Market Overview

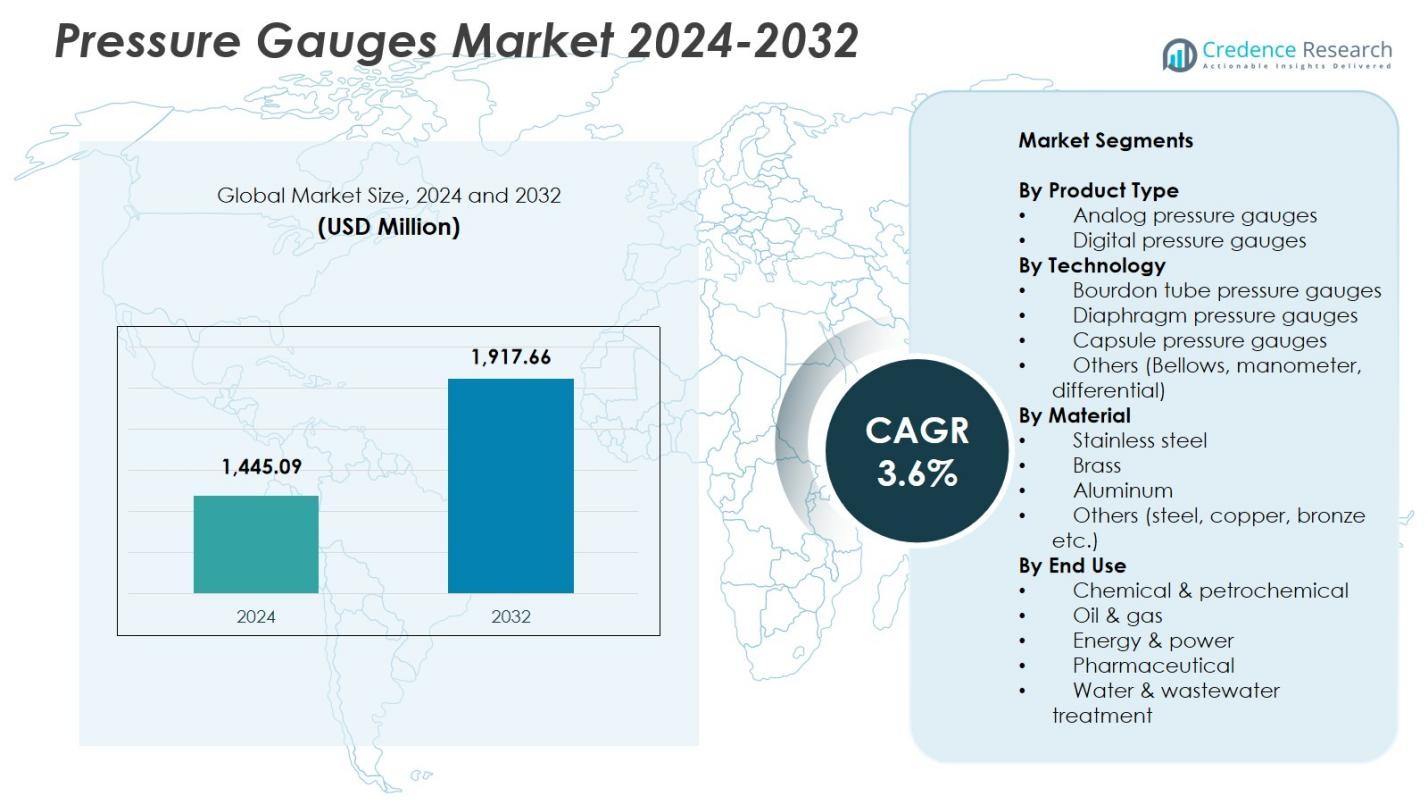

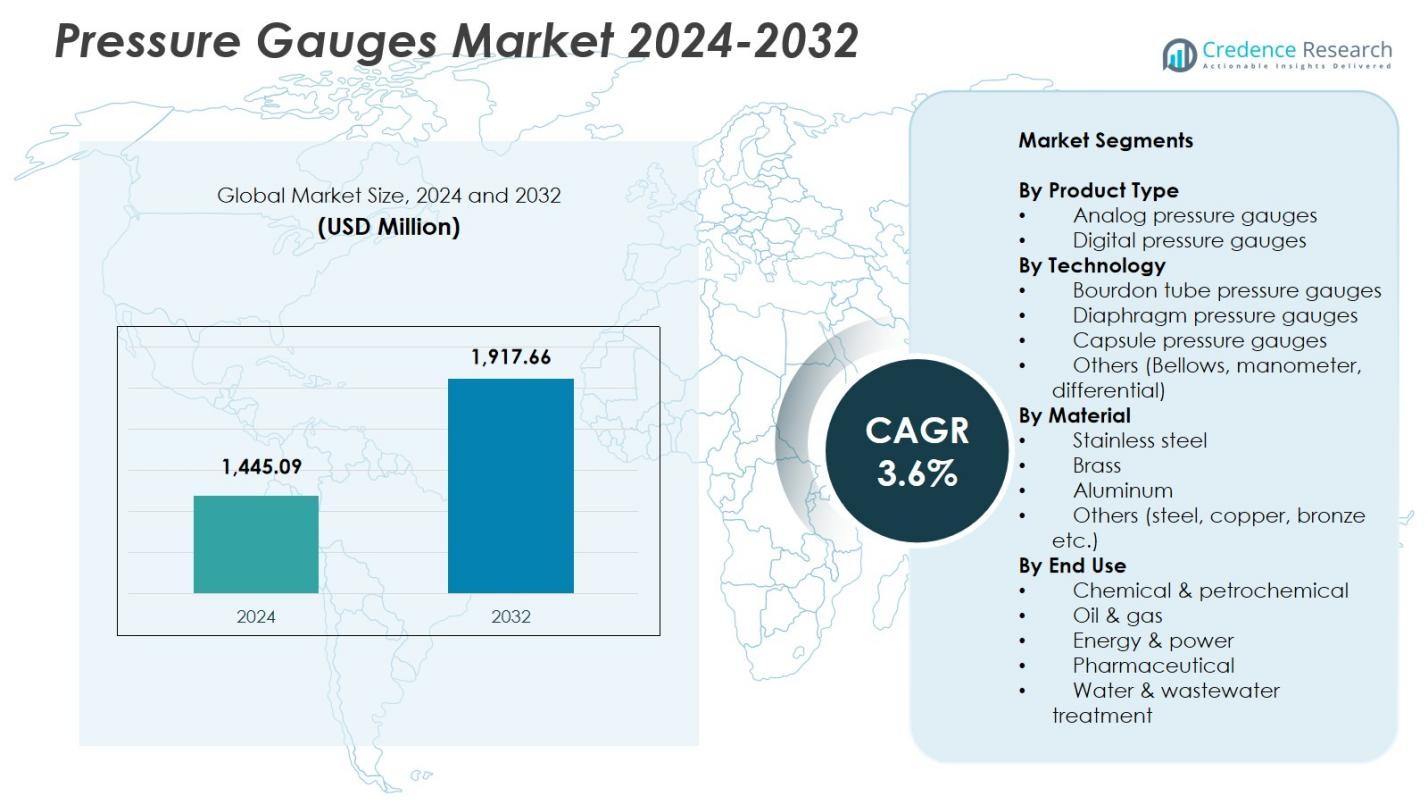

Pressure Gauges Market size was valued at USD 1,445.09 Million in 2024 and is anticipated to reach USD 1,917.66 Million by 2032, at a CAGR of 3.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pressure Gauges Market Size 2024 |

USD 1,445.09 Million |

| Pressure Gauges Market, CAGR |

3.6% |

| Pressure Gauges Market Size 2032 |

USD 1,917.66 Million |

Pressure Gauges Market features leading players such as Ametek, Badotherm, Circor, Dwyer, Emerson, Fluke Corporation, Honeywell International, Kobold Instruments, Newbow, and Omega Engineering, each focusing on precision engineering, material innovation, and expanded product portfolios to meet rising industrial measurement demands. These companies strengthen their presence through advanced analog and digital gauges designed for reliability in oil & gas, chemical processing, energy, and manufacturing applications. Regionally, North America led the market with a 32.6% share in 2024, supported by strong industrial infrastructure and high adoption of technologically advanced monitoring systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Pressure Gauges Market was valued at USD 1,445.09 Million in 2024 and is projected to grow at a CAGR of 3.6% through 2032.

- Growing industrial automation and rising investments in oil & gas, chemicals, and power generation drive strong demand for precision pressure monitoring instruments across end-use sectors.

- Digital gauge adoption accelerates as industries integrate IoT-enabled systems, real-time diagnostics, and predictive maintenance solutions, while analog gauges maintain dominance with a 68.4% share due to cost efficiency and reliability.

- Key players including Ametek, Emerson, Honeywell International, Fluke Corporation, Circor, and Badotherm expand portfolios through material innovation, stainless-steel designs, and application-specific offerings to strengthen market positioning.

- Regionally, North America led with a 32.6% share in 2024, followed by Europe at 28.4% and Asia-Pacific at 24.9%, while Bourdon tube technology remained dominant with a 54.7% share across global industrial applications.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type:

In the Pressure Gauges Market, analog pressure gauges dominated the product type segment with a 68.4% share in 2024, driven by their cost efficiency, operational simplicity, and widespread use in industrial, HVAC, oil & gas, and mechanical systems. Their durability, reliability in harsh environments, and suitability for applications without continuous power supply reinforce their leadership. Digital gauges continue to gain traction due to advanced features such as higher precision, data logging, and remote monitoring; however, their higher cost and maintenance requirements limit broader adoption, ensuring analog systems maintain strong preference across global industries.

- For instance, WIKA’s Bourdon tube pressure gauges, featuring elastic elements like stainless steel cases and glycerine filling, excel in hydraulic applications by damping vibrations for clear readability amid aggressive media in oil & gas and refrigeration systems.

By Technology:

Among the technology segments, Bourdon tube pressure gauges held the largest share at 54.7% in 2024, supported by their versatility, wide pressure measurement range, and strong mechanical reliability across industrial operations. Their proven performance in oil & gas, chemical processing, and heavy manufacturing environments further drives adoption. Diaphragm and capsule gauges are increasingly used for low-pressure and corrosive media applications, while other technologies such as bellows, manometers, and differential gauges serve specialized operational needs. However, Bourdon tube systems remain dominant due to their robust design, accuracy, and cost-effective deployment.

- For instance, Budenberg provides DMC-cased Bourdon tube gauges (model 966TGP) with safety patterns for corrosive petrochemical environments, used in producing ethylene and propylene while ensuring longevity through fire-retardant certification.

By Material:

The stainless-steel segment led the materials category with a 61.2% share in 2024, driven by its superior corrosion resistance, high mechanical strength, and long operational life in demanding conditions such as petrochemical, marine, and pharmaceutical applications. Stainless-steel gauges offer enhanced compatibility with aggressive media and high-pressure environments, supporting their widespread use in critical systems. Brass gauges follow in adoption for general-purpose measurement, especially in HVAC and water systems, while aluminum and other metals such as steel, copper, and bronze serve niche applications requiring lightweight or specialized performance characteristics.

Key Growth Drivers

Rising Industrial Automation and Process Optimization

Increasing adoption of automation across manufacturing, oil & gas, chemical processing, and power generation significantly drives demand for advanced pressure gauges. Industries rely on accurate, real-time pressure monitoring to ensure optimal process control, equipment safety, and operational efficiency. As facilities modernize legacy systems and integrate smart pressure monitoring solutions, the need for reliable gauges with high precision and durability expands. Growth in continuous production environments, where predictive maintenance and system uptime are critical, further accelerates market adoption of both analog and digital pressure measurement instruments.

- For instance, Icon Process Controls’ OBS Series plastic pressure gauges, featuring ±0.75% accuracy and color range tabs, integrate with gauge guards for chemical processing tanks, providing corrosion-resistant monitoring without filling or assembly.

Expansion of Oil & Gas, Petrochemical, and Energy Infrastructure

Global investments in upstream exploration, midstream transportation networks, and downstream refining operations strengthen the demand for robust pressure gauges capable of withstanding extreme temperatures, corrosive media, and high-pressure conditions. Refineries, LNG terminals, pipeline networks, and power plants depend on continuous pressure measurement to maintain system integrity and regulatory compliance. As developing economies expand energy infrastructure and advanced economies upgrade older facilities, the need for high-performance industrial-grade pressure gauges accelerates, fueling sustained market growth across heavy industrial segments.

- For instance, Bourdon’s model 262/263 series uses monel wetted parts for Bourdon tube gauges, providing corrosion resistance against aggressive acids and bases in chemical and petrochemical process industries.

Growing Focus on Safety Compliance and Equipment Reliability

Stricter safety regulations across industries such as pharmaceuticals, food processing, water treatment, and aerospace increase the need for accurate and certified pressure monitoring instruments. Pressure gauges play a critical role in preventing equipment failures, leakages, and pressure-related hazards, making them essential for compliance with ISO, ASME, and national safety standards. Manufacturers increasingly adopt high-precision gauges with improved materials, overload protection, vibration resistance, and tamper-proof designs. This focus on operational safety and reliability strengthens demand for both mechanical and digital pressure gauges across industrial and commercial environments.

Key Trends & Opportunities

Shift Toward Smart, Digital, and Connected Pressure Measurement

A major trend in the Pressure Gauges Market is the transition from conventional analog systems to intelligent digital gauges with features such as wireless connectivity, Bluetooth integration, data logging, and remote diagnostics. These technologies support predictive maintenance and seamless integration with IoT platforms, expanding opportunities in smart factories and digitalized industrial operations. As industries embrace Industry 4.0, manufacturers offering advanced digital gauges with enhanced analytics capabilities, cloud compatibility, and real-time monitoring are well positioned to capture emerging growth opportunities.

- For instance, Honeywell’s SmartLine Wireless Gauge Pressure transmitters in Series 800 and 700 provide wireless transmission for remote monitoring in industrial settings.

Rising Adoption of Corrosion-Resistant and Application-Specific Materials

Growing demand for specialized gauges designed for harsh environments presents strong opportunities for manufacturers. End users increasingly prefer stainless steel, Hastelloy, and chemically resistant materials that enhance durability in petrochemical, marine, and pharmaceutical applications. Similarly, sectors such as food & beverage, semiconductor manufacturing, and biotechnology require hygienic and contamination-free pressure measurement solutions. This shift toward material innovation and application customization encourages product differentiation, creating new avenues for suppliers focused on engineered materials, advanced coatings, and industry-specific performance enhancements.

- For instance, WIKA’s XSEL® process gauge Model 23x.34 features a bourdon tube, pressure connection, and all wetted parts made of 316L stainless steel, enabling it to handle corrosive petrochemical environments with positive pressures up to 30,000 psi (2,000 bar).

Key Challenges

Price Sensitivity and Competition from Low-Cost Manufacturers

The Pressure Gauges Market faces significant pressure from low-cost manufacturers offering budget alternatives, particularly in Asia-Pacific. This price sensitivity affects margins for established brands and complicates market penetration for advanced digital products. Many end users in cost-driven industries prioritize affordability over long-term performance, limiting adoption of high-specification gauges. As competition intensifies, manufacturers must balance cost efficiency with innovation while addressing customer expectations through value-added features, extended service life, and product differentiation to maintain their market position.

Maintenance Issues, Calibration Needs, and Performance Degradation

Pressure gauges, especially mechanical models, are prone to wear, vibration damage, temperature variations, and calibration drift over time. These performance challenges increase maintenance costs and may compromise measurement accuracy in critical applications. Industries with continuous operations require frequent calibration and replacement cycles, creating operational inefficiencies. Exposure to corrosive media or high-pressure conditions further accelerates degradation. To overcome these challenges, manufacturers must invest in enhanced materials, robust internal mechanisms, and digital alternatives that offer stable readings, reduced maintenance, and extended service reliability.

Regional Analysis

North America

North America led the Pressure Gauges Market with a 32.6% share in 2024, driven by strong industrial activity across oil & gas, petrochemicals, power generation, and manufacturing. The region’s emphasis on workplace safety, advanced process control, and modernization of industrial facilities accelerates adoption of both analog and digital gauges. Growth in shale gas exploration, pipeline expansions, and automation initiatives further strengthens demand. The presence of established instrumentation manufacturers and stringent regulatory frameworks ensures high product quality standards, supporting continued market dominance across critical infrastructure and industrial applications.

Europe

Europe accounted for a 28.4% share in 2024, supported by its advanced industrial base, strong regulatory environment, and rising investments in energy transition infrastructure. The region’s chemical, pharmaceutical, and food processing industries rely heavily on precision pressure monitoring for safety and quality compliance. Growing adoption of digital pressure gauges aligns with Industry 4.0 initiatives across Germany, the UK, France, and Italy. Additionally, stringent EU standards promoting equipment reliability and environmental protection drive the replacement of outdated mechanical gauges with high-performance, corrosion-resistant models suited for demanding industrial conditions.

Asia-Pacific

Asia-Pacific held a 24.9% share in 2024, emerging as the fastest-expanding region due to rapid industrialization, infrastructure development, and expanding manufacturing ecosystems in China, India, Japan, and Southeast Asia. Large-scale growth in chemicals, automotive, construction, and energy sectors fuels significant demand for cost-effective yet durable pressure gauges. Government-led industrial expansion programs and rising adoption of smart factory technologies further boost market penetration. The region also benefits from the presence of numerous low-cost manufacturers, enhancing product availability and supporting widespread use across mid-sized industrial facilities and high-volume commercial applications.

Latin America

Latin America captured a 7.3% share in 2024, driven by growing investments in oil & gas, mining, and food processing industries across Brazil, Mexico, and Argentina. The region’s reliance on pressure monitoring for pipeline operations, refinery safety, and industrial plant efficiency sustains steady demand. Structural modernization initiatives in water management, energy distribution, and manufacturing facilities support further market growth. However, economic fluctuations and cost-sensitive procurement practices influence adoption trends. Increasing awareness of equipment reliability and operational safety encourages gradual transition toward higher-quality pressure gauges and corrosion-resistant materials.

Middle East & Africa

The Middle East & Africa region held a 6.8% share in 2024, supported by expansion in oil & gas exploration, petrochemical refining, and desalination infrastructure. Countries such as Saudi Arabia, UAE, and Qatar continue to invest heavily in pressure-intensive industrial applications requiring robust and high-accuracy gauges. Growing construction activity and power generation projects further enhance regional demand. Africa’s mining, water treatment, and manufacturing sectors contribute to steady adoption, though budget constraints affect high-end product uptake. Increasing focus on operational safety and equipment durability drives gradual shift toward stainless steel and digital monitoring technologies.

Market Segmentations:

By Product Type

- Analog pressure gauges

- Digital pressure gauges

By Technology

- Bourdon tube pressure gauges

- Diaphragm pressure gauges

- Capsule pressure gauges

- Others (Bellows, manometer, differential)

By Material

- Stainless steel

- Brass

- Aluminum

- Others (steel, copper, bronze etc.)

By End Use

- Chemical & petrochemical

- Oil & gas

- Energy & power

- Pharmaceutical

- Water & wastewater treatment

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Pressure Gauges Market features leading manufacturers such as Ametek, Badotherm, Circor, Dwyer, Emerson, Fluke Corporation, Honeywell International, Kobold Instruments, Newbow, and Omega Engineering at the forefront of product innovation, material advancements, and global distribution expansion. These companies focus on enhancing precision, durability, and digital integration to meet rising industrial automation and safety requirements. Many players emphasize developing corrosion-resistant designs, IoT-enabled digital gauges, and application-specific solutions tailored for oil & gas, chemical processing, manufacturing, and pharmaceuticals. Strategic initiatives including product launches, capacity expansions, and aftermarket service offerings strengthen their market presence. Regional players also intensify competition by offering cost-effective analog gauges, particularly in Asia-Pacific, creating pricing pressure on global brands. Manufacturers increasingly adopt partnerships with distributors and engineering firms to expand reach into emerging markets. Overall, the landscape reflects a shift toward technologically advanced, high-reliability pressure measurement solutions aligned with Industry 4.0 and regulatory compliance trends.

Key Player Analysis

Recent Developments

- In September 2025 Honeywell International launched its new 13MM Pressure Sensor, a high-precision device designed for cleanroom and semiconductor-grade applications.

- In September 2025, ABB launched the P-300 versatile pressure transmitter series in the United States, featuring high accuracy up to 0.055% and coverage from 0.05 kPa to 105 MPa for petrochemical and chemical applications.

- In May 2024 AMETEK STC (in collaboration with Crystal Engineering) introduced the XP3i digital pressure gauge, offering enhanced accuracy and Bluetooth connectivity over its predecessor.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, Material, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady demand as industries prioritize accuracy, safety, and regulatory compliance.

- Adoption of digital and IoT-enabled pressure gauges will expand across automated and smart factory environments.

- Stainless-steel and corrosion-resistant materials will gain wider acceptance in harsh industrial applications.

- Growth in oil & gas, petrochemicals, and energy infrastructure will continue supporting high-pressure gauge adoption.

- Manufacturers will focus on advanced sensor integration for real-time monitoring and predictive maintenance.

- Low-cost regional suppliers will drive pricing pressure, encouraging global players to differentiate through innovation.

- Replacement demand will increase as industries upgrade legacy systems with modern precision gauges.

- Customized and application-specific gauges will grow in importance across pharmaceuticals, food processing, and water treatment.

- Environmental and safety regulations will accelerate adoption of certified, high-accuracy instruments.

- Emerging markets will offer strong expansion opportunities as industrialization and infrastructure development rise.

Market Segmentation Analysis:

Market Segmentation Analysis: