Market Overview

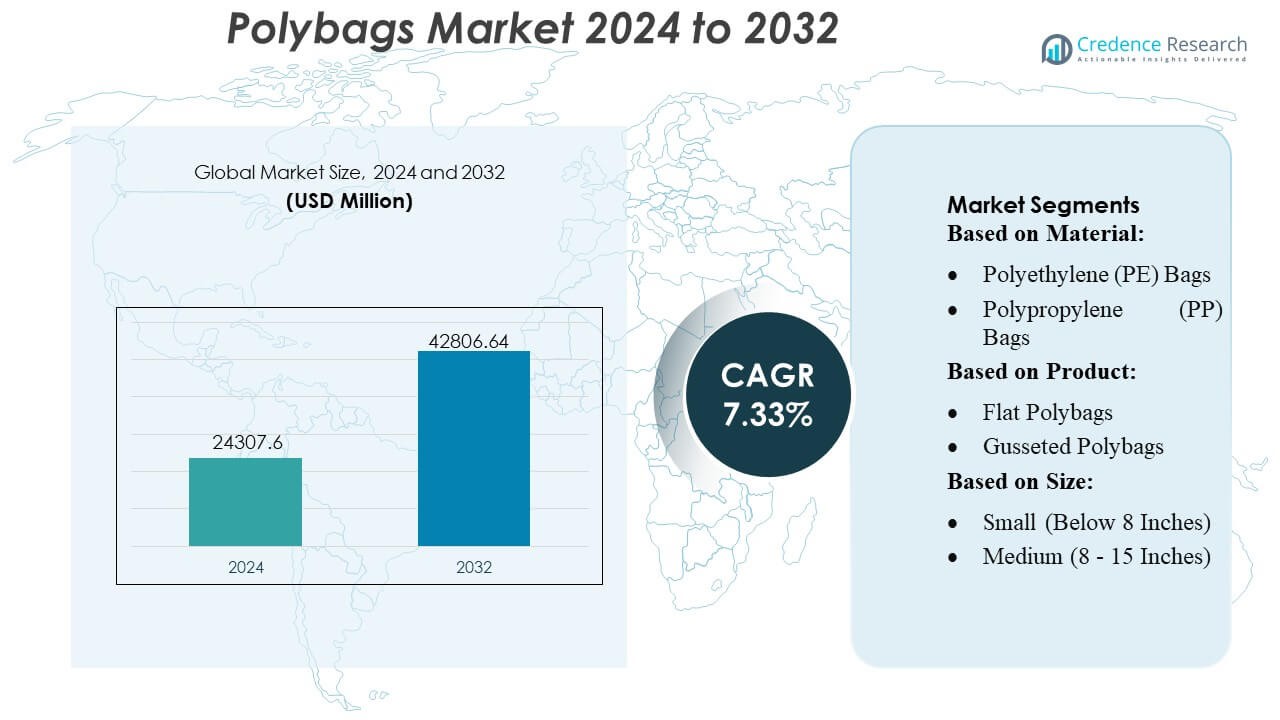

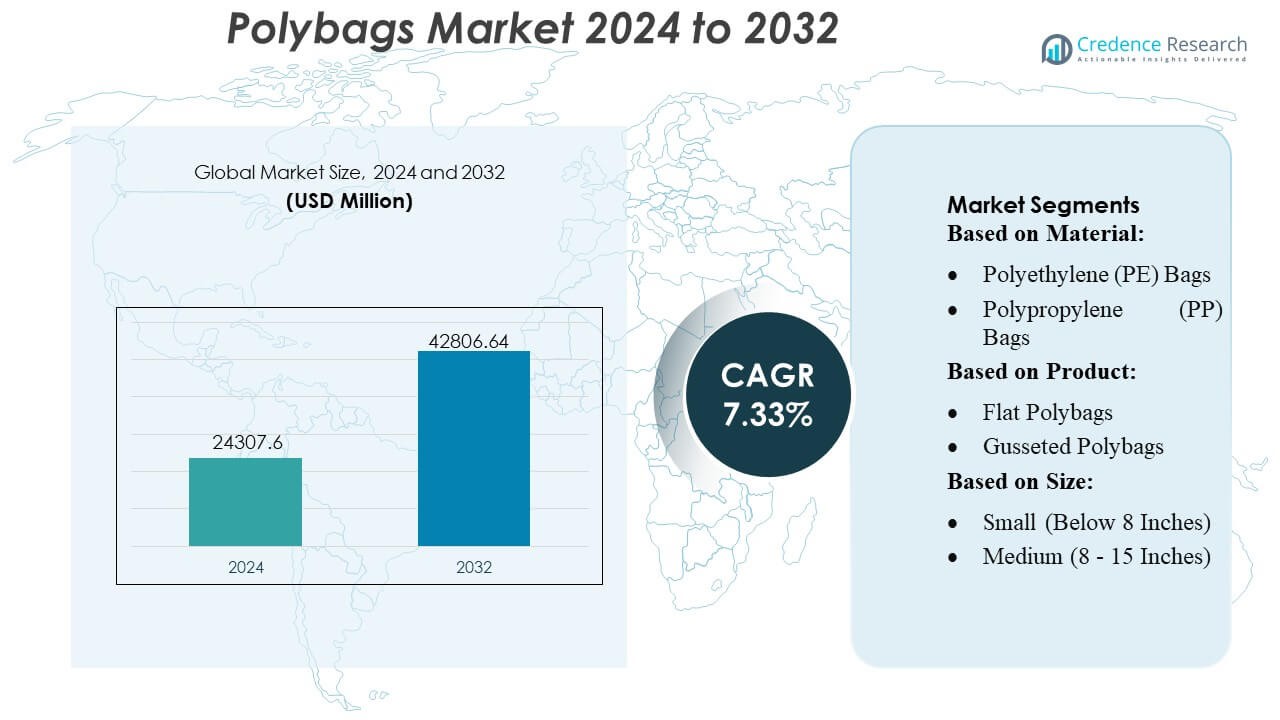

Polybags Market size was valued USD 24307.6 million in 2024 and is anticipated to reach USD 42806.64 million by 2032, at a CAGR of 7.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polybags Market Size 2024 |

USD 24307.6 Million |

| Polybags Market, CAGR |

7.33% |

| Polybags Market Size 2032 |

USD 42806.64 Million |

The Polybags Market features an active competitive landscape shaped by established manufacturers that focus on advanced polyethylene formulations, high-speed production technologies, and expanding e-commerce packaging demand. Leading companies strengthen their positions through investments in recycled-content polymers, customizable bag formats, and automated converting capabilities that improve output quality and cost efficiency. The market continues to attract innovators developing lightweight, multi-layer, and sustainability-aligned solutions tailored to retail, FMCG, and logistics applications. North America remains the dominant region with an exact 38% market share, supported by strong online retail penetration, mature manufacturing infrastructure, and rapid adoption of high-performance poly-based packaging formats across major consumer industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Polybags Market reached USD 24,307.6 million in 2024 and is projected to hit USD 42,806.64 million by 2032 at a 33% CAGR, reflecting steady demand across global packaging applications.

- Strong market drivers include expanding e-commerce shipments, rising FMCG consumption, and accelerated adoption of recycled-content polyethylene, strengthening the shift toward lightweight and customizable polybag formats.

