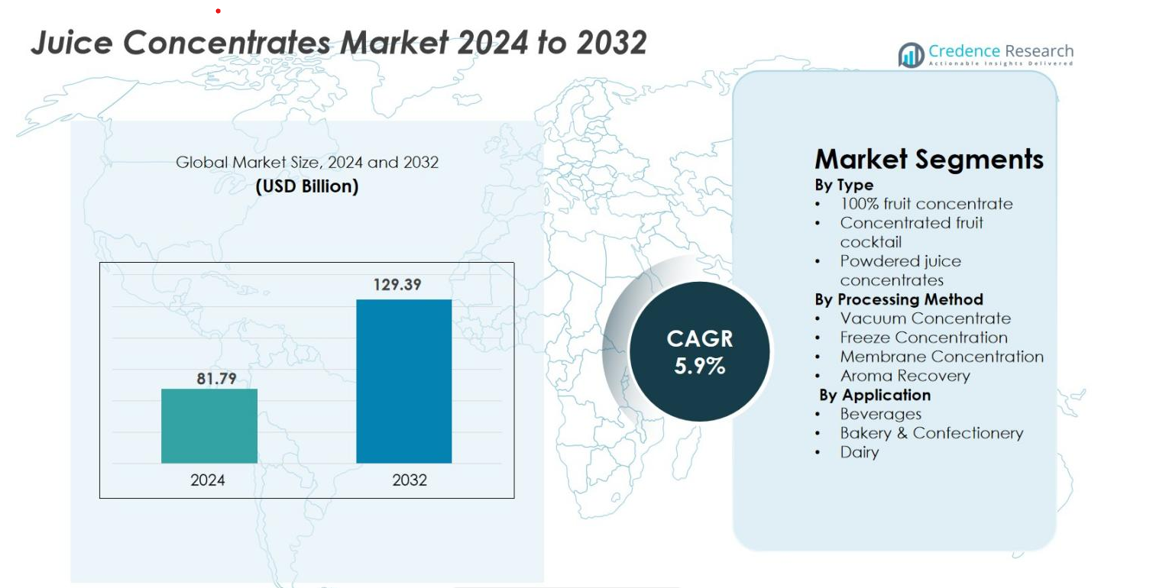

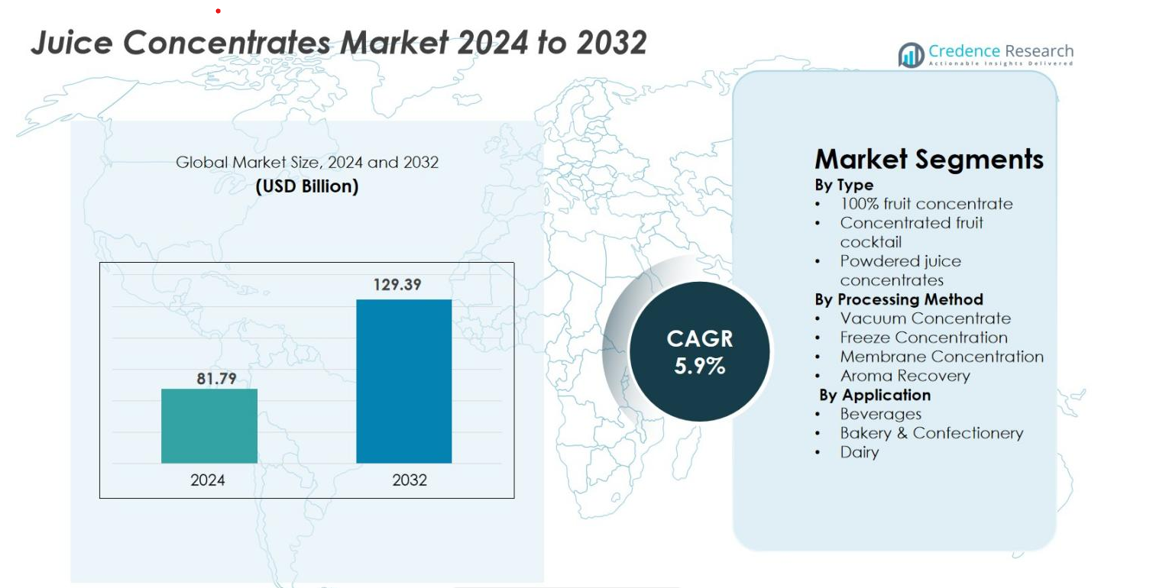

The Juice Concentrates market size was valued at USD 81.79 Billion in 2024 and is anticipated to reach USD 129.39 Billion by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Juice Concentrates Market Size 2024 |

USD 81.79 Billion |

| Juice Concentrates Market, CAGR |

5.9% |

| Juice Concentrates Market Size 2032 |

USD 129.39 Billion |

Juice Concentrates Market is characterized by the presence of several global leaders, including Archer Daniels Midland Company (ADM), Ingredion Incorporated, Döhler Group, SVZ Industrial Fruit & Vegetable Ingredients, and Kerry Group PLC, each leveraging advanced processing technologies and broad distribution networks. These companies focus on clean-label formulations and sustainable sourcing to meet rising demand for natural and functional beverages. North America leads the global market with a 41.3% share, followed by Europe at approximately 30%, driven by mature food processing industries and consumer preference for healthy juice-based products. Asia Pacific is the fastest-growing region, steadily increasing its current 15% market share due to urbanization and rising disposable incomes.

Market Insights

- The Juice Concentrates market was valued at USD 81.79 Billion in 2024 and is projected to reach USD 129.39 Billion by 2032, growing at a CAGR of 5.9% during the forecast period.

- Key drivers include the growing consumer preference for healthy, natural beverages and increasing demand for clean-label and functional juice products, particularly in North America and Europe.

- Major trends include the shift towards organic and non-GMO concentrates, along with technological advancements in processing methods such as vacuum and membrane concentration, improving product quality and efficiency.

- Competitive dynamics are shaped by industry leaders like ADM, Ingredion, and Döhler Group, who focus on sustainability, innovation, and expanding their market presence through strategic acquisitions and partnerships.

