Market Overview:

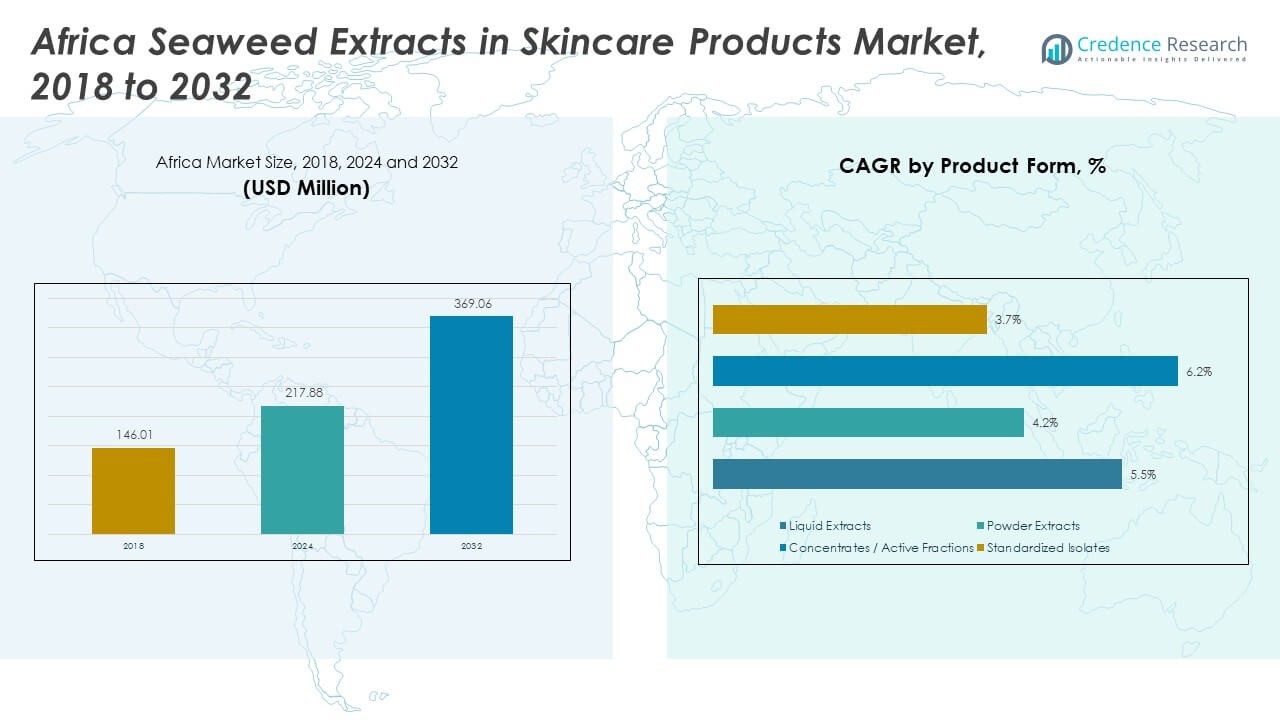

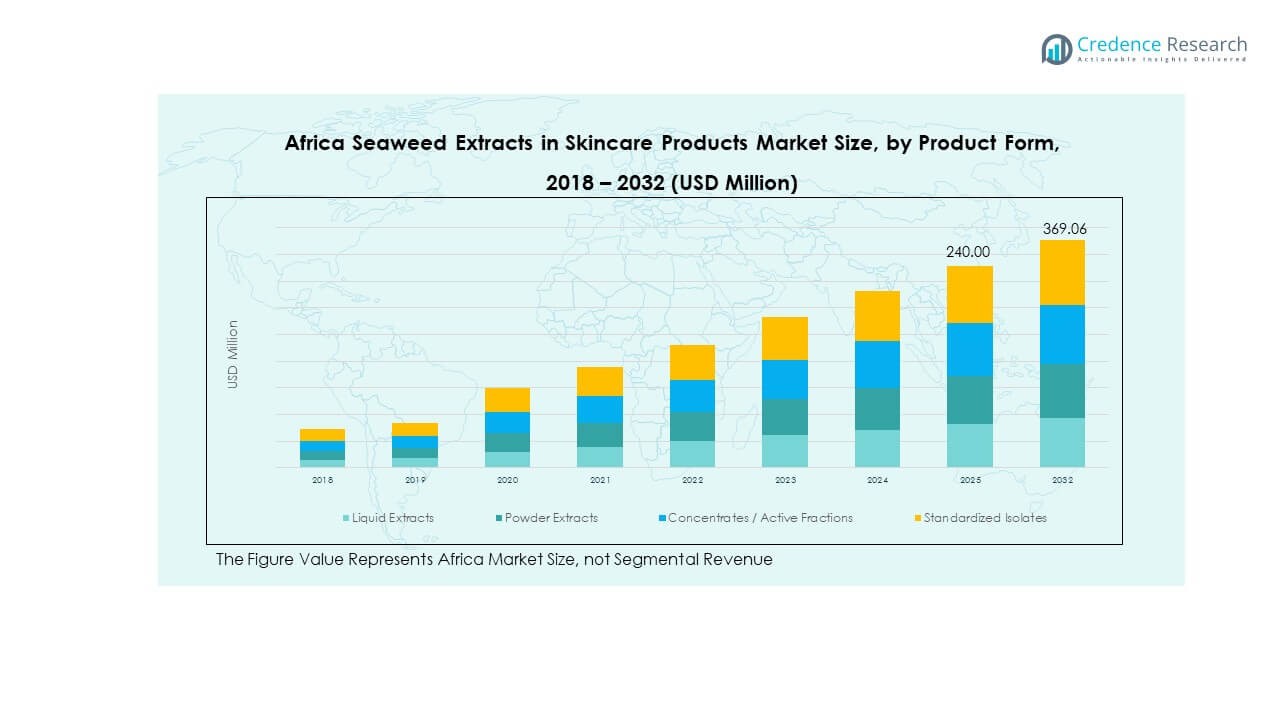

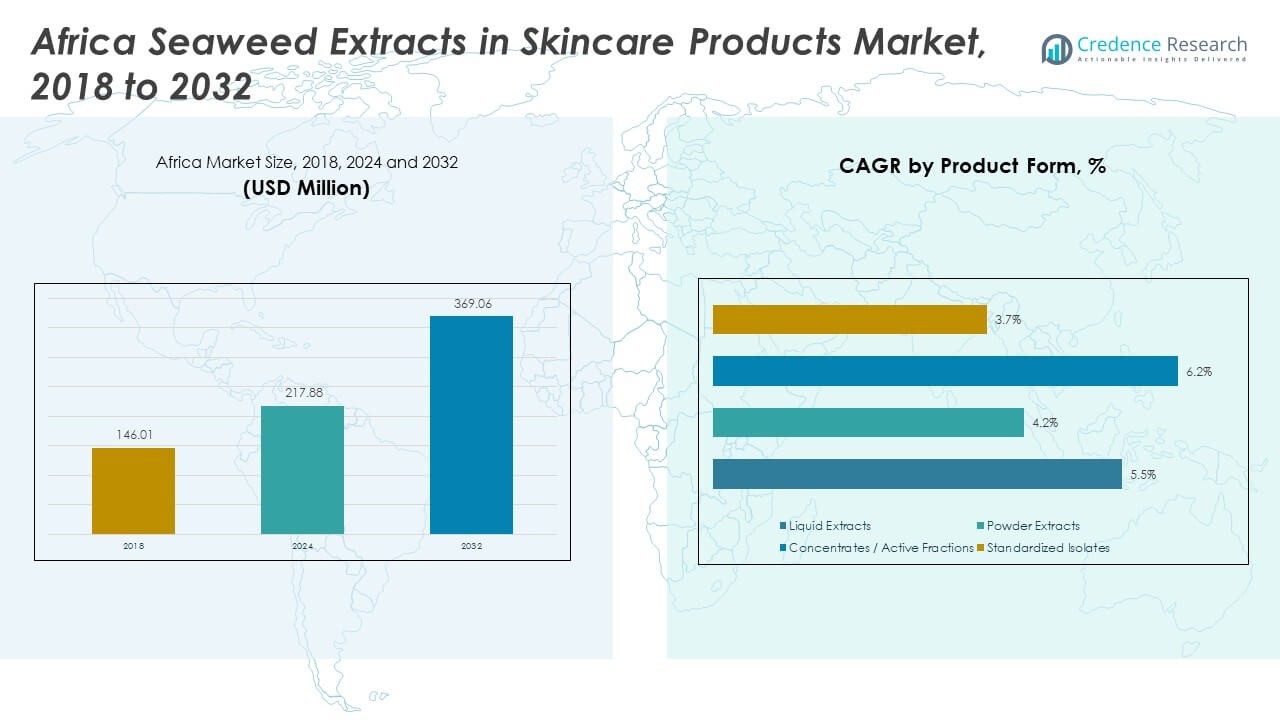

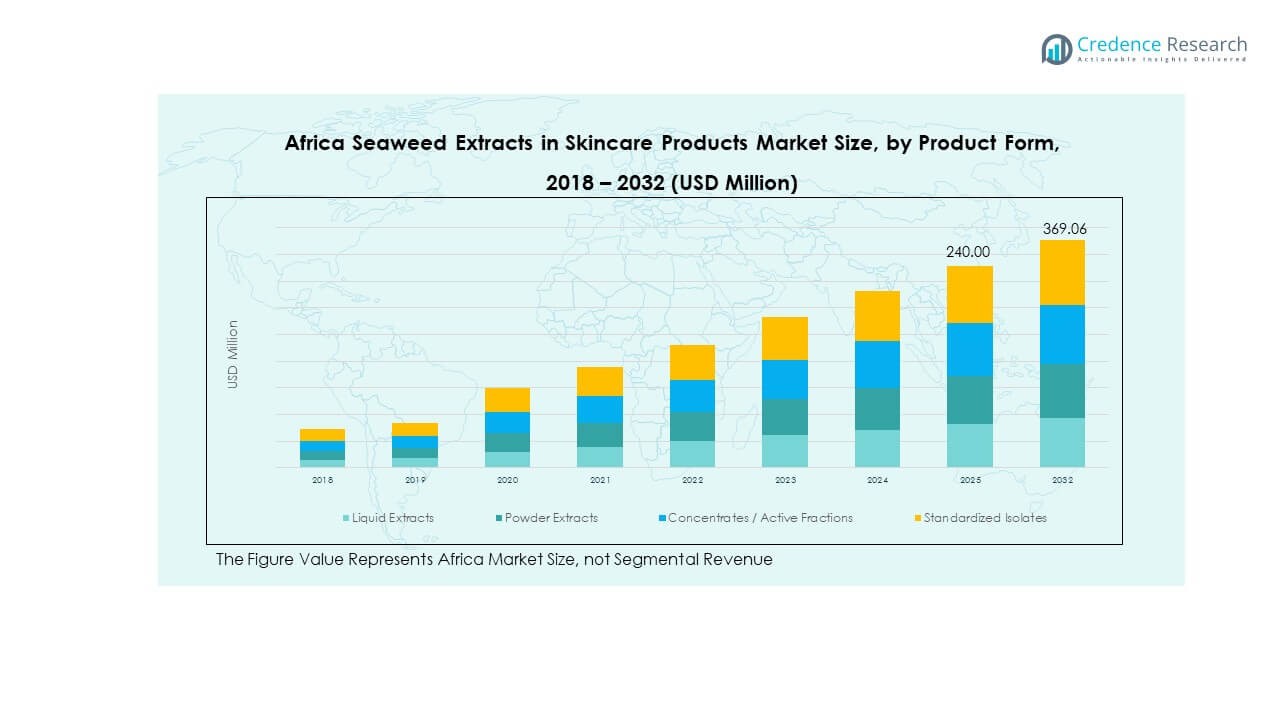

The Africa Seaweed Extracts in Skincare Products Market size was valued at USD 146.01 million in 2018 to USD 217.88 million in 2024 and is anticipated to reach USD 369.06 million by 2032, at a CAGR of 6.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Africa Seaweed Extracts in Skincare Products Market Size 2024 |

USD 217.88 Million |

| Africa Seaweed Extracts in Skincare Products Market, CAGR |

6.34% |

| Africa Seaweed Extracts in Skincare Products Market Size 2032 |

USD 369.06 Million |

Strong market drivers include the shift toward natural actives, steady growth in facial care, and rising brand investment in marine ingredients. Beauty makers rely on seaweed for its antioxidant profile, which supports anti-aging claims. Local producers focus on gentle formulas that appeal to sensitive-skin users. Global beauty houses expand sea-inspired lines to meet clean-label expectations. Retailers highlight eco-friendly sourcing to build trust among younger buyers. Social media trends lift awareness of ocean-derived skincare. This demand encourages larger production by African processors.

Regional growth is shaped by rising beauty spending in South Africa, which leads due to strong retail reach and higher adoption of clean beauty routines. Kenya and Tanzania emerge as key markets supported by seaweed farming clusters and growing local skincare brands. North African countries gain traction due to demand for natural cosmetics and strong product diversification. Coastal regions benefit from raw material access and active government support for seaweed cultivation. Expanding cosmetic manufacturing in East Africa helps wider regional availability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Africa Seaweed Extracts in Skincare Products Market grew from USD 146.01 million in 2018 to USD 217.88 million in 2024 and is projected to reach USD 369.06 million by 2032, supported by a steady CAGR of 6.34% driven by rising demand for clean, marine-derived skincare ingredients.

- South Africa (32%), North Africa (27%), and East Africa within the broader Rest of Africa group (approx. 20%) dominate regional share due to strong retail networks, established cosmetics manufacturing, and faster adoption of natural beauty products supported by local sourcing and established supply chains.

- East Africa, holding part of the collective 41% share, stands out as the fastest-growing region, supported by expanding seaweed farming clusters in Kenya and Tanzania and increasing partnerships between processors and skincare manufacturers seeking traceable raw materials.

- From the product form distribution seen in the chart, liquid extracts hold the largest share at roughly 40%, driven by their ease of incorporation into serums, creams, and hydrating formulations.

- Powder extracts account for about 25%, supported by longer shelf life, flexible formulation use, and growing adoption in both mass and clinical skincare applications.

Market Drivers:

Rising Demand For Marine-Based Actives Across Premium And Mass Skincare Lines

The Africa Seaweed Extracts in Skincare Products Market gains strong traction due to rising use of marine actives across face creams, serums, and soothing gels. Brands depend on seaweed to deliver hydration support and barrier repair benefits that appeal to daily skincare users. Many consumers prefer formulas rooted in natural sources, which drives sustained demand. Retail chains highlight sea-derived actives to shape clean beauty choices across urban centers. Local producers increase marine extraction capabilities to match rising product launches. Global brands push wider seaweed portfolios to strengthen their presence in Africa. The market grows due to steady preference for ocean-based ingredients. It expands its appeal across varied price tiers that target mass and premium buyers.

- For instance, L’Oréal’s Biotherm line uses its patented Life Plankton microalgae extract, an ingredient known for its regenerating properties and ability to help reinforce the skin’s barrier function, with consumer studies reporting visible skin improvement within eight days.

Growing Preference For Antioxidant-Rich Ingredients That Support Anti-Aging Benefits

Rising interest in anti-aging features supports higher use of seaweed extracts in creams and oils. Many buyers select marine formulas for firming and smoothing effects promoted by beauty brands. Skincare houses invest in R&D programs to enhance extraction purity. The Africa Seaweed Extracts in Skincare Products Market benefits from this shift toward performance-focused actives. Product makers highlight the antioxidant nature of seaweed to shape strong claims around elasticity and glow. Retailers promote natural solutions to reduce early signs of aging. Social media campaigns lift interest in marine-based routines adopted by younger groups. This demand strengthens brand portfolios across key African markets.

Stronger Movement Toward Clean Beauty And Ocean-Safe Ingredient Sourcing

Consumers across Africa push interest in clean beauty, which accelerates the use of marine extracts harvested under safe and controlled conditions. Many African brands highlight transparent sourcing to build deeper trust. It helps buyers differentiate natural skincare from synthetic-loaded formulas. Importers increase marine raw material flow from regional seaweed hubs to support steady manufacturing. Global labels commit to eco-safe marine extraction to align with sustainability commitments. Retail stores expand shelf space for sea-inspired lines that meet clean beauty norms. Skincare influencers drive education around ocean-friendly skincare routines. Wider transparency boosts purchasing confidence among urban users.

Growing Adoption Of Multifunctional Marine Extracts In Daily Skincare Routines

Marine extracts gain traction due to their ability to offer hydration, calming, and brightening support in one formula. This feature appeals to buyers seeking simple routines. Beauty brands highlight multifunctionality to lift product value and reduce routine complexity. The Africa Seaweed Extracts in Skincare Products Market leverages this trend to widen interest across diverse consumer groups. Producers use seaweed blends to improve product texture and skin compatibility. Retail stores pick multifunctional formats to meet demand for time-saving skincare. Formulators push seaweed-based actives to strengthen product performance across daily-use items. This trend encourages steady investments in marine extraction and processing technologies.

