Market Overview

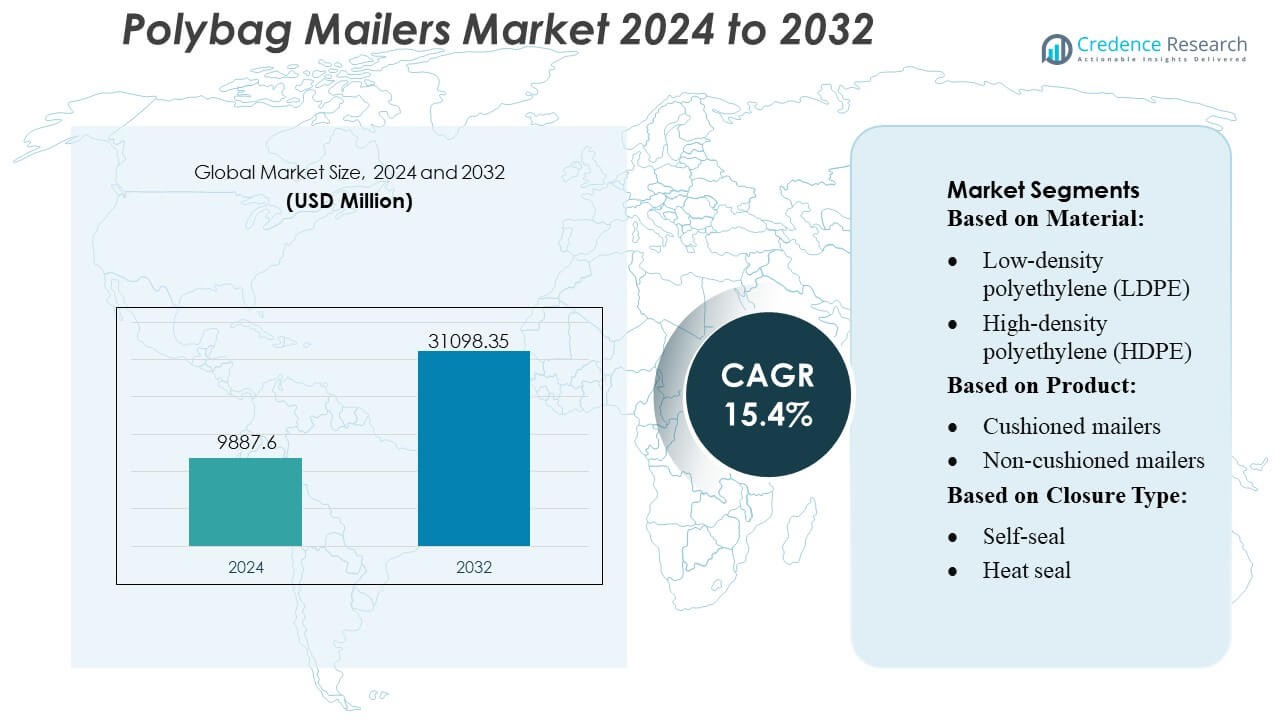

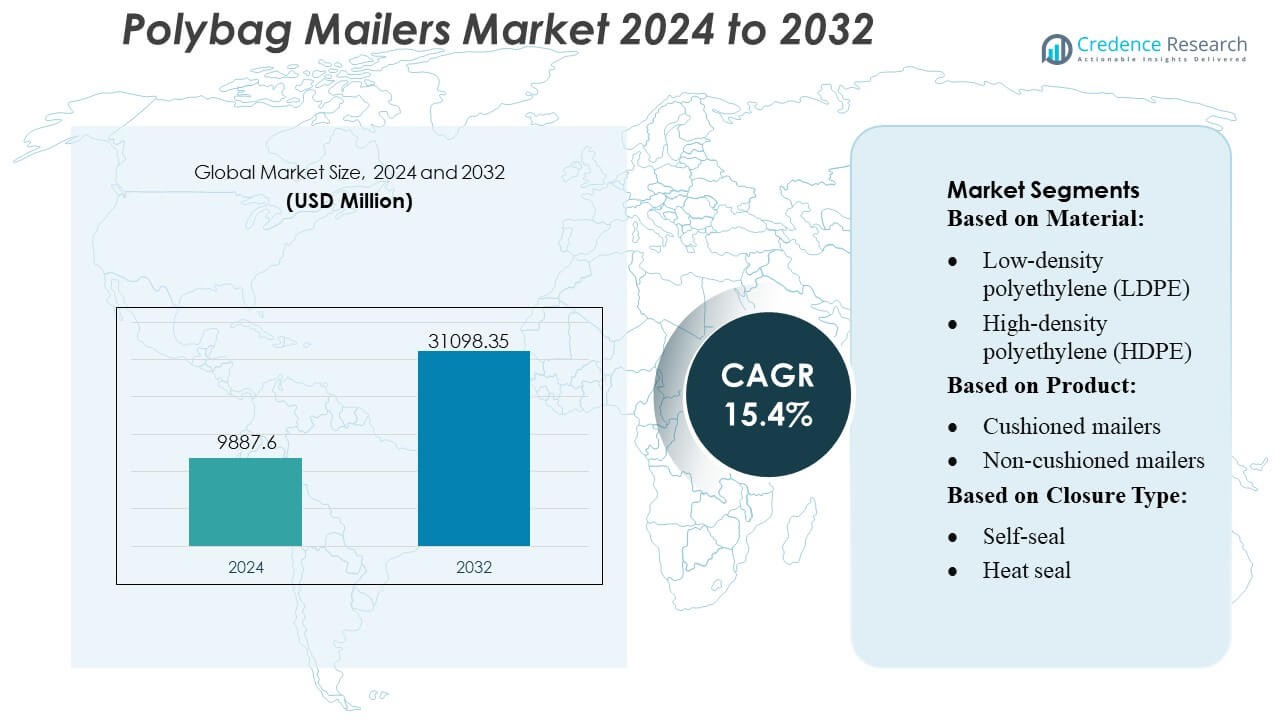

Polybag Mailers Market size was valued USD 9887.6 million in 2024 and is anticipated to reach USD 31098.35 million by 2032, at a CAGR of 15.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polybag Mailers Market Size 2024 |

USD 9887.6 Million |

| Polybag Mailers Market, CAGR |

15.4% |

| Polybag Mailers Market Size 2032 |

USD 31098.35 Million |

The Polybag Mailers Market features a competitive landscape shaped by established packaging manufacturers and sustainability-focused innovators that strengthen their positions through advanced materials, automation capabilities, and expanded e-commerce distribution networks. Key companies such as PAC Worldwide Corporation, International Plastics, Polycell International, EcoEnclose LLC, BRAVO PACK INC., Jflexy Packaging, Abriso Jiffy, Intertape Polymer Group Inc., Crown Packaging Corp., and Novolex focus on lightweight designs, recycled-content mailers, and customizable formats that support high shipping efficiency. North America leads the global market with an exact 38% market share, supported by strong online retail activity, rapid fulfillment infrastructure, and high adoption of protective poly-based mailers across consumer goods and subscription commerce channels.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Polybag Mailers Market reached USD 9,887.6 million in 2024 and is projected to hit USD 31,098.35 million by 2032 at a 15.4% CAGR, reflecting strong expansion driven by e-commerce growth and packaging optimization.

- Rising demand for lightweight, recyclable, and automation-friendly poly mailers accelerates adoption across consumer goods, apparel, subscription boxes, and fulfillment centers, strengthening segment growth for LDPE-based and non-cushioned mailers, which account for the largest share.

- Manufacturers such as PAC Worldwide Corporation, International Plastics, Polycell International, EcoEnclose LLC, Abriso Jiffy, Intertape Polymer Group Inc., BRAVO PACK INC., Jflexy Packaging, Crown Packaging Corp., and Novolex intensify competition by expanding recycled-content portfolios and enhancing customization capabilities.

- Market restraints emerge from recyclability concerns, regulatory pressure on single-use plastics, and volatility in polyethylene prices, which affect production costs and influence brand sustainability commitments.

- North America holds an exact 38% share, leading due to robust e-commerce penetration, while Europe and Asia-Pacific expand steadily; recycled polyethylene captures rising segment preference across regions as brands shift toward circular packaging.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Material

Low-density polyethylene (LDPE) leads the Polybag Mailers Market with an estimated 41% share, supported by its flexibility, tear resistance, and cost-efficient production profile. Its suitability for high-volume e-commerce shipments strengthens adoption among retailers seeking lightweight, protective packaging that reduces freight costs. Co-extruded polyethylene expands penetration through enhanced puncture resistance and multi-layer barrier performance, while recycled polyethylene gains momentum due to sustainability commitments. Increasing regulatory focus on recyclable plastics and growing demand for durable, high-clarity mailers continue to reinforce LDPE’s leadership within the broader material landscape.

- For instance, RCS100-certified recycled poly mailers are manufactured from 100% recycled LDPE resin, with 56% post-consumer waste (PCW) and 44% post-industrial resin (PIR).

By Product

Non-cushioned mailers dominate the segment with an approximate 62% market share, driven by their lightweight structure, lower material consumption, and compatibility with automated fulfillment systems. Their ability to ship apparel, documents, and soft goods efficiently supports extensive use across e-commerce, logistics, and postal services. Cushioned mailers maintain steady uptake for fragile items but face slower growth due to higher per-unit cost and bulkier form factors. Rising pressure to reduce packaging weight and improve throughput performance sustains the demand advantage for non-cushioned formats in high-volume distribution environments.

- For instance, Abriso Jiffy’s “TAP Comebag® bubble mailers” are specified with an inner “bubble foil weight” of 44 micron, with bubble dimensions of 10 mm diameter / 3.2 mm height.

By Closure Type

Self-seal closures hold the largest share at nearly 58%, supported by ease of use, time savings in packing operations, and strong adhesive strength that ensures tamper-evident security. Their ability to streamline fulfillment workflows makes them the preferred choice for e-commerce and postal applications handling large shipment volumes. Heat-seal and zip/slider closures retain adoption in specialized or heavy-duty packaging needs, while button or tie closure formats remain niche solutions. Growing emphasis on operational efficiency and user convenience continues to cement the dominance of self-seal mechanisms in bulk mailer applications.

Key Growth Drivers

E-commerce Expansion and High-Volume Shipment Demand

Rapid expansion of global e-commerce remains a primary growth driver for the Polybag Mailers Market, as retailers prioritize lightweight, cost-efficient, and durable packaging for high-frequency shipments. Rising online sales of apparel, electronics accessories, and small consumer goods strengthen consistent demand for flexible mailers that reduce freight charges and optimize storage. Fulfillment centers prefer polybag formats for their compatibility with automated sorting and labeling systems. Strong growth in direct-to-consumer brands and subscription services further accelerates adoption, reinforcing polybag mailers as a preferred packaging solution for scalable logistics operations.

- For instance, Novolex has published a capabilities sheet for its film & flexible-packaging operations showing that they run mono-extrusion as well as 3-, 7- and 9-layer co-extrusion film lines giving flexibility in film construction and barrier properties.

Shift Toward Sustainable and Recyclable Packaging Solutions

Intensifying environmental regulations and brand-led sustainability commitments strongly drive demand for recyclable and recycled-content polybag mailers. Retailers increasingly transition to post-consumer recycled polyethylene formats to reduce carbon footprints and comply with extended producer responsibility frameworks. Manufacturers invest in mono-material constructions that enhance recyclability without compromising strength or sealing performance. Growing consumer awareness around eco-friendly packaging reinforces market interest, encouraging companies to market sustainability credentials. This shift supports higher adoption of low-impact mailers while stimulating research into improved materials with minimal disposal challenges.

- For instance, Ashland’s Aqualon™ product is Aqualon™ EC-N200, an ethylcellulose ether. It is explicitly cited for forming “tough, flexible, and transparent films” over a wide range of temperatures.

Operational Efficiency and Cost Optimization Across Fulfillment Networks

Cost pressures across logistics operations create strong incentives for businesses to adopt materials that reduce weight, minimize dimensional shipping charges, and streamline handling. Polybag mailers offer significant labor efficiency with quick-packing self-seal formats that support shorter fulfillment cycles. Their compact storage footprint helps distribution centers optimize warehouse capacity and reduce overhead. Retailers value the reduced breakage rates and lower damage claims associated with durable polyethylene structures. These performance and cost advantages continue to position polybag mailers as an essential packaging choice for efficiency-driven supply chains.

Key Trends & Opportunities

Rising Adoption of Custom-Printed and Branded Mailers

A key trend shaping the Polybag Mailers Market is the strong shift toward custom-printed formats that enhance brand visibility and unboxing experiences. E-commerce brands increasingly integrate high-quality graphics, QR codes, and promotional messaging on mailers to strengthen customer engagement. The ease of printing on polyethylene materials enables short-run customization and supports targeted campaigns. This trend encourages packaging suppliers to expand digital printing capabilities, creating opportunities for value-added services with premium margins. The growing role of packaging as a marketing tool reinforces the relevance of customized mailer solutions.

- For instance, Mitsubishi Chemical Group Corporation offers advanced film-forming resin grades for highly specific applications. ACRYKING™ F-328, an advanced hard coat from the Mitsubishi Chemical Group Corporation. The recommended cured film thickness is officially documented in the manufacturer’s technical data sheets as 6 to 10 µm.

Growth in Recycled and Bio-Based Polymer Development

Innovation in recycled-content and bio-based polyethylene presents significant opportunities for manufacturers seeking competitive differentiation. Suppliers invest in advanced mechanical and chemical recycling to improve resin purity, enabling stronger and more reliable recycled mailers. Bio-based variants derived from plant sources gain initial traction among sustainability-focused brands aiming to reduce fossil-based plastic dependency. These advancements support regulatory compliance and enhance environmental branding, creating long-term growth potential for eco-forward product lines. Expanding green procurement policies across retailers further accelerates demand for sustainable material innovations.

- For instance, Lenzing AG’s biorefinery operations at its Austrian, Czech and Brazilian sites reach nominal dissolving-wood-pulp capacities of 320,000 tons, 285,000 tons and 500,000 tons respectively.

Key Challenges

Material Waste Management and Recycling Limitations

Challenges in polyethylene recycling infrastructure continue to restrict circularity goals for the Polybag Mailers Market. Many regions lack advanced sorting and processing systems capable of handling flexible plastics, causing a large share of discarded mailers to end up in landfills. Contamination risks and inconsistent collection streams further reduce recycling efficiency. Brands face difficulties in achieving sustainability targets when downstream systems remain underdeveloped. These limitations pressure manufacturers to redesign products for improved mono-material recovery while encouraging policymakers to strengthen recycling frameworks.

Competition from Paper-Based Alternatives

Polybag mailers face mounting competitive pressure from paper-based mailers promoted for their strong sustainability perception and easier recyclability. Retailers exploring plastic reduction strategies increasingly trial kraft-based padded and unpadded formats, especially for apparel and soft goods. Paper formats benefit from robust global recycling systems that enhance disposal convenience for consumers. This shift challenges polyethylene suppliers to demonstrate environmental advantages through lifecycle metrics, recycled content integration, and reduced resource consumption. Failure to communicate comparative sustainability benefits may accelerate substitution risks in environmentally sensitive markets.

Regional Analysis

North America

North America holds roughly 38% of the Polybag Mailers Market, supported by strong e-commerce penetration, rapid parcel movement, and the presence of advanced packaging converters. The region benefits from high adoption of lightweight, recyclable polyethylene mailers across apparel, consumer electronics, and subscription-box shipments. Brands prioritize custom-printed and tamper-evident formats that strengthen brand visibility and package security. Stringent sustainability commitments from major retailers accelerate the shift toward recycled polyethylene mailers. Growth in third-party logistics, coupled with expanding fulfillment centers, continues to fuel steady consumption, reinforcing the region’s leadership position in the global market.

Europe

Europe accounts for nearly 27% of the global Polybag Mailers Market, driven by strong regulatory pressure on sustainable packaging and rapid adoption of eco-friendly mailer formats. Retailers and delivery networks increasingly choose recycled and co-extruded polyethylene mailers to comply with EU circular-economy directives. High parcel volumes from fashion, luxury goods, and cross-border trade strengthen demand for lightweight and durable packaging solutions. Expansion of direct-to-consumer channels supports wider use of customized self-seal mailers. Ongoing investment in recycling infrastructure and material-efficiency programs continues to reposition the region toward low-impact packaging alternatives while sustaining market growth.

Asia Pacific

Asia Pacific captures close to 30% of the Polybag Mailers Market, supported by booming e-commerce ecosystems, large manufacturing capacity, and competitive production costs. China, India, and Southeast Asia drive substantial consumption as online retail accelerates across urban and tier-II cities. Local converters expand output of LDPE, HDPE, and recycled mailers to serve both domestic and export shipments. Growing export-focused industries rely on high-strength mailers that support long-distance logistics. Government emphasis on plastic-waste reduction encourages development of recycled and biodegradable alternatives, increasing investments in material innovation and sustainable production technologies across the region.

Latin America

Latin America holds an estimated 3% share of the Polybag Mailers Market, reflecting gradual adoption of e-commerce and expanding last-mile delivery networks. Brazil and Mexico lead consumption due to the rapid digitalization of retail and rising logistics activity. Demand for cost-efficient, lightweight, and printable mailers grows across small and medium-sized online sellers. Local manufacturers invest in recycled polyethylene solutions to align with evolving packaging-waste regulations. Although infrastructure limitations and logistics inefficiencies slow market expansion, increasing smartphone-based shopping and improving postal networks contribute to a steady, opportunity-driven growth environment.

Middle East & Africa

The Middle East & Africa region represents nearly 2% of the Polybag Mailers Market, shaped by emerging e-commerce activity and increasing adoption of digital payment systems. The UAE, Saudi Arabia, and South Africa lead regional demand due to rising online retail and investments in fulfillment centers. Businesses prefer low-cost LDPE and co-extruded mailers for apparel and small consumer goods. Government-driven sustainability initiatives encourage the shift toward recycled packaging, though availability remains limited in several markets. Growing participation of SMEs in online marketplaces and expanding courier networks gradually strengthen mailer consumption across the region.

Market Segmentations:

By Material:

- Low-density polyethylene (LDPE)

- High-density polyethylene (HDPE)

By Product:

- Cushioned mailers

- Non-cushioned mailers

By Closure Type:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Polybag Mailers Market players such as PAC Worldwide Corporation, International Plastics, Polycell International, EcoEnclose LLC, BRAVO PACK INC., Jflexy Packaging, Abriso Jiffy, Intertape Polymer Group Inc., Crown Packaging Corp., and Novolex. the Polybag Mailers Market is defined by a diverse mix of global packaging manufacturers and specialized e-commerce packaging suppliers that focus on material innovation, operational efficiency, and sustainability-led product development. Companies invest in advanced polyethylene formulations, high-strength co-extruded structures, and post-consumer recycled content to meet rising regulatory and brand-driven sustainability targets. Rapid expansion of e-commerce drives demand for customizable, tamper-evident, and lightweight mailers, prompting manufacturers to scale high-speed production lines and enhance print quality capabilities. Strategic collaborations with logistics providers and online retailers strengthen market positioning, while continuous improvements in recyclability, durability, and cost optimization shape competitive differentiation across regions.

Key Player Analysis

- PAC Worldwide Corporation

- International Plastics

- Polycell International

- EcoEnclose LLC

- BRAVO PACK INC.

- Jflexy Packaging

- Abriso Jiffy

- Intertape Polymer Group Inc.

- Crown Packaging Corp.

- Novolex

Recent Developments

- In May 2025, Mondi indeed expanded its MailerBAG production at its Krapkowice, Poland plant with a new line, directly addressing the high demand for sustainable, recyclable e-commerce packaging solutions, aligning with circular economy goals and offering paper-based alternatives to plastic.

- In October 2024, PAC Worldwide launched its Polyjacket mailers made from 100% post-consumer and post-industrial recycled content, debuting at PACK EXPO to meet growing demand for sustainable e-commerce packaging, a move aligning with industry trends for greener solutions and improved brand reputation.

- In April 2024, Rudholm Group partnered with Charter Next Generation (CNG) to launch a new poly mailer for e-commerce, featuring Aircarbon, a biomaterial made from captured greenhouse gases (GHG) that significantly lowers packaging’s carbon footprint, aligning with sustainability goals for circular packaging.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Material, Product, Closure Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will shift toward higher adoption of recycled and mono-material polyethylene mailers to meet global sustainability requirements.

- E-commerce expansion will continue to drive steady demand for lightweight, durable, and customizable polybag mailers.

- Manufacturers will invest in high-speed converting technologies to improve production efficiency and reduce lead times.

- Brands will increasingly prefer tamper-evident and security-enhanced mailers to support safer parcel movement.

- Custom printing and branding capabilities will gain importance as retailers strengthen visual identity in shipments.

- Demand for biodegradable and compostable alternatives will grow as regulations tighten on plastic packaging waste.

- Logistics providers will seek stronger and puncture-resistant mailers to support long-distance and high-volume deliveries.

- Regional manufacturing expansion will accelerate to reduce dependency on imports and shorten supply chains.

- Product innovation will focus on thinner yet high-strength films to improve cost efficiency and reduce material usage.

- Collaboration between packaging producers and e-commerce platforms will intensify to develop optimized, sustainable mailer formats.

Market Segmentation Analysis:

Market Segmentation Analysis: