Market Overview:

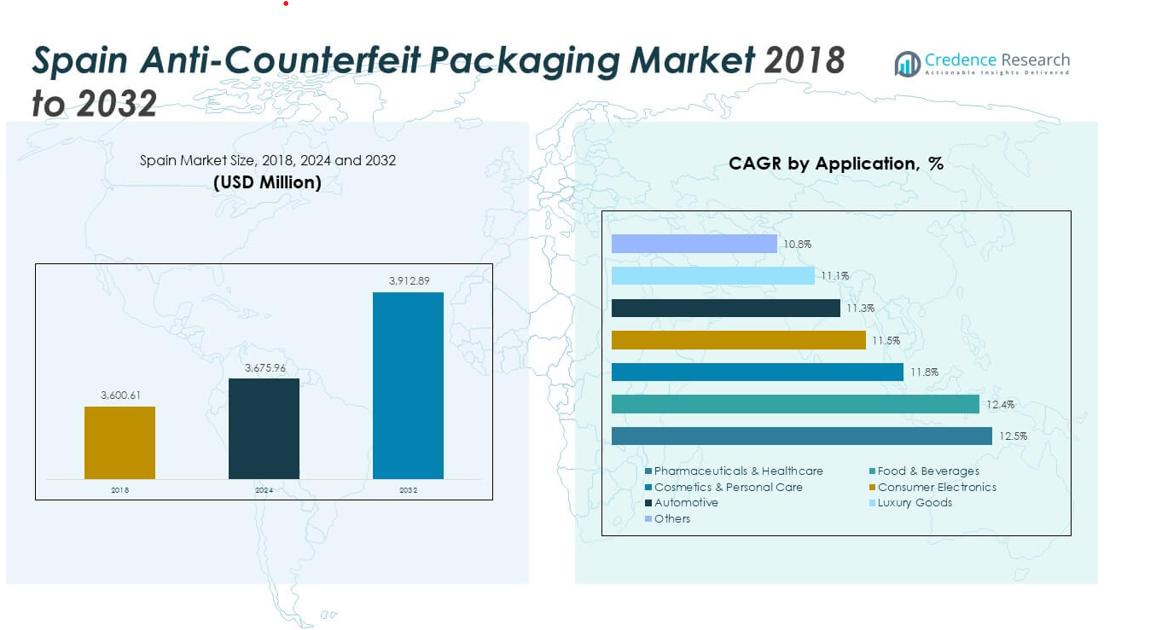

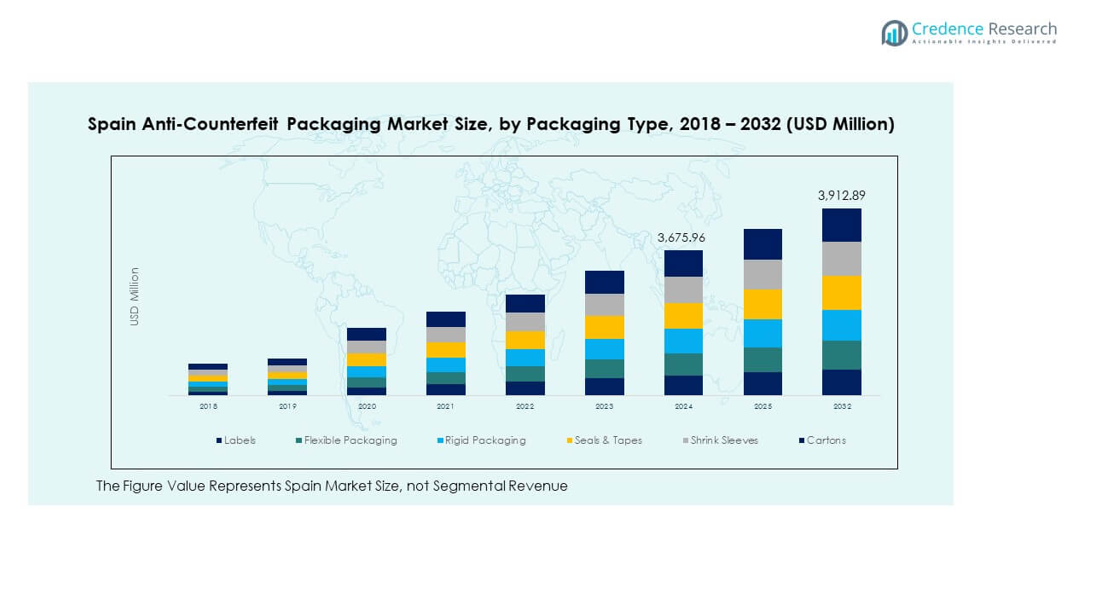

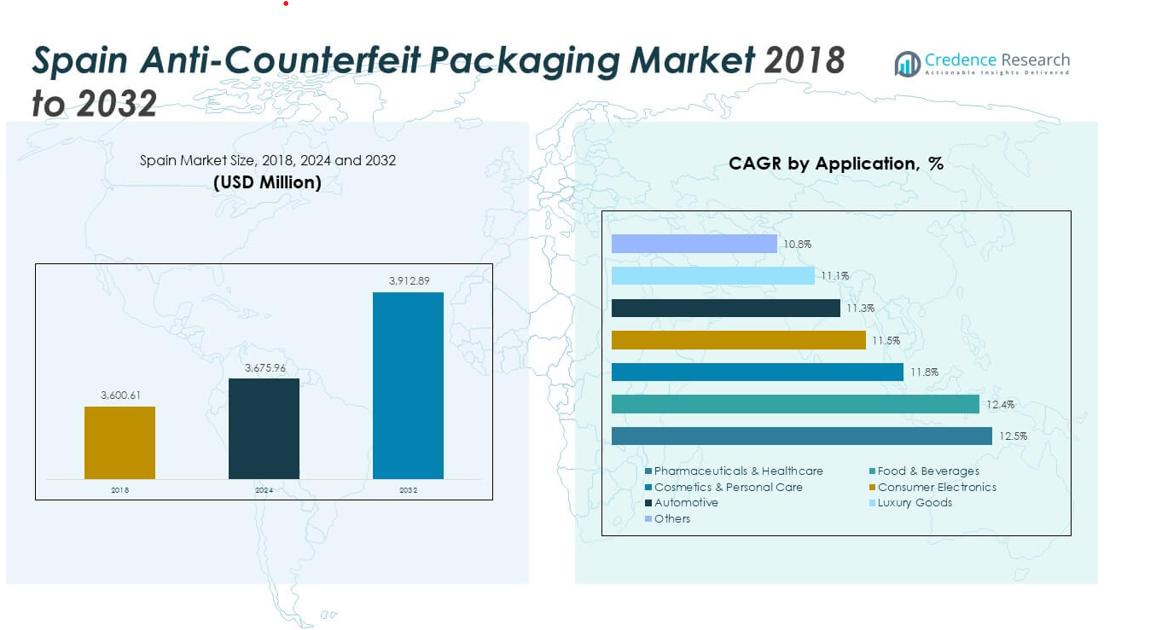

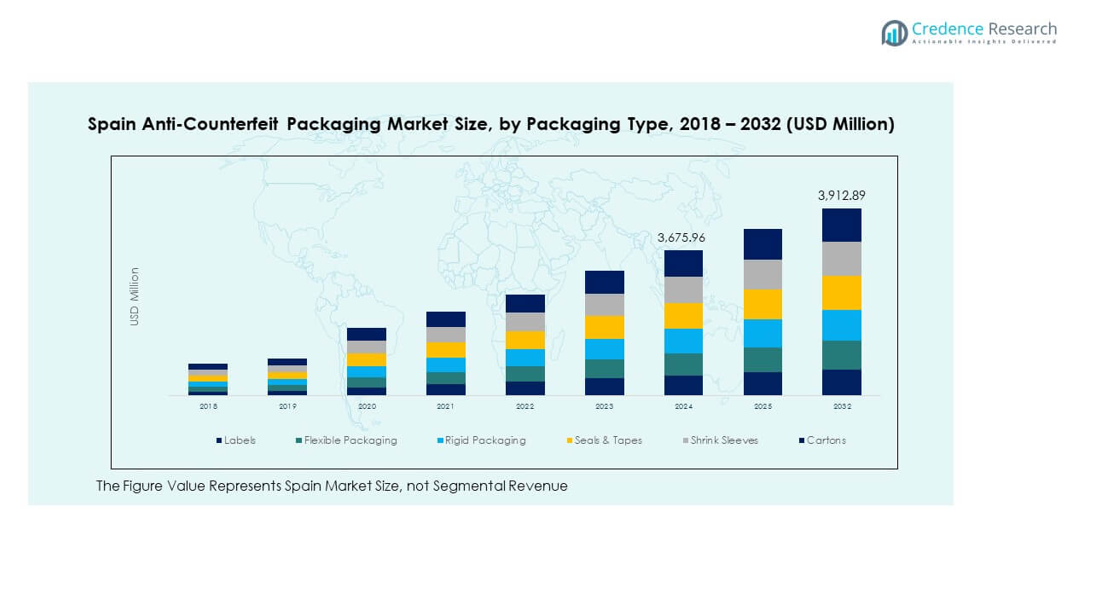

The Spain Anti-Counterfeit Packaging Market size was valued at USD 3,600.61 million in 2018 to USD 3,675.96 million in 2024 and is anticipated to reach USD 3,912.89 million by 2032, at a CAGR of 0.78% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Anti-Counterfeit Packaging Market Size 2024 |

USD 3,675.96 million |

| Spain Anti-Counterfeit Packaging Market , CAGR |

0.78% |

| Spain Anti-Counterfeit Packaging Market Size 2032 |

USD 3,912.89 million |

Strong demand for secure packaging across pharmaceuticals, food, and personal care sectors drives market growth. Manufacturers integrate serialization, holograms, and tamper-evident designs to protect brand integrity and consumer trust. Rising e-commerce transactions and counterfeit incidents push companies toward digital authentication technologies. Government regulations on product traceability further support the shift toward advanced security systems. The Spain Anti-Counterfeit Packaging Market gains consistent momentum as industries prioritize safety and compliance in packaging operations.

