Market Overview

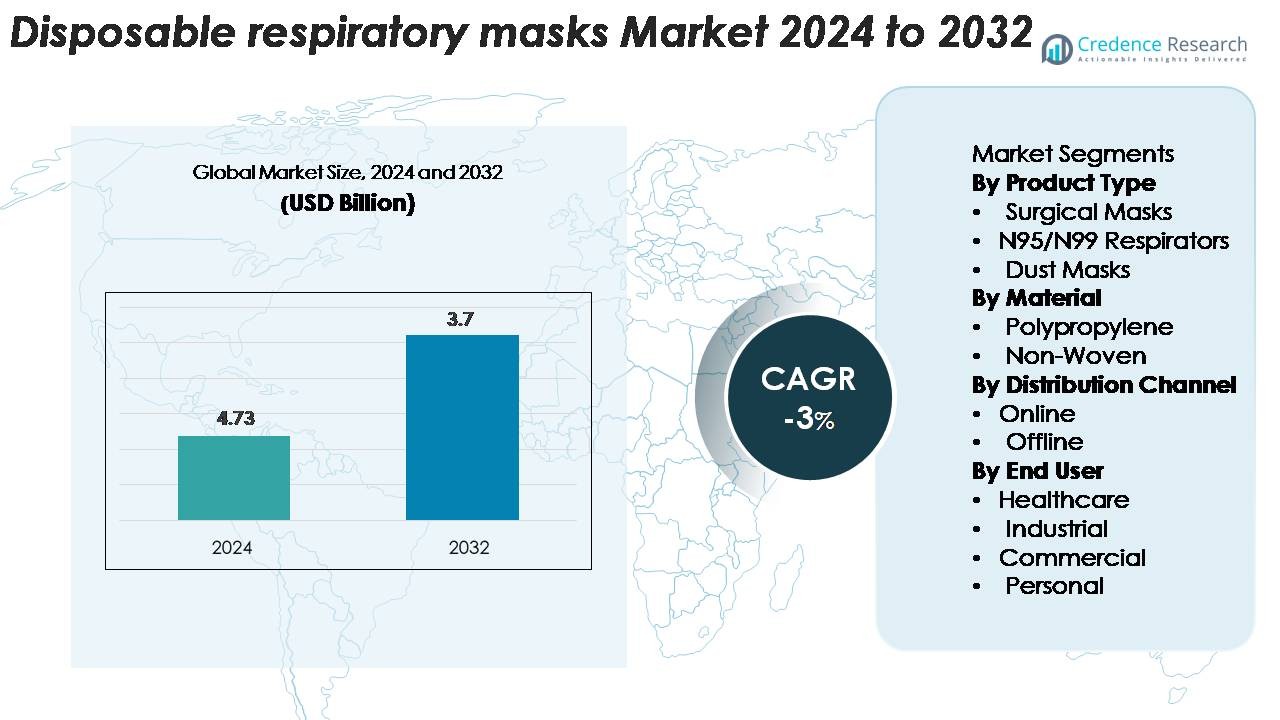

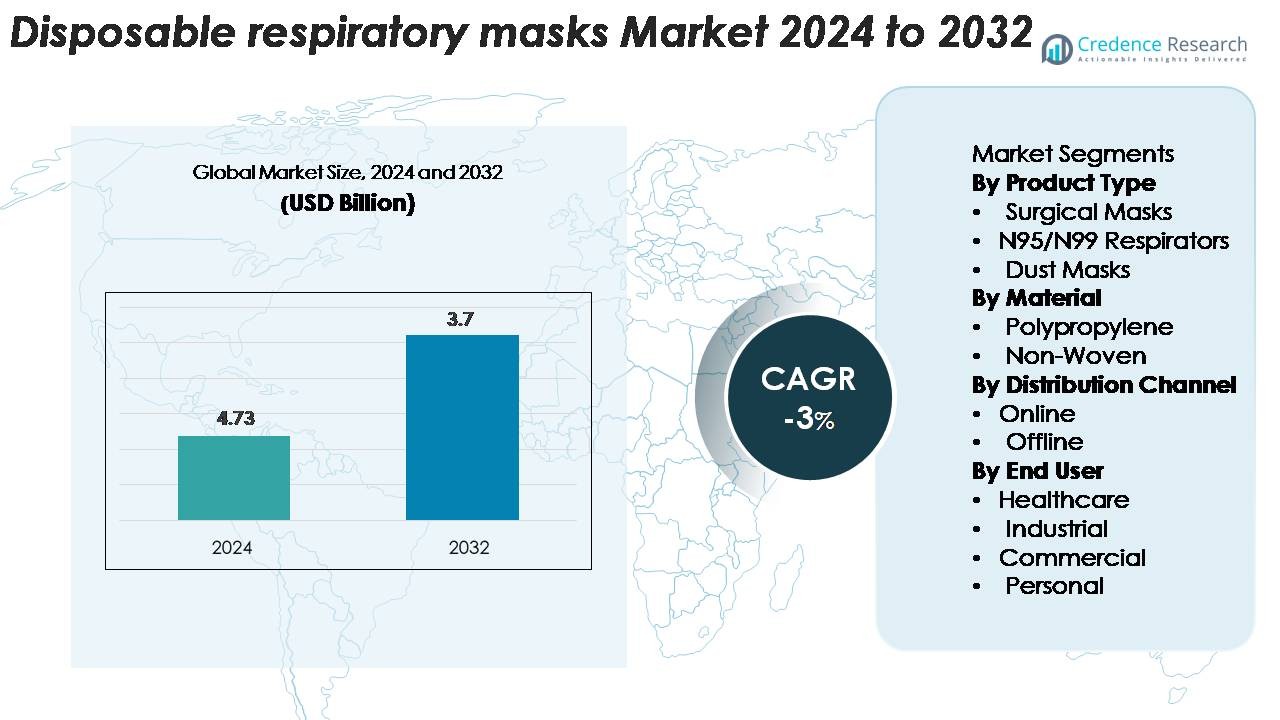

The Disposable Respiratory Masks Market was valued at USD 4.73 billion in 2024 and is projected to reach USD 3.7 billion by 2032, reflecting a CAGR of -3% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Disposable Respiratory Masks Market Size 2024 |

USD 4.73 Billion |

| Disposable Respiratory Masks Market, CAGR |

3% |

| Disposable Respiratory Masks Market Size 2032 |

USD 3.7 Billion |

The global disposable respiratory masks market is led by key firms such as 3M Company, Honeywell International Inc. and Kimberly‑Clark Corporation, each leveraging robust R&D, global distribution and strong brand presence. These players collectively dominate the market, contributing to an estimated ~56% share of the overall respiratory protective equipment segment. Regionally, the North America region maintains the largest share at 33.8% in 2023, driven by advanced manufacturing, stringent safety standards and high uptake across healthcare and industrial sectors. Meanwhile, the Asia‑Pacific region emerges as the fastest‑growing and is projected to hold approximately 35% of the market by 2037, reflecting rapid industrialisation and heightened safety awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global disposable respiratory masks market was valued at about USD 4.26 billion in 2023 and is forecast to reach USD 6.12 billion, registering a CAGR of ‑2.8% over 2024‑2032.

- Key growth drivers include rising industrial and healthcare safety awareness, regulatory mandates for workplace PPE, and escalating air‑pollution concerns prompting personal and occupational protection use.

- Prominent trends involve dominance of N‑series respirators (notably N95) in the product mix, expanding industrial applications (e.g., transportation, manufacturing) and regional rise in Asia‑Pacific driven by local production scale‑up.

- Restraints include environmental concerns over disposable‑mask waste, raw‑material price volatility, and market saturation in mature regions limiting incremental growth.

- Regionally, North America held approximately 33.8% of the market in 2023, while Asia‑Pacific is projected to hold up to 35% by 2037, reflecting shift toward high‑growth emerging markets.

Market Segmentation Analysis:

By Product Type

Surgical masks dominate the product type segment due to their widespread use in hospitals, clinics, and general public environments. Strong demand comes from routine medical procedures and continuous infection-control needs. N95/N99 respirators follow as workplaces adopt stricter safety rules in high-risk zones such as industrial plants and laboratories. Dust masks maintain steady use in construction and light manufacturing where basic filtration is enough. Growth across all categories is shaped by workplace safety standards, healthcare demand, and rising awareness of respiratory protection in crowded settings.

- For instance, Cardinal Health’s Level 3 surgical mask delivers a bacterial filtration efficiency of 98% as validated under ASTM F2101 testing.

By Material

Polypropylene leads the material segment because manufacturers rely on melt-blown and spun-bond polypropylene layers to achieve high filtration performance and breathability. This material supports large-scale production and meets healthcare-grade protection norms. Non-woven fabrics rank next as they offer comfort, durability, and strong airflow control for daily use. Their flexible structure allows multi-layer designs that improve particle capture. Demand for both materials increases as producers enhance filtration efficiency and focus on lightweight, skin-friendly mask designs for long wear times.

- For instance, Berry Global manufactures melt-blown polypropylene with fiber diameters as fine as 1–5 micrometers, enabling high-efficiency filtration used in medical masks.

By Distribution Channel

Offline channels dominate the distribution landscape due to bulk procurement by hospitals, clinics, and industrial buyers who prefer verified suppliers and assured quality checks. These channels support steady supply chains and predictable replenishment cycles. Online channels grow quickly as small businesses and personal buyers shift to digital platforms for faster delivery and better price visibility. E-commerce adoption rises further as users seek convenience and wider product availability, especially during supply shortages or seasonal spikes in respiratory infections.

Key Growth

Driver Rising Emphasis on Infection Control

Growing focus on infection control drives strong demand for disposable respiratory masks. Healthcare systems now maintain higher stock levels to protect workers during routine and emergency care. Many countries upgraded safety rules after recent outbreaks, which lifted long-term mask consumption. Hospitals continue to train staff on proper mask use, which keeps daily usage stable. Industrial units also rely on masks to reduce exposure to dust and fumes. These factors strengthen volume demand across both medical and non-medical settings. The sustained need for reliable protection places disposable masks at the center of basic safety compliance.

- For instance, 3M expanded its global respirator output to 2 billion units annually, strengthening hospital access to certified protective masks.

Expanding Industrial Safety Requirements

Industrial workplaces use disposable respiratory masks to protect workers from particulate exposure. Manufacturing, mining, construction, and metal processing units now follow stricter safety checks. Many operations require workers to wear masks during grinding, cutting, or machine cleaning. Companies invest in regular mask supply because it reduces health risk and downtime. Safety audits also push firms to adopt higher-grade masks for specific tasks. These actions support recurring bulk orders and steady growth from the industrial segment. Rising awareness of respiratory hazards keeps this demand strong across global industrial hubs.

- For instance, Honeywell’s industrial N-series respirators are certified under NIOSH testing to filter particles as small as 0.3 microns with a minimum 95% efficiency, meeting strict workplace safety needs.

Growth of E-Commerce Distribution

E-commerce expands mask accessibility for personal and small-business users. Online platforms offer fast delivery, wide product range, and simple price comparison. Many consumers prefer online buying because they can check reviews and select comfort-focused designs. Small clinics and shops also buy through digital stores when offline supply is limited. Seasonal infection spikes create short-term surges, and online channels usually respond faster than traditional distributors. This flexible supply chain helps maintain stable availability during high-demand periods. The convenience of online shopping continues to support rising adoption across personal and commercial users.

Key Trend & Opportunity

Shift Toward Comfort-Focused and Skin-Friendly Designs

Producers now focus on lightweight and skin-friendly mask designs that suit long wear. Many workers and patients need masks for extended hours, which increases demand for softer materials. Breathable layers reduce discomfort and encourage regular use. Manufacturers also add ergonomic features like adjustable straps and improved nose clips. These upgrades open new opportunities in premium mask categories. Growth in air-pollution-affected regions further pushes comfort-driven innovation. Companies that offer better airflow and reduced irritation gain strong visibility in both healthcare and personal-use markets.

- For instance, Kimberly‑Clark Corporation’s Fluidshield N95 (model 46727) features a “So Soft” lining and a pouch-style breathing chamber certified for N95 filtration of 0.3-micron particles.

Rising Adoption of High-Filtration Masks in Non-Medical Settings

High-filtration masks now move beyond hospitals into office spaces and public facilities. Many employers use these masks to protect workers in crowded environments. Schools, airports, and transport hubs have also increased procurement of better-grade masks. This shift creates new demand pockets across commercial and service sectors. As awareness of respiratory hygiene grows, more users prefer higher protection for daily activities. Manufacturers can tap this shift by offering affordable high-filtration options. The trend broadens market reach and improves long-term adoption across non-medical users.

- For instance, the 3M Aura 9205+ N95 features an advanced electrostatic media that captures particles as small as 0.3 microns with ≥95% filtration under NIOSH TC-84A certification, and its three-panel design expands to improve facial seal integrity.

Key Challenge

Declining Demand After Pandemic-Driven Peaks

Demand for disposable respiratory masks fell sharply after the pandemic surge. Many countries reduced bulk buying as emergency requirements eased. Healthcare systems now maintain controlled reserves instead of high stockpiles. Personal users also reduced mask purchases after restrictions lifted. This decline affects yearly production volumes and profitability. Manufacturers face slower replacement cycles in the personal-use segment. Balancing production capacity with lower demand levels becomes difficult. These shifts create a long-term challenge for companies that expanded rapidly during the peak years.

Increasing Competition from Reusable Respiratory Products

Reusable respiratory products create strong competition for disposable masks. Many users shift to reusable options to reduce waste and long-term cost. Companies offer reusable masks with replaceable filters, which extend product life. This shift reduces repeat orders for disposable units. Industrial buyers also prefer durable designs for predictable daily use. Environmental concerns push institutions to reduce single-use waste, which affects demand further. Manufacturers must adjust product lines and explore higher-performance disposable designs to stay competitive.

Regional Analysis

North America

In North America, the disposable respirators sector remains the most mature, capturing approximately 33.8% of global volume in 2023. Market growth is driven by strong industrial safety regulations, an established healthcare‑supply chain and high institutional procurement in the U.S. and Canada. Adoption in construction, manufacturing and oil & gas further underpins demand. While total growth rates are moderate due to market maturity, suppliers focus on premium product upgrades and compliance‑driven replacements rather than basic diffusion.

Asia‑Pacific

The Asia‑Pacific region held about 23% of global revenue in the disposable particulate respirators market in 2024, making it the second‑largest region and fastest growing. Expansion stems from rapid industrialisation in China, India and Southeast Asia, rising pollution concerns, increasing workplace safety awareness and local manufacturing scale‑up. The region increasingly shifts from low‑cost supply base toward higher‑specification respirators as regulatory frameworks strengthen and end‑users seek more advanced protection.

Europe

Europe constitutes a significant share of the global disposable respirator market, with estimates placing the region at around 28% of the disposable face‑mask segment in 2024. The region benefits from well‑defined occupational safety laws, strong healthcare infrastructure and high acceptance of certified protective devices. Although growth is slower compared to emerging markets, demand remains stable and driven by replacement cycles, innovation (e.g., biodegradable materials), and industrial use in automotive, chemicals and mining sectors.

Latin America

Latin America holds a smaller slice of the global disposable respiratory‑masks market, estimated at 5% of revenue in 2024. Growth is supported by expanding healthcare coverage, rising industrial safety adoption in mining and manufacturing, and increasing urban air‑quality awareness. However, the region faces challenges including lower per‑capita spend, import‑dependence and irregular supply chains. The market offers moderate upside for expansion, especially through base‑station replacement and public‑health initiatives.

Middle East & Africa (MEA)

The Middle East & Africa region accounts for approximately 3% of the global disposable‑face‑mask market in 2024. Growth is modest but consistent, driven by oil & gas safety, construction and rising healthcare investment in Gulf states and Africa. The region’s expansion is capped by infrastructure and regulatory gaps, yet manufacturers consider MEA a strategic frontier for long‑term growth as worker‑safety norms and public‑health priorities strengthen.

Market Segmentations:

By Product Type

- Surgical Masks

- N95/N99 Respirators

- Dust Masks

By Material

By Distribution Channel

By End User

- Industrial

- Commercial

- Personal

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the disposable respiratory masks market features a mix of global medical suppliers, industrial safety manufacturers, and specialized filtration material producers. Companies focus on improving filtration efficiency, enhancing breathability, and increasing wearer comfort to strengthen product acceptance. Many producers invest in melt-blown polypropylene technology to secure consistent output and meet healthcare-grade standards. Firms also expand distribution through offline dealer networks and fast-growing e-commerce platforms to reach medical, industrial, and personal users. Competition intensifies as manufacturers introduce masks with better fit, softer materials, and reliable multi-layer structures. Several players optimize production lines to reduce cost and maintain steady supply during demand fluctuations. Strategic partnerships with hospitals and industrial buyers further support market presence. Environmental concerns also encourage companies to explore low-waste packaging and sustainable material options, shaping future competition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Medline Industries, Inc.

- Kowa American Corporation

- 3M

- Makrite

- DACH

- Ambu A/S

- Alpha Pro Tech Ltd.

- Cardinal Health Inc.

- Honeywell International Inc.

- Ansell Limited

- Kimberly-Clark Corporation

Recent Developments

- In July 2025, Medline Industries updated its regulatory documentation related to [Nasal Cannulas], reflecting routine compliance with existing FDA premarket notification requirements.

- In 2025, Honeywell closed the sale of its Personal Protective Equipment unit, which included disposable masks, to Protective Industrial Products for $1.325 billion. This sale impacted 5,000 employees and 20 manufacturing sites, signaling a strategic refocus by Honeywell in this sector.

Report Coverage

The research report offers an in-depth analysis based on Product type, Material, Distribution channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will stabilize as hospitals maintain steady infection-control procurement.

- Industrial use will rise as safety rules become tighter across high-risk sectors.

- Online sales will grow faster as personal and small-business buyers shift to e-commerce.

- Manufacturers will focus on lighter, breathable, and skin-friendly mask designs.

- High-filtration masks will gain adoption in non-medical workplaces and public spaces.

- Supply chains will strengthen through regional manufacturing expansion.

- Competition will increase as reusable respiratory products gain more visibility.

- Sustainability efforts will push companies to reduce waste in packaging and materials.

- Innovation in filtration media will improve comfort and protection levels.

- Global health preparedness programs will support long-term baseline demand.