Market Overview

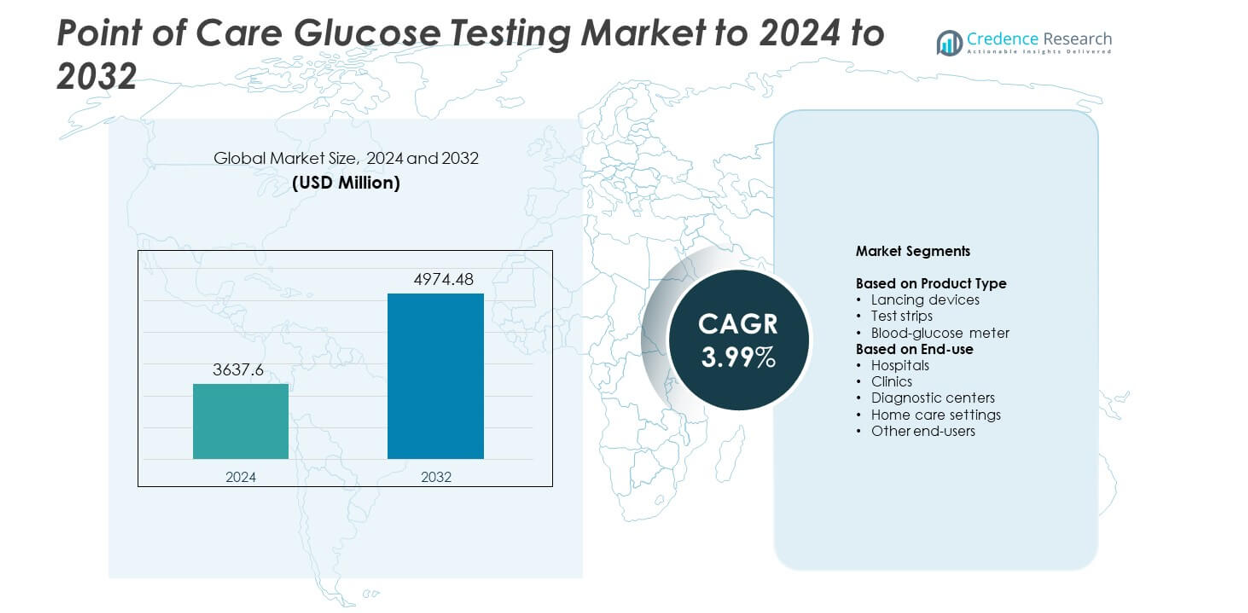

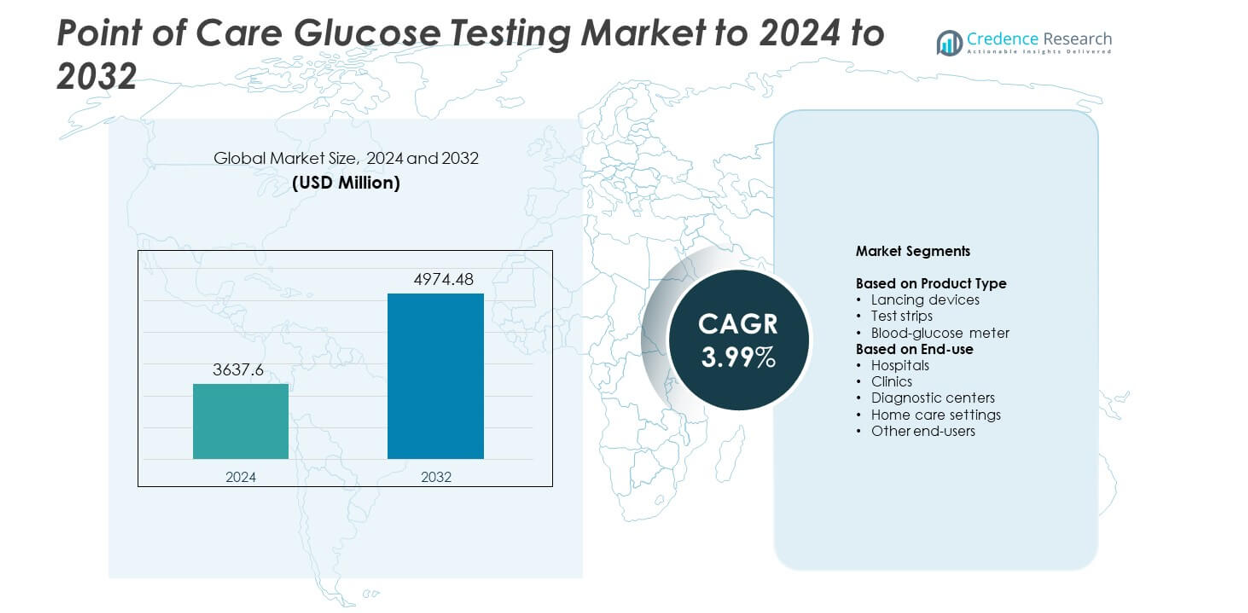

Point of Care Glucose Testing Market size was valued USD 3637.6 million in 2024 and is anticipated to reach USD 4974.48 million by 2032, at a CAGR of 3.99% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Point of Care Glucose Testing Market Size 2024 |

USD 3637.6 million |

| Point of Care Glucose Testing Market, CAGR |

3.99% |

| Point of Care Glucose Testing Market Size 2032 |

USD 4974.48 million |

The Point of Care Glucose Testing Market includes major players such as Dexcom, Inc., Sinocare, Medtronic plc, Abbott Laboratories, Roche, EKF Diagnostics Holdings plc, ACON Laboratories, Inc., Nipro Corporation, Nova Biomedical Corporation, Prodigy Diabetes Care, ARKRAY, Inc., Sanofi, B. Braun Melsungen AG and PHC Holdings. These companies compete through high-accuracy test strips, connected glucose meters and improved digital monitoring tools that support home care and clinical use. North America led the global market in 2024 with about 38% share, driven by strong adoption of self-monitoring devices, advanced reimbursement systems and high diabetes prevalence.

Market Insights

- The Point of Care Glucose Testing Market reached USD 3637.6 million in 2024 and is projected to hit USD 4974.48 million by 2032, growing at a CAGR of 3.99%.

- Rising diabetes cases and strong adoption of self-monitoring tools drive steady demand, with test strips holding about 58% share as the dominant segment.

- Key trends include rapid growth in connected glucose meters, digital reporting features and wider use of minimally invasive sampling options in home care settings.

- Competition intensifies as leading companies innovate in accuracy, strip quality and connectivity while expanding into emerging regions with affordable devices.

- North America led the market with about 38% share in 2024, followed by Europe at nearly 29% and Asia Pacific at around 23%, supported by strong screening programs and expanding home-based monitoring.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Test strips held the dominant position in 2024 with about 58% share. Strong demand came from frequent glucose monitoring needs among diabetic users, which increased strip consumption across home care and clinical settings. High accuracy, quick results, and compatibility with a wide range of meters supported greater adoption. Blood-glucose meters also grew as new models offered better connectivity and compact designs. Lancing devices maintained steady use due to improved needle safety. Rising global diabetes cases and wider self-testing habits continued to drive strong demand for test strips.

- For instance, Roche’s Accu-Chek Guide test strips need only 0.6 microliters of blood and give a glucose result in under 4 seconds, as specified in the official Accu-Chek Guide documentation and FAQs.

By End-use

Home care settings led this segment in 2024 with nearly 46% share. Growth came from rising self-monitoring practices, supported by affordable meters, easy-to-use test strips, and quick digital reporting. Hospitals and clinics also expanded adoption due to rapid testing needs in emergency and routine care. Diagnostic centers used these tools for fast triage and chronic disease management. Other end-users, including long-term care facilities, increased use as diabetes prevalence grew. Strong awareness programs and wider reimbursement support helped strengthen the lead of home-based testing.

- For instance, Dexcom states that its continuous glucose monitoring systems can provide up to 288 automatic glucose readings in 24 hours, with a new value every 5 minutes for home and clinical users.

Key Growth Drivers

Rising diabetes prevalence

Global diabetes cases continue to grow, which increases the need for quick and reliable glucose checks. More patients now monitor glucose at home, which supports steady demand for test strips and compact meters. Healthcare systems also promote early detection and routine tracking to reduce complications. This shift strengthens the role of point of care tools in both home care and clinical settings.

- For instance, Ascensia’s Contour Next One meter is cleared with a measuring range from 20 to 600 milligrams per deciliter, according to FDA review data for the system.

Shift toward self-monitoring

Patients prefer simple devices that offer fast results and fewer clinic visits. Modern meters now provide easy display formats, quick readings, and improved safety, which supports wider self-testing habits. Growing awareness programs help users manage glucose more effectively. This trend increases long-term demand for portable and user-friendly glucose testing products.

- For instance, Abbott’s FreeStyle Libre 2 sensor measures glucose every minute and stores up to 8 hours of readings in 15-minute intervals, while each sensor can be worn for up to 14 days.

Advances in device connectivity

New glucose meters now include Bluetooth links, mobile app support, and data-sharing features. These functions help users track trends and allow clinicians to adjust treatment plans quickly. Better digital tools also improve adherence and support remote monitoring models. Strong interest in digital healthcare continues to push innovation in point of care glucose testing.

Key Trends and Opportunities

Growth of digital health integration

Connectivity features in glucose meters support telehealth and remote care models. Users can send readings to providers, which improves treatment tracking and early intervention. Many manufacturers now develop app-based ecosystems that guide dose timing and lifestyle choices. This link between digital tools and glucose testing creates strong market expansion potential.

- For instance, Medtronic’s MiniMed systems with Guardian sensors can generate up to 288 sensor glucose readings in 24 hours, sending a new reading every 5 minutes to connected pumps for automated adjustments.

Rising focus on minimally invasive testing

Manufacturers work on reducing discomfort through thinner lancets and better sampling techniques. Some companies explore sensor-based formats that require fewer finger pricks while keeping accuracy high. These advances help attract new users who avoid routine checks due to pain concerns. Lower discomfort levels may increase test frequency and improve glucose control.

- For instance, BD’s Ultra-Fine pen needles are specified as 4 millimeters long with a diameter of 0.23 millimeters at 32-gauge, providing very short and thin needles for injections in home and clinical care.

Expansion in home-based chronic care

More patients now receive long-term care at home, which increases demand for simple and affordable glucose testing tools. Governments and insurers support home monitoring to reduce hospital load and improve outcomes. This shift opens opportunities for compact devices, subscription-based strip supply models, and connected monitoring platforms.

Key Challenges

Accuracy differences across devices

Some low-cost meters show variations in readings due to strip quality or calibration limits. These issues can affect treatment decisions and reduce user confidence. Regulators now push stricter quality rules, but uneven compliance remains a concern. Ensuring reliable accuracy across all device categories stays a major challenge.

High recurring cost of test strips

Frequent testing increases monthly spending, especially for patients without strong reimbursement support. Many users cut test frequency to manage cost, which affects long-term glucose control. Manufacturers work on low-cost strip designs, but price sensitivity stays high. This challenge limits adoption in low- and middle-income regions.

Regional Analysis

North America

North America held the largest share of the market in 2024 with about 38%. Demand stayed strong due to high diabetes prevalence, broad insurance coverage, and early adoption of digital glucose meters. Home care settings expanded rapidly as users preferred self-monitoring supported by easy device access and strong awareness programs. Hospitals and clinics increased use for quick triage and routine screening. Ongoing innovation in connected meters and test strips also strengthened market growth. Established players and widespread distribution networks helped North America maintain its lead.

Europe

Europe accounted for nearly 29% share in 2024, driven by strong clinical adoption and structured diabetes management programs across major countries. Healthcare systems encouraged early diagnosis and home-based glucose tracking, which improved uptake of portable meters and high-accuracy test strips. Regulatory focus on product quality supported trust in point of care tools. Rising elderly populations and chronic care needs helped expand routine monitoring. Growth also came from rising digital health integration, where users shared readings with clinicians for better treatment decisions. Stable reimbursement also supported market expansion.

