Market Overview:

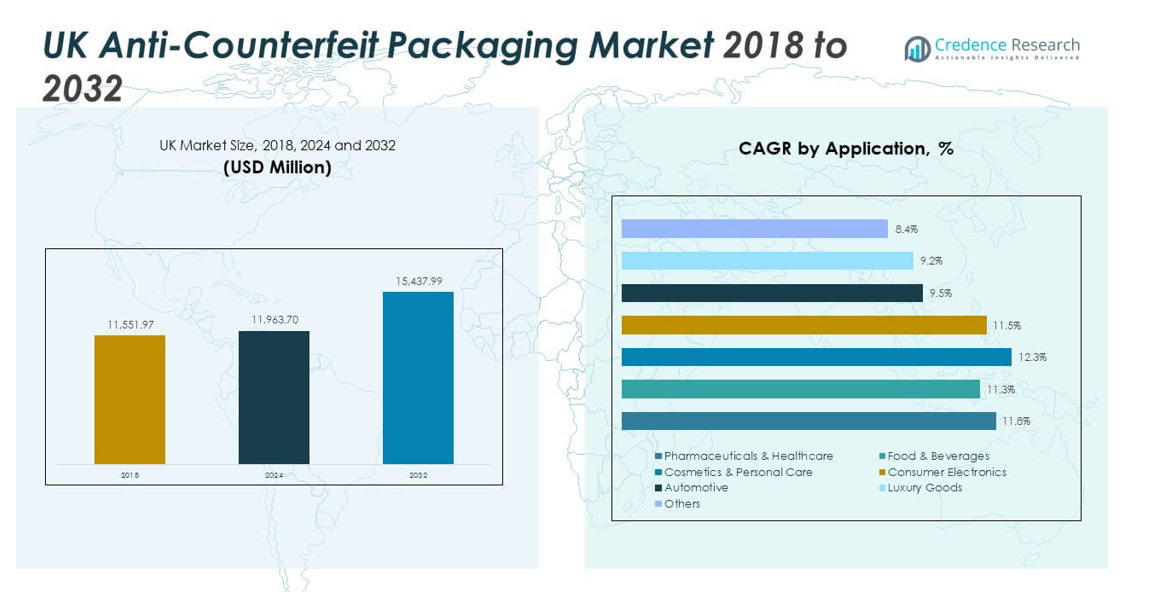

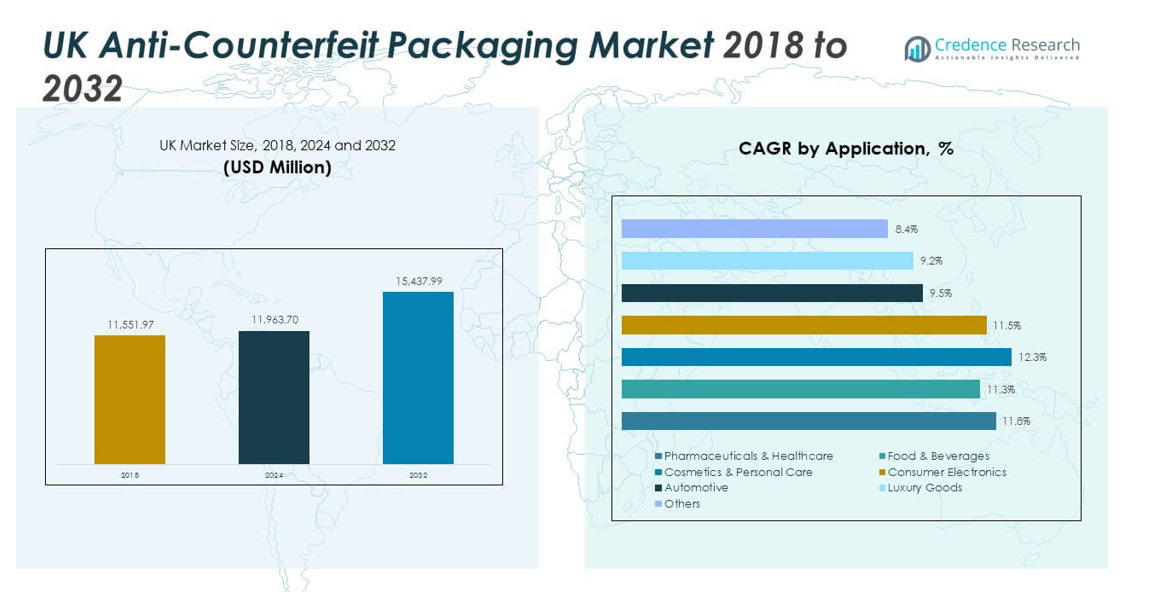

The UK Anti-Counterfeit Packaging Market size was valued at USD 11,551.97 million in 2018 to USD 11,963.70 million in 2024 and is anticipated to reach USD 15,437.99 million by 2032, at a CAGR of 3.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Anti-Counterfeit Packaging Market Size 2024 |

USD 11,963.70 million |

| UK Anti-Counterfeit Packaging Market, CAGR |

3.24% |

| UK Anti-Counterfeit Packaging Market Size 2032 |

USD 15,437.99 million |

The market shows steady expansion driven by increased counterfeiting risks across pharmaceuticals, luxury goods, and consumer electronics. Companies adopt serialization, holographic labeling, and digital authentication to enhance supply-chain visibility and product traceability. Growing government enforcement and strict compliance frameworks push industries toward advanced packaging technologies. Rising consumer demand for authenticity and safe product handling further accelerates innovation. The market benefits from investments in digital tools that strengthen brand protection and operational transparency.

Within the regional landscape, the UK leads due to robust regulations, advanced technology adoption, and strong consumer trust in verified goods. Western Europe remains an innovation hub with high uptake in the pharmaceutical and cosmetics sectors. Emerging Eastern European markets record faster growth due to evolving anti-counterfeit frameworks and rising import-export activity. The UK’s mature regulatory ecosystem, supported by collaborative efforts between industry and government, positions it as a central node in the European packaging security network. This leadership encourages continued investment and technology integration across key industries.

Market Insights

- The UK Anti-Counterfeit Packaging Market was valued at USD 11,551.97 million in 2018, reached USD 11,963.70 million in 2024, and is projected to attain USD 15,437.99 million by 2032, registering a CAGR of 3.24% during the forecast period.