Regionally, Northern Spain leads the market with its concentration of industrial and pharmaceutical manufacturers adopting traceable packaging solutions. Central Spain follows with strong consumer goods and logistics networks supporting serialized labeling adoption. Southern Spain is emerging as a fast-growing zone, supported by export-oriented food and cosmetics production hubs. The country’s diverse industrial base and expanding retail channels continue to drive technology integration across multiple sectors. The growing adoption of secure and eco-efficient packaging reinforces Spain’s position in Europe’s advanced packaging ecosystem.

Market Insights

- The Spain Anti-Counterfeit Packaging Market was valued at USD 3,600.61 million in 2018, reached USD 3,675.96 million in 2024, and is projected to hit USD 3,912.89 million by 2032, registering a CAGR of 0.78% during the forecast period.

- Northern Spain holds the largest share at 38%, driven by its strong pharmaceutical and industrial packaging base with advanced serialization systems. Central Spain follows at 34%, supported by dense logistics and retail networks, while Southern Spain represents 28%, backed by export-oriented food and cosmetics sectors.

- The fastest-growing subregion is Southern Spain, with expanding export trade and manufacturing hubs adopting RFID and QR-based packaging technologies for brand protection and product integrity.

- Among packaging types, Labels account for about 32% of total market revenue, maintaining dominance due to their low cost, ease of integration, and widespread use in pharmaceutical and FMCG industries.

- Flexible Packaging follows with nearly 25% market share, gaining traction from its adaptability in food, beverage, and personal care sectors where authentication and traceability solutions are increasingly essential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Implementation of Serialization and Regulatory Compliance Across Sectors

Strong regulatory enforcement drives adoption of serialized tracking across pharmaceuticals, food, and electronics. The Spain Anti-Counterfeit Packaging Market benefits from compliance with EU Falsified Medicines Directive and global GS1 standards. Serialization supports product identification through unit-level coding, enhancing transparency across complex distribution channels. It reduces counterfeit entry and ensures authenticity verification at each stage. Pharmaceutical producers deploy data matrix and barcode systems to trace shipments. Consumer safety priorities strengthen demand for traceable packaging. Companies integrate compliance-led designs for long-term safety assurance. It continues to evolve toward complete digitalized traceability within supply networks.

- For instance, pharmaceutical manufacturers across Spain and the wider EU comply with the Falsified Medicines Directive (2011/62/EU) by using 2D DataMatrix barcodes for unit-level serialization and traceability. This system enables secure tracking from production to dispensing, ensuring product authenticity and minimizing counterfeit risks across the regulated pharmaceutical supply chain.

Growing Consumer Awareness of Product Authenticity and Brand Protection Needs

Rising public awareness about counterfeit risks drives brand owners to invest in visible security layers. Many Spanish consumers demand verified product origins across food, cosmetics, and personal care segments. The Spain Anti-Counterfeit Packaging Market benefits from stronger consumer authentication habits supported by smartphone-based scanning. Companies emphasize holographic seals, QR codes, and tamper-evident closures for instant verification. Retail chains adopt product-level transparency tools to strengthen consumer trust. Local luxury and healthcare sectors leverage authentication packaging to reinforce credibility. Counterfeit losses push industries toward preventive technologies. It continues to reinforce trust-based marketing strategies aligned with consumer safety perceptions.

- For instance, Avery Dennison produces tamper-evident VOID labels that display irreversible patterns when removed, ensuring visible proof of tampering. These labels are part of the company’s certified brand protection portfolio designed for pharmaceuticals, cosmetics, and other regulated packaging applications across Europe.

Rapid Expansion of E-Commerce and Supply Chain Complexity Enhancing Risk Exposure

Expanding e-commerce in Spain multiplies the circulation of goods across multiple intermediaries. The Spain Anti-Counterfeit Packaging Market experiences high growth from the need to secure online product verification. E-retailers use digital codes and unique identifiers to validate authenticity at delivery points. Counterfeit infiltration in online supply lines drives investments in advanced tracking systems. Brand owners implement anti-tamper packaging to secure logistics and safeguard reputation. Authentication technologies like RFID and digital watermarks reduce manipulation risk during transit. Supply chain integration improves transparency between producers and retailers. It fosters long-term supply integrity and efficiency.

Increasing Technological Adoption Across Packaging and Printing Platforms

Innovation in packaging technology expands options for security enhancement. The Spain Anti-Counterfeit Packaging Market integrates RFID tags, holographic foils, and forensic inks into flexible and rigid packaging. Smart printing systems deliver micro-text and optical layers for deterrence. Advanced coatings prevent duplication in industrial-grade packaging. Companies integrate machine-readable codes compatible with mobile verification platforms. Printers deploy invisible inks detectable under ultraviolet light for hidden authentication. Growing automation supports faster incorporation of security features. It drives seamless blending of production efficiency and anti-fraud protection in packaging lines.

Market Trends

Integration of Digital Verification Platforms and Smart Packaging Systems

Brands in Spain integrate digital verification into connected packaging to ensure consumer interaction. The Spain Anti-Counterfeit Packaging Market shows an increasing shift toward IoT-enabled and cloud-based monitoring systems. Real-time verification platforms allow instant authentication through QR or NFC scans. Brands create serialized digital twins of products for accurate traceability. Integration with blockchain databases builds immutable transaction records for added trust. Retailers adopt smart shelves to validate authenticity before sale. Growing data analytics usage supports anomaly detection in counterfeit tracking. It enhances customer engagement while reinforcing product legitimacy.

- For instance, Zebra Technologies develops RFID and barcode-based smart shelf and verification solutions that enable retailers to authenticate and trace products in real time. Its systems are deployed across global retail and logistics operations, improving product visibility and counterfeit prevention through automated data capture and digital verification tools.

Adoption of Sustainable and Eco-Secure Packaging Materials

The Spanish packaging sector incorporates sustainability into anti-counterfeit protection. The Spain Anti-Counterfeit Packaging Market witnesses high demand for biodegradable security films and recyclable holographic foils. Green materials align with EU circular economy targets while maintaining product safety. Manufacturers develop plant-based polymers embedded with covert authentication codes. Security labels use water-based adhesives to reduce environmental impact. Sustainable inks replace solvent-heavy formulas in printing applications. Brands combine eco-labels with traceable identifiers to boost ethical perception. It reinforces Spain’s push toward environmental responsibility in secure packaging systems.

- For instance, UPM Raflatac offers Forest Film™, a 100% renewable wood-based label material certified under ISCC PLUS, advancing sustainable anti-counterfeit packaging. It also produces post-consumer recycled polypropylene (PP) labels using SABIC® certified circular resins, reducing virgin plastic use while meeting strict food safety standards.

Widening Application of Artificial Intelligence and Machine Vision in Detection Systems

AI-powered inspection tools strengthen authentication in manufacturing environments. The Spain Anti-Counterfeit Packaging Market benefits from AI integration in visual pattern recognition and code verification. Machine vision cameras detect tampering marks and print irregularities in real time. Data models classify counterfeit patterns based on microstructural differences. Predictive analytics forecast high-risk distribution zones. Factories automate line inspection to minimize human error. Cloud analytics provide dashboard-based counterfeit mapping for brands. It ensures proactive protection across end-use sectors.

Collaborative Ecosystem Between Technology Providers and Brand Manufacturers

Strategic partnerships enhance access to secure packaging solutions in Spain. The Spain Anti-Counterfeit Packaging Market grows through collaborations between tech firms, packaging converters, and manufacturers. Joint R&D programs accelerate development of digital authentication systems. Companies co-create smart labels compatible with mobile authentication apps. Partnerships improve interoperability between hardware sensors and enterprise software. Local startups engage with multinationals to pilot blockchain and digital watermark projects. Industry associations promote unified standards for traceability systems. It encourages innovation-led ecosystem growth and standard adoption.

Market Challenges Analysis

High Implementation Costs and Limited Standardization Across Small Manufacturers

Small enterprises face barriers in deploying full-scale anti-counterfeit systems due to cost constraints. The Spain Anti-Counterfeit Packaging Market experiences slower penetration in low-margin industries. High equipment and software integration expenses restrict adoption among SMEs. Lack of uniform standards complicates compatibility across authentication technologies. Smaller firms rely on basic visual indicators instead of digital coding. The gap between large corporations and regional players limits ecosystem scalability. Regulatory fragmentation across European markets increases compliance cost burden. It delays broad adoption despite rising awareness.

Technical Limitations and Evolving Counterfeit Tactics Across Diverse Industries

Counterfeiters adapt quickly to visual and digital deterrents, reducing long-term efficacy of certain systems. The Spain Anti-Counterfeit Packaging Market faces challenges from sophisticated reproduction technologies. Cloned holograms, reused QR codes, and counterfeit RFID chips weaken reliability. Companies must frequently upgrade encryption and sensor systems to stay ahead. Continuous R&D investment strains operational budgets for many sectors. Integration of multiple verification methods increases system complexity. It remains difficult to ensure universal interoperability across materials and regions.

Market Opportunities

Growing Demand for Advanced Digital Authentication and Data Analytics Platforms

The shift toward cloud-based monitoring and AI-backed analytics creates opportunity for local tech firms. The Spain Anti-Counterfeit Packaging Market gains potential from integration of big data systems for risk prediction. Platforms offering mobile authentication apps for end-users attract major brands. Startups providing SaaS-based traceability gain traction among mid-sized producers. Partnerships with logistics companies enhance visibility across transportation networks. Digital transparency solutions expand access to trusted supply channels. It encourages continuous innovation in authentication architecture.

Expansion of Cross-Industry Collaboration and Export Compliance Initiatives

Spain’s manufacturing strength in pharmaceuticals, automotive, and luxury goods creates scope for export-oriented anti-counterfeit solutions. The Spain Anti-Counterfeit Packaging Market benefits from European Commission’s ongoing trade and safety initiatives. Exporters deploy tamper-evident and serialized packages to comply with cross-border standards. Joint initiatives between local associations and global solution providers support harmonization. Rising international scrutiny of counterfeit flows opens new service prospects for compliance consultancy. It promotes broader integration of traceability standards across export-driven industries.

Market Segmentation Analysis

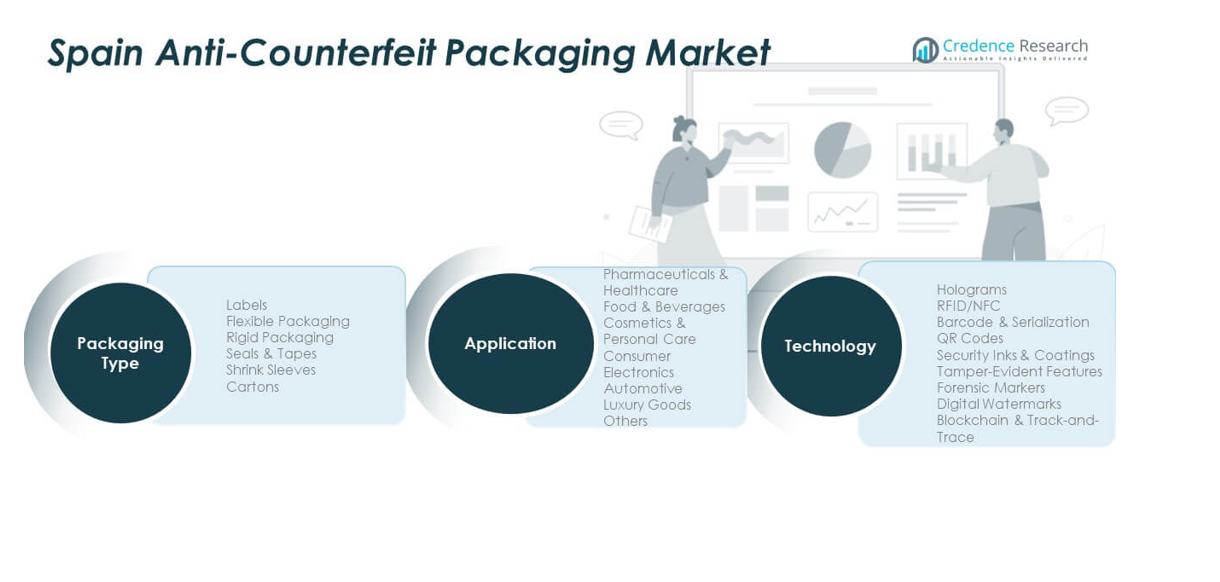

By Packaging Type

Labels dominate due to easy integration with existing production lines and cost efficiency. The Spain Anti-Counterfeit Packaging Market benefits from high use of serialized adhesive and holographic labels. Flexible packaging supports customization for food, healthcare, and retail sectors. Rigid packaging ensures protection for industrial goods and premium products. Seals and tapes secure first-use integrity across pharmaceutical logistics. Shrink sleeves deliver full-surface branding with hidden identifiers. Cartons with digital codes provide multi-layered authentication for consumer and export packaging. It enables end-to-end tracking and product safety assurance.

- For example, Schubert Group developed a packaging system for CSL Behring AG including anti-counterfeit labeling with process-stable color-change varnish and comprehensive MES integration, ensuring high safety and tamper evidence in plasma product packaging.

By Application

Pharmaceuticals and healthcare lead in usage due to strict traceability and patient safety needs. The Spain Anti-Counterfeit Packaging Market records strong participation from food and beverage brands seeking freshness tracking. Cosmetics and personal care firms use holographic foils for authenticity. Consumer electronics adopt NFC tags to prevent fake accessories. Automotive companies employ serialized labels to trace genuine components. Luxury brands protect high-value goods with covert and overt security layers. Other sectors like logistics adopt seals and tapes to prevent tampering. It supports cross-sector protection against counterfeiting.

- For example, NanoMatriX developed a luxury food anti-counterfeiting QR-ID tag with a unique scratch-off code allowing product authenticity verification and consumer engagement, deployed in premium food brands.

By Technology

Holograms remain vital for visual deterrence through optical layering. The Spain Anti-Counterfeit Packaging Market integrates RFID/NFC for real-time authentication and asset monitoring. Barcode and serialization systems enable unit-level traceability across supply chains. QR codes offer consumer-level scanning for instant validation. Security inks and coatings introduce hidden micro-patterns. Tamper-evident features safeguard physical integrity during shipment. Forensic markers add covert detection for legal enforcement. Digital watermarks enhance machine readability for automated authenticity checks. It strengthens holistic protection through multi-technology layering.

Segmentation

By Packaging Type

- Labels

- Flexible Packaging

- Rigid Packaging

- Seals & Tapes

- Shrink Sleeves

- Cartons

By Application

- Pharmaceuticals & Healthcare

- Food & Beverages

- Cosmetics & Personal Care

- Consumer Electronics

- Automotive

- Luxury Goods

- Others

By Technology

- Holograms

- RFID/NFC

- Barcode & Serialization

- QR Codes

- Security Inks & Coatings

- Tamper-Evident Features

- Forensic Markers

- Digital Watermarks

Regional Analysis

Northern Spain holds the largest share of the Spain Anti-Counterfeit Packaging Market, accounting for nearly 38% of total demand. The region benefits from dense industrial hubs in Basque Country and Navarre, where pharmaceutical and chemical manufacturers lead in adopting serialization and labeling technologies. Strong regional logistics networks support advanced track-and-trace solutions across manufacturing facilities. The local focus on innovation and technology transfer through packaging clusters strengthens implementation of secure digital coding systems. It remains a strategic center for production and export of safety-compliant packaging materials. Rising investment in research partnerships accelerates deployment of next-generation anti-fraud technologies.