Asia Pacific

Asia Pacific held about 23% share in 2024 and recorded the fastest growth. The region saw rising diabetes cases, increasing screening rates, and strong demand for affordable test strips. Home care use increased as patients sought low-cost monitoring options. Expanding urbanization and better healthcare access supported wider meter placement in clinics and diagnostic centers. Manufacturers targeted this region with cost-effective and connected devices. Government-led awareness campaigns helped strengthen early diagnosis and routine monitoring. Growing middle-class spending and broader retail availability continued to boost market penetration.

Latin America

Latin America captured around 6% share in 2024, supported by rising diabetes awareness and improving primary care services. Countries increased focus on community-level testing, which expanded use of low-cost meters and strips. Economic constraints limited adoption in some areas, but urban centers showed steady uptake due to better device availability. Clinics and diagnostic chains used point of care testing to manage growing chronic cases. Public health programs encouraged early detection efforts. Gradual digital health adoption and stronger supply chains helped improve access across major markets.

Middle East and Africa

Middle East and Africa held nearly 4% share in 2024, driven by rising diabetes rates and ongoing improvements in healthcare infrastructure. Gulf countries showed higher adoption due to strong investment in digital health and advanced monitoring tools. Other parts of the region relied on basic meters and affordable test strips to expand screening programs. Home care use grew slowly as awareness increased. Limited reimbursement and cost sensitivity remained barriers, but government-led initiatives continued to promote early testing. Gradual expansion of private healthcare networks supported market growth.

Market Segmentations:

By Product Type

- Lancing devices

- Test strips

- Blood-glucose meter

By End-use

- Hospitals

- Clinics

- Diagnostic centers

- Home care settings

- Other end-users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Point of Care Glucose Testing Market features leading players such as Dexcom, Inc., Sinocare, Medtronic plc, Abbott Laboratories, Platinum Equity Advisors, LLC., EKF Diagnostics Holdings plc, F. Hoffmann-La Roche Ltd., ACON Laboratories, Inc., Nipro Corporation, Nova Biomedical Corporation, Prodigy Diabetes Care, LLC., ARKRAY, Inc., Sanofi, B. Braun Melsungen AG and PHC Holdings. Companies compete through advanced glucose meters, high-accuracy test strips, and connected monitoring platforms that support home care and clinical use. Many manufacturers invest in digital integration, enabling Bluetooth links, app-based tracking and remote data sharing to enhance diabetes management. The competitive focus also includes expanding production capacity, improving strip quality and reducing sampling pain through refined lancing technologies. Firms aim to strengthen market reach by targeting emerging regions with low-cost devices while maintaining strong innovation in developed markets. Sustainability, ease of use and reliable accuracy continue to shape new product strategies across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dexcom, Inc.

- Sinocare

- Medtronic plc

- Abbott Laboratories

- Platinum Equity Advisors, LLC.

- EKF Diagnostics Holdings plc

- F. Hoffmann-La Roche Ltd.

- ACON Laboratories, Inc.

- Nipro Corporation

- Nova Biomedical Corporation

- Prodigy Diabetes Care, LLC.

- ARKRAY, Inc.

- Sanofi

- B. Braun Melsungen AG

- PHC Holdings

Recent Developments

- In 2025, Abbott Laboratories partnered with Walgreens to integrate FreeStyle Lite glucose data into an in-store diabetes counseling service for improved patient adherence and education.

- In 2024, ARKRAY, Inc. released a new glucose measurement instrument model, featuring an automatic rotating sample barcode reading function to reduce manual tasks and streamline testing operations.

- In 2024, Dexcom launched its proprietary Generative AI platform for glucose biosensing, integrating with the Stelo over-the-counter biosensor to provide personalized insights on glucose patterns related to lifestyle factors like diet, exercise, and sleep.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth as global diabetes cases rise.

- Home-based glucose testing will expand with better device access.

- Connected meters will gain wider adoption due to strong digital health growth.

- Test strips will remain a major revenue driver across all regions.

- Minimally invasive sampling methods will attract more users.

- Remote patient monitoring will increase due to wider telehealth use.

- Emerging markets will adopt low-cost glucose meters at a faster pace.

- Hospitals will continue using rapid tests for early diagnosis and triage.

- Manufacturers will focus on improving accuracy and reducing strip cost.

- AI-driven tracking tools will help improve treatment decisions and long-term care.