Market Trends:

Rising Movement Toward Fermented Seaweed Extracts In High-Performance Skincare

Fermented seaweed extracts gain attention due to strong absorption and smoother texture. Many brands introduce fermented variants to lift performance in serums and facial oils. Users prefer lighter formats that suit warm climates across African cities. The Africa Seaweed Extracts in Skincare Products Market sees growth in these advanced versions due to rising K-beauty influence. Retailers promote fermented lines to attract buyers who want upgraded natural formulations. Formulators improve fermentation steps to increase nutrient density. Global trends boost demand for bio-enhanced marine actives. This shift helps premium lines stand out across competitive spaces.

- For instance, Sulwhasoo uses its patented De-Aging Active (DAA) extracted from red pine in Timetreasure formulations, which documented a reduction of aged cells in clinical studies.

Expanding Use Of Seaweed In Sensitive-Skin And Microbiome-Focused Formulations

Brands launch gentle seaweed-based creams and lotions to support sensitive-skin users. Many producers highlight marine extracts as calming agents that help reduce redness. Microbiome-focused skincare grows fast, and seaweed aligns well with this direction. The Africa Seaweed Extracts in Skincare Products Market benefits from wider trust in nature-based soothing properties. Dermatologist-backed formulas lead to clearer user confidence. Retailers expand marine soothing ranges in urban beauty stores. Many start-ups develop minimalist formulations that feature clean marine extracts. This trend shapes new product pipelines across multiple African regions.

- For instance, Paula’s Choice products, such as those in the Calm line, contain various soothing ingredients like green tea extract and licorice extract known to help reduce visible redness in sensitive skin users. Paula’s Choice also offers the Defense Triple Algae Pollution Shield, which incorporates a blend of algae.

Growing Interest In Hybrid Beauty Products Blending Seaweed With Botanicals And Clays

Hybrid formulations gain pace due to rising demand for diverse natural blends. Many brands mix seaweed with aloe vera, shea, and African botanicals to enhance performance. Users prefer hybrid masks and gels for detox and hydration needs. The trend spreads across e-commerce platforms that highlight ingredient-focused storytelling. The Africa Seaweed Extracts in Skincare Products Market gains visibility through hybrid promotion campaigns. Retailers diversify offerings to match cross-ingredient interest. Skincare makers design new blends to handle climate-specific concerns such as dryness and dullness. This fusion approach lifts innovation across mid-range and premium portfolios.

Rising Penetration Of Sustainable Packaging In Marine-Based Skincare Lines

Sustainable packaging grows due to rising eco-conscious behavior in African cities. Many brands shift toward recyclable and refill-ready packaging to build trust. Marine-based products often align with ocean-safe positioning, which strengthens this trend. The Africa Seaweed Extracts in Skincare Products Market uses sustainable packaging to enhance brand value. Retail stores highlight eco-labels to pull younger buyers. Producers work with suppliers to cut plastic weight. E-commerce platforms promote sustainable bundles to support brand visibility. This trend boosts overall market differentiation in natural skincare.

Market Challenges Analysis:

Supply-Chain Constraints And Limited Local Processing Infrastructure Affecting Production Stability

The Africa Seaweed Extracts in Skincare Products Market faces supply bottlenecks due to limited processing facilities in key coastal regions. Many producers depend on imported extraction systems, which slows local output. Harvesting cycles vary across seasons and impact raw material consistency. It creates hurdles for brands that need steady ingredient supply. Transport difficulties raise lead times for inland manufacturers. Limited storage infrastructure reduces shelf stability of fresh seaweed. Small farmers lack access to advanced drying tools. These gaps restrict rapid scale-up efforts across the region.

High Cost Pressure And Intense Competition From Global Marine-Ingredient Suppliers

Cost pressure affects African producers due to the high expense of extraction technology and quality testing. Global marine suppliers offer refined extracts that compete strongly with local options. The Africa Seaweed Extracts in Skincare Products Market deals with competitive pricing gaps that challenge domestic expansion. Many African brands face difficulty meeting international purity benchmarks. Import duties raise ingredient costs for small manufacturers. Limited R&D investment reduces innovation speed. Retail buyers expect performance consistency, which demands strict quality control. This pressure shapes slower expansion across several African sub-regions.

Market Opportunities:

Expansion Of Local Seaweed Farming Networks And Region-Specific Marine Extraction Facilities

The Africa Seaweed Extracts in Skincare Products Market gains strong opportunity through expansion of farming clusters in coastal regions. New farming zones help reduce import dependence and improve supply continuity. Local extraction units strengthen product traceability. Many brands partner with seaweed cooperatives to secure stable raw materials. Governments support training programs to enhance marine cultivation. Retailers promote locally sourced products to build national identity. This opportunity drives more investments in extraction efficiency and quality upgrades.

Growing Scope For Premium Seaweed-Based Skincare Driven By Urban Wellness Adoption

Premium marine-based skincare sees rising interest from urban buyers seeking clean and high-performance ingredients. Many brands launch advanced serums and masks using refined seaweed extracts. The Africa Seaweed Extracts in Skincare Products Market uses this trend to target wellness-focused consumers. Skincare houses craft premium lines aimed at hydration, glow, and barrier repair. Retail stores highlight sea-inspired luxury items to shape modern beauty habits. E-commerce channels push high-end marine formulations across major cities. This space opens strong potential for brand differentiation and higher margins.

Market Segmentation Analysis:

By Product Form

The Africa Seaweed Extracts in Skincare Products Market shows strong activity across liquid extracts, which lead use due to easy blending in creams, serums, and masks. Powder extracts gain traction for longer shelf life and flexible formulation. Concentrates and active fractions appeal to premium brands focused on targeted benefits. Standardized isolates rise as clinical brands seek consistency and performance. Many producers invest in advanced purification to support higher-grade formats. Retailers highlight concentrated marine actives to shape product differentiation. This segment structure supports varied use across mass and luxury ranges.

- For instance, Ashland’s SeaStem biofunctional—derived from marine fractions—showed a 24% improvement in epidermal recovery in validated laboratory studies.

By Seaweed Type

The Africa Seaweed Extracts in Skincare Products Market benefits from strong demand for brown seaweed due to its nutrient density and antioxidant profile. Red seaweed attracts brands focused on soothing and gel-based textures. Green seaweed rises in popularity for hydration-focused lines. Microalgae, including chlorella and spirulina, gain importance in high-performance and anti-pollution products. Many formulators use mixed species to balance texture and efficacy. Seaweed type selection supports claims across firming, brightening, and barrier repair. This diversity enables wide formulation flexibility.

- For instance, The Inkey List uses a patented 2% Brightenyl™ ingredient in its Brighten-i Eye Cream, which acts as an antioxidant four times more potent than Vitamin C and helps to reduce the appearance of dark circles and uneven tone. It also includes a 0.7% Mica mineral blend to provide instant illumination by reflecting light, which contributes to an immediately brighter under-eye appearance.

By Application

Demand grows across anti-ageing and wrinkle care due to strong interest in firming benefits. Hydration and barrier repair products hold a major share in urban markets. Sensitive-skin and anti-inflammatory lines use seaweed to deliver gentle action with minimal irritation. Sunscreen and UV-protection adjuncts expand with rising awareness of sun damage. The Africa Seaweed Extracts in Skincare Products Market aligns these applications with clean and nature-based positioning. Brands highlight marine actives to meet growing ingredient transparency needs. This segment structure supports targeted skincare adoption.

By End Market

Prestige skincare leads due to high uptake of premium marine actives. Mass personal care expands with wider product access across retail chains. Dermocosmetic brands use seaweed for clinically oriented claims. Ingredient suppliers see stable demand from local and global formulators. Many companies diversify offerings to match each end market’s needs. It strengthens supply depth across Africa. This structure supports long-term growth across consumer and B2B channels.

Segmentation:

By Product Form

- Liquid Extracts

- Powder Extracts

- Concentrates / Active Fractions

- Standardized Isolates

By Seaweed Type

- Brown Seaweed (Kelp, Laminaria, Ascophyllum)

- Red Seaweed (Carrageenan species, Dulse)

- Green Seaweed (Ulva, Sea Lettuce)

- Microalgae (Chlorella, Spirulina)

By Application

- Anti-ageing & wrinkle care

- Hydration & barrier repair

- Sensitive-skin / anti-inflammatory

- Sunscreen / UV-protection adjuncts

By End Market

- Prestige / luxury skincare

- Mass / OTC personal care

- Dermocosmetic / clinical brands

- Ingredient suppliers / B2B

By Geography (Africa)

- South Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

South Africa: Leading Market With Strong Retail and Manufacturing Strength

South Africa holds the largest share of the Africa Seaweed Extracts in Skincare Products Market, accounting for roughly 32% of total demand. The region benefits from strong retail penetration and steady consumer interest in natural skincare. Many premium and dermocosmetic brands introduce seaweed-based lines due to rising awareness of marine actives. Local manufacturers expand partnerships with global suppliers to improve formulation quality. It supports wider product availability across pharmacies, specialty stores, and online channels. Strong adoption in urban hubs drives consistent growth. Rising focus on clean-label beauty continues to strengthen long-term demand.