Central Spain contributes around 34% of the market, driven by high product movement through Madrid’s logistics and retail corridors. The area hosts major consumer goods and food processing industries that emphasize tamper-evident packaging for retail safety. Strong regulatory oversight and rapid urban consumption growth sustain consistent demand for authentication products. The Spain Anti-Counterfeit Packaging Market benefits from adoption of integrated security printing and holographic systems by domestic packaging firms. Local innovation centers collaborate with universities to enhance traceability and sustainability standards. It positions Central Spain as a leading node for digital authentication system deployment.

Southern Spain represents approximately 28% of market share, with strong participation from Andalusia and Valencia’s export-driven industries. These regions rely on counterfeit-resistant packaging for olive oil, cosmetics, and luxury segments. Tourism-related retail creates higher exposure to counterfeiting risks, increasing adoption of security labels and digital seals. Ports like Valencia and Algeciras strengthen logistics integration with European and North African markets. The region’s flexible packaging producers embrace RFID and QR-based technologies for cost-effective brand protection. It continues to gain momentum from public-private initiatives supporting safer export packaging practices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Marchesini Group S.p.A.

- Leonhard Kurz Stiftung & Co. KG (Kurz)

- Tesa Scribos GmbH

- Arca Etichette S.p.A.

- Arvato Systems GmbH

- Atlantic Zeiser GmbH

- Schreiner Group GmbH & Co. KG

- Avery Dennison Corporation

- SICPA SA

- CCL Industries Inc.

- U-NICA Group AG

- Catalana de Etiquetaje S.L.

- Labelpack S.L.

Competitive Analysis

The Spain Anti-Counterfeit Packaging Market features a mix of global technology providers and regional packaging innovators. Leading companies include CCL Industries, Avery Dennison, SICPA, U-NICA Group, Schreiner Group GmbH, and Catalana de Etiquetaje, each focusing on multi-layered authentication technologies. Local converters such as Etiquetas Adhesivas Rever and Labelpack expand presence through serialized label production for pharmaceuticals and food brands. Firms emphasize partnerships with software developers to merge physical packaging security with digital verification. Global suppliers invest in Spanish facilities to strengthen local delivery timelines and reduce import reliance. The market remains moderately fragmented, with innovation-driven competition across security inks, digital printing, and smart labeling. It continues to evolve toward integrated digital ecosystems linking manufacturers, retailers, and consumers through secure data exchange. Strategic mergers, technological innovation, and compliance leadership remain key to sustaining market competitiveness.

Recent Developments

- In November 2024, Ennoventure, a leader in AI brand protection, secured $8.9 million in funding to expand its AI-powered anti-counterfeiting technology, supporting advancements in the Spain anti-counterfeit packaging market. This funding highlights the growing emphasis on technology-driven solutions to combat counterfeiting.

- In September 2024, kdc/one completed the acquisition of an Italian packaging specialist (S.r.l.) focused on cosmetics packaging to enhance its anti-counterfeit offerings in beauty and personal care.

- In April 2024, Avery Dennison Corporation announced the expansion of its AD Pure range of inlays and tags which are entirely plastic-free and utilize antenna manufacturing technology applied directly on paper.

Report Coverage

The research report offers an in-depth analysis based on packaging type, application, and technology segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising regulatory mandates will strengthen demand for serialized and tamper-evident packaging across core sectors.

- Increasing digitization of supply chains will support integration of cloud and blockchain authentication systems.

- Expansion of e-commerce networks will drive adoption of smart verification technologies for secure product delivery.

- Growing collaboration between packaging converters and software firms will enhance connected packaging solutions.

- Heightened consumer awareness about authenticity will push brands to invest in visible and covert identifiers.

- Sustainable security materials will emerge as a critical design focus under Europe’s green packaging regulations.

- Automation and AI-based inspection will improve real-time quality control and counterfeit detection efficiency.

- Local manufacturing partnerships will strengthen Spain’s capacity to serve domestic and export packaging needs.

- Government-backed innovation programs will promote adoption of traceability infrastructure in small enterprises.

- Continuous innovation in forensic markers and digital watermarks will set new benchmarks for anti-fraud protection.