Market Overview:

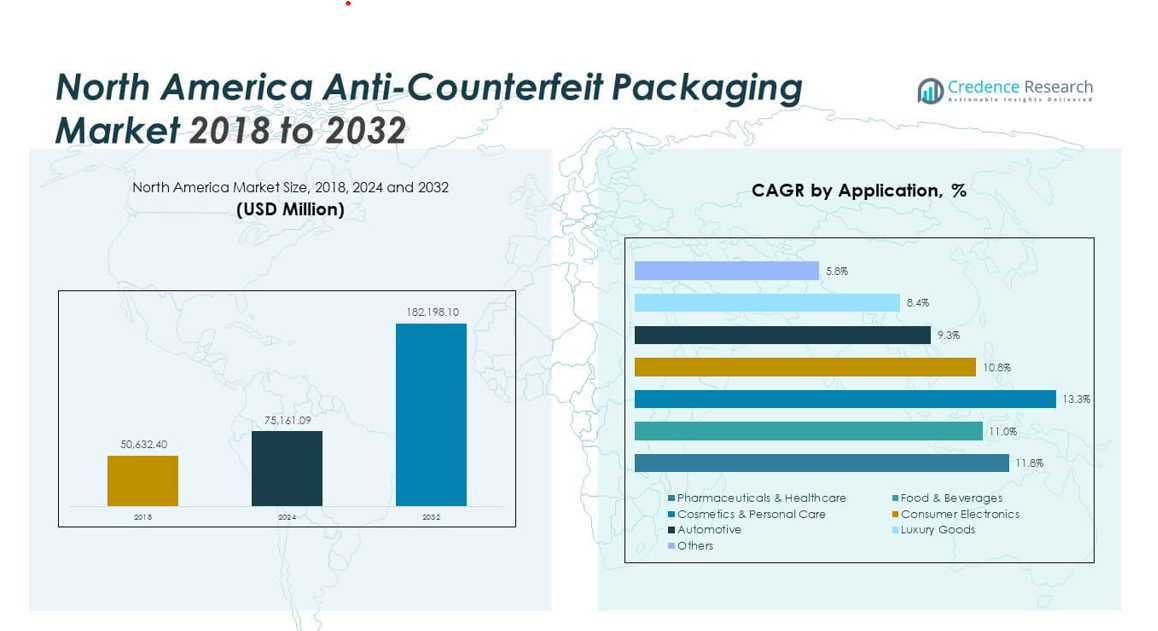

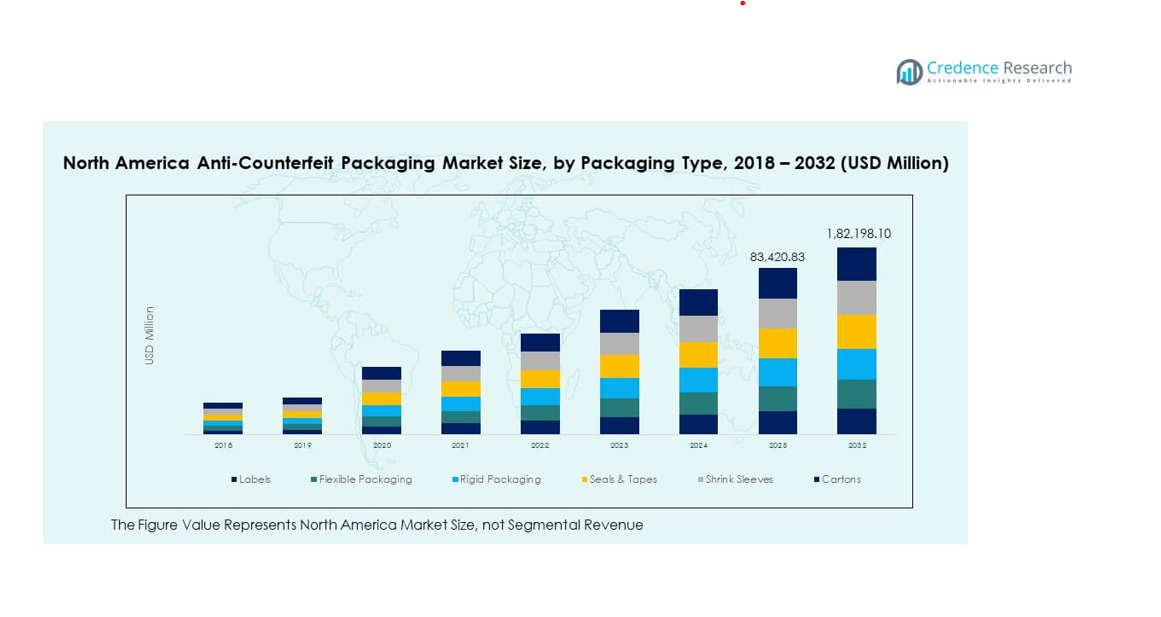

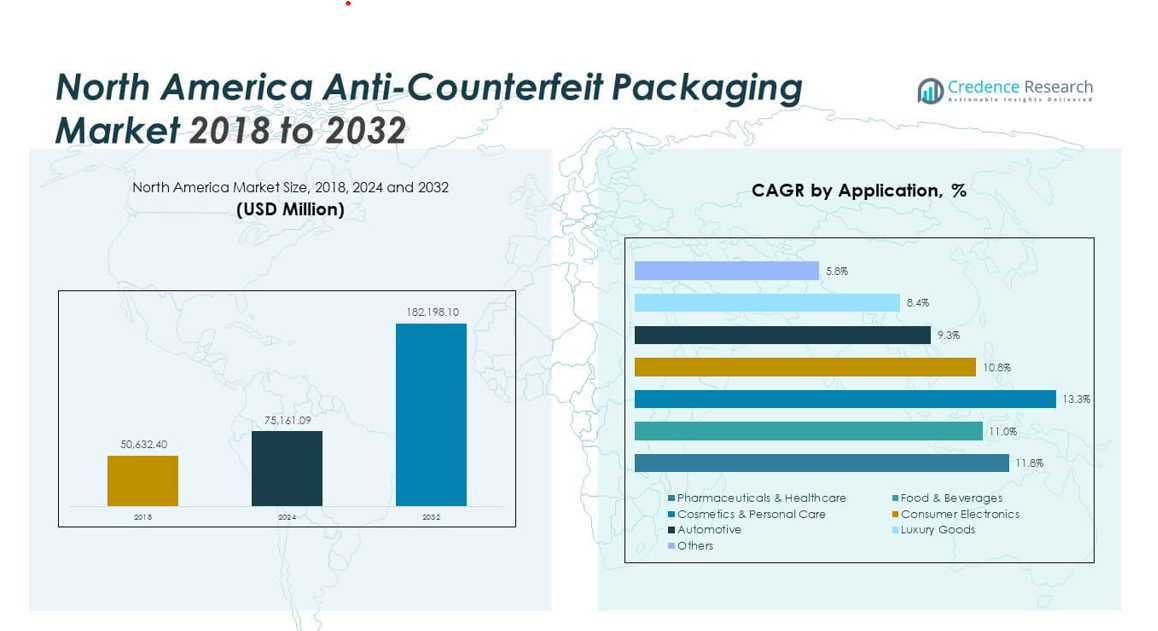

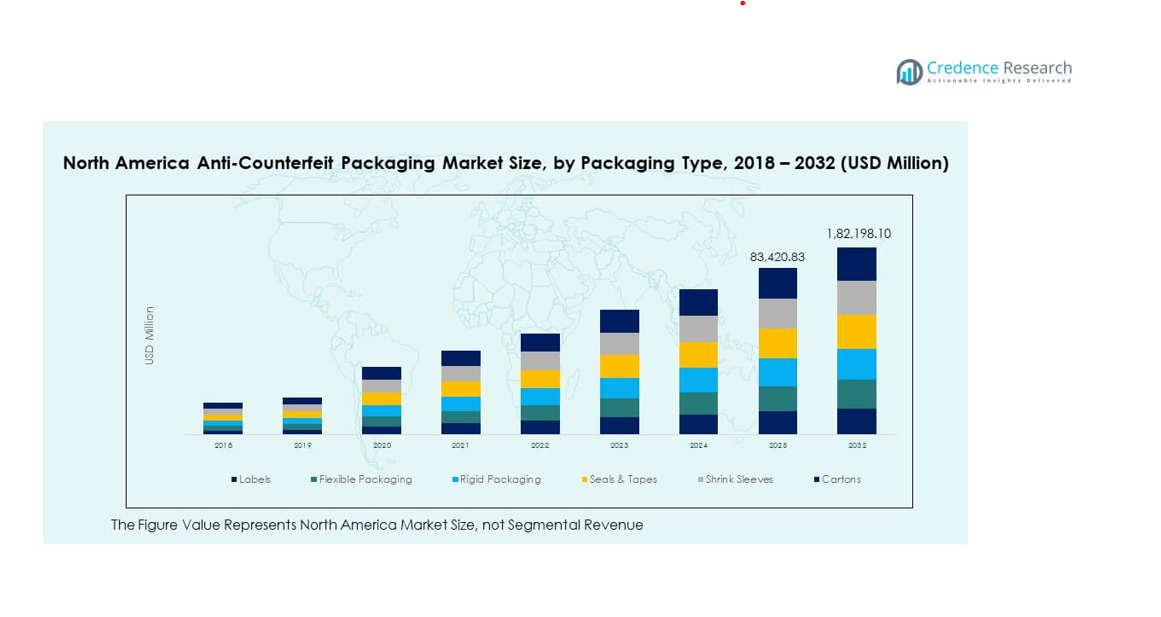

The North America Anti-Counterfeit Packaging Market size was valued at USD 50,632.40 million in 2018 to USD 75,161.09 million in 2024 and is anticipated to reach USD 1,82,198.10 million by 2032, at a CAGR of 11.70% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Anti-Counterfeit Packaging Market Size 2024 |

USD 75,161.09 million |

| North America Anti-Counterfeit Packaging Market, CAGR |

11.70% |

| North America Anti-Counterfeit Packaging Market Size 2032 |

USD 1,82,198.10 million |

Growth strengthens as industries adopt secure packaging to protect high-value goods from rising counterfeit threats. Pharma companies lead adoption through strict serialization, while food and beverage brands integrate tamper-evident formats to protect product trust. E-commerce expansion raises the need for trackable identifiers that secure fast-moving shipments. Technology vendors introduce improved digital verification systems that enhance supply-chain visibility. Consumer demand for safe and authentic products encourages stronger brand protection efforts across multiple categories. Regulatory authorities reinforce tighter standards that push companies toward advanced authentication features.

