Market Overview

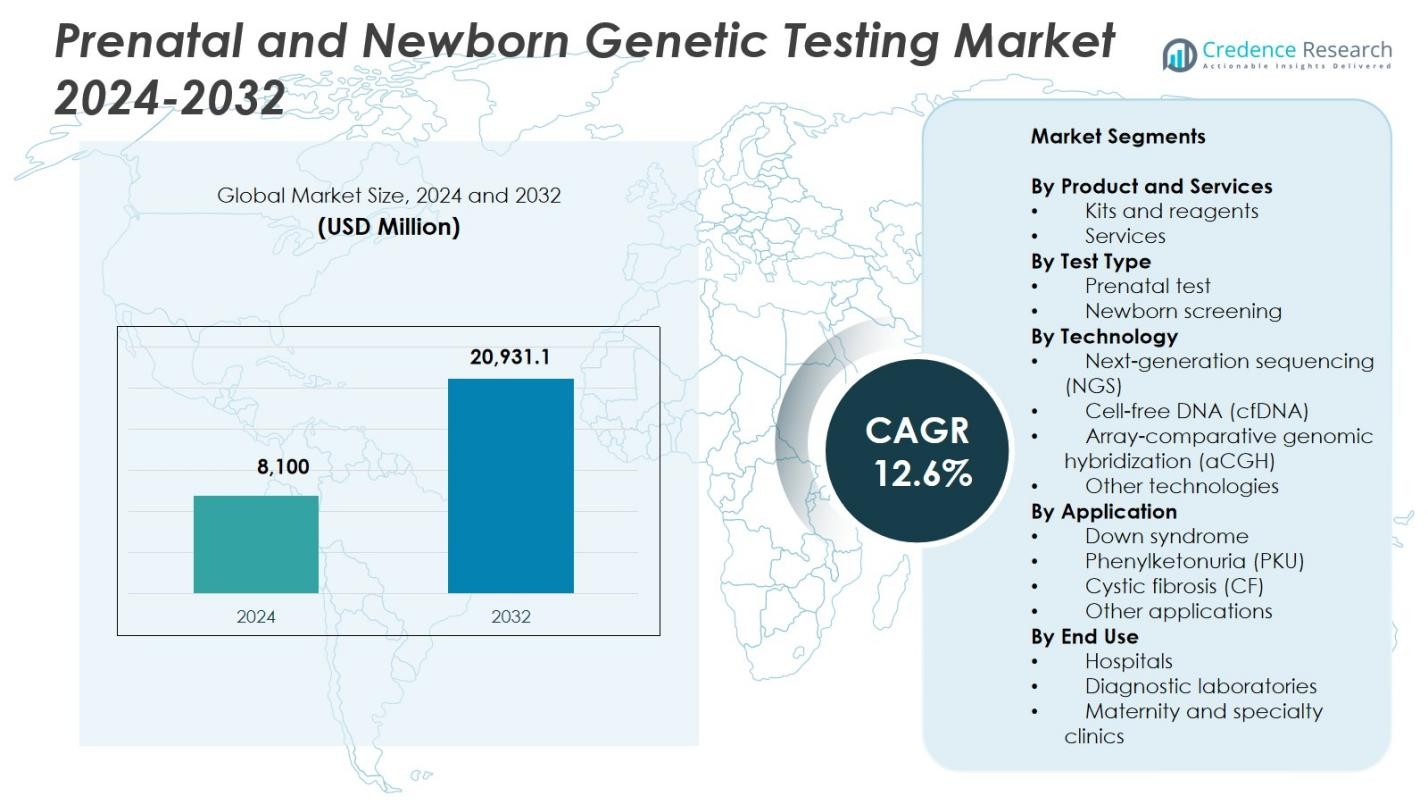

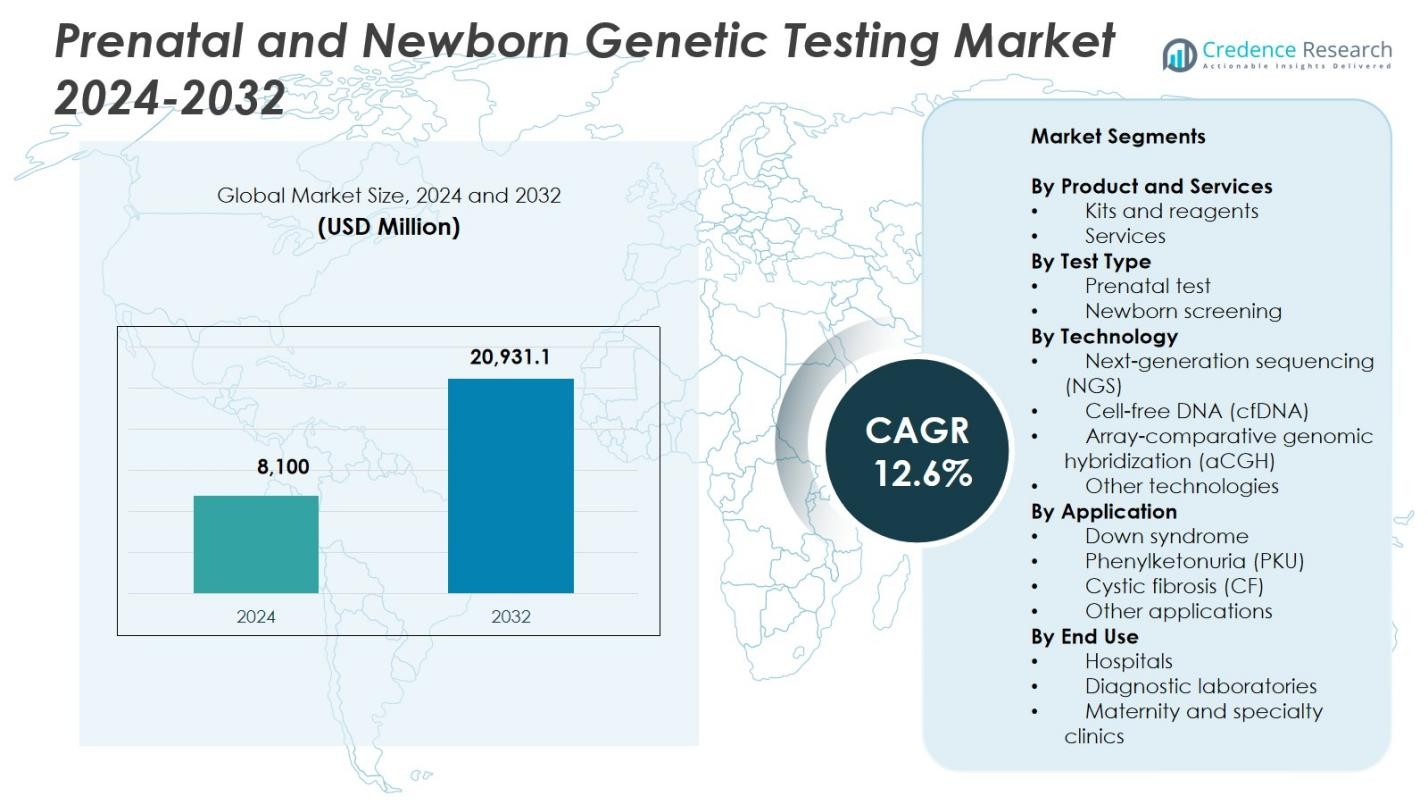

Prenatal and Newborn Genetic Testing Market size was valued at USD 8,100 Million in 2024 and is anticipated to reach USD 20,931.1 Million by 2032, at a CAGR of 12.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Prenatal and Newborn Genetic Testing Market Size 2024 |

USD 8,100 Million |

| Prenatal and Newborn Genetic Testing Market, CAGR |

12.6% |

| Prenatal and Newborn Genetic Testing Market Size 2032 |

USD 20,931.1 Million |

Prenatal and Newborn Genetic Testing Market features leading players such as Illumina, Agilent, Eurofins, BGI Group, Fulgent Genetics, BillionToOne, Centogene, Genes2Me, Genelab (Clevergene), and Aetna, all contributing to advancements in cfDNA testing, sequencing platforms, and newborn screening panels. These companies continue to expand technological capabilities and strengthen global service networks to meet rising clinical demand. North America led the Prenatal and Newborn Genetic Testing Market with a 41.6% share in 2024, supported by strong adoption of NIPT and robust genomic infrastructure, while Europe and Asia-Pacific followed as major regions with increasing integration of advanced prenatal and newborn testing solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Prenatal and Newborn Genetic Testing Market reached USD 8,100 Million in 2024 and will grow USD 20,931.1 at a CAGR of 12.6% through 2032.

- Market growth is driven by rising NIPT adoption, increasing incidence of genetic disorders, and strong demand for early-risk assessment, with services holding a 61.4% segment share.

- Key trends include rapid expansion of cfDNA-based testing, broader carrier screening adoption, and integration of AI-enabled genomic interpretation across clinical workflows.

- Leading players such as Illumina, Eurofins, Agilent, BGI Group, and Fulgent Genetics strengthen market presence through technological innovation, partnerships, and expanded newborn screening portfolios.

- North America led with a 41.6% regional share, followed by Europe at 29.4% and Asia-Pacific at 22.8%, while regions like Latin America and Middle East & Africa show rising demand despite infrastructure and affordability restraints.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product & Services:

The Prenatal and Newborn Genetic Testing Market shows strong dominance of services, which accounted for 61.4% share in 2024, driven by the growing adoption of advanced diagnostic testing provided through clinical laboratories and hospital networks. While kits and reagents continue to gain traction for decentralized workflows, service-based models expand faster due to heightened demand for non-invasive testing, rapid turnaround times, and integrated genetic counseling. The rise of high-throughput genomic platforms and expanding reimbursement support further accelerates service utilization, positioning this segment as the primary revenue contributor across developed and emerging markets.

- For instance, Labcorp provides MaterniT 21 PLUS, a noninvasive prenatal test using massively parallel sequencing to analyze chromosomal regions for trisomies 21, 18, 13, sex chromosome aneuploidies, and select microdeletions, with results typically in 3-5 days.

By Test Type:

The prenatal test segment led the Prenatal and Newborn Genetic Testing Market with 58.7% share in 2024, supported by the increasing preference for non-invasive prenatal testing (NIPT), early detection of chromosomal abnormalities, and rising maternal age worldwide. Enhanced accuracy of fetal aneuploidy detection and expanding clinical guidelines recommending prenatal screening reinforce segment growth. Newborn screening remains essential for metabolic and genetic disorder identification, yet prenatal tests continue to dominate due to technological advancement, broader clinical acceptance, and the growing shift toward early-risk assessment to guide pregnancy management decisions.

- For instance, Natera launched Fetal Focus in August 2025, a NIPT screening fetuses for inherited conditions like cystic fibrosis via maternal blood analysis. Early EXPAND trial data (n=101) showed 91% sensitivity, detecting all 5 homozygous variant cases.

By Technology:

The cell-free DNA (cfDNA) technology segment dominated the Prenatal and Newborn Genetic Testing Market with 46.3% share in 2024, propelled by its high sensitivity, non-invasive nature, and ability to detect fetal chromosomal abnormalities accurately from maternal blood. cfDNA’s rapid adoption reflects clinician confidence, expanding reimbursement coverage, and increasing availability of advanced NIPT panels. Next-generation sequencing (NGS) also shows strong growth due to its utility in rare disease diagnostics and expanded genomic profiling. However, cfDNA remains the leading choice due to patient safety, minimal procedural risk, and strong clinical performance across diverse populations.

Key Growth Drivers

Expanding Adoption of Non-Invasive Prenatal Testing (NIPT)

The rising global preference for non-invasive prenatal testing significantly accelerates growth in the Prenatal and Newborn Genetic Testing Market. NIPT enables early and highly accurate detection of chromosomal abnormalities using maternal blood, eliminating risks associated with invasive procedures. Increasing awareness among expectant parents, improved test sensitivity, and broader availability of cfDNA-based platforms continue to elevate demand. Healthcare providers increasingly integrate NIPT into routine prenatal care, and expanding reimbursement coverage strengthens adoption across both developed and emerging regions, fueling sustained market expansion.

- For instance, Natera introduced a cfDNA-based fetal RhD NIPT test to aid OB/GYN physicians amid a nationwide shortage of Rho(D) immune globulin therapy.

Rising Incidence of Genetic and Congenital Disorders

Growing cases of chromosomal abnormalities, metabolic disorders, and hereditary conditions contribute strongly to market growth. Increasing maternal age, environmental risk factors, and lifestyle changes globally have heightened the prevalence of fetal genetic disorders, driving the need for early detection technologies. Governments and healthcare bodies promote newborn screening programs as part of national health policies, further widening testing access. Continuous improvements in genomic technologies, coupled with the clinical push for early diagnosis and intervention, reinforce the demand for comprehensive prenatal and newborn genetic testing solutions.

- For instance, Myriad Genetics’ Prequel Prenatal Screen with AMPLIFY technology enables reliable non-invasive prenatal testing results as early as eight weeks gestation.

Advancements in Genomic Technologies and Testing Accuracy

Technological innovation plays a central role in expanding the Prenatal and Newborn Genetic Testing Market. High-throughput sequencing, refined cfDNA assays, improved bioinformatics pipelines, and advanced microarray platforms enhance test accuracy, speed, and clinical reliability. These innovations empower clinicians to detect a broader spectrum of genetic abnormalities with greater precision. Integration of AI-driven analytics and automation also reduces turnaround time and operational complexity, enabling laboratories to manage higher test volumes. As technology becomes more accessible and cost-efficient, adoption accelerates across healthcare ecosystems globally.