- England holds the largest regional share at 44.5%, driven by strong pharmaceutical production, regulatory compliance, and high investment in advanced labeling systems. Scotland follows with 29.6%, supported by growing luxury goods and beverage exports, while Wales accounts for 18.7%, benefiting from expanding food and packaging industries.

- Northern Ireland emerges as the fastest-growing region with 7.2% share, driven by expanding logistics, cross-border trade with Ireland, and the adoption of digital verification in small and medium manufacturing setups.

- Labels lead the market segment with approximately 28% share due to their versatility and cost-effectiveness across multiple industries, while flexible packaging contributes around 22%, reflecting demand from food and beverage applications.

- The combined contribution of rigid packaging, seals & tapes, shrink sleeves, and cartons strengthens total market resilience, supporting balanced growth across industrial, consumer, and healthcare end uses.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Counterfeit Activities Across Critical Consumer Sectors

The UK Anti-Counterfeit Packaging Market grows steadily due to rising threats in consumer goods, pharmaceuticals, and electronics. Counterfeit operations cause severe financial losses and damage brand credibility. Manufacturers respond by implementing advanced labeling and authentication systems. Firms apply track-and-trace solutions to ensure each product can be verified throughout its distribution. Regulatory bodies encourage secure packaging to protect public safety and supply integrity. Government policies tighten standards across high-risk categories such as drugs and food. Brands emphasize customer trust through visible authenticity indicators. Demand for serialized codes and tamper-proof packaging supports the ongoing expansion. Strong collaboration between industry players and regulators sustains momentum.

- For example, Avery Dennison Corporation launched its “Circus Tamper Loop” RFID-inlay solution which integrates NFC tags with tamper-detection loops to allow consumers and supply-chain actors to scan and verify sealing status via smartphones.

Increasing Stringency of Government Regulations and Product Authentication Laws

The market strengthens with the introduction of stricter anti-counterfeit laws across the UK and the European Union. Regulatory enforcement under directives like the EU Falsified Medicines Directive ensures compliance for traceable drug packaging. It compels pharmaceutical firms to implement data-rich barcodes and tamper-evident closures. The system ensures accurate tracking from manufacturer to retailer, reducing infiltration of fake products. Enforcement agencies push companies to verify authenticity using digital verification technologies. Industrial sectors align their packaging processes with compliance frameworks to maintain legal conformity. Brands leverage digital records to ensure faster recalls and incident reporting. Growing transparency requirements drive technology adoption among small and large firms. This environment nurtures steady long-term growth.

- For example, Systech International developed its “UniSecure e-Fingerprint®” authentication system that uses microscopic variations in printed barcodes to create unique signatures and enables real-time verification via mobile apps, with false acceptance rates below 1 in 55 quadrillion.

Growing Awareness Among Consumers Regarding Product Authenticity and Safety

Consumer awareness has emerged as a powerful growth factor for anti-counterfeit solutions. Buyers increasingly check authenticity features before purchase to avoid fraudulent products. Retailers and brands use QR codes, holographic labels, and NFC-enabled tags to meet expectations of secure sourcing. It enhances visibility and ensures that genuine products reach the final buyer. Social media campaigns and public education initiatives strengthen consumer vigilance. Counterfeit awareness among younger digital buyers further accelerates authentication demand. Companies redesign packaging layouts to highlight trust elements. Transparent labeling practices improve brand integrity. Evolving consumer behavior reinforces market confidence and encourages wider implementation.

Rapid Digitization and Technological Advancement in Packaging Ecosystems

Digital transformation strongly influences the UK Anti-Counterfeit Packaging Market across all sectors. Companies adopt cloud-connected authentication platforms and AI-powered scanning systems. These technologies support real-time verification, predictive analytics, and instant consumer alerts. Blockchain-based systems enhance traceability and secure data transmission between stakeholders. Machine-readable codes reduce manual intervention and minimize data errors. Manufacturers prefer scalable digital frameworks that fit existing production lines. Integration of IoT devices in logistics boosts tracking accuracy and product history documentation. It drives future investments in digital security infrastructure. Continuous innovation fosters trust and operational efficiency in high-value product categories.

Market Trends

Wider Integration of Blockchain and Data-Driven Traceability Platforms

Blockchain technology reshapes product authentication with immutable data storage and transparency. Enterprises integrate distributed ledger systems into packaging to record each supply movement securely. It supports multi-level verification, reducing reliance on intermediaries. The trend supports accountability for pharmaceuticals, automotive parts, and electronics. Supply partners use smart contracts to automate validation processes. Blockchain ensures that counterfeit infiltration is detected early through data discrepancies. Companies gain stronger visibility into cross-border logistics. Governments explore blockchain-enabled compliance reporting. The market adopts these solutions to secure product identity and trace complex supply chains.

- For instance, Everledger has recorded the provenance of more than 2 million diamonds using blockchain technology. The system creates immutable digital records to verify diamond origins and ownership changes, helping prevent fraud in the global gemstone supply chain.

Adoption of Smart Packaging with Embedded IoT and NFC Capabilities

The use of IoT sensors and NFC chips is gaining prominence for interactive packaging. Smart labels transmit real-time data to verify authenticity instantly through smartphones. It enhances customer trust while giving brands insights into product use and movement. NFC-enabled systems improve consumer engagement by connecting them to digital verification portals. Packaging producers design lightweight tags that fit various product types. Electronics and luxury sectors integrate these tools for fast authentication. Data collected from each scan supports predictive analytics for counterfeit detection. Retailers employ IoT networks to trace goods more efficiently. The rise of connected packaging transforms traditional safety mechanisms.

- For instance, Avery Dennison’s Intelligent Labels division produces billions of RFID and NFC inlays annually across retail, logistics, healthcare, and luxury sectors. Following its acquisition of Smartrac, the company became one of the world’s largest RFID manufacturers, enabling real-time product authentication and supply-chain visibility through digital ID technologies.

Sustainable and Recyclable Secure Packaging Materials in Focus

Sustainability goals influence the direction of secure packaging innovations. Manufacturers now create eco-friendly holographic films and biodegradable security inks. It addresses environmental concerns while maintaining strong protection standards. Consumer preference for recyclable packaging drives redesigns in labeling materials. Regulatory encouragement of green production strengthens these initiatives. Paper-based seals and solvent-free adhesives replace harmful synthetics. Packaging firms develop circular solutions with high tamper resistance. Biodegradable substrates combine sustainability with traceability benefits. This trend balances environmental responsibility with secure product identity.

Growing Role of AI and Machine Learning in Counterfeit Detection Systems

AI technology now plays a vital role in counterfeit detection and analysis. Algorithms can identify micro-pattern anomalies invisible to the human eye. It strengthens inspection accuracy for luxury goods, pharmaceuticals, and automotive parts. Machine learning tools analyze massive datasets to detect suspicious transactions. AI-powered scanners reduce manual errors and enable faster verification cycles. Manufacturers integrate deep learning into camera systems for pattern recognition. Data-driven tools help track emerging counterfeiting trends across geographies. Continuous system learning enhances adaptability against evolving threats. This transition toward AI-based security platforms boosts long-term efficiency.

Market Challenges Analysis

High Implementation Cost and Complex Integration of Security Technologies

The UK Anti-Counterfeit Packaging Market faces challenges related to high adoption costs. Smaller manufacturers often struggle to invest in advanced labeling and serialization tools. Integrating digital tracking with existing production lines requires substantial capital. Compatibility issues between various technologies slow deployment rates. Firms require specialized software and workforce training to operate systems efficiently. The absence of unified data standards complicates interoperability between supply partners. Maintenance of digital infrastructure increases recurring expenses. It restricts entry for medium-sized enterprises despite growing regulatory pressure. This limits broad accessibility across the manufacturing ecosystem.

Evolving Counterfeit Techniques and Lack of Global Standardization

Counterfeiters increasingly use sophisticated printing, replication, and distribution methods. It challenges packaging developers to stay ahead of emerging threats. Fragmented global standards weaken coordination among trade partners. Inconsistent verification frameworks complicate customs inspections and product authentication. Limited cross-border data exchange slows rapid validation efforts. Some sectors face delays in harmonizing their coding systems with EU regulations. Lack of unified law enforcement coordination further reduces deterrence efficiency. Firms must constantly update anti-counterfeit measures to stay compliant. Continuous innovation remains critical to sustain packaging credibility in a fast-changing market.

Market Opportunities

Emergence of Digital Verification Platforms and Cloud-Based Authentication Tools

Digital platforms offer scalable solutions that enhance traceability and user engagement. Cloud-based systems provide real-time monitoring and faster deployment across industries. It enables brands to centralize product verification while cutting manual workloads. Retailers integrate mobile applications for consumer authentication. Startups innovate lightweight plug-in modules for small-scale manufacturers. Online retail channels create strong demand for digital-proof systems. This transition promotes accessible verification for both brands and consumers. Widening digital adoption opens pathways for long-term technology investment.

Growing Cross-Sector Adoption in Luxury, Healthcare, and FMCG Domains

The UK Anti-Counterfeit Packaging Market benefits from strong traction across high-value industries. Luxury brands adopt microtext and laser-etched identifiers to secure authenticity. Healthcare sectors rely on serialized barcodes to protect patient safety. Food producers use tamper seals to ensure clean delivery channels. FMCG firms enhance product identity with QR-based verification portals. Expansion into cosmetics, beverages, and auto components extends market reach. Collaboration between regulators and brand owners supports rapid technology sharing. This trend reinforces cross-industry resilience against counterfeit threats.