Regional performance highlights strong leadership from the United States due to advanced compliance frameworks and high technology adoption in regulated industries. Canada shows consistent progress supported by improvements in packaging security across key sectors, including healthcare and retail. Mexico emerges as a growing market as manufacturers upgrade labeling and authentication systems to meet cross-border trade requirements. Adoption expands across all three countries as supply chains modernize. Strong regulatory influence drives continued investment in secure packaging formats. Buyers across the region show greater interest in verified products, strengthening the overall demand landscape.

Market Insights

- The North America Anti-Counterfeit Packaging Market was valued at USD 50,632.40 million in 2018, reached USD 75,161.09 million in 2024, and is forecast to touch USD 1,82,198.10 million by 2032, reflecting a robust CAGR of 11.70%.

- The United States holds around 68% share of the North America Anti-Counterfeit Packaging Market, supported by strict regulations, advanced manufacturing, and high e-commerce penetration, while Canada at 22% and Mexico at 10% benefit from rising enforcement and modernization across key industries.

- Mexico remains the fastest-growing country in the North America Anti-Counterfeit Packaging Market with a 10% share, driven by export-oriented manufacturing, stronger customs controls, adoption of serialized labels in automotive and electronics, and greater collaboration with U.S. and Canadian partners to reduce counterfeit inflows.

- From a packaging-type perspective, shrink sleeves command about 20% share, labels around 18%, and flexible packaging roughly 17% of the North America Anti-Counterfeit Packaging Market, reflecting strong use in high-volume consumer goods, beverages, and fast-moving retail categories.

- Seals and tapes account for nearly 16% share, rigid packaging about 15%, and cartons close to 14% in the North America Anti-Counterfeit Packaging Market, underlining demand for tamper evidence, structural protection, and brandable formats across logistics, pharma, and premium-product applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Regulatory Enforcement and Strong Focus on Product Authentication

The North America Anti-Counterfeit Packaging Market gains traction through strict regulatory checks. Agencies enforce tighter rules to secure pharma and food chains. Brands adopt safer identifiers to protect high-value categories. Demand grows in sectors that face heavy counterfeit risks. Firms improve traceability to meet compliance needs. Retailers use tighter screening at entry points to protect shelves. Technology vendors offer unified tools that improve product identity. Rising consumer awareness supports wider acceptance of secure labels. It strengthens adoption across regulated supply networks.

- For instance, the DSCSA (Drug Supply Chain Security Act) End-to-End Proof of Concept Pilot conducted by AmerisourceBergen in 2023 demonstrated that 19,168 total pharmaceutical cases shipped from five manufacturers were serialized with a 99.8% performance rating for EPCIS data exchange, ensuring regulatory compliance and enhanced product traceability across the supply chain.

Growing Dependence on Serialization and Digital Supply Chain Visibility

Serialization pushes steady expansion in the North America Anti-Counterfeit Packaging Market. Pharma producers scale item-level coding to block fake units. Retail chains expand digital checkpoints to secure goods. Cloud tools improve movement records across long routes. Packaging teams use codes that hold structured product history. Demand rises in high-volume hubs that handle sensitive goods. Regional logistics groups use digital scans to reduce entry of unsafe items. Companies deploy smart tags that deliver faster identity checks. It improves supply chain clarity for brands and buyers.

- For instance, GS1 US reported that Cardinal Health achieved a 93.1% compliance rate tracking homogeneous cases with serialized GS1 DataMatrix codes, demonstrating the tangible benefits of item-level coding and digital visibility to reduce counterfeit penetration and improve supply chain integrity in North America.

Rapid Growth of E-Commerce Prompting Need for Stronger Authentication Measures

The North America Anti-Counterfeit Packaging Market gains speed through intense e-commerce activity. Online platforms face higher exposure to fake products. Brand owners adopt unique markers to verify each shipped item. Couriers use embedded scans to flag suspicious parcels. Retailers verify inbound shipments through layered checks. Demand rises across beauty, electronics, and lifestyle goods. Buyers trust packages that show clear digital identity. Market expansion aligns with stronger brand protection needs. It supports safer online distribution networks.

Rising Adoption of Smart Packaging Solutions Across High-Value Product Lines

Smart features support wider uptake in the North America Anti-Counterfeit Packaging Market. Brands invest in RFID and tamper indicators for premium categories. Producers link codes to secure databases for identity checks. Cosmetics firms use interactive tags to boost customer trust. Electronics vendors use traceable parts to block unauthorized copies. Food companies improve freshness and origin tracking. Secure labels drive strong uptake in sensitive products. Users rely on quick-scan processes for validation. It strengthens the value of digital packaging tools.

Market Trends

Expansion of AI-Enabled Verification Platforms for Faster Authentication

AI platforms reshape growth trends in the North America Anti-Counterfeit Packaging Market. Companies use pattern learning to detect forged identifiers. Smart cameras read codes with higher clarity. Brands rely on automated alerts to track supply flow. Retailers deploy real-time scans for shelf-level checks. Cloud analytics improve threat detection across regions. AI tools support faster screening in large warehouses. Adoption grows across firms that handle bulk shipments. It improves authentication speed across distribution zones.

- For instance, Dexory’s AI-driven autonomous robots scan up to 10,000 pallet locations per hour and deliver inventory accuracy levels reaching 99.9%. GE Appliances is among the companies using Dexory’s real-time warehouse visibility platform to automate stock checks and strengthen operational efficiency.

Shift Toward Consumer-Facing Digital Engagement Through Secure Codes

Consumer-ready tools influence trends in the North America Anti-Counterfeit Packaging Market. Buyers scan codes to verify product truth at home. Brands use mobile apps to share origin details. Cosmetics and nutrition firms offer interactive product journeys. Secure labels help users confirm legitimacy quickly. Social platforms promote QR authentication features. Loyalty programs link rewards to verified packs. Engagement levels rise in young consumer groups. It strengthens brand trust through open access to information.

Rising Use of Tamper-Evident Packaging in Sensitive Distribution Channels

Tamper mechanisms drive new patterns in the North America Anti-Counterfeit Packaging Market. Healthcare groups adopt seals to protect sterile units. Food producers reinforce safety with visible breach markers. Luxury brands add layered barriers to block manipulation. Retailers use closures that show immediate damage signs. Demand grows in sectors with long transit cycles. Users trust clearer signals of package integrity. Technology vendors launch stronger film structures. It supports safer movement of sensitive items.

Growth of Hybrid Authentication Models Combining Physical and Digital Features

Hybrid formats shape emerging trends in the North America Anti-Counterfeit Packaging Market. Companies merge holograms with dynamic codes for stronger security. Producers embed micro-pattern inks with digital data. Electronics brands use multi-layered prints for device labels. Cloud links help teams confirm identity within seconds. Brands test new combinations that raise threat resistance. Retailers use dual checks at inbound docks. Markets with fast-moving goods adopt mixed solutions quickly. It builds multi-level protection through smart integration.

- For instance, Zebra Technologies provides RFID labels, barcode printers, and track-and-trace solutions widely used across retail, healthcare, and manufacturing to support product authentication. The company’s RFID systems offer item-level visibility that helps brands verify product movement across supply chains. These technologies strengthen anti-counterfeit protection by enabling reliable identification and real-time tracking.

Market Challenges Analysis

High Implementation Costs and Complex Integration Across Existing Packaging Lines

Cost pressure forms a core barrier for the North America Anti-Counterfeit Packaging Market. Firms face heavy investments in coding units and scanners. Older factories need upgrades to fit new tools. Staff training adds extra expenses across channels. Smaller brands hesitate to adopt high-tech tags. Logistics teams struggle with complex system alignment. Integration delays impact rollouts across long supply chains. Compatibility issues slow adoption in legacy environments. It limits uniform execution across varied production setups.

Rising Counterfeit Sophistication and Limited Cross-Border Enforcement Alignment

Evolving threats challenge the North America Anti-Counterfeit Packaging Market. Counterfeiters adopt advanced print tools that mimic secure designs. Brands struggle to keep pace with fast-changing fake methods. Cross-border checks lack uniform enforcement across trade points. Weak coordination creates blind spots in shared routes. Retailers face difficulty in tracing items that cross multiple hubs. Agencies push reforms yet face structural gaps. Market players demand stronger bilateral oversight. It increases pressure on firms to update defenses.

Market Opportunities

Expanding Role of IoT-Linked Packaging and Smart Traceability Networks

IoT tools create strong openings for the North America Anti-Counterfeit Packaging Market. Smart sensors track product conditions across each stage. Cloud links support better risk alerts. Brands use live dashboards to monitor routes. High-value sectors seek deeper traceability benefits. Retailers test smart-label features across new formats. Firms explore wider collaboration with digital vendors. It supports stronger growth in advanced packaging ecosystems.

Rising Demand for Clean-Label Validation and Transparency Across Consumer Segments

Transparency needs open major prospects for the North America Anti-Counterfeit Packaging Market. Food and beauty brands use codes to share origin proof. Ethical buyers prefer products with clear identity data. Labels help confirm quality in competitive aisles. Verified packages support trust in niche categories. Retailers benefit from lower return volumes. Producers gain a stronger voice in crowded markets. It drives broader adoption across emerging product types.

Market Segmentation Analysis

By Packaging Type

Labels dominate use within the North America Anti-Counterfeit Packaging Market due to strong compatibility with retail and pharma lines. Flexible packaging gains traction across food and personal care goods. Rigid packaging supports secure handling in electronics and automotive supply chains. Seals and tapes improve tamper visibility in sensitive shipments. Shrink sleeves expand adoption in beverages and cosmetics. Cartons hold value in premium and regulated product spaces. Each format strengthens security layers across diverse channels.

- For instance, Avery Dennison supplies RFID-enabled labeling solutions widely used across pharmaceutical packaging to support item-level identification and secure traceability. The company partnered with KitCheck to integrate RFID tags into high-speed drug packaging, improving verification accuracy in hospital dispensing workflows. These solutions enhance product authentication and strengthen supply-chain visibility in clinical settings.

By Application

Pharmaceuticals and healthcare build strong demand in the North America Anti-Counterfeit Packaging Market due to strict compliance needs. Food and beverages use safe identifiers to maintain consumer trust. Cosmetics and personal care brands adopt digital checks to protect premium formulas. Consumer electronics rely on secure codes to block unauthorized copies. Automotive suppliers use traceable labels for complex parts. Luxury goods integrate high-end markers for authenticity. Other categories expand use through rising safety awareness.

- For instance, Anheuser-Busch has implemented digital traceability and advanced packaging identifiers across select beverage lines to strengthen supply-chain visibility. The company uses data-driven tracking tools to monitor product movement and improve control over distribution networks. These measures help reduce unauthorized diversion and enhance brand protection.

By Technology

Holograms support strong adoption in the North America Anti-Counterfeit Packaging Market through visible security layers. RFID and NFC systems enhance item tracking in fast logistics. Barcode and serialization tools improve clarity in regulated sectors. QR codes support direct engagement through customer scans. Security inks and coatings improve covert detection. Tamper-evident features offer clear breach indicators across shipments. Forensic markers deliver deeper scientific verification. Digital watermarks support hidden authentication through layered data.

Segmentation

By Packaging Type

- Labels

- Flexible Packaging

- Rigid Packaging

- Seals & Tapes

- Shrink Sleeves

- Cartons

By Application

- Pharmaceuticals & Healthcare

- Food & Beverages

- Cosmetics & Personal Care

- Consumer Electronics

- Automotive

- Luxury Goods

- Others

By Technology

- Holograms

- RFID/NFC

- Barcode & Serialization

- QR Codes

- Security Inks & Coatings

- Tamper-Evident Features

- Forensic Markers

- Digital Watermarks

Regional Analysis

United States Holding the Leading Share Across End-User Categories

The North America Anti-Counterfeit Packaging Market shows strong dominance from the United States with nearly 68% share. The country benefits from strict regulatory structures that enforce serialization and tracking across major industries. Pharma and food sectors lead adoption due to high compliance needs. Retail and e-commerce operations expand secure packaging use across large networks. Technology vendors support rapid upgrades with advanced coding systems. Consumer awareness strengthens verification practices in premium categories. It maintains momentum through steady investments in digital authentication tools.

Canada Exhibiting Steady Expansion Supported by Technology Integration

Canada holds close to 22% share, driven by strong adoption across healthcare and food sectors. The region improves packaging security through advanced digital identifiers. Local producers use stronger labeling systems to support brand protection. Retailers integrate scanning solutions across major supply points. Rising demand for clean-label assurance encourages broader authentication use. Regulatory bodies promote safety-driven packaging formats across priority sectors. It advances growth with wider use of digital traceability.

Mexico Emerging as a High-Growth Market Through Supply Chain Modernization

Mexico accounts for nearly 10% share, with expanding demand across consumer goods and automotive parts. Companies modernize production workflows with secure tracking tools. Cross-border trade pushes stronger need for identity checks across long routes. Domestic manufacturers adopt robust seals and digital markers for sensitive goods. Retailers reinforce protection in fast-moving categories that face counterfeit risks. Adoption grows as local suppliers gain exposure to global standards. It strengthens progress through rising investment in secure packaging practices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The North America Anti-Counterfeit Packaging Market shows strong competition among leading global and regional suppliers that include Avery Dennison, 3M, Zebra Technologies, Seiko Epson, CCL Industries, Brady Corporation, Authentix, Digimarc, and SICPA. Vendors compete through secure labels, serialization tools, forensic inks, tamper-evident features, holographic films, and digital watermarks that support strict regulatory needs in pharma and food chains. Firms scale high-performance authentication systems to serve expanding e-commerce networks and large retail operations. Technology leaders invest in AI-enabled verification and cloud-linked traceability to strengthen product identity across complex routes. Partnerships with packaging converters help widen access to multi-layer security features across key categories. Competitors advance RFID, QR coding, and hologram solutions that fit high-speed production lines without disrupting output. Contract packagers seek scalable and flexible systems that support varied batch sizes across diverse sectors. Strong rivalry pushes companies to expand innovation pipelines and improve protection against increasingly sophisticated counterfeit threats.

Recent Developments

- In September 2025, Avery Dennison Corporation announced a series of product innovations at Labelexpo Europe 2025, including new labeling solutions with connectivity, traceability and enhanced security features suited for anti-counterfeit packaging usage.

Report Coverage

The research report offers an in-depth analysis based on packaging type, application, and technology segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for stronger supply-chain security will drive deeper adoption of smart authentication tools across regulated sectors.

- Digital traceability will gain priority as brands expand item-level identification to protect high-value categories across retail and e-commerce.

- Pharma companies will continue to lead growth due to strict serialization rules and rising compliance pressure across distribution points.

- Tamper-evident formats will see wider penetration across food, beauty, and consumer goods due to rising safety concerns.

- Hybrid authentication models combining physical and digital markers will reshape protection strategies across premium products.

- AI-enabled verification systems will improve real-time product screening across large logistics hubs and warehouse networks.

- Canada and Mexico will accelerate adoption through stronger regulatory alignment and modernization of packaging lines.

- IoT integration will support live tracking of goods across long-distance routes, improving visibility in sensitive shipments.

- Packaging converters will expand partnerships with tech vendors to offer multi-layer security formats at scale.

- Investment momentum will increase as companies adopt cloud-linked identity platforms to enhance brand protection across major channels.