Key Trends & Opportunities

Growing Shift Toward Personalized Maternal-Fetal Care

A significant trend shaping the market is the movement toward personalized care models driven by genomics. Expectant parents increasingly seek customized risk assessments, prompting providers to adopt expanded carrier screening, targeted gene panels, and integrated maternal health profiling. This shift opens opportunities for companies offering precision diagnostics and AI-enabled genomic interpretation tools. With healthcare systems prioritizing individualized pregnancy management, demand grows for tests that deliver comprehensive insights—not only for chromosomal disorders but also for hereditary predispositions influencing long-term newborn health.

- For instance, CENTOGENE’s CentoScreen provides expanded carrier screening with ≥99% coverage of 332 genes for autosomal recessive and X-linked diseases, offered in solo, paired, or duo formats to assess couples before or during pregnancy.

Expansion of Screening Programs in Emerging Markets

Emerging economies present substantial growth opportunities as governments strengthen public health infrastructure and implement nationwide prenatal and newborn screening programs. Increasing insurance coverage, rising healthcare expenditure, and improving diagnostic laboratory networks support wider access to advanced genetic testing. Companies expanding into Asia-Pacific, Latin America, and the Middle East benefit from growing awareness of maternal-fetal health and rising birth rates. Strategic collaborations, localized manufacturing, and affordable test offerings further accelerate adoption, positioning these regions as high-potential markets for long-term expansion.

- For instance, MGI Tech partnered with Genos Médica in Mexico to deploy the DNBSEQ-T7 ultra-high-throughput genetic sequencer and MGISP-960 automated sample preparation system, enabling faster workflows for genetic testing amid rising hereditary disease diagnostics needs.

Key Challenges

High Testing Costs and Limited Reimbursement Accessibility

Despite technological progress, cost barriers remain a significant challenge in the Prenatal and Newborn Genetic Testing Market. High prices for NIPT, sequencing-based tests, and specialized newborn screening panels often limit uptake in regions with insufficient reimbursement structures. Many healthcare systems still classify advanced genetic tests as optional, creating financial burdens for families. Limited funding in developing markets further constrains adoption. Addressing affordability, expanding insurance coverage, and introducing tiered pricing models are crucial to unlocking broader market penetration.

Ethical, Legal, and Data Privacy Concerns

Ethical considerations, regulatory complexities, and data privacy concerns continue to hinder market growth. Genetic testing raises sensitive questions surrounding informed consent, potential misuse of genetic information, and prenatal decision-making. Variability in global regulatory frameworks complicates compliance for test providers, especially regarding genomic data storage and cross-border data transfer. Public apprehension about genetic discrimination also affects uptake. Strengthening ethical guidelines, enhancing transparency, and implementing secure data management systems are essential to address these concerns and maintain trust in genetic testing services.

Regional Analysis

North America

North America dominated the Prenatal and Newborn Genetic Testing Market with a 41.6% share in 2024, driven by strong adoption of NIPT, advanced genomic infrastructure, and high healthcare spending. The region benefits from widespread availability of cfDNA testing, robust insurance coverage, and the presence of major industry players offering cutting-edge sequencing technologies. Expanding newborn screening mandates across the United States and Canada further strengthen demand. Increasing emphasis on early diagnosis, ongoing product innovation, and rising awareness among expecting parents continue to position North America as the leading revenue contributor throughout the forecast period.

Europe

Europe accounted for 29.4% share in 2024, supported by well-established prenatal screening programs, strong government policies, and rapid integration of genomic testing in maternity care. Countries such as Germany, France, and the United Kingdom demonstrate high uptake of NIPT due to favorable reimbursement frameworks and clinical guideline endorsements. The expansion of national newborn screening initiatives and investment in genomic medicine further drive market growth. Increasing R&D collaborations, regulatory harmonization under IVDR, and rising demand for advanced sequencing workflows reinforce Europe’s growing role in shaping clinical adoption across the region.

Asia-Pacific

Asia-Pacific held 22.8% share in 2024, emerging as the fastest-expanding region due to increasing birth rates, rising healthcare expenditure, and growing awareness of genetic disorders. China, India, Japan, and South Korea show rapid adoption of NIPT and newborn screening as healthcare infrastructure strengthens and test affordability improves. Government-backed genomic initiatives and public–private partnerships accelerate technology penetration. Expanding laboratory networks, rising maternal age, and the introduction of cost-effective sequencing solutions position Asia-Pacific as a high-growth market with significant long-term potential for prenatal and newborn genetic testing providers.

