Market Overview

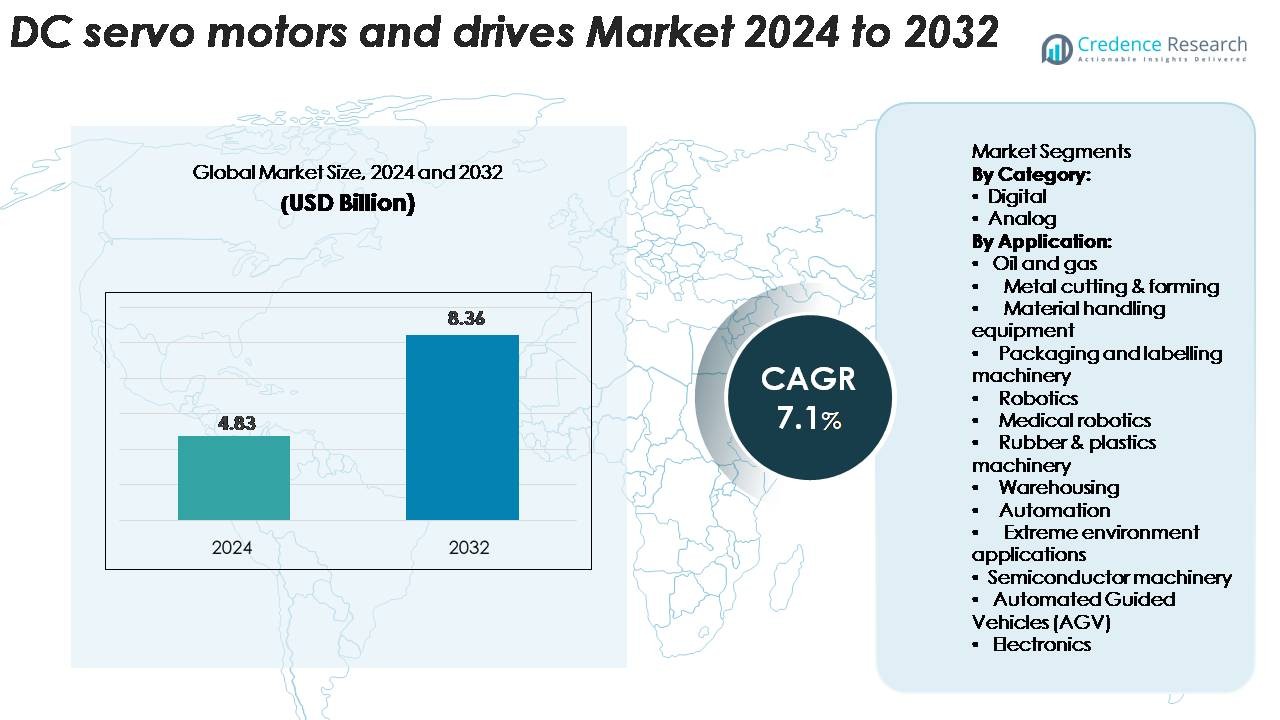

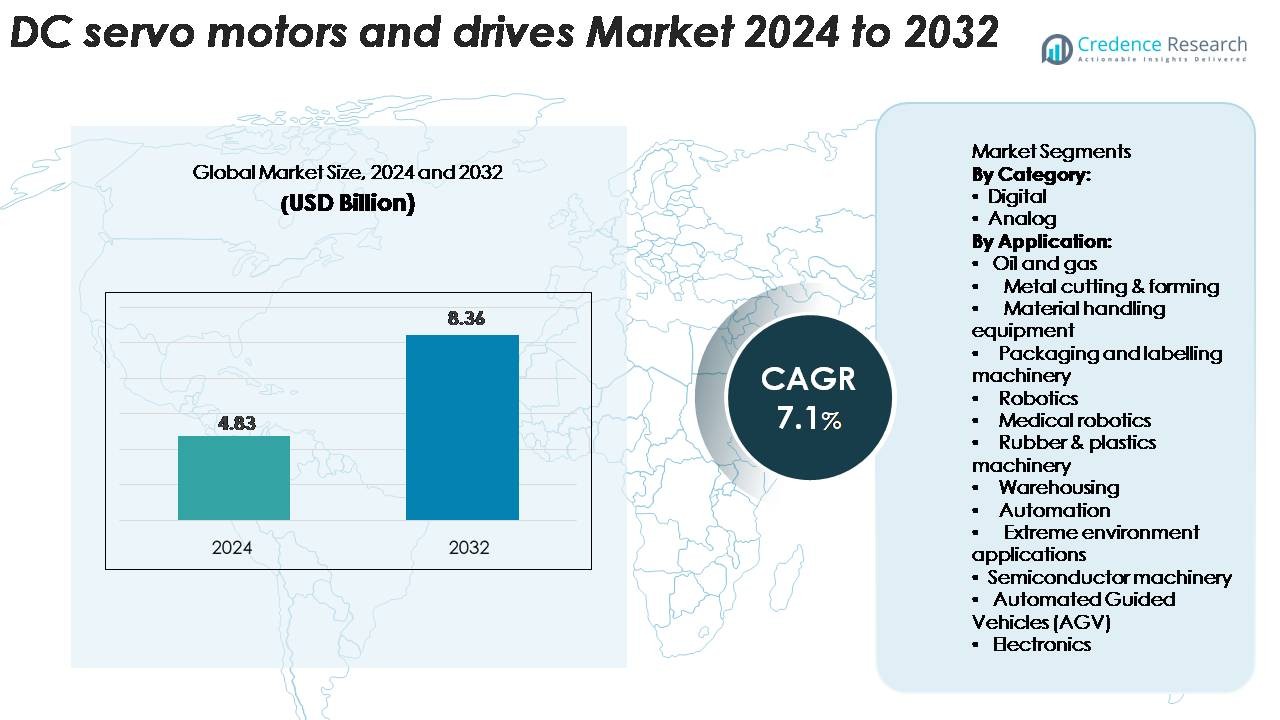

The DC servo motors and drives market was valued at USD 4.83 billion in 2024 and is projected to reach USD 8.36 billion by 2032, growing at a compound annual growth rate (CAGR) of 7.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| DC Servo Motors and Drives Market Size 2024 |

USD 4.83 Billion |

| DC Servo Motors and Drives Market, CAGR |

7.1% |

| DC Servo Motors and Drives Market Size 2032 |

USD 8.36 Billion |

The global DC servo motors and drives market features prominent players such as Siemens AG, Mitsubishi Electric Corporation, Yaskawa Electric Corporation, Rockwell Automation, Inc. and Schneider Electric SE. These manufacturers invest heavily in R&D, expand global footprints and introduce high‑precision drives for automation and robotics. Regional leadership rests with the Asia‑Pacific region, which commands about 43 % of the global market share, thanks to large‑scale industrial automation uptake across China, India, Japan and South Korea. European and North American markets follow, supported by legacy manufacturing infrastructure and strong automation spending.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global market size of the DC servo motors and drives segment stood at USD 4.83 billion in 2024 and is projected to reach USD 8.36 billion by 2032, registering a CAGR of 7.1%.

- Digital category commands the largest share among “By Category” segments, driven by demand for precision control and system integration; analog holds a smaller but steady portion due to cost‑sensitive applications.

- Asia‑Pacific is the dominant region, accounting for around 43.2 % of revenue by 2035, followed by Europe (~29 %) and North America (~23 %) under the “Regional Analysis” segments.

- Key trends include increasing automation, integration of IoT/IIoT technologies in servo systems, and growing emphasis on energy‑efficient solutions for high‑precision applications.

- Major restraints entail high initial investment cost of servo systems and complexity in retrofitting legacy machines with modern DC drives, which limit adoption in certain industrial segments.

