Market Overview

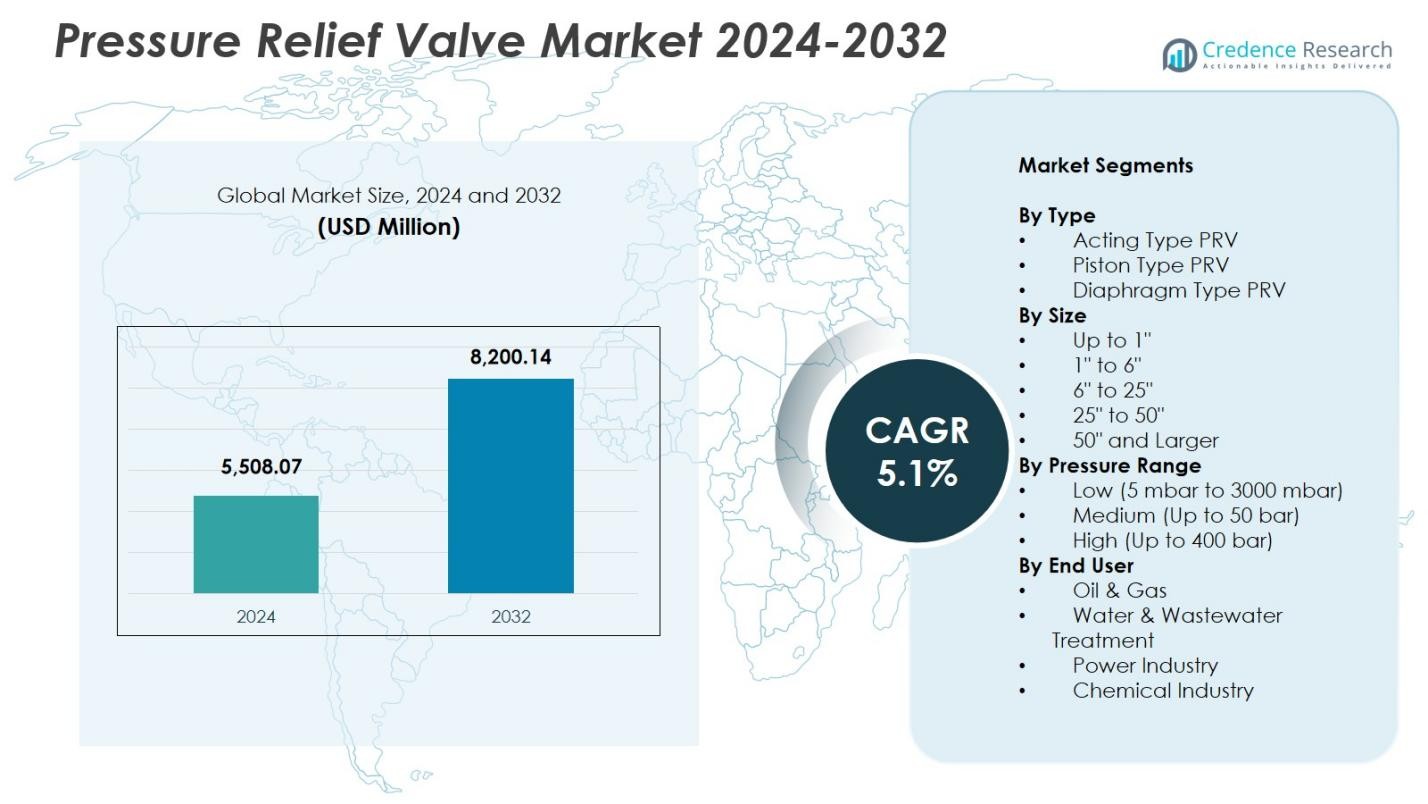

Pressure Relief Valve Market size was valued at USD 5,508.07 Million in 2024 and is anticipated to reach USD 8,200.14 Million by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pressure Relief Valve Market Size 2024 |

USD 5,508.07 Million |

| Pressure Relief Valve Market, CAGR |

5.1% |

| Pressure Relief Valve Market Size 2032 |

USD 8,200.14 Million |

Pressure Relief Valve Market features leading players such as Emerson Electric, GE–Baker Hughes, Parker Hannifin Corp., IMI plc, Yuanda Valve Group, Leser GmbH & Co. KG, Curtiss-Wright Corp., Mercer Valve Co. Inc., Watts Water Technologies, and Alfa Laval AB, each contributing to advancements in safety, performance, and material innovation across industrial applications. North America emerged as the leading region with 32.4% share in 2024, driven by strong demand from oil & gas, petrochemical, and power sectors supported by stringent safety regulations. Europe followed with 28.7% share, reflecting robust adoption in chemical processing, manufacturing, and renewable energy industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Pressure Relief Valve Market reached USD 5,508.07 Million in 2024 and is projected to grow at a CAGR of 5.1% through 2032.