Latin America

Latin America captured 4.1% share in 2024, with expansion driven by improving healthcare access, growing awareness of early genetic diagnosis, and gradual integration of newborn screening programs. Brazil, Mexico, and Argentina lead adoption, supported by increasing availability of molecular diagnostic services and collaborations with international testing companies. Economic constraints limit widespread uptake of advanced NIPT, yet demand continues to rise as affordable testing models and decentralized laboratory networks expand. Government efforts to strengthen maternal and child health programs further enhance the region’s growth trajectory.

Middle East & Africa

The Middle East & Africa region represented 2.1% share in 2024, reflecting a developing but steadily expanding market. Growth is supported by rising investments in healthcare modernization, increasing prevalence of hereditary disorders, and heightened demand for advanced prenatal screening in countries such as the UAE, Saudi Arabia, and South Africa. Limited reimbursement access and uneven diagnostic infrastructure remain challenges; however, expanding private healthcare networks and partnerships with global genomic firms improve access to high-quality testing. Growing awareness of early genetic risk detection continues to accelerate adoption across the region.

Market Segmentations:

By Product and Services

- Kits and reagents

- Services

By Test Type

- Prenatal test

- Newborn screening

By Technology

- Next-generation sequencing (NGS)

- Cell-free DNA (cfDNA)

- Array-comparative genomic hybridization (aCGH)

- Other technologies

By Application

- Down syndrome

- Phenylketonuria (PKU)

- Cystic fibrosis (CF)

- Other applications

By End Use

- Hospitals

- Diagnostic laboratories

- Maternity and specialty clinics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Prenatal and Newborn Genetic Testing Market is defined by the presence of key players such as Illumina, Agilent, Eurofins, BGI Group, Fulgent Genetics, BillionToOne, Centogene, Genes2Me, Genelab (Clevergene), and Aetna. These companies strengthen market growth through continuous technological innovation, diversified test portfolios, and global expansion strategies. Leading firms prioritize advancements in cfDNA-based NIPT, high-throughput sequencing platforms, and expanded newborn screening panels to meet rising clinical demand. Strategic partnerships with hospitals, diagnostic labs, and research institutions enhance market penetration, while acquisitions support portfolio integration and regional scaling. Companies increasingly invest in AI-enabled bioinformatics, rapid reporting systems, and cost-effective testing solutions to improve accuracy and accessibility. Growing emphasis on regulatory compliance and quality certifications further shapes competition, as firms aim to align with evolving clinical standards. The market remains dynamic, with innovation-driven differentiation and service expansion guiding long-term positioning.

Key Player Analysis

- Genes2Me

- Centogene

- Eurofins

- Genelab (Clevergene)

- Illumina

- BillionToOne

- Aetna

- Agilent

- Fulgent Genetics

- BGI Group

Recent Developments

- In March 2025, LaCAR MDx Technologies acquired the newborn screening division of Baebies, Inc. in the U.S., expanding its screening portfolio including lysosomal storage disease detection.

- In August 2025, Sidra Medicine partnered with BeginNGS to launch a genome-based newborn screening research program, aiming to detect hundreds of treatable genetic disorders at birth.

- In November 2025, Myriad Genetics, Inc. presented updated data at the NSGC Annual Conference highlighting enhancements across its prenatal and carrier screening tests, including the FirstGene™ Prenatal Screen and Prequel® Prenatal Screen.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product and Service, Test Type, Technology, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market adoption will accelerate as NIPT becomes a standard component of routine prenatal care across global healthcare systems.

- Advances in cfDNA analysis will expand test accuracy, enabling detection of a broader range of fetal genetic abnormalities.

- Newborn screening programs will continue to widen, driven by government mandates and increasing focus on early-life health outcomes.

- Integration of AI and bioinformatics will enhance interpretation speed and reduce diagnostic errors in complex genomic datasets.

- Affordable test offerings will expand access in emerging markets, supporting faster regional penetration.

- Sequencing-based newborn panels will gain momentum as healthcare providers prioritize early detection of metabolic and rare genetic disorders.

- Partnerships between diagnostic companies and hospitals will intensify to strengthen service delivery and turnaround time.

- Regulatory frameworks will evolve to support test standardization, quality assurance, and ethical data handling.

- Demand for personalized maternal-fetal care will increase, driven by individualized risk assessment models.

- Consolidation through mergers and acquisitions will rise as companies seek technological integration and global scaling.

Market Segmentation Analysis:

Market Segmentation Analysis: