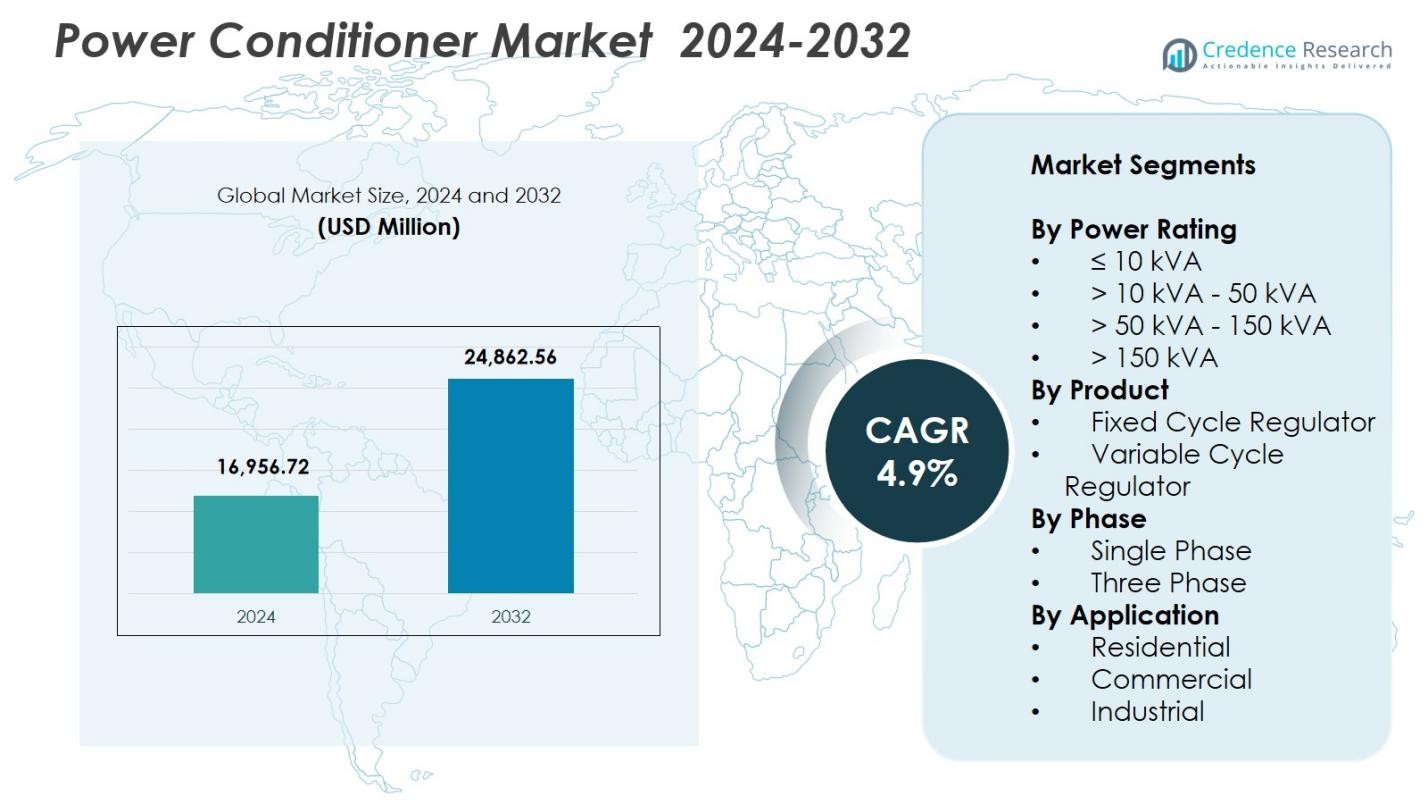

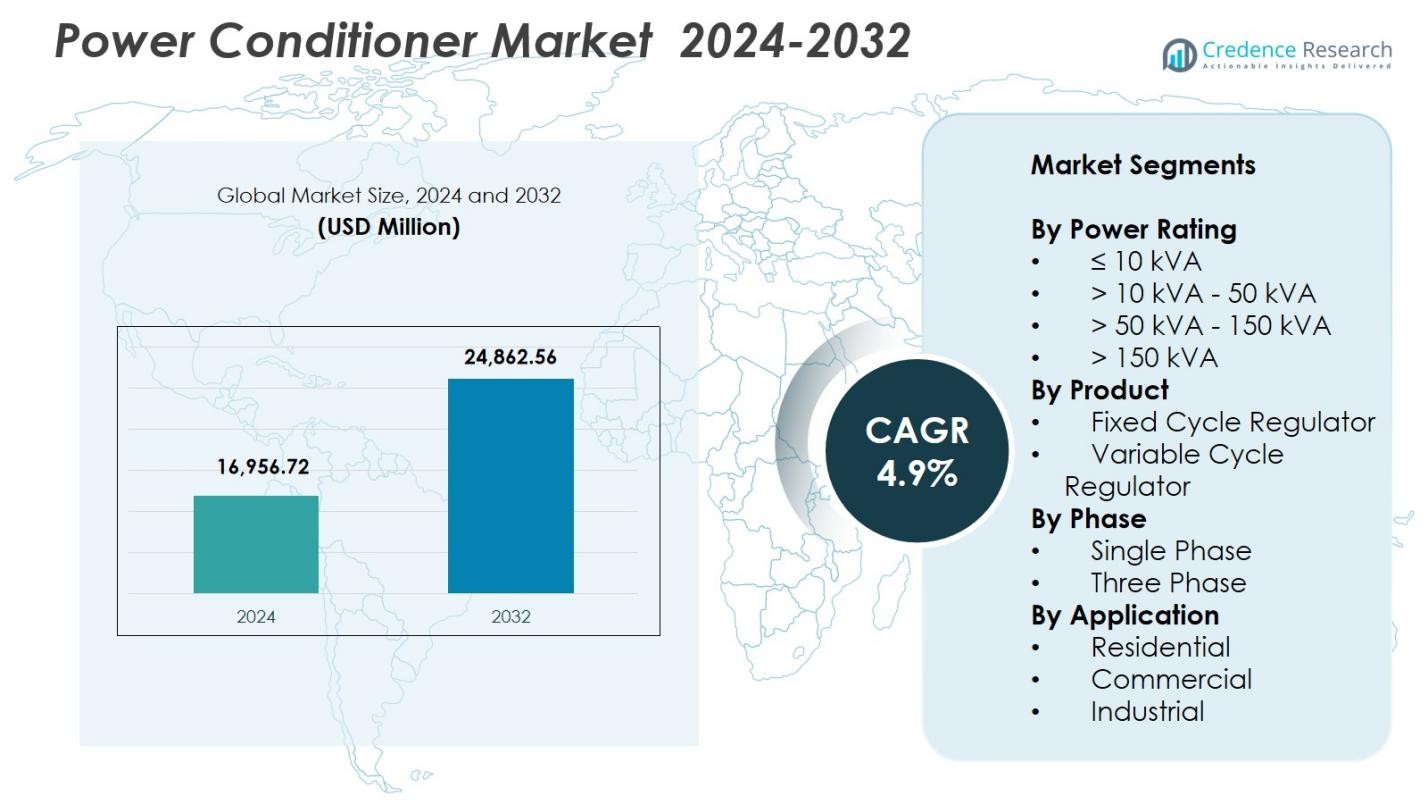

Power Conditioner Market size was valued at USD 16,956.72 Million in 2024 and is anticipated to reach USD 24,862.56 Million by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Power Conditioner Market Size 2024 |

USD 16,956.72 Million |

| Power Conditioner Market, CAGR |

4.9% |

| Power Conditioner Market Size 2032 |

USD 24,862.56 Million |

Power Conditioner Market features leading players such as AMETEK, Delta Electronics, Eaton, Emerson Electric, Farmax Technologies, Fuji Electric, Hubbell, Legrand, Mitsubishi Electric Corporation, and Panasonic Industry, each strengthening their presence through technology upgrades, energy-efficient designs, and IoT-enabled monitoring capabilities. These companies focus on expanding product portfolios to address rising demand across industrial, commercial, and residential sectors. North America led the market with 34.7% share, driven by strong adoption of advanced power-quality systems in data centers, telecom, and manufacturing. Asia-Pacific followed closely with 29.4% share, supported by rapid industrialization and expanding digital infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Power Conditioner Market reached USD 16,956.72 Million in 2024 and will grow at a CAGR of 4.9% through 2032, driven by rising demand for high-quality power regulation.

- Market growth is fueled by the increasing use of sensitive electronics, industrial automation expansion, and greater adoption of renewable energy systems requiring stable voltage support, with the ≤10 kVA segment holding 41.6% share.

- Key trends include the shift toward IoT-enabled conditioners, advanced monitoring features, and strong demand for energy-efficient and eco-friendly regulator designs across commercial and industrial environments.

- Major players such as AMETEK, Eaton, Emerson Electric, Delta Electronics, Legrand, and Mitsubishi Electric focus on technological enhancements, wider product offerings, and strategic expansions to strengthen market presence globally.

- North America led with 34.7% share, followed by Asia-Pacific at 29.4% and Europe at 27.9%, reflecting strong adoption in data centers, telecom, and automated manufacturing facilities, while Latin America and Middle East & Africa show steady emerging demand.

Market Segmentation Analysis:

By Power Rating

The ≤10 kVA segment accounted for 41.6% share, making it the dominant category in the Power Conditioner Market due to its widespread use across commercial offices, telecom sites, retail outlets, and residential environments requiring stable voltage regulation. Its strong adoption is driven by rising deployment of sensitive electronic equipment, expansion of SMEs, and increasing reliance on connected devices that require uninterrupted and clean power. Higher segments such as >10 kVA – 50 kVA and >50 kVA – 150 kVA continue to grow, supported by industrial automation and data center expansion.

- For instance, Schneider Electric’s APC line includes power conditioners specifically designed for small office environments and telecom racks, ensuring consistent voltage for IT equipment.

By Product

The Fixed Cycle Regulator segment commanded 58.3% share, emerging as the leading product type owing to its reliability, stable voltage control, and lower maintenance requirements across industrial, commercial, and institutional landscapes. This segment grows strongly as industries prioritize power quality enhancement, protection from voltage fluctuations, and long service-life solutions. Meanwhile, the Variable Cycle Regulator segment expands steadily, supported by demand for precise voltage adjustments in manufacturing facilities, medical equipment, and high-precision electronics, where advanced regulation performance becomes essential for operational efficiency.

- For instance, ABB’s PCS100 AVC platform has been widely adopted in manufacturing plants for stabilizing voltage under fluctuating grid conditions.

By Phase

The Three Phase segment held 63.4% share, dominating the Power Conditioner Market due to its critical role in industrial plants, large commercial buildings, and data centers that operate high-capacity machinery and sensitive automation systems. Its growth is driven by rapid industrialization, expansion of heavy electrical infrastructure, and rising integration of power-intensive applications requiring stable voltage profiles. The Single Phase segment, while smaller in comparison, remains vital for residential and small-business applications, supported by increasing consumer electronics penetration and growing need for consistent power conditioning across basic load environments.

Key Growth Drivers

Rising Demand for Clean and Stable Power Supply

Growing dependence on sensitive electronic equipment across industries, commercial facilities, and residential environments drives strong demand for clean and stable power supply. Power conditioners play a critical role in mitigating voltage fluctuations, harmonics, and electrical noise that can damage high-value systems. The expansion of digital infrastructure, including data centers, telecom networks, and automated manufacturing units, further accelerates adoption. As operational uptime becomes a priority and equipment protection gains strategic importance, organizations increasingly integrate power conditioning systems to maintain performance, reduce downtime, and extend asset life.

- For instance, Schneider Electric’s AccuSine PCS+ solution has been used in hospitals and research facilities to mitigate electrical disturbances and protect mission-critical devices.

Expansion of Industrial Automation and Smart Manufacturing

Industrial automation continues to advance, creating a significant need for consistent power quality to support robotics, PLCs, CNC machines, and precision-driven production lines. Power conditioners enable uninterrupted operations and safeguard automation technologies from distortions and transient surges that disrupt efficiency. Smart factories integrating IIoT-driven systems rely heavily on regulated power to maintain real-time communication and machine-to-machine workflows. As industries pursue higher productivity, lean manufacturing, and reduced energy waste, demand for advanced power conditioning solutions strengthens across automotive, electronics, pharmaceuticals, and heavy engineering sectors.

- For instance, SolaHD’s Constant Voltage Transformers (CVS Series) used in industrial automation and control equipment, which filter harmonics and regulate voltage to prevent downtime and protect sensitive electronic loads in factory automation.

Growing Adoption of Renewable Energy Systems

The rapid installation of solar and wind power systems increases the need for stable voltage regulation, as renewable sources often generate variable output. Power conditioners help maintain consistent power flow, protect inverters, and enhance overall grid quality, supporting smooth integration of renewable assets. The shift toward decentralized energy, microgrids, and hybrid power systems further amplifies requirements for conditioning technologies to stabilize intermittent supply. As governments intensify renewable deployment targets and industries adopt green power for cost and sustainability benefits, power conditioner demand rises significantly.

Key Trends & Opportunities

Integration of Intelligent Monitoring and IoT Capabilities

The adoption of IoT-enabled power conditioners is rising as end users prioritize real-time monitoring, predictive diagnostics, and remote control capabilities. Smart conditioners allow facility managers to detect faults, analyze power quality trends, and schedule maintenance more efficiently, reducing unplanned downtime. Integration with energy management platforms unlocks opportunities for optimization and performance insights. Manufacturers increasingly embed analytics-driven features, enabling customized regulation modes for specific applications. This shift toward intelligent, connected solutions creates strong opportunities in data centers, high-tech manufacturing, telecom infrastructure, and commercial facilities.

- For instance, Siemens Energy partnered with AWS to deploy the Connected Factory platform using AWS IoT SiteWise Edge, connecting legacy equipment in 18 factories for real-time asset data analysis, which cut manual data collection time by 50% and reduced maintenance costs by 25%.

Growing Preference for Energy-Efficient and Eco-Friendly Designs

A strong trend toward energy-efficient power conditioning technologies is emerging as organizations seek to lower operational costs and comply with evolving sustainability regulations. Manufacturers are introducing advanced designs that reduce heat loss, improve efficiency ratios, and ensure minimal environmental impact. Opportunities expand across industries adopting ESG-focused procurement and upgrading outdated electrical infrastructure. Demand is especially strong in regions prioritizing green buildings, industrial decarbonization, and renewable integration. As end users aim to enhance power reliability while reducing energy consumption, efficient power conditioners gain substantial market traction.

- For instance, integration of silicon carbide (SiC) and gallium nitride (GaN) based inverters in power conditioning systems supports high-power utility-scale applications with improved DC-DC conversion efficiency for energy storage.

Key Challenges

High Installation and Maintenance Costs

One of the major challenges for the Power Conditioner Market is the high upfront cost associated with installation, particularly in industrial and large commercial settings requiring multi-phase, high-capacity systems. Ongoing maintenance costs also add to budget pressures, restricting adoption among SMEs and cost-sensitive sectors. Complex infrastructure integration, customization needs, and long cabling requirements further elevate project expenses. These financial barriers often delay upgrade cycles and limit market penetration in developing regions where capital allocation for power-quality solutions remains constrained.

Limited Awareness and Technical Expertise in Emerging Markets

In several developing regions, limited awareness of power quality issues and inadequate technical expertise hinder the adoption of power conditioners. Many small enterprises fail to recognize the long-term financial impact of voltage inconsistencies, equipment failures, and downtime. Additionally, the shortage of trained professionals to install, configure, and maintain advanced conditioning systems restricts market expansion. Lack of structured standards and inconsistent enforcement of electrical regulations further complicate implementation. Addressing knowledge gaps and improving field-level technical support remain essential to unlocking growth in these markets.

Regional Analysis

North America

North America held 34.7% market share, driven by the widespread adoption of advanced electronic systems across data centers, telecom infrastructure, and industrial automation environments requiring stable and high-quality power. Strong regulatory focus on energy efficiency and electrical reliability accelerates modernization of commercial buildings and manufacturing facilities. The U.S. leads the region due to rapid expansion in IT workloads, cloud infrastructure, and smart manufacturing investments. Rising integration of renewable energy systems and continued upgrades to aging electrical networks further strengthen demand for power conditioners across commercial, residential, and industrial sectors.

Europe

Europe accounted for 27.9% market share, supported by stringent power quality standards, industrial automation growth, and widespread modernization of electrical infrastructure across Germany, the U.K., and France. The region benefits from strong adoption of energy-efficient power conditioning solutions aligned with EU sustainability frameworks. Expansion of EV charging infrastructure, renewable energy integration, and smart grid upgrades increases the requirement for stable voltage regulation. Manufacturing hubs, pharmaceutical plants, and advanced research facilities drive continued demand, while increasing digitalization and data center construction boost adoption across Western and Northern Europe.

Asia-Pacific

Asia-Pacific emerged as the fastest-growing region with 29.4% market share, propelled by rapid industrialization, expanding telecom networks, and rising deployment of consumer and industrial electronics. China, India, Japan, and South Korea contribute significantly due to large-scale manufacturing activity and increasing dependence on automated systems requiring stable power. Growth in cloud infrastructure, data centers, and renewable energy installations amplifies the need for advanced conditioning technologies. Urbanization, infrastructure upgrades, and expansion of commercial buildings further strengthen demand, positioning the region as a major long-term contributor to global market growth.

Latin America

Latin America captured 4.2% market share, driven by increasing adoption of voltage regulation solutions across industrial plants, utilities, and commercial centers. Brazil and Mexico lead the region due to ongoing investment in manufacturing, oil and gas operations, and telecom expansion requiring consistent power quality. Infrastructure modernization initiatives and rising awareness of equipment protection expand opportunities for power conditioners. However, budget constraints and uneven technical expertise limit adoption in smaller enterprises. Growth is supported by expanding renewable energy capacity and increasing digitization across large corporate and public-sector facilities.

Middle East & Africa

The Middle East & Africa region accounted for 3.8% market share, supported by growing industrial activity, infrastructure development, and rising deployment of automation technologies in utilities, oil and gas, and large commercial establishments. GCC countries lead adoption due to major investments in smart cities, large construction projects, and data center expansion. Africa shows gradual progress driven by power instability issues that heighten the need for conditioning systems. While demand grows steadily, challenges such as limited technical resources and capital constraints slow broader penetration across emerging markets.

Market Segmentations:

By Power Rating

- ≤ 10 kVA

- > 10 kVA – 50 kVA

- > 50 kVA – 150 kVA

- > 150 kVA

By Product

- Fixed Cycle Regulator

- Variable Cycle Regulator

By Phase

By Application

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Power Conditioner Market features key players such as AMETEK, Delta Electronics, Eaton, Emerson Electric, Farmax Technologies, Fuji Electric, Hubbell, Legrand, Mitsubishi Electric Corporation, and Panasonic Industry, each contributing to innovation and product expansion. The market exhibits strong technological advancement as manufacturers focus on improving energy efficiency, integrating IoT-enabled monitoring, and enhancing voltage regulation accuracy to support industrial automation and digital infrastructure. Companies invest heavily in R&D to develop compact, high-performance conditioners tailored for data centers, telecom networks, and precision manufacturing environments. Strategic initiatives—including portfolio diversification, global distribution expansion, and partnerships with utility companies—strengthen competitive positioning. Growing emphasis on renewable energy integration and sustainable electrical systems encourages players to introduce environmentally efficient designs. Additionally, rising customer demand for reliability, long lifecycle products, and real-time power quality analytics drives continual innovation, enabling manufacturers to differentiate offerings and capture emerging opportunities across industrial, commercial, and residential sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Farmax Technologies

- Panasonic Industry

- Emerson Electric

- Legrand

- Delta Electronics

- Hubbell

- Fuji Electric

- Mitsubishi Electric Corporation

- Eaton

- AMETEK

Recent Developments

- In July 2025, Eaton announced its acquisition of Resilient Power Systems Inc., a U.S.-based company specializing in advanced medium-voltage power conversion and solid-state transformer technologies, expanding its power management portfolio.

- In October 2025, ABB launched a new 600 V/690 V version of its PCS100 AVC-40 active voltage conditioner tailored for heavy industrial applications.

- In December 2024, ABB signed an agreement to acquire the power-electronics business of Gamesa Electric (previously part of Siemens Gamesa), a move that broadens ABB’s capabilities in renewable-power conversion and utility-scale power conditioning solutions.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Product, Phase, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady demand as industries prioritize consistent power quality to protect automation and digital infrastructure.

- Adoption of intelligent, IoT-enabled power conditioners will expand as end users seek real-time monitoring and predictive maintenance.

- Growth in data centers and cloud facilities will drive higher deployment of three-phase and high-capacity conditioning systems.

- Increasing integration of renewable energy sources will boost the need for advanced voltage stabilization technologies.

- Manufacturers will focus on energy-efficient and eco-friendly product designs to meet sustainability targets.

- Expansion of smart manufacturing and Industry 4.0 initiatives will elevate demand for precision power conditioning solutions.

- Rising urbanization and commercial infrastructure development will strengthen adoption across developing regions.

- Advances in semiconductor materials and control electronics will improve efficiency and performance.

- Growing reliance on sensitive medical, telecom, and research equipment will accelerate market penetration.

- Strategic partnerships and product innovation will reinforce the market’s long-term technological evolution.