- Rising industrial safety regulations and increased installation across oil & gas, power, and chemical industries drive strong adoption, with the Acting Type PRV segment holding 46.2% share in 2024.

- Smart monitoring technologies, advanced materials, and custom-engineered PRVs continue shaping market trends as industries seek enhanced reliability and digital integration.

- Key players, including Emerson Electric, GE–Baker Hughes, IMI plc, Parker Hannifin Corp., and Curtiss-Wright Corp., expand portfolios through innovation, partnerships, and product upgrades to strengthen global presence.

- North America led with 32.4% share in 2024, followed by Europe at 28.7% and Asia-Pacific at 29.8%, while adoption in Latin America and Middle East & Africa remains steady due to refinery modernization and infrastructure growth.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type:

In the Pressure Relief Valve Market, the Acting Type PRV segment dominated with 46.2% share in 2024, supported by its reliability, fast response capability, and widespread adoption across oil & gas, chemical processing, and power generation industries. Its efficient mechanism for preventing overpressure events and ensuring operational safety drives strong demand, particularly in high-risk environments. Piston Type PRVs accounted for 32.7% share, favored for durability in high-viscosity and high-pressure applications, while Diaphragm Type PRVs held 21.1% share, driven by their suitability for corrosive media, sterile conditions, and precise low-pressure control in pharmaceuticals and food processing sectors.

- For instance, CPV Manufacturing’s O-SEAL® series relief valves provide bubble-tight sealing up to 6000 PSI in high-pressure hydraulic systems and piping for petrochemical processing.

By Size:

The 1″ to 6″ size segment led the market with 41.5% share in 2024, driven by extensive deployment in pipelines, boiler systems, industrial reactors, and fluid transport applications requiring balanced flow capacity and compact design. Its dominance reflects its compatibility with diverse industrial installations and cost-efficient maintenance. The Up to 1″ segment contributed 27.4% share, supported by usage in instrumentation lines and low-flow systems, while the 6″ to 25″ segment held 21.8% share due to demand in large-scale plants. The 25″ to 50″ and 50″ & Larger categories collectively accounted for 9.3% share, driven by specialized heavy-duty applications.

- For instance, Swagelok stainless steel tube fittings in sizes from 1/4 inch to 1 inch, such as the SS-100-6 union and SS-810-1-6 male connector, provide leak-tight connections in power industry boiler systems, resisting vibration and thermal shock per ASME B31.1 standards.

By Pressure Range:

The Medium pressure (Up to 50 bar) segment dominated with 48.9% share in 2024, driven by its critical role across manufacturing, chemical processing, water treatment, and energy sectors that require consistent protection under moderate operational pressures. Its versatility and strong compatibility with standard industrial systems strengthen adoption. The Low-pressure segment held 33.6% share, supported by demand in ventilation, low-density gas applications, and sanitary processing lines. The High-pressure segment accounted for 17.5% share, primarily driven by oil & gas extraction, hydraulic systems, and high-pressure steam environments requiring robust valve integrity and enhanced safety performance.

Key Growth Drivers

Rising Industrial Safety Compliance Requirements

Stringent global safety regulations significantly drive demand in the Pressure Relief Valve Market as industries prioritize equipment protection and worker safety. Regulatory bodies mandate the use of certified PRVs to mitigate risks of overpressure in oil & gas, chemicals, power generation, and manufacturing facilities. Increasing inspection frequency and compliance audits compel industries to upgrade outdated systems with standardized, high-performance valves. Growing adoption of safety-instrumented systems and pressure management protocols further strengthens market expansion, as organizations seek reliable pressure control solutions to ensure operational integrity and regulatory adherence.

- For instance, Emerson’s Crosby J-Series direct spring-operated valves comply fully with ASME Section VIII, API 526/527, and EN4126 standards, providing overpressure protection for air, gas, steam, and liquid applications in oil & gas production.

Expansion of Oil, Gas, and Petrochemical Infrastructure

The rapid expansion of downstream and midstream oil & gas infrastructure fuels strong demand for pressure relief valves across pipelines, refineries, LNG terminals, and storage facilities. Rising global energy consumption and ongoing petrochemical plant construction increase installation volumes for high-capacity PRVs designed for harsh and high-pressure environments. Investments in maintenance, repair, and replacement activities also boost market growth as operators modernize assets to improve reliability. Additionally, the shift toward hydrogen, biofuels, and cleaner refinery technologies expands application opportunities for advanced corrosion-resistant valve systems.

- For instance, Baker Hughes developed control valves with corrosion-resistant materials and explosion-proof ratings for biofuels applications, addressing hydrogen presence and enabling reliable performance in synthetic fuels processing.

Growth of Power Generation and Process Industries

The accelerating development of thermal, nuclear, and renewable power plants drives adoption of pressure relief valves to maintain safe operating conditions in boilers, turbines, and heat-exchange systems. Process industries such as pharmaceuticals, food & beverages, pulp & paper, and water treatment increasingly require precise pressure regulation to ensure product quality and continuous operation. Technological upgrades, automation initiatives, and capacity expansions across these sectors strengthen demand for high-performance PRVs with improved reliability, low leakage, and compatibility with diverse process media.

Key Trends & Opportunities

Integration of Smart Monitoring and Digital Diagnostics

A major trend shaping the Pressure Relief Valve Market is the adoption of smart, sensor-enabled PRVs that support predictive maintenance and real-time monitoring. Digital diagnostics enhance visibility into valve performance, enabling early detection of anomalies such as seat wear, spring fatigue, or clogging. Industrial IoT platforms allow remote monitoring of pressure fluctuations and event logs, improving asset reliability while reducing unplanned downtime. This transition toward intelligent pressure-control systems creates strong opportunities for manufacturers offering connected, data-driven safety solutions tailored to automated industrial environments.

- For instance, WITT’s SV 805 SMART safety relief valve integrates high-tech sensors with a red/green diode for optical status display of “open” or “closed,” transmitting digital NPN/PNP signals to control systems for real-time process monitoring and accident prevention.

Increasing Adoption of Advanced Materials and Custom Engineering

Rising demand for corrosion-resistant, high-temperature, and specialty-media-compatible valves is creating new opportunities for PRVs engineered with high-grade alloys, composite materials, and surface-coating technologies. Industries handling aggressive chemicals, superheated steam, hydrogen, or cryogenic fluids increasingly prefer customized valve architectures optimized for durability and long lifecycle performance. This trend encourages manufacturers to invest in material science innovations, modular designs, and application-specific configurations. As end-users prioritize energy efficiency, low leakage rates, and extended maintenance intervals, advanced-material PRVs gain significant traction across global industrial sectors.

- For instance, Emerson’s Anderson Greenwood Type 84 PRV uses Arlon 3000XT thermoplastic seating and ASME SA-479 Type S21800 stainless steel spindle to deliver leak-tight performance up to 21,756 psig for hydrogen storage and refueling stations, resisting embrittlement from small-molecule diffusion.

Key Challenges

Maintenance Complexity and High Lifecycle Costs

Despite their importance, pressure relief valves often require rigorous inspection, recalibration, and periodic replacement to maintain performance, leading to substantial lifecycle costs. Issues such as seat damage, corrosion, and mechanical fatigue can impair reliability, especially in high-pressure or contaminated process environments. Industries with extensive PRV networks face added challenges in managing documentation, compliance testing, and unplanned servicing. These factors increase operational burdens for end-users and limit adoption of more sophisticated valve designs in cost-sensitive markets.

Performance Limitations Under Extreme Operating Conditions

Pressure relief valves operating in ultra-high-pressure, high-temperature, or highly corrosive environments face performance challenges that can compromise safety. Material degradation, pressure surges, and fluid impurities may reduce valve responsiveness or cause leakage, increasing the risk of system failure. Achieving consistent performance under extreme conditions requires advanced engineering, yet such solutions often involve higher costs and longer lead times. These technical constraints pose challenges for industries such as offshore oil & gas, petrochemicals, and nuclear power, where reliability demands are exceptionally stringent.

Regional Analysis

North America

North America dominated the Pressure Relief Valve Market with 32.4% share in 2024, driven by strong adoption across oil & gas, petrochemicals, power generation, and industrial manufacturing facilities. The region benefits from stringent OSHA, ASME, and API safety regulations that mandate certified pressure protection systems, driving recurring replacement and upgrade cycles. The United States leads demand due to extensive refinery capacity, shale gas operations, and nuclear power infrastructure. Increased investments in LNG export terminals and pipeline expansions further strengthen the need for high-performance PRVs engineered for harsh operating conditions and real-time monitoring integration.

Europe

Europe accounted for 28.7% share in 2024, supported by its advanced chemical processing sector, renewable energy expansion, and strict compliance with EN, PED, and ISO safety standards. Countries such as Germany, the U.K., France, and Italy drive significant adoption across manufacturing, district heating systems, and process industries requiring precision pressure control. The region’s accelerating hydrogen economy and decarbonization initiatives create additional demand for corrosion-resistant and specialty-material PRVs. Modernization of aging power plants and industrial facilities strengthens replacement demand, while ongoing digitalization encourages integration of smart monitoring technologies across valve systems.

Asia-Pacific

Asia-Pacific held the largest growth momentum with 29.8% share in 2024, driven by rapid industrialization, major refinery expansions, and large-scale investments in chemicals, power generation, and water treatment. China, India, Japan, and South Korea represent key markets as manufacturers increase production capacity and adopt advanced safety systems to support rising operational pressures. Government-led infrastructure development and steady growth in LNG import terminals boost demand for high-capacity PRVs. The region’s expanding pharmaceuticals and food processing industries further support adoption of diaphragm and sanitary-grade relief valves, strengthening Asia-Pacific’s position as a high-growth market.

Latin America

Latin America captured 5.4% share in 2024, influenced by oil & gas activities in Brazil, Mexico, and Argentina, along with growing chemical and mining industries. Investments in refinery modernization, offshore exploration, and natural gas pipeline extensions reinforce demand for heavy-duty relief valves designed for high-pressure and corrosive environments. Industrial safety reforms and rising maintenance activities encourage valve replacements across older facilities. Additionally, expanding water management and power generation projects, particularly in Brazil, contribute to steady adoption, though budget constraints and slower industrial upgrades limit faster market penetration.

Middle East & Africa

The Middle East & Africa region accounted for 3.7% share in 2024, driven primarily by large-scale oil & gas operations, desalination facilities, and petrochemical complexes across Saudi Arabia, UAE, Qatar, and South Africa. High-pressure applications in upstream and midstream sectors require robust PRVs capable of withstanding extreme temperatures and corrosive conditions. Significant investments in refinery expansions and gas processing plants support continued demand. In Africa, emerging power and water infrastructure projects add growth opportunities, though adoption remains moderate due to limited industrialization and slower technology transition in several economies.

Market Segmentations:

By Type

- Acting Type PRV

- Piston Type PRV

- Diaphragm Type PRV

By Size

- Up to 1″

- 1″ to 6″

- 6″ to 25″

- 25″ to 50″

- 50″ and Larger

By Pressure Range

- Low (5 mbar to 3000 mbar)

- Medium (Up to 50 bar)

- High (Up to 400 bar)

By End User

- Oil & Gas

- Water & Wastewater Treatment

- Power Industry

- Chemical Industry

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Pressure Relief Valve Market features leading players such as Emerson Electric, GE–Baker Hughes, Parker Hannifin Corp., IMI plc, Yuanda Valve Group, Leser GmbH & Co. KG, Curtiss-Wright Corp., Mercer Valve Co. Inc., Watts Water Technologies, and Alfa Laval AB. These companies strengthen their market position through continuous product innovation, global expansion, and technology integration focused on enhancing safety, durability, and operational efficiency. Manufacturers increasingly invest in advanced materials, digital monitoring solutions, and customized engineering to meet evolving industrial requirements across oil & gas, chemical processing, power generation, pharmaceuticals, and water treatment. Strategic initiatives such as mergers, acquisitions, and long-term supply agreements allow players to expand application reach and reinforce distribution networks. Furthermore, growing emphasis on predictive maintenance, real-time diagnostics, and compliance with international safety standards drives companies to upgrade product portfolios with high-performance PRVs that offer improved reliability, reduced leakage, and extended lifecycle value in diverse industrial environments.

Key Player Analysis

- Mercer Valve Co. Inc.

- GE – Baker Hughes

- Alfa Laval AB

- Emerson Electric

- IMI plc

- Yuanda Valve Group

- Curtiss-Wright Corp

- Leser GmbH & Co. KG

- Parker Hannifin Corp.

- Watts Water Technologies

Recent Developments

- In February 2025, Emerson introduced the Anderson Greenwood Type 84 pressure relief valve designed for hydrogen storage and other high-pressure gas applications.

- In April 2025, Alfa Laval launched its Unique SSV Pressure Relief Valve, expanding its hygienic-valve portfolio for the food, beverage, and personal care industries.

- In August 2025, KXC Valve Company launched a comprehensive stainless steel pressure reducing valve series, including threaded piston, flange piston, and diaphragm-type models for industrial fluid control up to 0.50 MPa.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Size, Pressure Range, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience sustained growth due to rising global industrial safety compliance requirements.

- Adoption of smart, sensor-enabled pressure relief valves will expand across automated facilities.

- Demand will increase in oil, gas, and petrochemical infrastructure driven by capacity expansions.

- Advanced materials and corrosion-resistant valve designs will gain wider acceptance in harsh environments.

- Power generation, especially nuclear and renewable sectors, will drive higher adoption of high-reliability PRVs.

- Replacement and modernization of aging industrial assets will accelerate product upgrades.

- Asia-Pacific will continue strengthening its position as the fastest-growing regional market.

- Customized and application-specific PRV solutions will become more important for specialized industries.

- Predictive maintenance and digital diagnostics will become standard offerings from major manufacturers.

- Sustainability-focused engineering will lead to development of energy-efficient and long-life PRV systems.

Market Segmentation Analysis:

Market Segmentation Analysis: