Market Overview

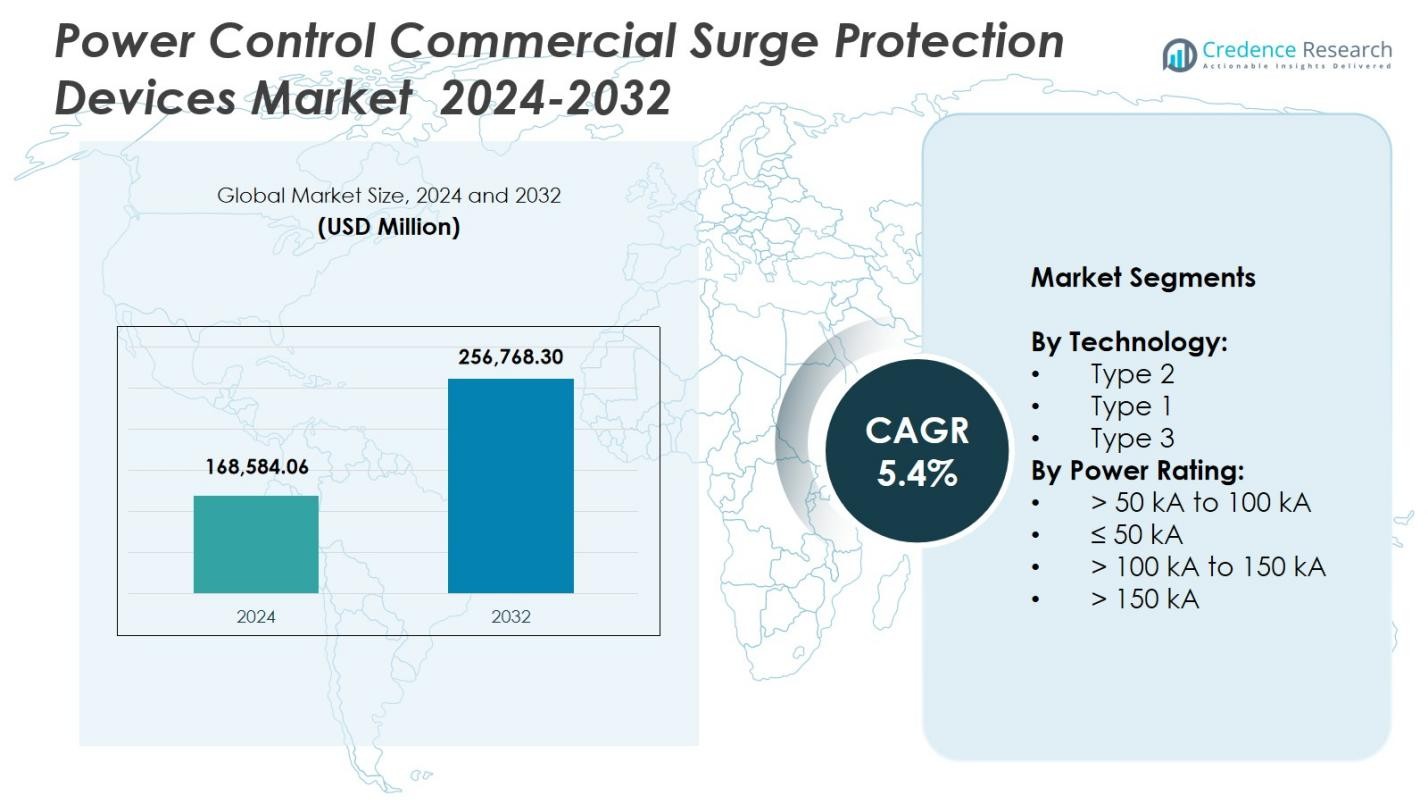

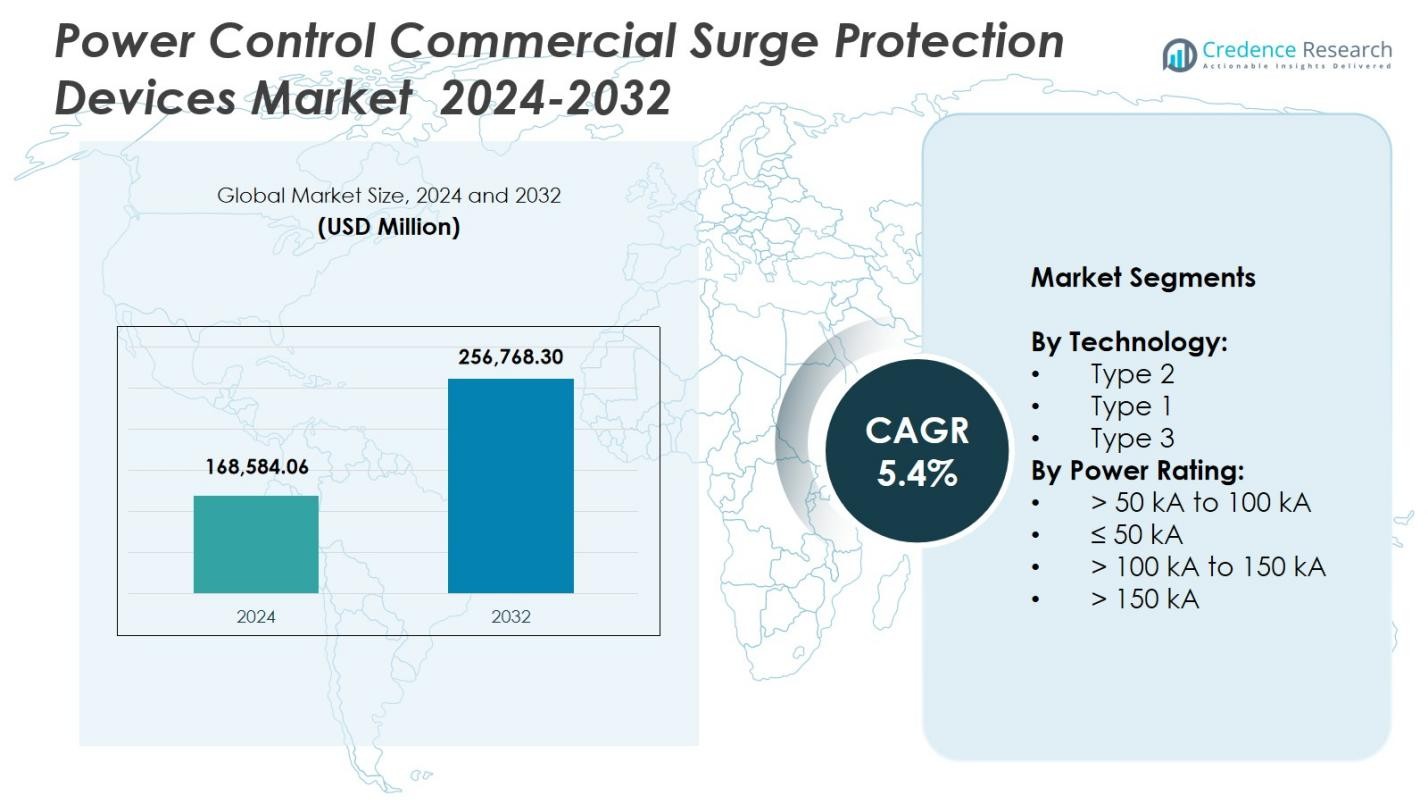

Power Control Commercial Surge Protection Devices Market size was valued at USD 168,584.06 Million in 2024 and is anticipated to reach USD 256,768.30 Million by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Power Control Commercial Surge Protection Devices Market Size 2024 |

USD 168,584.06 Million |

| Power Control Commercial Surge Protection Devices Market, CAGR |

5.4% |

| Power Control Commercial Surge Protection Devices Market Size 2032 |

USD 256,768.30 Million |

Power Control Commercial Surge Protection Devices Market features leading players such as Schneider Electric, ABB, Belkin, Eaton, Emerson Electric, Hubbell, Intermatic, JMV, Legrand, and Littelfuse, each strengthening their presence through advanced surge protection technologies and expanded commercial portfolios. These companies focus on high-capacity devices, smart monitoring capabilities, and UL-compliant solutions to address rising demand across commercial buildings, data centers, and industrial environments. Regionally, North America led the market with 35.4% share, driven by stringent safety standards and strong infrastructure modernization, while Europe and Asia Pacific followed as major growth contributors due to digitalization, industrial expansion, and increased adoption of automation systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Power Control Commercial Surge Protection Devices Market reached USD 168,584.06 Million in 2024 and will grow at a 4% CAGR, driven by rising adoption across commercial infrastructure.

- Strong market demand is fueled by increasing power disturbances, higher electrical load density, and rapid deployment of automation and IoT systems across industrial and commercial facilities.

- Type 2 surge protection dominated with 6% share, supported by widespread use in commercial buildings and mission-critical electrical networks requiring mid-level surge mitigation.

- Key players enhance market presence by expanding smart, high-capacity, and UL-certified surge protection portfolios, focusing on data centers, industrial plants, and modern commercial complexes.

- North America led with 4% share, followed by Europe at 28.7% and Asia Pacific at 24.9%, with growth supported by infrastructure upgrades, digital transformation, and increasing emphasis on electrical safety.

Market Segmentation Analysis:

By Technology

Type 2 devices dominated the Power Control Commercial Surge Protection Devices Market with a 47.6% share, driven by their essential role in protecting commercial electrical systems from transient surges originating within the facility and from utility fluctuations. Their widespread adoption in industrial plants, commercial buildings, and mission-critical infrastructure strengthens demand due to mandatory compliance with safety standards and enhanced medium-level surge mitigation. Type 1 devices captured 32.4% share, gaining traction in high-exposure installations, while Type 3 devices accounted for 20.0%, primarily supporting point-of-use protection across sensitive electronics.

- For instance, Phoenix Contact offers Type 2 surge protective devices designed for subdistribution and machine control cabinets, handling short-circuit currents up to 50 kA without needing a backup fuse for main fuse ratings up to that level, ideal for protecting against switching operation surges in commercial setups.

By Power Rating

The > 50 kA to 100 kA segment led the Power Control Commercial Surge Protection Devices Market with a 41.3% share, supported by strong demand in large commercial facilities, data centers, and industrial establishments where mid-range surge handling capacity aligns with equipment sensitivity and energy-efficiency requirements. The ≤ 50 kA rating accounted for 28.6% share, catering to small commercial applications, while the > 100 kA to 150 kA segment held 20.1% due to its relevance in heavy-duty operations. The > 150 kA class represented 10.0%, mainly serving high-risk and utility-grade electrical networks.

- For instance, Littelfuse offers SPDs below 50 kA tailored for telecom and sensitive electronics in retail settings.

Key Growth Drivers

Rising Commercial Infrastructure Expansion

Rapid global growth in commercial infrastructure such as data centers, industrial parks, healthcare facilities, and smart commercial buildings acts as a major catalyst for the Power Control Commercial Surge Protection Devices Market. Increasing electrical load density, wider use of automation systems, and higher dependency on sensitive electronic equipment accelerate the need for advanced surge protection solutions. Regulatory frameworks mandating electrical safety and system reliability further reinforce adoption. As businesses pursue uninterrupted operations and equipment longevity, surge protection becomes an indispensable component of modern commercial electrical architecture.

- For instance, DITEK surge protection devices protected Envera’s security systems during a lightning strike, preventing camera damage and enabling quick system recovery with minimal wiring adjustments.

Growing Frequency of Power Disturbances and Grid Instability

The market benefits significantly from the rising incidence of grid disturbances, voltage fluctuations, lightning strikes, and transient overvoltages that threaten commercial electrical systems. Aging power infrastructure in many regions, combined with elevated demand peaks from industrial clusters, increases vulnerability to surge events. Businesses prioritize surge protection to prevent downtimes, reduce equipment repair costs, and safeguard critical assets such as HVAC controls, networking systems, and automation devices. This heightened risk environment drives strong uptake of high-performance surge protection devices across medium and large commercial establishments.

- For instance,Siemens’ deployment of its Sivacon surge protection solutions in industrial facilities, which helped minimize costs related to voltage fluctuations and equipment downtime in multiple projects across Europe.

Increasing Adoption of IoT, Automation, and Electronic Control Systems

The rapid integration of IoT-enabled equipment, building automation systems, cloud-connected devices, and smart energy solutions elevates the demand for reliable surge protection. Modern commercial facilities depend on sophisticated electronic components that are highly sensitive to even minor voltage disturbances. Surge protection devices support system continuity, reduce lifecycle costs, and enhance operational efficiency by preventing equipment failure. The adoption of Industry 4.0, smart factories, and digitally managed commercial spaces amplifies the necessity for robust surge suppression, making this a pivotal driver for long-term market expansion.

Key Trends & Opportunities

Shift Toward Smart and Connected Surge Protection Solutions

A major trend in the market is the emergence of smart surge protection devices equipped with real-time monitoring, diagnostics, and remote management capabilities. Integration with IoT and cloud platforms enables predictive maintenance and provides insights into surge activity, device health, and electrical anomalies. This transition supports data-driven asset management in commercial buildings and industrial facilities, improving uptime and reducing maintenance costs. As organizations digitize facility infrastructure, smart surge protection becomes a high-value opportunity aligned with intelligent building development and advanced energy management strategies.

- For instance, Techwin’s intelligent lightning surge protection device integrates IoT big data technology with lightning protection modules to monitor transient currents, grounding resistance, and temperature anomalies in real time.

Growing Opportunity in High-Capacity and Customizable Industrial Surge Protection

Expanding industrial automation and electrification is creating substantial opportunities for high-capacity surge protection devices engineered for demanding environments. Industries such as manufacturing, logistics, utilities, and petrochemical operations require tailored surge solutions that accommodate heavy electrical loads, harmonics, and operational volatility. Customizable products with enhanced robustness, modular designs, and compliance with international standards gain preference. As industrial plants modernize electrical networks and upgrade legacy equipment, the need for high-performance, application-specific surge protection solutions accelerates, opening new growth avenues for manufacturers.

- For instance, Schneider Electric’s Acti 9 surge protective devices offer modular integration and compliance with IEC standards, supporting advanced electrical network modernization.

Key Challenges

High Installation and Maintenance Costs in Large Commercial Facilities

A significant challenge arises from the high upfront installation costs and ongoing maintenance expenditures associated with deploying surge protection across large commercial and industrial establishments. Multi-layered protection architectures, covering service entrances, distribution panels, and point-of-use systems, require substantial capital investment. Some businesses delay implementation due to budget constraints, especially in developing markets. Additionally, periodic inspections, replacements, and compliance upgrades increase ownership costs, limiting adoption among cost-sensitive commercial segments despite long-term reliability benefits.

Lack of Awareness and Limited Standardization Across Developing Regions

In many emerging markets, limited awareness about surge risks and inconsistent enforcement of electrical safety standards restrict market penetration. Commercial enterprises often underestimate the consequences of transient surges, leading to inadequate protection for critical equipment. The absence of clear regulatory frameworks and standardized guidelines further complicates product selection and proper system design. This knowledge gap results in fragmented adoption, improper installation practices, and insufficient protection measures, constraining broader market development and slowing the uptake of advanced surge protection technologies.

Regional Analysis

North America

North America held 35.4% share of the Power Control Commercial Surge Protection Devices Market, supported by strong adoption across data centers, industrial automation facilities, commercial complexes, and technologically advanced infrastructure. The region benefits from stringent electrical safety regulations, widespread integration of smart building systems, and rapid modernization of grid networks. High surge exposure driven by extreme weather events further accelerates deployment. The United States leads demand, driven by hyperscale data center investments, while Canada and Mexico expand adoption through growing commercial construction and increased emphasis on power reliability and equipment protection.

Europe

Europe accounted for 28.7% share of the market, driven by robust regulatory compliance, rapid digital transformation, and increased investments in commercial energy management systems. Industrialized economies such as Germany, the United Kingdom, France, and Italy prioritize surge protection to safeguard automation equipment, renewable energy integration points, and mission-critical commercial assets. The region’s focus on sustainable infrastructure and electrification initiatives enhances demand for advanced surge suppression technologies. Modernization of commercial buildings, rising use of electronic control systems, and EU-driven safety mandates continue to support steady market growth across Western, Central, and Northern Europe.

Asia Pacific

Asia Pacific captured 24.9% share, emerging as one of the fastest-growing regions due to large-scale urbanization, rapid commercial construction, and expansion of manufacturing and industrial facilities. China, Japan, South Korea, and India drive significant demand, supported by high electrical load density and elevated grid instability in developing markets. Growing adoption of building automation, data centers, and sensitive electronic systems enhances the need for reliable surge protection. Government-led infrastructure upgrades, industrial modernization, and increasing awareness of surge-related asset damage strengthen long-term opportunities, positioning Asia Pacific as a major growth engine for the market.

Latin America

Latin America represented 6.4% share of the market, with demand driven by commercial infrastructure expansion, increased industrial electrification, and rising sensitivity to voltage fluctuations across business environments. Brazil, Mexico, Chile, and Colombia lead adoption as commercial and industrial facilities incorporate automation and digital control systems requiring stable electrical performance. While economic constraints affect large-scale deployments, growing emphasis on electrical safety and equipment protection supports gradual market penetration. Investments in smart commercial buildings, telecommunications infrastructure, and distributed energy systems continue to create opportunities for surge protection solutions across the region.

Middle East & Africa

The Middle East & Africa held 4.6% share, supported by commercial expansion in sectors such as oil and gas, construction, hospitality, and utilities. Countries including the UAE, Saudi Arabia, South Africa, and Qatar invest in modern electrical systems, smart buildings, and industrial automation that require reliable surge protection. High exposure to lightning events in parts of Africa and grid instability in developing regions further accelerates adoption. While market maturity varies, increasing infrastructure spending, rising deployment of electronic control systems, and regulatory improvements are strengthening demand for commercial-grade surge protection technologies.

Market Segmentations:

By Technology:

By Power Rating:

- > 50 kA to 100 kA

- ≤ 50 kA

- > 100 kA to 150 kA

- > 150 kA

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Power Control Commercial Surge Protection Devices Market features major participants such as Schneider Electric, ABB, Belkin, Eaton, Emerson Electric, Hubbell, Intermatic, JMV, Legrand, and Littelfuse. These companies strengthen their market position by expanding product portfolios, enhancing surge protection performance, and integrating smart monitoring capabilities into commercial-grade systems. Vendors focus on developing high-capacity, modular, and UL-compliant solutions that meet the rising demand across commercial buildings, data centers, and industrial facilities. Strategic initiatives—including technology upgrades, partnerships with electrical contractors, and investments in digital diagnostics—enable suppliers to differentiate in a crowded market. Continuous innovation in Type 1, Type 2, and high-kA surge protection technologies further supports long-term competitiveness, while global expansion and aftersales service networks reinforce customer retention.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Intermatic

- Belkin

- Legrand

- Eaton

- Hubbell

- JMV

- Littelfuse

- Schneider Electric

- ABB

- Emerson Electric

Recent Developments

- In October 2025, Schneider Electric launched a new “plug-and-play” surge protection device for commercial applications.

- In April 2025, Eaton acquired Fibrebond, a modular electrical and data-center infrastructure provider, strengthening Eaton’s capability to deliver engineered power-distribution and surge-protection solutions.

Report Coverage

The research report offers an in-depth analysis based on Technology, Power Rating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as commercial facilities increase investments in electrical safety and equipment protection.

- Demand will rise with expanding data centers, automation systems, and smart commercial infrastructure.

- Surge protection adoption will strengthen as grid instability and transient events become more frequent.

- Smart surge protection devices with real-time monitoring will gain wider acceptance across large commercial sites.

- High-capacity solutions will see strong uptake in industrial and utility environments requiring advanced protection.

- Regulatory compliance and safety standards will continue to push commercial buildings toward multi-level surge architectures.

- Integration of IoT and digital diagnostics will enhance predictive maintenance and operational reliability.

- Manufacturers will focus on modular, scalable designs to support customized commercial applications.

- Emerging regions will adopt surge protection faster due to infrastructure modernization and rising awareness.

- Sustainability goals and energy-efficient building upgrades will reinforce long-term market expansion.