Market Segmentation Analysis

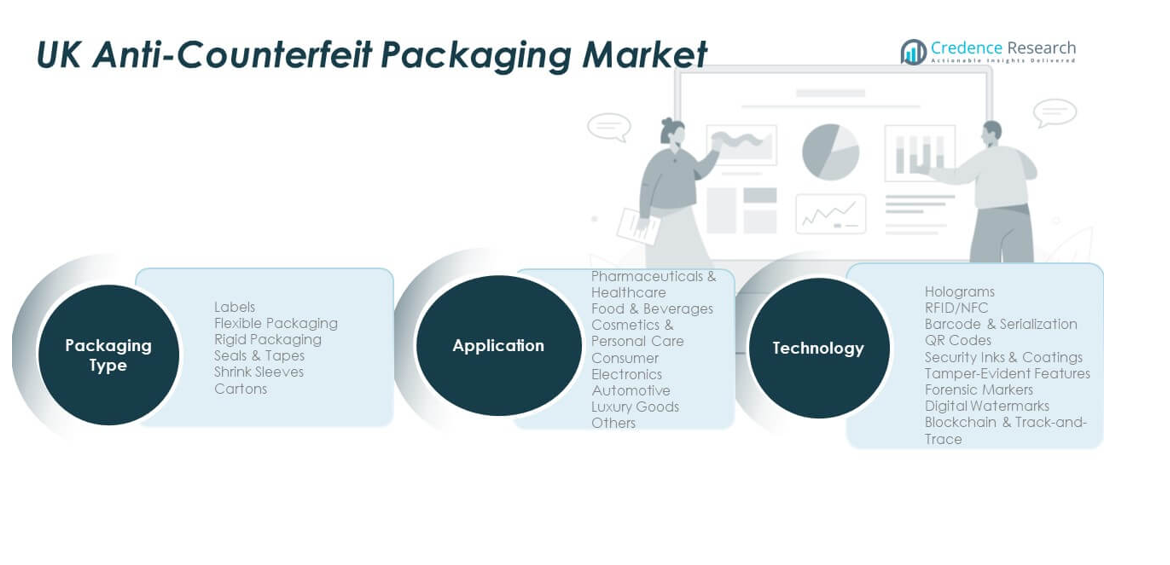

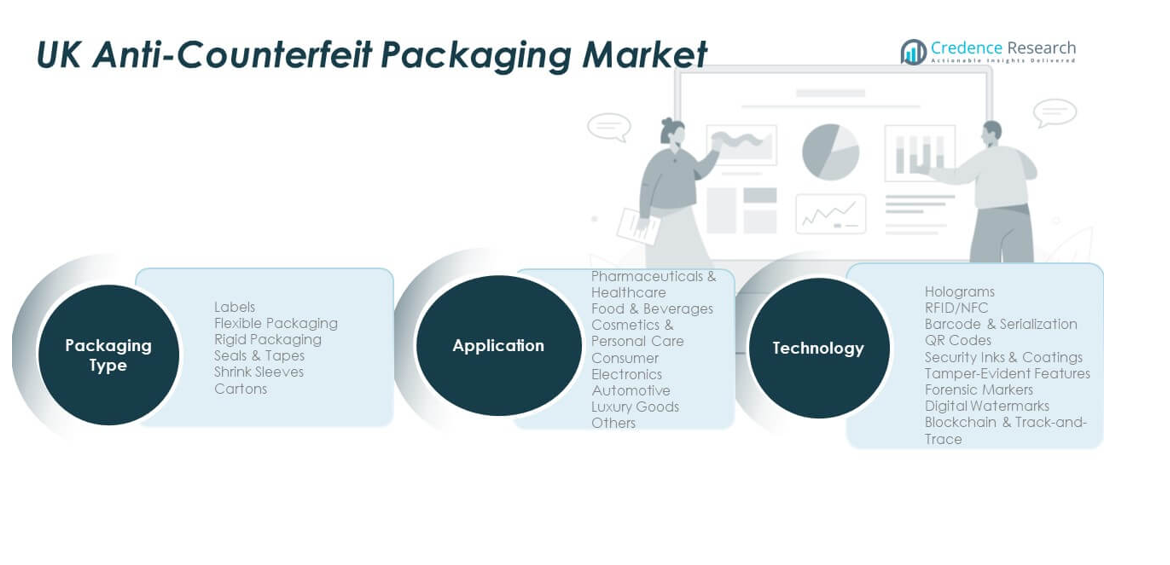

By Packaging Type

Labels remain the most widely used component for authentication due to cost efficiency and compatibility with various products. Flexible packaging supports dynamic labeling designs for food and consumer goods. Rigid packaging dominates industrial applications for tamper resistance. Seals and tapes ensure first-opening detection, critical in pharmaceuticals. Shrink sleeves provide 360-degree branding with hidden identifiers. Cartons integrate RFID and serial codes for multi-layered verification. The segment collectively improves visibility across the supply chain.

By Application

Pharmaceuticals and healthcare lead in adopting anti-counterfeit measures to ensure patient safety. Food and beverages follow with emphasis on freshness tracking and contamination prevention. Cosmetics and personal care brands employ holographic foils for premium appeal. Consumer electronics firms integrate NFC tags for instant verification. Automotive sectors implement serialization to monitor component authenticity. Luxury goods maintain adoption for brand reputation protection. Other sectors like apparel and logistics strengthen secure labeling practices.

- For example, tamper-evident seals and labels are widely used in the pharmaceutical industry to ensure package integrity and prevent counterfeit medicines, supported by the fact that regulatory bodies mandate clear evidence of tampering on drug packaging.

By Technology

Holograms offer visual security through intricate optical layers that deter replication. RFID and NFC support real-time traceability for asset movement. Barcode and serialization remain vital for scalable authentication. QR codes enable instant consumer engagement through mobile scanning. Security inks and coatings embed hidden patterns for advanced detection. Tamper-evident features highlight unauthorized access instantly. Forensic markers provide molecular-level product identity verification. Digital watermarks support digital content protection integrated into packaging design. The combination of these technologies drives innovation and broad market penetration.

- For example, the company HERMA Labels GmbH produces tamper-evident sealing labels that comply with EU Directive 2011/62/EU and provide visible proof of authenticity for pharmaceutical folding boxes, using film and adhesives designed for non-peel removal.

Segmentation

By Packaging Type

- Labels

- Flexible Packaging

- Rigid Packaging

- Seals & Tapes

- Shrink Sleeves

- Cartons

By Application

- Pharmaceuticals & Healthcare

- Food & Beverages

- Cosmetics & Personal Care

- Consumer Electronics

- Automotive

- Luxury Goods

- Others

By Technology

- Holograms

- RFID/NFC

- Barcode & Serialization

- QR Codes

- Security Inks & Coatings

- Tamper-Evident Features

- Forensic Markers

- Digital Watermarks

Regional Analysis

United Kingdom Market and Domestic Positioning

In the UK, the UK Anti‑Counterfeit Packaging Market commands a robust share of around 17.3 % of the European region in 2025. It retains a strong base with well-established packaging and authentication infrastructure. It benefits from stringent national regulatory frameworks, mature brand-protection programmes and high consumer awareness. It draws substantial demand from pharmaceuticals, luxury goods and FMCG sectors operating in the UK. Domestic adoption of serialization, tamper-evident features and smart verification systems remains elevated. It faces pressure from evolving e-commerce supply chains and must adapt to post-Brexit trade dynamics which influence material sourcing and cross-border operations.

Continental Europe Leadership — Germany, France and Italy

Elsewhere in Europe, Germany leads with approximately 26.8 % share of the European anti-counterfeit packaging market in 2025. France follows at about 18.9 % share in 2025, supported by its large luxury-goods industry and advanced pharmaceutical sector. Italy commands around 14.2 % share in 2025, driven by major manufacturing hubs and export-oriented supply chains. These countries benefit from deep industrial bases, rigorous intellectual property enforcement and established secure-packaging ecosystems. They serve both domestic demand and significant export-oriented operations which require anti-counterfeit solutions.

Emerging Regions and Growth Prospects in Europe

The rest of Europe region (including Eastern Europe and smaller markets) holds approximately 11.2 % share of the European market in 2025, rising to around 12.4 % by 2035. These emerging geographies attract attention due to accelerating regulation compliance, rising e-commerce penetration and increased counterfeit risks. Firms in these markets invest in track-and-trace systems, digital watermarks and tamper-evident features to meet brand-security demands. The region offers attractive growth opportunities, though absolute market size remains smaller compared with UK and the major Continental markets. Firms active in the UK market often expand into these emerging areas to capture incremental growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Avery Dennison Corporation

- 3M Company

- DuPont de Nemours, Inc.

- Zebra Technologies Corporation

- Essentra Packaging (Essentra PLC)

- Ingenia Technology

- PharmaSecure

- CCL Industries Inc.

- SICPA Holding SA

- Authentix Inc.

- Systech International

- AlpVision SA

- OpSec Security Group

- Zebra Technologies Europe Ltd.

- De La Rue PLC

Competitive Analysis

The UK Anti‑Counterfeit Packaging Market is characterised by a competitive landscape that combines global majors and regional specialists offering authentication technologies, secure materials and verification services. Leading global players such as Avery Dennison Corporation, 3M Company, and CCL Industries Inc. hold significant positions through broad portfolios of labels, RFID/NFC solutions and track-and-trace capabilities. These firms leverage scale, strong R&D capacity and global supply chains to serve high-value segments like pharmaceuticals and luxury goods. In the UK region, the marketplace also includes specialized firms within secure printing, digital verification and tamper-evident feature development that cater to local regulation and brand-specific demands. These players provide agile solutions tailored to UK regulatory frameworks, supply-chain structures and consumer behaviour. Firms must continuously innovate in holographic features, tamper-evident materials and authentication apps to maintain competitiveness. Barriers to market entry include high initial investment for serialization infrastructure, technology integration complexity and the requirement for compliance with multiple regional standards. Companies differentiate on technology strength, ease of integration and ability to service high-risk verticals.

Recent Developments

- In September 2025, Avery Dennison launched a suite of new labelling solutions at Labelexpo Europe 2025 in Barcelona, including innovations for connectivity, recycling and product safety that support anti-counterfeit functionality in pharmaceutical and luxury sectors.

- In November 2024, Ennoventure secured $8.9 million in funding to expand its AI-powered anti-counterfeiting technology, indicating growing investment in innovative solutions against counterfeiting.

- In April 2024, 3M Company launched the 3M Verify App designed to combat counterfeit personal protective equipment (PPE) by validating product authenticity and enhancing safety for workers across industries. This app represents a significant technological advancement in anti-counterfeit packaging efforts in the UK market.

Report Coverage

The research report offers an in-depth analysis based on packaging type, application, and technology segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing e-commerce activities will raise the need for verified and traceable packaging across industries.

- The pharmaceutical sector will continue driving adoption through strict serialization and regulatory mandates.

- Investments in smart labeling, QR codes, and RFID will strengthen brand protection strategies.

- AI-based authentication and predictive analytics will reshape supply-chain transparency and fraud detection.

- Consumer awareness about counterfeit risks will push demand for visible authenticity features on packaging.

- Sustainability initiatives will influence the use of eco-friendly materials integrated with secure labeling.

- Digital verification through mobile apps will enhance customer engagement and loyalty programs.

- Partnerships between packaging firms and tech providers will expand integrated security ecosystems.

- SMEs will adopt low-cost digital authentication platforms to improve market competitiveness.

- Advancements in blockchain and forensic markers will define the next generation of secure packaging systems.