Market Overview

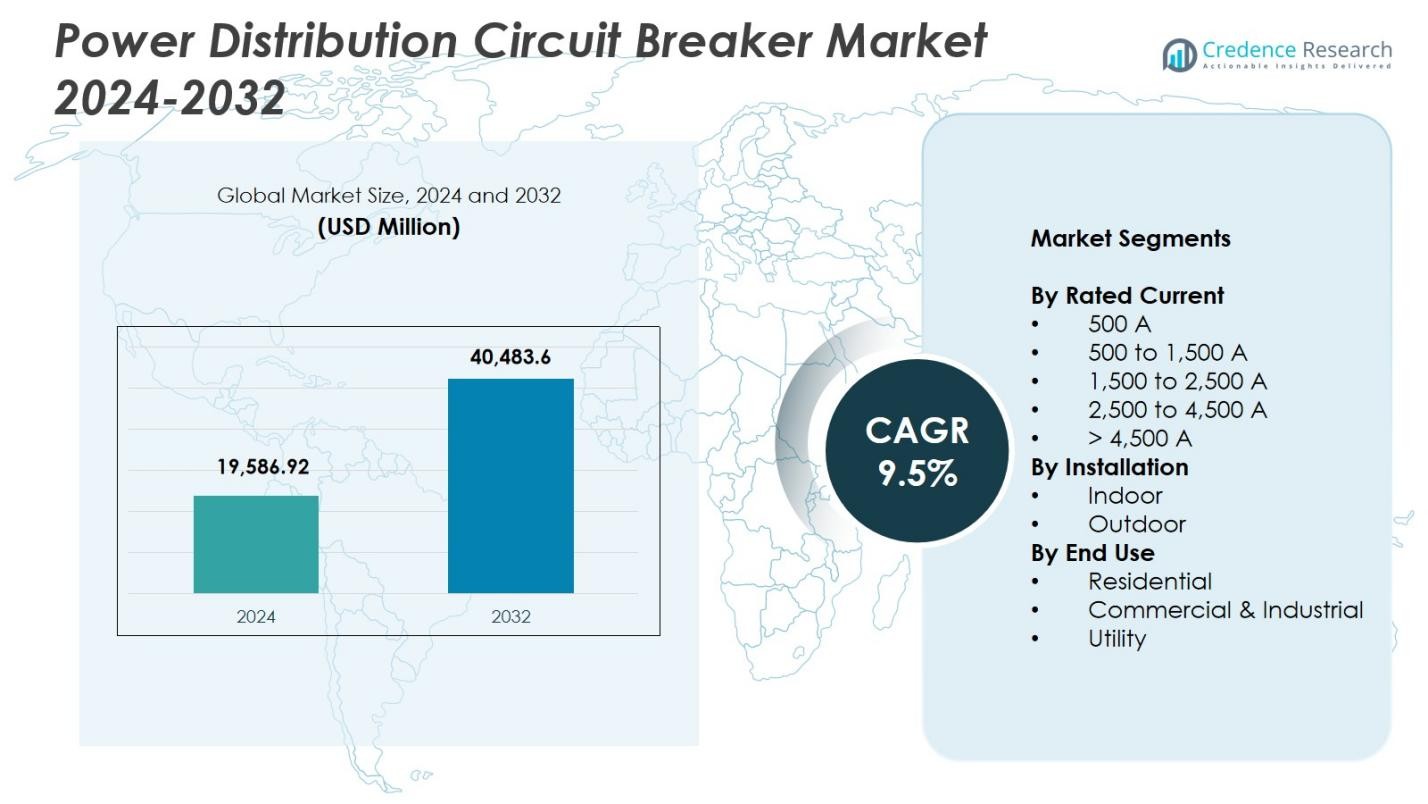

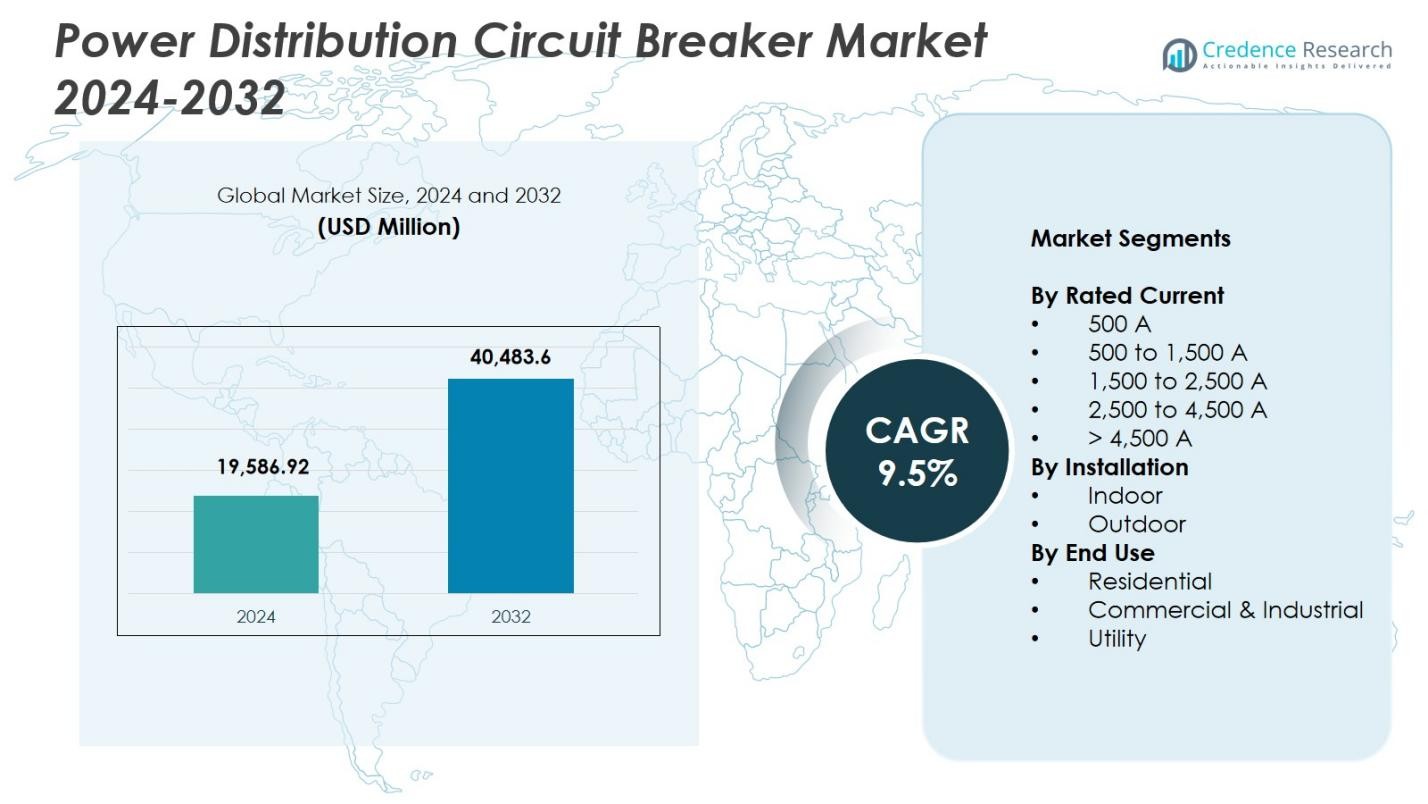

Power Distribution Circuit Breaker Market size was valued at USD 19,586.92 million in 2024 and is anticipated to reach USD 40,483.6 million by 2032, at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Power Distribution Circuit Breaker Market Size 2024 |

USD 19,586.92 Million |

| Power Distribution Circuit Breaker Market, CAGR |

9.5% |

| Power Distribution Circuit Breaker Market Size 2032 |

USD 40,483.6 Million |

Power Distribution Circuit Breaker Market features leading players such as ABB, Eaton, General Electric, Mitsubishi Electric Corporation, LS ELECTRIC Co., Ltd., HD Hyundai Electric & Energy Systems, CG Power & Industrial Solutions Ltd., Alfanar Group, Kirloskar Electric Company, and Powell Industries, all focusing on advanced protection technologies and digitalized switchgear solutions. Asia Pacific leads the global market with 34.9% share, driven by rapid industrialization, large-scale grid expansion, and strong investments in renewable energy integration. North America and Europe follow, supported by extensive modernization of distribution networks and accelerated adoption of smart substations across industrial, commercial, and utility applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Power Distribution Circuit Breaker Market size is USD 19,586.92 million in 2024 and will reach USD 40,483.6 million by 2032, registering a CAGR of 9.5%.

- Market growth is driven by rising grid modernization programs, industrial expansion, and increasing demand for reliable protection systems, with the 1,500 to 2,500 A segment holding 32.6% share due to its suitability for high-load commercial and industrial applications.

- Key trends include growing adoption of smart, IoT-enabled breakers, integration of digital monitoring, and accelerating shift toward SF₆-free and eco-efficient technologies across utilities and commercial sectors.

- Leading players such as ABB, Eaton, General Electric, Mitsubishi Electric, LS ELECTRIC, and Powell Industries emphasize advanced switchgear solutions, R&D investment, and product innovation to strengthen global presence and address evolving power-distribution needs.

- Asia Pacific leads the market with 34.9% share, followed by North America at 28.4% and Europe at 25.7%, while Latin America and the Middle East & Africa collectively contribute emerging growth opportunities through grid expansion and renewable-energy deployment.

Market Segmentation Analysis:

By Rated Current:

In the Power Distribution Circuit Breaker Market, the 1,500 to 2,500 A segment dominates with 32.6% share, driven by its widespread use across industrial power distribution networks, large commercial facilities, and utility-grade switchgear systems. Its ability to handle high load densities, ensure stable fault interruption, and support grid-modernization initiatives strengthens its market position. Growing deployment of smart substations, data centers, and heavy-duty manufacturing units further elevates demand. Meanwhile, breakers above 4,500 A gain traction in large transmission infrastructures, but the 1,500–2,500 A range remains preferred for its reliability, operational efficiency, and compatibility with advanced protection technologies.

- For instance, Eaton’s Power Defense molded case circuit breakers provide main and branch circuit protection up to 2500 A in the RG-Frame series. Designed for distribution systems, they integrate with advanced protection technologies for reliable fault management in heavy-duty applications.

By Installation:

The indoor installation segment leads the market with 57.4% share, supported by rising adoption across residential, commercial, and industrial environments where space optimization, safety, and controlled operating conditions are essential. Indoor breakers benefit from increased installation in data centers, manufacturing plants, high-rise buildings, and urban distribution networks. Growing investments in smart buildings and integrated electrical panels also reinforce segment dominance. Outdoor installations continue expanding in utilities and renewable energy sites, but indoor systems retain leadership due to reduced maintenance needs, enhanced insulation performance, and suitability for enclosed switchgear architectures.

- For instance, Schneider Electric’s Smart Panel systems have been widely deployed in data centers to enhance monitoring and energy efficiency while ensuring compact layouts.

By End Use:

The commercial & industrial segment commands 48.9% share, emerging as the dominant end-use category driven by rapid expansion in manufacturing, logistics hubs, processing plants, and high-power commercial infrastructure. Demand rises as industries adopt automation, electrification, and energy-intensive equipment requiring robust fault protection and continuous operational reliability. Utilities increasingly deploy advanced breakers for grid reinforcement, while residential use grows with urban electrification and smart-home integration. However, commercial & industrial users remain primary contributors to market growth due to large-scale load centers, stringent safety regulations, and accelerated investments in power-quality enhancement systems.

Key Growth Drivers

Rising Demand for Grid Modernization and Reliability

Growing investments in modernizing aging power grids drive strong adoption of advanced power distribution circuit breakers. Utilities, industries, and commercial facilities increasingly replace outdated protection systems with high-performance breakers that offer enhanced fault detection, arc-flash mitigation, and digital monitoring capabilities. Rapid electrification, integration of distributed energy resources, and surging power loads require breakers that ensure system stability and minimize downtime. Governments worldwide prioritize resilient infrastructure, further accelerating upgrades to substation equipment and distribution networks. These modernization efforts significantly strengthen market demand across developed and emerging economies.

- For instance, Schneider Electric’s Easergy P3 breakers support seamless integration with renewable sources, enhancing fault diagnostics and system control.

Expansion of Industrial and Commercial Infrastructure

Accelerating construction of manufacturing plants, logistics hubs, data centers, and commercial complexes boosts the need for reliable power protection equipment. Circuit breakers play a critical role in safeguarding high-capacity electrical systems, supporting uninterrupted operations, and meeting strict safety regulations. The rise in automation, EV charging networks, and energy-intensive machinery further increases demand for medium- and high-rated breakers. Emerging economies undergoing rapid industrialization continue to expand power distribution networks, amplifying installations across both greenfield and brownfield projects. This infrastructure boom positions the commercial and industrial segment as a major growth catalyst for the market.

- For instance, Schneider Electric Infrastructure Ltd (SEIL) is investing Rs.90.60 crore in a new Kolkata plant to boost circuit breaker capacity from 5,000 to 45,000 units annually by FY27, targeting new-generation breakers for domestic and international markets.

Integration of Smart Protection and Digital Monitoring

Widespread adoption of intelligent protection technologies fuels market growth as industries prioritize real-time monitoring, predictive maintenance, and automated fault response. Smart circuit breakers equipped with sensors, communication modules, and analytics software provide operators with actionable insights to prevent equipment failure and optimize load management. The shift toward smart grids and IoT-enabled switchgear enhances system visibility and supports remote diagnostics, reducing operational costs and unplanned outages. Digitalization trends across utilities and industrial infrastructures continue to transform breaker functionality from traditional protection devices to intelligent system-management components.

Key Trends & Opportunities

Growing Adoption of Renewable and Distributed Energy Systems

The accelerating deployment of solar, wind, and distributed energy resources generates strong opportunities for specialized circuit breakers capable of managing bidirectional power flows and fluctuating loads. As microgrids and rooftop PV systems expand, protection requirements become more complex, prompting demand for breakers with fast response times, higher insulation ratings, and digital coordination features. Grid operators invest in advanced protection architectures to stabilize renewable-rich networks, while manufacturers develop compact, environment-resistant, and high-efficiency breaker designs tailored to decentralized generation infrastructures.

- For instance, Siemens introduced its 3VA circuit breakers, designed to handle two-way current flows common in wind farms, with advanced digital communication capabilities for real-time grid monitoring.

Shift Toward Eco-Efficient and Sustainable Switchgear

A rising focus on environmental sustainability encourages adoption of eco-efficient circuit breakers that reduce greenhouse gas emissions and eliminate SF₆-based insulation. Manufacturers introduce alternatives such as vacuum and air-insulated breaker technologies that meet tightening environmental regulations. Companies also explore recyclable materials, energy-efficient designs, and low-maintenance components to support lifecycle sustainability. This trend creates significant opportunities for suppliers offering green switchgear solutions, especially as utilities and commercial facilities prioritize ESG compliance and long-term operational sustainability.

- For instance, ABB’s Frosinone site improved energy efficiency of each circuit breaker by 25% and reduced Scope 1 and 2 CO₂ emissions per product by 33% against a 2019 baseline, using ABB Ability Energy Manager for process optimization.

Key Challenges

High Installation and Upgrade Costs

Despite strong market potential, high upfront installation and equipment costs remain a major barrier, particularly for small industries and residential infrastructures. Upgrading to modern circuit breaker systems often requires redesigning switchgear layouts, integrating digital modules, and replacing legacy wiring—leading to substantial capital expenditure. Utilities in developing regions may delay modernization projects due to limited budgets, slowing adoption rates. These financial constraints can hinder large-scale deployment, especially for advanced smart breakers with integrated communication and monitoring technologies.

Complexity in Integration with Emerging Grid Architectures

The increasing complexity of power networks, driven by renewable integration, distributed energy resources, and dynamic load centers, makes coordination and protection more challenging. Circuit breakers must operate reliably under diverse grid conditions, requiring precise synchronization with protection relays, sensors, and digital control systems. Inadequate interoperability among multi-vendor components can cause protection delays or coordination failures. As grids evolve toward decentralized, digitalized models, ensuring seamless system compatibility and maintaining reliability across interconnected infrastructures becomes a significant technical challenge for operators and manufacturers.

Regional Analysis

North America

North America holds 28.4% share of the Power Distribution Circuit Breaker Market, driven by strong investments in grid modernization, renewable integration, and replacement of aging electrical infrastructure. The United States leads regional demand due to widespread upgrades in transmission and distribution networks, rising deployment of smart substations, and rapid data center expansion. Industrial automation and electrification initiatives further increase adoption of medium- and high-rated breakers. Canada also contributes significantly through clean-energy transition programs and large utility-scale modernization projects, reinforcing steady demand across both commercial and utility sectors.

Europe

Europe captures 25.7% share of the market, supported by stringent regulatory frameworks, accelerated decarbonization initiatives, and extensive deployment of renewable energy systems. Countries such as Germany, France, and the United Kingdom focus on upgrading switchgear infrastructure to meet evolving safety, efficiency, and sustainability standards. Demand strengthens as utilities transition toward eco-efficient and SF₆-free breaker technologies. The region’s growing EV charging networks, smart grid expansion, and industrial electrification bolster installations across medium-voltage and distribution-level systems. Eastern Europe also shows rising investment in grid infrastructure as governments prioritize power-sector resilience and modernization.

Asia Pacific

Asia Pacific dominates the global market with 34.9% share, driven by rapid industrialization, expanding urban infrastructure, and significant investment in large-scale power distribution projects. China and India lead demand as they strengthen transmission networks, expand manufacturing bases, and integrate renewable energy at accelerating rates. Southeast Asian countries add momentum through electrification programs and commercial infrastructure development. The region’s growing population and rising energy consumption further amplify the need for reliable and high-capacity circuit breakers. Favorable government policies, utility upgrades, and digital-grid initiatives position Asia Pacific as the fastest-growing regional market.

Latin America

Latin America accounts for 5.6% share, supported by steady growth in utility modernization programs, renewable-energy installations, and industrial expansion across Brazil, Mexico, and Chile. Upgrades to transmission and distribution networks, particularly in urban and industrial clusters, stimulate demand for advanced circuit breaker systems. The region also benefits from increasing investment in mining, oil and gas, and manufacturing sectors, which require robust power protection equipment. Although budget constraints limit widespread adoption of smart breakers, gradual infrastructure development and energy-sector reforms continue to drive market opportunities.

Middle East & Africa

The Middle East & Africa region holds 5.4% share, driven by ongoing development of utility networks, large-scale commercial projects, and power-system reinforcements across the Gulf Cooperation Council and African nations. The Middle East experiences strong demand from megaprojects, industrial zones, and renewable initiatives such as solar parks. Africa sees gradual growth due to electrification programs and investments in transmission upgrades. Expansion of oil and gas infrastructure further contributes to breaker deployment. Although adoption of smart technologies is still emerging, the region’s long-term infrastructure pipeline supports steady market expansion.

Market Segmentations:

By Rated Current

- 500 A

- 500 to 1,500 A

- 1,500 to 2,500 A

- 2,500 to 4,500 A

- > 4,500 A

By Installation

By End Use

- Residential

- Commercial & Industrial

- Utility

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Power Distribution Circuit Breaker Market features major players such as ABB, Alfanar Group, CG Power & Industrial Solutions Ltd., Eaton, General Electric, HD Hyundai Electric & Energy Systems, Kirloskar Electric Company, LS ELECTRIC Co., Ltd., Mitsubishi Electric Corporation, and Powell Industries. These companies focus on expanding product portfolios, enhancing digital protection capabilities, and developing eco-efficient breaker technologies to meet evolving grid and industrial requirements. Strategic initiatives include smart switchgear integration, remote monitoring solutions, and high-capacity fault-interruption systems tailored for modern power networks. Manufacturers increasingly invest in R&D to improve reliability, reduce maintenance cycles, and align with sustainability regulations. Partnerships with utilities and industrial operators support deployment of intelligent distribution systems, while geographic expansion strengthens market reach. Continuous innovation in medium-voltage and distribution-level breakers positions leading companies to capitalize on rising electrification, renewable integration, and infrastructure modernization across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kirloskar Electric Company

- Powell Industries

- LS ELECTRIC Co., Ltd.

- HD HYUNDAI ELECTRIC & ENERGY SYSTEM CO., LTD.

- General Electric

- ABB

- Mitsubishi Electric Corporation

- CG Power & Industrial Solutions Ltd.

- Eaton

- Alfanar Group

Recent Developments

- In July 2025, ABB introduced its new SACE Emax 3 air circuit breaker designed especially for data centers and high-demand facilities.

- In 2025, Eaton presented new smart power-management and distribution products at Elecrama 2025, aimed at enhancing reliability and efficiency for data centers, renewable energy sites, and industrial power distribution setups.

- In August 2024, Mitsubishi Electric Corporation signed an agreement with Siemens Energy to co-develop DC switching stations and DC circuit-breaker requirement specifications, targeting multi-terminal HVDC systems and large-scale renewable energy integration.

Report Coverage

The research report offers an in-depth analysis based on Rated Current, Installation, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as utilities accelerate modernization of distribution networks and replace aging protection infrastructure.

- Adoption of smart and digitally enabled circuit breakers will rise with increasing deployment of smart grids and automated substations.

- Industrial growth, especially in manufacturing, logistics, and data centers, will continue to boost demand for high-capacity distribution breakers.

- Renewable energy integration will drive development of breakers capable of managing bidirectional power flow and fluctuating load conditions.

- Eco-efficient and SF₆-free breaker technologies will gain traction as sustainability regulations tighten globally.

- Urbanization and commercial construction will support widespread installation of indoor distribution breaker systems.

- Advancements in IoT and predictive maintenance will enhance breaker performance and reduce operational downtime.

- Emerging economies will witness accelerated adoption due to grid expansion, electrification programs, and rising industrial investment.

- Modular and compact breaker designs will grow in popularity to support flexible and space-constrained installations.

- Strategic collaborations between manufacturers and utilities will strengthen innovation and enable deployment of next-generation distribution protection solutions.