Market Overview

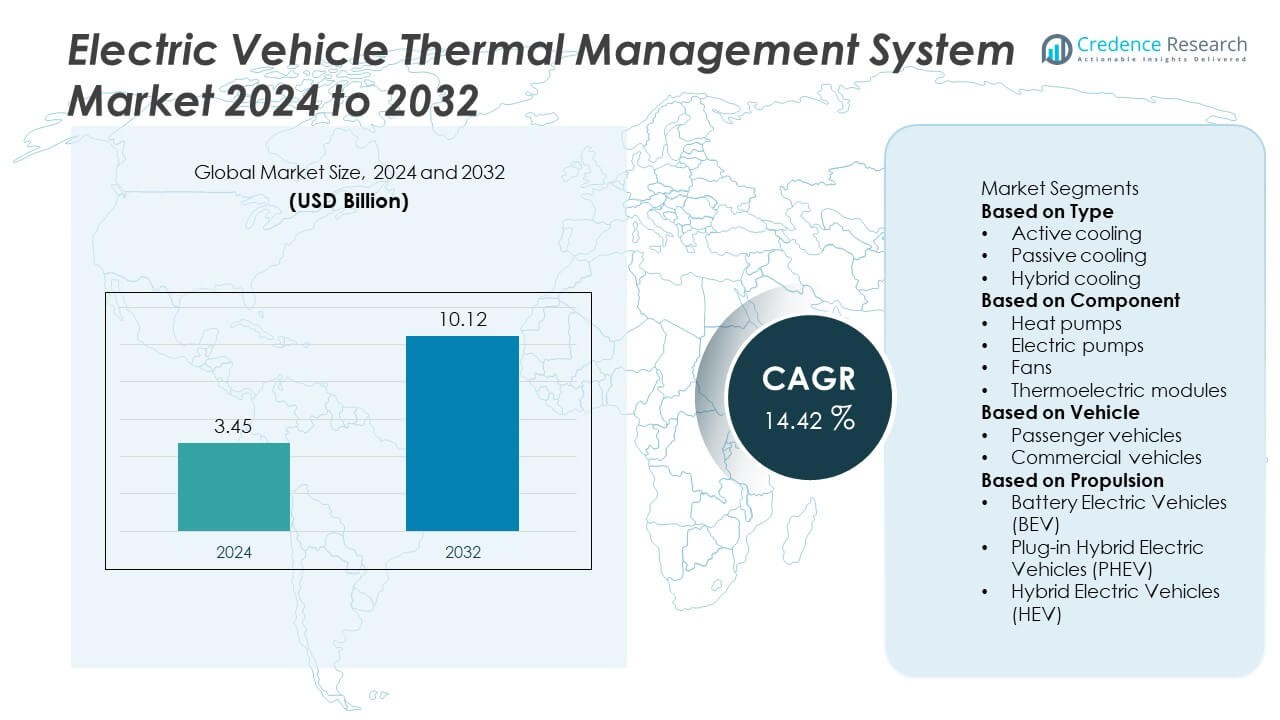

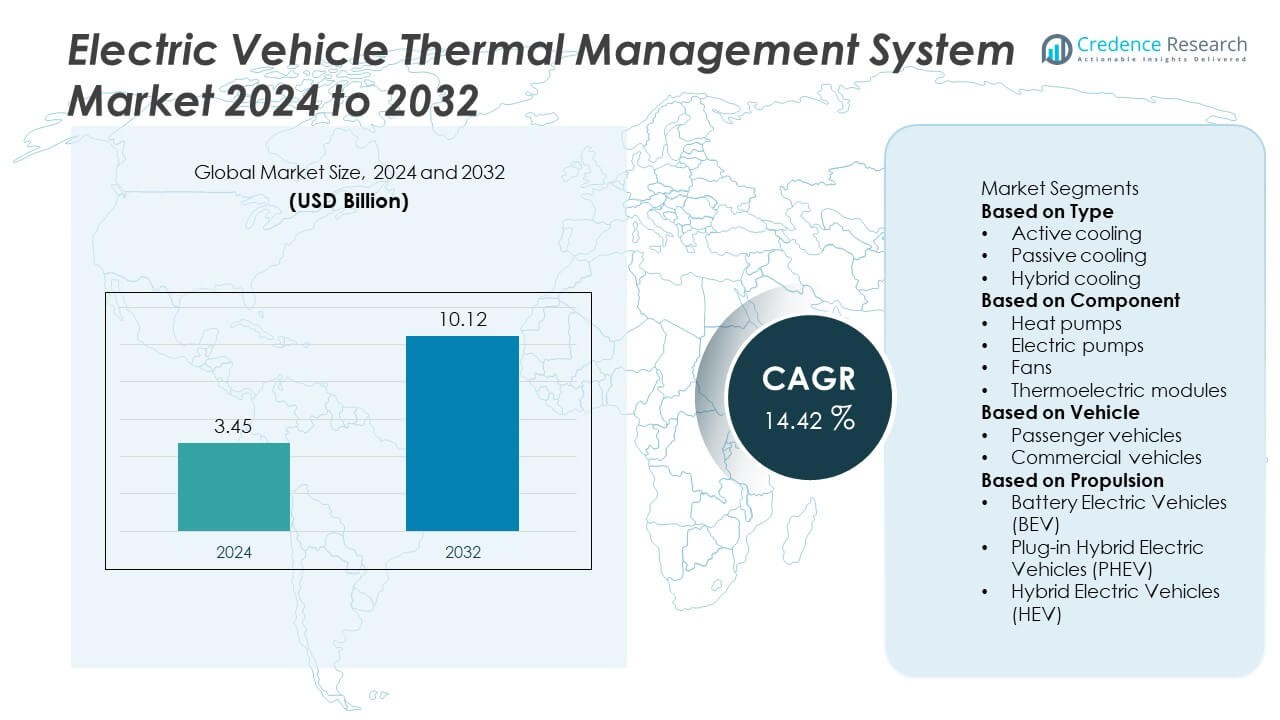

The Electric Vehicle Thermal Management System market was valued at USD 3.45 billion in 2024 and is projected to reach USD 10.12 billion by 2032, growing at a CAGR of 14.42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Thermal Management System Market Size 2024 |

USD 3.45 Billion |

| Electric Vehicle Thermal Management System Market, CAGR |

14.42% |

| Electric Vehicle Thermal Management System Market Size 2032 |

USD 10.12 Billion |

The electric vehicle thermal management system market is led by major players such as Hanon Systems, BorgWarner, LG Chem, Valeo SA, Gentherm, Denso, Mahle, Continental, Robert Bosch, and Grayson Thermal Systems. These companies dominate through innovations in liquid cooling, heat pump integration, and advanced phase-change materials to enhance EV performance and battery efficiency. They collaborate closely with leading automakers to deliver energy-optimized, compact, and intelligent thermal systems. Asia Pacific led the market with a 35% share in 2024, driven by large-scale EV production and strong government support, followed by Europe with a 33% share, supported by strict emission regulations, and North America with a 29% share, propelled by expanding electric vehicle infrastructure and consumer adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global electric vehicle thermal management system market was valued at USD 3.45 billion in 2024 and is projected to reach USD 10.12 billion by 2032, growing at a CAGR of 14.42% during the forecast period.

- Market growth is driven by rising EV production, technological advancements in battery cooling, and government incentives supporting electric mobility.

- Key trends include the adoption of liquid cooling, heat pump integration, and AI-enabled smart thermal management for enhanced energy efficiency.

- The market is competitive, with major players such as Hanon Systems, BorgWarner, LG Chem, and Valeo SA focusing on innovation, strategic collaborations, and system integration with EV manufacturers.

- Asia Pacific led with a 35% share, followed by Europe at 33% and North America at 29%, while the active cooling segment dominated with a 54% share due to its effectiveness in maintaining optimal battery and motor temperatures.

Market Segmentation Analysis:

By Type

The active cooling segment dominated the electric vehicle thermal management system market with a 54% share in 2024, driven by its efficiency in maintaining optimal battery and motor temperatures during high-performance operations. Active systems use pumps and refrigerants to regulate heat, ensuring better vehicle range and battery life. The increasing production of high-performance EVs and advancements in liquid-cooling technologies are strengthening this segment’s leadership. Passive cooling systems remain preferred for low-cost or small EVs, while hybrid systems combining both methods are gaining traction for next-generation electric vehicles.

- For instance, BorgWarner developed a high-voltage coolant heater system rated at 800 V and 10 kW output, supporting battery and power electronics thermal regulation under sub-zero conditions. The unit enables thermal stability across wide temperature ranges and integrates CAN-based smart control for optimized coolant flow management.

By Component

The heat pumps segment held a 39% share in 2024, emerging as the leading component in the electric vehicle thermal management system market. Heat pumps efficiently manage cabin and battery temperatures using reversible refrigerant cycles, reducing energy consumption compared to traditional resistive heating systems. Their growing integration in mid- to high-range EV models by manufacturers such as Tesla, Hyundai, and BMW supports strong demand. Electric pumps and fans also contribute significantly, enhancing system circulation and cooling performance, while thermoelectric modules are gaining interest for precise temperature control in compact EV architectures.

- For instance, Hanon Systems’ fourth-generation heat pump integrates a parallel heat-source recovery mechanism capable of utilizing waste heat from the motor and battery, as well as external air.

By Vehicle

The passenger vehicle segment accounted for a 71% share in 2024, making it the dominant category in the electric vehicle thermal management system market. Increasing adoption of electric passenger cars globally, supported by government incentives and infrastructure expansion, drives segment growth. Manufacturers are integrating advanced thermal management systems to improve comfort, efficiency, and battery performance. The rise in compact EV models with integrated battery-cooling systems further boosts demand. Commercial electric vehicles, though smaller in share, are expected to grow rapidly due to fleet electrification and rising logistics sector adoption.

Key Growth Drivers

Rising Electric Vehicle Adoption Worldwide

The rapid increase in global electric vehicle (EV) adoption is a primary driver for the electric vehicle thermal management system market. As battery performance and longevity depend on effective temperature regulation, automakers are prioritizing advanced thermal solutions. Governments promoting EV adoption through incentives and emission regulations further boost system demand. The growth of EV fleets in passenger and commercial segments increases the need for efficient thermal control to ensure safety, energy efficiency, and improved vehicle range under varying climatic conditions.

- For instance, Denso Corporation introduced a high-efficiency heat dissipation module for EV inverters capable of reducing semiconductor temperatures by 40 °C under peak load. The system uses a microchannel structure for improved refrigerant flow and ensures stable operation in battery packs exceeding 800 V architecture, enabling consistent performance in high-speed EV platforms.

Technological Advancements in Battery Cooling Systems

Continuous innovation in battery cooling technologies is significantly driving market growth. Liquid cooling and phase-change materials are replacing conventional air-based systems to enhance heat transfer efficiency. Manufacturers are investing in compact, lightweight designs with integrated sensors for precise temperature monitoring. Advanced cooling architectures improve energy utilization, reduce degradation, and extend battery life. As battery capacity and charging speeds rise, efficient cooling solutions become crucial for maintaining thermal stability and performance in modern EV platforms.

- For instance, MAHLE GmbH has developed advanced battery cooling technologies, including modular and bionic liquid-cooling plates. Its latest innovations enhance performance by up to 10% and reduce pressure loss by up to 20% compared to conventional designs, contributing to faster and more efficient charging.

Government Policies Promoting Energy Efficiency

Stringent government regulations and environmental policies are accelerating the demand for efficient EV thermal management systems. Initiatives such as zero-emission mandates, energy-efficiency standards, and carbon reduction goals compel automakers to optimize vehicle performance through advanced temperature control technologies. Thermal management contributes to compliance with emission-free mobility targets by improving EV efficiency. Subsidies and R&D incentives further encourage innovation in thermal system designs, fostering growth in both developed and emerging automotive markets worldwide.

Key Trends & Opportunities

Integration of Smart and Connected Thermal Management Systems

Smart thermal management systems using IoT and AI are transforming EV efficiency. These systems monitor temperature variations in real time and adjust performance dynamically for optimal energy distribution. Predictive algorithms prevent overheating and enhance system reliability, especially during fast charging. Integration with vehicle telematics and battery management systems allows seamless control, reducing maintenance costs and improving overall performance. As EV digitalization advances, smart thermal systems will play a vital role in maximizing range and energy optimization.

- For instance, Continental AG offers advanced thermal management solutions for electric vehicles, which helps optimize battery performance, increase range, and extend battery life. Their portfolio includes technologies such as Coolant Flow Control Valves, which manage heating and coolant circuits.

Growing Use of Heat Pumps and Phase-Change Materials

The increasing use of heat pumps and phase-change materials (PCMs) is a major opportunity in EV thermal management. Heat pumps efficiently regulate both cabin and battery temperatures while minimizing power consumption. PCMs absorb and release heat during operation, maintaining optimal thermal balance without excessive energy draw. These innovations improve battery performance and extend driving range. Their integration in next-generation electric vehicles supports manufacturers’ efforts to enhance comfort, energy efficiency, and sustainability in harsh temperature environments.

- For instance, Valeo SA developed its R-744 Smart Heat Pump Dual system, which offers up to 7.8 kW of heating capacity at −20 °C. The system uses advanced algorithms and heat recovery from the battery and powertrain to optimize energy consumption and maintain consistent cabin comfort and battery performance.

Key Challenges

High System Costs and Integration Complexity

The development and integration of advanced thermal management systems significantly increase vehicle manufacturing costs. Components like heat exchangers, sensors, and pumps require precision engineering and add weight to the vehicle. Integrating multiple subsystems—such as battery, motor, and cabin cooling—demands complex design and control coordination. These challenges increase production time and maintenance expenses. For cost-sensitive markets, balancing performance with affordability remains a key obstacle, requiring continuous R&D and scalable manufacturing solutions.

Thermal Management in Fast-Charging and Extreme Conditions

Rapid charging and extreme environmental conditions pose major challenges for thermal management systems. Fast charging generates high heat within battery cells, increasing the risk of degradation or safety hazards if not managed effectively. Similarly, cold climates reduce system efficiency and battery performance. Ensuring stable operation across temperature extremes requires advanced liquid cooling and smart control technologies. Manufacturers must develop robust, adaptive systems capable of maintaining consistent performance without compromising safety or energy efficiency.

Regional Analysis

North America

North America held a 29% share of the electric vehicle thermal management system market in 2024, driven by rising EV production and strong adoption of advanced battery technologies. The United States leads the region due to government incentives promoting electric mobility and investments in fast-charging infrastructure. Manufacturers are focusing on integrating smart cooling and heating solutions to enhance battery efficiency and performance. Collaborations between automakers and thermal system suppliers are accelerating innovation. Continuous growth in electric SUVs and light commercial vehicles further supports market expansion across North America’s well-established automotive ecosystem.

Europe

Europe accounted for a 33% share of the electric vehicle thermal management system market in 2024, supported by stringent emission regulations and widespread EV adoption. Leading countries such as Germany, France, and the United Kingdom are investing heavily in electric mobility and battery efficiency technologies. The region’s focus on sustainability and carbon neutrality drives demand for advanced thermal management systems with minimal energy losses. Automakers are adopting integrated cooling architectures and heat pumps to enhance performance in diverse climates. Growing EV infrastructure and supportive EU green policies continue to position Europe as a key innovation hub.

Asia Pacific

Asia Pacific dominated the electric vehicle thermal management system market with a 35% share in 2024, making it the fastest-growing regional segment. China, Japan, and South Korea lead the region, supported by large-scale EV manufacturing, government subsidies, and strong local supply chains. Increasing battery production and investments in high-capacity EV platforms are boosting demand for advanced thermal control systems. Local manufacturers are focusing on liquid cooling and heat recovery technologies to enhance energy efficiency. Rapid urbanization, growing consumer acceptance of EVs, and regional electrification initiatives sustain Asia Pacific’s leadership in the global market.

Latin America

Latin America captured a 2% share of the electric vehicle thermal management system market in 2024, driven by emerging adoption of EV technologies in Brazil, Mexico, and Chile. Government policies promoting electric mobility and rising investments in automotive infrastructure are fueling gradual growth. The demand for efficient battery cooling systems is increasing as regional manufacturers introduce hybrid and electric models. However, limited charging infrastructure and high system costs remain barriers to widespread adoption. Ongoing policy reforms and private investments are expected to strengthen regional competitiveness in the coming years.

Middle East & Africa

The Middle East & Africa region accounted for a 1% share of the electric vehicle thermal management system market in 2024, reflecting its early-stage adoption. The UAE, Saudi Arabia, and South Africa are leading markets due to growing interest in electric mobility and sustainable transportation initiatives. Expansion of smart city projects and renewable energy integration supports future growth potential. However, hot climatic conditions present challenges for battery cooling systems, driving demand for robust and high-efficiency thermal solutions. Increasing partnerships between automakers and local suppliers are expected to enhance market penetration over the forecast period.

Market Segmentations:

By Type

- Active cooling

- Passive cooling

- Hybrid cooling

By Component

- Heat pumps

- Electric pumps

- Fans

- Thermoelectric modules

By Vehicle

- Passenger vehicles

- Commercial vehicles

By Propulsion

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Hybrid Electric Vehicles (HEV)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The electric vehicle thermal management system market is highly competitive, featuring key players such as Hanon Systems, BorgWarner, LG Chem, Valeo SA, Gentherm, Denso, Mahle, Continental, Robert Bosch, and Grayson Thermal Systems. These companies compete through technological innovation, product efficiency, and strategic partnerships with leading electric vehicle manufacturers. Major players focus on developing integrated thermal management solutions that optimize battery cooling, cabin comfort, and power electronics performance. Continuous investment in research and development supports advancements in liquid cooling, heat pumps, and phase-change materials. Collaborations with OEMs help ensure system compatibility with next-generation EV platforms. Regional manufacturing expansion and localized supply chains strengthen their market presence. Additionally, the integration of AI-enabled monitoring systems and energy-efficient designs is emerging as a key differentiator, positioning these companies to capitalize on the global transition toward high-performance, sustainable electric vehicles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hanon Systems

- BorgWarner

- LG Chem

- Valeo SA

- Gentherm

- Denso

- Mahle

- Continental

- Robert Bosch

- Grayson Thermal Systems

Recent Developments

- In October 2025, DENSO Corporation said its optimized heat‐dissipation structure for EV power modules achieved approximately 40 % better cooling performance versus typical market trends.

- In September 2025, Valeo SA secured a contract to supply its Dual Layer HVAC system to a leading Chinese automaker; the system is credited with delivering an energy gain of up to 25 % in cabin climate control.

- In July 2025, BorgWarner secured contracts to supply high-voltage coolant heater (HVCH) technology to two major OEMs for plug-in hybrid platforms starting production in 2028.

- In August 2024, Hanon Systems announced its 4th-generation heat pump system for EVs, introducing a parallel heat-source recovery method that uses waste heat from both the motor and battery.

Report Coverage

The research report offers an in-depth analysis based on Type, Component, Vehicle, Propulsion and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for electric vehicle thermal management systems will rise with increasing global EV adoption.

- Liquid cooling and heat pump technologies will dominate future system designs.

- Integration of AI and IoT will enhance real-time monitoring and predictive temperature control.

- Manufacturers will focus on lightweight and compact designs to improve vehicle efficiency.

- Smart thermal systems will become standard in next-generation electric cars and commercial fleets.

- Battery safety and longevity concerns will drive innovation in advanced cooling materials.

- Asia Pacific will maintain leadership, supported by strong EV manufacturing growth.

- Europe will expand through strict emission norms and adoption of high-efficiency systems.

- North America will see growth from infrastructure investments and premium EV launches.

- Partnerships between OEMs and component suppliers will strengthen to enhance system integration and cost efficiency.