- Regional analysis reveals North America holds the largest share at 41.3%, followed by Europe with 30%, while Asia Pacific is the fastest-growing region, accounting for 15% of the market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The Juice Concentrates market is segmented by type into 100% fruit concentrate, concentrated fruit cocktail, and powdered juice concentrates. Among these, 100% fruit concentrate holds the dominant share, accounting for over 50% of the market in 2024. This sub-segment’s growth is driven by the increasing demand for natural, preservative-free juice products and consumer preference for healthy, authentic fruit beverages. The clean-label trend and rising health awareness globally further boost the popularity of 100% fruit concentrates, positioning it as the leading sub-segment in this category.

- For instance, Döhler Group expanded its portfolio by introducing a 100% fruit-based clear apple concentrate with a Brix value of 70, enabling beverage manufacturers to reduce added sugars while maintaining high natural sweetness.

By Processing Method

In the processing method segment, vacuum concentration leads with the highest market share, followed by freeze concentration, membrane concentration, and aroma recovery. Vacuum concentration holds a dominant share of approximately 40% in 2024 due to its ability to retain the natural flavors, colors, and nutrients of the juice while effectively reducing water content. This method is widely adopted in the production of high-quality juice concentrates, driven by its cost-efficiency and preservation of sensory attributes, making it the preferred choice in the industry.

- For instance, Bucher Unipektin supplies vacuum evaporators for juice and puree concentration that can operate at evaporation rates above 20,000 kilograms of water per hour in multi-effect systems, allowing processors to concentrate large juice volumes while maintaining low thermal impact on aroma and color.

By Application

The Juice Concentrates market is heavily utilized across various applications, including beverages, bakery & confectionery, and dairy products. The beverage sector dominates, accounting for around 60% of the market share in 2024. This dominance is attributed to the increasing consumption of fruit-based drinks, smoothies, and flavored beverages globally, driven by shifting consumer preferences towards convenient, healthy drink options. As consumers seek beverages with lower sugar content and natural ingredients, the beverage application remains the key driver for the growth of juice concentrates.

Key Growth Drivers

Health and Wellness Trends

The growing global focus on health and wellness is a key driver of the Juice Concentrates market. As consumers become increasingly health-conscious, there is a rising demand for natural, low-sugar, and preservative-free products. Juice concentrates, particularly 100% fruit concentrates, are seen as a healthier alternative to sugary beverages, aligning with the shift toward clean-label products. This demand for healthier options is further fueled by the increase in awareness about the adverse effects of artificial additives and preservatives. As people continue to prioritize their health, juice concentrates with added nutrients and antioxidants are becoming increasingly popular, providing both functional and natural benefits. This trend is especially prevalent in regions such as North America and Europe, where consumers are actively seeking beverages that offer more nutritional value and fewer artificial ingredients. Consequently, the juice concentrate market is expanding as brands innovate to meet the growing health-conscious consumer base.

- For instance, Welch’s introduced its 100% juice concentrate with no added sugars and 100% of the daily recommended Vitamin C, catering to families seeking nutrient-dense beverages.

Growing Demand for Convenience

Convenience is a significant driver of growth in the Juice Concentrates market, as consumers increasingly seek easy-to-use, ready-to-consume products. Juice concentrates, which offer a longer shelf life and more compact storage, align perfectly with this demand for convenience. Busy lifestyles, particularly among working professionals, young adults, and parents, are fueling the need for convenient food and beverage options. Additionally, the ability to easily reconstitute concentrated juice into ready-to-drink beverages makes them an appealing choice for both consumers and food manufacturers. The rise in on-the-go consumption and the demand for meal solutions that are both quick and nutritious is pushing the market for juice concentrates. This driver is especially potent in the beverage sector, where consumers value portability and ease of use, prompting manufacturers to focus on packaging innovations and product formulations that cater to these needs.

- For instance, SIG Combibloc International AG launched a spouted pouch system for juice-based drinks which allows consumers to pour or sip directly and the pouch takes up significantly less shelf and shipping space compared to rigid bottles.

Expanding Applications in Food & Beverage Industry

The increasing use of juice concentrates in a wide range of food and beverage applications is another key growth driver. Beyond beverages, juice concentrates are finding their way into bakery, confectionery, dairy, and frozen food products. Their versatility in flavor enhancement, coloring, and preservation properties makes them valuable ingredients across multiple sectors. In the bakery and confectionery industries, for example, juice concentrates are used to impart natural flavors and vibrant colors to a variety of products, while dairy manufacturers use them to create fruit-flavored yogurts and ice creams. This growing demand for juice concentrates across diverse applications is boosting market growth, particularly as consumer preferences shift toward more natural and innovative food products. As manufacturers explore new product categories and formulations, the expanding use of juice concentrates across various food and beverage applications is expected to sustain the market’s growth trajectory over the coming years.

Key Trends & Opportunities

Technological Advancements in Processing

Technological advancements in juice concentrate processing are offering new opportunities for market growth. Innovative methods like membrane filtration, freeze concentration, and vacuum concentration are helping improve the quality and nutritional value of juice concentrates while reducing production costs. These advanced processing techniques preserve the flavor, color, and nutrient content of the juice, making them more appealing to health-conscious consumers. Furthermore, these technologies also enable manufacturers to create specialized concentrates for niche markets, such as organic or functional beverages. For instance, the development of cold-pressed juice concentrates, which retain more nutrients, is gaining traction as consumers look for nutrient-rich beverages. As technology continues to improve, manufacturers can enhance product quality, increase yield, and reduce waste, creating opportunities for market expansion and differentiation.

- For instance, Sanitech Engineers provides custom membrane filtration systems for juice producers (microfiltration, ultrafiltration, nanofiltration) that remove proteins, starches and hazes while preserving natural colour, flavour and aroma.

Rise of Plant-Based and Functional Beverages

The growing trend of plant-based diets and functional beverages presents a significant opportunity for the Juice Concentrates market. As consumers seek alternatives to dairy and other animal-based ingredients, juice concentrates made from fruits, vegetables, and superfoods are increasingly being incorporated into plant-based and functional drinks. These beverages often feature added benefits such as probiotics, vitamins, and antioxidants, catering to health-conscious consumers looking for products that support immunity, digestion, and overall wellness. With the popularity of smoothies, detox juices, and other plant-based beverages on the rise, juice concentrates are playing an essential role in enhancing the flavor and nutritional content of these drinks. The shift toward plant-based and functional beverages is expected to continue, providing new growth avenues for juice concentrate manufacturers as they develop innovative products to meet the demands of this expanding market segment.

- For instance, Suja Life, a leader in organic cold-pressed juices, has developed functional beverage lines using fruit and vegetable concentrates fortified with probiotics and adaptogens, helping to support gut health and reduce stress

Key Challenges

Supply Chain Disruptions and Raw Material Sourcing

One of the key challenges facing the Juice Concentrates market is the vulnerability of supply chains, particularly in sourcing raw materials such as fruits and vegetables. Climate change, seasonal variations, and geopolitical instability can affect the availability and price of raw ingredients, leading to supply chain disruptions. These challenges are compounded by fluctuating agricultural yields, particularly for tropical fruits like oranges, which are essential for juice concentrate production. Additionally, the increasing demand for organic and sustainably sourced raw materials can strain supply chains further. Manufacturers must find ways to mitigate these risks by diversifying their supplier base, investing in local sourcing, and exploring more resilient supply chain models. Failure to address these challenges could lead to product shortages, cost increases, and potential market instability.

Regulatory and Quality Compliance Issues

Regulatory compliance and quality control are significant challenges in the Juice Concentrates market, particularly as consumer expectations for natural and clean-label products continue to rise. Manufacturers must navigate complex and varying regulations concerning food safety, labeling, and ingredient sourcing, which can differ across regions. Stringent quality control measures are essential to meet the growing consumer demand for high-quality, safe, and nutritious products. Additionally, the increasing focus on sustainability and eco-friendly packaging adds another layer of complexity, as manufacturers must ensure compliance with environmental regulations. As the market becomes more competitive, companies that fail to meet regulatory standards or address quality concerns may face reputational damage and potential legal challenges, affecting their market position and growth prospects.

Regional Analysis

North America

North America commands 41.3% of the global juice concentrates market, benefiting from strong consumer demand for health‑oriented beverages and a well-established food processing infrastructure. High disposable incomes and the growth of retail and e‑commerce channels drive market penetration. The region’s preference for natural, clean‑label juice concentrates and increasing usage in functional and convenience applications contribute significantly to market growth. Despite challenges such as regulatory scrutiny and raw material cost fluctuations, the mature market continues to attract investment in innovative, value-added products, ensuring its continued dominance.

Europe

Europe holds a dominant share of the global juice concentrates market, accounting for 30% of the market. The region’s leadership is supported by strong fruit cultivation, robust manufacturing capabilities, and strict clean-labelling regulations that promote premiumization. Growing consumer interest in organic and non-GMO products, along with the rising demand for natural ingredients, further drives market growth. Although the market is growing at a slower pace compared to emerging regions, Europe remains a strategic hub for manufacturers focusing on sustainability, authenticity, and innovative products.

Asia Pacific

The Asia Pacific region is the fastest-growing market for juice concentrates, with its market share increasing rapidly. The region currently holds 15% of the global market but is expected to grow at the highest CAGR due to rising disposable incomes, rapid urbanization, and increasing health awareness in countries such as China and India. Key drivers include expanding retail networks, the growing food service sector, and rising demand for convenient beverage formats. Although infrastructure and cold-chain challenges persist, significant investment is being made, further propelling the region’s growth potential.

Latin America

Latin America 8% of the global juice concentrates market, with steady growth driven by the region’s abundant fruit production, particularly in Brazil and Mexico. The market benefits from strong domestic consumption and export opportunities, supported by well-established fruit supply chains and processing infrastructure. While growth is tempered by economic volatility and logistics challenges, there is increasing demand for juice concentrates in both regional and export markets. Manufacturers focusing on tailoring products to local tastes and preferences can seize opportunities, especially in emerging economies.

Middle East & Africa

The Middle East & Africa (MEA) region holds a smaller share of the global juice concentrates market, contributing 5% to the total market. Despite its smaller market share, the region exhibits positive growth potential due to urbanization and the expansion of modern retail and trade channels. The rising demand for juice-based beverages, improved processing infrastructure, and increasing imports contribute to market development. However, the region faces challenges such as supply chain logistics, climate-related risks affecting raw material sourcing, and varying regulatory standards across countries.

Market Segmentations

By Type

- 100% fruit concentrate

- Concentrated fruit cocktail

- Powdered juice concentrates

By Processing Method

- Vacuum Concentrate

- Freeze Concentration

- Membrane Concentration

- Aroma Recovery

By Application

- Beverages

- Bakery & Confectionery

- Dairy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

In the global juice concentrates market, competition is shaped by a mix of large agribusinesses and specialized ingredient firms that emphasise scale, innovation and strategic partnerships. Leading companies such as Archer Daniels Midland Company (ADM), Ingredion Incorporated, Südzucker AG, Döhler Group, SVZ International B.V. and Kerry Group PLC consistently hold strong market shares and drive product development across regions. These players invest in advanced processing methods, clean‑label formulations and global supply‑chain optimisation to meet the growing demand for natural and functional concentrates. Regional and niche players—such as Lemonconcentrate S.L.U. and W. KÜNDIG & CIE AG—complement this landscape by focusing on specialty juices, organic certification and regional sourcing. Competitive pressure comes from raw‑material cost volatility, evolving regulatory standards and the need to continuously realise operational efficiencies. As market maturation continues, companies differentiate themselves through sustainable practices, premium product positioning and strategic alliances in emerging regions, preserving their leadership positions in a dynamically evolving sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2024, Ingredion Incorporated partnered with and invested in Better Juice to roll out sugar-reducing enzymatic technology for use in juice-based beverages and concentrates in the U.S.

- In March 2024, Louis Dreyfus Company (LDC) launched its own juice brand, Montebelo Brasil, in France leveraging its Brazilian orange-juice concentrate assets to tap the premium segment.

Report Coverage

The research report offers an in-depth analysis based on Type, Processing Method, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Juice Concentrates market will continue to grow due to rising health consciousness and the demand for natural beverage ingredients.

- Manufacturers will increasingly focus on clean-label and additive-free formulations to meet consumer expectations.

- Technological advancements in concentration methods will lead to improved product quality and cost-efficiency.

- Organic and non-GMO juice concentrates will gain significant traction, particularly in premium product segments.

- The Asia Pacific region will emerge as a key growth hub driven by urbanization and rising disposable incomes.

- Functional and fortified juice concentrates will see higher adoption, especially in nutraceutical and wellness products.

- Sustainability and ethical sourcing will become central to brand strategies, influencing consumer loyalty.

- E-commerce and direct-to-consumer channels will contribute to market expansion and convenience-based purchasing.

- Strategic partnerships and acquisitions will accelerate market consolidation among key players.

- Innovation in flavor profiles and tailor-made solutions will enable deeper penetration in food and beverage applications.