North Africa: Expanding Market Driven by Natural Beauty Adoption

North Africa captures nearly 27% of the Africa Seaweed Extracts in Skincare Products Market due to rising interest in natural and marine-based ingredients. Egypt and Morocco lead uptake supported by strong local cosmetics industries and demand for hydration-focused products. Regional formulators increasingly use brown and red seaweed to develop firming and brightening lines. Urban consumers adopt seaweed-based skincare due to high awareness of ocean-derived actives. It drives steady expansion across mid-range and premium categories. E-commerce platforms support rapid growth by offering wider access to marine-based products. Regulatory alignment with natural cosmetic standards accelerates brand entry.

East, West, and Rest of Africa: Emerging Clusters With Growing Farming Potential

East, West, and Rest of Africa collectively account for roughly 41% of the Africa Seaweed Extracts in Skincare Products Market. Kenya and Tanzania show strong progress due to seaweed farming clusters that support stable raw material supply. Nigeria leads West Africa with rising mass-market adoption and increasing presence of marine-inspired skincare lines. Many local brands experiment with microalgae and powdered extracts to target hydration and sensitive-skin needs. It helps expand product diversity across regional markets. Growing focus on sustainable sourcing supports collaboration between farmers and ingredient processors. Rising awareness of clean beauty encourages stronger penetration across emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Africa Seaweed Extracts in Skincare Products Market features a mix of global ingredient suppliers and regional producers competing on purity, extraction quality, and supply stability. Cargill, CP Kelco, and Acadian Seaplants strengthen their presence through advanced marine processing and wider distribution. Danisco South Africa and Zanzibar Seaweed Company support local production with region-specific sourcing advantages. Many brands focus on high-performance extracts that meet clean beauty demands. Companies invest in refining technologies to improve consistency and active concentration. It pushes stronger competition across premium and mass-market channels. Rising focus on marine sustainability also influences strategic positioning among key players.

Recent Developments:

- In November 2024, CP Kelco was officially acquired by Tate & Lyle in a landmark transaction valued at approximately $1.8 billion. This strategic acquisition combines CP Kelco’s leadership in nature-based ingredients—specifically its extensive portfolio of seaweed-derived carrageenan and pectin—with Tate & Lyle’s specialty food and beverage solutions. For the skincare market, this merger creates a powerhouse supplier capable of offering a more comprehensive range of clean-label, marine-based texturizing and stabilizing ingredients, significantly expanding their reach and R&D resources for personal care applications.

- In March 2024, the Zanzibar Seaweed Company (ZASCO) advanced its infrastructure capabilities by commencing the construction of a major seaweed processing factory in Zanzibar, valued at approximately TZS 8 billion (€3 million). Supported by a partnership with NMB Bank, this facility is set to be one of the largest of its kind in Africa, designed to process seaweed locally rather than exporting raw raw material. This strategic shift aims to capture more value within Tanzania by producing higher-margin seaweed extracts suitable for international skincare and cosmetic formulations, directly benefiting local farmers.

Report Coverage:

The research report offers an in-depth analysis based on product form, seaweed type, application, and end market. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for marine-based ingredients will rise as consumers adopt cleaner African skincare routines.

- Local seaweed farming will expand due to rising investment in coastal cultivation networks.

- Ingredient suppliers will strengthen extraction capacity to support higher purity and consistency.

- Premium skincare brands will adopt advanced isolates to improve anti-ageing performance.

- Mass personal care will widen seaweed use through hydration and barrier-repair products.

- Clinical skincare makers will integrate microalgae for sensitive-skin and anti-inflammatory claims.

- Sustainability preferences will encourage traceable sourcing and ocean-safe extraction methods.

- E-commerce platforms will drive faster penetration of seaweed-based formulations across cities.

- Regional distributors will broaden access to marine actives through diversified supply chains.

- The Africa Seaweed Extracts in Skincare Products Market will see stronger innovation in bio-fermented and multifunctional marine ingredients.