Market Overview

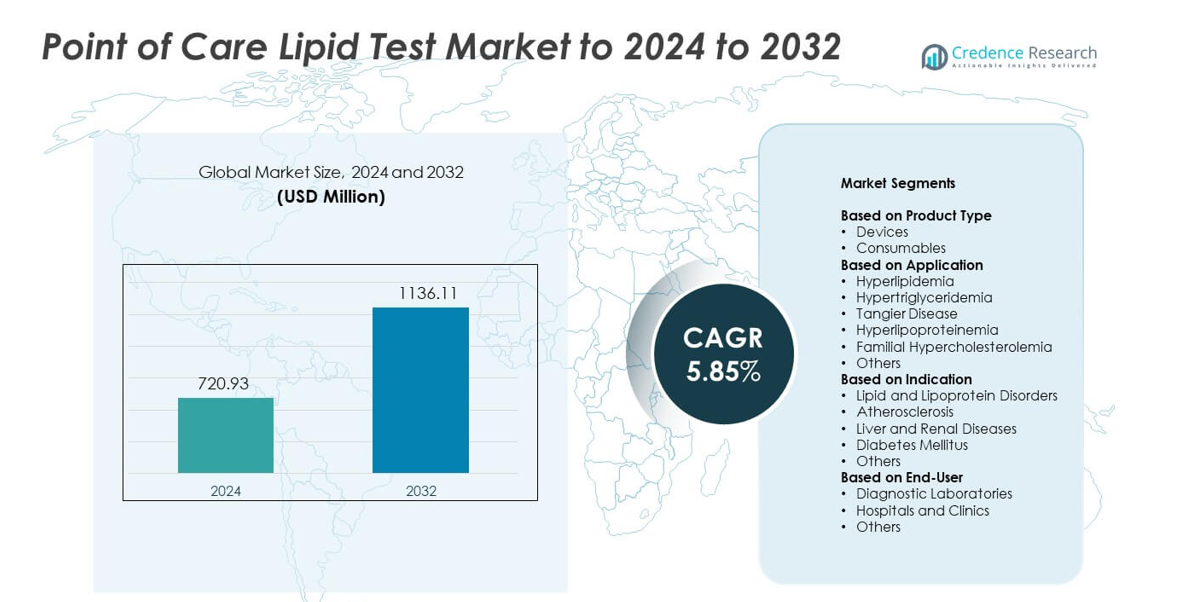

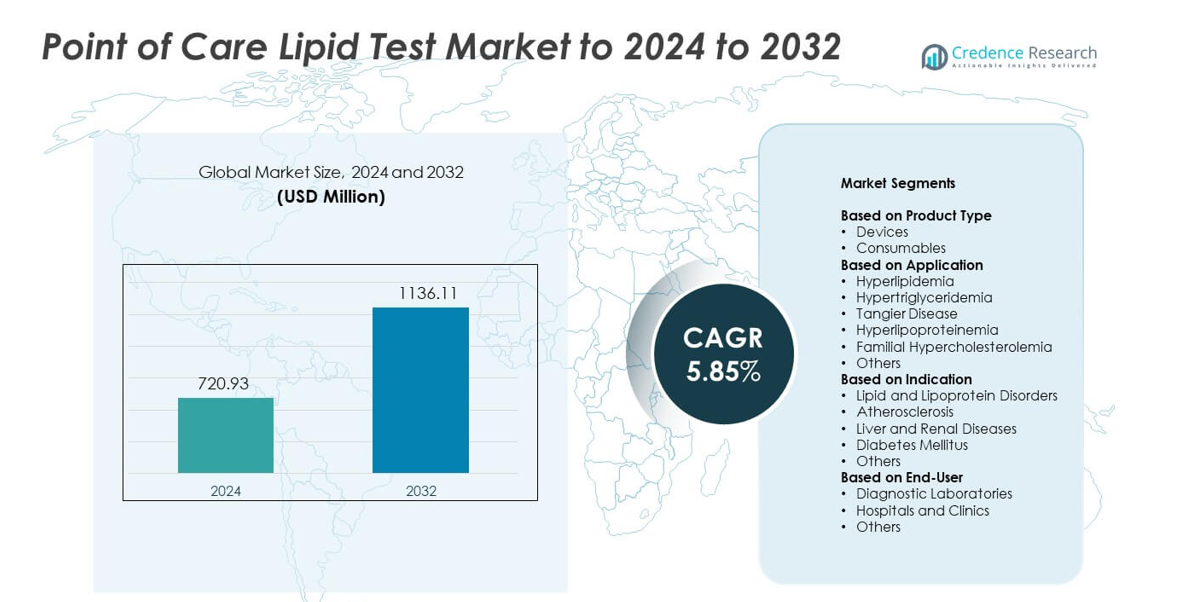

Point of Care Lipid Test Market size was valued USD 720.93 million in 2024 and is anticipated to reach USD 1136.11 million by 2032, at a CAGR of 5.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Point of Care Lipid Test Market Size 2024 |

USD 720.93 million |

| Point of Care Lipid Test Market, CAGR |

5.85% |

| Point of Care Lipid Test Market Size 2032 |

USD 1136.11 million |

Top players in the Point of Care Lipid Test Market include Menarini Group, Nova Biomedical, Callegari Srl, F. Hoffmann-La Roche Ltd., SD Biosensor, Inc., MiCoBio, Abbott Laboratories, Sinocare Inc., and VivaChek Biotech (Hangzhou) Co., Ltd., all of which compete through advanced handheld analyzers, wider consumable ranges, and strong digital integration. These companies focus on accuracy, speed, and affordability to strengthen adoption across clinical and home settings. North America leads the market with about 38.7% share due to high cardiovascular screening rates and strong uptake of decentralized testing. Europe follows with roughly 28.4% share, supported by structured preventive care programs and growing use of rapid lipid analyzers.

Market Insights

- The Point of Care Lipid Test Market reached USD 720.93 million in 2024 and is projected to hit USD 1136.11 million by 2032, growing at a CAGR of 5.85%.

- Growth is driven by rising cardiovascular cases and higher demand for rapid lipid screening in clinics, pharmacies, and home settings, with devices holding about 61% share.

- Key trends include stronger adoption of connected analyzers, wider use of pharmacy-based screening, and rising demand for home monitoring supported by digital health platforms.

- Competition intensifies as global manufacturers expand portable analyzers and consumable lines, focusing on accuracy, quick turnaround, and broader distribution to strengthen market reach.

- North America leads with around 38.7% share, followed by Europe at about 28.4%, while Asia Pacific holds nearly 23.9% due to improving healthcare access and rising awareness of lipid disorders.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Devices held the dominant share in 2024 with around 61% of the market. Strong demand came from handheld lipid analyzers that support rapid screening in clinics, pharmacies, and home settings. Wider adoption of Bluetooth-enabled meters also helped users track lipid levels with greater ease. Consumables grew due to frequent use of test strips and reagent cartridges, but device upgrades continued to drive most revenue. Rising cases of dyslipidemia and the need for quick cardiovascular risk checks strengthened demand for compact lipid testing devices across major markets.

- For instance, Abbott’s Afinion 2 analyzer measures lipid panels from a fingerstick sample and has approximate dimensions of 200 × 186 × 328 millimeters with a weight of about 3.4 kilograms, enabling true benchtop use in clinics and pharmacies.

By Application

Hyperlipidemia remained the leading application in 2024 with about 49% share. Growing global cases of high cholesterol increased the need for quick and routine lipid tests. Healthcare providers used point-of-care systems to support early detection and monitor treatment response. Other conditions, including hypertriglyceridemia and familial hypercholesterolemia, expanded at a steady pace due to rising clinical awareness. Broader preventive care programs and screening drives helped strengthen the use of lipid tests across hospitals, outpatient clinics, and wellness centers.

- For instance, Roche’s cobas b 101 system provides a complete lipid profile from a capillary blood sample with results available in about 6 minutes at the point of care.

By Indication

Lipid and lipoprotein disorders accounted for the largest share in 2024 at nearly 52%. Higher testing rates came from routine lipid panels used to assess cardiovascular risk. Atherosclerosis followed as demand increased for quick profiling among at-risk adults in primary care. Diabetes mellitus also supported strong adoption since glucose-lipid management often requires frequent monitoring. Liver and renal diseases contributed steady demand due to metabolic complications. Growing focus on early detection and wider availability of portable analyzers helped maintain strong use across all indication groups.

Key Growth Drivers

Rising cardiovascular disease burden

Cardiovascular cases continue to rise worldwide, which increases demand for quick lipid screening. Clinics and emergency units rely on point-of-care systems to assess risk within minutes. Portable analyzers help clinicians start timely treatment and support routine monitoring. Higher screening rates in primary care and pharmacy settings also strengthen adoption. Growing public awareness of cholesterol management further boosts this driver.

- For instance, Amgen’s FOURIER outcomes trial for the PCSK9 inhibitor evolocumab (Repatha) enrolled 27,564 patients with atherosclerotic cardiovascular disease to evaluate intensive LDL-cholesterol lowering and event reduction.

Shift toward decentralized testing

Healthcare systems are moving diagnostic services closer to patients, which supports steady uptake of compact lipid devices. Pharmacies, community clinics, and home users now prefer rapid tests that reduce delays linked to lab-based methods. This shift improves patient compliance and supports long-term disease management. The trend also aligns with telehealth platforms that integrate real-time lipid data. Wider availability of user-friendly devices strengthens this driver.

- For instance, CVS Health’s MinuteClinic network operates more than 1,000 walk-in clinics inside CVS Pharmacy and Target stores across 33 U.S. states and the District of Columbia, supporting on-site chronic disease screening including cholesterol checks.

Advances in handheld analyzers

Modern analyzers now offer improved accuracy, shorter turnaround times, and digital connectivity. These features help healthcare providers track lipid profiles with greater ease. Compact designs also support use in mobile clinics and remote areas. Better materials and sensor technology reduce error rates and enhance reliability. Continuous innovation encourages broader adoption across clinical and consumer-focused settings.

Key Trends and Opportunities

Growing integration with digital health platforms

Point-of-care lipid devices now connect with mobile apps and cloud systems that support remote patient monitoring. These platforms allow clinicians to track lipid changes over time and adjust therapies faster. Digital integration also improves patient engagement through reminders and personalized insights. Rising acceptance of virtual care opens strong opportunities for connected testing solutions.

- For instance, Dexcom reported adding over 600,000 users in 2023 and ending the year with approximately 2.3 million customers globally using its connected continuous glucose monitoring systems linked to mobile apps and cloud platforms.

Rising adoption in retail and pharmacy settings

Pharmacies are expanding preventive screening services, which increases demand for rapid lipid tests. Easy-to-use devices help pharmacists offer quick assessments without full laboratory support. This expansion improves access for populations with limited clinical reach. Strong foot traffic in retail outlets creates growth opportunities for device makers targeting walk-in testing models.

- For instance, Walgreens Boots Alliance supports preventive screening through a network of roughly 8,000 retail pharmacy locations in the United States, where in-store health services increasingly include cardiovascular risk and cholesterol assessments.

Expansion into home-based monitoring

More patients prefer self-testing to manage chronic lipid disorders. Compact analyzers and simplified workflows allow easy home use. This trend supports early detection and ongoing monitoring outside hospitals. Growing consumer interest in personal health tracking creates opportunities for companies offering subscription consumables and app-linked devices.

Key Challenges

Accuracy concerns in complex clinical cases

Some advanced lipid abnormalities require detailed lab-based analysis, which point-of-care systems may not fully provide. Variations in user handling, environmental conditions, and reagent stability can affect results. Clinicians may hesitate to rely solely on rapid devices for high-risk patients. This concern remains a key challenge for broader acceptance.

High cost of devices and consumables

Upfront device prices and recurring strip costs limit adoption in low-resource regions. Budget-constrained clinics often choose centralized testing to manage expenses. Reimbursement gaps also reduce incentives for widespread use. These cost barriers slow expansion across emerging markets and remain a significant challenge for manufacturers.

Regional Analysis

North America

North America held the largest share in 2024 at about 38.7%. Growth came from high screening rates for cardiovascular risk, strong adoption of advanced handheld analyzers, and broad insurance support for preventive testing. Clinics, pharmacies, and home users widely used rapid lipid devices for routine monitoring. Technological advancements and strong awareness programs also strengthened market demand. The United States led regional growth due to expanding decentralized care models and greater investment in point-of-care diagnostics.

Europe

Europe accounted for nearly 28.4% share in 2024, driven by structured screening programs and rising emphasis on early detection of lipid disorders. Countries such as Germany, the United Kingdom, and France supported adoption through established primary care networks and regulatory focus on preventive diagnostics. Hospital and outpatient settings used rapid lipid analyzers to speed treatment decisions and reduce laboratory workloads. Growing elderly populations and increasing cardiovascular cases continued to push demand for efficient point-of-care testing.

Asia Pacific

Asia Pacific captured around 23.9% share in 2024 and showed strong growth due to rising awareness of hyperlipidemia and expanding healthcare access. Urban centers adopted rapid lipid testing for faster cardiovascular risk assessment, while rural programs used portable analyzers for wider coverage. China, India, and Japan led adoption as chronic disease rates increased. Growing private clinic networks and higher investment in diagnostics technology supported further expansion. Affordable devices and consumables also strengthened the market.

Latin America

Latin America held approximately 5.4% share in 2024, supported by growing use of point-of-care systems in community clinics and preventive health programs. Countries such as Brazil and Mexico expanded screening for lipid disorders through government and private initiatives. Adoption increased where portable devices improved access in underserved areas. Economic constraints limited premium device uptake, but demand grew steadily for essential testing solutions. Rising cardiovascular disease cases also encouraged broader use of rapid lipid analyzers.

Middle East and Africa

The Middle East and Africa accounted for about 3.6% share in 2024, with growth supported by expanding diagnostic infrastructure and increased focus on noncommunicable disease management. Gulf countries adopted modern analyzers in hospitals and wellness centers, while African regions relied on portable systems to overcome laboratory gaps. Limited reimbursement slowed higher-end device use, but screening for cardiovascular risk continued to expand. International health programs and private sector investment helped improve access to lipid testing across the region.

Market Segmentations:

By Product Type

By Application

- Hyperlipidemia

- Hypertriglyceridemia

- Tangier Disease

- Hyperlipoproteinemia

- Familial Hypercholesterolemia

- Others

By Indication

- Lipid and Lipoprotein Disorders

- Atherosclerosis

- Liver and Renal Diseases

- Diabetes Mellitus

- Others

By End-User

- Diagnostic Laboratories

- Hospitals and Clinics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Point of Care Lipid Test Market is shaped by leading participants such as Menarini Group, Nova Biomedical, Callegari Srl, F. Hoffmann-La Roche Ltd., SD Biosensor, Inc., MiCoBio, Abbott Laboratories, Sinocare Inc., and VivaChek Biotech (Hangzhou) Co., Ltd. Companies focus on developing compact analyzers with higher accuracy, faster turnaround time, and enhanced digital connectivity. Many manufacturers invest in expanding consumable portfolios to support frequent testing in clinics, pharmacies, and home settings. Firms also strengthen market presence through partnerships with primary care networks and retail health providers. Product innovation centers on wireless data transfer, improved biosensors, and user-friendly interfaces that support widespread adoption. Growing interest in decentralized diagnostics pushes companies to broaden global distribution channels and offer competitive pricing in emerging markets. Strategic moves such as regulatory approvals, new product launches, and localized manufacturing continue to define competition in this expanding segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Menarini Group

- Nova Biomedical

- Callegari Srl

- F. Hoffmann-La Roche Ltd.

- SD Biosensor, Inc.

- MiCoBio

- Abbott Laboratories

- Sinocare Inc.

- VivaChek Biotech (Hangzhou) Co., Ltd.

Recent Developments

- In 2025, Sinocare Inc. showcased integrated diagnostic solutions at industry events, including devices covering lipids among other parameters like blood glucose and uric acid.

- In 2025, QuidelOrtho Corporation: Launched a new Certified Analyzer Program aimed at expanding access to high-quality diagnostic testing, including lipid panels, in rural and community hospitals across the U.S..

- In 2022, Roche obtained CE Mark approval and launched its cobas® pulse system in select countries.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Indication, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for rapid lipid testing will rise as cardiovascular screening becomes more routine.

- Connected lipid analyzers will gain adoption through integration with digital health platforms.

- Home-based lipid monitoring will expand as users prefer convenient self-testing options.

- Pharmacies will increase their role in preventive lipid screening services.

- Device makers will focus on improved accuracy and shorter test times.

- Emerging markets will adopt portable analyzers to strengthen primary care screening.

- AI-supported data interpretation will enhance patient risk assessment.

- Subscription-based consumable models will grow among home users.

- Hybrid care models will boost demand for fast results that support virtual consultations.

- Regulatory support for decentralized diagnostics will accelerate market expansion.