Market Segmentation Analysis:

By Category:

The DC servo motors and drives market is primarily divided into digital and analog categories. The digital category leads the market, accounting for the largest share due to its superior precision, programmability, and integration with advanced automation systems. Digital DC motors are increasingly favored across industries such as robotics, material handling, and packaging for their enhanced efficiency and reliability. The analog segment, though smaller, remains significant in applications where cost-efficiency and simpler control systems are sufficient, particularly in less complex or legacy machinery.

- For instance, Kollmorgen’s AKM Series digital servo motors, when integrated into a high-performance system with compatible drives and high-resolution absolute encoders, can achieve repeatability as fine as 0.0005 radians (approximately 0.028 degrees).

By Application:

The DC servo motors and drives market serves a wide range of industries, with key applications in oil and gas, metal cutting, material handling equipment, packaging machinery, and robotics. Robotics is the dominant application, driven by the rising demand for automation in manufacturing, medical robotics, and consumer electronics. The material handling sector, particularly in warehousing and automated guided vehicles (AGVs), is also seeing significant growth, fueled by the boom in e-commerce and logistics automation. Other notable applications include semiconductor machinery and extreme environment applications, which require highly reliable and precise motion control.

- For instance, Panasonic’s MINAS A6 series servo drives achieve a positioning resolution of 23 bits (equivalent to 8,388,608 pulses per revolution), enabling the precise and safe positioning essential for semiconductor wafer-handling equipment.

Key Growth Drivers

Increasing Automation in Industries

The growing demand for automation across various industries is a significant driver for the DC servo motors and drives market. Industries such as manufacturing, robotics, and automotive are increasingly adopting automation technologies to improve efficiency, precision, and production output. DC servo motors are integral to automated systems due to their ability to provide high torque at low speeds, ensuring precise control. As businesses aim to reduce operational costs and improve productivity, the adoption of automated solutions, driven by DC servo motors, is expected to increase. This trend is particularly evident in industries like electronics, packaging, and material handling, where automation is crucial for meeting the demands of mass production.

- For instance, Bosch Rexroth’s IndraDrive servo systems deployed in automated packaging machinery can utilize powerful motors, such as the IndraDyn S or MSK series, that provide continuous torque outputs up to 631 Nm.

Rising Demand for Robotics and Medical Robotics

The rise in robotics, particularly medical robotics, is significantly driving the demand for DC servo motors. Robotics has transformed sectors like healthcare, manufacturing, and consumer electronics, and medical robotics, in particular, is witnessing rapid growth. Surgical robots, for instance, require precise and reliable motion control, making DC servo motors essential for their operation. The demand for minimally invasive surgeries, combined with technological advancements in robotics, is creating new opportunities for DC servo motor applications. As the medical robotics market expands, the need for DC servo motors, which offer high precision and reliability, will continue to grow, supporting their market penetration across various healthcare applications.

- For instance, FAULHABER’s 2057…BHS DC servo motor, deployed in robotic endoscopy systems, provides a continuous output torque of 45 mNm and features encoder resolutions up to 10,000 counts per revolution, delivering the fine positional accuracy required for delicate intra-body navigation.

Growth in Warehouse and E-commerce Automation

The boom in e-commerce has led to significant growth in the demand for warehouse automation solutions, further fueling the DC servo motors and drives market. Automated guided vehicles (AGVs), sorting systems, and robotic arms are increasingly being used in warehouses to enhance efficiency and reduce manual labor. DC servo motors play a critical role in providing precise and reliable motion control in these systems. With e-commerce sales continuing to rise, companies are increasingly investing in automation technologies to streamline their supply chains and reduce operational costs. The need for high-performance, energy-efficient motors to handle complex tasks in dynamic environments is driving demand for DC servo motors in the warehouse automation and logistics sectors.

Key Trends & Opportunities

Technological Advancements in Drive Systems

A key trend in the DC servo motors and drives market is the continuous advancement in drive technologies. The integration of digital technologies such as IoT and AI into motor control systems is enhancing the performance and functionality of DC servo motors. Smart, interconnected servo drives are becoming increasingly popular, as they provide real-time monitoring, predictive maintenance, and enhanced energy efficiency. The increasing use of machine learning algorithms to optimize motor performance and reduce downtime is opening up new opportunities. As industries increasingly focus on improving operational efficiency and reducing maintenance costs, these advancements in drive systems are expected to drive the demand for DC servo motors in various sectors.

- For instance, a research team developed an embedded convolutional-neural-network (CNN) model for DC servo motor overload fault-detection that achieved 99.9997% accuracy and ran on a model with approximately 8 000 parameters.

Shift Toward Energy-Efficient Solutions

There is a growing emphasis on energy efficiency in the DC servo motors and drives market. As global industries face rising energy costs and increasing regulatory pressure to reduce emissions, energy-efficient technologies are becoming a key focus. DC servo motors offer significant energy-saving potential by providing precise control, reducing power consumption, and minimizing waste in high-performance applications. With industries looking for solutions that reduce their environmental footprint, energy-efficient DC servo motors are positioned as a crucial technology. The trend towards sustainability and green technologies presents significant opportunities for companies that specialize in energy-efficient drive systems, particularly in sectors such as automotive, manufacturing, and logistics.

- For instance, Yaskawa Electric Corporation offers multi-axis SERVOPACK systems, such as those used with the MP3300 machine controller, which are designed to reuse regenerative energy between axes, thereby reducing overall power consumption and increasing energy efficiency in motion control applications.

Key Challenges

High Initial Costs

One of the primary challenges in the DC servo motors and drives market is the high initial cost associated with these systems. While DC servo motors offer superior precision and efficiency, their high upfront costs can be a barrier for small and medium-sized enterprises (SMEs). The expense of purchasing and installing these advanced systems, along with the cost of maintenance and training, can be a significant deterrent, especially in price-sensitive markets. Despite the long-term benefits in terms of operational efficiency and reduced energy consumption, the initial investment required for DC servo motors and drives remains a key challenge for widespread adoption, particularly in developing regions.

Integration with Existing Systems

Integrating DC servo motors into existing machinery and systems can be a complex and costly process. Many industries still rely on legacy systems that are not compatible with modern drive technologies, requiring significant retrofitting or complete system overhauls. The complexity of integrating DC servo motors with older equipment can lead to increased costs and extended downtime, which can hinder the overall adoption of these advanced systems. Additionally, the need for specialized skills to install and maintain these systems can further complicate integration, creating challenges for industries looking to modernize their operations.

Regional Analysis

North America

The North American market holds approximately 23% of global revenues in the DC servo motors and drives segment. The region benefits from advanced manufacturing hubs in the U.S. and Canada, strong demand from the automotive, aerospace and packaging industries, and legislative pressure toward energy efficiency. Firms in this region increasingly invest in automation upgrades and motion‑control solutions to stay competitive. As a result, growth remains steady with a focus on retrofitting legacy systems and scaling precision robotics for industrial operations.

Europe

Europe accounts for about 29% of the global market share in this sector. The region’s growth is supported by strong uptake of Industry 4.0 initiatives, government incentives for smart manufacturing, and stringent energy‑efficiency regulations. Key industries such as automotive, electronics, and food & beverage lean heavily on DC servo motors for precision control and integration with digital systems. European suppliers also benefit from strong service ecosystems and the need for retrofit solutions in older manufacturing plants across Germany, France, UK and Italy.

Asia Pacific

Asia Pacific is the largest regional market with around 43% share projected by 2035. Growth in this region is driven by rapid industrialisation, large investments in automation, and booming e‑commerce which stimulates demand for warehousing, AGVs and robotics. China, India, Japan and South Korea lead adoption, spurred by infrastructure investments and rising energy‑consumption concerns. Local production expansion and government programmes targeting smart manufacturing further enhance regional demand for high‑performance DC servo motors and drives.

Latin America

Latin America contributes close to 5% of the global market share in DC servo motors and drives. The market in this region is driven by moderate industrial automation uptake, growth in logistics and warehousing tied to e‑commerce expansion, and investment in manufacturing in Brazil, Mexico and Argentina. However, growth lags behind other regions due to economic volatility and slower technology adoption. Companies active in Latin America often focus on cost‑effective solutions and retrofit markets to replace older motion‑control systems.

Middle East & Africa (MEA)

The MEA region holds about 2% share of the global market. Growth in Africa and the Middle East is currently modest, driven primarily by oil & gas applications, infrastructure developments and face‑specific extreme‑environment requirements. Key opportunities exist in sectors such as mining, utilities and renewable‑energy where motion‑control systems serve harsh‑condition applications. However, adoption is constrained by limited automation investment, slower infrastructure roll‑out and higher costs of implementation.

Market Segmentations:

By Category:

By Application:

- Oil and gas

- Metal cutting & forming

- Material handling equipment

- Packaging and labelling machinery

- Robotics

- Medical robotics

- Rubber & plastics machinery

- Warehousing

- Automation

- Extreme environment applications

- Semiconductor machinery

- Automated Guided Vehicles (AGV)

- Electronics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global DC servo motors and drives market is marked by firms like Siemens AG, Mitsubishi Electric Corporation, Yaskawa Electric Corporation, Rockwell Automation, Inc. and Schneider Electric SE, which lead the market through technological innovation, integrated service offerings and broad geographic reach. These companies continually refine precision motion‑control systems and expand service networks to serve high‑performance segments such as robotics and medical devices. Regional strongholds mirror these companies’ strengths: Asia‑Pacific remains dominant with roughly 43% of global share, followed by Europe (approximately 29%) and North America (around 23%). Competitive differentiation centers on features such as energy efficiency, digital connectivity and support for automation ecosystems. Smaller specialists and emerging regional players challenge incumbents via cost‑effective solutions for niche applications, forcing leading vendors to invest in specialization, partnerships and strategic acquisitions to maintain their edge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Applied Motion Products, Inc.

- Kollmorgen

- Bosch Rexroth Corporation

- Leadshine

- Allied Motion, Inc.

- JVL A/S

- AXOR IND. S.a.s

- Kinco Electric (Shenzhen) Ltd.

- Fuji Electric Co., Ltd.

- Ingenia Cat S.L.U.

Recent Developments

- In October 2023, Applied Motion Products Announced a range of 48 V DC brushless servo motors with 16‑bit magnetic encoders and compatible high‑current drives aimed at AGV/AMR applications.

- In March 2023, the company Leadshine Technology Co., Ltd. announced “new generation” AC servo systems (EL8 controllers + ELM1H motors).

Report Coverage

The research report offers an in-depth analysis based on Category, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Industry automation will drive higher adoption of DC servo motors and drives in manufacturing and logistics.

- Integration with smart factory systems and IoT will offer real‑time monitoring and optimization of motion control.

- Demand for compact and efficient digital drives will rise, pushing growth in high‑precision applications.

- Asia‑Pacific will continue leading the market, capturing around 43 % share by 2035, creating regional investment momentum.

- The analog segment will retain relevance in cost‑sensitive applications and is projected to hold around 56.7 % share by 2035.

- Expansion of robotics, AGVs and warehousing automation will open new opportunities for DC servo systems.

- Increasing regulations on energy efficiency will drive replacements of older motors with servo solutions.

- Emerging technologies such as AI‑based control and digital twins will enhance motion performance and reduce downtime.

- High initial investment and integration complexities will continue to challenge adoption in small and medium‑sized enterprises.

- Supply chain localization and modular product design will enable faster deployment and reduced lead times.