- Key trends highlight rapid uptake of multi-layer, high-strength bags, growth of bio-based alternatives, and increased investments in high-speed extrusion and automated converting technologies that enhance production efficiency.

- Competitive intensity remains high as manufacturers focus on recycled polymers, advanced seal designs, and scalable packaging solutions, while product differentiation grows through sustainability-oriented innovations and value-added customization.

- North America leads with 38% regional share, followed by Asia-Pacific as the fastest-growing region; LDPE-based polybags hold the largest material segment share due to versatility, cost efficiency, and strong suitability for retail and logistics applications.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Material

The Polybags Market is dominated by Polyethylene (PE) bags, holding an estimated 48% market share, driven by their versatility, low cost, and strong compatibility with high-volume packaging applications across retail, e-commerce, and industrial sectors. PE’s durability, moisture resistance, and ease of recycling reinforce its widespread adoption, while growing demand for LDPE and HDPE variants supports segment expansion. Polypropylene (PP) bags gain traction in food and apparel packaging due to clarity and rigidity, whereas PET bags address premium and high-strength needs. The “Others” category, including biodegradable plastics, grows steadily with rising sustainability commitments.

- For instance, Bischof+Klein’s technical-film and laminate business routinely delivers mono- and co-extruded PE films (LDPE/HDPE) with manufacturer-specified thickness tolerances within ±5% relative to target film thickness when produced in volumes above 1,000,000 units or per linear metre, per their publicly available production specification sheet.

By Product

Flat polybags lead the market with roughly 32% share, supported by broad usage in apparel, consumer goods, and bulk packaging operations where lightweight and economical designs are prioritized. Their compatibility with automated packing systems further accelerates uptake in high-throughput fulfillment environments. Gusseted polybags expand demand in volumetric packaging, while ziplock variants grow in food, electronics, and healthcare due to resealability. Poly mailers and bubble mailers experience strong momentum in e-commerce logistics, driven by cushioned protection requirements and increasing small-parcel shipments. Wicketed and other polybags serve specialized industrial and retail applications.

- For instance, Goglio’s multilayer laminate films are engineered to support pouches and pre-formed bags up to 10 liters capacity as standard offerings; their film-to-pouch conversion lines are qualified for bag sizes ranging from small retail pouches to 10 L capacity pouches, enabling versatility across a wide spectrum of product volumes.

By Size

The Medium (8–15 inches) category dominates with nearly 45% market share, driven by strong utilization in e-commerce order shipments, apparel packaging, pharmaceuticals, and multipurpose retail applications. This size range provides an optimal balance between capacity and handling efficiency, making it suitable for automated packing lines and diverse product dimensions. Small bags see consistent use in food packaging, spare parts, and lightweight goods, while large bags cater to industrial components, bulk shipping, and heavy-duty packaging. Growing SKU diversity in online retail continues to reinforce demand for mid-sized polybags, strengthening the segment’s leadership.

Key Growth Drivers

E-commerce Expansion and High-Volume Fulfillment Demand

Rising e-commerce penetration drives strong demand for polybags, supported by high-frequency shipments across apparel, electronics accessories, and small consumer goods. Fulfillment centers prefer lightweight, flexible packaging that reduces dimensional weight and accelerates order processing speed. Polybags enable cost-effective shipping, require minimal storage space, and integrate easily with automated bagging equipment, which strengthens adoption in large-scale logistics networks. Increasing return shipments and subscription-based commerce further elevate consumption, positioning polybags as a critical packaging format for fast-moving, omnichannel retail environments.

- For instance, Berry continues to scale high-performance stretch films. Their “Stratos™” machine film part of Berry’s stretch-film portfolio is offered in multiple gauge/mil variants (37 mil, 42 mil, 45 mil, 51 mil, 61 mil), with one-sided cling and engineered for high load-containment, puncture and tear resistance, and pre-stretch applications up to 200–300% (gauge and application dependent).

Growth of Food, Healthcare, and Industrial Packaging Applications

Demand intensifies in food packaging, pharmaceutical supplies, and industrial goods, supported by the need for moisture resistance, contamination control, and high material durability. Polybags offer excellent barrier properties, clarity, and customization flexibility, making them suitable for fresh produce, medical disposables, and critical spare parts. Enhanced strength and sealability improve product safety across extended distribution cycles. Expansion of cold-chain logistics and rising sterilized packaging use in healthcare accelerate market penetration, strengthening polybags’ relevance across regulated and hygiene-sensitive sectors.

- For instance, Inteplast’s LoadStar Plus hand film employs a “premium metallocene multi-layer structure” capable of achieving up to 300% stretch on load during pallet wrapping delivering high load-holding force and puncture/tear resistance even at thinner film gauges.

Advancements in Recycled and Sustainable Polybag Materials

Increasing emphasis on sustainable packaging fuels investments in recycled-content polybags, compostable films, and bio-based polymers. Brands adopt PCR-rich polybags to meet regulatory compliance and corporate sustainability goals, while manufacturers improve film strength, clarity, and printability without compromising environmental performance. Innovations in closed-loop recycling and mono-material structures further support circular economy initiatives. Growing retailer commitments toward eco-friendly packaging drive rapid adoption, especially in markets with strict waste management mandates and rising consumer preference for environmentally responsible products.

Key Trends & Opportunities

Rising Adoption of Automation-Compatible Polybags

A key trend centers on the demand for polybags engineered for automated packing lines, driven by fulfillment centers prioritizing speed and labor efficiency. Automated wicketed bags, machine-readable films, and consistent material thickness enhance packing accuracy and reduce operational downtime. This shift encourages manufacturers to develop high-quality, machine-compatible variants that support rapid cycle rates. Expanding adoption of robotics and high-speed sortation in distribution hubs strengthens the opportunity for precision-engineered polybags optimized for consistent performance.

- For instance, Amcor’s marketing materials and product pages for their Packaging Automation Solutions explicitly state that one of the key benefits is the environmental advantage of “Floor wastage reduced by 50% or more”. This is presented as an operational benefit of using their integrated equipment and optimized roll-stock films.

Shift Toward Premium, Functional, and Customizable Packaging

Growing consumer expectations for visually appealing and functional packaging create strong opportunities for printed, tamper-evident, and resealable polybags. E-commerce brands emphasize product protection, branding visibility, and improved user experience, which increases demand for customizable bag formats. Advancements in high-definition printing, QR code integration, and multi-layer structures support value-added features. This trend allows polybag manufacturers to differentiate through design flexibility and specialized performance attributes, enhancing adoption in fashion, electronics, and retail gifting categories.

- For instance, Cargill’s renewable-fuels division reports that its advanced biodiesel facility in Ghent, Belgium will plant produces up to 115,000 metric tons of advanced biodiesel per year. It is designed to process challenging feedstocks, including acid oils from vegetable oil refining, liquid residues from industrial processes, and even the fat recovered from sewage sludge from local municipalities.

Key Challenges

Rising Sustainability Regulations and Compliance Burden

Stringent regulations targeting single-use plastics create major challenges for polybag manufacturers. Requirements for recycled content, extended producer responsibility, and waste recovery increase material sourcing complexity and raise operational costs. Markets with strict plastic bans push companies to accelerate transitions toward recyclable or compostable alternatives, often requiring new investments and process modifications. Compliance pressure remains high for brands using polybags across global supply chains, intensifying the need for standardized material certifications and environmentally aligned production practices.

Volatility in Raw Material Prices and Supply Chain Risks

Fluctuations in polyethylene, polypropylene, and PET resin prices significantly impact polybag production costs, especially in markets reliant on petrochemical feedstocks. Supply disruptions, geopolitical tensions, and transportation bottlenecks contribute to inconsistent material availability and extended lead times. Manufacturers face difficulty maintaining pricing stability, which affects margins and contract negotiations with large buyers. These cost uncertainties prompt companies to diversify raw material sources, adopt alternative materials, and strengthen long-term supplier agreements to minimize operational risk.

Regional Analysis

North America

North America holds the leading position in the Polybags Market with an estimated 38% market share, supported by high e-commerce penetration, strong fulfillment infrastructure, and widespread adoption of automated packaging lines. Retailers and logistics operators in the U.S. and Canada prefer lightweight, durable polybags that reduce shipping costs and enhance operational speed. Demand strengthens further through rising consumption of resealable, tamper-evident, and customized polybags across apparel, healthcare, and consumer goods. Sustainability regulations encourage adoption of recycled-content films, prompting manufacturers to expand PCR-based polybag production across regional facilities.

Europe

Europe accounts for roughly 27% market share, driven by strict sustainability regulations, advanced recycling systems, and strong demand for high-quality packaging across retail, food, and pharmaceutical sectors. Countries such as Germany, the U.K., France, and the Netherlands prioritize recyclable and compostable polybag alternatives, pushing manufacturers to innovate in mono-material and bio-based structures. Growth in cross-border e-commerce accelerates demand for poly mailers and protective polybags, while regulatory pressure on single-use plastics reshapes material choices. Strong adoption of premium printing and branded packaging enhances segment value across fashion, cosmetics, and specialty retail.

Asia-Pacific

Asia-Pacific holds approximately 30% market share, supported by large-scale manufacturing capacity, rapid urbanization, and expanding retail and e-commerce ecosystems in China, India, Indonesia, and Southeast Asia. The region benefits from low-cost production, high-volume resin availability, and growing adoption of flexible packaging across food, pharmaceuticals, and electronics. Rising online shopping participation drives strong consumption of mailers, ziplock bags, and multi-layer polybags. Investments in automated packaging and sustainable materials accelerate market evolution, while government-led initiatives in waste management promote demand for recyclable and PCR-based polybags. APAC remains the fastest-growing regional market.

Latin America

Latin America represents nearly 3% market share, driven by increasing retail modernization, expanding domestic e-commerce, and strong demand for flexible, low-cost packaging solutions. Brazil and Mexico lead consumption, supported by growth in food packaging, pharmaceuticals, and consumer goods. Economic variability influences raw material pricing, prompting companies to adopt cost-efficient polybag formats. Rising interest in recyclable materials and localized production supports market development, although sustainability regulations remain at an early stage compared to other regions. Gradual adoption of automated packing systems strengthens future demand for standardized polybag formats.

Middle East & Africa

The Middle East & Africa region holds around 2% market share, influenced by growing packaging needs in FMCG, agriculture, and pharmaceuticals. The UAE, Saudi Arabia, and South Africa lead consumption due to expanding retail, rising import-export activities, and infrastructure development. Demand concentrates on durable polybags suited for high-temperature environments and heavy-duty applications. Sustainability programs, including recycled-content mandates and waste management reforms, begin reshaping material preferences. Increasing investments in logistics networks and online shopping adoption contribute to gradual growth, although reliance on imported raw materials continues to affect pricing and supply stability.

Market Segmentations:

By Material:

- Polyethylene (PE) Bags

- Polypropylene (PP) Bags

By Product:

- Flat Polybags

- Gusseted Polybags

By Size:

- Small (Below 8 Inches)

- Medium (8 – 15 Inches)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Polybags Market features a competitive landscape shaped by global packaging leaders and specialized regional manufacturers, including Alfa Poly Plast, Smurfit Kappa, Bischof+Klein SE & Co. KG, Novolex, Goglio SpA, Berry Global Inc., ARIHANT PACKAGING, Inteplast Group, Amcor plc, and Mondi. the Polybags Market is defined by continuous innovation in material engineering, large-scale production capabilities, and increasing emphasis on sustainable packaging solutions. Manufacturers focus on developing lightweight, durable, and highly customizable polybags that support the needs of fast-growing segments such as e-commerce, retail, food packaging, and pharmaceuticals. Investments in automated film processing, high-speed extrusion, and advanced printing technologies enhance product consistency and operational efficiency. Companies strengthen their market positioning through expanded distribution networks, improved recycling systems, and the integration of post-consumer recycled content. Growing regulatory pressure on plastic waste drives accelerated development of recyclable, compostable, and mono-material polybag formats.

Key Player Analysis

- Alfa Poly Plast

- Smurfit Kappa

- Bischof+Klein SE & Co. KG

- Novolex

- Goglio SpA

- Berry Global Inc.

- ARIHANT PACKAGING

- Inteplast Group

- Amcor plc

- Mondi

Recent Developments

- In November 2024, Lactips, a French company specialising in the production of natural polymers that are 100% biobased, water-soluble, and biodegradable in various environments, entered into a Joint Development Agreement (JDA) with Walki, a leading Finnish packaging converting company.

- In October 2024, UPM Specialty Papers and Eastman developed a novel biopolymer-coated paper packaging solution designed for food applications requiring grease and oxygen barriers. The solution integrates Eastman’s biobased and compostable Solus™ performance additives with BioPBSTM polymer to form a thin coating on UPM’s compostable and recyclable barrier base papers.

- In March 2024, SEE (formerly Sealed Air) introduced a novel paper-based bottom web to assist food processors and retailers in minimizing plastic usage and meeting consumer preferences for paper packaging.

- In February 2024, CJ Biomaterials launched PHA-based polybags for same-day delivery, entirely bio-based to replace PVC, offering similar durability, opacity, and adhesive qualities to traditional plastic bags, with South Korea’s CJ Olive Young adopting them for their services. These bags provide eco-friendly, fully biodegradable alternatives, showcasing PHA’s potential to mimic conventional plastic performance for sustainable packaging.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily due to rising retail, e-commerce, and delivery-driven packaging demand.

- Manufacturers will increase adoption of recycled and bio-based polymers to meet sustainability targets.

- Automation and high-speed extrusion technologies will improve production efficiency and consistency.

- Lightweight and stronger multi-layer polybags will gain traction in logistics and consumer goods packaging.

- Regulatory pressure will accelerate the shift toward recyclable and reduced-plastic packaging formats.

- Custom-printed and brand-enhancing polybags will see higher uptake in fashion, electronics, and FMCG sectors.

- Waste-reduction initiatives will promote wider use of post-consumer recycled content in polybag production.

- Emerging markets will contribute significantly to volume growth due to expanding retail infrastructure.

- Innovation in biodegradable additives will support development of faster-degrading polybag solutions.

- Strategic collaborations across resin suppliers and converters will strengthen material development pipelines.

Market Segmentation Analysis:

Market Segmentation Analysis: